Macroeconomics Canada in the Global Environment 10th Edition by Michael Parkin

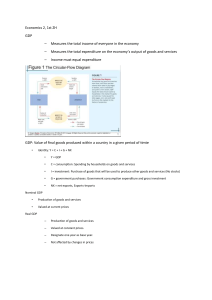

advertisement