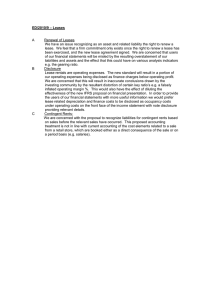

Breaking Into Wall Street - The 3 Financial Statements ($ in Thousands) Assumptions & Model Output Starting Assumptions: Tax Rate: 25.0% Share Price ($ as Stated): Shares Outstanding (Thousands): $ Initial Cash Balance ($ in Thousands): Income Statement Changes: Year 1 $ 1.00 1,000 1,000 Year 2 Cash Revenue Increases By: Depreciation Period on CapEx (Years): Depreciation: Accelerated Tax Depreciation: Finance Lease Annual Cash Payment: Finance Lease Term (Years): Finance Lease Depreciation: Discount Rate for Finance Leases: Interest Expense on Finance Lease: 10 Operational Balance Sheet Events: Year 1 Year 2 Cash Flow Statement Events: Accounts Receivable (Linked to Revenue): Increases By: Decreases By: Sign Operating Leases: Operating Lease Depreciation: Operating Lease Principal Repayment: Prepaid Expenses (Linked to General & Administrative): Increases By: Decreases By: Buy Financial Investments: Sell Financial Investments: End of Year 1 End of Year 2 - - 10 Capital Expenditures: - 6% Inventory (Linked to COGS): Increases By: Decreases By: Issue Long-Term Debt: Repay Long-Term Debt: Accrued Expenses (Linked to General & Administrative): Increases By: Decreases By: Operating Lease Annual Cash Payment: Discount Rate for Operating Leases: Interest Expense on Operating Lease: 6% Interest Rate on Financial Investments: Interest Income: 2% - Issue Finance Leases: Repay Finance Lease Principal: Issue Preferred Stock: Repay Preferred Stock: Accounts Payable (Linked to Sales & Marketing): Increases By: Decreases By: Common Dividends Issued: - Interest Rate on Debt: Interest Expense on Debt: 4% Preferred Stock Coupon: Preferred Dividends: 8% - Deferred Revenue (Linked to Revenue): Increases By: Decreases By: Cash BEFORE Any Changes: - Issue New Common Shares: Repurchase Common Shares: $ 1,000 $ 1,150 $ 1,300 - Income Statement: Balance Sheet: Period of Period of Year 1 Year 2 Revenue: $ 1,000 $ 1,000 Cost of Goods Sold (COGS): 100 100 Gross Profit: 900 900 Operating Expenses: Sales & Marketing: Research & Development: General & Administrative: Rental Expense: Total Operating Expenses: Depreciation: Lease Depreciation: Operating Income: (+) Interest Income: (-) Interest Expense: Pre-Tax Income: (-) Income Taxes: Net Income (Profit After Taxes): (-) Preferred Dividends: Net Income to Common: $ 300 250 150 700 300 250 150 700 - - 200 200 200 200 (50) (50) 150 150 $ 150 150 Tax Schedule: Book Pre-Tax Income: (+) Book Depreciation: (-) Tax Depreciation: Cash Taxable Income: Beginning NOL Balance: (+) NOLs Created: (-) NOLs Used: Ending NOL Balance: Period of Period of Year 1 Year 2 $ 200 $ 200 200 200 ASSETS: Current Assets: Cash: Accounts Receivable: Prepaid Expenses: Inventory: Total Current Assets: $ 1,000 1,000 End of Year 1 $ 1,150 1,150 Long-Term Assets: Net Property, Plant & Equipment (Net PP&E): Operating Lease Assets: Finance Lease Assets: Financial Investments: Deferred Tax Assets (DTAs): Total Long-Term Assets: Total Assets: LIABILITIES & EQUITY: Current Liabilities: Accounts Payable: Accrued Expenses: Deferred Revenue: Total Current Liabilities: $ 1,000 $ - Long-Term Liabilities: Debt: Operating Lease Liabilities: Deferred Tax Liabilities (DTLs): Finance Lease Liabilities: Total Long-Term Liabilities: Equity: Common Shareholders' Equity: Preferred Stock: Total Equity: End of Year 2 $ 1,300 1,300 - - $ 1,150 $ - $ Period of Period of CASH FLOW FROM OPERATIONS: Year 1 Year 2 Net Income to Common: $ 150 $ 150 Non-Cash Adjustments: (+) Depreciation: (+) Lease Depreciation: (+/-) Deferred Income Taxes: (+/-) Change in Op. Lease Assets: (+/-) Change in Op. Lease Liabilities: Changes in Operating Assets & Liabilities: Accounts Receivable: Prepaid Expenses: Inventory: Accounts Payable: Accrued Expenses: Deferred Revenue: Cash Flow from Operations: 150 150 1,300 $ - - - - 1,000 1,000 1,150 1,150 1,300 1,300 CASH FLOW FROM INVESTING ACTIVITIES: (-) Buy Financial Investments: (+) Sell Financial Investments: (-) Capital Expenditures: (-) Additions to Finance Lease Assets: Cash Flow from Investing: - - CASH FLOW FROM FINANCING ACTIVITIES: (+) Issue Debt: (-) Repay Debt: (+) Issue Finance Leases: (-) Repay Finance Leases: (+) Issue Preferred Stock: (-) Repay Preferred Stock: (-) Common Dividends Issued: (+) Issue New Common Shares: (-) Repurchase Common Shares: Cash Flow from Financing: - - Net Change in Cash: Total Liabilities & Equity: NOL-Adjusted Taxable Income: Common Shares Outstanding (Thousands): Cash Taxes Payable: Balance Sheet Balanced? Deferred Income Taxes: Cash Flow Statement: End of Year 0 $ 1,000 1,000 OK! $ 1,150 1,000 OK! $ 1,300 1,000 OK! $ 150 $ 150 Net Operating Losses (NOLs) and Deferred Tax Assets (DTAs) ($ in Thousands) Assumptions & Model Output Tax Rate: Beginning Net Operating Loss (NOL) Balance: Income Statement: Year 0 Pre-Tax Income: (-) Income Taxes: Beginning NOL Balance: (+) NOLs Created: (-) NOLs Used: Ending NOL Balance: $ Year 1 Year 2 $ $ (200) $ 100 25.0% 100 Year 3 300 <-- These are the "Book Taxes" on the Income Statement. <-- Pre-Tax Income * Tax Rate. <-- The NOL Balance itself is NOT on the Balance Sheet! It's a separate item! <-- If Pre-Tax Income is negative, add it to the NOL balance; otherwise add $0. <-- Apply the lesser of the total remaining NOLs, or the Pre-Tax Income.. …but if Pre-Tax Income is negative, just use $0 - nothing to offset. NOL-Adjusted Pre-Tax Income: Cash Taxes Payable: Increase / (Decrease) in DTA: Deferred Tax Asset (DTA): <-- DTA will decrease each year that we use NOLs, and will increase whenever we accumulate NOLs from taking losses. Lesson Notes: Scenario: In addition to Deferred Tax Liabilities (DTLs), created due to timing difference in items such as Depreciation, among others, there are also Deferred Tax Assets (DTAs) - the opposite - which represent potential future tax savings . Many items can comprise DTAs, but the most important one for modeling/finance/valuation purposes is the Net Operating Loss, or NOL. Idea: If the company has lost money (negative Pre-Tax Income) in prior years, it can reduce its future Taxable Income with these losses and save money in the future. NOTE: The rules around NOLs depend heavily on the country/region you're in - in some countries there are expiration dates or requirements around their usage, so we're covering a fairly simple, generic scenario here that could apply anywhere. Scenario: A company suddenly turns profitable and starts recording positive Pre-Tax Income, but has several years of prior losses accumulated in its NOL balance. Cash Flow Statement and Balance Sheet Impact: If the DTA increases , then the company's cash flow decreases, and on the Balance Sheet, the DTA is up and Cash is down to balance it. Intuition: From the Income Statement, the company appeared to receive a Tax Benefit, or actual cash back from the government, when it took a loss, but it did not do so in reality! Simply paid 0 in Cash Taxes. If the DTA decreases , then the company's cash flow increases, and on the Balance Sheet, the DTA is down and cash is up to balance it. Intuition: The NOL was used! So the company appears to have paid $25 in taxes from the IS, for example, but did NOT actually pay them out in cash! IMPORTANT POINT: NOLs are NOT the same as Deferred Tax Assets! The DTAs represent only the tax savings potential arising from NOLs, so a $100 NOL will be recorded as a $25 DTA. The full amount of the NOL itself is an "off-Balance Sheet" item.