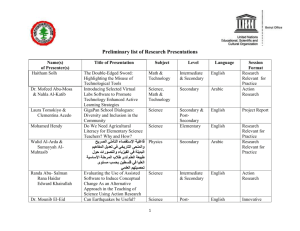

FINANCIAL REPORTING (F7)

S. No

Topic

1

IAS 40 – Investment Property

2

IAS 23 – Borrowing Costs

3

IAS – 16 Property, Plant & Equipment (PPE)

4

IAS 36 – Impairment of Assets

5

IAS 38 – Intangible Assets

6

IFRS 05 – NCA held for sale

7

IAS 41 – Agriculture

8

IAS 02 – Inventories

9

IAS 37 – Provision, Contingent Assets & Contingent Liabilities

10

IFRS 15 – Revenue from Contracts with Customers

11

IAS 21 – Foreign Currency

12

IAS 08 – Accounting Policies, Estimates & Errors

13

IAS 10 – Events after Reporting

14

IAS 32, IFRS 9(IAS 39) – Financial Instruments

15

IAS 20 – Government Grants

16

IFRS 16 – Leases

17

IAS 12 – Income Tax

18

IFRS 13 – Fair Value Measurement

19

IAS 01 – Presentation of Financial Statements

20

Frameworks

21

Final accounts

22

Group Accounts / Consolidation

23

IAS 07 – Cash Flows

24

Ratio Analysis / Interpretation of Financial Statements

25

IAS 33 – Earning Per Share (EPS)

26

Group Disposal + Factoring + Sales or Return Basis + Consignment Inventory

+ Sale & Lease back

ACCA FR (F7): Financial Reporting

By:

Zya Rana

IAS 40: INVESTMENT PROPERTY

DECISION TREE:

1

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Scope of IAS 40:

Land or building, or part of a building, or both, held by the owner or to earn rentals and/or for capital

appreciation, rather than for;

-

Use in production or supply of goods and services or

-

For administrative purposes or

-

For sale in the ordinary course of business

Case Study 1:

XYZ Inc. and its subsidiaries have provided you, their IFRS specialist, with a list of the properties they

own:

(a) Land held by XYZ Inc. for undetermined future use

(b) A vacant building owned by XYZ Inc. and to be leased out under an operating lease

(c) Property held by a subsidiary of XYZ Inc., a real estate firm, in the ordinary course of its business

(d) Property held by XYZ Inc. for the use in production

Required: Advice XYZ Inc. and its subsidiaries as to which of the above-mentioned properties would

qualify under IAS 40 as investment properties. If they do not qualify thus, how should they be treated

under IFRS?

Recognition Criteria:

Investment property shall be recognized as an asset when and only when

•

It is probable that future economic benefits will flow to the entity; and

•

The cost of the investment property can be measured reliably.

Recognition principles are similar to those contained in IAS 16.

Components of Total Cost (As per IAS 16):

2

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Initial Measurement:

-

An investment property shall be measured initially at cost, including transaction charges.

-

Again, the principles for determining cost are similar to those contained in IAS 16, in particular

for replacement and subsequent expenditure.

Subsequent Measurement:

For subsequent measurement of Investment Property, An entity shall select either the

-

Cost Model or the

-

Fair Value model for all its investment property

Few Important Points:

-

It depends upon the management to use any of the above models

But, same class of assets should accounted under same treatment

Management can change/transfer from one model to another model but there should be an

appropriate reason for the change.

3

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Subsequent Measurement Under Cost Model:

-

Under the cost model the asset should be accounted for in line with the cost model laid out in

IAS 16

• The property will be depreciated as normal and

• Shown in the statement of financial position at NBV (Cost Less Accumulated Depreciation)

Subsequent Measurement Under Fair value Model:

Under the fair value model:

-

Fair value is normally established by reference to current prices on an active market for

properties of in the same location and condition

• The asset is revalued to fair value at the end of each year

• The gain or loss is shown directly in the income statement

• No depreciation is charged on the asset

4

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case study 2:

Celine, a manufacturing company, purchases a property for $1 million on 1 January 20X1 for its

investment potential. The land element of the cost is believed to be $400,000, and the buildings

element is expected to have a useful life of 50 years. At 31 December 20X1, local property indices

suggest that the fair value of the property has risen to $1.1 million. Show how the property would be

presented in the financial statements as at 31 December 20X1 if Celine adopts:

(a) The cost model

(b) The fair value model

5

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 3:

Investors Galore Inc., a listed company in Germany, ventured into construction of a mega shopping

mall in south Asia, which is rated as the largest shopping mall of Asia. The company’s board of directors

aftermarket research decided that instead of selling the shopping mall to a local investor, who had

approached them several times during the construction period with excellent offers which he

progressively increased during the year of construction, the company would hold this property for the

purposes of earning rentals by letting out space in the shopping mall to tenants. For this purpose it

used the services of a real estate company to find an anchor tenant (a major international retail chain)

that then attracted other important retailers locally to rent space in the mega shopping mall, and

within months of the completion of the construction the shopping mall was fully let out.

The construction of the shopping mall was completed and the property was placed in service at the

end of 20X1. According to the company’s engineering department the computed total cost of the

construction of the shopping mall was $100 million. An independent valuation expert was used by the

company to fair value the shopping mall on an annual basis. According to the fair valuation expert the

fair values of the shopping mall at the end of 20X1 and at each subsequent year-end thereafter were

20X1

20X2

20X3

20X4

$100 million

$120 million

$125 million

$115 million

The independent valuation expert was of the opinion that the useful life of the shopping mall was 10

years and its residual value was $10 million.

Required: What would be the impact on the profit and loss account of the company if it decides to

treat the shopping mall as an investment property under IAS 40:

(a) Using the “fair value model”; and

(b) Using the “cost model.”

6

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Transfer TO / FROM Investment Property:

Transfers to and from investment property shall be made when and only when there is a change of use

evidenced by

• Commencement of owner occupation (transfer from investment property to property, plant, and

equipment)

• Commencement of development with a view to sale (transfer from investment property to

inventories)

• End of owner occupation (transfer from property, plant, and equipment to investment property)

• Commencement of an operating lease to another party (transfer from inventories or property, plant,

and equipment to investment property)

• End of construction or development (transfer from property under construction, covered by IAS 16,

to investment property)

In cases where the fair value model is not used, transfers between classifications are made at the

carrying value: the lower of cost and net realizable value if inventories, or cost less accumulated

depreciation and impairment losses if property, plant, and equipment.

If owner-occupied property is transferred to investment property that is to be carried at fair value,

then, up to the change, IAS 16 is applied. That is to say, any revaluation in fair value is treated in

accordance with IAS 16.

Transfers from investment property at fair value to property, plant, and equipment shall be at fair

value, which becomes deemed cost.

For transfers from inventories to investment properties that are to be carried at fair value, the remeasurement to fair value is recognized in the income statement.

When a property under construction is completed and transferred to investment property to be

carried at fair value, the re-measurement to fair value is recognized in the income statement.

7

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Examples Transfer TO / FROM Investment Property:

8

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Disposals:

An investment property shall be derecognized on disposal or at the time that no benefit is expected

from future use or disposal. Any gain or loss is determined as the difference between the net disposal

proceeds and the carrying amount and is recognized in the income statement.

9

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

IAS 23: BORROWING COST

Objective of IAS 23:

-

The objective of IAS 23 is to prescribe the accounting treatment for borrowing costs (finance cost).

-

Borrowing cost are interest and other costs that an entity incurs in connection with the borrowing of

funds

-

This standard applies where the particular borrowing are applied to the construction of certain assets;

so called Self-Constructed assets.

Qualifying Asset:

-

A qualifying asset is an asset that takes a substantial period of time to get ready for its intended use or

sale

-

That asset could be property, plant, and equipment and investment property during the construction

period, intangible assets during the development period, or "made-to-order" inventories

Capitalization of Borrowing Cost to the Cost of Asset:

-

Borrowing costs that are directly attributable to the acquisition, construction or production of a

qualifying asset form part of the cost of that asset and, therefore, should be capitalised.

-

Other borrowing costs are recognised as an expense

Borrowing Cost and Interest Income on Short-Term Investment of

Funds:

Costs eligible for capitalization are

-

the actual costs incurred less any income earned on the temporary investment of such borrowings

1

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 1:

On 1 January 20X6 Stremans Co borrowed $1.5m to finance the production of two assets, both of which were

expected to take a year to build. Work started during 20X6. The loan facility was drawn down and incurred on

1 January 20X6, and was utilised as follows, with the remaining funds invested temporarily.

Asset A

$'000

250

250

1 January 20X6

1 July 20X6

Asset B

$'000

500

500

The loan rate was 9% and Stremans Co can invest surplus funds at 7%.

Required: Ignoring compound interest, calculate the borrowing costs which may be capitalized for each of the

assets and consequently the cost of each asset as at 31 December 20X6.

2

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Commencement of Capitalization:

-

expenditures are being incurred

-

borrowing costs are being incurred and

-

activities that are necessary to prepare the asset for its intended use or sale are in progress (may

include some activities prior to commencement of physical production).

Suspension of Capitalization:

-

Capitalisation should be suspended during periods in which active development is interrupted. –

-

Capitalisation should cease when substantially all of the activities necessary to prepare the asset for

its intended use or sale are complete.

-

If only minor modifications are outstanding, this indicates that substantially all of the activities are

complete.

Cessation of Capitalization:

-

Where construction is completed in stages, which can be used while construction of the other parts

continues, capitalisation of attributable borrowing costs should cease when substantially all of the

activities necessary to prepare that part for its intended use or sale are complete.

Disclosure

The accounting policy adopted [required only until 1 January 2009 if immediate expensing model is used]

Amount of borrowing cost capitalised during the period

Capitalisation rate used

3

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 2:

On December 1, 20X4, Compassionate Inc. began construction of homes for those families that were hit by the

tsunami disaster and were homeless. The construction is expected to take 3.5 years. It is being financed by

issuance of bonds for $7 million at 12% per annum. The bonds were issued at the beginning of the construction.

The project is also financed by issuance of share capital with a 14% cost of capital. Compassionate Inc. has opted

under IAS 23 to capitalize borrowing costs.

Required

Compute the borrowing costs that need to be capitalized under IAS 23.

4

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 3:

On 1 January 20X5, Sainsco began to construct a supermarket which had an estimated useful life of 40 years. It

purchased a leasehold interest in the site for $25 million. The construction of the building cost $9 million and the

fixtures and fittings cost $6 million. The construction of the supermarket was completed on 30 September 20X5

and it was brought into use on 1 January 20X6.

Sainsco borrowed $40 million on 1 January 20X5 in order to finance this project. The loan carried interest at 10%

pa. It was repaid on 30 June 20X6.

Calculate the total amount to be included at cost in property, plant and equipment in respect of the

development at 31 December 20X5.

5

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

2 Types of Borrowing:

-

General Borrowing (from different bank or financial institutions)

e.g.

15 million @ 10%

10 million @ 9.5%

25 million @ 9%

50 million

In this situation; we will use “Weighted Average Rate”.

-

Specific Borrowing (It is a project specific borrowing @ specified rate)

6

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 4:

A socially responsible multinational corporation (MNC) decided to construct a tunnel that will link two sides of

the village that were separated by a natural disaster years ago. Realizing its role as a good corporate citizen, the

MNC has been in this village for a couple of years exploring oil and gas in the nearby offshore area. The tunnel

would take two years to build and the total capital outlay needed for the construction would be not less than

$20 million. To allow itself a margin of safety, the MNC borrowed $22 million from three sources and used the

extra $2 million for its working capital purposes. Financing was arranged in this way:

• Bank term loans: $5 million at 7% per annum

• Institutional borrowings: $7 million at 8% per annum

• Corporate bonds: $10 million at 9% per annum

In the first phase of the construction of the tunnel, there were idle funds of $10 million, which the MNC invested

for a period of six months. Income from this investment was $500,000.

Required

How would it capitalize the borrowing costs, and what would it do with the investment income?

7

https://www.facebook.com/zya.rana

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

IAS 16: PROPERTY PLANT AND EQUIPMENT

Objective of IAS 16:

The objective of IAS 16 is to prescribe the accounting treatment for property, plant, and

equipment.

The principal issues are;

-

the timing of recognition of assets

-

the determination of their carrying amounts, and

-

the depreciation charges to be recognised in relation to them

Scope

The requirements of IAS 16 are applied to accounting for all property, plant and

equipment but there are certain exceptions as follows:

Property, plant and equipment classified as held for sale

Biological assets

Property, plant and equipment:

-

Tangible assets that are held for

-

use in production or supply of goods and services

-

for rental to others, or

-

for administrative purposes and are

-

expected to be used during more than one period.

Cost:

The amount paid or fair value of other consideration given to acquire or construct an

asset.

1

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Useful life:

-

The period over which an asset is expected to be utilized or

-

the number of production units / hours expected to be obtained from the use of

the asset

Residual Value:

The estimated amount, less disposal cost that could be currently realized from the

asset„s disposal if the asset were already of an age and condition expected at the end

of its useful life.

Depreciable amount:

Total cost – Residual value

Depreciation:

The systematic allocation of the depreciable amount of an asset over its expected

useful life.

2

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Recognition Criteria:

Items of property, plant, and equipment should be recognised as assets when it is

probable that:

the future economic benefits associated with the asset will flow to the enterprise;

and

The cost of the asset can be measured reliably

Initial Measurement:

An item of property, plant and equipment that satisfies the recognition criteria should be

recognized initially at its TOTAL COST.

Components of Total Cost:

Purchase price, including import duties nonrefundable purchase taxes, less trade

discount and rebates.

Costs directly attributable to bringing the asset to asset to the location and

condition necessary for it to be used in a manner intended by the entity

Initial estimates of dismantling, removing, and site restoration if the entity has an

obligation that it incurs on acquisition of the asset to the extent that it is

recognized as a provision under IAS 37.

3

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Example of directly attributable costs includes:

Cost of site preparation

Initial delivery and handling costs

Cost of testing, less the net proceed from the sale of any product arising from

test production

Borrowing costs to the extent permitted by IAS 23

Professional fees

Examples of costs that are not directly attributable costs and

therefore must be expensed in the income statement include:

Costs of opening a new facility

Costs of introducing a new product or services

Advertising and promotional costs

Costs of conducting business in a location or with a new class of customer

Training

Administration and other general overheads

Initial operating losses

Costs of relocating or reorganization part or all of an entity‟s operations.

If an asset is acquired in exchange for another asset, then the acquired asset is

measured at its value unless the exchange lacks commercial substance or the fair value

cannot be reliably measured in which case the acquired asset should be measured at

the carrying amount of the asset given up.

4

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

QUESTION 1:

On 1 October 20X6, Omega began the construction of a new factory. Costs relating to

the factory, incurred in the year ended 30 September 20X7, are as follows:

$000

Purchase of the land

10,000

Costs of dismantling existing structures on the site

500

Purchase of materials to construct the factory

6,000

Employment costs (Note 1)

1,800

Production overheads directly related to the construction (Note 2)

1,200

Allocated general administrative overheads

600

Architects‟ and consultants‟ fees directly related to the construction 400

Costs of relocating staff who are to work at the new factory

300

Costs relating to the formal opening of the factory

200

Interest on loan to partly finance the construction of the factory (Note 3)

1,200

Note 1

The factory was constructed in the eight months ended 31 May 20X7. It was brought

into use on 30 June 20X7. The employment costs are for the nine months to 30 June

20X7.

Note 2

The production overheads were incurred in the eight months ended 31 May 20X7. They

included an abnormal cost of $200,000, caused by the need to rectify damage resulting

from a gas leak.

Note 3

Omega received the loan of $12m on 1 October 20X6. The loan carries a rate of interest

of 10% per annum.

Note 4

The factory has an expected useful economic life of 20 years. At that time the factory

will be demolished and the site returned to its original condition. This is a legal

obligation that arose on signing the contract to purchase the land. The expected costs

of fulfilling this obligation are $2m. (Ignore discounting)

Requirement

Compute the initial total cost of the factory.

5

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Question 2: Accounting year operates from 1 October to 30 September.

On 1 October 2005 Dearing acquired a machine under the following terms:

Manufacturer‟s base price

Trade discount (applying to base price only)

Early settlement discount taken

Freight charges

Electrical installation cost

Staff training in use of machine

Pre-production testing

Purchase of a three-year maintenance contract

$

1,050,000

20%

5%

30,000

28,000

40,000

22,000

60,000

Estimated residual value

Estimated life in machine hours

20,000

6,000 Hours

Hours used during 30 September 2006

Hours used during 30 September 2007

1,200

1,800

On 1 October 2007 Dearing decided to upgrade the machine by adding new

components at a cost of $200,000.This upgrade led to a reduction in the production time

per unit of the goods being manufactured using the machine. The upgrade also

increased the estimated remaining life of the machine at 1 October 2007 to 4,500

machine hours and its estimated residual value was revised to $40,000.

Hours used during 30 September 2008

850

Required:

Prepare extracts from the income statement and statement of financial position for the

above machine for each of the three years to 30 September 2008.

6

ACCA FR: Financial Reporting

IAS 16 PPE

7

By:

Zya Rana

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Change in Estimations:

Residual

Value

Straight Line

Method,

&

Units Method

Used In

Useful life

&

(Both are

Estimates)

Hours

Method

But, at time of change in Estimations, calculate the

-

NBV of that time

and then

-

Revised Depreciation

QUESTION 3:

An item of plant was acquired for $220,000 on 1 January 2012. The estimated useful life

of the plant was five years and the estimated residual value was $20,000. The asset is

depreciated on a straight line basis. On 31 December 2012 the future estimate of the

useful life of the plant was changed to three years, with an estimated residual value of

$12,000.

Required:

Compute the depreciation expense for 2012 and 2013?

8

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Change in Method of Depreciation:

-

Is allows, because it is an estimation

-

Should reflect consistency

-

Same class of assets should accounted under same treatment

But, at time of change in method of depreciation, calculate the

-

NBV of that time

and then

-

Revised Depreciation

QUESTION 4:

A piece of PPE purchased for $300,000 on 1 January 2017. The estimated useful life of

the plant was five years with a NIL residual value. The asset is being depreciated @

10% on a reducing balance method for first two years and on 31 December 2018, entity

decided to depreciate the asset on straight line basis.

Required:

-

Compute the depreciation expense for 2017 and 2018?

How to incorporate the change in method of depreciation for calculating

depreciation expense for the year ended 2019 and onwards?

9

ACCA FR: Financial Reporting

IAS 16 PPE

Component Accounting:

10

By:

Zya Rana

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Subsequent Measurement:

IAS 16 permits two accounting models for subsequent measurement of PPE:

Cost Model:

The asset is carried at cost less accumulated depreciation and impairment.

Revaluation Model:

The asset is carried at a revalued amount, being its fair value at the date of revaluation

less subsequent depreciation, provided that fair value can be measured reliably.

KEY POINT:

Once selected, the policy shall apply to an entire class of property, plant and equipment.

Deprecation: For all depreciable assets:

Each part of an item of property, plant and equipment with a cost that is

significant in relation to the whole shall be depreciated separately.

Both the useful life and the residual value shall be reviewed annually and the

estimates revised as necessary in accordance with IAS 8.

Depreciation commences when an asset is in the location and condition that

enables it to be used in the manner intended by management.

Depreciation should be charged to the income statement, unless it is included in

the carrying amount of another asset

The depreciation method should be reviewed at least annually and, if the pattern

of consumption of benefits has changed, the depreciation method should be

changed prospectively as a change in estimate under IAS 8.

The depreciation method used should reflect the pattern in which the asset's

economic benefits are consumed by the enterprise

Depreciation shall cease at the earlier of it‟s derecognition (Sale or scrapping) or

its reclassification as “held for Sale” (IFRS 5)

11

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Subsequent Measurement under Revaluation Model:

Under the revaluation model, revaluations should be carried out regularly, so that the

carrying amount of an asset does not differ materially from its fair value at the balance

sheet date.

If an item is revalued, the entire class of assets to which that asset belongs should be

revalued.

Revalued assets are depreciated in the same way as under the cost model (see below).

If a revaluation results in an increase in value, it should be credited to equity under the

heading "revaluation surplus" unless it represents the reversal of a revaluation decrease

of the same asset previously recognised as an expense, in which case it should be

recognised as income.

A decrease arising as a result of a revaluation should be recognised as an expense to

the extent that it exceeds any amount previously credited to the revaluation surplus

relating to the same asset.

The revaluation reserve may be released to retained earnings in one of two ways:

1)

2)

When the asset is disposed of or otherwise derecognized, the surplus can be

transferred to retained earnings.

The difference between the depreciation charged on the revaluation amount and

that based on cost can be transferred from the revaluation reserve to retained

earnings. The transfer to retained earnings should not be made through the

income statement (that is, no "recycling" through profit or loss).

12

ACCA FR: Financial Reporting

IAS 16 PPE

Revaluation of a Non-Depreciable Asset:

Example:

PPE Initial total cost

Revaluation @ end if year 3

Revaluation @ end if year 4

Revaluation @ end if year 7

Revaluation @ end if year 9

Revaluation @ end if year 14

Revaluation @ end if year 15

=

=

=

=

=

=

=

100k

130k

150k

125k

90k

94k

105k

13

By:

Zya Rana

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Revaluation of a Depreciable Asset:

QUESTION 5:

At 1 January 2001, an item of plant acquired at a total cost of $500,000. Estimated

useful life is 25 years with no scrap value.

At 31 December 2013, company decided to revalue the asset at revalued amount of

$750,000.

Required:

1. NBV at time of revaluation?

2. Calculate revaluation reserve?

3. Calculate depreciation expense for year 14

4. Calculate excess depreciation

5. Adjustment of excess depreciation against revaluation reserve of asset

14

ACCA FR: Financial Reporting

IAS 16 PPE

15

By:

Zya Rana

ACCA FR: Financial Reporting

IAS 16 PPE

By:

Zya Rana

Revaluation Reserve Decrease Due To:

-

When excess depreciation is adjusted

-

Disposal of asset

-

Fall in value of asset (Impairment of asset)

-

Deferred tax liability

De-recognition (Retirements and Disposals):

An asset should be removed from the balance sheet on disposal or when it is withdrawn

from use and no future economic benefits are expected from its disposal. The gain or

loss on disposal is the difference between the proceeds

16

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

IAS 36: IMPAIRMENT OF ASSETS

Objective:

To ensure that assets are carried at no more than their recoverable amount, and to

define how recoverable amount is calculated.

Scope:

IAS 36 applies to (among other assets):

land

buildings

machinery and equipment

investment property carried at cost

intangible assets

goodwill

investments in subsidiaries, associates, and joint ventures

assets carried at revalued amounts under IAS 16 and IAS 38

IAS 36 does not apply to the following assets:

investment property carried at fair value

inventories

assets held for sale

deferred tax assets

financial assets

certain agricultural assets carried at fair value

(IAS 40)

(IAS 02)

(IFRS 5)

(IAS 12)

(IAS 39)

(IAS 41)

Impairment:

An asset is impaired when its carrying amount exceeds its recoverable amount.

Carrying Amount:

The amount at which an asset is recognised in the balance sheet after deducting

accumulated depreciation and accumulated impairment losses

1

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Recoverable Amount:

The higher of:

or

-

Fair Value Less Costs to Sell (NRV)

Value in use

Fair Value less Costs to Sell:

If there is a binding sale agreement, use the price under that agreement less

costs of disposal.

If there is an active market for that type of asset, use market price less costs of

disposal. Market price means current bid price if available, otherwise the price in

the most recent transaction.

If there is no active market, use the best estimate of the asset's selling price less

costs of disposal.

Costs of disposal are the direct added costs only (not existing costs or

overhead).

Value in Use:

The discounted present value of estimated future cash flows expected to arise from:

the continuing use of an asset, and from

its disposal at the end of its useful life

Indications / Factors of Impairment:

External Factors:

market value declines

negative changes in technology, markets, economy, or laws

increases in market interest rates

company stock price is below book value

Internal Factors:

obsolescence or physical damage

asset is part of a restructuring or held for disposal

worse economic performance than expected

2

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Recognition of an Impairment Loss

An impairment loss should be recognised whenever recoverable amount is below

carrying amount. The impairment loss is an expense in the income statement

(unless it relates to a revalued asset where the value changes are recognised

directly in equity).

Adjust depreciation for future periods.

3

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Question 1

On 1 January 2018, Big Company acquired a NCA at a total cost of $50,000.

Depreciation for the year ended is $5,000.

At year end date i.e. on 31 December 2018, there were some indications of impairment.

Company conducted an impairment test review which revealed that the asset may

generate estimated cash inflows $7000 per year till next 3 years and then could be sold

at end of year 3 for a sum of $10,000 (ignoring PV).

Company also checked the fair value less cost to disposal of asset and observed that

the asset may generate proceeds of $40,000 and a cost of $5,000 needs to be incurred

before disposal.

Required:

1.

2.

3.

4.

5.

6.

Net book value at 31 December 2018 (as per IAS 16)?

Value in use at 31 December 2018?

Fair value less cost to sell at 31 December 2018?

Impairment loss (if any)?

Double entry to record the impairment loss?

Book value of asset after considering the implications of IAS 16 & IAS 36?

4

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Question 2

A company that extracts natural gas and oil has a drilling platform in the Caspian Sea. It

is required by legislation of the country concerned to remove and dismantle the platform

at the end of its useful life.

Accordingly, the company has included an amount in its accounts for removal and

dismantling costs, and is depreciating this amount over the platform's expected life.

The company is carrying out an exercise to establish whether there has been an

impairment of the platform.

(a) Its carrying amount in the statement of financial position is $3m.

(b) The company has received an offer of $2.8m for the platform from another oil

company. The bidder would take over the responsibility (and costs) for dismantling and

removing the platform at the end of its life.

(c) The present value of the estimated cash flows from the platforms continued use is

$3.3m (before adjusting for dismantling costs).

(d) The carrying amount in the statement of financial position for the provision for

dismantling and removal is currently $0.6m.

Required:

What should be the value of the drilling platform in the statement of financial position,

and what, if anything, is the impairment loss?

5

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Question 3

DR

$“m”

Land and buildings: cost (including Rs.90m land)

840

Accumulated depreciation at 1 January 2002

Plant and equipment: cost

CR

$“m”

120

258

Accumulated depreciation at 1 January 2002

126

Adjustments:

(i) Depreciation rates as per the company's accounting policy note are as follows:

Buildings

Plant and equipment

Straight line over 50 years

20% reducing balance

Company accounting policy is to charge a full year's depreciation in the year of an

asset's purchase and none in the year of disposal. Company’s land and buildings were

eight years old on 1 January 2002.

(ii) On 31 December 2002 the company revalued its land and buildings to $760m

(including $100m for the land). The company follows the revaluation model of IAS 16 for

its land and buildings, but no revaluations had previously been necessary.

(iii) At the beginning of the year, Company disposed of some malfunctioning equipment

for $7m. The equipment had cost $15m and had accumulated depreciation brought

forward at 1 January 2002 of $3m.

There were no other additions or disposal to property, plant and equipment in the year.

(iv) Due to a change in the company's product portfolio plans, an item of plant with a

carrying value $22m at 31 December 2002 (after adjusting for depreciation for the year)

may be impaired due to a change in use. An impairment test conducted at 31

December, revealed its fair value less costs of disposal to be $16m. The asset is now

expected to generate an annual net income stream of $3.8m for the next five years at

which point the asset would be disposed of for $4.2m. An appropriate discount rate is

8%. Five-year discount factors at 8% are:

Simple

Cumulative

0.677

3.993

Required: Show the treatment of above NCA for the year ended 31 December

2002.

6

ACCA FR: Financial Reporting

IAS 36

7

By:

Zya Rana

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Cash-Generating Units:

Recoverable amount should be determined for the individual asset, if possible.

If it is not possible to determine the recoverable amount (fair value less cost to

sell and value in use) for the individual asset, then determine recoverable amount

for the asset's cash-generating unit (CGU).

The CGU is the smallest identifiable group of assets:

that generates cash inflows from continuing use, and

that are largely independent of the cash inflows from other assets or groups of

assets.

Examples of CGU:

Note:

Whenever there is impairment in a CGU, then the allocation of impairment should as

follows:

1.

Impairment due to a specific asset

2.

Goodwill

3.

Impairment on remaining NCA on Prorate Basis

8

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Question 4

An impairment loss of £60,000 arises in connection with an IGU. The carrying amount of

the assets in the IGU, before the impairment, is as follows:

Goodwill

Patent (with no market value)

Tangible fixed assets

£000

20

10

40

–––

70

Show the impact of the impairment on 1 January.

9

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Question 5

A company runs a unit that suffers a massive drop in income due the failure of its

technology on 1 January. The following carrying values were recorded in the books

immediately prior to the impairment:

£m

Goodwill

20

Technology

5

Brands

10

Land

50

Buildings

30

Other net assets

40

The recoverable value of the unit is estimated at £80 million. The technology is

worthless, following its complete failure. The other net assets include stock, debtors and

creditors. It is considered that the book value of other net assets is a reasonable

representation of its NRV.

Show the impact of the impairment on 1 January.

10

ACCA FR: Financial Reporting

IAS 36

By:

Zya Rana

Impairment of Goodwill:

Goodwill should be tested for impairment annually.

To test for impairment, goodwill must be allocated to each of the acquirer's cashgenerating units, or groups of cash-generating units, that are expected to benefit from

the synergies of the combination.

A cash-generating unit to which goodwill has been allocated shall be tested for

impairment at least annually by comparing the carrying amount of the unit, including the

goodwill, with the recoverable amount of the unit:

The impairment loss is allocated to reduce the carrying amount of the assets of the unit

(group of units) in the following order:

first, reduce the carrying amount of any goodwill allocated to the cash-generating

unit (group of units); and

Then, reduce the carrying amounts of the other assets of the unit (group of units)

pro rata on the basis.

The carrying amount of an asset should not be reduced below the highest of:

its fair value less costs to sell (if determinable);

its value in use (if determinable); and

zero.

If the preceding rule is applied, further allocation of the impairment loss is made pro rata

to the other assets of the unit (group of units).

Reversal of an Impairment Loss:

Same approach as for the identification of impaired assets: assess at each

balance sheet date whether there is an indication that an impairment loss may

have decreased. If so, calculate recoverable amount.

The increased carrying amount due to reversal should not be more than what the

depreciated historical cost would have been if the impairment had not been

recognised.

Reversal of an impairment loss is recognised as income in the income statement.

Adjust depreciation for future periods.

Reversal of an impairment loss for goodwill is prohibited.

11

ACCA FR (F7): Financial Reporting

By:

Zya Rana

IAS 38: INTANGIBLE ASSETS

Objective:

-

The objective of IAS 38 is to prescribe the accounting treatment for intangible assets that are not dealt

with specifically in another IAS.

-

The Standard requires an enterprise to recognise an intangible asset if, and only if, certain criteria are

met.

-

The Standard also specifies how to measure the carrying amount of intangible assets and requires

certain disclosures regarding intangible assets.

Scope:

IAS 38 applies to all intangible assets other than:

financial assets

intangible assets covered by another IAS, such as intangibles held for sale, deferred tax assets, lease

assets, assets arising from employee benefits, and goodwill. Goodwill is covered by IFRS 3

Intangible Asset:

-

An identifiable nonmonetary asset without physical substance.

An asset is a resource that is controlled by the enterprise as a result of past events (for example, purchase or

self-creation) and from which future economic benefits (inflows of cash or other assets) are expected. Thus,

the three critical attributes of an intangible asset are:

Identifiability

control (power to obtain benefits from the asset)

future economic benefits (such as revenues or reduced future costs)

Identifiability:

An intangible asset is identifiable when it:

is separable (capable of being separated and sold, transferred, licensed, rented, or exchanged, either

individually or as part of a package) or arises from contractual or other legal rights, regardless of

whether those rights are transferable or separable from the entity or from other rights and obligations.

Examples of possible intangible assets include:

computer software

patents

copyrights

motion picture films

customer lists

licenses

import quotas

franchises

https://www.facebook.com/zya.rana

1

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Intangibles can be acquired:

by separate purchase

as part of a business combination

by a government grant

by exchange of assets

by self-creation (internal generation)

Recognition Criteria:

-

-

IAS 38 requires an enterprise to recognise an intangible asset, whether purchased or self-created (at

cost) if, and only if:

it is probable that the future economic benefits that are attributable to the asset will flow to the

enterprise; and

the cost of the asset can be measured reliably.

This requirement applies whether an intangible asset is acquired externally or generated internally. IAS

38 includes additional recognition criteria for internally generated intangible assets (see below).

If recognition criteria not met:

-

If an intangible item does not meet both the definition of and the criteria for recognition as an

intangible asset, IAS 38 requires the expenditure on this item to be recognised as an expense when it is

incurred

Initial Recognition – Research and Development Costs:

-

Charge all research cost to expense

-

Development costs are capitalised only if the following criteria are met:

There is a clearly defined project

Expenditure is separately identifiable

The project is commercially viable

The project is technically feasible

Project income is expected to outweigh cost

Resources are available to complete the project

If an enterprise cannot distinguish the research phase of an internal project to create an intangible asset from

the development phase, the enterprise treats the expenditure for that project as if it were incurred in the

research phase only.

Initial Recognition: Internally Generated Brands, Titles, Lists

-

Brands, publishing titles, customer lists and items similar in substance that are internally generated

should not be recognised as assets.

https://www.facebook.com/zya.rana

2

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Measurement Subsequent to Acquisition: Cost Model and Revaluation

Models Allowed:

An entity must choose either the cost model or the revaluation model for each class of intangible asset.

Cost Model:

-

After initial recognition the intangible assets should be carried at cost less any amortisation and

impairment losses

-

This method is more commonly used in practice

Revaluation Model:

-

Intangible assets may be carried at a revalued amount (based on fair value) less any subsequent

amortisation and impairment losses only if fair value can be determined by reference to an active

market. Such active markets are expected to be uncommon for intangible assets.

-

Under the revaluation model, revaluation increases are credited directly to "revaluation surplus" within

equity except to the extent that it reverses a revaluation decrease previously recognised in profit and

loss. If the revalued intangible has a finite life and is, therefore, being amortised (see below) the

revalued amount is amortised.

Classification of Intangible Assets Based on Useful Life:

Intangible assets are classified as:

-

Indefinite life:

No foreseeable limit to the period over which the asset is expected to generate net cash inflows for the

entity

-

Finite life:

A limited period of benefit to the entity

Measurement Subsequent to Acquisition: Intangible Assets with Finite

Lives:

-

The cost less residual value of an intangible asset with a finite useful life should be amortised over that

life

-

The amortisation method should reflect the pattern of benefits

If the pattern cannot be determined reliably, amortise by the straight line method.

The amortisation charge is recognised in profit or loss unless another IFRS requires that it be

included in the cost of another asset

-

The amortisation period should be reviewed at least annually

-

The asset should also be assessed for impairment in accordance with IAS 36

https://www.facebook.com/zya.rana

3

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Measurement Subsequent to Acquisition: Intangible Assets with Indefinite

Lives:

-

An intangible asset with an indefinite useful life should not be amortised

-

Its useful life should be reviewed each reporting period to determine whether events and circumstances

continue to support an indefinite useful life assessment for that asset

-

If they do not, the change in the useful life assessment from indefinite to finite should be accounted for

as a change in an accounting estimate.

-

The asset should also be assessed for impairment in accordance with IAS 36

Subsequent Expenditure:

-

Subsequent expenditure on an intangible asset after its purchase or completion should be recognised as

an expense when it is incurred, unless it is probable that this expenditure will enable the asset to

generate future economic benefits in excess of its originally assessed standard of performance and the

expenditure can be measured and attributed to the asset reliably.

https://www.facebook.com/zya.rana

4

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Practice Question – Biogenics

(Part – A)

Over the last 20 years many companies have spent a great deal of money internally developing new intangible

assets such as software. The treatment for these assets is prescribed by IAS 38 Intangible assets.

Required: In accordance with IAS 38, discuss whether internally-developed intangible assets should be

recognised, and if so how they should be initially recorded and subsequently accounted for.

https://www.facebook.com/zya.rana

5

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Practice Question – Biogenics

(Part – B)

Biogenics is a publicly listed pharmaceutical company. During the year to 31 December 20X9 the following

transactions took place:

(i) $6m was spent on developing a new obesity drug which received clinical approval on 1 July 20X9 and is

proving commercially successful. The directors expect the project to be in profit within 12 months of the

approval date. The patent was registered on 1 July 20X9. It cost $1.5m and remains in force for three years.

(ii) A research project was set up on 1 October 20X9 which is expected to result in a new cancer drug. $200,000

was spent on computer equipment and $400,000 on staff salaries. The equipment has an expected life of four

years.

(iii) On 1 September 20X9 Biogenics acquired an up-to-date list of GPs at a cost of $500,000 and has been visiting

them to explain the new obesity drug. The list is expected to generate sales throughout the life-cycle of the

drug.

Required: Prepare extracts from the statement of financial position of Biogenics at 31 December 20X9 relating

to the above items and summarise the costs to be included in the statement of profit or loss for that year.

https://www.facebook.com/zya.rana

6

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Answer: Biogenic

(a) To be recognised, an intangible asset must first of all meet the definition of an intangible asset in IAS 38. It

must be controlled by the entity, it must be separably identifiable and it must be something from which the

entity expects future economic benefits to flow. It must then meet the recognition criteria of having a cost that

can be measured reliably.

For this reason internally-generated intangibles are not normally recognised as assets. They have not been

acquired for a consideration and therefore do not have a cost or value that can be measured reliably. For this

reason, a brand name that has been acquired can be capitalised, a brand name that has been internally

developed cannot be capitalised. The exception to this is development costs which can be capitalised if/when

they meet the IAS 38 criteria. They are initially recognised at cost.

After initial recognition development costs are amortised over the life cycle of the product. If at any point it

becomes apparent that the development costs no longer meet the capitalisation criteria, they should be written

off. Intangible assets with an indefinite useful life are not amortised but tested annually for impairment.

https://www.facebook.com/zya.rana

7

ACCA FR (F7): Financial Reporting

By:

Zya Rana

IFRS-05: Non-Current Asset Held For Sale and

Discontinued Operations

Held-For-Sale Classification:

IFRS 5 establishes a classification for non-current assets 'held for sale’. The following conditions must be met for

an asset (or 'disposal group') to be classified as held for sale:

Management is committed to a plan to sell

The asset is available for immediate sale

An active programme to locate a buyer is initiated

The sale is highly probable, within 12 months of classification as held for sale (subject to limited

exceptions)

The asset is being actively marketed for sale at a sales price reasonable in relation to its fair value

Actions required to complete the plan indicate that it is unlikely that plan will be significantly changed or

withdrawn.

The assets need to be disposed of through sale. Therefore, operations that are expected to be wound down or

abandoned would not meet the definition (but may be classified as discontinued once abandoned).

Disposal group:

-

A 'disposal group' is a group of assets, possibly with some associated liabilities

-

which an entity intends to dispose of in a single transaction

Question 1:

An entity is committed to a plan to sell a building and has started looking for a buyer for that building.

The entity will continue to use the building until another building is completed to house the office staff located

in the building. There is no intention to relocate the office staff until the new building is completed.

Required

Would the building be classified as held for sale?

https://www.facebook.com/zya.rana

1

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Question 2:

An entity is planning to sell part of its business that is deemed to be a disposal group. The entity is in a business

environment that is heavily regulated, and any sale requires government approval. This means that the sale time

is difficult to determine. Government approval cannot be obtained until a buyer is found and known for the

disposal group and a firm purchase contract has been signed. However, it is likely that the entity will be able to

sell the disposal group within one year.

Required

Would the disposal group be classified as held for sale?

Question 3:

An entity has an asset that has been designated as held for sale in the financial year to December 31, 20X5.

During the financial year to December 31, 20X6, the asset still remains unsold, but the market conditions for the

asset have deteriorated significantly. The entity believes that market conditions will improve and has not

reduced the price of the asset, which continues to be classified as held for sale. The fair value of the asset is $5

million, and the asset is being marketed at $7 million.

Required

Should the asset be classified as held for sale in the financial statements for the year ending December 31,

20X6?

Measurement of NCA as Held For Sale:

IFRS 05 says; classify NCA as held for sale at LOWER OF

-

Carrying Value (NBV)

Or

-

Fair Value Less Cost To Sell (FVLCTS)

Impairment:

Impairment must be considered both at the time of classification as held for sale and subsequently.

Non-depreciation:

Non-current assets or disposal groups that are classified as held for sale shall not be depreciated.

SOFP presentation:

Assets classified as held for sale, and the assets and liabilities included within a disposal group classified as held

for sale, must be presented separately on the face of the balance sheet.

https://www.facebook.com/zya.rana

2

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Question 4:

An asset has a carrying value of $600,000.

It is classified as held for sale on 30 September 20X6. At that date its fair value less costs to sell is estimated at

$550,000. The asset was sold for $555,000 on 30 November 20X6. The year end of the entity is 31 December

20X6.

Requirement 1:

How would the classification as held for sale, and subsequent disposal, be treated in the 20X6 financial

statements?

https://www.facebook.com/zya.rana

3

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Question 4:

Requirement 2:

How would the answer differ if the carrying value of the asset at 30 September 20X6 was $500,000, with all

other figures remaining the same?

https://www.facebook.com/zya.rana

4

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Subsidiaries Held for Disposal:

IFRS 5 applies to accounting for an investment in a subsidiary for which control is intended to be temporary

because the subsidiary was acquired and is held exclusively with a view to its subsequent disposal in the near

future. For such a subsidiary, if it is highly probable that the sale will be completed within 12 months then the

parent should account for its investment in the subsidiary under IFRS 5 as an asset held for sale, rather than

consolidate it under IAS 27.

However, IAS 27 still requires that if a subsidiary that had previously been consolidated is now being held for

sale, the parent must continue to consolidate such a subsidiary until it is actually disposed of. It is not excluded

from consolidation and reported as an asset held for sale under IFRS 5.

An entity that is committed to a sale involving loss of control of a subsidiary that qualifies for held-for-sale

classification under IFRS 5 shall classify all of the assets and liabilities of that subsidiary as held for sale, even if

the entity will retain a non-controlling interest in its former subsidiary after the sale.

Classification as Discontinuing:

A discontinued operation is a component of an entity that either has been disposed of or is classified as held for

sale, and:

represents a separate major line of business or geographical area of operations,

is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area

of operations, or

is a subsidiary acquired exclusively with a view to resale and the disposal involves loss of control

https://www.facebook.com/zya.rana

5

ACCA FR (F7): Financial Reporting

By:

Zya Rana

IAS-41: Agriculture

Scope:

Agriculture standardizes the accounting for agricultural activity:

that is the conversion of biological assets into agricultural produce

as a generalization, the standard requires biological assets to be

measured at “fair value less costs to sell”

Definitions:

biological assets – living plants and animals

agricultural produce – the produce harvested from the biological assets

costs to sell – incremental costs directly attributable to the disposal of an asset excluding finance

costs and taxation

Initial Recognition:

An entity should recognise a biological asset or agricultural produce only when the entity:

controls the asset

as a result of past events

it is probable that future economic inflows will result

the asset and inflows are capable of reliable measurement

Measurement of Biological Assets:

On initial recognition and on subsequent reporting dates, should be measured at fair value less

estimated costs to sell, unless fair value cannot be reliably measured (see below)*

Measurement of Agricultural Produce:

should be measured at fair value less estimated costs to sell at the point of harvest

because harvested produce is a marketable commodity, there is no exception for measurement

unreliability

any gain on initial recognition of biological assets at fair value less costs to sell, and any changes

during a period in fair value less costs to sell of biological assets are reported in the statement of

profit or loss

similarly, any gain on initial recognition of agricultural produce at fair value less costs to sell

should be included in the statement of profit or loss for the period in which it arises

all costs related to biological assets measured at fair value are recognised as expenses in the

period in which they are incurred with the exception of the purchase cost of those assets

https://www.facebook.com/zya.rana

1

ACCA FR (F7): Financial Reporting

By:

Zya Rana

* From above,

There remains a problem with measurement of a biological asset for which fair value cannot be

reliably measured it is conceivable that, at initial measurement, there is no quoted price in an active

market for the biological asset and no alternative appropriate and workable method exists,

in this case, the asset should be measured at cost less accumulated depreciation and

impairment losses but the entity must still measure all of its other biological assets at fair

value less costs to sell

and if circumstances change and fair value becomes reliably measurable, a switch to fair

value less costs to sell is required

Guidance on the Measurement of Fair Value:

best measure is “quoted market price in an active market”

if no active market, a market–based price such as the most recent market price for that type (or

similar) asset

if market–based prices not available, the net present value of related cash flows from that asset,

discounted at the entity’s current cost of capital

in rare circumstances, cost may be taken as fair value where there has been little or no change

to the biological asset since acquisition or where such change is not likely to have a material

effect on value

the fair value of a biological asset is based on current prices and is not reflective of actual prices

agreed in binding sales contracts requiring delivery at some time in the future

Sundry Points:

change in fair value of biological assets is part due to physical change (asset is one year older)

and part due to market price change separate disclosure of the two elements is encouraged but

not required

fair value measurement stops at harvest. After that, IAS on inventory applies

agricultural land is accounted for under IAS on PPE

but agricultural assets attached to the land (for example fruit trees) are measured separately

from the land

intangible agricultural assets (for example milk quotas) are accounted for under IAS 38 intangible

assets

government grants unconditionally received in respect of biological assets measured at fair value

less costs to sell are accounted for as income in the period when the grant is receivable

but if the grant is conditional, it shall be recognised as income only when the conditions have

been met, this includes grants receivable where an entity is required NOT to engage in

agricultural activities

https://www.facebook.com/zya.rana

2

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 1

A Colombian entity is considering the valuation of its harvested coffee beans. Industry practice is to

value the coffee beans at market value. The national accounting body has always used this practice

and uses as its source of reference “Accounting for Successful Farms,” a local publication.

Required

The entity wishes to adopt IAS 41 but does not know what the impact will be on its inventory of coffee

beans.

https://www.facebook.com/zya.rana

3

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case Study 2

An entity has these balances in its financial records:

$m

Value of biological asset at cost 12/31/X1

600

Fair valuation surplus on initial recognition at fair value 12/31/X1

700

Change in fair value to 12/31/X2 due to growth and price fluctuations

100

Decrease in fair value due to harvest

90

Required

Show how these values would be incorporated into the financial statements at December 31, 20X2.

https://www.facebook.com/zya.rana

4

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Case study 3

Show the treatment of transactions at year start, during the year and at year-end.

Information regarding fair values is as follows:

Item

Fair value less point of sale costs

1 October 2012

1 April 2014

30 September 2014

$

$

$

Land

47

51.7

55.4

New born calves (per calf )

47

49.35

51.7

Six month old calves (per calf )

54.05

56.4

58.15

Two year old cows (per cow)

211.5

216.2

220.9

Three year old cows (per cow)

218.55

223.25

227.95

1.41

1.29

1.29

Milk (per litre)

At year start, on 1 October 2012, Numbers carried out the following transactions:

Purchased a large piece of land for $47 million

Purchased 10,000 dairy cows (average age at 1 October, 2012 two years) for $2.35 million

Received a grant of $940,000 towards the acquisition of the cows. This grant was non–returnable

https://www.facebook.com/zya.rana

5

ACCA FR (F7): Financial Reporting

By:

Zya Rana

During the year ending, Numbers incurred the following costs and on 30 September 2013, the

calves were also born:

$1,175,000 to maintain the condition of the animals (food and protection).

$705,000 in breeding fees to a local farmer

On 1 April, 2013 5,000 calves were born. There were no other changes in the number of animals

during the year ended 30 September, 2013

At year end date, on 30 September 2013, apart from above assets (Land, Cows and Calves)

Numbers had 10,000 litres of unsold milk in inventory

https://www.facebook.com/zya.rana

6

ACCA FR (F7): Financial Reporting

By:

Zya Rana

IAS 2: Inventories

1.

Objective

The objective of IAS 2 is to prescribe the accounting treatment for inventories. It provides

guidance for determining the cost of inventories and for subsequently recognising an expense,

including any write down to net realisable value. It also provides guidance on the cost

formulas that are used to assign costs to inventories.

2.

Scope

IAS 2 applies to all inventories other than

Financial instruments (IAS 39)

Biological assets (IAS 41)

3.

Key definitions

Inventories include

Finished goods (assets held for sale in normal course of business)

Work in process (assets in production process for sale in the ordinary course of

business)

Raw materials (materials and supplies that are consumed in production)

4.

Net Realisable Value

The estimated selling price in the normal course of business less estimated cost of completion

and estimated cost of disposal.

5.

Measurement of Inventories

Inventories are required to be stated at the lower of cost and NRV (Net Realisable Value).

6.

Cost of Inventories

Cost should include all:

Costs of purchase (including taxes, transport and handling) net of trade discount

received.

Costs of conversion (including fixed and variable manufacturing overheads) and

Other costs incurred in bringing the inventories to their present location and condition.

1

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

7.

By:

Zya Rana

Cost of conversion of inventory

Cost of conversion of inventory includes costs directly attributable to the unit production for

example direct labor. The allocation of overhead to the cost of inventory is based on the

normal capacity of the facility.

8.

Excluded costs form inventory valuation

Inventory costs should not include:

9.

Abnormal waste

Storage costs

Selling costs

Administrative overheads unrelated to production

Interest cost when inventories are purchased with deferred settlement terms

Foreign exchange differences arising directly on the recent acquisition of inventories

invoiced in a foreign currency.

Methods for the Inventory Valuation:

FIFO (First In, First Out) Heterogeneous Nature Inventory Separately

Identifiable

AVCO (Weighted Average) Homogeneous Nature Inventory Cannot be

Separately Identifiable

10.

Systems for Valuation:

Perpetual System Continuous System

Periodic System

11.

Inventory should be recorded at Lowe of:

- Total Cost

- NRV (Net Realizable Value)

NRV = Estimated Selling Price – Estimated Cost to Sell

2

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

Inventory Relationship COGS and Profits

Normal I/S

Sales

Situation 1

Situation 2

2000

COGS

Opening stock

400

A: Purchases

200

L: Closing stock

(150)

COGS

(450)

Gross profit

1550

Expenses

(200)

Net Profit

1350

LAST YEAR Closing Stock Error found this year;

3

https://www.facebook.com/zya.rana

ACCA FR (F7): Financial Reporting

By:

Zya Rana

1.

A)

B)

C)

D)

Inventory should be stated at:

Lower of cost and fair value

Lower of cost and NRV

Lower of cost and nominal value

Lower of cost and net selling price

2.

A)

B)

C)

D)

Which of the following costs of conversion cannot be included in cost of inventory?

Cost of direct labor

Factory rent and utilities

Salaries of sales staff (sales deptt. Shares the building with factory supervisors).

Factory overheads based on normal capacity

3.

A)

B)

C)

D)

E)

F)

G)

Inventories are assets:

Used in the production or supply of goods and services for administrative purposes

Held for sale in ordinary course of business

Held for long-term capital appreciation

In the process of production for such sales

In the form of materials or supplies to be consumed in the production or the rendering

of services

Choices B and D

Choices B, D and E

4.

A)

B)

C)

D)

E)

F)

G)

The cost of inventory should not include:

Purchase Price

Import duties and other taxes

Abnormal amounts of wasted materials

Administrative overheads

Fixed and variable production overheads

Selling costs

Choices C, D and F

5.

ABC Co’ manufactures and sells paper envelopes. The stock of envelopes was included

in the closing inventory as of December 31, 2005, at a cost of $50 each per pack. During the

final audit, the auditors noted that the subsequent sales price for the inventory at January 15,

2006, was $40 each per pack. Furthermore, inquiry reveals that during the physical stock take,

a water leakage has created damages to the paper and the glue. Accordingly, in the following

week, ABC Co’ has spent a total of $15 per pack for repairing and reapplying glue to the

envelopes. The net realisable value and inventory write-down (loss) amount to:

A)

B)

C)

D)

E)

$40 and $10 respectively

$45 and $10 respectively

$25 and $25 respectively

$35 and $25 respectively

$30 and $15 respectively

4

https://www.facebook.com/zya.rana

ACCA (FR) F7: Financial Reporting

By:

Zya Rana

IAS 37: Provisions, Contingent Liabilities and Contingent Assets

Objective:

The objective of IAS 37 is to ensure that appropriate recognition criteria and measurement bases are applied to;

-

provisions, contingent liabilities and contingent assets and

-

that sufficient information is disclosed in the notes to the financial statements to enable users to

understand their nature, timing and amount

-

The Standard aims to ensure that only genuine obligations are dealt with in the financial statements planned future expenditure, even where authorised by the board of directors or equivalent governing

body, is excluded from recognition.

Provision:

Is a liability of

-

Uncertain time OR

Amount

Examples:

-

Provision of warranty claims

Legal claims provisions

Liability:

A present obligation arose due

- Past event &

- Future economic benefits outflow when? Yes

Liability:

-

How much? Yes

Possible obligation

arose due to past events

whose existence will depend upon future uncertain event &

event is not in entity’s control

Recognition of a Provision:

An enterprise must recognise a provision if, and only if:

o

a present obligation (legal or constructive) has arisen as a result of a past event (the obligating event),

payment is probable ('more likely than not'), and

o

the amount can be estimated reliably.

https://www.facebook.com/zya.rana

1

ACCA (FR) F7: Financial Reporting

By:

Zya Rana

Obligation:

Depends on the obligatory events

Types of obligatory events:

1.

Legal obligation ---------Defined by law

2.

Constructive obligation --------Written policies, Established pattern of past practices

Provisions:

Recurring nature events ----------Probability of past history

Examples:

- Warranty claims

- Provision of bad debts

-

One off nature events -------------Management best judgment of estimate

Examples:

- Dismantling cost

Onerous Contracts:

Means, Loss making contracts

Should we make provisions for onerous contracts?

YES

Restructuring:

Means, major change in business.

Examples:

Operation close

Automation

Subsidiary sale

Redundancy

Dismantling

Should we make provision for restructuring?

YES; If the following conditions met:

-

-

Detailed formal plan

affected parties should informed

public announcement

sale binding agreement

Future operating losses ----should not be taken in restructuring provisions

If losses arise on the sale of fixed assets, then to cover that loss, No provision should be made

https://www.facebook.com/zya.rana

2

ACCA (FR) F7: Financial Reporting

By:

Zya Rana

Some Examples of Provisions

Circumstance

Accrue a Provision?

Restructuring by sale of an operation

Accrue a provision only after a binding sale agreement

Restructuring by closure or reorganization

Accrue a provision only after a detailed formal plan is

adopted and announced publicly. A Board decision is not

enough

Warranty

Accrue a provision (past event was the sale of defective

goods)

Customer refunds