scribd.vdownloaders.com chap-15-guerrero-joint-product-and-by-product-acctg

advertisement

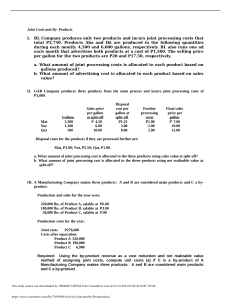

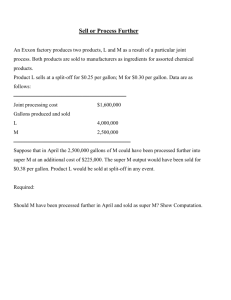

Chapter 15 Joint Product & By-Product Accounting In the process of of manufacturing one one or more products, products, a company may also also produce other other products which may either be joint products products or by-products depending depending upon their importance to the firm. The problems encountered encountered in the CPA examinations examinations relative to joint joint products and by-products accounting are the following: 1. Allocation Allocation of joint joint (common (common)) costs costs at the point point of split-off. split-off. 2. Accou Accounti nting ng for by-pro by-produc ducts. ts. ALLOCATION OF JOINT (COMMON) COSTS The allocation of the joint costs among the individual products produce is to be made at the split-off point, which is the point where the joint products are separated from each other. The following methods are usually used in allocating joint costs: 1. Relati Relative ve marke markett (sales (sales)) value value method method.. The application of this method will depend on whether the products are sold at the point of separation or whether additional costs are incurred as a result of additional processing. The following procedures should be remembered by the candidate: a. Sale value at point of split-off. If the products are sold at the point of separation, cost is allocated to each product based on the relative market value at that point (split-off point). b. Sale value after further processing. Joint cost is to be allocated on the basis of each product’s net realizable value. Net realizable value is the difference between the final sales value and the actual cost to complete and sell. (Further processing cost). 2. Physical Physical Measures Measures (Units (Units Produce Produced) d) Method. Method. This method allocates joint costs to products based on a physical measure of units. If the allocation is based on physical quantities, each unit of each product is assigned at the same value regardless of the nature or value of the product. ACCOUNTING FOR BY-PRODUCTS By-products are those products of limited sales value produced simultaneously with products of greater sales value known as main or joint products. The methods of accounting for by-products fall into the following categories: 1. By-pro By-produc ducts ts are are reco recogni gnized zed when when sold. Under this method no income is recorded from them until they are sold. Net by-product income equals actual sales revenue less any actual additional processing costs and marketing and administrative expenses. Net byproduct income may be shown in the income statement as: a. Addition Addition to to income, income, either either as as “other “other sales” sales” or or “other “other income income”. ”. b. A deductio deduction n from cost of goods goods sold sold of the main main produc product. t. produced. Under this category the cost of the by2. By-pro By-produc ducts ts are are reco recogni gnized zed when when produced. product is computed by using the following methods: a. Net realizable value method. Under this, the expected sales value of the byproduct produced is reduced by the expected additional processing cost and marketing and administrative expenses. The resulting net realizable value of the by-product is deducted from the total production costs of the main product. b. Reversal cost method. The expected value of the by-product produced is reduced by the expected additional processing costs and normal gross profit of the by product (or by the marketing and administrative expenses and net income). This method is called the reversal cost method because you have to work backward from the gross revenue to arrive at the estimated joint cost of the by-product at the point of split-off. The joint cost allocated to the production production of the by-product is deducted from the total production cost of the main product, and charge to a by-product inventory account. Proceeds from the sale of by-products are treated the same same as sales of the main main product. PROBLEMS 1. Tomasa Inc. manufactures products X, Y and Z from a joint process. Joint product costs were P60,000. Additional information is as follows: Products X Y Z Sales Value and Additional Costs if processed further Final Sales Values Additional Costs P49,000 P9,000 42,000 7,000 30,000 5,000 Units Produced 6,000 4,000 2,000 What is the total costs allocated to product X? Physical Measure Relative Sales Values a. P30,000 P28,000 b. 29,000 27,000 c. 30,000 21,000 d. 39,000 33,000 2. Camille Company manufactures products W, X, Y and Z from a joint process. Additional information is as follows: Products Units Produced W X Y Z 6,000 5,000 4,000 3,000 18,000 Value at Split-off P80,000 60,000 40,000 20,000 P200,000 If processed further Additional Sales Costs Value P7,500 P90,000 6,000 70,000 4,000 50,000 2,500 30,000 P20,000 P240,000 Assuming that total joint costs of P160,000 were allocated using the relative-sales value at split-off approach, what were the joint costs allocated to each product? W X Y Z a. P40,000 P40,000 P40,000 P40,000 b. 53,333 44,444 35,556 26,667 c. 60,000 46,667 33,333 20,000 d. 64,000 48,000 32,000 16,000 3. Solomon Inc. manufactures products F, G and H from a joint process. Additional information is as follows: Products F G H Total Units produced 8,000 4,000 2,000 Joint cost ? ? 18,000 Sales value at split-off P120,000 ? ? Additional costs if processed further 14,000 10,000 6,000 Sales value if processed further 140,000 60,000 50,000 Assuming that joint product costs are allocated using the relative sales-value at approach, what were the joint costs allocated to product G? a. P28,000 b. 30,000 c. 34,000 d. 51,000 14,000 120,000 200,000 30,000 250,000 split-off 4. A company produces two joint products, A and B. For the month of March, the joint production costs were P120,000. Further processing costs beyond split-off point required to make the products into marketable form and other related data follow: A B Additional processing costs P100,000 P140,000 Units after split-off 1,600 800 Unit selling price 200 400 The company uses the net realizable value method for allocating joint product costs. For the month of March, the joint costs allocated to A amounted to a. P66,000 b. 72,000 c. 60,000 d. 80,000 5. Kamagong Inc. produces two joint products, PEI and VEL. The joint production costs for March 2013 were P15,000. During March 2013, further processing costs beyond the split-off point, needed to convert the products into salable form were P8,000 and P12,000 for 800 units of PL and 400 units VEL, respectively. PEL sells for P25 per unit and VEL sells for P50 per unit. Assuming that Kamagong uses the net realizable value method for allocating joint product costs, what were the joint costs all allocated to product PEL for March 2013? a. P5,000 b. 6,000 c. 9,000 d. 10,000 6. Dennis Mfg. Co. manufactures two joint products and it uses the net realizable value method for allocating joint costs. Product A sells for P30 while Product B sells for P60. Joint costs for June, 2013 were: Materials P30,000 Direct labor 15,000 Factory overhead 10,000 Further processing costs after the split-off point in order to finish the products into their final form amounted to P24,000 for Product A and P36,000 for Product B. the total units produced during the month were 2,000 for Product A and 1,000 for Product B. The amount of joint costs allocated to Product A was: a. P33,000 b. 27,500 c. 22,000 d. 32,000 7. Adan Inc. purchases its major raw material from Eva Co. and processes them up to splitoff point, where two products (AA and CC) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. For the month just ended the following data were made available: Raw material purchased 25,000 Units Production AA 15,000 Units CC 15,000 Units Sales AA 14,500 units@P2 CC 15,000 units@P5 The cost of purchasing 25,000 units raw materials and processing them up to the splitoff point to yield equal number of production of AA and CC of 15,000 units each amounted to P37,500. There were no beginning inventories but there were 500 units of AA at the end of the month, using the sales value at split-off method the approximate weighted cost proportions (may be rounded) of AA and CC were: a. AA, 29% and CC, 71% b. AA, 33% and CC, 67% c. AA, 49% and CC, 51% d. AA, 50% and CC, 50% 8. Kasoy Manufacturing Company manufactures two products, AA and BB. Initially, they are processed from the same materials and then, after split-off, they are further processed separately. Additional information is as follows: AA BB Total Final sales price P9,000 P6,000 P15,000 Joint costs prior to split-off ? ? 6,600 Costs beyond split-off point 3,000 3,000 6,000 Using the relative-sales-value approach, what are the assigned joint costs of AA and BB respectively? a. P3,000 and P3,300 b. 3,960 and 2,640 c. 4,400 and 2,200 d. 4,560 and 2,040 9. Vivien Company manufactures products N, P and R from a joint process. The following information is available: N P R Total Units produced 12,000 ? ? 24,000 Sales value at split-off point ? ? P50,000 P200,000 Joint costs P48,000 ? ? 120,000 Sales value if processed further 110,000 P90,000 60,000 260,000 Additional costs if processed further 18,000 14,000 10,000 42,000 Assuming that joint product costs are allocated using the relative-sales-value at split-off point approach, what was the sales at split-off for products N and P? Product N Product P a. P66,000 P84,000 b. 80,000 70,000 c. 98,000 84,000 d. 100,000 50,000 10. Cebu Inc. manufactures product P, Q and R from a joint process. Additional information is as follows: Products P Q R Total Units produced 4,000 2,000 1,000 7,000 Joint cost P36,000 ? ? P60,000 Sales value at split-off ? ? P15,000 100,000 Additional costs if processed further 7,000 P5,000 3,000 15,000 Sales value if processed further 70,000 30,000 20,000 120,000 Assuming that joint costs are allocated using the relative sales value at split-off approach, what was the sales value at split-off for Product P? a. P58,333 b. 59,500 c. 60,000 d. 63,000 11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the portion of the total joint costs properly allocated to Product S u sing the relative-sales-value at split-off approach was P30,000, what were the total joint costs? a. P40,000 b. 42,500 c. 45,000 d. 60,000 12. Sisa Company manufactures Product J and Product K from a joint process. For Product J, 4,000 units were produced having a sales value at split-off of P15,000. If Product J were processed further, the additional costs would be P3,000 and the sales value would be P20,000. For product K, 2,000 units were produced having a sales value at split-off of P10,000. If Product K were processed further, the additional costs would be P1,000 and the sales value would be P12,000. Using the relative sales value at split-off approach, the portion of the total joint product costs allocated to Product J was P9,000. What were the total joint product costs? a. P14,400 b. 15,000 c. 18,400 d. 19,000 13. Stella Corporation manufactures products R and S from a joint process. Additional information is as follows: Products R S Total Units produced 4,000 6,000 10,000 Joint cost P36,000 P54,000 P90,000 Sales value at split-off ? ? ? Additional costs if processed further 3,000 26,000 29,000 Sales value if processed further 63,000 126,000 189,000 Additional margin if processed further 12,000 28,000 40,000 Assuming that joint costs are allocated on the basis of relative-sales-value at split-off, what was the sales value at split-off for Product S? a. P72,000 b. 82,000 c. 98,000 d. 100,000 14. Bacolod Company manufactures Products F, G and W from a joint process. Joint costs are allocated on the basis of relative sales value at split-off. Additional information for the June 2013 production activity is as follows: Products F G W Total Units produced 50,000 40,000 10,000 100,000 Joint cost ? ? ? 450,000 Sales value at split-off P420,000 P270,000 P60,000 P750,000 Additional costs if processed further 88,000 30,000 12,000 130,000 Sales value if processed further 538,000 320,000 78,000 936,000 Assuming that the 10,000 units of Product W were processed further and sold for P78,000, what was Bacolod gross profit on this sale? a. P21,000 b. 28,500 c. 30,000 d. 66,000 15. Luzon Company manufactures three products, R, S and T, in a joint process. For every ten kilos of raw materials input, the output is five kilos of R, three kilos of S, and two kilos of T. During August, 50,000 kilos of raw materials costing P120,000 were processed and completed, with joint conversion costs of P200,000. Conversion costs are to be allocated to the products on the basis of market values. To make the products salable, further processing which does not require additional raw materials was done at the following costs: Product R Product S Product T The unit selling prices are: P30,000 20,000 30,000 Product R Product S Product T What are the unit cost of Product R, S and T? R S T a. P7.12 P8 10.20 b. 8 7.12 10.20 c. 10 8 10 d. 25.32 7.12 10 P10 12 15 16. It costs Visaya Corp. P1,400,000 to process a main material to produce three chemicals: #111, #777 and #999. This joint cost is allocated to the product lines based on the relative market values of the products produced. Additional data are summarized below: Units of Additional Unit Sales Price at Production Processing Cost Split-off #111 60,000 960,000 P20 #777 20,000 168,000 40 #999 20,000 520,000 100 The product costing line that will have the least per unit contribution margin (after accounting for share in joint and additional processing costs) is: a. #111 at P(3) b. #777 at 17.60 c. #111 at 13 d. #111 at (10.48) 17. Mindanao producers manufactures three joint products, JKA, JKB and JKC and a byproduct JJD, all in a single process. Results for July were as follows: Materials used Coversion cost Output: 10,000 kgs. P28,000 P24,000 No. of Kilos Product Sales Value per Kilo 4,000 JKA P11 3,000 JKB 10 1,000 JKC 26 2,000 JJD 1 The revenue from the by-product is credited to the sales account. Process costs are apportioned on a relative sales value approach. What was the cost per kilogram of JKA for the month? a. P5.72 b. 5.50 c. 5.61 d. 5.20 18. Payaso Inc. produces chemicals Koo and Lam. The processing also yields a by-product, Wiz, another chemical. The joint costs of processing is reduced by the net realizable value of Wiz. For the month of March, the joint costs were registered at P3,840,000. Below are additional data: In Thousands Product Production Market Value Koo 2,000 P3,000 Lam 3,000 2,000 Wiz* 1,000 420 *An additional P180,000 were spent to complete the processing of Wiz. Assuming that the company uses the net realizable value method for allocating joint costs, the allocated costs to Koo would amount to: a. P2,160,000 b. 1,800,000 c. 2,208,000 d. 2,700,000 19. Abel Corp. manufactures a product that yields the by-product, “Yum”. The only cost associated with Yum are selling costs of P.10 for each unit sold. Abel accounts for sales of Yum by deducting Yum’s separable costs from Yum’s sales, and then deducting this net amount from the major product’s cost of goods sold. Yum’s sales were 100,000 units at P1 each. If Abel changes its method of accounting for Yum’s sales by showing the net amount as additional sales revenue, then Abel’s gross margin would: a. Increase by P90,000 b. Increase by 100,000 c. Increase by 110,000 d. Be unaffected 20. Panday Company, which began operations in 2013, produces gasoline and a gasoline byproduct. The following information is available pertaining to 2013 sales and production: Total production costs to split-off point P120,000 Gasoline sales 270,000 By-product sales 30,000 Gasoline/Inventory 15,000 Additional by-product costs: Marketing 10,000 Production 15,000 Panday accounts for the by-product at the time of production. What are Panday’s 2013 costs of sales for gasoline and the by-product? a. b. c. d. Gasoline P105,000 115,000 108,000 100,000 By-product P25,000 0 37,000 0 21. Bataan Co. produces main products JJ and MM. the process also yields by-product BB. Net realizable value of by-product BB is subtracted from joint production cost of JJ and MM. the following information pertains to production in July 2013 at a joint cost of P54,000. Product Units produced Production Market Value JJ 1,000 P40,000 P0 MM 1,500 35,000 0 BB 500 7,000 3,000 If Bataan uses the net realizable value method for allocating joint cost, how much of the joint cost should be allocated to product JJ? a. P18,800 b. 20,000 c. 26,667 d. 27,342 22. Aguilar Sweets Factory manufactures a coconut candy, Coco, which is sold for P5 a box. The manufacturing process also results in a by-product, Soloc. Without further processing, Soloc sells for P1 per pack; with further processing, it sells for P3 per pack. During the month of April, the total joint manufacturing costs up to the point of separation consisted of the following charges to work in process: Raw materials P225,000 Direct labor 100,000 Factory overhead 45,000 During the month, the production for the two products was as follows; Coco, 591,000 boxes, Soloc, 45,000 packs. The following additional costs are necessary for further processing to complete Soloc, in order to obtain a selling price of P3 per pack, during the month of April: Raw materials P30,000 Direct labor 22,500 Factory overhead 7,500 Assuming that the by-product, Soloc, is further processed and then transferred to the stockroom at net realizable value with a corresponding reduction of Coco’s manufacturing costs, the journal entry would be: a. By-product inventory – Soloc 45,000 Work in process – Coco 45,000 b. By-product – Soloc 135,000 Raw materials 30,000 Direct labor 22,500 Factory overhead 7,500 Work in process – Coco 75,000 c. By-product inventory – Soloc 6,750 Work in process – Coco 6,750 d. Work in process – Soloc 60,000 Raw materials 30,000 Direct labor 22,500 Factory overhead 7,500 23. A chemical company manufactures joint products PP and VV, and a by-product ZZ. Costs are assigned to the joint products by the market value method, which considers further processing costs in subsequent operations. For allocating cost to the by-product, the market value, or reversal cost, method is used. Total manufacturing costs for 10,000 units were P172,000 during the quarter. Productions and costs data follow: PP VV ZZ Units produced 5,000 4,000 1,000 Sales price per unit P50 P40 P5 Further process cost per unit 10 5 Selling & admin. expense per unit 2 Operating profit per unit 1 What is the gross profit from the sales of PP? a. P70,000 b. 80,000 c. 100,000 d. 98,000 24. AMG Paper Mfg. Co., which started operations in 2013, manufactures paper from wood pulp. The company grades its products and classified them into Products A, B and C. in processing the chipped woods, a fatty soap is produced, extracted, and refined into a by-product identified as Product X. The following information related to AMG’s operations for 2013 are obtained from the company’s records: Units (in Tons) Sales Price Products Produced Sold On hand Per Ton A 152.5 66 86.5 P100 B 68.5 41.5 27 100 C 11 5 6 100 X 85 30 55 33 Sales, including Product X, totaled P12,240 while production costs amounted to P24,884.50. Selling expenses, on the other hand, were P612. The cost accountant, in order to find which accounting method best approximates actual costs, computed the December 31, 2013 inventory (at the lower of cost or market) based on the following alternative methods: Method A – joint cost method of accounting, with costs apportioned on a unit cost per ton basis. Method B – recognize income in the period in which the by-product is produced, with no selling expense assigned to the by-product. The ending inventory on December 31, 2013 would be: a. b. c. d. Method A P13,698 13,115 11,105 11,105 Method B P13,765 13,698 13,698 13,115 25. Cooper Company manufactures products MM, RR, SS and CC with product CC classified as a by-product and sold at a lower price. Sales, including that for product CC, totaled P49,200 while production costs amounted to P99,538. Selling expenses amounted to P2,460. The following information concerning the company’s operations for 2013 are obtained from the company’s records: Sales Price Units in Kilos Products Per Kilo Produced Sold On Hand MM P100 610 264 346 RR 100 274 166 108 SS 100 44 20 24 CC 35 340 120 220 Compute the ending inventory (at lower of cost or market) at December 31, 2008 based on the following methods: Cost apportioned Income recognition in the period a unit cost per kilo basis of by-product production a. P44,838 P53,275.15 b. 44,838 52,842.32 c. 54,793 56,159 d. 56,159 55,159.08 26. Makiling Sawmill, Inc., purchases logs from independent timber contractors and processes the logs into two joint products, two-by-fours of Narra A and four-by-eight of Yakal B. In processing the two products, sawdust emerges and classified as by-product. The packaged sawdust can be sold for P10 per kilo. Packaging cost for the sawdust is P0.50 per kilo and sales commission is 105 of sales price. The by-product net revenue serves to reduce joint processing costs for joint products. Joint products are assigned joint cost based on board feet. Data follows: Joint processing costs P100,000 Narra A 400,000 Yakal B 200,000 Sawdust produced (kilos) 2,000 What is the cost assigned to Narra A? a. P61,000 b. 62,000 c. 63,000 d. 62,130 Use the following information in answering Numbers 26 to 30: Manuel Tuason is the owner and operator of MT Bottling, a bulk soft-drink producer. A single production process yields two bulk soft drinks: Rain Dew (the main product) and Resi-Dew (the by-product). Both products are fully processed at the split off point, and there are no separable costs. For July 2013, the cost of the soft-drink operations is P120,000. Production and sales data are as follows: Production Sales Selling Price (In Liters) (In Liters) Per Liter Main product: Rain Dew 10,000 8,000 P20 By-product: Resi – Dew 2,000 1,400 2 There were no beginning inventories on July 1, 2013. Assuming by-product is recognized when produced: 27. What is the gross margin for MT Bottling? a. P67,200 b. 71,200 c. 71,200 d. 70,000 28. What are the inventory costs reported in the balance sheet on July 31, 2013, for Rain Dew and Resi – Dew? Rain Dew Resi-Dew a. P23,200 P1,200 b. 23,200 4,000 c. d. 22,300 25,200 1,200 4,000 Assuming the by-product is recognized at sale? 29. What is the gross margin for MT Bottling? a. P66,800 b. 64,000 c. 60,000 d. 65,000 30. What are the inventory costs reported on July 31, 2013, for Rain Dew and Resi-Dew? Rain Dew Resi-Dew a. P24,000 P0 b. 23,200 1,200 c. 24,000 1,200 d. 23,200 0 Use the following data for Numbers 31-34: JMG Company buys Article X for P.80 per unit. At the end of processing in Department 1 Article X split into Products D, E, and F. Product D is sold at split-off point with no further processing. E and F require further processing before they can be sold. E is processed in Department 2; and F is processed in Department 3. The following is a summary of costs and other data for the fiscal year ended July 31, 2013: Cost of Article X: Direct materials Direct labor Factory overhead Department 1 Department 2 Department 3 P144,000 21,000 15,000 P67,500 31,500 P97,500 73,500 Product D Product E Units sold 30,000 45,000 Units on hand, July 31, 2012 15,000 Sales P45,000 P144,000 JMG uses the estimated net realizable method of allocating joint costs. 31. What is the sales value of Product D at split-off point? a. P45,000 b. 30,000 c. 67,500 d. 22,500 32. What is the cost of Product E sold for the year ended July 31, 2013? a. P147,000 b. 99,000 c. 144,000 Product F 67,500 22,500 P212,625 d. 135,000 33. What is the cost of the inventory of Product D on July 31, 2013? a. P27,000 b. 18,000 c. 22,500 d. 54,000 34. What is the cost of the inventory of Product F on July 31, 2013? a. P33,500 b. 65,250 c. 42,750 d. 90,000 Question 35 and 36 are based on the following data: JGG Company produces three products: Product A, B and C from the same materials. Joint costs for this production run are P32,500. Data for the three products are: Sales price per Disposal cost kilo at split-off per kilo at Product Kilos point split-off point A 800 P6.50 P3.00 B 1,100 8.25 4.20 C 1,500 8.00 4.00 35. Using the sales value at split-off, what is the amount of joint cost allocated to Product A? a. P11,225 b. 10,525 c. 8,225 d. 9,525 36. Using the net realizable value at split -off, what is the allocated joint cost to Product C? a. P15,605 b. 14,711 c. 15,750 d. 14,500 Use the following information in answering numbers 37 – 40: The J&J Chemical Company produces a product knows as “VITAMIX” from which a byproducts results. This by-product can be sold at P4.14 per unit. The manufacturing costs of the main product and by-product up to the point of separation for the three months ended March 31, 2013 follows: Materials P50,000 Labor 40,000 Overhead 30,000 The units produced were 15,000 units for the main product and 900 units for the byproduct. During the period 12,000 units of the “VITAMIX” were sold at P16 per unit, while the company was able to sell 600 units of the by-product. Selling and administrative expenses related to the main product amounted to P18,000. Disposal cost per unit of the by-product is P1.75. 37. If the by-product is recorded at net realizable value, what is the unit of cost “VITAMIX”, if the net realizable value of the by-product is deducted from the manufacturing costs of “VITAMIX”? a. P7 b. 7.85 c. 8.75 d. 8.50 38. If the by-product is recognized when sold, what is the cost of the inventory of “VITAMIX”? a. P24,000 b. 25,000 c. 24,500 d. 25,500 39. If the net realizable value of the by-product is deducted from the cost of goods sold of “VITAMIX”, what is the gross profit? a. P90,500 b. 95,700 c. 97,500 d. 87,500 40. If the net realizable value of the by-product is treated as other income, what is the net profit? a. P79,500 b. 75,900 c. 89,600 d. 85,700 ANSWERS 1. 2. 3. 4. 5. D D B A C 6. 7. 8. 9. 10. A A C B C 11. 12. 13. 14. 15. C B A C A 16. 17. 18. 19. 20. C A B D D 21. 22. 23. 24. 25. C B C D B 26. 27. 28. 29. 30. B A A A A 31. C 32. D 33. B 34. B 35. A 36. 37. 38. 39. 40. B B A C A SOLUTIONS AND EXPLANATIONS 1. Physical measures (units produced): Allocated joint cost (6,000/12,000 x P60,000) Add: Additional processing cost Total costs allocated to Product X Relative sales value at split-off: Allocated joint cost (P40,000/P100,000) x P60,000 Add: Additional processing cost Total costs allocated to Product X P30,000 9,000 P39,000 P24,000 9,000 P33,000 Note: Sales value at split-off is equal to final sales value less additional processing costs. The ratio is shown below: Product X (P49,000 – P9,000) P40,000 - 40/100 Product Y (42,000 – 7,000) 35,000 - 35/100 Product Z (30,000 – 5,000) 25,000 - 25/100 P100,000 2. Since the sales values at split-off are already known, you should not have attempted to compute the relative sales value by subtracting the additional processing costs from the final sales values. This approach is only used when sales values at the split-off point are not available. Although the question required the correct allocated joint cost for products W, X, Y and Z, you only needed to compute the correct allocated cost for onr product to select the proper choice. The easiest approach would have been as follows: Allocation to Product Z: 20,000 x 160,000 = P16,000 200,000 3. The problem indicates that relative sales value at split-off is used to allocate joint costs. Product H has been allocated 15% (P18,000 ÷ P120,000) of the total joint costs. Therefore, Product H has 15% of the total sales value at split-off of P30,000 (15% x P200,000). Since Product F has sales value at split-off of P120,000, Product G’s sales value at split-off is P50,000 (P200,000 – P30,000 – P120,000). The Product G sales value just computed represents 25% (50,000 ÷ 200,000) of the sales value at split-off. The joint costs allocated to product G is 120,000 x 25% = P30,000. 4. First compute the sales value at split-off ratio as follows: Final Add’l Sales Value Sales Value Processing Cost At split-off Ratio Product A (1,600 x P200) P320,000 P100,000 P220,000 220/400 Product B (800 x P400) 320,000 140,000 180,000 180/400 P400,000 The allocated joint cost to A can now be computed as shown below: 220 x P120,000 = P66,000 400 5. The net realizable values for products PEL and VEL are: PEL VEL Sales value – (800 x P25) P20,000 (400 x P50) P20,000 Costs to convert into a salable form 8,000 12,000 Net realizable value P12,000 P8,000 Product PEL represents 60% (P12,000 ÷ P20,000) of the total net realizable value and thus should be assigned 60% of the joint costs. Thus, the joint costs allocated to product PEL would be (P12,000 ÷ P20,000) x 15,000 = P9,000. 6. A 2,000 x P30 B 1,000 x 60 Total = = Final Sales Value P60,000 60,000 Further Process Costs - P24,000 = - 36,000 = Joint costs allocated to Product A: 36/60 x P55,000 = P33,000 7. Product AA (15,000 costs x P2) Product BB (15,000 units x P5) Total The ratio therefore are: AA = 30/105 or 29% BB = 75/105 or 71% 8. The computation is: Sales Value at Point of Split-off P36,000 24,000 P60,000 P30,000 75,000 P105,000 Product AA BB Sales Value P9,000 6,000 P15,000 Additional Processing Cost P3,000 3,000 P6,000 Sales Value at Split-off P6,000 3,000 P9,000 9. Apply the following formula: Joint Sales value at spilt-off costs = Total sales value allocated P48,000 Sales Value (N) = = Sales value at (N) P200,000 Joint % of Cost total 66 2/3 P4,400 2,200 33 1/3 100% P6,600 X total joint costs X P120,000 P200,000 x P48,000 P120,000 = P80,000 Since the answer (b) is the only one which assigns P80,000 sales value to product N, we can stop here. Obtaining the sales value of product P is a simple operation: Sales Value (P) = Total sales value – sales value (N) – sales value (R) = P200,000 – P80,000 – P50,000 = P70,000 10. Plug given amounts into the basic relative sales value method Joint Cost allocation formula applicable to product P: Joint Sales value at spilt-off costs = Total sales value X total joint costs Allocated P36,000 = P36,000 x P100,000 P60,000 = P60,000 11. Since Product S represents 66 2/3% (50,000/75,000) of the total, the total joint cost can be determined as follows: P30,000 Or P30,000 x 3/2 = P45,000 66 2/3% 12. The portion of the total joint product costs allocated to Product J was P9,000. Using the relative sales value at split-off approach, this means that 60% of the total joint costs have been allocated to Product J (15,000/25,000 = .60). Therefore, total joint product costs are calculated as follows: P90,000 = P15,000 60 13. Sales value if processed further (Product S) P126,000 Less: Additional costs if processed further P26,000 Additional margin if processed further 28,000 54,000 Sales value at split-off P72,000 14. The gross profit on this sale is the ultimate sales price less the cost of goods sold. In a joint processing situation, the cost of the goods sold includes both the allocation of joint costs up to the split-off point and all further processing costs. The allocation of joint costs incurred prior to split-off is based on relative sales value at the split-off point. For Product W, relative sales value is its sales value at split-off divided by total sales value at split-off or P60,000/P750,000 = 8%. The allocation of joint costs is then 8% of total joint costs, or (8%) (P450,000) = P36,000. The gross profit is computed as follows: Ultimate sales price Allocation of joint costs P36,000 Further processing costs 12,000 Gross profit 15. First compute the total production cost as shown below: R Units produced: 5/10 x 50,000 3/10 x 50,000 = 25,000 2/10 x 50,000 Materials: P120,000 x 5/10 120,000 x 3/10 = P60,000 120,000 x 2/10 Joint conversion: P200,000 x 22/50 200,000 x 16/50 = 88,000 200,000 x 12/50 Further processing = 30,000 Total cost of production P178,000 P78,000 (48,000) P30,000 S T 15,000 10,000 P36,000 P24,000 64,000 48,000 20,000 P120,000 30,000 P102,000 NOTE: The materials cost is allocated to the three joint products on the basis of relative production units; the total joint conversion cost is allocated on the basis of relative sales values at split-off point, as follows: R S T Final sales values: 25,000 x P10 15,000 x 12 P250,000 P180,000 P150,000 10,000 x 15 Less: Further processing costs Sales values at split-off point Fractional share of conversion costs 30,000 P220,000 22/50 20,000 30,000 P160,000 P120,000 16/50 12/50 The unit cost can now be computed as follows: Product R (P178,000 ÷ 25,000) P7.12 Product S (120,000 ÷ 15,000) P8.00 Product T (102,000 ÷ 10,000) P10.20 16. First allocate the joint cost among the three products: Products Sales Value Ratio Allocated Joint Cost #111 P1,200,000 1,200/4,000 P420,000 #777 800,000 800/4,000 280,000 #999 2,000,000 2,000/4,000 700,000 P4,000,000 P1,400,000 #111 #777 Final sales value P2,160,000 P968,000 Less: Allocated Joint Cost 420,000 280,000 Addt’l. Processing Cost 960,000 168,000 Total 1,380,000 448,000 Contribution margin P780,000 P500,000 Units produced 60,000 20,000 Contribution margin/unit P 13 P 26 Sales value at split-off + additional processing cost. #999 P2,520,000 700,000 520,000 1,220,000 P1,300,000 20,000 P 65 17. Product JKA JKB JKC Sales Value P44,000 30,000 26,000 P100,000 Ratio 44% 30% 26% Allocated Joint Cost P22,880 15,600 13,520 P52,000 18. Joint Cost Less: Cost of By Product – Wiz Sales Value (1,000 x P420) Less: Addt’l. processing cost Joint cost to be allocated to Koo and Lam The allocation is as follows: Market Value Koo – P6,000,000 Lam – 6,000,000 P12,000,000 Ratio 50% 50% ÷ No. of Kilos 4,000 3,000 1,000 = Unit Cost P5.72 5.20 13.52 P3,840,000 420,000 180,000 Allocated JC P1,800,000 1,800,000 P3,600,000 240,000 P3,600,000 19. The requirement is to determine the effect on gross margin by reporting the sale of a by-product as additional sales revenue instead of a deduction from the major product’s cost of goods sold. The solutions approach is to determine what is currently being done, then calculate the effect of the accounting change. To facilitate understanding, assume that peso amounts for sales and cost of goods sold (CGS) are P300,000 and P200,000, respectively. Present Method Proposed Method Sales P300,000 P300,000 + P90,000* CGS P200,000 – P90,000 P200,000 Gross Margin P190,000 P190,000 *100,000 units x (P1 selling price – P0.10 selling cost) Note that the change in accounting treatment has no effect on gross margin. 20. The requirement is to find the cost of sales for both gasoline and the gasoline byproduct. The value of the by-products may be recognized at two points in time: (1) at the time of production, or (2) at the time of sale. Under the production method (as given in the problem), the net realizable value of the by-products produced is deducted from the cost of the major products produced. The net realizable value of the byproduct is as follows: Sales value of by-product Less: Separable costs Net realizable value P30,000 25,000 5,000 (10,000 + 15,0000) Therefore, cost of sales for gasoline is calculated as follows: Total production (joint) costs Less: Net realizable value of by-product Net Production Cost Less: Costs in 12/31/13 inventory Cost of Sales P120,000 5,000 115,000 15,000 P100,000 Therefore, total cost of gasoline sales is P100,000, and no cost of sales is reported for the by-product. 21. The requirement is to determine how to allocate joint cost using the net realizable va lue (NRV) method when a by-product is involved. NRV is the predicted selling price in the ordinary course of business less reasonably predictable costs of completion and disposal. The joint cost of P54,000 is reduced by the NRV of the by-product (P4,000) to get the allocable joint cost (P50,000). The computation is: Products Sales Value at Split-off Weighting Joint Costs Allocated JJ P40,000 40,000/75,000 x 50,000 P26,667 MM 35,000 35,000/75,000 x 50,000 23,333 P75,000 P50,000 Therefore, P26,667 of the joint cost should be allocated to product JJ. 22. The entry in answer choice “b” is the result of the following procedures related to the by-product sales: a) Reduce the manufacturing costs of Coco by the estimated realizable value of byproduct sales: Work in process – Saloc P75,000 Work in process – Coco Computation: Sales price of Saloc (45,000 x P3) Less: Further processing cost Net realizable value of Saloc b) Record further processing costs of Saloc: Work in process – Saloc P60,000 Raw materials Direct labor Factory overhead c) Record cost of By-Product transferred to stockroom: By-product – Saloc 135,000 Work in process – Saloc 23. First compute the allocable joint cost to PP and VV. Joint cost Less: Cost of by-product ZZ: Sales price (1,000 x P5) Less: Operating expense (1,000 x P2) Operating profit (1000 x P1) Allocable Joint Cost P75,000 P135,000 60,000 P 75,000 30,000 22,500 7,500 135,000 P172,000 P5,000 2,000 1,000 3,000 2,000 P170,000 Allocated as follows: PP: 5,000 x (P50-P10) VV: 4,000 x (40-5) Total Sales Value at Split-off P200,000 140,000 P340,000 Ratio 200/340 140/340 The gross profit from sales of PP can now be computed: Sales (5,000 x P50) Less: Allocated joint cost 100,000 Further processing cost (5,000 x P10) 50,000 Gross profit Allocated Joint Costs P100,000 70,000 P170,000 P250,000 150,000 P100,000 24. Method A Unit cost (total production cost divided by total units produced): Prod. A Prod. B Prod. C Prod. X P24,884.50/317 P78.50 P78.50 Unit “market”: Unit selling price P100 P100 Unit selling expense: P612/P12,240 = 5% 5 5 Unit realizable value P 95 P 95 Prod. A, B & C = 119.5 x P78.50 By-product X = 55 x 31.35 Dec. 31, 2013 inventory at lower of cost or market P78.50 P78.50 P100 P100 5 1.65 P 95 P 31.35 P9,380.75 1,724.25 P11,105 Method B Prod. A Prod. B Unit cost (total production cost less sales value of X produced, divided by total units of A, B & C produced): P22,079.50/232 P95.16 P95.16 Unit “market”: Unit selling price P100 P100 Unit selling expense: P612/P11,250 = 5.44% 5.44 5.44 Unit realizable value P 94.56 P 94.56 Prod. A, B & C = 119.5 x P94.56 By-product X = 55 x 33 Dec. 31, 2013 inventory at lower of cost or market Prod. C P95.16 P100 5.44 P 94.56 P11,300 1,815 P13,115 25. Unit cost, if joint production costs is apportioned on a “unit cost per kilo” basis: P99,538/1,268 kilos Percent of selling expense to selling price: P2,460/49,200 P78.50 5% December 31, 2011 inventory at “lower of cost or market”: MM: 346 kilos @ P78.50 RR: 108 kilos @ 78.50 SS: 24 kilos @ 78.50 Total 478 kilos @ 78.50 CC 220 kilos @ 33.25 (net of 5% selling expense) Total: 698 kilos P37,523 7,315 P44,838 Unit cost, if the company recognizes income in the period in which the by-product is produced with no selling expense assigned to the by-product: Total production costs Less: By-product sales value: 340 kilos @P35 Joint costs of MM, RR & SS P99,538 11,900 P87,638 P87,638/928 kilos P94.44 December 31, 2013 inventory at “lower cost or market”: MM, RR & SS: 478 kilos @ P94.44 P45,142.32 By-product 220 kilos @ 35.00 7,700.00 Total 638 kilos P52,842.32 26. Sales revenue of by-product – Sawdust (P10 x 2,000 kilos) P20,000 Selling expenses Packaging costs (P.50 x 2,000) P1,000 Sales commission (10% x 20,000) 2,000 3,000 Net revenue P17,000 Joint processing costs P100,000 Less net revenue from sale of by-product 17,000 Joint costs to be allocated to Main products P93,000 Allocation to Narra A (P93,000 x 400/600) 27. Sales revenue: Main product (8,000 x P20) Cost of goods sold: Total manufacturing costs P120,000 Less by product revenue (2,000 x 2) 4,000 Net manufacturing costs P116,000 Less Main product inventory: (2,000/10,000 x P116,000) 23,200 Gross margin 28. Rain Dew (per no. 27) P23,200 Resi – Dew (2,000 – 1,400) x P2 P 1,200 29. Sales revenue: Main product (8,000 x P20) By product (1,400 x P2) Total revenues Cost of goods sold: Total manufacturing costs P120,000 Less Main product inventory: (2,000/10,000 x P120,000) 24,000 Gross margin 30. Rain Dew (per no. 29) P24,000 Resi – Dew P 0 31. The answer is (c). the computation is as follows: Units produced (30,000 + 15,000) Selling price per unit (45,000 ÷ 15,000) Sales value at split-off 45,000 P 1.50 P67,500 P62,000 P160,000 92,800 P67,200 P160,000 2,800 P162,800 96,000 P66,800 Before answering numbers 32-34, prepare a schedule of allocating joint cost of P180,000 (total cost in Department 1) among the joint products as follows: Product Final Additional Estimated % Allocated Sales value Processing cost Net realizable Joint cost D P67,500 P67,500 30% P54,000 E 144,000 P99,000 45,000 20% 36,000 F 283,500 171,000 112,500 50% 90,000 P225,000 32. The answer is (d) computed as follows: Allocated joint cost P36,000 Additional processing cost 99,000 Total costs of product E P135,000 33. The correct choice is P18,000 (P54,000 x 15/45) 34. The answer is P65,250, computed as follows: Allocated joint cost P90,000 Additional processing costs 171,000 Total cost P261,000 Cost of ending inventory (P261,000 x 22,500/90,000) P62,250 35. The answer is (a), computed as follows: Product Units Unit Sales value at produced Sale price split-off A 800 P6.50 P5,200 B 1,100 8.25 9,075 C 1,500 8.00 12,000 Total P26,275 Allocated joint cost of product A (P9,075/P26,275 x P32,500) P11,225 36. The answer is (b). The computation is: Product Units Unit Sales value at produced Sale price split-off A 800 P3.50 P2,800 B 1,100 4.05 4,455 C 1,500 4.00 6,000 Total P13,255 Allocated joint cost of product C (P6,000/P13,255 x P32,500) P14,711 37. The correct choice is (b). Sales value of by-product (900 x P4.25) P3,825 Disposal cost (900 x P1.75) (1,575) Net realizable value P2,250 Manufacturing costs P120,000 Net realizable value of by-product ( 2,250) Cost of “VITAMIX” P117,750 Unit cost (P117,750/15,000 units) P 7.85 38. The answer is P24,000 (P120,000 x 3,000/15,000). 39. The correct answer is (c). the computation is as follows: Sales (12,000 units x P16) Cost of goods sold: Main product (P12,000 x 12,000/15,000) P96,000 By-product (600 x P2.50) ( 1,500) Gross profit 40. The answer is (a) as computed below: Sales P192,000 Cost of goods sold ( 96,000) Gross profit 96,000 Expenses ( 18,000) Operating income 78,000 Other income (by-product) 1,500 Net income P79,500 P192,000 94,500 P97,500