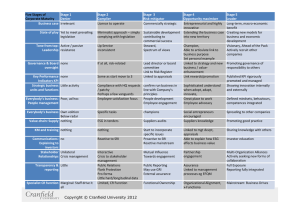

A systematic literature review of socially responsibleinvestment and environmental social governance metrics 2019

advertisement