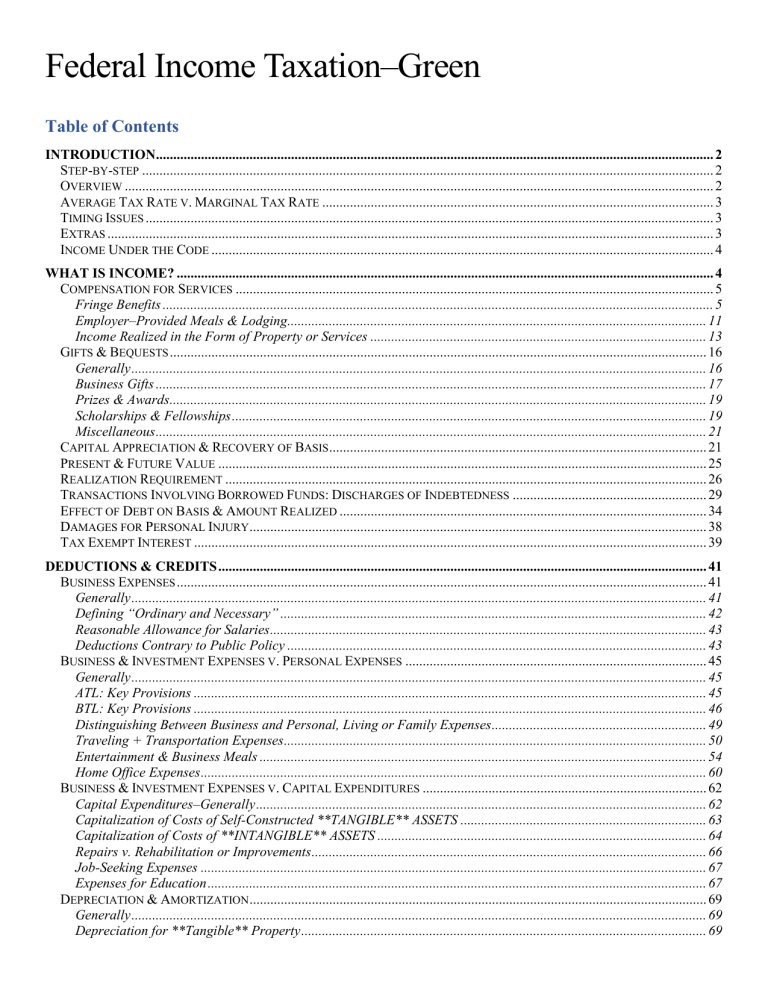

Federal Income Taxation–Green Table of Contents INTRODUCTION................................................................................................................................................................. 2 STEP-BY-STEP ..................................................................................................................................................................... 2 OVERVIEW .......................................................................................................................................................................... 2 AVERAGE TAX RATE V. MARGINAL TAX RATE ................................................................................................................. 3 TIMING ISSUES .................................................................................................................................................................... 3 EXTRAS ............................................................................................................................................................................... 3 INCOME UNDER THE CODE ................................................................................................................................................. 4 WHAT IS INCOME? ........................................................................................................................................................... 4 COMPENSATION FOR SERVICES .......................................................................................................................................... 5 Fringe Benefits ............................................................................................................................................................... 5 Employer–Provided Meals & Lodging......................................................................................................................... 11 Income Realized in the Form of Property or Services ................................................................................................. 13 GIFTS & BEQUESTS ........................................................................................................................................................... 16 Generally ...................................................................................................................................................................... 16 Business Gifts ............................................................................................................................................................... 17 Prizes & Awards........................................................................................................................................................... 19 Scholarships & Fellowships ......................................................................................................................................... 19 Miscellaneous ............................................................................................................................................................... 21 CAPITAL APPRECIATION & RECOVERY OF BASIS ............................................................................................................. 21 PRESENT & FUTURE VALUE ............................................................................................................................................. 25 REALIZATION REQUIREMENT ........................................................................................................................................... 26 TRANSACTIONS INVOLVING BORROWED FUNDS: DISCHARGES OF INDEBTEDNESS ........................................................ 29 EFFECT OF DEBT ON BASIS & AMOUNT REALIZED .......................................................................................................... 34 DAMAGES FOR PERSONAL INJURY .................................................................................................................................... 38 TAX EXEMPT INTEREST .................................................................................................................................................... 39 DEDUCTIONS & CREDITS ............................................................................................................................................. 41 BUSINESS EXPENSES ......................................................................................................................................................... 41 Generally ...................................................................................................................................................................... 41 Defining “Ordinary and Necessary” ........................................................................................................................... 42 Reasonable Allowance for Salaries .............................................................................................................................. 43 Deductions Contrary to Public Policy ......................................................................................................................... 43 BUSINESS & INVESTMENT EXPENSES V. PERSONAL EXPENSES ....................................................................................... 45 Generally ...................................................................................................................................................................... 45 ATL: Key Provisions .................................................................................................................................................... 45 BTL: Key Provisions .................................................................................................................................................... 46 Distinguishing Between Business and Personal, Living or Family Expenses .............................................................. 49 Traveling + Transportation Expenses .......................................................................................................................... 50 Entertainment & Business Meals ................................................................................................................................. 54 Home Office Expenses .................................................................................................................................................. 60 BUSINESS & INVESTMENT EXPENSES V. CAPITAL EXPENDITURES .................................................................................. 62 Capital Expenditures–Generally .................................................................................................................................. 62 Capitalization of Costs of Self-Constructed **TANGIBLE** ASSETS ....................................................................... 63 Capitalization of Costs of **INTANGIBLE** ASSETS ............................................................................................... 64 Repairs v. Rehabilitation or Improvements .................................................................................................................. 66 Job-Seeking Expenses .................................................................................................................................................. 67 Expenses for Education ................................................................................................................................................ 67 DEPRECIATION & AMORTIZATION .................................................................................................................................... 69 Generally ...................................................................................................................................................................... 69 Depreciation for **Tangible** Property ..................................................................................................................... 69 Special Rules ................................................................................................................................................................ 70 Depreciation of **Intangible** Property .................................................................................................................... 70 INTEREST .......................................................................................................................................................................... 72 Generally ...................................................................................................................................................................... 72 Economic Substance Doctrine...................................................................................................................................... 75 LOSSES .............................................................................................................................................................................. 76 Problems....................................................................................................................................................................... 77 Losses on Sales and Exchanges Between Related Persons .......................................................................................... 78 CHARITABLE CONTRIBUTIONS ......................................................................................................................................... 79 General Rationale ........................................................................................................................................................ 79 General Provisions & Concepts ................................................................................................................................... 80 Giving Appreciated Property as a Gift......................................................................................................................... 81 Tax Exempt Organizations ........................................................................................................................................... 83 Giving Services ............................................................................................................................................................. 84 CAPITAL GAINS & LOSSES........................................................................................................................................... 84 Mechanics..................................................................................................................................................................... 84 What is NOT a Capital Asset?...................................................................................................................................... 86 1231 Asset .................................................................................................................................................................... 87 Recapture ..................................................................................................................................................................... 88 Non-Recognition of Gain or Loss................................................................................................................................. 89 THE ALTERNATIVE MINIMUM TAX ......................................................................................................................... 90 Introduction Income tax = [taxable income, or “gross income” – deductions] x [tax rate] -- credits Step-by-step 1) Calculate gross income 2) Subtract “above-the-line” deductions (§ 62) adjusted gross income 3) Subtract “below-the-line” deductions (§§ 151, 63, 67) taxable income (§ 63) a) Personal exemptions (§ 151) + std deduction or itemized deductions (start with §§ 63, 67) 4) Apply tax rate schedules (§ 1) to taxable income tentative tax liability 5) Subtract any available tax credits Overview Gross Income includes: Gains derived from sales of securities, real estate, works of art, and other tangible & intangible property Gain Realized = Amount Realized – Adjusted Basis Ex: bought stock = $100, sold 5 yrs later = $150, thus $50 (GR) = $150 (AR) – $100 (AB) Accrual: increase in value of $10 for each of the 5yrs Realization: wait for event (disposition/sale) lump sum Why realization instead of accrual? Tax rates change wait. Time value of $ could earn interest. 2 Basis: portion of sales proceeds taxpayer can recover without incurring tax liability AB (in a purchased asset): purchase price (PP) adjusted upward or downward to reflect subsequent expenditures or tax benefits Losses: AB > sales price Not taken into account until realized by sale or other disposition of the property Preference: postpone as much as possible Deductions Business or investment expenses deductible Rules tighter for investment expenses Costs of earning income Personal expense NOT deductible Ordinary expense immediately deductible Won’t have value at end of year Ex: photo copy paper Capital expenditure NOT immediately deductible Deduct portion – depreciation Ex: photo copy machine Individual Deduction GI ATL deductions: few if any limits, ATL > BTL Business expenses, losses from sales of property AGI BTL deductions: Limits. Standard (avg - $6,300) or Itemized + Personal exemptions ($4,050) Average Tax Rate v. Marginal Tax Rate ATR = tax liability / taxable income o How much out of your taxable income are you paying in taxes? MTR: additional tax TP would owe if TP earned one additional $ of taxable income (last dollar of TI) Timing Issues Taxable year = calendar year for most individuals and businesses. Income or loss typically is allocated to one taxable year or another according to one of two basic methods of accounting. Cash Method: Most businesses and individuals Accrual Method: Most manufacturing, wholesale, retail and other corporations Income Deductions When received When paid Cash Method When earned When incurred (owed) Accrual Method Extras Everything is individual or sole proprietor Capital gains treated favorably Deductions of capital losses are limited ** Rev. Rul. are not binding. ** o Cts give little deference, and some give none. Terminology o Immediately deductible expenses o Capitalized expenditures Deductions v. Credits o Deductions reduce taxable income (look to marginal rate $1 = $0.28) 3 o Credits directly reduce tax liability (independent of tax rate, $1=$1) Alternative Minimum Tax o Purpose: prevent ppl from combining preferences, exclusions, deductions, and credits to yield tax liability of $0. o Top rate is much lower, base is much bigger (lower the rates and widen the base – Hutchens style) Income Under the Code ** All below-mentioned lists are non-exhaustive. I.R.C. § 61 (a) General definition. Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items: (1) Compensation for services, including fees, commissions, fringe benefits (undefined, form of compensation other than cash), and similar items; (2) Gross income derived from business; (3) Gains derived from dealings in property; (4) Interest; (5) Rents; (6) Royalties; (7) Dividends; (8) Alimony and separate maintenance payments; (9) Annuities; (10) Income from life insurance and endowment contracts; (11) Pensions; (12) Income from discharge of indebtedness; (13) Distributive share of partnership gross income; (14) Income in respect of a decedent; and (15) Income from an interest in an estate or trust. (b) Cross references §§ 71–90: items specifically included in gross income §§ 101–150: items specifically excluded from gross income What is Income? Not defined in Code. Definitions of Income SCOTUS: “Undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion” – Glenshaw Glass (1955) “Income” should be broadly construed in the absence of a specific congressional directive to the contrary Haig-Simons (H-S) Taxable Income = net worth + FMV of personal consumption During taxable year = Saving (acquire any asset that lasts longer than the year) + consumption Look at increase in net worth over the year and consumption Don’t look at what comes in Examples: start w/ net worth = $0. 1) Earn $100 salary, use to buy stock for $100, FMV of stock at end of year is $100. - Buying of stock is not deductible (capital expenditure) 4 - Gross income & taxable income = $100 - H-S, same 2) Same, except FMV of stock at end of year is $120 - Only $100 of income, appreciation is not taxable until realized (not yet sold) - H-S you are richer, accrual (doesn't have realization requirement) 3) Earn $100 of salary, use to see Carmen at the Met for $100 - Not deductible, personal expense (if take client, then business deductible) - H-S, no increase in net worth, started from the bottom, still at the bottom. Compensation for Services Fringe Benefits in kind benefits + ER-EE relationship. Usually where TP provides services as an EE and ER provides EE with something other than cash that makes TP better off. Q: Should these benefits be considered income? - Many not subject to income tax under current law, not because they are not income, but because Congress has chosen to treat them specially. Remember § 61(a) “Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items: compensation for services, including fees, commissions, fringe benefits, and similar items” Treas. Reg. 161-1(a) “Gross income includes income realized in any form, whether in money, property, or services.” § 132(a) Fringe Benefits The following are excludable: (1) No-additional-cost service (2) Qualified EE discount (3) Working condition fringe (4) De minimis fringe (5) Qualified transportation fringe (6) Qualified moving expense reimbursement (7) Qualified retirement planning services No-Additional-Cost Service § 132(b): Any service provided by an ER to an EE for use by such EE if– (1) offered for sale to customers in the ordinary course of the line of business (2) ER incurs no substantial additional cost (including forgone revenue) in providing such service to the EE (determined w.o regard to any amount paid by the EE for such service) ** Watch for discrimination 132(j)(1) ** Treas. Reg. 1.132-2(a)(2): Excess capacity services are eligible for treatment as no-additional-cost services Hotel accommodations Transportation by aircraft, train, bus, subway, cruise line Telephone services Non-excess capacity services are NOT eligible; but may be eligible for qualified EE discount of up to 20% of the value of the service provided (see 1.132-3) Facilitation by a stock brokerage firm of purchase of stock Problem A commercial airline permits its EEs and their families to fly for free on any scheduled flight on a standby basis. Does TP have TI as a result? Would your answer be different if airline served a free meal on the flight? Answer 5 - - Flight = excludable o No-additional-cost service under 132(b) Meal excludable o If doesn’t cost much, likely excludable under 132(b) bc meals are usually served on flights (ordinary course of the line of business) and ER wouldn’t incur a substantial additional cost Note: 1.132-2(a)(5)(ii) directly addresses in-flight meals o “…the in-flight services of a flight attendant and the cost of in-flight meals provided to airline EEs traveling on a space-available basis are merely incidental to the primary service being provided (i.e., air transportation). Similarly, maid service provided to hotel EEs renting hotels rooms on a space-available basis is merely incidental to the primary service being provided (i.e., hotel accommodations). Qualified Employee Discount § 132(c) (1) An EE discount with respect to qualified property or services to the extent such discount < (A) Property – gross profit percentage of price at which property is offered by ER to customers, or (B) Services – 20% of price at which services are offered by ER to customers. (3) “EE discount” means amount by which– (A) Price at which property or services are provided by ER to an EE for use by such EE, is < (B) Price at which such property or services are being offered by ER to customers. (4) “Qualified property or services” = any property (not real property or personal property held for investment) or services which are offered for sale to customers in the ordinary course of the line of business of the ER in which the EE is performing services ** Watch for discrimination 132(j)(1) ** Problem Airline from problem above also permits EE to purchase reserved seat tickets for themselves or their family members at a 10% discount. Scott buys such a ticket for himself. Does Scott have taxable income as a result? Answer - No taxable income. o Discount = qualified EE discount under 132(c) bc it is < 20% - Likely not a no-additional-cost service bc if reserved, then there is additional cost can’t sell to a customer (open seat would go to waste if you didn’t fill it) Working Condition Fringe § 132(d): any property or services where if EE paid for it would be deductible under 162 or 167 ordinary & necessary business expense De Minimis Fringe § 132(e) (1) Any property or service the value of which is (after taking into account the frequency with which similar fringes are provided by the ER to the EEs) so small as to make accounting for it unreasonable or administratively impracticable. (2) Operation by an ER of any eating facility for EEs = de minimis fringe if– (A) facility is located on or near business premises of ER, AND (B) revenue from facility normally > direct operating costs of facility The preceding sentence shall apply with respect to any highly-compensated EE only if access to the facility is available on substantially the same terms to each member of a group of EEs which is defined under a reasonable classification set up by the ER which does not discriminate in favor of highly compensated EEs. For purposes of subparagraph (B), an EE entitled under section 119 to exclude the value of a meal provided at such facility shall be treated as having paid an amount for such meal equal to the direct operating costs of the facility attributable to such meal Treas. Reg. 1.132-1(b)(4): for purposes of § 132(a)(4) (de minimis fringe) “EE” means any recipient of a fringe benefit 6 Partners, sole proprietors & independent contractors = EEs Treas. Reg. 1.132-6 (a) In General— Gross income does not include the value of a de minimis fringe provided to an EE. The term “de minimis fringe” means any property or service the value of which is (after taking into account the frequency with which similar fringes are provided by the ER to the ER's EEs) so small as to make accounting for it unreasonable or administratively impracticable. (b) Frequency (1) EE-measured frequency. Frequency is determined by reference to frequency with which ER provides fringes to each individual EE. Ex: if ER provides a free meal in kind to one EE on a daily basis, but not to any other EE, the value of the meals is not de minimis with respect to that one EE even though with respect to the ERs entire workforce the meals are provided “infrequently.” (2) ER-measured frequency. Notwithstanding the rule of paragraph (b)(1) of this section, except for purposes of applying the special rules of paragraph (d)(2) of this section, where it would be administratively difficult to determine frequency with respect to individual EE, the frequency with which similar fringes are provided by the ER to EEs is determined by reference to the frequency with which ER provides fringes to the workforce as a whole. Therefore, under this rule, the frequency with which any individual EE receives such a fringe benefit is not relevant and in some circumstances, the de minimis fringe exclusion may apply with respect to a benefit even though a particular EE receives the benefit frequently. Ex: if ER exercises sufficient control and imposes significant restrictions on personal use of company copying machine so that at least 85% of use is for business purposes, any personal use of copying machine by particular EEs is considered a de minimis fringe. (d) Special Rules (2) Occasional meal money or local transportation fare. Meals, meal money, or local transportation fare provided to an EE is excludable as a de minimus fringe benefit if the benefit provided is reasonable and is provided in a manner that satisfies three conditions: The services must be provided on an occasional basis The services must be provided bc EE must work overtime Regarding meals and meal money, they must be provided to enable EE to work overtime. (e) Examples (1) Benefits excludable from income. Occasional typing of personal letters by a company secretary; occasional personal use of copying machine (provided ER exercises sufficient control and imposes significant restrictions on personal use of machine so that at least 85% of use is for business purposes); occasional cocktail parties, group meals, or picnics for EEs and their guests; traditional birthday or holiday gifts of property (not cash) with a low fair market value; occasional theater or sporting event tickets; coffee, doughnuts, and soft drinks; local telephone calls; and flowers, fruit, books, or similar property provided to EEs under special circumstances (e.g., on account of illness, outstanding performance, or family crisis). (2) Benefits not excludable as de minimis fringes. Season tickets to sporting or theatrical events; the commuting use of an ER-provided automobile or other vehicle > one day/month; membership in a private country club or athletic facility (regardless of the frequency with which the EE uses the facility); ER-provided group-term life insurance on the life of the spouse or child of an EE; and use of ER-owned or leased facilities (such as an apartment, hunting lodge, boat, etc.) for a weekend. Some amount of the value of certain of these fringe benefits may be excluded from income under other statutory provisions, such as the exclusion for working condition fringes. See 1.132-5. Problem 7 You are an associate in a law firm. The firm follows a policy of reimbursing its associates for the cost of dinner at a restaurant and taxi fare home on any day on which the associate works past 8:00pm. If you regularly work until 9:00pm and regularly receive dinner and taxi expense reimbursements, do you have TI as a result? - - Answer YES, not a de minimis fringe you have taxable income. o 132(e) easily accountable + not administratively impractical o Does not meet 1.132-6(d)(2) requirements [Regular occasional] + [regular = no overtime] HOWEVER, law is what the IRS enforces and it does not enforce this. Firms usually exclude this stuff. Qualified Transportation Fringe § 132(f) (1) Any of the following provided by ER to EE. (A) Transportation in commuter hwy vehicle if in connection with travel btwn EE’s residence + place of employment (B) Any transit pass. (C) Qualified parking (2) Amount excludable is capped at (A) $100/m for aggregate of transportation in commuter hwy vehicle + transit pass (B) $175/ m for qualified parking (C) The applicable annual limitation in the case of any qualified bicycle commuting reimbursement. In the case of any month beginning on or after the date of the enactment of this sentence and before January 1, 2014, subparagraph (A) shall be applied as if the dollar amount therein were the same as the dollar amount in effect for such month under subparagraph (B). (3) QTF includes cash reimbursements. (4) No Constructive Receipt. No amount shall be included in the gross income of an EE solely because the EE may choose between any qualified transportation fringe (other than a qualified bicycle commuting reimbursement) and compensation which would otherwise be includible in gross income of such EE. (5) Definitions (C) Qualified parking: parking provided to an EE on or near business premises of ER or on or near a location from which EE commutes to work by transportation described in (1)(A), in a commuter hwy vehicle, or by carpool. Does not include any parking on or near property EE uses for residential purposes. (6) Inflation Adjustment (A) In General. In the case of any taxable year beginning in a calendar year after 1999, the dollar amounts contained in subparagraphs (A) and (B) of paragraph (2) shall be increased by an amount equal to— (i) Such dollar amount, multiplied by (ii) The cost-of-living adjustment determined under section 1(f)(3) for the calendar year in which the taxable year beings, by substituting “calendar year 1998” for “calendar year 1992.” In the case of any taxable year beginning in a calendar year after 2002, clause (ii) shall be applied by substituting “calendar year 2001” for “calendar year 1998” for purposes of adjusting the dollar amount contained in paragraph (2)(A). (B) If any increase determined under subparagraph (A) is not a multiple of $5, such increase shall be rounded to the next lowest multiple of $5. (7) Coordination with Other Provisions. Working condition fringe and de minimis fringe do not include any qualified transportation fringe. Problem ER provides free parking to EE in building where law firm is located. FMV = $300/m. Does EE have taxable income as a result? Answer 8 - YES $55 of TI. o Parking = qualified parking under 132(f)(5)(C) o 132(f)(2)(B) limits to $175/m $125 of TI o Must also adjust for inflation 132(f)(6) CCH p. xii, (Rev. Proc. 2015-53, 3015-44 I.R.B. 615) excludable amount for free parking is $255. $300-$255 = $45. Problem ER provides free parking in the building only to partners. Do partners who take advantage of this benefit have taxable income as a result? Answer - YES. Whole amount is taxable. o Partner EE @ CL & under tax law partners, sole proprietors & independent contractors EEs o No discrimination issue bc 132(j)(1) does not apply. Even if provided to everyone, partners will be taxed Qualified Moving Expense Reimbursement § 132(g) —Any amount received (directly or indirectly) by an individual from an ER as a payment for (or a reimbursement of) expenses which would be deductible as moving expenses under section 217 if directly paid or incurred by the individual. Such term shall not include any payment for (or reimbursement of) an expense actually deducted by the individual in a prior taxable year. Certain Individuals Treated as EEs for Purposes of Subsections (a)(1) and (2) § 132(h): For no-additional-cost service & qualified EE discount (1) Retired and Disabled EEs and Surviving Spouse of EE Treated as EE—With respect to a line of business of an ER, the term “EE” includes (A) Any individual formerly employed and separated bc of retirement or disability, and (B) Any widow or widower of any individual who died while employed by such ER in such line of business or while an EE within the meaning of subparagraph (A) (2) Spouse and Dependent Children (A) In General—spouse or a dependent child of EE = EE. (B) Dependent Child— any child (as defined in section 152(f)(1)) of the EE- (i) Who is a dependent of the EE, or (ii) Both of whose parents are deceased and who has not attained age 25 For purposes of the preceding sentence, any child to whom section 152(e) applies shall be treated as the dependent of both parents. (3) Special Rule for Parents in the Case of Air Transportation—Parent of an EE (determined without regard to paragraph (1)(B)) = EE. Problem Airline permits EE to purchase reserved seat tickets for themselves or their family members at a 10% discount. Scott buys such a ticket for his wife. Does Scott or his wife have taxable income as a result? Answer - No, neither have TI. 132(h)(2)(A) spouse = EE. Problem Scott buys a discounted ticket for his dad. Does Scott or his father have taxable income as a result? Answer - No, neither have taxable income. 132(h)(3) parents = EEs. Reciprocal Agreements 9 § 132(i): For purposes of paragraph (1) of subsection (a), any service provided by an ER to an EE of another ER shall be treated as provided by the ER of such EE if— (1) Such service is provided pursuant to a written agreement between such ERs (2) Neither of such ERs incurs and substantial additional costs (including forgoing revenue) in providing such service or pursuant to such agreement. Special Rules § 132(j) (1) Exclusions Under Subsection (a)(1) and (2) Apply To Highly Compensated EEs Only If No Discrimination—Paragraphs (1) (no-additional-cost service) and (2) (qualified EE discount) of subsection (a) shall apply with respect to any fringe benefit described therein provided with respect to any highly compensated EE only if such fringe benefit is available on substantially the same terms to each member of a group of EEs which is defined under a reasonable classification set up by the ER which does not discriminate in favor of highly compensated EEs. (4) On-Premises Gyms and Other Athletic Facilities— (A) In General—Gross income shall not include the value of any on-premises athletic facility provided by an ER to his EEs. (B) On-Premises Athletic Facility—For purposes of this paragraph, the term “on-premises athletic facility” means any gym or other athletic facility— (i) Which is located on the premises of the ER, (ii) Which is operated by the ER, and (iii) Substantially all the use of which is by EEs of the ER, their spouses, and their dependent children (within the meaning of subsection (h)). (6) Highly Compensated EE—For purposes of this section, the term “highly compensated EE” has the meaning given such term by section 414(q) (7) Air Cargo—For purposes of subsection (b), the transportation of cargo by air and the transportation of passengers by air shall be treated as the same service. (8) Application of Section to Otherwise Taxable Educational or Training Benefits—Amounts paid or expenses incurred by the ER for education or training provided to the EE which are not excludable from gross income under section 127 shall be excluded from gross income under this section is (and only if) such amounts or expenses are a working condition fringe. Problem Airline only allows top executives to purchase reserved seat tickets at a 10% discount. Does an executive who purchases such a ticket have taxable income as a result? Answer - YES. Not excludable under 132(j). o Discount = qualified EE discount under 132(c) bc it is < 20% o HOWEVER, only top execs = discriminatory 132(j) limits. Customers Not to Include EEs § 132(k)—For purposes of this section (other than subsection (c)(2)), the term “customers” shall only include customers who are not EEs. Section Not to Apply to Fringe Benefits Expressly Provided for Elsewhere § 132(l)—This section (other than subsections (e) and (g)) shall not apply to any fringe benefits of a type the tax treatment of which is expressly provided for in any other section of this chapter. Regulations § 132(o)—The Secretary shall prescribe such regulations as may be necessary or appropriate to carry out the purposes of this section. 10 Economic Analysis What is the most efficient way to tax? * A rule is inefficient if it makes someone worse off and no-one better off * Goal: No distortion of provision of fringe benefits neutral system. Efficient valuation = Ee's (marginal) willingness to pay o But subjective… o However, at equilibrium Ee's (marginal) willingness to pay = Er's cost (accounting cost) - any noncompensatory benefit ER receives Ex: Qualified EE discount non-compensatory benefit EE may be more familiar w/ product (this isn’t something they would get if they used cash) Qualified Ee discount should be excluded o [ERs cost (which is probably < FMV)] – [significant non-compensatory benefit to ER] 20% discount No additional cost service = should be excluded cost is 0 sort of by definition Employer–Provided Meals & Lodging Benaglia: [manager of luxury hotels in HA given free meals + lodging] Salary = $10k, IRS adds FMV (M+L) = $8k. If furnished for the convenience of the ER, not taxable. If compensatory, then taxable. Non-compensatory benefit to ER (needed EE to be on-call 24hrs) = FMV (ER’s cost) excluded Dissent: this kid manages TWO hotels and wasn't living in the other one! He also took several leaves of absences for months at a time away from HA! Didn’t seem to really impact his job duties or the running of the hotel! Alt.: Ee's willingess to pay = $3,600 Green - exclusion is the wrong answer bc 0 is the wrong answer. Doesn’t think benefit = cost in this case. * Codified in § 119 (below). § 119—Meals or Lodging Furnished for the Convenience of the ER (a) Meals and Lodging Furnished to EE, his Spouse, and his Dependents, Pursuant to Employment—There shall be excluded from gross income of an EE the value of any meals or lodging furnished to him, his spouse, or any of his dependents by or on behalf of his ER for the convenience of the ER, but only if— (1) In the case of meals, the meals are furnished on the business premises of the ER, or (2) In the case of lodging, the EE is required to accept such lodging on the business premises of his ER as a condition of employment. (b) Special Rules—For purposes of subsection (a)— (1) Provisions of Employment Contract or State Statute not to Determinative—In determining whether meals or lodging are furnished for the convenience of the ER, the provisions of an employment contract or of a State statute fixing terms of employment shall not be determinative of whether the meals or lodging are intended as compensation. (2) Certain Factors not Taken into Account with Respect to Meals—In determining whether meals are furnished for the convenience of the ER, the fact that a charge is made for such meals, and the fact that the EE may accept or decline meals, shall not be taken into account. (3) Certain Fixed Charges for Meals— (A) In General—If— (i) An EE is required to pay on a periodic basis a fixed charge for meals, and (ii) Such meals are furnished by the ER for the convenience of the ER, there shall be excluded from the EE’s gross income an amount equal to such fixed charge. (B) Application of Subparagraph (A)—Subparagraph (A) shall apply— 11 (i) Whether the EE pays the fixed charge out of his stated compensation or out of his own funds, and (ii) Only if the EE is required to make the payment whether he accepts or declines the meal. (4) Meals Furnished to EEs on Business Premises Where Meals or Most EEs are Otherwise Excludable—All meals furnished on the business premises of an ER to such ER’s EEs shall be treated as furnished for the convenience of the ER if, without regard to this paragraph, more than half of the EEs to whom such meals are furnished on such premises are furnished such meals for the convenience of the ER. Treas. Reg. 1.119-1 (a) Meals (1) In General—The value of meals furnished to an EE by his ER shall be excluded from the EE's gross income if two tests are met: (i) The meals are furnished on the business premises of the ER, and (ii) the meals are furnished for the convenience of the ER. The question of whether meals are furnished for the convenience of the ER is one of fact to be determined by analysis of all the facts and circumstances in each case. If the tests described in subdivisions (i) and (ii) of this subparagraph are met, the exclusion shall apply irrespective of whether under an employment contract or a statute fixing the terms of employment such meals are furnished as compensation. (2) Meals Furnished Without a Charge— (i) Meals furnished by an ER without charge to the EE will be regarded as furnished for the convenience of the ER if such meals are furnished for a substantial non-compensatory business reason of the ER. If an ER furnishes meals as a means of providing additional compensation to his EE (and not for a substantial non-compensatory business reason of the ER), the meals so furnished will not be regarded as furnished for the convenience of the ER. Conversely, if the ER furnishes meals to his EE for a substantial non-compensatory business reason, the meals so furnished will be regarded as furnished for the convenience of the ER, even though such meals are also furnished for a compensatory reason. In determining the reason of an ER for furnishing meals, the mere declaration that meals are furnished for a noncompensatory business reason is not sufficient to prove that meals are furnished for the convenience of the ER, but such determination will be based upon an examination of all the surrounding facts and circumstances. In subdivision (ii) of this subparagraph, there are set forth some of the substantial non-compensatory business reasons which occur frequently and which justify the conclusion that meals furnished for such a reason are furnished for the convenience of the ER. In subdivision (iii) of this subparagraph, there are set forth some of the business reasons which are considered to be compensatory and which, in the absence of a substantial non-compensatory business reason, justify the conclusion that meals furnished for such a reason are not furnished for the convenience of the ER. (ii) Examples of non-compensatory business reasons (including Banaglia scenario) (iii) If meals are furnished to promote the morale or goodwill of the EE, or to attract prospective EEs, then meals = furnished for a compensatory business reason. Remember: the bigger the value of the non-compensatory benefit, the closer it becomes 0 and should be excluded. See equation above. (3) Meals Furnished With a Charge (i) Discusses when the EE may or may not purchase the meals offered by the ER. Says that they are not for the convenience of the ER (ii) Discuses when the EE is charged a flat-rate whether or not he chooses to accept the meal. The flat rate charge is not part of income. However, whether the value of the meal is excludable from gross income is determined by the subsection (2). Gotcher: [Expenses paid trip for Mr & Mrs by non-ER] IRS: cost of trip is TI. §61 case, broad reading, unless a statutory exclusion, then it covers. 12 VW paid for cost and there was no Er-Ee relationship (can't use 119) Ct of App: Non-compensatory things can be income. But IRS is too broad. (Old cases said income = compensation for income or capital; Glenshaw v. Glass re-defined this with accession of wealth idea.) Primary test: intent of the Er. Could they have provided him with just cash? Legitimate business purpose Once again, look at the non-compensatory benefit to Er of the equation! EEs willingness to pay Trip was oriented to business. Did traveler have any choice but to go? Ct: this was not a trip he would want to take bc it was pure business (not pleasure) Economic benefit will be taxable to the recipient only when the payment of expenses serves no legitimate corporate purpose. If indirect gain is subordinate to an overall business purpose not taxed. Mrs. G's trip was a vacation and is taxable. Only nontaxable if wife's presence is necessary to the conduct of business, would expenses be deductible under §162 Green - thinks you could make a business reason argument ** Looking at both sides of the equation, the value of trip is low exclude ** Problem A Washington, D.C. law firm invites Alice, a Cornell Law School student, to Washington for a call-back. The firm flies her to Washington, puts her up in the Four Seasons Hotel, and takes her to lunch at the Willard Room and to dinner at Citronelle. Does Alice have taxable income as a result of this trip? Answer - NO o Not an EE + not on business premises not 119 o Not an EE so not 132 * Perhaps de minimis fringe (anyone who receives a benefit = EE 1.132-1(b)(4)) but can easily account so no… o Gotcher: firm isn’t trying to compensate the student, must emphasize non-compensatory benefit fit, how just giving cash to recruit would not achieve the same ends. o Also Rev. Rul. 63-77 (108): excludes income allowances or disbursements made to individuals by prospective ER for expenses including M+L incurred bc of interview invited by the ER. Problem Do the attorneys who accompany Alice to lunch and dinner have taxable income as a result? Answer - NO o Likely working condition fringe 132(d) Remember: If EE had purchased item themselves, would TP be able to deduct cost under 162 or 167? Yes, meals = ordinary or necessary business expense Income Realized in the Form of Property or Services Almost always corporate stock Liquidity problem: how do you pay the tax if restricted stock? Wait until it vests! Then reason, could sell stock for cash to pay the tax. When either transferable or not subject to a substantial risk of forfeiture Substantially vested (Treas. Reg. 1.83-3(b)) Treas. Reg. 1.61-1. Gross Income (a) General Definition—Gross income means all income from whatever source derived, unless excluded by law. Gross income includes income realized in any form, whether in money, property, or services. Income may be realized, therefore, in the form of services, meals, accommodations, stock, or 13 other property, as well as in cash. Section 61 lists the more common items of gross income for purposes of illustration . . . . Gross income, however, is not limited to the items so enumerated. Treas. Reg. 1.61-2 (d) Compensation Paid Other Than in Cash (1)—In General—Except as otherwise provided in paragraph (d)(6)(i) of this section (relating to certain property transferred after 1969), if services are paid for in property, the FMV of the property taken in payment must be included in income as compensation. If services are paid for in exchange for other services, the FMV of such other services taken in payment must be included in income as compensation. If the services are rendered at a stipulated price, such price will be presumed to be the FMV of the compensation received in the absence of evidence to the contrary. Sec 83: Property Transferred In Connection with Performance of Services (a) General Rule—If, in connection with the performance of services, property is transferred to any person other than the person for whom such services are performed, the excess of— (1) The fair market value of such property (determined without regard to any restriction other than a restriction which by its terms will never lapse) at the first time the rights of the person having the beneficial interest in such property are transferable or are not subject to a substantial risk of forfeiture, whichever occurs earlier, over (2) The amount (if any) paid for such property, Shall be included in the gross income of the person who performed such services in the first taxable year in which the rights of the person having the beneficial interest in such property are transferable OR are not subject to a substantial risk of forfeiture, whichever is applicable. The preceding sentence shall not apply if such person sells or otherwise disposes of such property in an arm’s length transaction before his rights in such property become transferable or not subject to a substantial risk of forfeiture. *** If you think stock will appreciate, this becomes less attractive *** (b) Election to Include in Gross Income in Year of Transfer— (1) In General— Any person who performs services in connection with which property is transferred to any person may elect to include in his gross income for the taxable year in which such property is transferred, the excess of— (A) The fair market value of such property at the time of transfer (determined without regard to any restriction other than a restriction which by its terms will never lapse), over (B) The amount (if any) paid for such property. If such election is made, subsection (a) shall not apply with respect to the transfer of such property, and if such property is subsequently forfeited, no deduction shall be allowed in respect of such forfeiture. (2) Election—An election under paragraph (1) with respect to any transfer of property shall be made in such manner as the Secretary prescribes and shall be made not later than 30 days after the date of such transfer. Such election may not be revoked except with the consent of the Secretary. (c) Special Rules—For purposes of this section— (1) Substantial Risk of Forfeiture—The rights of a person in property are subject to a “substantial risk of forfeiture” if such person’s rights to full enjoyment of such property are conditioned upon the future performance of substantial services by any individual. (2) Transferability of Property—The rights of a person in property are “transferable” only if the rights in such property of any transferee are not subject to a substantial risk of forfeiture. (3) Sales Which May Give Rise to Suit Under Section 16(b) of the Securities Exchange Act of 1934—So long as the sale of property at a profit could subject a person to suit under section 16(b) of the Securities Exchange Act of 1934, such person’s rights in such property are— (A) Subject to a substantial risk of forfeiture, and (B) Not transferrable 14 (4) For purposes of determining an individual’s basis in property transferred in connection with the performance of services, rules similar to the rules of Sect. 72(w) shall apply. (e) Applicability of Section—This section shall NOT apply to— (3) The transfer of an option without a readily ascertainable FMV (4) The transfer of property pursuant to the exercise of an option with a readily ascertainable FMV at the date of grant. (f) Holding Period—In determining the period for which the taxpayer has held property to which subsection (a) applies, there shall be included only the period beginning at the first time his rights in such property are transferable or are not subject to a substantial risk of forfeiture, whichever occurs earlier (h) Deduction By Employer—In the case of a transfer of property to which this section applies or a cancellation of a restriction described in subsection (d), there shall be allowed as a deduction under Sec 162, to the person for whom were performed the services in connection with which such property was transferred, an amount equal to the amount included under subsection (a), (b), or (d)(2) in the gross income of the person who performed such services. Such deduction shall be allowed for the taxable year of such person in which or with which ends the taxable year in which such amount is included in the gross income of the person who performed such services. ER’s deduction (providing compensation, see cash/stock ex in notes below) is matched by EE’s income ER will want EE to take 83(b) election so they can get deduction earlier, whereas EE will want to postpone paying tax until later and want 83(a) Treas. Reg. 1.83-1: Property Transferred in Connection with the Performance of Services (a) Inclusion in Gross Income (1) General Rule—Sec 83 provides rules for the taxation of property transferred to an employee or independent contractor (or beneficiary thereof) in connection with the performance of services by such employee or independent contractor. In general, such property is not taxable under Sec 83(a) until it has been transferred (as defined in 1.83-3(a)) to such person and become substantially vested (as defined in 1.83-3(b)) in such person. In that case, the excess of— (i) The FMV of such property (determined without regard to any lapse restriction, as defined in 1.83-3(i)) at the time that the property becomes substantially vested, over (ii) The amount (if any) paid for such property. Shall be included as compensation in the gross income of such employee or independent contractor for the taxable year in which the property becomes substantially vested. Until such property becomes substantially vested, the transferor shall be regarded as the owner of such property, and any income from such property received by the employee or independent contractor (or beneficiary thereof) or the right to the use of such property by the employee or independent contractor constitutes additional compensation and shall be included in the gross income of such employee or independent contractor for the taxable year in which such income is received or such use is made available. This paragraph applies to a transfer of property in connection with the performance of services even though the transferor is not the person for whom such services are performed. Treas. Reg. 1.83-3(b) Substantially Vested and Substantially Non-vested Property For purposes of Sec 83 and the regulations thereunder, property is substantially non-vested when it is subject to a substantial risk of forfeiture, within the meaning of paragraph (c) of this section, and is non-transferable within the meaning of paragraph (d) of this section. Property is substantially vested for such purposes when it is either transferable or not subject to a substantial risk of forfeiture. NOTES: When stock vests: 15 ER gives stock to EE, or IRS claim: ER gives EE $5k in cash (compensation), and EE buys stock from ER In the end, same thing Choice: 83(a) or 83(b)? 83(a) if: Think stock will go down Don’t think you will stay for time period before vesting With inflation values are relative, so even though taxed on more money, could be better option Make 83(b) election if: Stock is worth very little and think it will appreciate Think you will stay for time period before vesting (would forfeit if leave) Receiving dividends Under 83(a) ER gets dividends and then gives to EE inform of compensation (40% tax) Under 83(b) dividends from stock are capital gains 20% tax Also consider impact on ER’s deduction. ER + EE against the IRS, look at both and share tax savings amongst yourself. Problem X Corp. gives TP, an EE, a share of restricted X stock. Terms of restricted stock are: (1) EE may not transfer the stock for 5 yrs, and (2) if EE terminates employment during that 5-yr period, EE must return stock to X. FMV of unrestricted stock: = 2k at time of transfer of restricted stock to EE = 5k at time of vesting (5 years after transfer to EE). = 8k at time of sale by EE (10 yrs after transfer to EE) How much taxable income does TP have under § 83(a) and 83(b)? Answer (1) = not transferable, (2) = stock is subject to substantial risk of forfeiture. Have to wait until 5 yr period is up until stock is substantially vested under Treas. Reg. 1.83-3(b). Income At transfer to EE At vesting At sale by EE Total $0 $5,000 $3,000 $8,000 § 83(a) $2,000 $0 $6,000 $8,000 § 83(b) Remember: Gross income includes gain under 61 GR = AR – AB o AR = amount received in exchange for property o AB = (usually) amount paid for the property o At sale reasoning: Over the entire 10 yr period, TP’s total income (increase in net worth) = 8k, and I have either paid taxes on 5k, or 2k, which means I must have taxable income when I sell of 3k, or 6k Hard to say which is better. o Although, tax at sale is capital gain so will be taxed at lower rate 83(b) might be better option but usually won’t know what these #s are going to be in 5 or 10 yrs. Gifts & Bequests Generally § 102–Gifts and Inheritances (a) General Rule–Gross income does not include that value of property acquired by gift, bequest, devise, or inheritance. Two main categories: 16 Non-Business (aka Personal gifts) Business Gifts amongst family members, Christmas gift… Changed dramatically in 1986 Donor gift donee Pre-1986 §162 deduction so long as (appropriate) Donee: No taxable income §102(a) important to business o According to H-S and Glenshaw (increase in net Still not included in income under §61 worth) def looks like this is income… Wanted to reinterpret "gift" Donor: no deduction Duberstein §102 o §274(b) - limitations on deductions Post1986 Policy argument: donor likely in higher bracket (has capital to §102(c) & §274(b) give gift) so IRS will actually lose MORE money than take in bc deduction is subject to marginal tax Business Gifts Origins Duberstein: [Thanks for referring customers to me, here is a Cadillac] NOT a gift. At bottom was a recompense for past services, or an inducement for him to be of further service in the future RULE: gift must proceed from detached and disinterested generosity. Matter of fact-finding Look at motive of gift-giver Can’t be: given out of expectation of future services, or inducing future services, or as compensation for past services already preformed Stanton: [$20k when retired] Gift, not taxable. If make a practice of this, then may be inducing other EEs to do better work and not considered a gift. Post-Duberstein & Stanton Sec 102(c)—Employee Gifts (1) In General—Subsection (a) shall not exclude from gross income any amount transferred by or for an employer to, or for the benefit of, an employee. Basically, § 102 does not apply in ER-EE context. (2) Cross References—For provisions excluding certain employee achievement awards from gross income see Sec. 74(c). For provisions excluding certain de minimis fringes from gross income, see Sec 132(e). Sec 274(b)—Gifts Deduction— (1) Limitation—No deduction shall be allowed under Sec 162 or Sec 212 for any expense for gifts made directly or indirectly to any individual to the extent that such expense, when added to prior expenses of the taxpayer for gifts made to such individual during the same taxable years, exceeds $25. For purposes of this section, the term “gift” means any item (1) excludable from gross income of the recipient under section 102 (2) which is not excludable from his gross income under any other provision of this chapter . . . NOTE: Recognize how these two sections interact with 102 to ensure (almost always–see DM fringe stuff below) that the IRS is getting paid by someone no matter what. If recipient can exclude (according to §102), then can't deduct. If gift from Er to Ee, Er will never be able to deduct. If recipient can't exclude (according to §102), then can deduct. SUMMARY: 17 Donor’s Motivation (Intent) Donor Employs Donee? Helpful to Donor’s Business*? (Effect) Generosity No No Generosity No Yes Other (compensation, quid pro quo, etc. past services) No Yes Yes Yes – anytime you give to an EE you can always argue that it is helpful to the business Any Tax Treatment of Donor Non-deductible (not an “ordinary and necessary” business expense 162) Deductible as a business expense, but deduction limited to $25 per person per year because it is a “gift” for purposes of 274(b)** Fully deductible as a business expense; it is not a “gift” for purposes of 274(b) Fully deductible as a business expense 162; it is not a “gift” for purposes of 274(b) Tax Treatment of Donee Excludable 102(a) Excludable 102(a) Not excludable under 102(a) because it is not a “gift” under Duberstein Not excludable under 102(a) because of 102(c); it might, however, be excludable as a fringe benefit (e.g., a de minimis fringe) * Business used broadly, covers “investment” ** Unless the gift is excludable from gross income of the recipient under some other tax provision in addition to §102(a). Problem A corp. gives all staff a present at Christmas time. Do the staff have taxable income? May the corp. deduct the cost of the presents? Answer - Staff can’t exclude unless de minimis fringe. o Not excludable as a gift under 102(c) (says 102(a) does not apply in ER-EE situation). If pre-1986, likely could under "detached and disinterested generosity" o Could be de minimis under Treas. Reg. 1.132-6(e) so long as (1) given as a holiday gift of property w/ (2) low FMV. (If so, everyone wins except IRS!) If cash cannot exclude, no matter how small. - ER likely can deduct. o 274(b) can only deduct gifts up to $25. o HOWEVER, a gift under 274(b) = something excludable by 102(a) & 102(c) says 102(a) doesn’t apply! o So, ER can deduct entire cost under 162 Problem You are a self-employed attorney. At Christmas, one of your clients sends you a case of wine with FMV = $1,000. Do you have taxable income as a result? May the client deduct the cost of the present? Answer - Duberstein problem bc whether or not something can be excluded from income under 102(a) depends on Duberstein standard. o What client does governs. Likely will say NOT a gift so can take full deduction under 162 and not bother with 274(b) limitations. Which means you have TI. Problem A law professor gives his administrative assistant a present of $100 in cash at Christmas time. Does the administrative assistant have taxable income as a result? Can the professor deduct the amount of the present? Answer 18 Duberstein problem again, and 102(c) does not pose an issue bc administrative assistant is the University’s EE, not profs. o As above problem, hangs on professor’s intent. Prizes & Awards Treas. Reg. 1.102-1(a): Provides that the gift exclusion of Sec 102 does not apply to prizes and awards. Sec 74: Prizes and Awards (a) General Rule—Except as otherwise provided in this section or in Sec 117 (relating to qualified scholarships), gross income includes amounts received as prizes and awards. (b) Exception for Certain Prizes and Awards Transferred to Charities—Gross income does not include amounts received as prizes and awards made primarily in recognition of religious, charitable, scientific, educational, artistic, literary, or civic achievement, but only if— (1) The recipient was selected without any action on his part to enter the contest or proceeding; (2) The recipient is not required to render substantial future services as a condition to receiving the prize or award; and (3) The prize or award is transferred by the payor to a governmental unit or organization described in paragraph (1) or (2) of Sec 170(c) pursuant to a designation made by the recipient. Problem Is a prize for winning a moot court competition taxable? What if you contribute the prize to a charity? Answer YES. §74(a) o Even if you donated it to charity, presumably you entered the moot court competition [(b)(1)] so that already makes this income. Moreover, the prize wasn’t in recognition of the abovementioned achievements. o Also, if you donated it to charity it wouldn’t count! Sec. 74(b)(3) The payor must donate the prize to charity. If you accept it and then donate it, it is still taxable income. (you can claim a charitable contribution deduction, but most ppl take the std deduction…) You need to inform the payor that you don’t want it— “give it directly to charity.” Scholarships & Fellowships Sec 117: Qualified Scholarships (a) General Rule—Gross income does not include any amount received as a qualified scholarship by an individual who is a candidate for a degree at an educational organization as described in Sec 170(b)(1)(A)(ii) (b) Qualified Scholarship—For purposes of this section— (1) In General—The term “qualified scholarship” means any amount received by an individual as a scholarship or fellowship grant to the extent the individual establishes that, in accordance with the conditions of the grant, such amount was used for qualified tuition and related expenses (2) Qualified Tuition and Related Expenses—For purposes of paragraph (1), the term qualified tuition and related expenses” means— (A) Tuition and fees required for the enrollment or attendance of a student at an educational organization described in Sec 170(b)(1)(A)(ii), and (B) Fees, books, supplies, and equipment required for courses of instruction at such at an educational organization. (c) Limitation— (1) In General—Except as provided in paragraph (2), subsections (a) and (d) shall not apply to that portion of any amount receive which represents payment for teaching, research, or other services by the student required as a condition for receiving the qualified scholarship or qualified tuition reduction. 19 (2) Exceptions—Paragraph (1) shall not apply to any amount received by an individual under— (A) The National Health Service Corps Scholarship Program under Sec 338A(g)(1)(A) of the Public Health Service Act, or (B) The Armed Forces Health Professions Scholarship and Financial Assistance program under subchapter I of chapter 105 of title 10, USC. (d) Qualified Tuition Reduction (1) In General—Gross income shall not include any qualified tuition reduction. (2) Qualified Tuition Reduction—The term qualified tuition reduction means the amount of any reduction in tuition provided to an employee of an organization described in Sec 170(b)(1)(A)(ii) for the education (below the graduate level) at such organization (or another organization described in Sec 170(b)(1)(A)(ii)) of— (A) Such employee, or (B) Any person treated as an employee (or whose use is treated as an employee use) under the rules of Sec 132(h). (3) Reduction Must Not Discriminate In Favor of Highly Compensated, Etc.—Paragraph (a) shall apply with respect to any qualified tuition reduction provided with respect to any highly compensated employee only if such reduction is available on substantially the same terms to each member of a group of employees which is defined under a reasonable classification set up by the employer which does not discriminate in favor of highly compensated employees (within the meaning of Sec 414(q)). For purposes of this paragraph, the term highly compensated employee has the meaning given such term by Sec 414(q). (4) Speical Rules for Teaching and Research Assistants—In the case of the education of an individual who is a graduate student at an educational organization described in Sec 170(b)(1)(A)(ii) and who is engaged in teaching or research activities for such organization, paragraph (2) shall be applied as if it did not contain the phrase “below the graduate level.” PROPOSED. Treas. Reg. 1.117-6 (d) Inclusion of qualified scholarships and qualified tuition reductions representing payment for services (2) For purposes of this section, a scholarship or fellowship grants represents payment for services when the grantor requires the grantee to perform services in return for the granting of the scholarship or fellowship. A requirement that the recipient pursue studies, research, or other activities primarily for the benefit of the grantor is treated as a requirement to perform services. A requirement that a recipient furnish periodic reports to the grantor for the purpose of keeping the grantor informed as to the general progress, however, does not constitute performance of services. A scholarship or fellowship grant conditioned upon either past, present, or future teaching, research, or other services by the recipient represents payment for services under this section. (5) Look at examples 1–3 NOTE: Proposed treasury regulations are NOT law. However, a temporary regulation is law even though it hasn’t been finalized Problem Sylvia has worked as an associate at a law firm for three years. The law firm offers to send her to NYU full time to obtain an LL.M. in taxation. The law firm offers to pay her $100,000 during her year at NYU, which is intended to cover tuition, books, and living expenses. Sylvia promises that if she does not return to the law firm and continue to work there for at least one year after graduation, she will repay the $100,000. Is the $100,000 tax-exempt under § 117? Answer No, it is payment for future services Prop. Treas. Reg. §117-6(d)(5) ex. (2) … o But since proposed, it’s actually: It Depends. If gratuitous promise, then excludable and (c) does not apply (no condition) 20 Look into services issue! Sec. 117(c). Green thinks that this is dividable—i.e., the portion given in exchange for services will not be excluded. Grantor has to impose it as a condition. If must repay if doesn't come back, then condition - not excludable. However much of the 100k is used for tuition and books may be excluded under Sec 117(a) and (b). BUT, the amount for living expenses may not be excludable under Proposed Treas. Reg. 1.117-6(c)(2)(ii): living expenses are considered an “incidental expense.” Problem Cornell University offers a tuition reduction plan to its employees. Under this plan, employees’ children may attend Cornell as undergraduates at a substantially reduced tuition. Is the value of this benefit includable in an employee’s gross income? What if Cornell offered the tuition reduction plan only to faculty members? Answer No, excludable under Sec. 117(d)(2)(B)-covers spouse and dependent children If only faculty members, would run afoul of the nondiscrimination requirement and therefore wouldn’t be excludable. Sec. 117(d)(3) Miscellaneous Tips: taxable income under Treas. Reg. 1.61-2(a). Political Contributions: o Rev. Rul. 68-512, 1968-2 C.B. 41: political contributions are not taxable income to a political candidate to the extent used for expenses of a political campaign. However, any amount for personal use is taxable. Support and Government Transfer Payments: o Support provided by family members, like intra-family gifts, is not included in gross income. There is no specific statutory authority for this rule, but the Service has never sought to tax family support. o It also has been the longstanding policy of the Service to exclude form income most government benefits and other welfare payments. Employee Achievement Awards: o Certain “employee achievement awards are excludable from income. These are awards of tangible personal property for length of service or safety achievements— “gold watch awards.” This is laid out in Sec 274(j)(3). o If the employer’s cost does not exceed limits defines in Sec 274(j) (generally $400), the employee may exclude the full FMV. o Otherwise the employee must include in income the greater of: The excess of the employer’s cost over the limitation (but not in excess of FMV), or The excess of the award’s FMV over the max allowable employer deduction. Bequests: Like gifts, are also excludable under Sec. 102. (See pages 129-130 if this is on the exam) Capital Appreciation & Recovery of Basis I.R.C. §§ 61(a)(3), 1001(a)–(c), 1011(a), 1012, 1015(a), 1016(a)(1)–(2), 1041(a)–(c) Treas. Reg. § 1.1015-1(a)(2), Example Sec. 61(a)(3) - gross income includes “gains derived from dealings in property" Gain Sec. 1001(a)—Computation of Gain or Loss “The gain [realized] from the sale or other disposition of property shall be the excess of the amount realized therefrom over the adjusted basis provided in Sec 1011 for determining gain . . .” Gain Realized (GR) = Amount Realized (AR) – Adjusted Basis (AB) Amount Realized Sec 1001(b): Amount Realized “The amount realized from the sale or other disposition of property shall be the sum of any money received plus the FMV of the property (other than money) received.” Basis and Adjusted Basis Sec. 1011(a)—Adjusted Basis for Determining Gain or Loss—General Rule 21 “The adjusted basis for determining the gain or loss from the sale or other disposition of property, whenever acquired, shall be the basis (determined under Sec 1012 or other applicable sections of this subchapter . . .), adjusted as provided in Sec 1016.” Sec. 1012(a)—Basis of Property—In General “The basis of property shall be the cost of such property, except as otherwise provided in this subchapter . . .” NOTE FROM CASEBOOK (132) — “Basis generally is cost (tax cost) even if the taxpayer has ‘underpaid’ or ‘overpaid’ for the property. If the property is purchased at less than its FMV, the purchaser takes a cost basis and is not taxed on the gain until she disposes of the property at its FMV. Similarly, if the taxpayer overpays for property, the basis is the amount paid, and the loss will be realized only when she sells the property for its FMV.” Sec. 1016(a)(1) and (2)—Adjustments to Basis—General Rule “Proper adjustments to basis shall be made… (2) …for exhaustion, wear and tear, obsolescence, amortization, and depletion, to the extent of the amount…(A) allowed as deduction in computing taxable income…” NOTE: If you take depreciation in property, you subtract the amount of depreciation from your basis If you make a capitalized investment/improvement, you add that amount to the basis. Recognition Sec. 1001(c)—Recognition of Gain or Loss “Except as otherwise provided in this subtitle, the entire amount of the gain or loss, determined under this section, on the sale or exchange of property shall be recognized.” NOTE: This provision is essentially saying that any gain or loss realized will be recognized unless otherwise provided. Gain: Special Case Transfers of Property Between Spouses or Incident to Divorce Sec 1041(a) General Rule—No gain or loss shall be recognized on a transfer of property from an individual to (or in trust for the benefit of)— (1) A spouse, or (2) A former spouse, but only if the transfer is incident to the divorce. (b) Transfer Treated as Gift; Transferee Has Transferor’s Basis—In the case of any transfer of property described in subsection (a)— (1) For purposes of this subtitle, the property shall be treated as acquired by the transferee by gift, and (2) The basis of the transferee in the property shall be the adjusted basis of the transferor. (c) Incident to Divorce—For purposes of subsection (a)(2), a transfer of property is incident to the divorce if such transfer— (1) Occurs within 1 year after the date on which the marriage ceases, or (2) Is related to the cessation of the marriage. Basis: Special Cases Property Received in Exchange for Services The basis is FMV—ALWAYS! The Reg is just a more complicated way of saying it!—Green literally said “Don’t worry about it! It’s FMV!” The taxpayer must include the fair market value of the property received (less any amount paid for the property) in gross income as compensation. Treas. Reg. § 1.61-2(d); § 83. Where the taxpayer receives property in exchange for services, her basis is he FMV of the property received. Treas. Reg. 1.61-2(d)(2)(i). 22 In effect, it is as if the taxpayer has received the compensation in cash and then used the cash to purchase the property (“tax cost”) Hypo: Imagine you work for a company, and the company lets you buy corporate stock for 1k. This stock has a FMV of 10k. AB = Amount paid (1k) + (FMV of property (10k) – Amount paid (1k)) AB = 10k (which is FMV anyway!) (FMV of property – Amount paid) = What you need to report as income Basis of Property Acquired by Gifts and Transfers in Trust NOTE: §102(a) excludes inheritances from gross income Sec 1015(a) Gifts After December 31, 1920--If the property was acquired by gift after December 31, 1920, the basis shall be the same as it would be in the hands of the donor or the last preceding owner by whom it was not acquired by gift, except that if [the donor’s] basis (adjusted for the period before the date of the gift as provided in section 1016) is greater than the fair market value of the property at the time of the gift, then for the purpose of determining loss the basis shall be such fair market value. If the facts necessary to determine the basis in the hands of the donor or the last preceding owner are unknown to the donee, the Secretary shall, if possible, obtain such facts from such donor or last preceding owner, or any other person cognizant thereof. If the Secretary finds it impossible to obtain such facts, the basis in the hands of such donor or last preceding owner shall be the fair market value of such property as found by the Secretary as of the date or approximate date at which, according to the best information that the Secretary is able to obtain, such property was acquired by such donor or last preceding owner. IN OTHER WORDS Gain: Basis of donee = donor’s basis (“transferred basis”). Loss: Basis = either donor’s basis or FMV at time of gift Whichever is lower. Treas. Reg. 1.1015-1(a)(2): Example: A acquires by gift income-producing property which has an adjusted basis of 100k at the date of gift. The FMV of the property at the date of gift is 90k. A later sells the property for 95k. In such case there is neither gain nor loss. The basis for determining loss is 90k; therefore, there is no loss. Furthermore, there is no gain, since the basis for determining gain is 100k. Problem An individual buys property for the amount in column A. She gives it to her son as a gift when it is worth the amount in column B. He holds it for a while and then sells it for the amount in column C. How much gain or loss does the son recognize on the sale? Case 1 Case 2 Case 3 Case 4 Column A $100 $100 $100 $100 Column B $150 $50 $50 $50 Column C $175 $25 $125 $75 Answer Giving a gift is not a realization, it’s not income. But there might be a gift/estate tax for donor (mother). No tax when he receives. Gifts are excludable from income under 102(a). Column A $100 $100 $100 Column B $150 $50 $50 Column C $175 $25 $125 Son's Basis Case 1 $100 Case 2 $50 Case 3 $100 T.R. 1015-1(a)(2) Case 4 $100 $50 $75 indeterminate Case 1: Son recognizes gain; must use his mother’s basis. 23 Gain or Loss $75 §1015(a) ($25) §1015 $25 §1015(a) No gain or loss Case 2: Clearly loss, either (1) mother’s basis or (2) the FMV at the time of the gift— whichever is lower. We use FMV to get a loss of $25. o Exception for FMV can only be used for loss. General rule: must use donor's basis Case 3: Gain, donor’s basis. Case 4: Neither rule works. When you use the donor’s basis you get a loss. But when you use the FMV, you get a gain. Thus, there is no loss or gain. o Each time it looks like you should use the other rule! Basis of Property Acquired From a Decedent Sec 1014(a) In General—Except as otherwise provided in this section, the basis of property in the hands of a persona acquiring the property from a decedent or to whom the property passed from a decedent shall, if not sold, exchanged, or otherwise disposed of before the decedent’s death by such person, be— (1) The FMV of the property at the date of the decedent’s death. (b) Property Acquired From the Decedent—For purposes of subsection (a), the following property shall be considered to have been acquired from or to have passed from the decedent: (1) Property acquired by bequest, devise, or inheritance, or by the decedent’s estate from the decedent. Problem An individual buys property for $100. He dies and his daughter inherits the property. On the date of the individual’s death, the property has a fair market value of $150. Must the daughter include the value of the property in gross income when she receives it? The daughter subsequently sells the property for $175. How much gain does the daughter recognize on the sale? Answer NO § 102 includes bequests. She recognizes a $25 gain because we use the FMV at the time of death under §1014(a)(2) o Note: Old, rich people shouldn’t sell appreciated property. Children use the FMV at time of death as basis, not donor’s basis. Recovery of Capital (Basis) Three ways TP accounts for costs (1) immediately deductible expenses “expensed” (2) capitalized, purchase price or cost is taken into account only when asset is sold or exchanged. Ex: stock cost or basis is taken into account only when stock is sold or exchanged (recovery of basis at disposition or when asset becomes worthless; once you have identifiable event, deduct basis. (3) depreciated (limited life)– periodic deductions allowed for asset’s cost. Hypo: Suppose a firm purchases a piece of equipment for $10,000 today (t=0). Firm uses it in its business for 5 yrs, then disposes by scrapping it at end of 5 yrs (t=5). 24 How do these methods result in tax savings with a 35% tax bracket? What would you prefer? Option 1: $3,500 in 5 yrs Option 2: $700 each year for 5 yrs Option 3: $3,500 today This one, want money today. Why? You know you got it, may not get it in the future (risky) Time value of money Can invest and it will be more in the future Future value of best investment Present & Future Value General Idea: $1 today is worth more than $1 tomorrow. Want to take deductions as soon as possible Want to delay reporting income as much as possible. Future Value Future Value of $1, invested at 10%, after t years = Amount to which $1, invested at an interest rate of 10% per year will grow in t years. Thus: This is compound interest Present Value PV of $1 to be received after t years, discounted at 10% = Amount you must invest today, at an interest rate of 10%, in order to have $1 after t years. You’re essentially saying, I want a dollar in the future, how much do I need today, given 10% interest? So, if you want a dollar one year from now, you need to invest .91 today. Thus: 25 Illustration Suppose you have the right to receive $1 at the end of 5 years. You can convert this to $0.62 today by borrowing $0.62 at 10% interest, using your right to receive $1 at the end of 5 years as security. Thus: The third column is an extra amount you borrow because you can’t pay the interest on the loan because you spent the initial .62! If you have any questions, watch lecture 09 at roughly 19:00. Realization Requirement Although according to H-S, each time you have an increase in worth you have realized income, our tax system does not function this way. Gains and losses in the value of property generally are reflected in taxable income only when “realized.” Ex: Jeremy buys a painting for $100 and it increases in value to $1k, he has no income until the painting is sold. Ex: J bought the painting at an auction and it turns out to be worth $5k more than he paid for it, the $5k gain will not be income until the painting is sold. Cesarini v. United States: [Ps bought used piano ($15) in 1957. In 1964, they found $4k of cash in piano. Ps paid tax on sum in '64 and then sued for refund claiming that not includable in income. IRS bite me.] If it's treasure trove, you have income once you reduce it to exclusive possession. Treasure trove is property defined by state law (different in different states). Most states agree that if it’s gold, silver, or cash treasure trove. Note: This case is limited to its facts—applies to treasure trove. Treas. Reg. 1.61-14: “Treasure trove, to the extent of its value in United States currency, constitutes gross income for the taxable year in which it is reduced to undisputed possession.” HYPO: Suppose the Cs bought piano, and then it appreciated in value? Taxable income? No! Mere appreciation is not taxable—you need a realization event (e.g. selling it) ** New information that causes value to go up is just appreciation as well. HYPO: What if Cs discovered one of the piano keys was made of gold? Would you be taxed on the value of the gold key? Green doesn’t think so - it's still part of the piano. However, if you removed the key from the piano, then Green thinks it would be taxable as treasure trove realization event 26 Green says Eisner supports this. Haverly v. United States: [Principal receives free unsolicited copies of textbooks from publisher. P then donates books to school library and takes deduction (charitable donation). P did not report value of books as income.] Textbooks are taxable income. Focuses on a std of “complete dominion.” Donating samples to charitable institution + taking a deduction = intent to exercise complete dominion Possession of books increased TP’s wealth. TP’s receipt and possession of books indicate income was ‘clearly realized’ Looked at Rev. Rul. 70-498: Newspaper’s book reviewer must include in value of unsolicited books received from publishers which are donated to a charitable organization and for which a charitable deduction is taken. Notes: Probably isn’t looking to draw a definitive line—only looking to decide facts of particular case. HYPO: What would happen if the principal didn’t donate the books? Kind of dist ct’s argument in saying it wasn’t income—if you donate it, yes, it shows an intent to first accept the books as your own, but, so does putting the books on your bookshelf, and surely you wouldn’t be taxed for that. Green isn’t really sure of the answer. Rev. Ruling 70-330: any books a book reviewer receives + accepts must be included in income. IRS General Counsel’s Memo: If book reviewer retains book in library they've accepted it. If stored in garage they have NOT accepted it. Rev. Ruling 70-498 (supersedes 70-330) – book reviewer receives free book and gives to charity and takes deduction must include in income Administrative result is that IRS won’t tax unless you give to charity and take deduction Problem Your client found a diamond ring with a FMV of $5k. The prior owner could not be found, and under state law your client became the owner of the ring. The client later sold the ring for 6k. What are the tax consequences for your client of (i) finding the ring and (ii) selling the ring? Answer If treasure trove: o Finding of ring creates income for year in which it is found (Cesarini) o Selling ring creates income = AR ($6,000) – AB ($5,000) = $1,000 (§1001(a)) If find & sell in same year TI will still = $6,000 (AB = $0) If not treasure trove: o No TI of finding ring o Still would have TI off sale of $6,000, however, would be taxed as capital gain lower rate! Preference: NOT treasure trove o Avoid liquidity problems o Practical and administrative difficulties There is no general rule about when found property is income. Note: If you find cash you cannot delay inclusion of income bc cash cannot appreciate in value. o What if you find a rare coin worth $1k? Probably can treat as non-treasure trove and wait for realization event, basis = face value. Eisner v. Macomber: [Stock dividend (a distribution of additional shares of stock in distributing corporation based on a shareholder’s outstanding ownership). Is a pro rata stock dividend taxable income? 27 Green: Must have moved value of stock from earnings to capital. Treat as if cash dividend to shareholders, then shareholders took that $25 dividend and contributed it to the corp -- getting extra 25 shares. Looks like you end up in the same place by distributing the shares of stock! Same thing, and everyone agrees that a cash dividend is taxable! Net worth that increases from $50, to $75 = income of $25. Court got messed up by focusing in on the realization event! But you never really earn income at the realization events, it’s just a timing thing! Income accrues and is waiting to be taxed realization req tells you when to tax. No taxable income Receiving a stock dividend does not amount to realization. At the time, shareholder increase in FMV = income. "The mere issue of a stock does not increase the shareholders’ value" More pieces of paper, but not this that is valued, it’s the right that they represent. But this is kind of missing the point… Ct said the shareholder has not received any assets out of the corporation Liquidity issues (practical policy reasons) back up the ruling Notes: Court’s constitutional analysis is not important or considered valid. However, Congress amended IRC to include rule: A pro rata pure stock dividend, in which the stockholder receives shares identical to those producing the dividend and has no option to choose cash, produces no taxable income under § 305. Stock dividend cannot change the percentage of the taxpayer’s ownership in the company. If the stock dividend changes someone’s relative interest, then it is taxable. The only stock dividend that isn’t taxable is a pro rata stock dividend that leaves everyone’s relative interests unchanged. Summary: Cash dividend: taxable Pure pro rata stock dividend that doesn’t affect relative interests: not taxable Any stock that changes taxpayer’s relative ownership: taxable Cottage Savings Ass’n v. Commissioner: [Cottage exchanged a mortgage for another mortgage of same FMV, even though face value > FMV. Cottage did not report loss on its balance sheet, but took deduction on loss. IRS: if exchanging mortgages isn’t a realization event for purposes of your balance sheet, then it shouldn’t be one for tax purposes either.] Ct: IRS loses. Realization req is an administration convenience -- underlying policy. 28 An exchange of property gives rise to a realization event under § 1001(a) only if the properties exchanged are ‘materially different' in kind or extent. Materially different = respective possessors enjoy legal entitlements different in kind or extent Ct rejected IRS’s definition: only if they differ in economic substance. Rule: To realize gain or loss from exchange of property, the properties must be legally different. Here, the mortgages exchanged were economically equivalent, but were nonetheless materially different because they were subject to distinct legal entitlements—they were made to different obligors and secured by different homes. (legal rights completely different) Notes: IRS shouldn’t complain because holding makes realization super easy—including for gains! o Here, we’re dealing with loss, so maybe IRS takes a hit, BUT most transactions result in gain. Will be more taxable income for IRS to collect in cases of gain. o But make sure you look at 1001(c)—draws a distinction between realization and recognition. Illustrates that you can have realization, but there’s no tax because the gain or loss resulting from the transaction is not recognized. One of few decisions saying that an income tax provision is unconstitutional. Purpose of legislation was to generate tax losses that would not jeopardize accounting losses Transactions Involving Borrowed Funds: Discharges of Indebtedness In General If you borrow money you do not have income Net worth doesn’t go up assets go up, liability goes up. If you lend money you do not have a deduction. Replacing one asset with another Wealth = assets – liabilities. With a loan, your assets increase as much as liabilities no accession to wealth no income. Cancellation of Indebtedness Income If a debt gets cancelled you do have income. And lender can take a deduction. Net worth goes up. May not have amount of money in cash, but you consumed it (H-S consumption) Ex: Lender cancels $100 of a borrower’s indebtedness. Cancellation is included in income under 61(a)(12). Lender can take a bad debt deduction. Any time you can pay back a debt for less than you got for it, you have COD income. Kirby Lumber: TP has COD income even though no one formally cancelled the debt. If you never intend to repay loan, all of the loan is income (Zarin—see below) Summary Exceptions: Bankruptcy and Insolvency If TP borrower is insolvent (§§ 108(a)(1)(B) and definition @ 108(d)(3)) or in bankruptcy (108(a)(1)(A)), discharge of indebtedness is excludable from income. Insolvency exclusion is limited to amount of insolvency If debt > assets, but assets > amount of insolvency, then 108(a) exclusion applies only insomuch as taxpayer is insolvent. (If your-would-be “COD” > you are insolvent; you will be taxed on the excess and only the “COD” = insolvency amount will be excluded) I.e., exclude the amount by which liabilities exceed assets from income (108(a)(3)) EXAMPLE: (corrected from casebook - p178): Imagine a balance sheet with 13k assets and 20k liabilities. Suppose the TP’s liabilities are discharged for 12k, and 8k of the TP’s liabilities are forgiven. §108(a)(3) provides that the amount excluded under 108(a)(1)(B) shall not exceed the amount by which the taxpayer is insolvent (i.e. 7k). 29 Thus, the taxpayer has $1k COD income. Note: You are insolvent when your total liabilities exceed your total assets. You MUST reduce the following by the amount excluded under 108(a): Net operating loss and other similar deductions §108(b)(2)(A) Basis in any property §108(b)(2)(E) Income Not Realized to Extent of Lost Deductions If there is a cancellation of debt that would have been deductible if it were paid (e.g., legal fees), the discharge of such debt does not give rise to COD income §108(e)(2) Purchase Price Reduction When a seller gives a buyer a discharge of debt that arose out of purchase of property and treats that discharge as a purchase price change, then the discharge is excludable. §108(e)(5) You MUST reduce basis of property to post-price-reduction cost Student Loans Discharge of loans made by educational institutions pursuant to a loan repayment assistance program that is designed to encourage the institution’s students to serve in occupations/areas with unmet needs and under which the services provided by the students are for or under the direction of a governmental unit or 501(c)(3) non-profit is excludable. §108(f) TEN-YEAR LIMIT on this exclusion. Provisions Sec. 108— Exceptions to the Income from Discharge of Indebtedness Rule (§61(a)(12) exceptions) (a) Exclusion from Gross Income— (1) In General—Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the discharge (in whole or in part) of indebtedness of the taxpayer if— (A) The discharge occurs in a title 11 case, (B) The discharge occurs when the taxpayer is insolvent, ... (E) The indebtedness discharge is qualified principal residence indebtedness which is discharged before January 1, 2014. NOTE: (E) is capped at 2 million under Sec 108(h). (3) Insolvency Exclusion Limited to Amount of Insolvency—In the case of a discharge to which paragraph (1)(B) applies, the amount excluded under paragraph (1)(B) shall not exceed the amount by which the taxpayer is insolvent. (b) Reduction of Tax Attributes— (1) In General—The amount excluded from gross income under subparagraph (A), (B), or (C) of subsection (a)(1) shall be applied to reduce the tax attributes of the taxpayer as provided in paragraph Basically, going to lose sources of future deductions. Becomes a pure timing issue. (2) Tax Attributes Affected; Order of Reduction—Except as provided in paragraph (5), the reduction referred to in paragraph (1) shall be made in the following tax attributes in the following order: (A) NOL—Any net operating loss for the taxable year of the discharge, and any net operating loss carryover to such taxable year. ... (E) Basis Reduction— (i) In General—The basis of the property of the taxpayer Note: Every $ you decrease our basis, you increase your gain that you will eventually have when you do sell (or have a realization event). You are insolvent so we don’t want to tax you today, but we will tax you in the future, when you do have money. (3) Amount of Reduction— 30 (A) In General—Except as provided in subparagraph (B), the reductions described in paragraph (2) shall be one dollar for each dollar excluded by subsection (a). (c) Treatment of Discharge of Qualified Real Property Business Indebtedness— (1) Basis Deduction (A) In General—The amount excluded from gross income under subparagraph (D) of subsection (a)(1) shall be applied to reduce the basis of the depreciable real property of the taxpayer. (B) Cross Reference—For provisions making the reduction described in subparagraph (A), see Sec 1017 (2) Limitations— (A) Indebtedness in Excess of Value--The amount excluded under subparagraph (D) of subsection (a)(1) with respect to any qualified real property business indebtedness shall not exceed the excess (if any) of— (i) The outstanding principal amount of such indebtedness (immediately before the discharge), over (ii) The FMV of the real property described in paragraph (3)(A) (as of such time), reduced by the outstanding principal amount of any other qualified real property business indebtedness secured by such property (as of such time). (B) Overall Limitation—The amount excluded under subparagraph (D) of subsection (a)(1) shall not exceed the aggregate adjusted bases of depreciable real property (determined after any reductions under subsections (b) and (g)) held by the taxpayer immediately before the discharge (other than depreciable real property acquired in contemplation of such discharge). (3) Qualified Real Property Business Indebtedness—The term “qualified real property business indebtedness” means indebtedness which— (A) Was incurred or assumed by the taxpayer in connection with real property used in a trade or business and is secured by such real property, (B) Was incurred or assumed before January 1, 1993, or if incurred or assumed on or after such date, is qualified acquisition indebtedness, and (C) With respect to which such taxpayer makes an election to have this paragraph apply. Such term shall not include qualified farm indebtedness. Indebtedness under subparagraph (B) shall include indebtedness resulting from the refinancing of indebtedness under subparagraph (B) (or this sentence), but only to the extent it does not exceed the amount of the indebtedness being refinanced. (4) Qualified Acquisition Indebtedness—For purposes of paragraph (3)(B), the term “qualified acquisition indebtedness” means, with respect to any real property described in paragraph (3)(A), indebtedness incurred or assumed to acquire, construct, reconstruct, or substantially improve such property. (5) Regulations—The Secretary shall issue such regulations as are necessary to carry out this subsection, including regulations preventing the abuse of this subsection through crosscollateralization or other means. (d) Meaning of Terms; Special Rules Relating to Certain Provisions— (1) Indebtedness of Taxpayer—For purposes of this section, the term “indebtedness of the taxpayer” means any indebtedness— (A) For which the taxpayer is liable, or (B) Subject to which the taxpayer holds property (2) Title 11 Case—For purposes of this section, the term “title 11 case” means a case under title 11 of the USC (relating to bankruptcy), but only if the taxpayer is under the jurisdiction of the court in such case and the discharge if indebtedness is granted by the court or is pursuant to a plan approved by the court (3) Insolvent—For purposes of this section, the term “insolvent” means the excess of liabilities over the FMV of assets. With respect to any discharge, whether or not the taxpayer is insolvent, and 31 the amount by which the taxpayer is insolvent, shall be determined on the basis of the taxpayer’s assets and liabilities immediately before the discharge. (e) General Rules for Discharge of Indebtedness (Including Discharges Not in Title 11 Cases or Insolvency) (1) No Other Insolvency Exception—Except as otherwise provided in this section, there shall be no insolvency exception from the general rule that gross income includes income from the discharge of indebtedness. (2) Income Not Realized to Extent of Lost Deductions—No income shall be realized from the discharge of indebtedness to the extent that payment of the liability would have given rise to a deduction. (5) Purchase-money Debt Reduction for Solvent Debtor Treated as Price Reduction. —If— (A) The debt of a purchaser of property to the seller of such property which arose out of the purchase of such property is reduced, (B) Such reduction does not occur— (i) In a title 11 case, or (ii) When the purchaser is insolvent, and (C) But for this paragraph, such reduction would be treated as income to the purchaser from the discharge of indebtedness, Then such reduction shall be treated as a purchase price adjustment. Hypo: Go to car dealer and buy a car PP = $25k. Get a loan, dealer says pay me $20k now, and I’ll forgive the $5k. Retroactively adjusting basis to say you bought car for $20k. Can happen bc product is a lemon, interest rate issue, or cash flow issue of seller. Doesn’t necessarily have to do with the value of the thing you bought Later sell for 10k. Loss = (10k) But not deductible bc arose in a personal situation. Therefore, you don’t mind that you’ve hurt your basis bc you don’t get depreciation nor deductions! Hypo: You use a car in your business and you sell for a loss. Bought for 25, dealer cancelled 5, PP now = 20 You exclude 5k from income under 108(e)(5)(C). Depreciation is 5k. AB = $15k Sell for $10k. AR-AB = ($5k), so can deduct. If in business context, you mind reducing your AB, bc you are losing deduction for depreciation and for loss. Note: This provision does not apply if the purchaser is insolvent or the subject of bankruptcy proceedings, if the seller has transferred the debt to a third party or if the purchaser has transferred the property to a third party. Note: This section applies to property only—not services. (f) Student Loans (1) In General—In the case of an individual, gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the discharge (in whole or in part) of any student loan if such discharge was pursuant to a provision of such loan under which all or part of the indebtedness of the individual would be discharged if the individual worked for a certain period of time in certain professions for any of a broad class of employers. For purposes of § 108(f)(1), “student loans” include loans made by an educational institution pursuant to a loan repayment assistance program that is designed to encourage the institution’s students to serve in occupations or areas with unmet needs and under which the services provided by the students (or former students) are for or under the direction of a governmental unit or an organization described in section 501(c)(3). Note: 32 Gross income does not include any amount from the forgiveness of certain student loans (generally made by a government agency), provided the forgiveness is contingent on the student working for a certain period of time in certain professions (e.g. providing health care services to a nonprofit). Gross income also does not include forgiveness of student loans made by tax-exempt charities (ex: universities) where a condition of the loan is that the student must fulfill a public service requirement. The statute defines this as an occupation or working in an area with unmet needs so long at the work is performed for or under the direction of a tax-exempt organization or a government entity. The proceeds can be used to pay tuition and expenses or to refinance outstanding student loans. § 108(f)(2)(D)(ii); Rev. Rul. 2008-34 (law school loan repayment assistance programs). Zarin: [gamblin’ + loans] Tax Court: Zarin had a bona fide debt (i.e., he had an intent to repay) and accordingly he owes 2.9 in COD. Zarin can’t use purchase price adjustment agreement rule of Sec. 108(e)(5)(C) (only applies to property). Here, he only received services, i.e., “the opportunity to gamble.” If it could be considered property then AB = $5k, and when exchanges chips for services you still realize a gain of $2.9m!! Zarin can’t use 165(d) (which provides that wagering losses shall be allowed as a deduction but only to the extent of the gains during the taxable years from such transactions) because court says he incurred the gambling loss 1980 and received the gain in 1981. rd 3 Cir.: No income; NJ statute that enabled casino to grant loan was unenforceable. Not bonafide, so income in 1980 (same year as gambling loss), SoL had run so IRS can't collect. Court follows contested liability doctrine: if a taxpayer disputes amount of a debt, a subsequent settlement is treated as actual amount of indebtedness. Notes: Went from a net worth of 0 and ended up with a debt = $500k. There is no income! Green: Something wrong with concept of COD. Sec 165(d): You can only deduct gambling losses to the extent that you have gains from wagering transactions in the same year. Should be allowed to carry gambling loss forward and use it against income in 1981, would wipe out income and still have $500k loss which is the right answer. Treas. Reg. 1.165-10: Losses sustained during the taxable year on wagering transactions shall be allowed as a deduction but only to the extent of the gains during the taxable year from such transactions. Zarin’s lawyers should have used the insolvency provision of 108(a)(1)(B), but they were incompetent. Thieves have income when they steal, never intend to repay (ignore offsetting legal obligation) Miscellaneous Corporate Debt to a Shareholder: If a shareholder forgives a debt owed him by a corporation, Sec 108(e)(6) treats this as if the corporation has satisfied the debt with an amount of money equal to the shareholder’s basis in the debt. Thus, in the usual case, where the SH’s basis is equal to the face amount of the debt, the corporation would have no discharge on indebtedness income. Corporate Stock Issued in Exchange for Debt: Sec 108(e)(8) provides that a corporation that is not insolvent or in bankruptcy proceedings realizes COD income when it issues stock in cancellation of its debt to the extent that the value of the stock is less than the principal amount of the debt. Discharge of Indebtedness Treated as a Gift: 33 In a commercial setting, a discharge of indebtedness is not a gift. In a noncommercial setting, such as a loan between family members, a discharge may be treated as a gift excludable under Sec 102. If a party who is related to the debtor acquires the debt from an unrelated party, the debt is treated as acquired by the debtor, which may result in COD income to the debtor and the debtor is treated as issuing a new debt to the related party. (See 108(e)(4); 267(b)) Qualified Farm Indebtedness Under certain circumstances, gross income does not include the discharge of qualified farm indebtedness. See Sec. 108(a)(1)(C) and 108(g). Real Estate Business Debt Take a look at 108(a)(1)(D). Permits individual TPs to elect to exclude from gross income the discharge of real property business indebtedness in exchange for reducing the basis of property. Discharge of Interest You have COD income whether or not the principal or the interest is forgiven—unless an exception applies. And if the interest was nondeductible personal interest, 108(e)(2) obviously wouldn’t apply. Effect of Debt on Basis & Amount Realized Two General Types of Borrowing Recourse Debt: Borrower is personally liable for repayment of debt. Lender can look to any asset securing debt + any of borrower’s other assets for repayment. Nonrecourse Debt: Borrower is not personally liable. Lender can look only to assets that secure the debt for repayment. Ex: You buy $1M in property and there is a non-recourse loan. Property drops in value to 800k. Lender says he wants his million. Since it’s a non-recourse loan you should do 1 of 2 things: Go ahead and have lender foreclose property because lender can only get 800k Pay lender off with 800k so that he’ll go away and you can keep property, 800k is all he can get anyway! Analysis: FMV of property (at time of sale) > Liability o Gain/loss = [money received from buyer + amount of loan assumed by buyer] – [adjusted basis = (cost of property for seller to initially purchase -- deductions taken)] Whether loan is recourse or nonrecourse is irrelevant (Crane) FMV of property (at time of sale) < Liability o If discharge is of recourse debt, then... (Treas. Reg. 1.1001-2(c) Ex. 8) Seller has *TWO* forms of income: (1) Ordinary COD income = (balance of recourse loan) – (FMV of property at time of sale); AND (2) Capital gain/loss = (FMV of property at time of sale) -- (cost of property for seller to initially purchase -- deductions taken) NOTE: state these two values separately in your final answer o If discharge is of nonrecourse debt (Treas. Reg. 1.1001-2 & Tufts) Seller has ONE form of income: Gain/loss = [money received from buyer + nonrecourse loan relief] -- adjusted basis (= cost of property for seller to initially purchase -- deductions taken) Borrowed Amounts & Basis & Amount Realized General rule: a loan, whether recourse or nonrecourse, is included in the basis of the asset it finances. Ex: A buys a building for $1mil by paying 100k in cash and assuming 900k mortgage. A’s basis is 1 mil whether he borrows the 900k from a bank or the seller or assumes an outstanding 900k mortgage on the property. 34 When property is sold (or otherwise disposed of), any balance of the recourse or nonrecourse debt is included in the amount realized. Ex: If B purchases A’s building for 1.1 million by transferring 300k in cash and assuming the mortgage with an outstanding principal amount of 800k, A’s AR = 1.1 million. When FMV of property > liability Crane: [Property FMV = 255k, but subject to a 255k (non-recourse) mortgage. Rents outs apts, treating building like a business and taking depreciation. 6yrs later FMV = 257k and still owes 255k on mortgage. Her net worth is now roughly 2.5k. Crane sells building. Buyer pays 2.5k for building and assumes 255k mortgage. What is Crane’s gain when selling the property?] If a buyer relieves seller of a debt, its equivalent to buyer giving seller the money to pay off the debt. Crane’s basis = 255k (only property), which was then adjusted via 25k in depreciation, creating an AB = 230k. Crane’s AR included COD from the nonrecourse loan; thus, it is 257k. $2500k + Relief of $255k nonrecourse mortgage Crane experienced 27.5k in gain. In other words: GR = AR [cash + COD] – AB [cost (or, here, FMV at death) – depreciation] GR = (2.5k + 255k) – (255k – 25k deductions) GR = 27.5k Notes: Which approach is better for taxpayer? IRS approach because of time value of money. Depreciation dollars in present are more valuable than dollars paid at the back-end present value deduction. Because it's a capital gain every dollar in deduction says .40 cents, she pays only .20 at back-end (capital gains rate). IRS would have been better off in long run if Crane had won. When FMV of the property < liability at time of sale Tufts: [Tufts constructs commercial building for 1.9M from a nonrecourse loan from bank. Tufts takes roughly 400k of total depreciation, reducing basis to 1.5M. FMV drops to 1.4M. Meanwhile, Tufts has not paid off any principal on loan—he still owes 1.9M. Tufts decides to sell, but knows can only get 1.4M. Essentially gives away building to seller in exchange for seller’s assumption of loan. How much gain?] Ct agrees w/ IRS & uses Crane: Tufts realized gain of 400k since cash selling price was essentially 0 and he received COD income of 1.9M. GR [400k] = AR [0 + 1.9M] – AB [1.9M – 400k] Tufts argued Crane was limited to cases where FMV of the property > liability at the time of sale. If he kept building and then foreclosed, he would only have to pay 1.4M or just give building back (which again is only worth 1.4M). GR [-100k] = AR [0 + 1.4M] – AB [1.9M – 400k] 35 Notes: Tufts couldn’t have been right in his analysis! Why? Well, Tufts already deducted 400k, so under his analysis he would have a 500k loss. But Tufts really has lost nothing because he put up none of his own money! He essentially walks away with a 500k loss for nothing! (net worth started at $0 and ended with $0) IRS must be correct because Tufts had 400k in deductions and then recognized 400k in gain = 0. IRS started with an incorrect Basis (Basis is too high, should have been 1.4 bc won’t ever pay back the 1.9) but by getting the GR too high by 500k and the Basis too high by the same amount, they cancel each other out symmetrical mistake! Barnett Approach Bifurcates transaction & separates “borrowing” aspect and “property transaction” aspect. In Tufts transaction should be treated as if: Partnership acquired an apartment complex using $1.9 million of its own funds. Thus you clearly have a basis of 1.9M Partnership obtained a nonrecourse loan of $1.9 million by pledging apartment complex as security. Partnership properly claimed depreciation deductions totaling $400,000, reducing its AB in the property to $1.5 million; property actually declined in FMV to $1.4 million. Using cash on hand, partnership bought off mortgage for the market value of apartment complex ($1.4 million; remember this makes sense because it is nonrecourse!). Partnership realizes COD income of $500,000. Partnership sold the apartment complex for its FMV of $1.4 million. Partnership recognizes gain of $1.4 million − $1.5 million = ($100,000) (i.e., a loss of $100,000) Summary of Three Approaches Preference: IRS view over Barnett view! COD income is ordinary income and the 100 is a capital loss—both ordinary income and capital losses (restricted based on cap gains and doesn’t have any on this method) get unfavorable tax treatment. Under IRS approach, 400 gain is capital gain— favorable tax treatment. § 1.1001-2 Discharge of liabilities. (a) Inclusion in amount realized – (1) In general. Except as provided in paragraph (a) (2) and (3) of this section, the amount realized from a sale or other disposition of property includes the amount of liabilities from which the transferor is discharged as a result of the sale or disposition (2) Discharge of indebtedness. The amount realized on a sale or other disposition of property that secures a recourse liability does not include amounts that are (or would be if realized and recognized) income from the discharge of indebtedness under section 61(a)(12). For situations where amounts arising from the discharge of indebtedness are not realized and recognized, see section 108 and §1.61-12(b)(1). (4) Special rules. For purposes of this section – (i) The sale or other disposition of property that secures a nonrecourse liability discharges the transferor from the liability; (ii) The sale or other disposition of property that secures a recourse liability discharges the transferor from the liability if another person agrees to pay the liability (whether or not the transferor is in fact released from liability); (c) Example 8. (Barnett Approach) In 1980, F transfers to a creditor an asset with a fair market value of $6,000 and the creditor discharges $7,500 of indebtedness for which F is personally liable. The amount 36 realized on the disposition of the asset is its fair market value ($6,000). In addition, F has income from the discharge of indebtedness of $1,500 ($7,500 − $6,000). Note: Adopts Crane and Tufts in context of non-recourse. Except in Tufts situation and if the loan is recourse Barnett analysis. Problem Individual B buys real property for $100,000, using $60,000 in cash plus the proceeds of a $40,000 nonrecourse mortgage loan. Over the next 10 years B properly takes $50,000 of depreciation deductions with respect to the property and then disposes of the property in the situations described below. Assume that the property remains subject to the $40,000 mortgage at the time of disposition. How much gain or loss does B recognize in each of the situations below? Situation 1. After 10 years, the property has fallen in value to $70,000. B sells the property to C for $30,000 in cash. C takes the property subject to the $40,000 mortgage. Situation 2. After 10 years, the property has fallen in value to $30,000. B transfers the property to the lender in cancellation of the $40,000 nonrecourse mortgage Situation 3. Same as Situation 2, except suppose the mortgage is recourse. Answer Situation 1: Crane. GR = 70k [30k cash + 40k relief] – 50k [100k – 50k deductions] = $20k Economic analysis? o H-S: started w/ $60k in cash and then in 10 yrs you sell building and get $30k in cash (30k) o Tax: $50 in depreciation and then gain of $20k ($30k) Situation 2: Tufts GR = [0k in cash + 40k relief liability] - 50k = (10k) Economic analysis: o Start w/ $60k and ended up with nothing ($60k) o ($50k) dep + ($10k) = ($60k) Situation 3: Barnett Approach Treas. Reg. 1.1001-2(c), example (8) Imagine paid off loan for FMV of property (30k), she has $10k COD (from $40k recourse loan) Imagine she sold property for $30k o GR = 30k – 50k = (20k) Adds up to (10k) but its different from Tufts bc here some of this will be treated as ordinary income (COD) and some as capital loss (- 20k) Hypo w/ Estate of Franklin facts except assume no fraud and the 700k FMV is not involved. Would still be 975k principle unpaid Didn't intend for the final payment to be paid. Intended for default on loan and they would take title. At end of 10 years they are in the same position and no cash was ever changing hands Associates get tax benefits Romneys need some incentive Pre-paid interest - 7,500 payoff to get them to do this deal Look at the payments over the 10-year period to see what the tax consequences are Deductions > income 9,000 rent is not deductible, only interest How much is interest? Take total rental income and subtract the total principal repaid (excess of balloon payment) 975k principal amount of debt at time of foreclosure Use this as the AR (relief from remaining liability) 37 AB at time of foreclosure is initial cost basis (1.2m - 500k (dep)) = $700k GR = 975-700 = $275k Net tax deductions generated over the 10-year period = $0 Interest deductions are big in beginning and get smaller and smaller (bc of dep your principle gets smaller therefore less and less interest) ** this is with straight line but you can get accelerated Big thing of income is at end of the year, so big savings bc taxed at lesser rate (20%) And large deductions first w benefit of 40% tax rate Estate of Franklin: No money changing hands. Motel not worth 1.2m (FMV of $700k) Looks like the 1.2m won’t ever be repaid… (1.2m v. 700k…) Assumption would be repaid is extremely unlikely (assumption from Crane + Tufts does not hold!) So now what to do with the basis? IRS: we can’t give this non-recourse loan any weight at all Debt is not bonafide Basis = 0 (exception to Crane and Tufts) NO DEPRECIATION Also, bc debt is not bonafide interest payments get denied NO DEDUCTIONS Rule: If transaction lacks economic substance all deductions are denied. Reasonable business purpose Reasonable possibility of profit Criticism: this seems to be overriding the statute, hard to rely on statute (code) Congress then codified it: §7701(0) Same idea in these doctrines Step transaction doctrine Substance over form Sham Today it would be "passive activity" and you can't use them against your active businesses Would work well in 1976, but loads of problems if tried to do today Damages for Personal Injury Summary: §104 Compensation for Injuries or Sickness (a)(2): Income does not include the amount of damages received (whether by suit or agreement and whether lump sums or as periodic payments) on account of personal physical injuries or physical sickness o Emotional distress not treated as physical injury/sickness even if sleeplessness, etc. Look to underlying cause and what happened first If physical injury leads to emotional distress, that IS excludable But if emotional distress causes physical symptoms, NOT excludable o You can NEVER exclude punitive damages STATUTE Sec 104 Compensation for Injuries or Sickness (a) In General—Except in the case of amounts attributable to (and not in excess of) deductions allowed under Sec 213 (relating to medical, etc., expenses) for any prior taxable year, gross income does not include (2) The amount of any damages (other than punitive damages) received (whether by suit or agreement and whether as lump sums or as periodic payments) on account of personal physical injuries or physical sickness; For purposes of paragraph (2), emotional distress shall not be treated as a physical injury or physical sickness. ** The preceding sentence shall not apply to an amount of damages not in excess of the amount paid for medical care (described in subparagraph (A) or (B) of section 213(d)(1)) attributable to emotional distress. ** 38 Notes: Under the flush language, damages not in excess of (<) the amount paid for medical care attributable to emotional distress = excludable. Otherwise, damages for emotional distress = taxable. BTL Deduction for Medical Expenses Personal expense but specific section in code that allows you to deduct this Usually, can only deduct the excess of 10% of AGI If 20k of medical expenses from emotional distress and AGI=100k, 10% of AGI = 10k, so TI=90k The exclusion allows you to deduct in full so instead of taking the deduction you exclude the full amount so your AGI = 80k and your TI = 80k Preferable! Amounts received for defamation, sexual harassment, and age and racial discrimination are taxable. Emotional distress: Damages for physical injury or sickness resulting from emotional distress (headaches, insomnia) = not excludable. Damages for emotional distress resulting from physical injury, however, like are excludable because the origin of the claim is a physical injury. Look through to root cause of injury Plenty of gray areas though—what about PTSD? Is it emotional or physical? If you’re given the choice between a lump sum and a structured settlement it is a tough call. Time value of money suggests you should take the money up front. Tax Exempt Interest Sec 103--Interest on State and Local Bonds (a) Exclusion—Except as provided in subsection (b), gross income does not include interest on any State or local bond. (b) Exceptions—Subsection (a) shall not apply to— (1) Private Activity Bond Which is Not a Qualified Bond—Any private activity bond which is not a qualified bond (within the meaning of Sec 141) (2) Arbitrage Bond—Any arbitrage bond (within the meaning of Sec 148). (3) Bond Not in Registered Form—Any bond unless such bond meets the applicable requirements of Sec 149. (c) Definitions—For purposes of this section and part IV— (1) State or Local Bond—The term “State or local bond” means an obligation of a state or political subdivision thereof (2) State—The term “State” includes DC and any possession of the United States. Importance of the Exemption These bonds are essentially a subsidy to state and local governments by the federal government. Tax-exempt bonds are intended primarily to benefit state and local governments, but they also have the incidental effect of benefitting the people who buy the bonds. Because the interest is tax-free, the buyer is more likely to invest, thereby giving the gov’t money. Since the interest is tax-free, the gov’t can offer lower interest rates on the bonds. Given the tax-free nature of municipal bonds, why would anyone want to buy corporate bonds? Because they offer a higher interest rate! For people in the 40% tax bracket, a $10,000 municipal at 6% interest yields the same after tax income as a $10,000 corporate bond at 10% interest--$600! Private Activity Bonds 39 Often used as a way to attract business to a state or locality. The local government borrows the funds, and then turns the funds over to private enterprises. The private enterprises then simply pay the interest on the bonds. The IRS, however, has limited the extent to which these types of bonds can be used. They must be qualified (103(b)(1)). And such qualified bonds are subject to limitations under 141. In case of emergency see p. 208. Arbitrage Bonds When the municipality issues bonds to investors and then the municipality uses the funds to buy corporate bonds that have a high interest rate. This essentially enables municipal governments to pocket a profit here—they pay back their initial investors and then pocket the remaining money (because the corporate bonds pay a higher interest rate). This practice is heavily restricted by 103(b)(2) and 148. U.S. Treasury Bonds The interest on federal bonds is generally subject to tax. There is one exception. Sec 135 exempts the interest on certain US savings bonds to the extent the proceeds are less than college tuition and fees for the taxpayer, her spouse or dependents. This exclusion is phased out for married coupled with income exceeding 60k (40k for single taxpayers). Problem Suppose that Cora and Mona are identical in all respects save for the fact that Cora receives $1,000 in interest from corporate bonds while Mona receives $1,000 in interest from municipal bonds. What are the income tax consequences to Cora and Mona? Does this violate the principle of “horizontal equity,” which holds that taxpayers who are similarly situated should pay the same amount in taxes? Answer Cora will be taxed on the interest, while Mona will not. Cora's after tax-income < Mona's No, two taxpayers with the same economic income receive the same after-tax return Cora Mona Interest rate earned 10% 6% Amount Invested 10k 10k Before tax income 1k 600 Tax 400 0 After tax income 600 600 Both are burdened in different ways ne with tax burden, one with the market so both end up in the same position in the end o Ex: payroll tax (taxes on wages and salary) ~ 15% tax split between Ee and Er (withheld from salary). Er is not bearing the burden bc the market wage rate has been suppressed to reflect a 7.5% reduction. Ee is actually bearing the full burden (illusion that Er is bearing the burden) 40 Deductions & Credits Deductions are better defined than income and are enumerated. Generally, a taxpayer can use deductions only to the extent of her income for the taxable year. Some deductions can be preserved and carried over to be used in a succeeding taxable year, and others are lost. A credit that is usable only to the extent of the tax liability for the taxable year is nonrefundable. A few credits are refundable, meaning the taxpayer will get a check from the government even if he has no tax liability. Some credits can be carried over to a succeeding year. Credit for Employment-Related Child Care Expenses (§ 21) Credit = “applicable percentage” × employment-related dependent care expenses “Applicable percentage” = 35% if AGI ≤ $15,000 reduced if AGI > $15,000 (to 20% if AGI > $43,000) Subject to other restrictions and ceilings (e.g., creditable expenses limited to $3,000 for 1 dependent and $6,000 for 2 or more dependents) Business Expenses Generally §162: expenses in connection with a trade or business (ToB) are deductible ToB is not defined in code must be actively engaged in activity. Occasional investment in stock market is not a ToB § 212: “ordinary and necessary” expenses stemming from income-producing activities that do not qualify as a ToB ONLY applies to individuals Are miscellaneous itemized deductions subject to 2% floor Generally, TP must have itemized deductions > standard deduction Only a deduction from Adjusted Gross Income to obtain taxable income Deductions attributable to rents and royalties, however, are deductible from gross income in determining AGI as per 62(a)(4). ~ Allows ~ Deductions § 162—Trade or Business Expenses (a) In General—There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including— (1) A reasonable allowance for salaries or other compensation for personal services actually rendered; (2) Traveling expenses (including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances) while away from home in the pursuit of a trade or business; and (3) Rentals or other payments required to be made as a condition to the continued use or possession, for purposes of the trade or business, of property to which the taxpayer has not taken or is not taking title or in which he has no equity. For purposes of the preceding sentence, the place of residence of a Member of Congress (including any Delegate and Resident Commissioner) within the State, congressional district, or possession which he represents in Congress shall be considered his home, but amounts expended by such Members within each taxable year for living expenses shall not be deductible for income tax purposes in excess of $3,000. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period exceeds 1 year. The preceding sentence shall not apply to any Federal employee during any period for which such employee is certified by the Attorney General (or the designee thereof) as traveling 41 on behalf of the United States in temporary duty status to investigate or prosecute, or provide support services for the investigation or prosecution of, a Federal crime. (b) Charitable Contributions and Gifts Excepted—No deduction shall be allowed under subsection (a) for any contribution or gift which would be allowable as a deduction under section 170 were it not for the percentage limitations, the dollar limitations, or the requirements as to the time of payment, set forth in such section. § 212—Expenses for Production of Income—In the case of an individual, there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year— (investment deductions) (1) For the production or collection of income (2) For the management, conservation, or maintenance of property held for the production of income; or (3) In connection with the determination, collection, or refund of any tax. ~ Prohibits ~ Deductions § 262—Personal, Living, and Family Expenses (a) General Rule—Except as otherwise expressly provided in this chapter, no deduction shall be allowed for personal, living, or family expenses. (b) Treatment of Certain Phone Expenses—For purposes of subsection (a), in the case of an individual, any charge (including taxes thereon) for basic local telephone service with respect to the 1st telephone line provided to any residence of the taxpayer shall be treated as a personal expense. § 263—Capital Expenditures (a) General Rule—No deduction shall be allowed for— (1) Any amount paid out for new buildings or for permanent improvements or betterments made to increase the value of any property or estate. This paragraph shall not apply to— See Stat. Sup. Pg. 246 for the list. It’s mostly obscure things. ** More general than real estate (2) Any amount expended in restoring property or in making good the exhaustion thereof for which an allowance is or has been made. Defining “Ordinary and Necessary” Welch: [Officer of corp that went bankrupt and personally paid back some debts (even though no legal obligation) for 'goodwill' reasons bc he was starting up his own (self-employed but doing same thing as old business that went under) wanted to deduct payback of debts. IRS disallowed deduction.] Necessary = appropriate & helpful Super easy std to meet Ordinary = common and accepted (still lingering today) Look at life of business people in the industry or in general Whether it is common for a single taxpayer is not determinative Today, Ordinary = not a capital expenditure TP has burden of proof Jenkins v. Commission [Welch, country music style. Goes bankrupt and investors lose $, Twitty pays the investors back (no obligation to) and deducted as O&N] IRS --> personal expense! His business is that he is a country music performer Helping out his friends § 262 Twitty --> no, this is important for my country music career (reputation) Why not a capital expenditure? (should be) Differences Welch: new business (startup expenses = capitalized), creating reputation Twitty: already had a business, maintaining reputation (repairs to maintain equipment = deductible) Gilliam [crazy artist on plane wants to deduct litigation expenses from defending against his attack of passengers on plane (invited to speak in TX)] 42 Uses old def of ordinary (common and accepted) not ordinary expense Should be a personal v. business expense case (should be personal, arise out of personal situation or business situation -- but for the invitation to speak he wouldn’t have been on the plane, but for his mental state he wouldn't have attacked passengers) [hit child while driving car for business] Common and accepted? Yeah! Reasonable Allowance for Salaries under § 162(a)(1) Exacto Spring Corp.: [tax payer is CEO and a shareholder and gets paid $1m, how to categorize?] Dividend - nondeductible by comp and taxable income to Heitz Salary - deductible by comp and taxable income to Heitz IRS - even if salary, not reasonable $400k is salary (reasonable) excess must have been a dividend Court - 7 factors (traditional approach and still most common) The type and extent of the services rendered The scarcity of qualified employees The qualifications and prior earning capacity of the employee The contributions of the employee to the business venture The next earnings of the employer The prevailing compensation paid to employees with comparable jobs The “peculiar” characteristics. $700k! (split the difference…) Appeal -- Posner, come on. You just being arbitrary Ask directly: was salary reasonable? (7 factors) Ask indirectly through Independent Investor Test: what is he getting as a return on capital? 13% required rate of return Actual 20% No one is going to complain about his salary given this return When the “investors in [the] company are obtaining a far higher return then they had reason to expect, the salary is presumptively reasonable.” This number, however, was probably calculated by corp's books (accounting), which is different from FMV of stock which is difficult to measure in a closely held company. Green not convinced. Judges not good at determining what a reasonable salary is, but apparently can determine what a reasonable investor would expect? Economic returns (dividends and share appreciation (P)) Difficult to value shares bc no market (closely held shares) Some think there is a built-in protection against over paying CEOs in publicly held corporations. Hostile take overs § 162(m): only $1m of salary paid to CEO or any of the four most highly compensated EEs of a publicly held corp is deductible unless based on performance (basically bonus) No one thinks this is effective Deductions Contrary to Public Policy I.R.C. §§ 162(c)(1)–(3), (f), (g), 280E; Treas. Reg. § 1.162-21(a)–(b), (c) Example (2) Courts can't invent knew public policy limitations (purpose of these code sections) § 162(c): Certain illegal bribes, kickbacks, and other payments are disallowed. § 162(f): Any fine or similar penalty paid to a government for the violation of any law is disallowed. A fine or similar penalty includes an amount paid in settlement of the taxpayer’s actual or potential liability for a fine or penalty. Treas. Reg. § 1.162-21(b)(1)(iii). 43 Compensatory damages paid to a government do not constitute a fine or penalty. Treas. Reg. § 1.162-21(b)(2). What is compensatory? Environmental, civil penalty (remediation, based on amount of harm) Ally: Can’t reduce the fine by donating the reduced amount (it’s in lieu of penalty). A company that makes a court-ordered charitable contribution in lieu of a criminal fine may NOT take a business deduction under 162 or a charitable contribution under 170. BUT Exxon Mobile oil spill - agreed to pay small fine and a HUGE charitable donation to a fund; IRS never challenged Now you write into the settlement agreement that no amount is a basis for deduction (c) Example (2) N Corp. was found to have violated 33 U.S.C. 1321(b)(3) when a vessel it operated discharged oil in harmful quantities into the navigable waters of the United States. A civil penalty under 33 U.S.C. 1321(b)(6) of $5,000 was assessed against N Corp. with respect to the discharge. N Corp. paid $5,000 to the Coast Guard in payment of the civil penalty. Section 162(f) precludes N Corp. from deducting the $5,000 penalty. § 162(g): No deduction for 2/3 of any amount paid or incurred on a judgment for antitrust damages (Clayton Act § 4) following a related criminal antitrust conviction (1), or settlement (2) Kicks in once you have already been convicted of the crime § 280E: Expenses in connection with a trade or business that “consists of trafficking in controlled substances.” Not much effect (political theatre) 44 Business & Investment Expenses v. Personal Expenses Generally ATL deductions are much less restricted than BTL deductions. LOOK AT § 163(a) & (b) GROSS INCOME § 61 ToB Deductions o Exception: if TP = EE ToB are not ATL deductions Exceptions to exception: If expenses reimbursed by ER ATL If TP is self-employed ATL o Note: Read § 62(a)(1), (a)(2)(A) carefully Certain other ATL Deductions o Losses from sale or exchange of property, deductions attributable to rents and royalties, certain retirement savings, alimony, and moving expenses. = ADJUSTED GROSS INCOME § 62 ~the line~ Itemized Deductions §63(d) or Std Deduction § 63(c) o Std deduction (2015) = $6,300 for single individuals and $12,600 for married couples filing jointly, w/ additional amounts for TPs who are 65 or older, or blind. o Note: Miscellaneous Itemized Deductions Only deductible if total MIDs for a taxable yr > 2% of TP’s AGI § 67(a) § 67(b): MIDs = all itemized deductions except those listed in § 67(b) o Listed, so not MID: deductions for interest expense; taxes; casualty, theft, and gambling losses; charitable contributions; and medical expenses… Unreimbursed EE business expenses and §212 investment expenses are MID o Note: § 68 reduces total amount of certain itemized deductions for higher-income TPs (2015, AGIs > $285,250 for individuals and $309,900, or more for married couples filing jointly) The higher your income the more itemized deductions you have to give up, but don’t worry too much bout dis Personal Exemptions (§ 151; one for yourself, your spouse, and each of your dependents; $4,000 per exemption for 2015, phased out for higher-income taxpayers) = TAXABLE INCOME § 63 ATL: Key Provisions § 62—Adjusted Gross Income Defined (a) General Rule—For purposes of this subtitle, the term “adjusted gross income” means, in the case of an individual, gross income minus the following deductions: (1) Trade and Business Deductions--The deductions allowed by this chapter (other than by part VII of this subchapter) [like depreciation deduction] which are attributable to a trade or business carried on by the taxpayer, if such trade or business does not consist of the performance of services by the taxpayer as an employee. (2) Certain Trade and Business Deductions of Employees— (A) Reimbursed Expenses of Employees--The deductions allowed by part VI (section 161 and following) which consist of expenses paid or incurred by the taxpayer, in connection with the performance by him of services as an employee, under a reimbursement or other expense allowance arrangement with his employer. The fact that the reimbursement may be provided by a third party shall not be determinative of whether or not the preceding sentence applies. 45 (B) Certain Expenses of Performing Artists--The deductions allowed by section 162 which consist of expenses paid or incurred by a qualified performing artist in connection with the performances by him of services in the performing arts as an employee. (3) Losses From Sale or Exchange of Property —The deductions allowed by part VI (Sec 161 and following) as losses from the sale or exchange of property. Ex: Stock (4) Deductions Attributable to Rents and Royalties—The deductions allowed by part VI (Sec 161 and following), by Sec 212 (relating to expenses for production of income), and by Sec 611 (relating to depletion) which are attributable to property held for the production of rents or royalties. (10) Alimony—The deduction allowed by Sec 215, can elect. (20) Costs Involving Discrimination Suits, Etc.-- Any deduction allowable under this chapter for attorney fees and court costs paid by, or on behalf of, the taxpayer in connection with any action involving a claim of unlawful discrimination (as defined in subsection (e)) or a claim of a violation of subchapter III of chapter 37 of title 31, United States Code or a claim made under section 1862(b)(3)(A) of the Social Security Act (42 U.S.C. 1395y (b)(3)(A)). The preceding sentence shall not apply to any deduction in excess of the amount includible in the taxpayer’s gross income for the taxable year on account of a judgment or settlement (whether by suit or agreement and whether as lump sum or periodic payments) resulting from such claim. (b) Qualified Performing Artist— (1) In General—For purposes of subsection (a)(2)(B), the term “qualified performing artist” means, with respect to any taxable year, any individual if— (A) Such individual performed services in the performing arts as an employee during the taxable year for at least 2 employers (B) The aggregate amount allowable as a deduction under section 162 in connection with the performance of such services exceeds 10 percent of such individual’s gross income attributable to the performance of such services, and (C) The adjusted gross income of such individual for the taxable year (determined without regard to subsection (a)(2)(B)) does not exceed $16,000. (2) Nominal Employer Not Taken Into Account--An individual shall not be treated as performing services in the performing arts as an employee for any employer during any taxable year unless the amount received by such individual from such employer for the performance of such services during the taxable year equals or exceeds $200. (c) Certain Arrangements Not Treated as Reimbursement Arrangements—For purposes of subsection (a)(2)(A), an arrangement shall in no event be treated as a reimbursement or other expense allowance arrangement if— (1) Such arrangement does not require the employee to substantiate the expenses covered by the arrangement to the person providing the reimbursement, or (2) Such arrangement provides the employee the right to retain any amount in excess of the substantiated expenses covered under the arrangement. The substantiation requirements of the preceding sentence shall not apply to any expense to the extent that substantiation is not required under section 274 (d) for such expense by reason of the regulations prescribed under the 2nd sentence thereof. (e) Unlawful Discrimination Defined—For purposes of subsection (a)(20), the term “unlawful discrimination” means an act that is unlawful under any of the following: See page 53 of Stat. Sup. BTL: Key Provisions Sec 63(c)—Standard Deduction—For purposes of this subtitle— (1) In General—Except as otherwise provided in this subsection, the term “standard deduction” means the sum of— (A) The basic standard deduction (B) The additional standard deduction 46 (D) The disaster loss deduction (2) Basic Standard Deduction—For purposes of paragraph (1), the basic standard deduction is: (A) 200 percent of the dollar amount in effect under subparagraph (C) for the taxable year in the case of— (i) A joint return, or (ii) A surviving spouse (as defined in section 2(a)) (B) $4,400 in the case of a head of household (as defined in section 2(b)), or (C) $3,000 in any other case. (3) Additional Standard Deduction for Aged and Blind—For purposes of paragraph (1), the additional standard deduction is the sum of each additional amount to which the taxpayer is entitled under subsection (f). (4) Adjustments for Inflation—In the case of any taxable year beginning in a calendar year after 1988, each dollar amount contained in paragraph (2)(B), (2)(C), or (5) or subsection (f) shall be increased by an amount equal to— (A) Such dollar amount, multiplied by (B) The cost-of-living adjustment determined under section 1 (f)(3) for the calendar year in which the taxable year begins, by substituting for “calendar year 1992” in subparagraph (B) thereof— (i) “Calendar year 1987” in the case of the dollar amounts contained in paragraph (2)(B), (2)(C), or (5)(A) or subsection (f), and (ii) “Calendar year 1997” in the case of the dollar amount contained in paragraph (5)(B). (5) Limitation on Basic Standard Deduction in the Case of Certain Dependents—In the case of an individual with respect to whom a deduction under section 151 is allowable to another taxpayer for a taxable year beginning in the calendar year in which the individual’s taxable year begins, the basic standard deduction applicable to such individual for such individual’s taxable year shall not exceed the greater of— (A) $500, or (B) The sum of $250 and such individual’s earned income. (6) Certain Individuals Not Eligible for Std. Deduction—In the case of— (A) A married individual filing a separate return where either spouse itemizes deductions, (B) A nonresident alien individual, (C) An individual making a return under section 443 (a)(1) for a period of less than 12 months on account of a change in his annual accounting period, or (D) An estate or trust, common trust fund, or partnership, the standard deduction shall be zero. (8) Disaster Loss Deduction—For the purposes of paragraph (1), the term “disaster loss deduction” means the net disaster loss (as defined in section 165 (h)(3)(B)). Sec 63(d)—Itemized Deductions—For purposes of this subtitle, the term “itemized deductions” means the deductions allowable under this chapter other than— (1) The deductions allowable in arriving at adjusted gross income, and (2) The deductions for personal exemptions provided by Sec 151 Sec 67—2-Percent Floor on Miscellaneous Itemized Deductions (a) General Rule—In the case of an individual, the miscellaneous itemized deductions for any taxable year shall be allowed only to the extent that the aggregate of such deductions exceed 2 percent of adjusted gross income. (b) Miscellaneous Itemized Deductions—For purposes of this section, the term “miscellaneous itemized deductions” means the itemized deductions other than— See Stat. Sup. Pg. 58. —Includes the deductions for interest expense; taxes, casualty, theft, and gambling losses; charitable contributions; and medical expenses Sec 68—Overall Limitation on Itemized Deductions This provision essentially reduces the total amount of certain itemized deductions for higher-income taxpayers (for 2014, AGIs of 254,200k or more for single filers and 305,050k or more for married couples filing jointly). 47 Sec 151—Allowance od Deductions for Personal Exemptions (a) Allowance of Deductions—In the case of an individual, the exemptions provided by this section shall be allowed as deductions in computing taxable income (b) Taxpayer and Spouse—An exemption of the exemption amount for the taxpayer; and an additional exemption of the exemption amount for the spouse of the taxpayer if a joint return is not made by the taxpayer and his spouse, and if the spouse, for the calendar year in which the taxable year of the taxpayer begins, has no gross income and is not the dependent of another taxpayer. (c) Additional Exemption for Dependents—An exemption of the exemption amount for each individual who is a dependent (as defined in section 152) of the taxpayer for the taxable year. (d) Exemption Amount—For purposes of this section— (1) In General—Except as otherwise provided in this subsection, the term “exemption amount” means $2,000. (2) Exemption Amount Disallowed in Case of Certain Dependents—In the case of an individual with respect to whom a deduction under this section is allowable to another taxpayer for a taxable year beginning in the calendar year in which the individual’s taxable year begins, the exemption amount applicable to such individual for such individual’s taxable year shall be zero. (3) Phase-out— (A) In General—In the case of any taxpayer whose adjusted gross income for the taxable year exceeds the applicable amount in effect under section 68(b), the exemption amount shall be reduced by the applicable percentage. (B) Applicable Percentage—For purposes of subparagraph (A), the term “applicable percentage” means 2 percentage points for each $2,500 (or fraction thereof) by which the taxpayer’s adjusted gross income for the taxable year exceeds the applicable amount in effect under section 68(b). In the case of a married individual filing a separate return, the preceding sentence shall be applied by substituting “$1,250” for “$2,500”. In no event shall the applicable percentage exceed 100 percent. (C) Coordination with Other Provisions—The provisions of this paragraph shall not apply for purposes of determining whether a deduction under this section with respect to any individual is allowable to another taxpayer for any taxable year. (4) Inflation Adjustment—In the case of any taxable year beginning in a calendar year after 1989, the dollar amount contained in paragraph (1) shall be increased by an amount equal to— (A) Such dollar amount, multiplied by (B) The cost-of-living adjustment determined under section 1(f)(3) for the calendar year in which the taxable year begins, by substituting “calendar year 1988” for “calendar year 1992” in subparagraph (B) thereof. (e) Identifying Information Required—No exemption shall be allowed under this section with respect to any individual unless the TIN of such individual is included on the return claiming the exemption. Problem After you go to work as an attorney-advisor in the Treas. Dept.’s Office, you join the ABA and pay dues of $100. The Treas. Dept. does not reimburse you. Suppose your AGI for the year is 100k. How much, if any, of the $100 cost of the dues may you deduct? Answer Can’t deduct any of it. But might be able to argue it is a ordinary and necessary business expense… BTL deduction (not reimbursed by ER) MID (not listed in 67(b)) can only deduct if > 2% of AGI = 2k. 100 < 2k Can’t deduct any. Problem If the Treas. Dept. reimburses you for the ADA dues, how much, if any, of the $100 cost of the dues may you deduct? Must you include the amount of the reimbursement in gross income? Answer 48 ATL deduction (reimbursed by ER). Treas. Reg. 1.62-2(c)(4) breaks down reimbursement into “two plans”—accountable plans and nonaccountable plans. For accountable, there are three requirements: o The reimbursement must be (1) for something that has a business connection, (2) there must be substantiation, and (3) you have to return the excess amount over your reimbursement. If the three are satisfied, you exclude the reimbursement from gross income! If you fail any one of the three requirements, it is a non-accountable plan, which means that the reimbursement is reported in gross income, and is deductible as a miscellaneous itemized deduction, subject to the 2% floor. ONLY FOR EES AND ERS Distinguishing Between Business and Personal, Living or Family Expenses Problem Suppose you are an associate in a law firm. You buy some pictures and a plant to decorate your office. May you deduct the cost? Answer This isn’t an easy answer. Is this an ordinary and necessary business expense? o Well, you could argue that it is helpful to your business because it improves the environment for clients. But is it ordinary? And even if it was, it’s still subject to the 2% floor, which makes it unlikely that you’d be able to deduct. Thinks deductible. Could get depreciation photo + plant = Capital expenditure! not ordinary. Is this a personal expense? § 262 o Debatable; Green disagrees with presumption some courts have; if ER doesn’t provide it then it probably isn’t necessary. Not right, there are tons of unreimbursed deductible expenses! There is a case on point—Henderson [worked for gov't and didn’t have a client like in the associate case] The taxpayer loses, but Green doesn’t think the case holds any water because it was argued pro se. Also pre 2% floor. o Tax ct memorandum (TCM) (not much precedential value - bound to facts of case, but can distinguish). o Note: if going to Tax ct: don’t pay tax. If going to dist, or claims ct: pay tax and apply for refund What if furnished by ER? De minimis - too small to keep track of (arguable); OR can argue working condition fringe (counter-factual): If you had paid for it out of our pocket, would it have been deductible? (162, OR 167 - depreciation from capital expenditure) o Green yes! Capital expenditure working condition fringe o Henderson nope, taxable o Alt. (flip presumption around) bc Er provided it = necessary, therefore would be deductible Clothing Pevsner: [Manager in fancy clothing store required to wear fancy clothing. Never wore clothes outside of work bc too fancy for her. Took deduction on cost of clothing under Sec 162.] (242) Cost of clothing is deductible as a business expense only if: The clothing is of a type specifically required as a condition of employment. Pevsner satisfies this. The clothing is not adaptable to general usage as ordinary clothing, and; Objective standard = adaptability for personal or general use depends on what is generally accepted for ordinary street wear. It is not so worn. 49 Pevsner satisfies this prong. Problem Your client is a professional musician employed by a small-town orchestra. In the current year, he spends 1k for a tux and related accessories, which he wears only during concert appearances. The orchestra doesn’t reimburse him for these expenses. May he deduct the cost of the formal clothing? If so, is the deduction subject to the 2% floor on miscellaneous itemized deductions? Answer Deductible, either subject to floor, or fully deductible. Will likely satisfy Pevsner test (was it required as a condition of employment?), but more importantly there is an actual case on point! In Fisher, the court permitted a deduction for a tuxedo for worn by a piano soloist. This will be subject to the 2% floor because it is not reimbursed… But: 62(a)(2)(B)–non-reimbursed employee business expenses for qualified performing artists are fully deductible. o Qualified performing artist is defined in 62(b) and it essentially means poor performing artists. Have to make sure he is "qualified.” Inherently Personal Standard Some courts hold that some expenses are “inherently personal in nature.” – Haircuts Not all courts follow this, and it is truly an arbitrary standard. Examples include: – Trebilcock: Disallowed deductions for payments by a businessman to a minister for business and personal advice based on prayer. – Fred W. Amend: Disallowed deduction where a businessman hired a Christian Science practitioner who provided spiritual guidance on business and personal matters. – Kelly: Disallowed deduction for cost of athletic equipment by CPA who claimed he needed the equipment in order to establish necessary stamina for tax practice Public Employees: Although, in general, a trade or business expense must be profit-seeking, a limited exception has been carved out for public employees. In Frank v. United States, the 9th Circuit allowed deductions for food, lodging, and transportation expenses as part of his job as a virtually uncompensated aid to a US Senator. The aid’s expenses were sometimes more than 30-times his salary! The court says that not every public officer could be considered a trade or business, but a position that entails “a definite work assignment” and is not undertaken “as a tax dodge” would qualify as a trade or business. Domestic Services and Child Care Smith v. Commissioner (1939) – Both parents work and incurred childcare expenses as a result. They deducted the expenses as an ordinary and necessary business expense. The court denied the deduction under § 262, finding that the choice to having children is personal. In 1954, Congress put a provision in the code that allowed some deductions, but this was eventually replaced by § 21, which creates a two-tiered credit. Taxpayers with AGI of 15k or less may offset tax liability by 35% of their employment-related dependent care expenses. Those with an AGI above 43k may offset 20%. Traveling + Transportation Expenses Terminology Transportation expense = actual cost of transportation. Transportation expenses generally travelling expenses, and are NOT subject to away from home requirement. 50 Traveling expenses are those that normally would be strictly personal but bc you are travelling away from home are deductible. 162(a)(2) Lodging, meals, and incidental expenses (e.g. dry-cleaning) Away from home (oveight) requirement (Correll). Traveling expenses do NOT include “transportation expenses.” Sec 162—Trade or Business Expenses (a) In General—There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business, including— (2) Traveling expenses (including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances) while away from home in the pursuit of a trade or business; and Home = Tax Home (term of art) Flush: For purposes of the preceding sentence, the place of residence of a Member of Congress (including any Delegate and Resident Commissioner) within the State, congressional district, or possession which he represents in Congress shall be considered his home, but amounts expended by such Members within each taxable year for living expenses shall not be deductible for income tax purposes in excess of $3,000. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period exceeds 1 year. The preceding sentence shall not apply to any Federal employee during any period for which such employee is certified by the Attorney General (or the designee thereof) as traveling on behalf of the United States in temporary duty status to investigate or prosecute, or provide support services for the investigation or prosecution of, a Federal crime. Transportation Expenses Generally, transportation expenses such as airfare and cab fare are deductible when the taxpayer is traveling on business. This may be the cost of traveling from one city to another, but it may also be the cost of traveling from one business engagement to another in the same metropolitan area. Commuting Treas. Reg. 1.162-2(e): The cost of commuting from home to work and back are nondeductible personal expenses. Rationale: you decided to live far away! Rev. Rul. 99-7: Provides a number of exceptions to Treas. Reg. 1.162-2(e) (1) A taxpayer may deduct daily transportation expenses incurred in going between the taxpayer’s residence and a temporary work location outside the metropolitan area where the taxpayer lives and normally works. Doesn’t require a regular work location (2) If a taxpayer has one or more regular work locations away from the taxpayer’s residence, the taxpayer may deduct daily transportation expenses incurred in going between the taxpayer’s residence and a temporary work location in the same trade or business, regardless of the distance. (3) If a taxpayer’s residence is the TP’s PPB within the meaning of § 280A(c)(1)(A), the taxpayer may deduct daily transportation expenses incurred in going between the residence and another work location in the same trade or business, regardless of whether the other 51 work location is regular or temporary and regardless of the distance. You can totally take advantage of these exceptions: Problem Suppose you are a self-employed attorney whose office is in DC. You reside in Arlington, VA. One day you take a morning flight from National Airport in Arlington to Cincinnati, meet with a client in Cincinnati during the day, and then take a late afternoon flight back to National. May you deduct: Cost of driving between you home and the airport? Cost of the airfare? Cost of your breakfast and lunch while in Cincinnati? Answer Cost of driving between your home and the airport is deductible. Part of the commute, falls under first exception of Rev. Rul. 99-7 to Treas. Reg. 1.162-2(e) because you’re traveling from your residence to a temporary place of work that is outside metropolitan area from where you live and work. It also qualifies under the second exception. o Commute bc between residence and work involving two modes of transportation (car, then plane) o Transportation expense ∴ not subject to overnight requirement o Can also deduct parking cost for the airport (commuting expense) Cost of airfare is deductible for same reasons as above. Falls under first and second exceptions of Rev. Rul. 99-7 to Treas. Reg. 1.162-2(e). And not subject to overnight requirement. Cost of breakfast and lunch in Cincinnati likely is not deductible as a traveling expense, but perhaps as a business meal… 162(a)(2): Attorney is not staying overnight, so the meals aren’t deductible. If you have a meal with a client and have a business discussion “business meal.” Problem Suppose instead that you take the trip as an associate (employee) in a law firm, and the law firm reimburses you for the expenses in (a) –(c). Is the reimbursement excludable from gross income? Answer 1.62-2(c), (d): If reimbursed business expense, can usually exclude. Airfare: Form argument deductible under 162, should report income and then take deduction but regulation says just exclude it if ER has accountable plan. Substance argument fringe benefit § 132 (working condition fringe) exclusion (substance) Meals reimbursement is likely taxable. If what is being reimbursed in a non-deductible expense, then you MUST report the reimbursement. o ** If ER’s plan reimburses you for traveling expenses when EE is not away from home (doesn’t meet req and therefore not deductible), it is NOT an accountable plan! 52 Tools of the Trade Fasuner: USSC carves out an exception for “additional expenses [that] may at times be incurred for transporting job-required tools and materials to and from work.” Rev. Rul. 75-380: IRS permits a deduction only for the portion of the cost of transporting the work implements by the mode of transportation used which is in excess of the cost of commuting by the same mode of transportation without the work implement. McCabe: Police officer can’t deduct the extra cost of having to travel a longer route because he can’t get a permit for his gun in NJ. Working and Driving Pollei: Police officers, who began active patrol when they left home, were engaged in their jobs while driving to and from the stationhouse. Therefore, the commuting expenses allocable to that time were deductible. Commuting at the Midnight Hour The regulations permit the cost of transportation provided by the employer to employees paid on hourly basis to be valued at $1.50 (regardless of actual value) if the transportation is furnished solely due to unsafe conditions. Unsafe conditions exist if a reasonable person would not consider it safe to walk or take public transportation at the applicable time of day. Treas. Reg. 1.61-21(k) Luxury Travel Even where the employee travels on business, the style of travel may be so luxurious as to produce clear personal benefit. Still, Congress has acted to limit deductions in only a few cases. See Sec 274(m); Sec 280F. Meals and Lodging Food and lodging = traveling expenses 162(a)(2). EEs unreimbursed travel expenses are deductible as a MID and are subject to the 2% floor. Travel expenses reimbursed by ER (as well as those incurred by self-employed individuals) are deductible as ATL deductions. Hantzis (1st Cir): [HLS student summer associate in NYC. Married and husband worked in Boston—own a house in Boston. Position is for 10 weeks and deducts apt rent + meals. IRS disallows: your home for purposes of 162(a)(2) is not where you live, it’s your regular place of business. It’s only when you don’t have a regular place of business that you can fall back on where you live. IRS: H’s PPB= NYC. Not away from home for purposes of 162(a)(2).] Must can’t show a business reason for why she maintained her home in Boston. Thus, the deduction is disallowed. “Mrs. Hantzis’ trade or business did not require that she maintain a home in Boston, as well as one in NY.” NOTES: Don’t forget this: “The location of a person’s home for purposes of 162(a)(2) becomes problematic only when the person lives in once place and works another. Where a taxpayer resides and works at a single location, he is always home, however defined; and where a taxpayer is constantly on the move due to his work, he is never ‘away’ from home” The Second Circuit, in Rosenspan, says that your home is always your place of abode, but you only get the benefit of 162 if you have a business reason for maintaining your abode in a different place than where you work. Travelling salesman, no place of abode (said ER's HQ is his PPB bc he's there 5 days out of the year) IRS: If you don’t have a home, you are never away from home! Thus, the 1st and the 2nd Circuit end up at the same result, but they just get there a little differently. Temporary v. Indefinite Employment Where a taxpayer leaves his regular place of employment to take a temporary job at another location, the taxpayer may treat his regular residence or place of employment as “home” and deduct the costs of food and lodging at his temporary job. If the duration of the new job is “indefinite,” however, the taxpayer may not deduct his expenses. § 162(a)(2) provides that the taxpayer is not treated as being temporarily 53 away from home if the period of employment exceeds one year. The IRS has interpreted this to mean that expenses attributable to employment which is realistically expected to last for more than a year are not deductible regardless of how long the employment actually lasts. Expenses relating to employment expected to last for less than a year that in fact does last for less than a year are deductible, but if the expectation changes, only the expenses until that date (meaning that date where your expectations change) are deductible. NOTE: Green does not think that the IRS’ interpretation is law because it comes from a Rev. Rul. He thinks that statute provides a bright-line rule, and that’s it! But then again, he isn’t sure. Problem Suppose that after graduating from law school you take a job as an associate in a law firm in New York City. During your first year you apply for a clerkship with a newly appointed judge on the Tax Court and are offered the job. At the end of your first year at the firm, you resign from the law firm and move to Washington, D.C., to assume the clerkship. At the end of one year of clerking, you return to your associate job at the law firm in New York City. Are your traveling expenses while you are in Washington, D.C., deductible? Does it matter whether you also maintain a residence in New York City during the year you spend in Washington, D.C.? Does it matter if the clerkship ends up lasting slightly more than one year? Answer Green isn’t entirely sure of the answer—doesn’t think it’s clear-cut. Don’t get confused by Hantzis—there, the taxpayer failed to establish a tax home in Boston, and thus could not even gain access to the temporary employment doctrine. If she had, then we could discuss the one-year requirement. SO, according to Green: the real temporary employment doctrine is: once you establish a tax home (a regular place of business), if you’re temporarily away from that location, your tax home does not shift. Here, the student will argue that she has a tax home in NYC and she is just temporarily away (and she expected it to be less than a year). Here, the IRS will likely say that because of your resignation, you likely abandoned your business connection to NY and therefore you don’t have a tax home there anymore. Thus, no deduction. o You could argue that you had to resign and that there was an understanding that you would return to NYC at the end of the year. o Abandonment is a Q of intent (resignation is a mere formality) Green thinks that the court will look at your abode because of the above language in Hantzis (Section 162(a)(2) seeks rather to mitigate the burden of the taxpayer who, because of the exigencies of his trade or business, must maintain two places of abode and thereby incur additional and duplicate living expenses.”). So, Green thinks if you don’t have an apartment in NYC anymore then you might lose in court. As long as you are temporarily away on business then your tax home stays Would be difficult in 2d Cir. Bc tax home = abode (worst) See pg 24 on short outline if confused. Entertainment & Business Meals There is a very long-standing doctrine that so called “business meals” can be deducted. These are meals with people with whom you do business (i.e., people outside your firm like clients). So long as you can show a sufficiently strong business connection, you are allowed to deduct the cost of the meals. Connection = conversation about business before, during, or after meals What if you simply eat meals with your coworkers? Can you deduct the meal expense? Moss v. Commissioner: pre- 274(n) 50% limitation! [Small litigation firm in Chicago. Each partner deducted their share of the meal expenses under 162(a)(2).] (261) Tax court: disallows, personal, not a business expense. You have to eat meals no matter what! So why should we allow the deduction? Under Sec 162, for non-travelling business meals you may only deduct the excess of that which would have been made for personal expenses. (old rule) Here, then, the tax court is saying that there was no excess! The partners would have eaten this food regardless the circumstances. Since there is no excess, nothing is deductible. 54 The meals occurred every single day and are therefore inherently personal. Maybe if this was occasional, it would have been deductible, says the court. 7th Cir.: Affirmed! Posner: reason you have a meal with a client is to make it easier to conduct business, i.e., it creates a more relaxed environment in which to negotiate. If you want to deduct a meal with coworkers you need to be fostering that same environment. Here, though, we have a small firm—they all know each other already and they all have a good rapport with one another. Maybe if this was a big law firm, this would justify an occasional meal. GREEN: Green wonders if this comes out the right way. Indeed, Rev. Rule 63-144 and Sutter state the “excess rule,” but the Rev. Rule goes on to further say that the excess rule is only really applied in cases of abuse. Thus, Green thinks the normal rule is that the meal should be fully deductible. But then again, Rev. Rules aren’t binding law! Moreover, Green doesn’t really buy the “occasional meal” argument—he thinks if there is a sufficient business connection then it should be deductible. Nevertheless, Moss is the law. This isn’t deductible. HYPO: What if associates went out with the partners and the partners paid for their lunch; the associates get a free meal (no cost, so not a deduction, talking about an exclusion). What then—is the value of the meal part of the associates’ compensation? One way to exclude would be to say, ok, this is gross income under 62, but it is excludable as a working condition fringe—which of course is tied to 162 and in Moss is not deductible (you could say that this is truly an ordinary and necessary business expense for the associates because they have no choice in refusing the meal; lots of pressure; might get fired if they turn it down; can’t bring a PB&J from home). Or, alternatively, the associates could say this is not even income under Gotcher (lacked dominion). Hard to make in Er-Ee situation though… Doesn’t think would qualify as de minimus fringe RESTRICTIONS on Business Meals and Entertainment Change in law in 1986 I.R.C. §§ 274 (n)(1), (2)(A)–(E) NOTE: The claim of the deduction is always 162. The only thing 274 ever does is limit what otherwise would be an allowable deduction. First you need to get past 162 and 262—only if you qualify under those provisions do you need to look at 274. FIRST – 162 o Allows SECOND – 274(a) o Disallows THIRD – 274(n) o Check exemptions in 274(n)(2)(A) Which includes (e)(3)(B) SUMMARY §274(a)(1)(a): Activities o Entertainment, amusement, or recreation costs only deductible if: Item was “directly related to” active conduct of TP’s ToB; OR 55 Item preceded or was followed by a substantial and bona fide business discussion associated w/ TP’s ToB §274(d): Substantiation requirement o No deduction under §162 (ToB expenses) or §212 (expenses for production of income) for any traveling expense UNLESS taxpayer substantiates by adequate records/receipts o **this is assumed on exam!!!!** §274(n)(1): Can only deduct 50% of meal & entertainment expenses (50/50 Rule) o (A): Deduction only includes costs for food or beverages, and o (B): Any item that’s generally considered to constitute entertainment, amusement, or recreation §274(n)(2): Exceptions o Any expense described in Paragraphs 2, 3, 4, 7, 8, or 9 of §274(e) o (B): If expense is for food or beverage, its excludable if considered de minimis fringe under §132 Key Provisions Sec 274—Disallowance of Certain Entertainment, Etc. Expenses. (a) Entertainment, Amusement, or Recreation (1) In General--No deduction otherwise allowable under this chapter shall be allowed for any item— (A) Activity—With respect to an activity which is of a type generally considered to constitute entertainment, amusement, or recreation, unless the taxpayer establishes that the item was directly related to, or, in the case of an item directly preceding or following a substantial and bona fide business discussion (including business meetings at a convention or otherwise), that such item was associated with, the active conduct of the taxpayer’s trade or business, or (B) Facility—With respect to a facility used in connection with an activity referred to in subparagraph (A). FLUSH—In the case of an item described in subparagraph (A), the deduction shall in no event exceed the portion of such item which meets the requirements of subparagraph (A). (2) Special Rules—For purposes of applying paragraph (1)— (A) Dues or fees to any social, athletic, or sporting club or organization shall be treated as items with respect to facilities. (B) An activity described in section 212 shall be treated as a trade or business. (C) In the case of a club, paragraph (1)(B) shall apply unless the taxpayer establishes that the facility was used primarily for the furtherance of the taxpayer’s trade or business and that the item was directly related to the active conduct of such trade or business. (3) Denial of Deduction for Club Dues—Notwithstanding the preceding provisions of this subsection, no deduction shall be allowed under this chapter for amounts paid or incurred for membership in any club organized for business, pleasure, recreation, or other social purpose. (d) Substantiation Required—No deduction or credit shall be allowed— (1) Under section 162 or 212 for any traveling expense (including meals and lodging while away from home), (2) For any item with respect to an activity which is of a type generally considered to constitute entertainment, amusement, or recreation, or with respect to a facility used in connection with such an activity, (3) For any expense for gifts, or (4) With respect to any listed property (as defined in section 280F (d) (4)), FLUSH—Unless the taxpayer substantiates by adequate records or by sufficient evidence corroborating the taxpayer’s own statement (A) the amount of such expense or other item, (B) the time and place of the travel, entertainment, amusement recreation, or use of the facility or property, 56 or the date and description of the gift, (C) the business purpose of the expense or other item, and (D) the business relationship to the taxpayer of persons entertained, using the facility or property, or receiving the gift. The Secretary may by regulations provide that some or all of the requirements of the preceding sentence shall not apply in the case of an expense which does not exceed an amount prescribed pursuant to such regulations. This subsection shall not apply to any qualified nonpersonal use vehicle (as defined in subsection (i)). (e) Specific Exceptions to Application of Subsection (a)—Subsection (a) shall not apply to— (1) Food and Beverages for Employees—Expenses for food and beverages (and facilities used in connection therewith) furnished on the business premises of the taxpayer primarily for his employees. (2) Expenses Treated as Compensation— (A) In General—Except as provided in subparagraph (B), expenses for goods, services, and facilities, to the extent that the expenses are treated by the taxpayer, with respect to the recipient of the entertainment, amusement, or recreation, as compensation to an employee on the taxpayer’s return of tax under this chapter and as wages to such employee for purposes of chapter 24 (relating to withholding of income tax at source on wages). (B) Specified Individuals— (i) In General—In the case of a recipient who is a specified individual, subparagraph (A) and paragraph (9) shall each be applied by substituting “to the extent that the expenses do not exceed the amount of the expenses which” for “to the extent that the expenses”. (ii) Specified Individuals—For purposes of clause (i), the term “specified individual” means any individual who— (I) Is subject to the requirements of section 16(a) of the Securities Exchange Act of 1934 with respect to the taxpayer or a related party to the taxpayer, or (II) Would be subject to such requirements if the taxpayer (or such related party) were an issuer of equity securities referred to in such section. FLUSH--For purposes of this clause, a person is a related party with respect to another person if such person bears a relationship to such other person described in section 267(b) or 707(b). (3) Reimbursed Expenses—Expenses paid or incurred by the taxpayer, in connection with the performance by him of services for another person (whether or not such other person is his employer), under a reimbursement or other expense allowance arrangement with such other person, but this paragraph shall apply— (A) Where the services are performed for an employer, only if the employer has not treated such expenses in the manner provided in paragraph (2), or (B) Where the services are performed for a person other than an employer, only if the taxpayer accounts (to the extent provided by subsection (d)) to such person. See Stat. Supp. Page 260 for the rest. (k) Business Meals— (1) In General—No deduction shall be allowed under this chapter for the expense of any food or beverages unless— (A) Such expense is not lavish or extravagant under the circumstances, and (B) The taxpayer (or an employee of the taxpayer) is present at the furnishing of such food or beverages. (2) Exceptions—Paragraph (1) shall not apply to— (A) Any expense described in paragraph (2) (3) (4) (7) (8) or (9) of subsection (e), and (B) Any other expense to the extent provided in regulations. (n) Only 50 Percent of Meal and Entertainment Expenses Allowed (1) In General—The amount allowable as a deduction under this chapter for— (A) Any expense for food or beverages, and 57 (B) Any item with respect to an activity which is of a type generally considered to constitute entertainment, amusement, or recreation, or with respect to a facility used in connection with such activity, Flush—Shall not exceed 50 percent of the amount of such expense or item which would (but for this paragraph) be allowable as a deduction under this chapter. (2) Exceptions—Paragraph (1) shall not apply to any expense if— (A) Such expense is described in paragraph (2), (3), (4), (7), (8), or (9) of subsection (e), (B) In the case of an expense for food or beverages, such expense is excludable from the gross income of the recipient under section 132 by reason of subsection (e) thereof (relating to de minimis fringes), (C) Such expense is covered by a package involving a ticket described in subsection (l)(1)(B), (D) In the case of an employer who pays or reimburses moving expenses of an employee, such expenses are includible in the income of the employee under section 82, or (E) Such expense is for food or beverages— (i) Required by any Federal law to be provided to crew members of a commercial vessel, (ii) Provided to crew members of a commercial vessel— (I) Which is operating on the Great Lakes, the Saint Lawrence Seaway, or any inland waterway of the United States, and (II) Which is of a kind which would be required by Federal law to provide food and beverages to crew members if it were operated at sea, (iii) Provided on an oil or gas platform or drilling rig if the platform or rig is located offshore, or (iv) Provided on an oil or gas platform or drilling rig, or at a support camp which is in proximity and integral to such platform or rig, if the platform or rig is located in the United States north of 54 degrees north latitude. FLUSH: Clauses (i) and (ii) of subparagraph (E) shall not apply to vessels primarily engaged in providing luxury water transportation (determined under the principles of subsection (m)). In the case of the employee, the exception of subparagraph (A) shall not apply to expenses described in subparagraph (D) Key Notes 274(a) applies to meals! (see page. 267 of casebook). If a partner eats lunch with a client and pays for both meals, the cost of the client’s meal would be deductible if it is “directly related” or “associated with the active conduct of a trade or business.” 274(d) imposes substantiation rules. 274(a)(1)(B), 274(l)(2), 274(a)(3), etc., prohibit or limits the deduction for certain kinds of entertainment. – Yachts, hunting lodges, etc.; club dues, Even if the entertainment expense meets the “directly related” test of 274, it must still be an ordinary and necessary expense! The 50 Percent Disallowance 274(n) limits the deduction for meals and entertainment to 50% of cost. The 50% limitation also applies to meals while away from home overnight on business! It does not apply to, among other things: food or beverage expenses excludable from the gross income of an employee under 132, traditional recreational expenses for employees, such as a holiday party or summer outing, and meals fully taxed to the recipient as compensation. If the taxpayer is reimbursed for the cost of business meals or entertainment, the 50% limitation applies to the one who makes the reimbursement, not the taxpayer. – Ex: Law firm separately bills and is reimbursed by a client for meals and entertainment; the client, not the firm, is subject to the 50% limitation on those expenses. – This has BIG implications for the 2% floor (see page 268 of CB). Unreimbursed v. reimbursed 58 Problem Suppose you are a self-employed attorney. One day you take a client to lunch. The bills for the two of you comes to $100, which you pay. You do not bill the client for the lunch. How much may you deduct? Answer Only $50–under 162, ordinary and necessary business expense 274(n) limitation. Self-employed ATL If EE, then would be BTL Problem Same as above, but in accordance with your normal practice, you include the $100 expense as an itemized disbursement on the bill you send to your client. Your client pays the bill, thus reimbursing you for the meal. Does this change the result? Answer Yes, does change answer. Client reimbursed, so client subject to 50% limitation. Client can only deduct $50. Lawyer must report reimbursement as income and then take ATL deduction. However, 274(n)(2)(A) refers you to 274(e)(3)(B), which says 274(a) does not apply if you give detailed accounting (i.e., itemizing to client that the $100 is for the meal, date, time and place) can deduct FULL $100. If EE, take 50% hit then take MID subject to 2% floor. See pg 14 of short outline if confused. Problem Same as above, except that instead of itemizing the $100 expense on your bill, you simply add the $100 amount to the line on your bill labelled “other disbursements,” without further elaboration. Does this change the result above? Answer Yes, does change answer. 274(e)(3)(B) won’t apply, so subject to 274(n) limitation only $50 deduction. Client will get full $100 deduction though under 162 assuming this is a business expense bc client doesn’t know if it is a meal expense or not! MUST ITEMIZE FOR ATTORNEY TO GET DEDUCTION Problem Corporation throws lavish Xmas party in a ballroom for its employees and spouses. (a) May the employees exclude from gross income the FMV of the food and beverages they (and their spouses) consumed? If so, how? (b) May the firm deduct the cost of the food and beverages? Are there any limitations on the amount of the allowable deduction? Answer (a) Likely EEs can exclude 132(e) De minimus fringe? o TR 1.132-6(e)(1): includes occasional banquets, picnics, or group meals for EEs and their guests. Be careful about “lavish” but still very hard to calculate who ate and drank what! o Also remember that EE = any individual that receives the benefit; so spouses Gucci too. Working condition fringe? o If you paid for it out of your own pocket would it be deductible under 162? o Provides social lubricant, and occasional, so not like Moss probs working condition fringe. o TR 1.132-5(a)(1)(vi): ignore 2% floor and 50% rule if deductible as O+N business expense; O+N is ATL [NOTE exception] (b) ER can deduct full amount Deductible? o 274(k)(1)(A) potentially provides a problem because this is lavish. o BUT, 274(k)(2) provides exceptions and refers you to 274(e)(4), which provides an exception for recreational expenses for employees (firm-wide recreation, may not favor highly compensated). So, it looks good for the corporation to exclude the full amount. Limitations? o 274(n)(2)(B): no 50% rule for de minimis fringe benefits (ER can deduct full amount of food and beverages bc counts as a de minimis fringe to the EEs) 59 o §274(n)(2)(A): no 50% rule for §274(e)(4) expenses Home Office Expenses Key Cases Soliman: [anesthesiologist, spare bedroom for administrative work] Leading SCOTUS case; almost all analysis is still valid, however, 280A FLUSH over rules holding. You can only have one PPB. Look at two factors: (1) relative importance of the location and Normally place where goods or services are delivered (2) the amount of time spent there Gave a lot of weight to where services are actually performed—hospital. Aggregated hospitals together spent more time at hospitals collectively than at home office. Not PPB, no deduction. Popov: [Violinist] Allowed deduction. Relevance prong of Soliman is inconclusive. Importance test would point to the symphony hall despite practice being “essential”… but ct just doesn’t do it. Satisfies second prong because spent a lot more time practicing at home than she did performing and recording at the studios (Aggregated studios and halls). Thus, PPB = home office. Exclusive…? basically she prohibited her kid and husband from using living room?? Key Provisions § 280A—Disallowance of Certain Expenses in Connection with Business Use of Home, Rental of Vacation Homes, Etc. (a) General Rule—Except as otherwise provided in this section, in the case of a taxpayer who is an individual or an S corporation, no deduction otherwise allowable under this chapter shall be allowed with respect to the use of a dwelling unit which is used by the taxpayer during the taxable year as a residence. (b) Exception for Interest, Taxes, Casualty Losses, Etc.—Subsection (a) shall not apply to any deduction allowable to the taxpayer without regard to its connection with his trade or business (or with his income-producing activity). (c) Exceptions for Certain Businesses or Rental Use; Limitation on Deduction for Such Use (1) Certain Business Use—(Green paraphrase) Home office deductions are allowable if a portion of a dwelling unit (home office) is exclusively used on a regular basis— (A) As the principal place of business for any trade or business of the taxpayer, Most common (B) As a place of business which is used by patients, clients, or customers in meeting or dealing with the taxpayer in the normal course of his trade or business, or (C) In the case of a separate structure which is not attached to the dwelling unit, in connection with the taxpayer’s trade or business. FLUSH: In the case of an employee, the exclusive use must be for the convenience of the employer. For purposes of subparagraph (A), the term “principal place of business” includes a place of business which is used by the taxpayer for the administrative or management activities of any trade or business of the taxpayer if there is no other fixed location of such trade or business where the taxpayer conducts substantial administrative or management activities of such trade or business. Sole place where you do administrative management things (an additional PPB of business) CAN HAVE MORE THAN ONE PPB (against Soliman) 60 (2) Certain Storage Use—Subsection (a) shall not apply to any item to the extent such item is allocable to space within the dwelling unit which is used on a regular basis as a storage unit for the inventory or product samples of the taxpayer held for use in the taxpayer’s trade or business of selling products at retail or wholesale, but only if the dwelling unit is the sole fixed location of such trade or business. (5) Limitations on Deductions—In the case of a use described in paragraph (1), (2), or (4), and in the case of a use described in paragraph (3) where the dwelling unit is used by the taxpayer during the taxable year as a residence, the deductions allowed under this chapter for the taxable year by reason of being attributed to such use shall not exceed the excess of— (A) The gross income derived from such use for the taxable year, over (B) The sum of— (i) The deductions allocable to such use which are allowable under this chapter for the taxable year whether or not such unit (or portion thereof) was so used, and (ii) The deductions allocable to the trade or business (or rental activity) in which such use occurs (but which are not allocable to such use) for such taxable year. FLUSH: Any amount not allowable as a deduction under this chapter by reason of the preceding sentence shall be taken into account as a deduction (allocable to such use) under this chapter for the succeeding taxable year. Any amount taken into account for any taxable year under the preceding sentence shall be subject to the limitation of the 1st sentence of this paragraph whether or not the dwelling unit is used as a residence during such taxable year. (6) Treatment of Rental To Employer—Paragraphs (1) and (3) shall not apply to any item which is attributable to the rental of the dwelling unit (or any portion thereof) by the taxpayer to his employer during any period in which the taxpayer uses the dwelling unit (or portion) in performing services as an employee of the employer. (f) Definitions and Special Rules— (1) Dwelling Unit Defined—For purposes of this section— (A) In General—The term “dwelling unit” includes a house, apartment, condominium, mobile home, boat, or similar property, and all structures or other property appurtenant to such dwelling unit. (B) Exception—The term “dwelling unit” does not include that portion of a unit which is used exclusively as a hotel, motel, inn, or similar establishment. (g) Special Rule for Certain Rental Use—Notwithstanding any other provision of this section or section 183, if a dwelling unit is used during the taxable year by the taxpayer as a residence and such dwelling unit is actually rented for less than 15 days during the taxable year, then— (1) No deduction otherwise allowable under this chapter because of the rental use of such dwelling unit shall be allowed, and (2) The income derived from such use for the taxable year shall not be included in the gross income of such taxpayer under section 61. Problem June is a self-employed plumber who lives in Ithaca. June does not have an office outside of her home. She performs the actual plumbing work at her customers’ home. She handles the administrative work relating to her plumbing business at the kitchen table in her residence. The majority of her customers live in Ithaca, but she occasionally drives to Cortland to serve a customer. (a) What deductions may June take with respect to her business use of her home? (b) May June deduct the cost of driving between her residence and the residences of her customers who live in Ithaca? (c) May June deduct the cost of driving between her residence and the residences of her customers who live in Cortland? Answer 61 (a) 280A(c)(1)(A). Doesn’t have to be a portioned off room; separately identifiable place is fine (T. Reg. 1.280A2(g)1). Kitchen table is probably fine. Q: Was table exclusively used for admin? o Never ate? Set cooking ware on it? Likely not… Assuming, she does satisfy exclusivity requirement, we need to know if the office is her PPOB. o Soliman factor test – ambiguous Relevant importance where services delivered so customer's Time Home office (unless aggregated) Green thinks you shouldn’t aggregate all customer’s homes o BUT, wins on PPB bc FLUSH gives her deduction regardless of regularity or exclusivity! **Just may not be able to get deduct bc exclusivity is shaky. Need to meet ALL THREE If she wins, how much can June deduct? o Rents: can deduct a small portion of rent. Green: normally done via square footage. o Owns home: can depreciate a small amount of house’s value. (b) Yes. Look back at Rev. Rul. 99-7. (1) and (2) don’t work. BUT, (3) likely does! Even though she loses on her home office argument, her commute to anywhere in Ithaca to do plumbing will be deductible because her PPOB is her residence. Yes; (1) works here (Cortland not same metro area) and (3) works too. (c) Business & Investment Expenses v. Capital Expenditures Further distinction between ordinary expenses (deductible) and capital expenditures "Ordinary" = not a capital expenditure (Welsh) If you acquire an asset that produces benefits beyond the taxable year that is likely a capital expenditure Three Possibilities for Business or Investment Costs Expense/Expenditure Tax Treatment Expense is an "ordinary and necessary" business or investment expense, i.e., it falls under § 162 or 212 and does not fall under § 263 Immediate deduction of the expense (full amount) ** Best for TPs Expenditure is a "capital expenditure" – i.e., it falls under § 263–and the property does not qualify for depreciation No immediate deduction; expenditure is capitalized* and taken into account only when the taxpayer disposes of the property (see § 1001) ** Worst due to long wait Expenditure is a "capital expenditure"–i.e., falls under § 263–the property does qualify for depreciation No immediate deduction; the expenditure is capitalized* and deducted over a period of time as provided in the Code (see §§167, 168) * Resulting in a cost basis in the property (§ 1012) or, in the case of a capital improvement, increasing the property's adjusted basis (§ 1016(a)(1)). TPs want deductions up front. Deduction reduces ordinary income, capitalization reduces capital gains. Capital Expenditures–Generally §263: Capital Expenditures General Rule – No deductions for: Any amount paid out for new buildings or for permanent improvements or betterments made to increase the value of any property or estate If capital expenditure Does it qualify for depreciation? If not, expenditure is capitalized & taken into account only when taxpayer disposes of asset. 62 TR 1.263(a)-1T – Capital Expenditures, in general (a) In general, no deduction allowed for: (1) Any amount paid for new buildings or permanent improvements or betterments made to increase the value of the property; or (2) Any amount paid in restoring property or in making good the exhaustion thereof (b) Coordination with §263A §263(a) taxpayers must capitalize amounts paid to acquire, produce, or improve real or personal tangible property. §263A generally sets the direct and indirect costs that must be capitalized to property produced by the taxpayer and property acquired for resale. Woodward: transaction costs are part of the acquisition of stock & must be capitalized AB in the shares will be > than what you paid because you add the capitalization of the broker fees TR §1.263(a)-2T(f): Transaction Costs Codified Woodward Taxpayer must capitalize amount paid to obtain property, and ALSO any costs you incur to facilitate the acquisition (including appraisal to determine value of property, finders’ or brokers’ fees, etc.) Ex: Buy 100 shares of Apple Inc. at $80/share Broker’s commission for purchase of shares Adjusted Basis $20 $8,020 Sell 100 shares of Apple Inc. at $530/share Broker’s commission for sale of shares* $8,000 $53,000 ($20) Amount Realized $52,980 Gain Recognized (AR − AB) $44,960 Two $20 brokers’ commissions reduced gain by $40 (first by adding to basis and second by reducing AR). If TP argued broker’s commission does not produce a life-long asset and it should be deducted then gain would be $20 more but a deduction of $20 (net = $0). Better off deducting than capitalizing, but Code won’t allow Capitalization of Costs of Self-Constructed **TANGIBLE** ASSETS Commissioner v. Idaho Power: (SCOTUS 1974) IP bought construction equipment for $30,000; allowable depreciation=$3,000/year over 10 years. Used equipment for one full taxable year exclusively to construct a new building for its own use. IRS said depreciation for that year is actually part of cost of building the building, must capitalize & add to basis. Held: IP can’t deduct the $3,000 depreciation for the year of construction; must capitalize it & add it to basis of building IP can depreciate the additional $3,000 of basis over the 30-year life of building, so $100 depreciation each year Since §263A was not in the code, court went back to §263(a)(1): no deduction shall be allowed for any amount paid out for new buildings RULE: Capitalization of virtually all indirect costs, in addition to direct costs, is required, and that cost is allocated to construction or production of real property or personal tangible property - Codified in §263(A) §263A: Capitalization and Inclusion in Inventory Costs of Certain Expenses Lists what you must capitalize 63 If you are self-constructing real or tangible personal property (not real estate), you must capitalize or include in inventory costs (1) Direct costs of the property and (2) Property’s share of those indirect costs Indirect costs = indirect labor costs, officers’ compensation, pension costs, insurance, utilizes (See TR 1.263A-0-15 for full list) Example: if construction company employee is paid for 1 year to build a building for the construction company’s use, his salary must be capitalized (normally salaries are deductible to corps as ordinary & necessary biz expense). There may also be employees doing support work, e.g. secretaries. Their salary must be allocated to the building & capitalized too Capitalization of Costs of **INTANGIBLE** ASSETS INDOPCO v. Commissioner (SCOTUS 1992) Unilever preparing for friendly takeover of INDOPCO (Unilever to get INDOPCO stock in exchange for cash). INDOPCO hired i-banker, cost $2.2M & $18k in legal fees Unilever capitalizes amount it pays for INDOPCO stock plus acquisition costs Sum becomes Unilever’s basis in INDOPCO stock it acquires (TR 1.263(5)(g)(2)(i): must capitalize facilitative costs of stock acquisitions) But does INDOPCO have to capitalize its costs?? (hiring i-banker + legal fees) Not CREATING A NEW ASSET (it is the thing being acquired) INDOPCO tried to claim these fees as biz expense deductions IRS: even though INDOPCO’s not creating a new asset, its value is being enhanced (intangible benefit), so it needs to capitalize Held: INDOPCO must capitalize (agrees with IRS) RULE: Capitalization requirement also applies to expenses that produce significant future benefits, even if intangible; read as meaning that basically everything involved in creating asset must be capitalized Creating separate & distinct asset is not a requirement for capitalization Notes: So, INDOPCO must capitalize, but the question remains, where does the basis go? Treas. Reg. 1.167(a)-3(a): if an intangible asset has a limited useful life that can be estimated with reasonable accuracy (e.g., patents and copyrights), then the capitalized costs of acquiring or creating the asset may be amortized (read: depreciated) over the life of the asset. But corporate stock doesn’t fall under this rule because it has an unlimited life. Treas. Reg. 1.167(a)-3(b)(1): safe-harbor rule–if an intangible asset does not have a limited useful life that can be estimated with reasonable accuracy, then the taxpayer may treat it as having a useful life equal to 15 years. See Casebook p. 296, Note (I). Treas. Reg. 1.167(a)-3(b)(2): safe-harbor rule does not apply to an amount required to be capitalized by Treas. Reg. § 1.263(a)-5, relating to amounts paid to facilitate an acquisition of a trade or business (applies to both the target and the acquirer) This means that INDOPCO couldn’t get the 15-year rule. Treas. Reg. 1.263(a)-5(g)(2)(ii)(B) deals with the treatment of capitalized costs by the Target corporation in a stock acquisition. It simply states “[Reserved].” This means that the Treasury could not decide what the rule should be! So who the hell knows what INDOPCO does? Green thinks that the best thing to do is still amortize over 15 years. SCOTUS doesn’t say that anytime you have a benefit lasting longer than 1 year you must capitalizedoesn’t really articulate a rule! Confusion after case leads to . . . TR 1.263(a)-4: Amounts Paid to Acquire or Create Intangibles 64 (b) Taxpayer generally must capitalize an amount paid out: To acquire an intangible (different than creating) To create specified types of intangibles Corp stock, bonds, K rights, prepaid expenses, certain memberships [notes say not to worry about these] To create or enhance a separate and distinct tangible asset (has ascertainable and measureable value, is protected under law, & can be transferred separately – funny b/c INDOPCO said this was irrelevant) To create or enhance future benefit identified in published IRS guidance INDOPCO type cases are covered by this ^^ To facilitate an acquisition or creation of an intangible asset described above (de minimis exception of $5,000 – may be deducted) (e)(4): Employee compensation and overhead (**EXCEPTION**) Employee compensation (including salary, bonus, & commissions) and overhead relating to the acquisition or creation of an intangible do not have to be capitalized; note there is a circuit split here Does not apply to ICs (CB–292) Example 8: P corp. is a bank that maintains a loan acquisition dep’t whose sole function is to acquire loans from other banks. As provided in (e)(4)(i), P is not required to capitalize any portion of compensation paid to the employees in its loans acquisitions dep’t or any portion of its overhead allocable to the loan acquisition dep’t. Compare this to §263A & uniform capitalization rule for real and tangible personal property produced by the taxpayer. ** If you’re creating tangible property, you must capitalize: direct labor costs, indirect labor costs, officer compensation, pension costs, etc. ** ** If you’re creating intangible property, you do not capitalize these ** (f): 12-month rule In general, taxpayer not required to capitalize under this section amounts paid to create or facilitate creation of any right or benefit for the taxpayer that does not extend beyond the earlier of: (i) 12 months after the first date the taxpayer realizes right/benefit; or (ii) The end of the taxable year following the taxable year in which the payment is made Basically, pick whichever is shorter, and if asset/benefit lasts longer than the shorter time, you must capitalize Advertising TR §1.162-1(a): ad expenses are deductible business expenses Post INDOPCO: INDOPCO does not mean to change the advertising rule, still deductible “Only in the unusual circumstance where advertising is directed towards obtaining future benefits significantly beyond those traditionally associated with ordinary product advertising or with institutional or goodwill advertising, must the costs of that advertising be capitalized.” see Rev Rule 92-80 Expenses of Starting Up a New Business §195: no deduction (TP must capitalize start-up expenses) except as provided in 195 (b): taxpayer may elect to deduct a limited amount not exceeding 5k of start-up expenses in the taxable year in which the active trade or business begins, and to deduct the remainder of a start-up expenses ratably over the 180-month (15 years) period beginning with the month in which the active trade or business begins. Potential issue: Starting up a new business versus expanding an existing business (e.g., banks opening new branches). 65 Repairs v. Rehabilitation or Improvements Repairs: TR §1.162-4 Can deduct amounts paid for repairs and maintenance to tangible property if amounts are not required to be capitalized Improvements: TR 1.263(a)-3 Generally must capitalize improvements (including “betterments”) (d): Improvements are expenditures that: (1) Are for the “betterment” of the property (i) Ameliorates material condition or defect that either existed prior to taxpayer’s acquisition of the property or that arose during production of the property, whether or not taxpayer was aware of condition or defect at the time of acquisition/production (ii) Results in material addition to the unit; or (iii) Results in material increase in capacity, productivity, efficiency, strength, or quality of property (2) Restore the unit of property (3) Adapt the unit of property to a new or different use (h): Safe harbor for routine maintenance on property (deductible) Not an improvement can deduct costs that keep property in its ordinarily efficient operating condition Problem An automobile manufacturing company decides to build a racetrack in a remote area. The company will use the racetrack in testing prototypes of new car designs. The company pays $1 million for a suitable parcel of land. After purchasing the land, the company discovers that endangered turtles live on the land. If the company wants to develop the land, it must relocate the turtles under the supervision of a biologist. May the company deduct the cost of moving the turtles? Answer Turtles on land when property bought betterment capital expenditure; can’t deduct. 263 –tangible Betterment bc land that can't be built on bc it has turtles land that can now be built on, and it does not matter that the company didn’t know about the turtles (TR 1.263(a)-3: whether or not the TP was aware of the condition). The cost must be capitalized. Used to be able to argue that the FMV decreased bc new information of turtles. Removing turtles returns FMV to original valuation --> repair. But this regulation makes it explicit that this doesn’t matter. Can also be considered converting property to new use Treas. Reg. 1.263(a)-3(l)(1) Moreover, Rev. Rul. 94-38: if you buy property that’s good and then contaminate it, you can deduct the expense to clean it up—but if you buy land that is contaminated, the cost must be capitalized. Rationale: if you bought the land then contaminated it, you can be said to be repairing the land (i.e. restoring it to its original state). Conversely, if you bought the land when contaminated, then you’d be really improving the land (i.e., increasing the value beyond what you paid for it). Problem Salaried employee of auto company supervises track construction by independent contractor. Employee’s salary attributable to construction period is $50,000. Can corp. deduct his salary? Answer No. Corp. must capitalize it. Racetrack = tangible & self-constructed Idaho Power & §263A(a)(2)(B): virtually all indirect costs allocable to construction or production of real property or tangible personal property must be capitalized TR 1.263(a)-2T: cost of constructing a capital asset must be capitalized Note: If this were intangible, would not have to capitalize wages (TR §1.263(a)-4(e)). If IC must capitalize regardless. Problem 66 Henry does work on his home. Deductible? Answer Personal, home expense not deductible. Repairs are deductible only if a §162 business or §212 investment-related expense Can either ignore the repair (not report), OR try to call it an improvement If improvement, would be capitalized & added to basis in house. This is valuable bc although you can’t depreciate your house, when you sell it the higher basis will reduce your gain! prefer capitalization here instead of deduction! Job-Seeking Expenses Rev Rule 75-120: Can deduct (under 162) expenses incurred in seeking new employment, but MUST be in the employee’s continuing/same trade or biz, even if employment was not obtained “Hiatus principle” if you leave employment & seek new job, you will be considered to be in that same trade/biz for 1 year Must resume a job in the same trade/biz w/in 1 year to be a hiatus If not, it’s abandonment of that trade Note: courts don’t always defer to these bc it’s a rev. rule & IRS-created principle Problem You travel as your own expense to LA for clerkship interview after graduation. Are airfare, hotel & meals deductible? Answer Non-deductible. Student hard to say you’re involved in any ToB. Rev. Rul. 63-77: Reimbursements made to individuals by prospective employers for expenses (transportation, meals, and lodging) at the invitation of the employer are not included in taxable income. Green thinks this is just Gotcher. Expenses for Education TR§1.162-5(a)–General rule: Expenditures made by an individual for education are deductible as O+N business expenses, if education: (1) Maintains or improves skills required by the individual in his employment or other ToB, or: (2) Meets express requirements of the individual's employer, or the requirements of applicable law or regulations, imposed as a condition to retention of the EE by an established employment relationship You must already be employed. Ex: Continuing education course for lawyers. Exceptions - Non-deductible educational expenses see Rev Rule 75-120 TR §1.162-5(b)(2) Expenditures made on education which is required of him in order to meet minimum educational requirements for qualification in his employment or their trade or business Talking about getting a job in the first instance (e.g., getting your JD to practice law) Example 3: E, who has completed 2 years of a normal 3-year law school course leading to a bachelor of laws degree (LL.B.), is hired by a law firm to do legal research and perform other functions on a full-time basis. As a condition to continued employment, E is required to obtain an LL.B. and pass the State bar examination. E completes his law school education by attending night law school, and he takes a bar review course in order to prepare for the State bar examination. The law courses and bar review course constitute education required to meet the minimum educational requirements for qualification in E's trade or business and, thus, the expenditures for such courses are not deductible. TR 1.162-5(b)(3) Expenditures part of program of study which will (read: “could”) lead to qualifying him in a new trade or business 67 E.g., Accountant that doesn’t want to be a lawyer, but thinks he will be a better accountant if he gets a JD. It won’t qualify him for a new trade or business, because he isn’t seeking one. Maybe he’ll never become a lawyer or take the Bar—but he could and therefore falls under this provision. He cannot deduct the cost of the JD. Example 1: A, a self-employed individual practicing a profession other than law, for example, engineering, accounting, etc., attends law school at night and after completing his law school studies receives a bachelor of laws degree. The expenditures made by A in attending law school are nondeductible because this course of study qualifies him for a new trade or business. Example 2: Assume the same facts as in example (1) except that A has the status of an employee rather than a self-employed individual, and that his employer requires him to obtain a bachelor of laws degree. A intends to continue practicing his nonlegal profession as an employee of such employer. Nevertheless, the expenditures made by A in attending law school are not deductible since this course of study qualifies him for a new trade or business Wassenauer: [Went right from JD to LLM program, but made money on law review in both his second and third years of law school; wants to deduct LLM Is the ToB that he intends to go into after program the same as ToB that he was in before? Wassenauer theories (1) His trade/business is rendering services to employer for compensation; this is super broad (2) T/B is analyzing or solving legal problems for compensation (tries to apply both of these t/bs to both law review and associate job Court: fails both exceptions Entering a NEW trade or business; relying on 1.162-5(b)(3); Green says this is wrong; he already had a JD which is necessary for the profession, but an LLM is not required to qualify as a tax lawyer Court may be treating JD/LLM as one course of study; Green: possible that he never had a trade or profession since he was only working for law review Problem Are costs for bar review course deductible? Answer No. TR §1.162-5(b)(2)(iii): Example 3: Bar review class is education required to meet minimal educational requirements for qualification in trade/biz, & not deductible. GREEN: weird b/c bar review class not required, just need to pass bar… The better answer would be not deductible b/c its in pursuit of a new trade/biz Intention in taking bar review course is to become a lawyer, which is different trade/biz than being a student Problem Is bar review reimbursement from firm taxable/includable in income? Answer Probably taxable. Not clear you are even an EE… but Working Condition Fringe N/A, wouldn’t be deductible had you not paid for it (as by problem above) § 127: Education Assistance Programs may apply here can exclude up to certain amount of educational expenses paid for by employer, but still, law firm is not really yet your employer… Problem NYC financial analyst quits job at bank to attend Johnson School for 2 years to get MBA. After, returns to NYC to work at different bank. Can she deduct b-school expense? Answer 68 IRS would say not deductible 2 yrs, so no 1-year Hiatus Rule; Rev. Rul 68-591 But, many courts don’t accept Hiatus Rule and instead concentrate on Q of whether its an indefinite period or whether it’s a fixed, definite period during which you’ll be away & then you’ll go back o Here, it’s a definite 2 years away, then you return o Note: must establish yourself in a trade/biz before leaving (she did here) Many courts say that MBA is not a requirement for job, so doesn’t qualify you for a new trade/biz & so it IS deductible; could say deduction b/c it “maintains or improves skills” Argument that even if you meet general exception, you fail bc it is not a minimum educational requirement Counter-argument; even though the MBA is not really required, industry practice is that most people who get these jobs have MBAs, might get away with deducting (can look to industry practice, law, and requirement of the ER) Courts generally say that MBA is completely optional Depreciation & Amortization Generally Spreading income deduction over the years of the life/decline in value of property Depreciation is an attempt to match expenditures with gross income to calculate net income o Income is a change in net worth, so trying to deduct amount your net worth falls as the property at issue becomes less valuable (or as you consume*) Generally, depreciation is for tangibles and amortization is for intangibles (e.g., goodwill) §167: Depreciation (a) Can deduct as depreciation “reasonable allowance” for exhaustion, wear & tear of: (1) Property used in trade or business (§ 162); or (2) Property held for the production of income (§ 212) (c) Basis for depreciation = AB (§1011) Depreciation for **Tangible** Property §168: Accelerated Cost Recovery System (for Tangible Property) (a) To calculate depreciation deduction allowable under §167(a) for TANGIBLE property must use: (1) Recovery period (2) Method of depreciation (3) Convention for determining when property is treated as having been placed in service (b) Applicable depreciation method (c) Applicable recovery period (d) Applicable convention (e) Classification of property Problem Client is sole proprietor of business, buys Xerox machine for $10,000 on March 4. Xerox machine has “class life” under ADR system of 6 years. Client chooses to use straight-line depreciation. How large a depreciation deduction can client claim each year? Answer 69 (1) Recovery Period o Class life=6 years o §168(e)(1) translates 6-year class life into 5-year property o §168(c)(1) says 5-year property has recovery period of 5 years (2) Method of Depreciation o §168(b)(1) 3, 5, 7, and 10-year property is depreciated under 200% declining balance method, switching to straight-line when straight-line gives larger deduction Taxpayer likes that more is deducted up front o §168(b)(3)(D), (b)(5) taxpayer can elect straight-line depreciation instead Divide basis (cost) by number of years Here, $2,000/year ($10k divided by 5 years) *Taxpayer almost always wants to deduct more sooner, so would usually use 200% method in this situation o NOTE: you MUST use straight-line depreciation for real property (3) Convention o §168(d)(1), (d)(4)(A) personal property usually depreciated by using half-year convention, which treats all personal property placed in service during the year as having been placed in service in the MIDDLE of the year Under this, depreciation deduction for first (and last) year is ½ of full year’s deduction Note: for other kinds of property there are different kinds of conventions (ex: midmonth convention for real estate) SO: o Straight-line method: Year 1=$1,000 (1/2 yr); Yrs 25=$2,000; Yr 6=$1,000 (1/2 yr) o 200% declining balance method: Year 1=$2,000; Year 2=$3,200; Year 3=$1,920; Year 4=$1,152; Year 5=$1,152; Year 6=$576 Special Rules Treas. Reg. 1.167(a)-2: Land is NOT depreciable Land is forever; it has an indefinite life. If you buy a building on land, the building is depreciable. You would have to allocate costs amongst the building and the land to determine how much you could depreciate. Congress allows depreciation b/c stimulates investment, relief for small businesses etc. But, keeping track of depreciation is super confusing, lots of paperwork, etc. So, Congress also enacted §179 §179: Depreciation by Small Businesses If your investments are less than $200,000, can just deduct up to $25,000 (excess have to capitalize & depreciate) (d)(1): Only applies to tangible property. Depreciation of **Intangible** Property ANALYSIS Is it covered by 197? o Yes -- 15 yrs o No -- TR 1.167(a)-3. Can you determine life? o Yes -- amortize over that life o No -- 15 yrs 197 governs enumerated intangible property. If excluded from (not covered by) 197 TR 1.167(a)-3. 70 §197: Depreciation of Goodwill & Intangible Property Really only applies to intangibles that you purchase from someone else. Must be either: Purchased as an individual intangible, or Created in connection w/ conduct of ToB or an investment activity (§212) (a): General rule. Can take depreciation deduction for any amortizable intangible, the amount of which is determined by amortizing the AB (for purposes of determining gain) of such intangible ratably over the 15-yr period beginning w/ the month the intangible was acquired (mandatory) (c)(2): Does NOT apply to self-created intangibles (e.g., self-created patent) unless TP creates intangible in connection with a transaction involving the acquisition of assets constituting a ToB or a substantial portion thereof **See note** (d): LISTS COVERED INTANGIBLES Includes goodwill, business books & records, operating systems, patents or copyright, licenses or permits, covenants not to compete, any similar item (e): Lists what is NOT covered: Does NOT include interests in a corporation, partnership, trust, or estate, and interests in land (leaseholds - intangible but can amortize over actual life bc you know its life! (term of years) Old rules (TR 1.167(a)-3) apply to the above! Ex: corporate stock **Note**: A “section 197 intangible” is created by TP to extent TP makes payments or otherwise incurs costs for its creation, production, development, or improvement, whether actual work is performed by TP or by another person under a K with TP entered into prior to production of intangible. Treas. Reg. § 1.197-2(d)(ii)(A). Ex: a technological process developed specifically for a taxpayer under an arrangement with another person pursuant to which the taxpayer retains all rights to the process is a self-created intangible. Green examples: customer lists and subscriber lists TR 1.167(a)-3: Self-Created Intangibles & Everything not Covered under § 197 (1149) If you self-create an intangible that has a limited useful life, amortize over that period If you can’t ascertain limited useful life of asset, then use 15 years Problem Client buys ongoing biz for $150,000. Biz had tangible assets (FMV $100,000) and patent (FMV $10,000). Seller gave client covenant not to compete for 5 years. What intangible assets can client amortize? What basis and recovery periods applicable to calculate deductions? Answer Must figure out basis in each asset: o AB tangible assets=$100,000 o AB of patent=$10,000 o AB of covenant not to compete: We’ll say $5,000 o AB of Goodwill=$30,000 Residual asset-show fact that there’s some intangible value not reflected by other amounts E.g. reputation, trained work force, customer relationships How to depreciate? o Tangible property look up life of each asset in §168 o Intangible assets §197 or TR 1.167(a)-3(b) All are covered under §197 bc intangible and created/purchased while acquiring a business! Patent: §197 amortized over 15 yrs (even though 20 yr term) Goodwill: §197 amortized over 15 yrs o Can’t purchase this separately, must be part of ongoing business Covenant: §197 amortized over 15 yrs (even though 5-year covenant) 71 Bonus Depreciation § 168(k) (expiring in 2019): Can immediately deduct 50% of cost then take regular deductions (1/2 that in chart) over the next years. Remember: A taxpayer may elect under 195 to deduct a limited amount of start-up expenses in the year the business beings and then amortize the rest over 15 years Under 248 a corporation may elect to deduct up to 5k of organizational expenses. The deduction is phased out and is eliminated if expenses exceed 55k. The remainder is amortized over 15 years. Interest Generally Pre-1986, all interest expenses were deductible, subject to a few exceptions Current general rule=most interest expense is limited/NOT deductible Why do we tax interest expenses? o Mostly to prevent tax arbitrage Produces loss, but get tax benefits that outweigh loss To prevent this, disallow some interest expense deductions o HYPO: Suppose corp. bonds paying 10% interest. Municipality wants to raise $ and attempts to market bonds to people in 35% tax bracket. It would have to offer them 6% interest return. Taxpayer in 40% bracket borrows $1,000 from bank at 10% interest. Uses loan to buy municipal bond for $1,000 at 7.2% interest So each year taxpayer: Pays $100 interest on the $1,000 bank loan Gets $72 interest from municipal bond Before tax, you lose $28 But after tax, you get $35 deduction (if interest expenses were deductible) So end up earning $7 on the transaction This is tax arbitrage (Congress wants to prevent) Interest expense is deductible, but there are several exceptions that have essentially gutted the rule (see below) ** Sometimes interest has to be capitalized (self-constructing an asset, some interest expense might need to be allocated to that asset and then capitalized) § 263; See § 263A(f) (Uniform Capitalization Rules) Interest not under any special rule - 163(a) Special Rule Categories: o Personal – not deductible 163(h)(1) o Investment – deductible up to investment income 163(d) o Muni bonds – not deductible Exception to Special Rule Categories aka General Rule 163(a) applies o QRI – deductible subject to certain limits § 163(h)(3) Home equity indebtedness is not a category it is an exception to the categories that gets you back to the OG rule. ANALYSIS: 1) Start with General Rule 2) Are there any exceptions? a. Personal? b. Investment? 3) If neither, then general rule applies. Deduction of Interest Expense 163(a): General rule – interest expense is deductible. 72 Applies to interest paid or accrued on indebtedness properly allocable to a (non-employee) ToB. §163(h(2)(A) How do you know if interest is related to business? Tracing rules. Treas. Reg. 1.163-8T (Green thinks this is insane since money is fungible) EXCEPTIONS Personal Interest § 163(h)(1): personal interest is not deductible by individuals (e.g., consumer credit, financing a car used for personal purposes, etc.) “Personal interest” all interest except interest described in Sec. 163(h)(2)(A)-(F) (h)(2)(A) is for business - interest paid or accrued on indebtedness properly allocable* to a ToB (other than the trade or business of performing services as an EE) No rule for ToB so general rule applies fully deductible. (h)(2)(B): any investment interest within the meaning of subsection (d) (h)(2)(D): qualified residence interest under (h)(3)(A) Investment Interest § 163(d) interest on debt incurred by individual and properly allocable to investment property is deductible, but it is limited to net investment income. Net investment income is total investment income less investment expenses for taxable year (Sec 163(d)(4)). Can only deduct interest related to investment property to extent you have interest income from it If unable to deduct for any taxable year, you can carry it forward “In general—the term ‘investment interest’ means any interest…which is paid or accrued on indebtedness properly allocable* to property held for investment “Investment interest” is not “personal interest” as per Sec 163(h)(2)(B). “Investment interest” does not include any qualified residence interest §163(d)(3)(B). Qualified Resident Interest § 163(h)(3), qualified residence interest is deductible, subject to certain limits. § 163(h)(4): “Qualified residence” definition This category is divisible into two distinct subsets 163(h)(3)(A) (i) Acquisition Indebtedness What you normally think of—borrowing money to buy/improve a house. Acquisition indebtedness must be secured by the house. Cannot exceed $1million Most ppl argue you shouldn't have a deduction for this bc it is personal (ii) Home Equity Indebtedness Borrowing, but to use the funds on something other than your house. This indebtedness must be secured by the house. Limitations: Total home equity indebtedness cannot exceed FMV of qualified residence – acquisition indebtedness (equity) AND cannot exceed $100,000 Interest Related to Tax-Exempt Income §265(a)(2): If you borrow money & can trace proceeds to an investment in tax-exempt securities (i.e., MUNICIPAL BONDS), then none of the interest expenses on the borrowing is deductible E.g. if you borrow money to buy state & local bonds, cannot deduct interest expense B/c §103 says interest paid on state & local bonds is tax-free Ex: 1) own $10k muni bonds (bought with own cash) and 2) borrow $10k to buy stock (total investment income for yr = $100, but interest expense is $300) Looks like investment interest but since you secured with tax-exempt muni bonds you can't!! 73 Any time you secure a loan with muni bonds it gets picked up!! Problem Taxpayer owns house (principal residence). Basis=$60,000; FMV=$100,000. T borrowed $20,000 (secured by house) to buy house. On Jan. 1 of current year, T borrows $70,000 secured by a 2nd mortgage on house & uses this borrowed money to buy stock. During year, T pays $2,000 interest on the 1st mortgage loan and $7,000 interest on the 2nd. He receives $500 dividends on the stock. No other investments or debts. Is $7,000 interest paid on 2nd mortgage deductible? Answer The $7,000 is interest paid on home equity indebtedness (§163(h)(3)(C)) o House is security interest & 2nd mortgage is not involved in the acquisition of the house o 163(h)(3)(C): Home Equity Indebtedness is deductible 2 limits on home equity indebtedness: (1) Cannot exceed $100k AND (2) Cannot exceed: FMV of house – home acquisition indebtedness o Here, for part (2): $100k-$20k=$80k (so cannot exceed $80k) o He only borrowed $70k, so satisfies limits General rule=deduction for all interest payments (§163(a)) Check exceptions: o (1) Investment Interest Limitation §163(d)(3)(A) Here, $7,000 interest paid on the $70k loan is traceable to the home (secured by home), and is being used to buy stock, so it looks like investment interest BUT, §163(d)(3)(B) exception QRI is NOT investment interest T’s deduction is not limited by interest exception o (2) Personal Interest not deductible §163(h)(1) §163(h)(2)(D): personal interest is interest OTHER THAN qualified residence interest SO, his home equity indebtedness is not personal interest SO, his home equity indebtedness/qualified residence interest is neither investment interest, which is limited, nor is it personal interest, which is non-deductible o §163(a) general rule that interest is deductible applies His interest IS deductible Problem Same as above, but the amount on the 1st mortgage is $40,000 Answer 163(h)(3)(C)(i): Limitation on home equity indebtedness o FMV ($100k) minus amount of acquisition indebtedness ($40k) = $60k o So can only have $60k count as home equity indebtedness (on which interest paid is fully deductible) o $6,000 is deductible (b/c 10% interest rate paid on the $70k loan) o $10k of the interest he must repay is not qualified residence indebtedness Excess $10k gets picked up as investment interest b/c not excluded as qualified residence interest anymore o Investment interest deductible only to extent that it doesn’t exceed net investment income o Here, net investment income=$500 (dividend payments) o So $1,000 interest payment is limited to $500 o And 163(h)(2)(B): investment interest is not personal so no issues there TOTAL DEDUCTION = $6,500 o Deduct $6,000 interest on portion treated for home equity indebtedness, & deduct $500 on portion treated as investment interest §163(d) Problem Same as above, but taxpayer uses the $70k to buy $70k of municipal bonds. During year, bonds pay $5,000 tax-exempt interest to taxpayer. How much of the $7,000 interest paid on the 2nd mortgage is “qualified residence interest” & how much of it can taxpayer deduct? Answer Conflict: o §265(a) says $7,000 is non-deductible 74 If you borrow & trace proceeds to investment in tax-exempt securities, then no interest expense on the borrowing is deductible o §163(a): says the $7,000 IS deductible (home equity indebtedness) Says all interest is deductible (unless investment interest or personal interest) TR 1.163-10T: o Qualified residence interest is subject to limitation imposed by §265(a)(2) o §265 takes precedence over §163 And, §163(n)(2): cross references you to §265(a)(2) So, non-deductible Economic Substance Doctrine §7701(o) – Sham Doctrine or Economic Substance Doctrine Substance over form. If Code provides for some tax benefit that derives from some transaction, but the transaction that you engage in has no economic substance, lacks a business purpose, or is a sham, you will be denied the benefit. Undercuts statutes Knetch (SCOTUS): Bought $4M life insurance policy using borrowed money from insurance company. Paid 3.5% interest annually on the loan. At end of year, he owes $140,000 in interest Bank would loan him more & more to pay back interest (but money stayed w/ bank) At time, no limitation on deductibility of interest payments So when he filed taxes, he claimed deduction for all interest he was paying Out of pocket cost for 1st year=$40k (reduced tax liability by $112k bc he was subject to 80% tax rate) He was coming out way ahead b/c of tax savings NB: year after Knetch did this, Congress enacted §264(a)(2): if you borrow in order to acquire single premium annuity contract, cannot deduct interest expense on borrowed funds But didn’t make it retroactive so K thought he was all set IRS: couldn’t take deduction b/c Knetch was only doing it to avoid taxes Held: Interest expense deduction denied It was a sham transaction only purpose was to create a deduction & there were no assets outside of the deal that could be called on to satisfy liability If you do transaction with no economic substance, not entitled to any tax benefits that come from it Problems w/ Sham Doctrine: Taxpayers should be able to read Code & rely on it & know consequences So, 2010: Congress codified it Economic Substance Doctrine §7701 §7701(A): Economic Substance Doctrine (1) if you argue your transaction does have economic substance, must satisfy 2 tests: (i) Transaction changes taxpayer’s economic position in a meaningful way (apart from tax effects) [objective test]; and (ii) Taxpayer has a substantial purpose (apart from tax effects) for entering into such transaction [subjective test] (2) Special rule where taxpayer relies on profit potential.— (A) In general.—The potential for profit of a transaction shall be taken into account in determining whether the requirements of subparagraphs (A) and (B) of paragraph (1) are met with respect to the transaction only if the present value of the reasonably expected pre-tax profit from the transaction is substantial in relation to the present value of the expected net tax benefits that would be allowed if the transaction were respected. Green thinks this doctrine is vague and problematic! Doesn’t this diminish our reliance on what the code says?! A lot of judges really don’t like applying this doctrine. It was only codified 4 years ago. 75 Losses §165(a): General rule = loss sustained during taxable year & not compensated by insurance is deductible Ways to sustain losses: Sell, exchange or other disposition of property (most common way) § 1001: AR < AB = loss Loss = AB - AR Worthlessness Need: (1) Identifiable event, and (2) No reasonable possibility of recovery E.g. S.S. White case: property seized by GR in WWI. TP: loss! IRS: possibility we may win war. SCOTUS: for TP; no reasonable possibility that he’d recover it (some possibility is not enough) loss Commonly corporate stock & securities; corporation goes bankrupt Casualty or theft Damage by storm, shipwreck, fire, or stolen Gambling loss Can only deduct gambling losses to extent that you have gambling gains that year (b) Amount of deduction Basis for determining amount of deduction for any loss is AB as provided in §1101 (Same as for determining loss from sale or other disposition of property) Does not say Loss=Basis; really just setting an upper limit Treas. Reg. 1.165-1(c)(1)—loss can’t exceed basis (c): Individual deductions limited to: (1) Business losses: see TR 1.165-7(b)(1)(ii) ATL deduction (unless EE) (§62(a)(1)) (2) Investment property losses ATL only if it arises from: sale or exchange of property (§62(a)(3)) or if it was held for purposes of rents or royalties (§62(a)(4)) Otherwise, BTL + miscellaneous itemized deduction Unless the loss is due to casualty or theft (then it is just BTL, not miscellaneous) § 67(b)(3) (3) Personal Losses: if casualty (fire, storm, shipwreck) or theft Apply (h) limits. BTL itemized, not miscellaneous. (d): Gambling loses Losses are allowed only to the extent of the gains from such transactions (e): Theft losses Loss arising from theft treated as sustained in taxable year in which taxpayer discovers loss (h): Casualty losses – these limitations only apply to PERSONAL losses, NOT BUSINESS (1) Amount of each casualty must be reduced by $100 (2) Only deductible to extent loss exceeds 10% of AGI (3) Definitions of casualty gain & loss (4)(E) Any individual loss covered by insurance shall be taken into account only if individual files timely insurance claim TR 1.165-7(b)(1) Amount deductible. TEST: Deduct the lesser of (i) drop in FMV caused by the casualty [FMV (before collision) – FMV (after collision)] or (ii) AB as per § 1.1011-1 76 Problems Problem You buy property for $100. Property appreciates to $150, then stolen. What’s your loss? Answer TR 1.165-1(c)(1): amount of deduction for loss shall not exceed AB Change in net worth is (100), you were never taxed on the gain (appreciation). Economically same thing as selling for nothing. AB – 0 = AB Problem Brett spent summer working in LA. Bought car at beginning of summer for $10k for personal use. Sold at end of summer for $12k. What’s her taxable income for the sale? Answer GR=AR – AB $12k - $10k = $2,000 §1001 & no depreciation b/c car used for personal reasons Problem Same as above, except Brett sold car for $8k. What’s deductible loss? Consistent w/ H-S definition of income? Answer Loss=$2k, but NO deduction o §165(c): individual deductions limited to: (1) Business losses; (2) Investment property losses; and (3) Personal losses resulting from casualty/theft o SO, non-deductible (personal loss, not casualty/theft) H-S is change in net worth + FMV of consumption o Rationale: if you own property for personal use, you’re getting consumption as you use the property, & should be taxed every year on that Here, change in net worth = negative $2,000, but she used car for 3 months, so must have gotten some value/use out of property So, assume change in net worth attributable to consumption; IS H-S consistent Note: Rationale for Taxing Losses (generally) When you buy property for personal use, you’re buying the future use (valuing ability to use it in future. As time goes on, you use up & extract value consumption Should be included in taxable income imputed income Expect property to drop in value, & so you’re taxed on amount you’ve used up. But in casualty/theft losses, you didn’t get the chance to use up the value w/ consumption, so IRS does allow deduction in those cases Problem Buy car in 2010 for $20,000 exclusively for personal use. Crash & total car in 2014. AB=$20k. FMV of car right before crash=$9,000. 2014 AGI is $80,000. Car not insured. No other casualty losses or gains in 2014. What casualty loss can you deduct in 2014? Answer TR 1.165-7(b)(1): Deduct the lesser of: o Drop in FMV caused by the casualty [9k – 0 = $9,000]; OR o AB = $20k Personal so no depreciation, basis stays at $20k Drop from $20k to $9k isn’t deductible (its just the ordinary use of car/consumption) Drop due to crash IS deductible ($9k) Deduction: o Start with loss = $9,000 (FMV) o Then subtract (h) limitations: §165(h)(1): amount of each casualty must be reduced by $100 $8,900 §162(h)(2): personal casualty losses only allowed to extent it exceeds 10% of AGI Here, AGI=$80k; 10% of $80k=$8,000 SO can only deduct $8,900 - $8,000 = $900 77 o Final amount you can deduct for loss =$900 Rationale: IRS doesn’t want people taking deductions for absurd things e.g. stealing a pen o Only want people to report theft/casualty if it’s a big loss (administrative rationale) Problem Same as above but now you’re self-employed and use the car solely for business. Right before crash, AB in car = $10k. What amount of casualty loss can you deduct? Answer Now that it has a business purpose not subject to limits in §165(h) TR 1.165-7(b)(1)(ii): If property is (1) used in trade or business, (2) totally destroyed, and (3) its FMV before casualty is less than AB, then amount of loss = AB Here, AB=$10k & FMV is $9k (less than AB) So can deduct AB here = $10k o Rationale: anytime you have biz property, you’re allowed to deduct your basis (cost of building your income etc.), so, should be able to deduct remaining basis here Problem Corporation’s bookkeeper embezzled funds for years. By time company discovers it he’s fled country. Manager decides not to file claim w/ insurance company (wants to avoid negative publicity). Can corp deduct loss? If so, in what year (year loss occurred or year it was discovered)? Answer Treas. Reg. 1.165-8(d)— embezzlement = theft Sec 165(h)(4)(e)—Any loss of an individual described in subsection (c)(3) to the extent covered by insurance shall be taken into account under this section only if the individual files a timely insurance claim with respect to such loss. o First, this isn’t a loss of an individual—it’s a loss of a corporation o Moreover, it’s talking about (c)(3), which is for personal use. Here, it’s a (c)(1) issue Sec 165(a)— “and not compensated by insurance.” o Suggests there isn’t a requirement to file a claim; simply talks about compensation. o Miller v. Commissioner: 6th Cir. — what matters is whether or not it is compensated, not why or why it wasn’t compensated. Sec 165(e)—Theft Losses—For purposes of subsection (a), any loss arising from theft shall be treated as sustained during the taxable year in which the taxpayer discovers such loss. Thus, the deduction is likely fine and CAN deduct a business loss where no insurance claim filed (at least in 6th Cir). Losses on Sales and Exchanges Between Related Persons §267(a): In general, NO deduction for losses from sale or exchange of property btwns persons related as defined by subsection (b). §267 (b) Relationships include: (1) Members of family, as defined by (c)(4) (2) Individuals of corp. more than 50% in value of outstanding stock of which is owned, directly or indirectly, by or for such individual §267 (c)(4): “Family” includes siblings (half or whole), spouse, ancestors, and lineal descendants §267 (d): Amount of gain where loss previously disallowed Gain is only recognized to the extent that it exceeds amount of loss that original seller recognized but did not get to deduct TR 1.267(d)-1(a)(1) says this too §267 (g): This rule doesn’t apply to any transfer described in §1041(a) (re: transfers of property btwn spouses incident to divorce) TR 1.267(d)-1(a)(1): General rule If taxpayer acquires property by purchase or exchange from a transferor who sustained a loss on transaction that isn’t allowable as a deduction for purposes of §267(a)(1), then any gain the taxpayer 78 realizes on the sale or other disposition of that property is recognized ONLY if the gain exceeds the amount of the loss TR 1.267(d)-1 (a)(4): Examples (1) F sells stock to daughter D for $500; F’s AB is $800. D later sells stock for $1,000. Loss of F of $300 isn’t allowable as a deduction to him per §267(a)(1) D realizes gain of $500 when she sells, but her recognized gain under §267(d) is only $200 (excess of realized gain of $500 minus loss of $300 which wasn’t allowable to F) (2) Same facts as Example 1 except that D later sells stock for $300 instead of for $1,000 Her recognized loss is $200 and not $500 b/c §267 only applies to the non-recognition of gain & doesn’t affect basis Problem Ernest buys property for $10k, later sells to granddaughter Margaux for $1k. Answer Ernest cannot deduct the $9k loss b/c 267(a)(1) denies losses on sales between related parties—we know a granddaughter is a related party because 267(b) directs us to (c)(4). o Margaux is a lineal descendant Gift? o §1001 gain should be realized on a sale or disposition (which is what a gift could be) o But this isn’t how gifts work-longstanding rule not in Code Problem Margaux later sells property to unrelated 3rd party for $5k. Recognizable gain/loss? Answer GR = AR – AB o GR = $5k - $1k = $4k BUT §267(d): gain only recognized/taxed to extent it exceeds loss Ernest had but wasn’t allowed to take So only recognized to extent that it exceeds $9k $4k < $9k, so no gain recognized o So throughout transactions, no one in family can claim a loss, but at least we aren’t taxing M on the gain when she sells it So, to recap: 1. Calculate the gain realized under 1001(a) using the cost basis rule of 1012. 2. Calculate the gain recognized. a. General rule: all gain realized is recognized (1001(c)) “except as otherwise provided.” i. Look to exceptions. 1. 267(d): In this kind of transaction, recognize gain = amount > amount of loss previously disallowed. a. So Margot realizes a gain of 4k, but it will only be recognized if it exceeds 9k. Note: this does not apply if M experienced a loss in her sale or she gifted it away. Charitable Contributions Rationale Doesn’t make sense to deduct charitable contributions under H-S definition o Income=change in net worth + FMV of consumption o If you give $100 to charity, that decreases your net worth o But, Q: do you have consumption? Must be getting some value out of giving to charity… Dominant view: charitable contribution is not best measure of income o If you make $100 and give $50 to charity, the $100 better reflects your ability to give taxes to gov’tso deduction is not measure of income, it’s more of a subsidy Gov’t allows deduction bc it wants to incentivize people to give to charity (positive externality) 79 BUT, does it really alter behavior? o Subsidy (deduction) only available to those who itemize their deductions (usually high-income people) So why are we only subsidizing the wealthy? And, value of subsidy/deductions increased with tax rate So, the wealthy are deciding where to put their money (certain causes) instead of giving to gov’t (democratic process; So many people want to get rid of the charitable deduction But universities, orgs., etc. want to keep it Donating APPRECIATED PROPERTY o Wealthy donors tend to give property or stock. So if you buy property for $100 then it appreciates to $150 & you donate it, should deduction be $100 or $150? Change in net worth is $100 o But, TR 1.170A-1(c): deduction for gifts to charity is FMV of property at time of contribution o So giving appreciated property to charity has big tax advantage! Can deduct full FMV w/o being taxed on appreciation o To address this, Congress enacted §170(e), which sometimes reduces deduction to amount of basis Congress wanted to limit it more, but non-profit lobbyists complained (would kill their funding) so they compromised with §170(e)(1) (see below) General Provisions & Concepts Standard for charitable gift Must be given to organization that qualifies under §501(c)(3) Must be detached & disinterested generosity (Duberstein) No “quid pro quo” If you get something of value in exchange, it’s not charitable contrib. deduction If you get something, you’re actually making a dual payment You’re paying for value of whatever you get in return. The remaining amount is charitable & you can deduct Problem Public radio station has fundraising drive, gave those who donated $100 or more a coffee mug. Mug’s FMV=$10. You donate $500 & got the mug. How much can you deduct? What if you later sell the mug for $15? Answer Deduction only allowed to extent there is no quid pro quo, so can only deduct $490 If he sells it for $15: AB in mug=$10 and AR=$15 Gain of $5, which is taxable Hernandez (SCOTUS): TPs donating $ to Scientology Church. In exchange they got various religious services from Church (purely religious benefit) Held: this is quid pro quo, cannot deduct it as charitable contribution Key issue: payment was obligatory to get the religious services Dissent: How can you value these services that aren’t in the marketplace? How do you know people aren’t overpaying, maybe this is not quid pro quo!! BTL – itemized deductions §170(a)(1)–General Rule: Can deduct charitable contribution (described in (c)) payments made in taxable year, only if verified under regulations prescribed by the Secretary. §170(c)– Definition: Contribution for the use of (1) State, possession, or political subdivision of the US only if for exclusively public purposes; (2) Corporation trust or community chest, fund, or foundation 80 (A) Created or organized in the US (B) Organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes, or to foster national/int’l amateur sports (C) No part of net earnings benefit private SHs or individuals; (D) Not disqualified for tax exemption under § 501(c)(3) by reason of attempting to influence legislation, and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office. FLUSH: Contribution by corporation to a trust, chest, fund, or foundation is deductible by reason of this paragraph only if it is used within the US (3) A post or organization of war veterans, or an auxiliary unit or society of, or trust or foundation for, any such post or organization— (A) Organized in the United States or any of its possessions, and (B) No part of the net earnings of which inures to the benefit of any private shareholder or individual. (4) In the case of a contribution or gift by an individual, a domestic fraternal society, order, or association, operating under the lodge system, but only if such contribution or gift is to be used exclusively for religious, charitable, scientific, literary, or educational purposes, or for the prevention of cruelty to children or animals. (5) A cemetery company owned and operated exclusively for the benefit of its members… FLUSH: For purposes of this section, the term “charitable contribution” also means an amount treated under subsection (g) as paid for the use of an organization described in para (2), (3), or (4). Giving Appreciated Property as a Gift §170(e)(1): Certain contributions of ordinary income and capital gain property (limiting provision) NOTE: if this applies, limits deduction to adjusted basis Amount of charitable contribution of property shall be reduced by the sum of: (A) The amount of gain which would NOT have been long-term capital gain had the property been sold by taxpayer at its FMV; and (B) In the case of a charitable contributions (i) of tangible personal property: (I) If the use by the donee is unrelated to the purpose or function of the charity…the amount of gain which would have been long-term capital gain if the property contributed had been sold by the taxpayer at FMV (determined at the time of such contribution). Terminology: Capital gain gain from sale or exchange of capital asset (§1222) (Cf. sale/exchange of not a capital asset, which produces ordinary gain) Capital asset any property held by taxpayer subject to 8 specific exclusions under §1221(a) Generally, property that you hold for personal or investment purposes, e.g. stocks, bonds, jewelry, coin/stamp collections, cars and furniture used for personal purposes Long-term capital gain gain from sale or exchange of capital asset held for more than 1 year (§1222(3)) How much can be deducted? Longstanding rule = deduct FMV TR 1.170A-1(c) deduction for gifts to charity is FMV of property at time of contribution So, deduct FMV, subject to reductions in §170(e)(1) If the property produces something other than long-term gain, then you simply reduce your contribution deduction by the amount of gain you would have recognized had you sold the property. If the property would have produced long-term capital gain, then you only make an adjustment if: It’s tangible personal property (= not real property) The charity uses the property for purposes other than its charitable purposes. 81 If you meet these two conditions, then you make the reduction by the amount of gain you would have recognized had you sold the property. Problem You donate antique furniture that you held for personal use to charity. Basis in furniture=$1,000. Antique dealer offered to buy furniture for $4,000 (before you donated it-you said no). Charity held auction & sold it for $5,000. What’s your charitable contribution? Answer This is a capital asset. It’s a long-term capital asset—you held it for several years. This is tangible personal property—it’s tangible and it’s not real estate The charity is using the property for purposes other than its charitable purposes—it sold it! (B) exception applies. o Treas. Reg. 170A-4(b)(3) ex: a TP donates a painting to an art school. Art school puts it in library so that kids can study it. This is related. But if it sells the painting, then not related. Could maybe argue they thought charity would use it to furnish So now the rule kicks in! But what is the FMV? o Assume it’s 5k here. Now we reduce the FMV by the amount of gain the taxpayer would have recognized had he sold the property. o 4k – [4k - 1k] = 1k. This is a 1k deduction. o Trick: If you donate appreciated property and this rule kicks in, your deduction is always the same amount as adjusted basis) FMV - [FMV - AB] = AB Problem Would answer to above change if charity used furniture to furnish office instead of selling at auction? Answer The question becomes whether this use is related to the charity’s charitable purpose. Yes. Treas. Reg. 1.170A-4(b)(3) gives this exact example and says that this is a related use. So (B) doesn’t apply; (A) applies but all of the gain would have long-term capital gain, so you’d be reducing the amount by 0. So you would get to deduct the FMV. o Don’t know what FMV is though! (could just say 4k) Problem You donate 100 shares of stock to a charity that then sells the stock for $12k to pay operating expenses. Your basis in stock, which you bought 10 years ago, was $5k. FMV on day you contributed it was $11k. What’s amount of your charitable contribution? Answer (B) doesn’t apply because stock isn’t tangible property. And again, all of the gain is long-term, so nothing can get reduced. You can therefore deduct the full 11k. Problem Would the answer above be different if you held stock for only 9 months? Answer Yes wouldn’t have given rise to LTCG, so must reduce FMV ($11k) by gain would have realized if sold property ($6k) Deduction = $5,000 (AB!) Problem You donate real estate to a charity (not a private foundation), which shortly thereafter sells the real estate for $1 million to pay operating expenses. Your basis in the real estate, which you purchased 10 years ago and held for investment purposes, was $800,000. Its FMV the day you contributed it was $1 million. What is the amount of your charitable contribution deduction? Answer 170(e)(1)(B) doesn’t apply bc real estate isn’t personal property. If capital asset (A) applies and all of gain is long term, so nothing can get reduced. Deduct full $1m. 82 Tax Exempt Organizations §501(c)(3): Corporations that are exempt– Corporations, any community chest, fund or foundation organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or int’l amateur sports… No part of the net earnings of which inures to the benefit of any private SH or individual, No substantial part of the activities of which is carrying on propaganda or attempting to influence legislation, And which does not participate in, or intervene in, any political campaign on behalf of (or in opposition to) any candidate for public office. What Counts as a Charity? §170(c) refers you to §501(c)(3) (see longer explanation above) Must be an entity (not an individual) that qualifies under §501(c)(3) And, §170(c)(2)(A): entity must be organized in the U.S. NB: some orgs are tax-exempt, but if you donate to them, it’s not deductible (§501(c)(4) orgs) Problem You make contribution to University of Toronto. Is it deductible? Answer NO. Not organized in US (violates §170(c)(2)(A)) Note: there actually is a tax treaty btw US & Canada that allows this to be deducted if you or family member attended the university (works both ways) Problem Suppose Bd. of University of Toronto forms US corp., “Friends of U. Toronto Inc.” to raise $ for school. Friends, Inc. will turn money over to school to spend in Canada. Is your contribution deductible? What about IBM’s contribution to Friends Inc.? Answer If an individual contributes, its fine. If IBM contributes: o Potential problem bc §170(c)(2) Flush language: Contribution by corporation to trust, chest, fund, or foundation deductible only if its used in US o So money needs to be used in US o BUT, this list doesn’t include corporations! Here, Friends Inc. is a corp. o SO all you have to do is organize a US corp. to get around 170(c)(2) o A Rev Rule specifically says that if a corporation gives $ to another corp, there’s no restriction on where money can be used IRS has created some rules to ensure you don’t have a sham corp o E.g. can’t be a “conduit” org. (if every time there’s a donation they just send the money straight to the foreign org)-Friends Inc. must have some independence o But in reality, it’s just a formality Problem What if you give to United Nations? Answer Not a U.S. org, so not deductible, but Ted Turner set up a US corp. (UN Foundation) so you can donate to that & deduct it Problem Does a nonprofit formed to conduct public forums for lectures and debates on political matters qualify for taxexempt status under 501(c)(3)? What if political candidates are invited to speak? Answer Fine if you don’t invite political candidates But with political candidates, might be a problem 83 o 501(c)(3) status is not awarded if org. participates or intervenes in (including publishing or distributing statements), any political campaign on behalf of (or in opposition to) any candidate for public office Rev. Rule 2007-41: tries to specify when political activities cross the line o No clear line…use facts & circumstances o Is a political campaign imminent? If so, MUST give candidates equal time Problem A and B are candidates for state senate. A supports funding for new mass transit project, B opposes it. C is director of non-profit. 1 month before election, C makes speech at fundraising dinner. Does not name candidates’ names, but urges audience to vote for candidate who supports mass transit. Does this speech jeopardize 501(c)(3) status? Answer IRS concluded that this DOES violate restriction on intervening in political campaigns o Here he clearly identified one of the candidates, election is in 1 month, specific reference to election; is it obvious that you favor one over the other? o Combination of these things invalidates 501(c)(3) qualification What about 1st Amendment rights? o SCOTUS case: held that no one is preventing you from speaking, the gov’t just isn’t going to subsidize it if you do. Problem Can a 501(c)(3) org. publish newspaper ads opposing SCOTUS nominee? Answer Technically this isn’t influencing legislation, but substance over form… And this is not an election… BUT IRS says Senate confirmation vote for a SCOTUS Justice IS legislation, so the org. must be careful (can’t have substantial part of activities devoted to influencing) Treas Reg.: intervening in campaigns is restricted to candidates for ELECTED PUBLIC OFFICE, & SCOTUS nominees aren’t elected…but prob IRS takes precedence Giving Services TR 1.170A-1(g): No deduction allowed for contribution of services Plus, §170 is limited to property (and money); doesn’t cover services BUT, unreimbursed expenditures made w/r/t rendition of services to charitable orgs ARE deductible (e.g. cost of buying uniform w/o general utility to wear while performing services) Problem You pass bar & become solo practitioner. You draft corporate charter & bylaws for local charity & help it apply for tax-exempt status. Takes 20 hours, FMV of services is $4,000. Answer §170 is limited to property (including money), cannot deduct value of the services you provide Consistent w/ H-S definition: o Its as if TP provided services, got paid, then turned around & gave $ right back to charity Capital Gains & Losses Taxable Income divided into: (1) Net Capital Gain taxed at reduced §1(h) reduced rates (20%) o Taxpayer wants this to be as big as possible so you get lower rates (2) Taxable Income – Net Capital Gain taxed at your regular tax rate Mechanics §1222 To Compute Net Capital Gain: (1) Compute Net long-term capital gain 84 Excess of (LTCG minus long-term capital loss) for taxable Net LT CG = LT CG - LT CL year If loss is bigger than gain, there’s no excess Net ST CL = ST CL - ST CG This number is never zero (2) Compute Net short-term capital loss Net CG = LT CG - SR CL Excess of (STCL minus short-term capital gain) for taxable year This number is never negative If you have more gains than losses, this number is zero & have no excess (3) Subtract Net short-term capital loss FROM Net long-term capital gain Net capital gain POSSIBLE OUTCOMES: 1) Net gains in both LT CG = § 1(h); and ST CG = ordinary 2) Net losses in both Net losses combine & can be offset against up to $3k of ordinary income w/ unlimited carry forward 3) Net loss in one & gain in other: a. If *ST* CG > LT CL excess is ST CG = ordinary rate b. If *LT* CG > ST CL excess is LT CG = § 1(h) c. If net loss > net gain the excess loss is offset against $3k of ordinary income, w/ unlimited carry forward Recap re: gains from sales of property: §61(a)(3): Gross income includes ordinary and capital gains §1001: GR = AR – AB AR = $ received + FMV of property received + relief from liabilities §1001(b); TR §1001-2(a)(1) AB = cost +/- adjustments (add capital expenditures, subtract depreciation deductions). §§ 1011, 1012, 1016 §62(a)(3): Losses from sale/exchange of property are ALWAYS ATL deductions ** regardless of ordinary or capital** §165(c): for individuals, losses w/r/t biz & investment property are deductible. Losses w/r/t personal property NOT deductible unless casualty or theft §1222: Capital gain or loss means gain/loss from sale/exchange of capital asset “long-term” capital gain or loss held for more than 1 year “short-term” capital gain or loss held for less than 1 year §1221: Capital asset means any property held by taxpayer, except 8 exclusions in §1221(a)(1)-(8) Unless property falls under one of these 8 exclusions, it’s a capital asset Restrictions on deductibility of capital losses: §165(f): capital losses deductible only to extent allowed in §1211 & §1212 §1211: Corporations may deduct capital losses only to extent of capital gains. Individuals may deduct capital losses only to extent of capital gains plus $3k of ordinary income §1212: Corporations may carry excess capital losses back 3 yrs & forward 5 yrs Individuals can carry excess capital losses forward indefinitely Problem On Jan 1st you buy stock of 2 corps, X & Y, for $100k each. On Dec. 31: FMV of X=$50k, FMV of Y=$150k. You sell your X shares but keep Y shares. Answer 85 H-S analysis: no income b/c no change in net worth (initially had $200k, & on Dec. 31 you have $200k worth of stock). Federal tax analysis: Only taxed on realizations; so, report loss of $50 (for X corp), nothing w/r/t Y shares. Congress doesn’t want you to indefinitely postpone paying tax on gain of Y shares, so in any year, can only deduct capital losses to extent you have capital gains, plus $3,000 of ordinary income (§1211) (need to have capital gains in oreer to have capital loss deductible Reporting the losss as if happened in the prior years.) Here, if person had $100k salary, taxable income of $97k o Could deduct $3,000 of the $50k capital loss Can’t deduct the remaining $47k this year (bc you don’t have gains to cancel it out) (but you can carry it forward & deduct $3k each year) THREE kinds of property: Capital asset produces capital gains/loss Ordinary asset produces ordinary gain/loss §1231 assets special rule: produces either capital gain or capital loss What is NOT a Capital Asset? Exception 1: §1221(a)(1) Inventory Property held by taxpayer for sale to customers in ordinary course of biz Finished goods Goods in process (at different stages of production) Supplies that will be incorporated into finished goods NB: jet fuel for plane doesn’t count bc its not a good that the plane sells, but it does fall under (a)(8) exclusion: “supplies used or consumed by taxpayer in ordinary course of trade/biz” Exception 2: §1221(a)(2) Depreciable property or real property used in trade/biz Almost all of the property that biz uses E.g. factory, equipment Exception 3: §1221(a)(3) Copyright; literary, musical, or artistic composition; & letters or memoranda or similar property Excluded from definition of “capital asset” if held by: (A) Taxpayer whose personal efforts created the property, or (B) In the case of letter/memo/similar property, a taxpayer for whom the property was produced, or (C) Taxpayer in whose hands the basis of the property is determined by reference to the basis of the property in the hands of a taxpayer described in (A) or (B) This exclusion is meant for people who are gifted these (not inheritance) and for those that sell their paintings as compared to painting on commission (hired) Exception 4: §1221(a)(4) Accounts or notes receivable acquired in the ordinary course of business for services rendered or form the sale of inventory Makes Notes ordinary assets Exception 5: §1221(a)(5): Publications of the U.S. Government A publication of US Gov’t is excluded from the definition of “capital asset” if it is received other than by purchase at the price at which it is offered for sale to the public, and is held by: (A) Taxpayer who received the publication, or (B) Taxpayer in whose hands the basis of property is determined by reference ot the basis of property in hands of a taxpayer described in (A) Can’t just give it to your kid & have him deduct, bc kid takes your basis E.g. gov’t employee gets copy of Tax Code for free, then donates it & tries to deduct it for donating it; its ordinary property (similar to Haverly case). And §170(e)(1)(A): anytime you donate ordinary asset to charity, must reduce your deduction in your AB, & if you got it for free your basis is zero, so you get no charitable contribution deduction. 86 Exception 6: §1221(a)(6): Certain commodities derivative financial instruments held by a commodities derivatives dealer Exception 7: §1221(a)(7): Certain hedging transactions Corn Products: corp. bought corn & made corn oil. Inventory would include the corn too. Worried that corn was in short supply, so bought futures K (buy corn in future for specific fixed price). Then sold futures K, producing a (capital?) gain of difference between Pn and specific fixed P. Instead of the full difference between MP & specific fixed P (of K) being ordinary gain, they converted the portion between to capital gain through the k! If future K were treated as capital asset, could get capital gain & ordinary loss So, to prevent that need to make the derivative an ordinary asset Transactions entered into by the TP in the normal course of business primarily to manage risks such as P changes or currency fluctuations with respect to ordinary property held by the TP Exception 8: §1221(a)(8): Supplies consumed by taxpayer in ordinary course of business Ex: jet fuel. If fuel oil was a capital asset then the hedging Ks could be capital gains/losses! Exception to rule that most financial products are capital assets if you are holding it for hedging purposes = ordinary income. ** So, very few business assets are actually capital assets (bc its either depreciable property or real property used in trade/biz or inventory, so if they’re not excluded per a (a)(1)-(8) provision, they’re just ordinary assets). But, §1231 provides a special rule… 1231 Asset §1231(a)(3): A §1231 gain or loss is any recognized gain or loss on the sale or exchange of “property used in the trade or business” §1231(b)(1): defines property used in the trade or business: Depreciable property used in trade or biz held for more than 1 year; and/or Real property used in trade or biz held for more than 1 year §1231 assets do not include things listed in § 1231(b)(1)(A)-(D) How to tax §1231 assets: (1) Add all §1231 gains for year (2) Add §1231 losses for year (3) If (1) > (2), each §1231 gain or loss produces capital gain or loss (4) If (1) < (2), each §1231 gain or loss is treated as ordinary gains/losses SO, if overall your §1231 transactions produce: GAINS treated as capital gains. LOSSES treated as ordinary losses. Good for TPs bc LTCG taxed at lower rate, & ordinary losses more favorable for TPs! Problem Ezra had $250k salary and also realized the following gains/losses. Held each asset for long term. What’s his net capital gain for year? (1) $9k gain on sale of business inventory (2) $12k loss on sale of his personal residence (3) $5k loss on sale of stock held as investment (4) $12k gain on sale of boat used solely for recreational purposes (5) $6k loss on sale of real estate used in his business Answer (1) $9k gain on sale of business inventory: o Not a capital asset; excluded under §1221(a)(1). Just ORDINARY INCOME. o §1231 assets do not include things listed in §1232(b)(1)(A) – (D), and (A) is inventory, so not a §1231 asset 87 o No effect on net capital gain (2) $12k loss on sale of his personal residence: o §165(c)(3) limits deductions for losses to losses from casualty or theft o This loss is not one of those, so not deductible o No effect on net capital gain (3) $5k loss on sale of stock held as investment: o This is CAPITAL LOSS. Not excluded by any §1221 exception o §165(c)(2) allows deductions for losses on property held for investment o NB: this would be ATL (4) $12k gain on sale of boat used solely for recreational purposes: o This is CAPITAL GAIN Not excluded by any §1221 exception (5) $6k loss on sale of real estate used in his business: o §1221(a)(2) excludes it (real property used in trade/biz is not a capital asset) o But then §1231 picks it up bc its real property used in biz that taxpayer held for more than 1 year, so it’s a §1231 LOSS It says these are the only property transactions that TP had all year, so the total §1231 gain is zero, and the §1231 losses outweigh it So, treated as ORDINARY NET CAPITAL GAIN: o Net LTCG - Net STCL (here, zero) o (LTCG – LTCL) – 0 o ($12k - $5k) – 0 = $7k Net Capital Gain Taxable income: o Gross income - EVERYTHING gets included 250k salary (ordinary) 9k gain from inventory sales (ordinary) 12k gain from boat sale (LTCG) =271k o Calculation of AGI - subtract ABOVE THE LINE 271 Gross income -5k loss from IBM stock (LTCL, See 1211 to see how much you can deduct 3k) -6k loss from real estate sale (ordinary) NOTE: when computing taxable income, don’t distinguish btw ordinary income, capital gain/loss, etc. – all gets put together. ALL property gain/loss is above the line, regardless of nature!! o Taxable income - SUBTRACT BELOW THE LINE 260 AGI -6300 standard deduction (single, assume no §68 limitation) -4050k personal exemption (assume no 151d3 phase-out) o Tax liability Net Capital Gain=7k-0=7k Tax on net capital gain = 20%x7k = Capital gains tax 40% tax on $253k Recapture Ex.: Initial basis in biz property is $10k. Take $4k worth of depreciation deductions (x 40% tax to see savings), then sell it for $10k (its actually retained its value!) AR=$10k AB=$6k GR= $10k - $6k=$4k nets out to zero, no effect on net worth But, doesn’t work bc it’s a §1231 gain (depreciable property used in biz) 88 If it’s the only transaction, it will be taxed as a capital gain & at lower rate huge profit just by holding onto property that never changes in value GREEN thinks tax law should do something, but not administratively feasible So, RECAPTURE: when you sell property at a gain, to extent that you only have a gain bc of prior depreciation deductions, you re-characterize the gain up to the amount of depreciation as ordinary So you’re taxed on gain at the ordinary rate Taxed on $1,600 Offsets huge tax savings Applies mostly to property held for business ONLY APPLIES TO GAINS, not losses §1245 Rule: If TP sells §1245 property at gain, then the lesser of: Gain recognized; or Allowable depreciation deduction Will be treated (“recaptured”) as ordinary income §1245(3) Defines Section 1245 property: Any property allowable for depreciation provided by §167 and is either: (A) Personal property (B) Other tangible property whose AB has adjustments for period where property was used for (i) manufacturing, production, extraction, communications, gas, water, sewage; (ii) or was a research facility used re: any activities described in (i), or; (iii) was a facility for those Or storage facility, railroad grading, agricultural structure etc. Problem TP buys equipment for $10k, takes $4k depreciations. Holds for more than 1 year. Sells it for $12k [look out for depreciation taken and then sold at or above basis]. Answer *Anytime you take depreciation deductions, must reduce basis* AB=(10k-$4k) = $6k AR=$12k GR=$12k-$6k=$6k If §1245 recapture rule didn’t exist: o This would be §1231 property (depreciable property used in trade/biz, held for more than 1 year) o If it were the only §1231 transaction, it would be treated as capital gain Applying §1245 rule: amount recaptured is always the smaller of the gain recognized and the previous allowable depreciation o Here, GR=$6,000 o Previous allowable depreciations=$4k o So, recapture $4k as ordinary gain Non-Recognition of Gain or Loss Realization requirement TR §1.1001-1(a) (not really in the code); see Cottage Savings Lock-in effect: realization requirement permits you to game the system based on when you sell We have this bc we don' t know where people would get the money to pay tax; issue that realization events include exchanges of property Realization only solves the problem in a cash transaction doe Therefore, you must both REALIZE and RECOGNIZE gain §1031: Like-Kind Exchange (NOT a sale for cash) Only applies if properties exchanged are used in a business or investment purpose "of like kind" ~ not like Cottage Savings Basically a real estate provision; generally all real property = like kind ~ very generous Ex: 89 undeveloped land & built up property - like kind Real estate for non-real estate is NOT like kind Cannot exchange stock, bonds, and notes § 1031(a)(2) 1031(d): if you exchange property, basis in new property = basis in property you exchanged (old prop) Ex: A owns WA with FMV = 200 and basis = 150; B owns BA with FMV = 200 and Basis = 180; A transfers WA to B in exchange solely for BA; A realizes gain: FMV(BA) 200 - 150(basis) = 50 § 1001 BUT recognizes NO gain § 1031(a)(1) gain of 50 gets "built-in" to the asset! Not permanently avoiding tax, just putting it off If you immediately sell for cash you then will recognize $50 of gain. The Alternative Minimum Tax Discussed in Sec 55. How it Works: Taxpayers must pay the higher of their regular tax liability or their alternative minimum tax liability. The regular tax is imposed on taxpayer’s “taxable income,” as defined above The alternative minimum tax is imposed on the taxpayer’s “alternative minimum taxable income” (“AMTI”) reduced by the “exemption amount.” AMTI is equal to taxable income with various adjustments, including the disallowance of the following deductions: Miscellaneous itemized deductions State and local income and property taxes The standard deduction and the deduction for personal exemptions The exemption amount is a number that establishes a threshold for taxation under the alternative minimum tax. The AMT exemption amount for 2016 is $53,900 for singles and $83,800 for married couples filing jointly. The AMT exemption amount is phased out for higher-income taxpayers. The alternative minimum tax has two tax brackets: 26% and 28%. 90