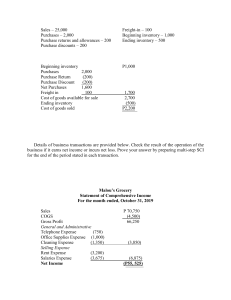

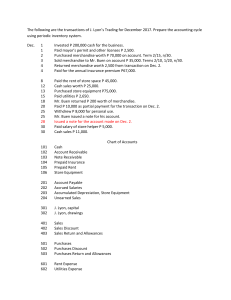

ComtJ/f.;_•ting the Cycle [o r ~ i►ill •••• ?WNtn1iH)f tt:O . . . p , . - - ,,..... we- ; ar ~-:C'!~~d~!!:?.,.~uas/~!~.J.~: 1 2 ;;q - -- . . .. ........ . - -- · 1 SCORE: __ PROFESS~R:_ _ _ _ ~ - - - ---problem #1 Merchandise Inventory At the End of the Period The beginning and ending merchandi se inventories for Ma ribeth Villon Store for th e year ended Dec. 31, 2019 are as f ollows: Merchandi se Inventory, 1/1/2019 M erchandi se Inventory, 12/31/2019 P 300,000 230,000 Required: Prepare th e adjusting entries to update the merchandise inventory account as at Dec. 31, 2019. ,Problem #2 Adjusting Entry for Merchandise Inventory Listed below is a partial trial balance of the Charito Guillermo Retailers at Dec. 31, 2019: Merchandise Inventory Sales Sales Returns and Allowances Purchases Purchases Discounts Transportation-In PS0,000 Pl90,000 20,000 60,000 3,000 1,000 The merchandise inventory on Dec. 31 is P74,000. Required: l.' Prepare the adjusting entry needed for merchandise inventory. 2- Prepare the partial income statement. .l /, I 8-22 I by Pro; WIN Ba/Jad a rt· . . . . 'J · Bps,c FmanCJal Accou ntmg and Repo mg J I SCORE: NAME: : - - - - - - - -] o:::R:-Fe=s=-=s::: o-= R-= P-=__:_ _ _ _ _ _ _ _ _ __ + -=LS!.!E~CT~IO_'._N I Problem #3 Missing Elements - Reconstruction inser t the m iss ing figures in To test your know ledge of the relationships of these items , of net sa les and profit is the follow ing incom e state ment . Note that gross profit is 40% 10% of 'let sales. Net Sales Gross Sales Less: Sales Returns & Allowances Sales Discounts Net Sales Cost of Goods Sold Invent ory, Jan. 1, 2019 Purchases Less: Purchases Returns & Allowances Purchases Discounts Net Purchases Transp ortatio n-In Net Cost of Purchases Cost of Goods Availa ble for Sale Less: Invent ory, Dec. 31, 2019 p P45,00 0 15,000 p P220,0 00 P985,000 P31,000 20,000 p 36,000 p 260,00 0 Cost of Goods Sold Gross Margin from Sales Opera ting Expenses P620,000 p Profit Prob lem #4 Work shee t Procedures Accou nt Titles Merch andis e Inven tory, Beginning Sales Sales Returns & Allowances Purchases Purchases Returns & Allowances Purchases Discounts Trans portat ion In Salaries Payable Merch andis e Inven tory, Ending Income Statement Credit Debit Balance Sheet Cred it Debit / ;' , •' / I - Required: nted. Put a check mark (/) A porti on of a work shee t for a merchandising entity is prese extended. in the colum ns wher e balan ce of the listed account s shoul d be .......... Completing the Cycle for a Merchandising Business I 8-23 ~--= NAME: SCORE: PROFESSOR: SECTION: problem #5 preparing the Worksheet The unadjusted trial balance of the Dores Marie ·Pateno Hobby Shop on Dec. 31, 2019 appears below: Dores Marie Pateno Hobby Shop Unadjusted Trial Balance Dec.31,2019 · Cash Accounts Receivable Merchandise Inventory Prepaid Rent Shop Equipment Accumulated Depreciation Accounts Payable Pateno, Capital Pateno, Withdrawals Sales Sales Discounts Purchases Purchases Returns and Allowances Transportation In Salaries Expense Advertising Expense Utilities Expense Supplies Expense Totals P 100,000 500,000 700,000 300,000 1,600,000 P 200,000 400,000 1,300,000 100,000 2,900,000 100,000 800,000 200,000 100,000 400,000 150,000 100,000 50,000 PS,000,000 Additional information: Accrued salaries at year-end amounted to P30,000. b. Rent in the amount of Pl00,000 has expired during the year. a. c. Depreciation on shop equipment is P200,000. d. The Dec. 31 merchandise inventory amounted to PS00,000. Required: Prepare the worksheet. :ir:M~~.:,_J! .,_ .- - -. . , 4,T ...,.,._.. ,,,~~•:,,1"-,\~7.; . ' •. ,,, ,··:b~1';~~ii;'!& .iiii..,.;, .•'i:....t1~.lii;j;~~f,. PS,000,000 8-24 I · by Prof WIN Bal/ado Basic Financial Accounting and Reportmg ;v, 77112-:zv~- r s · wn- zn v -1 . t ~NA~M~E_:_ : - - - - -- - - - -SECTION: t -; S~ CO ~R ~E ~.:~;:-- - - - - - - - -] PROFES~OR: -1 Problem #6 Preparing the Worksheet The unadjusted trial balance of the John Bala Maps as at Dec. 31, 2019 follows: John Bala Maps Unadjusted Trial Balance Dec. 31, 2019 Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Office Supplies Office Equipment Accumulated Depreciation Accounts Payable Bala, Capital Bala, Withdrawals Sales Sales Returns and Allowances Sales Discounts Purchases Purchases Returns and Allowances Purchases Discounts Transportation In Salaries Expense Advertising Expense Rent Expense Totals p 31,000 83,000 627,000 54,000 68,000 370,000 p 50,000 58,000 517,000 87,000 2,675,000 26,000 23,000 1,512,000 14,000 19,000 38,000 327,000 61,000 26,000 P3,333,000 P3,333,000 Additional information: a. Merchandise inventory as at Dec. 31J 2019 amounted to PS32,000. b. Insurance coverage with premiums of P18,000 has expired during the year. c. Depreciation for the year amounted to P25,000. d. Office supplies remaining at year-end amounted to PlS,000. e. Salaries in the amount of P9,000 have accrued as at Dec. 31, 2019. Required: Prepare the worksheet. :z. 7 r u n tO n - na > 3. 71 rr _ dising Busin ess I 8-25 ~omp leting th e Cycle for a M erchan -z vv -1 iFZE s ~-· - -a · ~· r 1 ~ , · · s- • r5c a - -·- --- --- --- --I SCORE:S_S_O_R_: - - - - --- ---i NAME: PROFE _EJTIQ~~ [s problem #7 Statements preparing the Worksheet, Adjusting and Closing Entries, and Financial 2019 are as The ledger accounts of the Christin e Sousa Bags for the year ended Dec. 31, follows: Accu. Depreciation -Off. Bldg. Accu. Depreciation -Off. Equipt. Accounts Receivable Accounts Payable cash Transportation In Insurance Expense Interest Expense Sousa, Capital Sousa, Withdrawals Land Merchandise Inventory Mortgage Payab le P 100,000 150,000 136,000 74,000 72,000 72,000 25,000 208,000 1,510,000 200,000 400,000 598,000 1,100, 000 Notes Payable du e in 2 yrs . Office Buildin g Office Equipm ent Office Suppli es Prepai d Advert is ing Purchases Discou nts Purchases Rets . & Allow. Purchases Salaries Expense Sales Discou nts Sales Return s and Allow. Sales Travel Expense p 200,000 1,600,000 570,000 42,000 75,000 172,000 133,000 2,643,000 862,000 161,000 187,000 4,600,000 188,00 0 Additional inform ation : a. Office supplies consu med during the year amounted to Pl 7,000. b. Advertising expense in the amou nt of P25,000 has expired during the year. c. Salaries of P21,0 00 have accrued as at Dec. 31, 2019. amou nted to Depreciation on the office building and on the office equip ment PlS,0 00 and P20,0 00, respectively. e. The Dec. 31, 2019 endin g inven tory is P723,000. d. Required: 1. Prepare the works heet. 2. Prepare the financ ial statem ents. 3. Prepare the ad~usting and closing entries. NAME: SECTION: SCORE: PROFESSOR: - ~ ~ ~- - - - - - -~:..:.:::.:_..:==-=- - -- - - - Problem #8 Preparing the Income Statement-Function of Expense Method Accounts selected from the Dec. 31, 2019 trial balance of the Victoriano Navarette Traders are listed below: Sales Purchases Merchandise Inventory, 1/1/2019 Merchandise Inventory, 12/31/2019 Salaries Expense-Selling Salaries Expense-General Office Supplies Expense Depreciation Expense-Office Equipment Sales Returns and Allowances Insurance Expense _,. Sales Discounts Transportation Out Depreciation Expense-Store Equipment Purchases Returns and Allowances Selling Supplies Expense Purchases Discounts Tra.nsportation In Miscellaneous Expenses P 9,630,000 4,720,000 2,170,000 1,430,000 1,140,000 920,000 460,000 320,000 280,000 55,000 210,000 170,000 160,000 110,000 80,000 70,000 50,000 30,000 Required: Prepare the income stateme~t using the function of expense method. Completing the Cycle for a Merchandising Business I 8-27 ---- [tE: se(r10N: SCORE: PROFESSOR: problem #9 trial The accounts of Marissa Babilonia Health Store selected from the Dec. 31, 2019 balance are as follows : P 150,000 Advertising Expense Transportation Out Depreciation Expense-Office Equipm ent Depreciation Expense-Store Equipm ent Transportation In Merchandise Inventor y, 1/1/201 9 Merchandise Inventor y, 12/31/2 019 Miscellaneous Expenses Office Supplies Expense Purchases Purchases Returns and Allowances Purchases Discoun ts Salaries Expense-Selling Salaries Expense-General 260,000 110,000 140,000 100,000 1,160,000 1,040,000 90,000 430,000 6,710,000 250,000 180,000 960,000 1,130,000 9,810,000 260,000 140,000 70,000 Sales Sales Returns and Allowances Sales Discounts Selling Supplies Expense Required: Prepare the income statem ent using the function of expense metho d. Problem #10 The accounts of Ramon Woo Milk Products follow: Accounts Payable Accounts Receivable Accumulated Deprec iationOffice Equipm ent Accumulated Deprec iationStore Equipm ent Cash Woo, Capital Cost of Goods Sold Woo, Withdra wals General Expenses Interest Expense Interest Payable Inventory, 1/1/201 9 P 16,950 43,700 22,450 16,000 7,890 74,620 ? 9,000 116,700 5,400 1,100 69,350 Inventory, 6/30/20 19 Long-term Notes Payable Office Equipment Purchases Purchase Discounts Purchase Returns & Allows. Salaries Payable Sales Discounts Sales Returns & Allows. Sales Selling Expenses Store Equipment Supplies Unearned Revenues P 65,520 39,000 58,680 364,000 1,990 3,400 2,840 10,400 18,030 731,000 132,900 88,000 5,100 13,800 d. In a Required: Prepare the income statem ent using the functio n of expense metho separate schedule, show the compu tation of cost of goods sold . . 8-28 I . d Reporting by Prof WIN Bailado Basic Financial A~~o~~!!_-=-- - SCORE: : - - - - - -- - - T .P~R~O~FE~S:SISODIRR::~ - - - - - - ~N~A~M~Ei_ SECTION: Problem #11 Preparing the Closing Entries A portion of the Dec. 31, 2019 worksheet for Jun Torres Distributors is shown below. For simplicity, all operating expenses have been combined. The periodic inventory system is used. I Income Statement Account Titles Debit Merchandise Inventory, Beginning Torres, Capital Torres, Withdrawals Sales 128,000 Sales Returns & Allowances Sales Discounts Purchases 3,000 9,000 660,000 Purchases Returns & Allowances Purchases Discounts Transportation In Operating Expenses Merchandise Inventory, Ending Credit 280,000 24,000 1,000,000 6,000 13,200 16,000 250,000 118,000 Required : Prepare the closing entries. I Balance Sheet Credit Debit 118,000 I