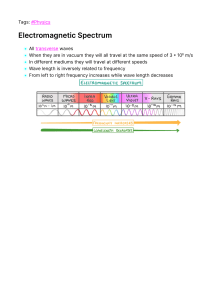

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/257572696 Quantum-Like Tunnelling and Levels of Arbitrage Article in International Journal of Theoretical Physics · November 2013 DOI: 10.1007/s10773-013-1722-0 CITATIONS READS 9 227 2 authors: Emmanuel Haven Andrei Khrennikov University of Leicester Linnaeus University 73 PUBLICATIONS 1,223 CITATIONS 1,064 PUBLICATIONS 14,909 CITATIONS SEE PROFILE Some of the authors of this publication are also working on these related projects: Analysis on adele ring View project Summer schools at Joao Pessoa View project All content following this page was uploaded by Andrei Khrennikov on 04 June 2014. The user has requested enhancement of the downloaded file. SEE PROFILE Quantum-Like Tunnelling and Levels of Arbitrage Emmanuel Haven & Andrei Khrennikov International Journal of Theoretical Physics ISSN 0020-7748 Int J Theor Phys DOI 10.1007/s10773-013-1722-0 1 23 Your article is protected by copyright and all rights are held exclusively by Springer Science +Business Media New York. This e-offprint is for personal use only and shall not be selfarchived in electronic repositories. If you wish to self-archive your article, please use the accepted manuscript version for posting on your own website. You may further deposit the accepted manuscript version in any repository, provided it is only made publicly available 12 months after official publication or later and provided acknowledgement is given to the original source of publication and a link is inserted to the published article on Springer's website. The link must be accompanied by the following text: "The final publication is available at link.springer.com”. 1 23 Author's personal copy Int J Theor Phys DOI 10.1007/s10773-013-1722-0 Quantum-Like Tunnelling and Levels of Arbitrage Emmanuel Haven · Andrei Khrennikov Received: 27 January 2013 / Accepted: 25 June 2013 © Springer Science+Business Media New York 2013 Abstract We apply methods of wave mechanics to financial modelling. We proceed by assigning a financial interpretation to wave numbers. This paper makes a plea for the use of the concept of ‘tunnelling’ (in the mathematical formalism of quantum mechanics) in the modelling of financial arbitrage. Financial arbitrage is a delicate concept to model in social science (i.e. in this case economics and finance) as its presence affects the precision of benchmark financial asset prices. In this paper, we attempt to show how ‘tunnelling’ can be used to positive effect in the modelling of arbitrage in a financial asset pricing context. Keywords Quantum-like models · Finance · Wave numbers · Arbitrage 1 Introduction Recently, a number of models exploring the mathematical formalism of quantum mechanics have been developed in order to attempt to shed further light on various problems of the financial market.1 We have witnessed, after the last financial crisis of 2007, an increasing interest in the use of alternative mathematical models which differ from the standard approach where classical stochastic processes are employed. It became clear that classical 1 See the monographs [9, 12], for an extended bibliography. We especially emphasize the interest for mod- eling the behavior of financial agents. See the aforementioned monographs and papers of Piotrowski and Sladkowski [15, 16], Choustova [6, 7], Accardi et al. [1], Asano et al. [2, 3] and authors’ paper [13]. We also want to call the reader’s attention to one of the pioneering articles which justifies the usage of methods of quantum mechanics in social science [11]. E. Haven School of Management and Institute of Finance, University of Leicester, Leicester, UK B A. Khrennikov ( ) International Centre for Mathematical Modelling, Linnaeus University, Växjö, Sweden e-mail: andrei.khrennikov@lnu.se Author's personal copy Int J Theor Phys stochasticity does not describe financial processes adequately. Quantum theory provides a new possibility to better understand financial market processes.2 The concept of ‘financial arbitrage’ is of fundamental importance in asset pricing and its essential meaning is quite easy to understand: arbitrage exists whenever it is possible to make a risk free profit. A profit is risk free if the realization of such profit does not entail any risk taking. The arbitrage return ensuing from the risk free profit position is required to be in excess of the so called ‘risk free rate of return’. An example of an asset which carries a risk free rate of return is a government bond. Such bond is supposed to be paid via the taxes a government collects and therefore should carry no risk of default. Clearly, the 2007 crisis has shown that certain countries have a much higher propensity to default on a bond repayment than others. The formal expression of arbitrage is contained in the seminal paper by Harrison and Kreps [8]. Financial asset pricing models typically impose the non-existence of arbitrage as such assumption makes the pricing of assets precise. As an example, if the Black-Scholes [5] option pricing model were to allow for the existence of arbitrage then an interval of possible prices, rather than a unique price, would be obtained. We cover in detail the basics of this model in the next section of this paper. We stress our paper is not concerned about proposing a new finance result. This is not a ‘finance’ paper. Rather our paper aims to convince its reader that the well known concept of ‘tunnelling’ can be a very useful device in helping to better understand financial arbitrage. We note from the outset that the paper is self contained and any financial concepts which are needed to aid in the construction of our arguments will be explained within the paper. The paper starts out with a brief presentation of a result obtained by Tan [20] who argues for the introduction of correction terms in the Black-Scholes option pricing solution. It is shown that those correction terms depend on the type of probability density function the underlying asset follows. It can be argued that such density function is affected by the presence or not of arbitrage in a financial system. After briefly re-formulating the basic roots of Tan’s [20] proposed theory in terms of Fourier integration, the main objective of this paper crystallizes in bringing the concept of quantum-like ‘tunnelling’ to the forefront. We show that the above Fourier integration fails completely in the presence of such ‘tunnelling’. As we have indicated above this paper is not a ‘finance paper’. The interested reader may surely then wish to know in which part of the ‘intellectual landscape’ our work can be localized. This paper will emphasize the wave function quality of the Fourier apparatus used in the Tan [20] result. Our paper explicitly imposes that the wave function plays a crucial role in the probability density function used in Tan’s [20] correction term result. We argue that such imposition constrains the wave function to take on a quantum mechanical-like flavor. In the next section of this paper, we briefly introduce the formal expression of the proposed correction term in the Black-Scholes option pricing formula. In the section following, we formulate this approach with Fourier integration and argue that in effect the approach is equivalent to using reflective waves. After having expanded upon how potential energy can have an economics based interpretation, the next two sections then attempt to provide for, what we believe to be, reasonable arguments why (non) arbitrage and economic equilibrium can be modelled with elementary physics concepts. The last two sections of this paper then propose the central plea of this paper: why quantum-like tunnelling can be seen as a natural device by which one can model arbitrage. 2 Of course, in such studies one has to separate sharply physical features from operational ones. We are interested in the operational approach to quantum waves and probability, cf. Plotnitsky [17]. See also his monographs [18, 19]. Author's personal copy Int J Theor Phys 2 Probability Density Function (PDF) Based Correction Terms in the Black-Scholes Option Pricing Function The Black-Scholes [5] option pricing model provides for the non-arbitrage based price of so called ‘vanilla’ call and put options. In Bailey [4] (p. 439) a call option3 is defined as a security that gives its owner the right, but not the obligation, to purchase a specified asset for a specified price, known as the exercise price or the strike price. The set up of the Black-Scholes option pricing partial differential equation is very well described in Hull [10] and we follow it here to generate Eqs. (1) to (4) below. The so called Black-Scholes portfolio, Π , can be written as: ∂F Π = −F + S; (1) ∂S indicates the quantity where F is the financial option price; S is the stock price and + ∂F ∂S one needs to buy of the underlying asset, say a stock with price, S. One can assume that the underlying price process follows a geometric Brownian motion: dS = μSdt + σ SdW ; (2) where μ is the expected return; σ is the (constant) volatility of the stock price S; dW is a Wiener process and t is time. Given Eq. (2), the Taylor expansion4 of dF (S, t) can be written as: ∂F ∂F 1 ∂ 2F 2 2 ∂F dF = μS + + σ S dt + σ SdW. (3) ∂S ∂t 2 ∂S 2 ∂S dS and assuming that there does not Substituting Eqs. (2) and (3) in dΠ = −dF + ∂F ∂S exist arbitrage, one obtains the celebrated Black-Scholes partial differential equation (PDE): ∂F ∂F 1 ∂ 2F (4) + rf S + σ 2 S 2 2 = rf F ; ∂t ∂S 2 ∂S where rf is the risk free rate of interest. The beauty of this theory resides in the explicit independence of the above PDE from the expected return μ which appears in Eq. (2). Such independence does therefore not require the use of a formal approach to modelling ‘preferences for risk’. It needs to be stressed that modelling such preferences is notoriously difficult. Tan [20] provides for a very interesting approach by which he convincingly generalizes the solutions obtained from the above PDE (4). We can not provide for every detail of this approach but we can mention the following essential steps. We follow Eqs. (5.25) (p. 114) until (5.31) (p. 116) in Tan [20]. As starting point of his approach, a characteristic function P(z) is defined and it is the Fourier transform of a PDF, P (x): (z) = P (x) exp(izx)dx. P (5) Tan [20] then defines P(z) as: (z) = exp P ∞ (iz)n cn n=2 n! ; (6) d where cn = (−i)n dz n log P (z)|z=0 ; n = 1, 2, . . . . n 3 We can define put options in a similar way. We do not need that definition in this paper. 4 Such expansion carries the name of ‘Itô Lemma’. The expansion is peculiar since it occurs within a stochastic context. Author's personal copy Int J Theor Phys Equation (5.27) (p. 115) in Tan [20] then reads: −iz(SN −Sk ) 1 N (z) ∂e (SN − Sk )P (SN , N |Sk , k) = dz P 2π ∂(−iz) ∞ (−1)n cn,N ∂ n−1 P (SN , N |Sk , k) =− , (n − 1)! ∂SNn−1 n=2 k = 1, 2, . . . , N ; (7) where k, and N denote time t and T (t < T ) in continuous time. T is often denoted as maturity time, i.e. this is the time when the option matures (i.e. has to be exercised or not). N (z) SN − Sk denote the prices of the underlying asset of the option at those times N and k. P is the characteristic function of P (SN , N |Sk , k) and cn,N = N cn . An essential property of the Black-Scholes theory is the full absence of the Wiener process, dW , which we first encountered in Eq. (2) above. Denote as in Tan [20] (p. 109) the so called fluctuations due to the Wiener process: R = E(W 2 ). Those fluctuations need to be minimized such that: ∂R = 0; (8) ∂φ(St , t) φ=φ ∗ where φ(St , t) is the hedging strategy followed by the seller of an option contract. Tan [20] calls (p. 109) φ ∗ the “optimal hedging strategy which minimizes the risk.” Tan [20] (p. 111) obtains for φ ∗ the following (this is Eq. (5.17) (p. 117)): ∞ (ST − K) ∗ dSt ∗ E (9) φ (St , t) = P (ST , T |St , t)dST ; dt σ 2 S02 K where K is the strike price of the option. Tan [20] (p. 115) then substitutes Eq. (7) into Eq. (9): φ ∗ (St , t) = ∞ 1 cn ∂ n−1 C(St , K, T , t) ; 2 σ 2 S0 n=2 (n − 1)! ∂Stn−1 (10) where C is the call price function. As Tan [20] indicates for the Gaussian density, c2 = σ 2 and cn≥3 = 0. This is a promising result, which is clearly a generalization of standard BlackScholes theory. We note that Black-Scholes option pricing theory assumes a lognormal density on the underlying asset price. We now skip some steps in Tan [20] where he essentially uses φ ∗ (St , t) in Eq. (10) above, in the average gain expression for the so called writer of the option. The writer of the option is the trader who sells the call (or put) option. This then leads to the following highly interesting generalization of the call option pricing function: Cnew = CBlack − ∞ μS0 T cn ∂ n−3 P (K, T |S0 , 0) . σ 2 S02 n=3 (n − 1)! ∂S0n−3 (11) We note that ‘Cnew ’ is the new call price (i.e. the price which takes into account the correction terms). The notation ‘CBlack ’ indicates the call price as obtained via the solution of the standard Black-Scholes PDE in Eq. (4). For a Gaussian PDF, cn≥3 = 0 and the correction term disappears. For non-Gaussian PDF’s this correction term may not be zero and the dependency on the drift rate, μ, which we first encountered in Eq. (2), is now explicit. As indicated above, such dependency on preferences for risk makes the option theory much more complicated. We can also argue that the existence of non-Gaussian PDF’s could occur if there exists arbitrage. The above equation also shows how the slope of the PDF, P , is of high importance in the weight the correction term has in the option pricing equation. Author's personal copy Int J Theor Phys 3 Reflective Waves as Inputs in the PDF Based Correction Terms (z) = eizx P (x)dx The characteristic function, which was defined in Eq. (5) above as P (where we recall P (x) is the PDF), can be re-written as a Fourier transform but with the sign reversed on the exponential function. We can thus write, using slightly different notation: ∞ 1 f (x) exp(ikx)dx; (12) gc (k) = √ 2π −∞ where gc (k) symbolizes the characteristic function and k is a so called ‘wave number’;5 and f (x) symbolizes the PDF. From Eq. (12) above, the format of an inverse Fourier transform will yield: ∞ 1 gc (k) exp(−ikx)dk. (13) f (x) = √ 2π −∞ In basic quantum physics, f (x) indicates a wave which serves as an input into a PDF which is obtained via so called complex conjugation. The wave exp(−ikx) in Eq. (13) can be interpreted as a wave function which travels in the −x direction. In that sense it can be termed as a ‘reflected’ wave. We want to make the remark6 that forward waves can also be used in a financial setting. As an example, within the setting of state prices such approach can be followed. We must explicitly state that the wave exp(−ikx) need not at all be quantum mechanical in nature. Indeed, such wave could represent an electric or magnetic field. We obtain some possible interesting points of analysis: • the equivalent in wave behavior of the characteristic function approach, as exemplified by Eq. (5), is a wave behaving in the ‘−x’ direction • this wave can be seen as an input to a PDF. However, in a classical mechanics environment, such wave may not have such interpretation • we can claim that a wave, as expressed in Eq. (13), is a reflected wave. If we were to attempt to emulate a quantum mechanical environment, we would need to have the wave to be partially reflected through a so called ‘barrier’.7 This argument, which may undo the writing of Eq. (13), will be fully discussed in the section on quantum-like tunnelling. It can be useful to underline slightly more the argument we are attempting to make. We note that Tan [20] when referring to Eq. (5) does not give any financial or economic meaning to the term exp(izx), and it is one of the objectives of our paper to precisely do this: i.e. impute a degree of meaning to this exponential function. We also point the reader to the possibly interesting fact that if we compare the second part of Eq. (7) with Eq. (11), then we can witness a high resemblance. This likeliness can be used as a heuristic argument to show how important the role is of P , as used in the determination of the characteristic function in Eq. (5) and in the correction term of Eq. (11). Let us now elaborate more on our heuristic argument by attributing financial meaning to the exponential function as it is written in Eq. (13) above. We want to force f (x) to be a wave which is the input into a PDF, and by so doing this would emulate the role of P in the correction term of Eq. (11). If f (x) receives such a role then it is reasonable to claim 5 Definition 2 below explains the notion of wave number in an economics context. 6 We want to thank one of the referees for pointing this out. 7 A barrier symbolizes a level of potential energy. See also Fig. 1 below. Author's personal copy Int J Theor Phys this function must be having a quantum mechanical flavour—so to speak. In other words, from a plain classical wave mechanics point of view, f (x) would surely not function as an input into a PDF. We also observe that a very tight gc (k) in Eq. (13) implies a very wide PDF, which is derived thus from f (x). Note also that the wave number, k, could also have a financial interpretation here, and we will return to this issue below. In contrast, when using Eq. (5), the variable z, does not have any financial meaning. We need to note that it would be very beneficial if we could provide for a specific functional form of a wave function which is financially senseful. This is not an easy matter. If we consider the polar form of a wave function, then there is scope to consider the amplitude function part of that wave function as an input in a so called ‘pricing rule’. We do not expand on this possible approach but Haven and Khrennikov [9] provide for much more detail on this possible avenue of further work. The reflective wave in Eq. (13), exp(−ikx), indicates that it has been reflected after the wave has encountered a barrier or an obstacle. Consider again Eq. (11), where the size of the correction term is affected by the degree of narrowness of the PDF. Clearly, for n ≥ 3, |S0 ,0) if applied on a very narrow PDF, will indeed be very large. the first derivative ∂P (K,T ∂S0 In terms of using the mechanism pictured by Eq. (13), this would mean that a very wide amplitude function gc (k) would induce a very tight f (x). The opposite case, where the amplitude function is of the Dirac Delta type, allows for a flat PDF. Hence, in that case the |S0 ,0) and any higher derivatives would all be zero. In that case, there first derivative ∂P (K,T ∂S0 would thus be no correction term at all. We can simply write: ∞ cn ∂ n−3 P n=3 (n−1)! ∂S n−3 c4 ∂P 3! ∂S + c4!5 ∂2P ∂S 2 + c5!6 ∂3P ∂S 3 +··· = = 0. The urgent question which begs answering is: what is the financial meaning of obtaining a very wide amplitude function gc (k)? To begin answering such a question, we need to define what is meant, financially then, with the wave number k. We propose the following two definitions: Definition 1 The momentum p can be defined in an economics context as: p = first derivative of position8 (S) towards time, t . dS , dt i.e. the Choustova [7] used the classical definition p = mv, where m is mass9 (the number of shares) and v is the derivative of price towards time. Definition 2 The wave number, k can be defined in an economics context as: k = σ 2 is squared volatility. p , σ2 where Hence, we can define the wave number, k, as: k= 1 dS . σ 2 dt (14) If there is a Dirac Delta amplitude function on k, then k = σ12 rf ; where rf is the risk free rate. This is the same rate of return we also found in Eq. (4), i.e. the Black-Scholes PDE. The definition of k makes it quite obvious that indeed with a flat PDF, there is no correction term. The return is the risk free rate of return (the amplitude function being of the Dirac 8 Position could be the price of the asset, like a stock. 9 Mass is incorporated into the volatility parameter we mention in Definition 2 below. Please see also the discussion, immediately under Eq. (15), on this issue. Author's personal copy Int J Theor Phys Delta type) as basic Black-Scholes option pricing theory would predict. On the contrary, a very tight PDF would indeed yield a very wide amplitude function, hence signifying that many different returns, besides the risk free rate, can be considered. Hence, this signifies a dependence on preferences for risk. We can expand slightly on the above two definitions. Recall geometric Brownian motion, which was Eq. (2): dS = μSdt + σ SdW . We can write this motion also in a format where the time change is ‘small’ but not infinitesimally small. In that case we√can write Eq. (2) as: S = μSt + σ SW , and we note, as per Hull [10] that W = t , where is a random variable which is drawn from a Gaussian PDF with mean zero and variance unity. We can write: √ σ t σ S 1 =μ+ =μ+ √ . (15) t S t t The return μ is risk free if for instance no randomness exists: = 0. Let us consider again the geometric Brownian motion (2), but we now assume there does not exist a Wiener 1 process, dW . We can write that dS = μ. For an arithmetic Brownian motion (again in the S dt = μ. However, this is only possible beabsence of a Wiener process) we simply have: dS dt cause we impose the constraint there is no Wiener process. As is well known from stochastic does not exist. calculus, the ordinary calculus expression dW dt As in Paul and Baschnagel [14], we can set: σ 2 = m , where m is mass and is the Planck constant, and σ 2 is squared volatility (see Definition 2). We realize the conversion of the Planck constant to the equality proposed here does raise questions. Indeed, at this point in the paper it is important to pause a little more on the significance of this Planck constant, especially within the macroscopic setting we propose in this paper. This constant has a close connection to quantum discreteness10 which is a deep concept having important ramifications for the model we propose in this paper (especially in view of the tunnelling argument we make in Sect. 7). Within quantum mechanics, the Planck constant can be seen as being part of discrete energy changes. As an example the functional form of time dependent wave functions for stationary states can depend on discrete energy states (which are part of a discrete energy spectrum). The difference between an excited energy state and the ground state will depend on that Planck constant. The Planck constant has the dimension of action and one could propose that action has a connection to arbitrage. Can we claim that each act of arbitrage can be seen as an irreducible quant of action? This is an issue which needs further investigation. We will continue this discussion in Sect. 7. We note the work of Choustova [7] where the useful interpretation is made that the Planck constant in a macroscopic financial environment is equivalent to a “price scaling parameter”. Similar discussions on how to understand the meaning of the Planck constant outside of quantum mechanics have been made in other work by Choustova [6]. The proposal of setting the Planck constant equal to some variance parameter may to some extent echo the proposal by Choustova [7] that the macroscopic Planck constant would reflect the unit of price change. This is a difficult problem which still needs further investigation. Up to this point in the paper, we have given an economic interpretation of the amplitude function and the wave (as an input into the PDF). However, so far, we have said very little about the economic significance of the reflected wave. We will see later in this paper that when we introduce the idea of quantum-like ‘tunnelling’, we will obtain the economic meaning of a wave being ‘reflected’. 10 We thank one of the referees of this paper for bringing up the important point of quantum discreteness. Author's personal copy Int J Theor Phys 4 Potential Energy and Wave Numbers: An Economic Interpretation Potential energy is modelled via the real potential function. Khrennikov [12] (pp. 155–157) was amongst the first to give a specific economic meaning to real and potential energy terms. We want to carry those meanings a little further in this paper. A useful functional form of the real potential, for economics purposes is as follows: V= n (qi − qj )2 ; (16) j =1 where qi ; qj are the prices held by n traders i and j for the same asset. Another potential function could be: n |qi − qj |. (17) V= j =1 We remark that in the sequel of the paper when we refer to the potential function, V , we explicitly mean the potential taking on the functional forms as given by either Eqs. (16) or (17). We can make the claim that in the case of no arbitrage, it must be that the sum of price differences is zero. To have a zero potential in Eqs. (16) and (17) above, each and every price difference, across the different traders, for the same asset, must be zero. As an example, if we were to use for instance: nj=1 qi − qj , without the absolute value, then negative and positive price differences could cancel each other and make this sum zero. Would such a zero sum then indicate no arbitrage? It would not. Positive and negative price differences would clearly indicate that arbitrage opportunities exist and thus contradict the overall zero potential (which would indicate no arbitrage). We note the richness of being able to model (non) arbitrage with a plethora of different potential functions. Remark also, as is evident from Eqs. (16) and (17), that the higher the price differences are in |qi − qj | or in (qi − qj )2 , the higher the potential value will be. In financial terms, the higher the arbitrage opportunities are, the more non-zero the potential will be. Furthermore, for a given level of kinetic energy, the higher the total energy, E, in the system. Kinetic energy plays an important role in the determination of the wave number in quantum physics. The phenomenon of so called ‘quantum mechanical tunnelling’ means essentially that a wave can be partially transmitted through a barrier even though total energy, E, is smaller than potential energy. As is well known, such a phenomenon is entirely impossible in classical mechanics. The wave number in the context of tunnelling can take on two different values depending on whether kinetic energy is positive or negative. When total energy E is larger than potential energy, V : k= 2m (E − V ). 2 (18) Note that m is mass and is the Planck constant. In the next section we use σ 2 = m (as in [14]). When total E is smaller than potential energy V (a wholesome quantum mechanical phenomenon): 2m (V − E); (19) 2 where κ is also called the decay constant. In classical mechanics, κ would be complex valued. κ= Author's personal copy Int J Theor Phys 5 Modelling the Case of Non-arbitrage Consider the definition of the wave number as above: k = 1 2 n 2 j =1 mj vj , 2m (E 2 − V ) and define kinetic energy as: where n indicates the number of traders. Assume we do not take into account the summation sign in the kinetic energy term, and we substitute this definition 2 2 1 mv 2 = m2v = 1 mv = 1 p; where p is the momentum. into k: k = 2m 2 2 Undoing the summation sign in the kinetic energy term allows us to argue that in economics terms, we work with a representative agent framework. In the multiagent approach, we consider the return the agent has on the same asset. Hence, in case there is no-arbitrage: all agents will have the same return on the asset. This return can be the risk free rate. In the representative agent framework (without the summation sign thus): this return is also the risk free rate. The wave number k in that case would be the risk free rate. The parameter k, using the multi-agent framework, considers the sum of (squared returns) of the selling and buying of stock, indicated by respectively a negative and positive sign on mj . Hence, v in n 1 2 j =1 mj vj considers in effect the wave number of the individual trader. 2 If there is no arbitrage then no price differences exist amongst prices, for the same stock, across all n traders: nj=1 (qi − qj )2 = 0. Therefore, the return of the same asset, across all n traders must be identical. This is indeed a very intuitive approach to non-arbitrage.11 If there exists a price difference, for exactly the same asset, then indeed there is an arbitrage opportunity. As an example, if the stock of company A is priced differently (after currency conversion and transaction costs) in the UK stock market as opposed to the US stock market, then there is a clear arbitrage opportunity. Using kinetic energy: 2m 1 m1 v12 + m2 v22 + m3 v32 + · · · ; (20) 2 2 and assuming no arbitrage, then the returns on the asset, across all n traders, must be the same. Hence (in this multi-agent framework), we obtain: k= k= 2m 1 2 v (m1 + m2 + m3 + · · ·); 2 2 which can be simplified, using: σ 2 = 1 σ (21) : m 1 2 v (m1 + m2 + m3 + · · ·). (22) By virtue of the absence of arbitrage, we could say that v 2 is the squared risk free rate. Remark that the value of k would surely be different, if we had a representative agent framework. We can make the reasonable assumption that mi is negative if the trader sells; while mi is positive when buying occurs. From a total energy, E, point of view it is intuitive that buying augments E while selling should decrease E. Assume now that (m1 + m2 + m3 + · · ·) = 0. Such condition could be obtained under symmetric buying and selling (i.e. the same amount of people selling as the same amount of 11 The free particle, V = 0 puts in peril spatial localization and this condition is intimately related to the ex- istence of so called ‘hermiticity’. It can be interesting to connect the existence of arbitrage with the existence of hermiticity. We do not expand on this in this paper. Author's personal copy Int J Theor Phys people buying). However, (m1 + m2 + m3 + · · ·) = 0 can easily be zero by having a few very different positions across traders, i.e. a few traders may sell huge amounts, while a few other traders may sell substantially less. Some traders may sell nothing. Hence, this condition of (m1 + m2 + m3 + · · ·) = 0 could be seen as an equilibrium condition; i.e. there is no excess selling (i.e. when the overall sum would be negative); or there is no excess buying (i.e. when the overall sum would be positive). Thus, k can be seen, from a multi-agent point of view as being zero when there is no arbitrage and there is equilibrium. However, we do also want to remark that k may also be zero if the return is zero for all traders, no matter whether there is equilibrium or not. We can summarize as follows: • If E − V = 0 and V = 0 (no arbitrage) then it is clear that E = 0. • If E − V > 0: there is more buying than selling: (m1 + m2 + m3 + · · ·) > 0: nonequilibrium • If E − V < 0: there is more selling than buying: (m1 + m2 + m3 + · · ·) < 0: nonequilibrium Consider again: k = 2m (E 2 − V ); then when there is more buying than selling: k is real. (V − E); k is complex valued if there is more selling than buying. One uses also: κ = 2m 2 where then κ is real valued. We could be tempted to interpret k in the multi-agent context as a measure of equilibrium or disequilibrium. We need to be careful about this. The equilibrium condition: (m1 + m2 + m3 + · · ·) = 0 implies k = 0. But this implication will be correct only when one assumes there is no arbitrage to start with. We present some useful propositions. Proposition 1 If there is no arbitrage and if the risk free rate is strictly positive, and if the multi-agent market is in equilibrium then k = 0. Proof The proof is immediate. Since there is no arbitrage, we can write: 2m 1 (m1 v12 2 2 rate, v 2 = rf2 + m2 v22 + m3 v32 + · · ·) as 1 σ 1 2 v (m1 + m2 + m3 + · · ·). Since the risk free is non-zero, k can only be zero if (m1 + m2 + m3 + · · ·) = 0. This means that indeed there is neither excess selling nor excess buying in the market. In other words, the market is in equilibrium. Proposition 2 Assume v 2 = rf2 is non-zero and there is no-arbitrage. k = 0 implies the multi-agent market must be in equilibrium. Proof The proof is immediate. Since there is no-arbitrage and k = 0 is assumed (and v 2 = rf2 is non-zero), we can write that: k = σ1 1 v 2 (m1 + m2 + m3 + · · ·) = 0 and this is only possible if (m1 + m2 + m3 + · · ·) = 0; i.e. when there is equilibrium. Proposition 3 If there is no arbitrage then there can not be excessive selling. Proof Assume if there is more selling than buying: E − V < 0 but if V = 0; i.e. there is no arbitrage, then this would mean that E < 0. This is not possible. Remark however, that excessive buying is possible: i.e. E − V > 0 is acceptable even if V = 0. Remark that the above proposition is an implication. The next section shows clearly that even though there is equilibrium this may not mean there is absence of arbitrage. Author's personal copy Int J Theor Phys Proposition 4 There are upper bounds on how much arbitrage and excessive selling can occur in an economy. Proof If arbitrage occurs then V > 0. If there is excessive selling, then E − V < 0. Clearly, it can not be that |E − V | > V . 5.1 Non-arbitrage and the Schrödinger PDE The Schrödinger PDE can be defined as: k = 0 then d2 dx 2 d2 dx 2 ψ = 0. Integrating, d2 dx 2 d2 ψ dx 2 = −k 2 ψ . Using Proposition 2, if indeed ψdx = dψ dx + C. Using the Schrödinger PDE: d2 dx 2 ψdx = −k ψdx. Therefore, if k = 0: ψdx = dψ + Constant will be zero, if dx the Constant = 0. This could be interpreted as the first derivative of the wave towards position to be zero. If we think back of our discussion on how the wave can enter the correction term in Tan [20] (see Sect. 3), then a first derivative of the PDF towards the asset price being zero will imply that the correction terms disappears. Hence, in an option pricing context, there is full dependence on the risk free rate of return. In our framework, we would also in addition, propose this occurs when there is equilibrium (i.e. following Proposition 2). 2 6 Modelling the Case of Arbitrage When arbitrage exists, and we assume the real potential function takes on the form of (for instance) either nj=1 (qi − qj )2 or nj=1 |qi − qj |, then we are effectively claiming that the price differences for the same asset, across all different agents, are non-zero. The higher those prices differences are, the higher the potential value will be. In effect, for a given level of kinetic energy, higher potential levels induce higher total energy levels. The kinetic energy term needs to be re-written, since arbitrage opportunities deriving from the price differences clearly trigger, relative to each trader, different returns for the same asset. Thus, we can = μ + η, where η is some error factor which can follow some PDF, write, using v = dS dt which we do not specify in this paper. Please see also our discussion under Definition 2. We write: 2m 1 m1 (μ1 + η)2 + m2 (μ2 + η)2 + m3 (μ3 + η)2 · · · . (23) 2 2 Intuitively, it can be seen from above, that k is unlikely to be zero given the fact that the returns μi + η are different. Remark that the returns are squared and hence arbitrage returns in excess of 100 % will have a higher weight in k than arbitrage returns which are less than 100 %. If our condition for equilibrium is that there does not exist (i) excess buying: (m1 + m2 + m3 + · · ·) > 0 and (ii) excess selling: (m1 + m2 + m3 + · · ·) < 0, then clearly in the arbitrage case, this does not need to translate into k = 0. In other words, if we impose thus: (m1 + m2 + m3 + · · ·) = 0, in the above equation for k, then k = 0 is not necessarily obtained since the different returns may make k not zero. k= Corollary 1 (to Proposition 1) If there is arbitrage and if the multi-agent market is in equilibrium then it is not guaranteed that k = 0. Proof The k= proof 2m 1 (m1 (μ1 2 2 is + η)2 immediate. + m2 (μ2 + η)2 Since there + m3 (μ3 is + η)2 · · ·). arbitrage, we can write: Even if we assume that there Author's personal copy Int J Theor Phys Fig. 1 A naive representation of the transition of no-arbitrage into LA (Local Arbitrage) and MWA (Market Wide Arbitrage (i.e. arbitrage which is picked up market wide)). Note the “asymptotic” decay of the wave function through the barrier, as measured by κ. This parameter can be a proxy for the degree of efficiency in the market system is equilibrium in the market: i.e. (m1 + m2 + m3 + · · ·) = 0, this can not guarantee that k = 0, since the returns μi + η are different. Hence, if k = 0 this can be obtained in the arbitrage setting even when there is no equilibrium. Recall that Proposition 2 above showed that in a non-arbitrage context the k = 0 condition implies the existence of equilibrium. This is thus not the case when there is arbitrage. 7 Quantum-Like ‘Tunnelling’ and Arbitrage The figure below exemplifies a one dimensional translation of a situation where a flat wave (it coincides with the X axis) is moving towards a barrier (which starts at the point x1 on the X axis and ends at the point x2 on the X axis). Assume we have the one-dimensional equivalent of a potential V of the form nj=1 |qi − qj |. We are assuming that k = 0 is obtained from the situation where there is no arbitrage (i.e. V = 0). We have also drawn total energy E to be coinciding with the X axis, up to point x0 (on the X axis). In effect the system has no total energy at all. Figure 1 also indicates a sudden raise of the total energy level E at point x0 . The real potential then jumps up at x1 and stays positively constant over a length L = x2 − x1 . Remark also that V > E over that length L. Beyond L the real potential then drops to zero again. The barrier, which is exemplified with the non-zero constant potential of length L, can be of interest from an economics point of view. It could be interpreted as a proxy for the existence of an information event. As we have began to discuss in Sect. 4 of the paper, when V > 0, arbitrage exists. The transition from a situation of no arbitrage towards one of arbitrage, as expressed via the change of value in V , must implicitly express a change in information in the market. The presence of arbitrage information may first be situated at a very specific locus12 in the market. With time progressing,13 the opportunity may get extended to more financial players. Obviously, at some point in time, the opportunity gets fully extinguished. At this point, we may also want to argue that the wave is a carrier of information too. See Khrennikov [12] and Haven and Khrennikov [9] where the wave (within Bohmian mechanics) is proposed to be used within a social science setting. We would like to argue that the overall information structure would be the result of: 12 For instance, a very specific investment house may have spotted an arbitrage opportunity. 13 Time scales for arbitrage opportunities can be very short. Author's personal copy Int J Theor Phys (i) the functional form of the potential function (ii) the functional form of the wave (iii) the dynamical behavior of the wave with the potential (i.e. for instance as being incident to a barrier and then to transmit to a degree14 through the barrier) If the above three classes of sources of information can be argued to generate an overall information structure then this adds, we believe, much strength and power to the theory we present in this paper. After all, the richness of the various allowable functional forms (at the level of the potential function; the wave and the interactive behavior of both) is truly vast. However, although it may be reasonably clear from this paper which are some of the possible functional forms the real potential can take, it is quite much vaguer what functional forms the wave could carry. We made mention in Sect. 3 of this paper, about the inverse width relationships between the amplitude and wave function but such relationship is of course not very much defining in terms of the functional form of a wave. However, research is being performed on this issue. Khrennikov and Haven [13] give an example of a wave which can carry a very precise and unambiguous piece of information. Let us re-consider Fig. 1 above. The wave to the left of point x0 is flat and fully coincides with the X axis. If we recall the discussion on using the Schrödinger PDE in Sect. 5.1, we + Constant = 0, when Constant = 0. The flat wave function may obtained, for k = 0, dψ dx not be a sole reflection of the existence of non-arbitrage! In effect, as per Corollary 1, in the presence of arbitrage, we could indeed have that k = 0 is a possibility and thus a flat wave could occur. In that case E = V and the kinetic energy is zero but the potential energy is not zero and hence E is not zero either. As we have already mentioned above, the partial transmission of a wave function through a potential barrier even though potential energy exceeds total energy is a quantum mechanical phenomenon. This is a good point in the paper to discuss somewhat more the important issue we raised at the end of Sect. 3: namely what is quantum discreteness in our model? We believe that the equivalent of quantum discreteness in this paper corresponds to the idea that each act of arbitrage is a discrete event corresponding to the detection of a quantum system after it passed in the barrier. In reality arbitrage opportunities do not occur on a continuous time scale. They appear at discrete time spots and often experience very short lives. We would like to argue that it is the tunnelling effect which is closely associated to the occurrence of arbitrage. This argument is linked to Proposition 5 below. We also mentioned the wave function in the discussion above, and quantum discreteness is narrowly linked with quantum probabilities.15 Those are very difficult and important issues which need addressing. We hope to make this part of future research. In light of this discussion, we believe it is appropriate to call the tunnelling effect we try to emulate here, as being ‘quantum-like’. Hence, the titles of Sects. 7 and 8 carry this qualifier. It is a basic fact of elementary quantum mechanics, that the ratio κk plays a crucial role in the so called ‘transmission coefficient’ of the wave. In case of equilibrium we know that if there is no arbitrage, then k = 0 and hence the transmission coefficient of the wave is zero: i.e. the wave is fully reflected. However, if there is arbitrage, the equilibrium condition will not necessarily make k = 0. The length of the barrier, L, also affects the transmission coefficient: the higher L is, the lower the transmission coefficient is. Another basic fact from quantum mechanics is that the partially transmitted wave will decay with parameter κ. This parameter was defined in Eq. (19). 14 Again, within a classical mechanical context, such transmission is fully impossible. 15 We thank one of the referees for raising this important issue. Author's personal copy Int J Theor Phys It is probably not unreasonable to posit that the length of the barrier is implicitly taking ‘time’ into account. The longer the barrier’s length the more the wave can decay. It is as if, we obtain the tail of the wave and we measure that the first derivative of that wave, at the tail, is going to zero. In effect, we are back, at the tail, to a situation where k = 0. Thus, if we picture the barrier length L as the implicit time needed for the arbitrage opportunity to ‘tail out’, then this can explain how the tail is getting very flat and we approach a situation of k = 0. The above figure also shows an ominous problem: i.e. the abrupt changing level of E! To the left of point x0 , if there is no arbitrage (V = 0) and if there is equilibrium then k = 0 and one obtains a flat wave. This is an acceptable situation, but it also means that total energy in the system is zero! Hence, there is no energy to ‘launch’ a wave so that it can possibly become incident to a potential barrier. What does it mean that the total energy level E before the point x0 is zero? What is the meaning of total energy in the economy? Using the definitions of zero potential energy and zero kinetic energy, it is reasonable to associate those two quantities to, respectively the absence of arbitrage and the presence of an equilibrium. This leads to the use of a risk free rate of return. However, we should note that the existence of the risk free rate of return in an economy, does not require as such, the existence of an equilibrium. An economy which has a pervasive risk free rate of return on all of its financial assets can not be an economy where risk is in existence. Therefore, it could be claimed that the level of total energy E must have a relationship to the level of aggregate risk taking in an economy. The problem with Fig. 1 above, is that from the left of x0 , the wave function is coinciding with the X axis and it does not hit the barrier at all. It has no energy. For the wave to transmit partially through the barrier, it needs to be non flat. A non-flat wave, using the Schrödinger d2 2 equation, dx 2 ψ = −k ψ , implies setting k = 0. By making such wave explicitly none flat, we are immediately introducing, from the Fourier point of view,16 a divergence from the Dirac Delta behavior of the amplitude function A(k). Thus E > V or V > E are now both possibilities. Clearly, non-arbitrage is still possible, with V = 0, but this now only occurs when E > V . If one were to consider V > E with V = 0 then as per Proposition 3, one obtains that E < 0! This is not possible! Here follows another Proposition: (V − E) exists as a real number (i.e. V > E), then this is only Proposition 5 If κ = 2m 2 possible when there is arbitrage. Proof This is obvious. If V = 0, and V > E, clearly the total energy is becoming negative. This Proposition also corroborates Proposition 3. Proposition 6 The level of total energy has the financial interpretation of measuring the total risk in the economy. Proof If there is no arbitrage, then V = 0. Given no arbitrage, if there is an equilibrium in the economy, i.e. no excess selling or buying, then k = 0. Thus, E = V and E = 0. A situation of no arbitrage and full equilibrium, must be an economy where the risk free rate of interest is pervasive. Hence, the inherent risk in that economy is zero and E = 0. This situation of k = 0 also corresponds to the appearance of a flat wave. If arbitrage exists in the economy, 16 But please see the next section (Sect. 8) in this paper for an argument why we need to be very careful in using the Fourier (integration/transformation) apparatus in the tunnelling environment. Author's personal copy Int J Theor Phys it must be that the returns on such positions must be in excess of the risk free rate. This translates in the fact that V > 0 and therefore the level of total energy is above zero. Let us briefly return to our figure. If the wave coincides with the X axis, i.e. it has no energy, then this proxies for an economic system which is in equilibrium and has no-arbitrage. If we up the level of total energy E then we inject risk in the economy. However, the next question becomes then: what is the barrier then proxying for? What is the length of the barrier proxying for? Let us consider another Proposition. Proposition 7 The level of κ indicates the level of arbitrage. The level of decay of the arbitrage is also measured by κ. Proof This is quite obvious. The level of κ is clearly measured by the distance between V and E. The higher the prices differences, the higher V will be. κ is a decay parameter: it measures how the wave function tails out once it travels inside the length of the barrier. In our interpretation of the figure, the flatness of the wave must induce κ to tend to zero and hence the level of risk in the economy E goes down to the X axis again. Remark also how the decaying is dependent on the type of functional form of the wave. We may want to argue that the barrier indicates the point in time, where the arbitrage is uncovered market wide. Alternatively, but in some sense related to this, is the argument that the degree of efficiency of the market will make that the arbitrage opportunity is decaying over time. So κ as a decay parameter is a good indicator of the level of efficiency in the market: when the level of arbitrage decays out very quickly, the level of efficiency in the market is high.17 When the level of arbitrage languishes for a long time, the market efficiency may be much less intense. We may want to claim that the length of the barrier is the ‘clicking clock’, which takes out the arbitrage opportunity, to the point where V goes back to 0 and there is no total risk in the economy. The upped E level at point x0 may proxy a local arbitrage opportunity (indicated by the abbreviation ‘LA’ in the figure), which is thus not known at a market wide level. The erection of the barrier symbolizes the market setting of a ticking clock: i.e. ‘the market knows about the arbitrage opportunity’. This type of arbitrage is indicated with the abbreviation ‘MWA’: market wide arbitrage. We believe Proposition 5 to be important. Tunnelling only exists when κ is non-zero. The very much quantum mechanical occurrence of V > E is only senseful is V is non-zero. In our set up, a non-zero V occurs when there is arbitrage. Hence, tunnelling can be argued to be closely related to arbitrage. As we already mentioned above, the functional form of the real potential leaves an enormous leeway to the theory we envisage here. What if the real potential is time dependent? The functional form of the real potential could be adapted so that it can reflect arbitrage and no-arbitrage for certain periods of time. 17 Remark that the transmission coefficient only exists when κ is non-zero. But κ is non-zero only when there is arbitrage, since V > E only can make sense when V is not zero. Author's personal copy Int J Theor Phys 8 Quantum-Like Tunnelling and the Wave Equivalent of the Characteristic Function Approach We recall the discussion in Sect. 3 of this paper where we explicitly considered the wave ∞ equivalent of the characteristic function approach: f (x) = √12π −∞ gc (k) exp(−ikx)dk. We recall that the transmission coefficient for a wave to penetrate through a barrier is a function of the ratio κk . The parameter κ is positively real valued when, as per Proposition 5, there is arbitrage. We believe that it is in this sense that we can connect the tunnelling argument with the existence of arbitrage. We now want to make the simple argument that when considering transmission through a barrier, i.e. by assuming thus that the ratio κk exists (and thus that arbitrage exists), we must resolutely steer away from the wave equivalent of the characteristic function approach. Let us revisit Fig. 1. The real potential V is zero up to the point x1 . Basic quantum mechanics indicates that the wave will take on the form of: ψ (1) = A(1) exp(ikx) + (E − V ). This is thus a suB (1) exp(−ikx); where k is defined as in Eq. (18): k = 2m 2 perposition of a transmitted and reflected wave. Once the wave is partially transmitted through the barrier (i.e. between x1 and x2 ) the wave then becomes: ψ (2) = A(2) exp(κx) + B (2) exp(−κx); where κ is defined as in Eq. (19): κ = − E). The wave takes on the 2m (V 2 form of: ψ = A exp(ikx), beyond x2 . When the wave function is moving away from the barrier, only the transmitted component remains: ψ (3) = A(3) exp(ikx). We now have the following Proposition. (3) (3) Proposition 8 If we assume that the existence of arbitrage can be expressed via the existence of quantum-like tunnelling then the wave equivalent of the characteristic function approach is inappropriate as a formal model to express the existence of arbitrage. Proof Proposition 5 indicates that κ exists as a real number only when there exists arbitrage. Hence, the transmission coefficient is defined, since it is a function of κk . As noted before, remark that in classical mechanics, κ is not defined. Assume for the sake of argument that we ∗ ∗ −ikj x , use the discrete version of the wave equivalent of the characteristic function: N j =1 Aj e ∗ ∗ ∗ ∗ ∗ and we write out the first five terms: A∗1 e−ik1 x + A∗2 e−ik2 x + A∗3 e−ik3 x + A∗4 e−ik4 x + A∗5 e−ik5 x . Now consider the superposition of the waves; (i) incident through the barrier (at point x1 in Fig. 1); (ii) partially transmitted through the barrier (between points x1 and x2 in Fig. 1) and; (iii) exiting the barrier (away from point x2 in Fig. 1): A1 eik1 x + A2 e−ik1 x + A3 eκx + ∗ A4 e−κx + A5 eik1 x . Let us compare this superposition with 5j =1 A∗j e−ikj x . Assume, for simplicity, we let the weights Ai = A∗i be the same. For a comparison between the wave equivalent of the characteristic function and the tunnelling approach we must set: k1∗ = −k1 ; k2∗ = k1 ; k3∗ is now complex valued; k4∗ is now complex valued and k5∗ = −k1 . This shows ∞ that we can not write f (x) = √12π −∞ gc (k) exp(−ikx)dk as a continuous approximation ∗ ∗ ∗ ∗ ∗ ∗ ∗ −ikj x of N : A∗1 e−ik1 x + A∗2 e−ik2 x + A∗3 e−ik3 x + A∗4 e−ik4 x + A∗5 e−ik5 x with k1∗ = −k1 ; j =1 Aj e k2∗ = k1 ; k3∗ is now complex valued; k4∗ is now complex valued and k5∗ = −k1 , since dk in that integral allows for infinitesimally small changes in k, but it certainly does not allow, in a one dimensional setting, for changes from negative to complex valued k’s. Proposition 8 indicates that the type of wave which can be considered in the wave equiv∞ alent of the characteristic function approach, via thus f (x) = √12π −∞ gc (k) exp(−ikx)dk, is a reflected wave. No transmitted waves are possible. If our approach to using tunnelling as Author's personal copy Int J Theor Phys a formal device to model arbitrage is correct, then this may show that the approach by Tan [20] is in fact not able to accommodate arbitrage. However, we need to keep in mind that the theoretical model proposed by Tan [20] is primordially concerned about accommodating different PDF’s, including thus the Gaussian. It remains reasonable however to claim that the existence of arbitrage can affect the shape of those PDF’s. References 1. Accardi, L., Khrennikov, A., Ohya, M.: Quantum Markov model for data from Shafir–Tversky experiments in cognitive psychology. Open Syst. Inf. Dyn. 16, 371–385 (2009) 2. Asano, M., Ohya, M., Tanaka, Y., Basieva, I., Khrennikov, A.: Quantum-like model of brain’s functioning: decision making from decoherence. J. Theor. Biol. 281, 56–64 (2011) 3. Asano, M., Basieva, I., Khrennikov, A., Ohya, M., Tanaka, Y.: Quantum like dynamics of decision making. Physica A 391, 2083–2099 (2012) 4. Bailey, R.: The Economics of Financial Markets. Cambridge University Press, Cambridge (2005) 5. Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973) 6. Choustova, O.A.: Bohmian mechanics for financial processes. J. Mod. Opt. 51, 1111 (2004) 7. Choustova, O.: Application of Bohmian mechanics to dynamics of prices of shares: stochastic model of Bohm-Vigier from properties of price trajectories. Int. J. Theor. Phys. 47, 252–260 (2008) 8. Harrison, J.M., Kreps, D.M.: Martingales and arbitrage in multiperiod securities markets. J. Econ. Theory 20, 381–408 (1979) 9. Haven, E., Khrennikov, A.: Quantum Social Science. Cambridge University Press, Cambridge (2013) 10. Hull, J.: Options, Futures and Other Derivatives. Prentice Hall, New York (2006) 11. Khrennikov, A. Yu.: Classical and quantum mechanics on information spaces with applications to cognitive, psychological, social and anomalous phenomena. Found. Phys. 29, 1065–1098 (1999) 12. Khrennikov, A. Yu.: Ubiquitous Quantum Structure: From Psychology to Finance. Springer, Berlin (2010) 13. Khrennikov, A. Yu., Haven, E.: Quantum mechanics and violations of the sure-thing principle: the use of probability interference and other concepts. J. Math. Psychol. 53, 378–388 (2009) 14. Paul, W., Baschnagel, J.: Stochastic Processes: From Physics to Finance. Springer, Berlin (2000) 15. Piotrowski, E.W., Sladkowski, J.: An invitation to quantum game theory. Int. J. Theor. Phys. 42, 1089– 1099 (2003) 16. Piotrowski, E.W., Sladkowski, J.: Trading by quantum rules: quantum anthropic principle. Int. J. Theor. Phys. 42, 1101–1106 (2003) 17. Plotnitsky, A.: “This is an extremely funny thing, something must be hidden behind that”: quantum waves and quantum probability with Erwin Schrödinger. In: Foundations of Probability and Physics-3. Ser. Conference Proceedings, vol. 750, pp. 388–408. American Institute of Physics, Melville (2005) 18. Plotnitsky, A.: Reading Bohr: Physics and Philosophy. Springer, Dordrecht (2006) 19. Plotnitsky, A.: Epistemology and Probability: Bohr, Heisenberg, Schrödinger, and the Nature of Quantum-Theoretical Thinking. Springer, Berlin (2009) 20. Tan, A.: Long memory stochastic volatility and a risk minimization approach for derivative pricing an hedging. Ph.D. Thesis, School of Mathematics University of Manchester (UK) (2005) View publication stats