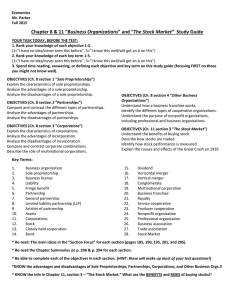

Advantages and Disadvantages of forms of Business Organization

advertisement

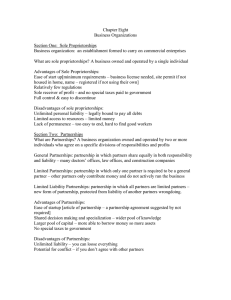

1 Advantages and Disadvantages of Forms of Business Organization 2 Advantages and Disadvantages of Forms of Business Organization Proprietorships and partnerships are two forms of business organizations that offer unique advantages and disadvantages. Proprietorships which are owned by a single individual provide several benefits. First they are relatively easy to form requiring minimal legal formalities and paperwork. This makes them a convenient choice for entrepreneurs who want to start their own businesses quickly. Additionally proprietorships are subject to fewer government regulations compared to other forms of business organizations. This allows owners to have more control and flexibility in managing their businesses. Another advantage of proprietorships is lower income taxes. Unlike corporations where profits are subject to both corporate and individual income taxes proprietorships are taxed only at the individual level. This can result in significant tax savings for small business owners especially if their income falls within lower tax brackets. However proprietorships also have their limitations. One major drawback is unlimited personal liability for debts. In other words the owner's personal assets can be used to satisfy business debts. This puts the owner's personal finances at risk and can have serious consequences in the event of business failure. Additionally proprietorships have limited lives as they are closely tied to the lifespan of the owner. If the owner dies or decides to sell the business the proprietorship ceases to exist. Partnerships on the other hand are legal arrangements between two or more individuals who decide to do business together. They share both advantages and disadvantages with proprietorships. Like proprietorships partnerships are relatively easy to form and have fewer government regulations compared to corporations. They also offer the advantage of lower income taxes as profits are taxed at the individual level. 3 However partnerships also come with the drawback of unlimited personal liability for debts. Each partner is personally responsible for the partnership's obligations which can put their personal assets at risk. Additionally partnerships can face challenges when it comes to raising large amounts of capital. It may be difficult to attract investors or secure loans without the legal structure and credibility of a corporation. Corporations as separate legal entities offer several advantages and disadvantages compared to proprietorships and partnerships. One major advantage is their unlimited life. Corporations can continue to exist even if ownership changes or key individuals leave the organization. This provides stability and continuity which can be crucial for long-term business success. Another advantage of corporations is their ability to raise large amounts of capital. Unlike proprietorships and partnerships corporations can issue stocks and bonds to attract investors and secure financing. This makes it easier for corporations to fund expansions research and development and other business activities. However corporations are subject to double taxation. This means that corporate profits are taxed at the corporate level and then shareholders are taxed again when they receive dividends or sell their shares. This can result in a higher overall tax burden compared to proprietorships and partnerships. To address this issue Congress created S corporations which are taxed similarly to partnerships. These corporations are exempt from corporate income tax and profits and losses are passed through to the shareholders' individual tax returns. However S corporations have limitations such as a maximum of 75 stockholders which restricts their use to small privately owned firms. In conclusion each form of business organization has its own advantages and disadvantages. Proprietorships and partnerships offer ease of formation and lower income 4 taxes but come with the risk of unlimited personal liability for debts. Corporations on the other hand provide unlimited life and the ability to raise large amounts of capital but are subject to double taxation. Understanding these factors is crucial for entrepreneurs and business owners to make informed decisions about the most suitable form of business organization for their specific needs. 5 References