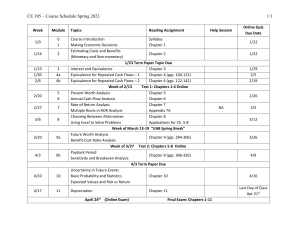

CHƯƠNG 2: The Objective in Decision Making and Corporate Governance Giảng viên: PGS.TS. Trần Thị Thùy Linh 1 OUTLINE CHAPTER 2 2.1. Choosing the right objective. 2.2. The classical objective. 2.3. Maximize stock prices: The best- case Scenario. 2.4. Maximize stock prices: Real-world conflicts of interest 2.5 Alternatives to stock prices maximization. 2.6 Maximize stock prices: Salvaging a Flawed objective. 2.7 A Postscrip: Limits of Finance corporate ▰ Live Case study 2 CHAPTER 2 ▰ An objective specifies what a decision maker is trying to accomplish and by so doing provides measures that can be used to choose between alternatives. In most publicly traded firms, the managers of the firm, rather than the owners (stockholders), make the decisions about where to invest or how to raise funds for an investment. ▰ Thus, if stock price maximization is the objective, a manager choosing between two alternatives will choose the one that increases stock price more. In most cases, the objective is stated in terms of maximizing some function or variable, such as profits or growth, or minimizing some function or variable, such as risk or costs. 3 CHAPTER 2 ▰ Một mục tiêu xác định những gì mà người ra quyết định đang cố gắng đạt được và bằng ▰ cách đó cung cấp các biện pháp có thể được sử dụng để lựa chọn giữa các phương án. Trong hầu hết các công ty giao dịch công khai, các nhà quản lý của công ty, chứ không phải chủ sở hữu (cổ đông), đưa ra quyết định về nơi đầu tư hoặc cách gây quỹ cho một khoản đầu tư. Do đó, nếu tối đa hóa giá cổ phiếu là mục tiêu, một nhà quản lý lựa chọn giữa hai phương án sẽ chọn phương án làm tăng giá cổ phiếu nhiều hơn. Trong hầu hết các trường hợp, mục tiêu được nêu dưới dạng tối đa hóa một số chức năng hoặc biến số, chẳng hạn như lợi nhuận hoặc tăng trưởng, hoặc giảm thiểu một số chức năng hoặc biến số, chẳng hạn như rủi ro hoặc chi phí. 4 CHAPTER 2 ▰ Trong chương này sẽ xem xét mối quan hệ giữa các quyết định tài chính và giá trị doanh nghiệp với điều hành công ty cổ phần. ▰ Về lý thuyết, trong hầu hết các công ty giao dịch công khai, các nhà quản lý của công ty, không phải chủ sở hữu (cổ đông), đưa ra quyết định về đầu tư hoặc tài trợ cho một khoản đầu tư. Do đó, nếu tối đa hóa giá cổ phiếu là mục tiêu, một nhà quản lý lựa chọn giữa hai phương án sẽ chọn phương án làm tăng giá cổ phiếu nhiều hơn. 5 Corporate governance defined ▰ "Corporate governance is the system by which business corporations are directed and controlled. The corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation, such as, the board, managers, shareholders and other stakeholders, and spells out the rules and procedures for making decisions on corporate affairs. By doing this, it also provides the structure through which the company objectives are set, and the means of attaining those objectives and monitoring performance," OECD April 1999. 6 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Decision-making objectives 7 2.1. Choosing the right objective. Corporate Finance relates three questions as: 1. What long-term investments should the firm choose? 2. How should the firm raise funds for the selected investments? 3. How should short-term assets be managed and financed? 8 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Firm objective n The objective of the firm is to maximize the value of the owners of the firm, which means maximizing stock price. n In order to determine whether management’s actions are consistent with this objective, we need to understand the corporate governance structure and practices of the firm. 9 13/01/2023 PGS.TS Trần Thị Thuỳ Linh The Goal of Financial Management n What is the correct goal? n Maximize profit? n Minimize costs? n Maximize market share? n Maximize shareholder wealth? 10 2.1. Choosing the right objective 13.1 There are a number of different objectives that a firm can choose between when it comes to decision making. How will we know whether the objective that we have chosen is the right objective? A good objective should have the following characteristics. PGS.TS. TRẦN THỊ THÙY LINH 2.1. Choosing the right objective n Studies have found that firms with better corporate governance characteristics tend to perform better. Stock returns of firms with “good” corporate governance practices are significantly greater than returns for firms with “bad” corporate governance practices n n n Reduced expropriation of corporate resources by managers Lenders and investors more willing to provide funds leading to lower costs of capital. Gompers, Ishii, and Metrick (2003), “Corporate Governance and Equity Prices” 12 2.2 THE CLASSICAL OBJECTIVE n Multiple Stakeholders and Conflicts of Interest: In the modern corporation, stockholders hire managers to run the firm for them; these managers then borrow from banks and bondholders to finance the firm’s operations. Investors in financial markets respond to information about the firm revealed to them often by the managers, and firms have to operate in the context of a larger society n Potential Side Costs of Value Maximization: The objective in corporate finance can be stated broadly as maximizing the value of the entire business, more narrowly as maximizing the value of the equity stake in the business, or even more narrowly as maximizing the stock price for a publicly traded firm PGS.TS Trần Thị Thuỳ Linh 13 THE CLASSICAL OBJECTIVE ▰ Nhiều bên liên quan và xung đột lợi ích : Trong công ty hiện đại, các cổ đông thuê các nhà quản lý để điều hành công ty cho họ; những người quản lý này sau đó vay từ các ngân hàng và trái chủ để tài trợ cho hoạt động của công ty. Các nhà đầu tư trên thị trường tài chính phản hồi thông tin về công ty thường được các nhà quản lý tiết lộ cho họ và các công ty phải hoạt động trong mội trường xã hội lớn hơn. ▰ Chi phí phụ tiềm ẩn của việc tối đa hóa giá trị : Mục ▰ tiêu trong tài chính doanh nghiệp có thể được hiểu rộng hơn là tối đa hóa giá trị của toàn bộ doanh nghiệp, hẹp hơn là tối đa hóa giá trị vốn cổ phần trong doanh nghiệp, hoặc thậm chí hẹp hơn là tối đa hóa giá cổ phiếu cho một công ty giao dịch công cộng. 13/01/2023 14 THE CLASSICAL OBJECTIVE n Multiple Stakeholders and Conflicts of Interest: In the modern corporation, stockholders hire managers to run the firm for them; these managers then borrow from banks and bondholders to finance the firm’s operations. Investors in financial markets respond to information about the firm revealed to them often by the managers, and firms have to operate in the context of a larger society n Potential Side Costs of Value Maximization: The objective in corporate finance can be stated broadly as maximizing the value of the entire business, more narrowly as maximizing the value of the equity stake in the business, or even more narrowly as maximizing the stock price for a publicly traded firm PGS.TS Trần Thị Thuỳ Linh 15 2.2 THE CLASSICAL OBJECTIVE ▰ Why Corporate Finance Focuses on Stock Price Maximization ▰ Much of corporate financial theory is centered on stock price maximization as the sole objective when making decisions. This may seem surprising given the potential side costs just discussed, but there are three reasons for the focus on stock price maximization in traditional corporate finance. PGS.TS Trần Thị Thuỳ Linh 16 2.3. Maximize stock prices: The best- case Scenario. 13.1 If corporate financial theory is based on the objective of maximizing stock prices, it is worth asking when it is reasonable to ask managers to focus on this objective to the exclusion of all others. There is a scenario in which managers can concentrate on maximizing stock prices to the exclusion of all other considerations and not worry about side costs. PGS.TS. TRẦN THỊ THÙY LINH 2.3. Maximize stock prices: The best- case Scenario. 13.1 For this scenario to unfold, the following assumptions have to hold. 1. The managers of the firm put aside their own interests and focus on maximizing stockholder wealth. 2. The lenders to the firm are fully protected from expropriation by stockholders. 3. The managers of the firm do not attempt to mislead or lie to 4. There are no social costs or social benefits. PGS.TS. TRẦN THỊ THÙY LINH 13/01/2023 PGS.TS Trần Thị Thuỳ Linh The classical corporate governance framework STOCKHOLDERS Hire & fire managers - Board - Annual Meeting Lend Money BONDHOLDERS n . Maximize stockholder wealth Managers Protect bondholder Interests Reveal information honestly and on time No Social Costs SOCIETY Costs can be traced to firm Markets are efficient and assess effect on value FINANCIAL MARKETS 19 13/01/2023 2.4 MAXIMIZE STOCK PRICES: REAL-WORLD CONFLICTS OF INTEREST n n n n n Stockholders and Managers The Annual Meeting The Broad of Directors Ownership Structure The Consequences of Stockholder Powerlessness (Hậu quả của sự bất lực của cổ đông, không có quyền hành) n ILLUSTRATION 2.1 Assessing Disney’s Corporate Governance PGS.TS Trần Thị Thuỳ Linh 20 13/01/2023 PGS.TS Trần Thị Thuỳ Linh 21 13/01/2023 PGS.TS Trần Thị Thuỳ Linh 22 PGS.TS Trần Thị Thuỳ Linh 13/01/2023 23 Mô hình quản trị, tổ chức kinh doanh và bộ máy quản lý công ty FLC 24 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Hypothetical Organization Chart Board of Directors Chairman of the Board and Chief Executive Officer (CEO) President and Chief Operating Officer (COO) Vice President and Chief Financial Officer (CFO) Treasurer Controller Cash Manager Credit Manager Tax Manager Cost Accounting Capital Expenditures Financial Planning Financial Accounting Data Processing 25 13/01/2023 PGS.TS Trần Thị Thuỳ Linh A Comparison Corporation Partnership Liquidity Shares can be easily exchanged Subject to substantial restrictions Voting Rights Usually each share gets one vote Taxation Double Reinvestment and dividend payout Broad latitude General Partner is in charge; limited partners may have some voting Partners rights pay taxes on distributions All net cash flow is distributed to partners Liability Limited liability Continuity Perpetual life General partners may have unlimited liability; limited partners enjoy limited Limitedliability life 26 13/01/2023 PGS.TS Trần Thị Thuỳ Linh ILLUSTRATION 2.2 Corporate Governance at Vale: Voting and Nonvoting Shares & Golden Shares Stockholders in Vale 27 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Stockholder vs. Management Theory n The stockholders have significant control over management. n The mechanisms for disciplining management are the annual meeting and the board of directors. Practice n Most small stockholders do not attend meetings n Incumbent management starts off with a clear advantage when it comes to the exercising of proxies. n For large stockholders, sometimes, when confronted by managers that they do not like, is to vote with their feet 28 The problem with the board of directors n n The board of directors is the body that oversees the management of a publicly traded firm. The board of directors are supposed to represent the shareholders and discipline and guide management if necessary. Historically, however, n most directors in the past were hand-picked by CEOs n n n n many have insufficient knowledge of the business at times, management is too heavily represented on the board there may be insufficient interest or motivation for the directors to take an active role some boards are too large to be effective in administration PGS.TS Trần Thị Thuỳ Linh 29 Table 2.1 DISNEY’S BOARD OF DIRECTORS 1996 Insiders Outsiders PGS.TS Trần Thị Thuỳ Linh 30 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Visible managerial actions that provide no benefit to the shareholders n Greenmail: The (managers of ) target of a hostile takeover buy n n n n out the potential acquirer's existing stake, at a price much greater than the price paid by the raider, in return for the signing of a 'standstill' agreement Golden Parachutes: Provisions in employment contracts, that allows for the payment of a lump-sum or cash flows over a period, if managers covered by these contracts lose their jobs in a takeover. Poison Pills: A security, the rights or cashflows on which are triggered by an outside event, generally a hostile takeover, is called a poison pill. Overpaying on takeovers. This transfers wealth from the stockholders of the acquiring firm to those of the acquired firm. How would we know? Look at market reactions to takeover bids. Perks: Benefits provided to the CEO and management. 2.5 Alternatives to stock prices maximization. 31 2.5 Alternatives to stock prices maximization. There are obvious problems associated with each of the linkages underlying wealth maximization. Stockholders often have little power over managers, and 13.1 managers consequently put their interests above those of stockholders. Lenders who do not protect their interests often end up paying a price when decisions made by firms transfer wealth to stockholders. Information delivered to financial markets is often erroneous, misleading, or delayed, and there are significant differences between price and market value. Finally, firms that maximize wealth may do so while creating large costs for society. PGS.TS. TRẦN THỊ THÙY LINH 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Stockholder vs. Bondholder Theory n There is no conflict of interest between stockholders and bondholders. Practice n Stockholders may maximize their wealth at the expense of bondholders by: n Taking riskier projects than those agreed to at the outset. n Borrowing more on the same assets: If lenders do not protect themselves, a firm can borrow more money and make all existing lenders worse off. 33 14/01/2023 PGS.TS Trần Thị Thuỳ Linh ’tFigure live in2.3 a Utopian world Stock Price Maximization in the Real World STOCKHOLDERS Have little control over firm Put managerial interests over stockholder interests Lend Money BONDHOLDERS Managers Large Social Costs SOCIETY Hurt by stockholder actions Cannot trace Social Costs to firm Delayed or missing information Markets that are volatile, shortterm, and make mistakes FINANCIAL MARKETS n Agency costs refer to the conflict of interest that arise between the different parties and thus make parties act in a manner that is inconsistent with stock price maximization. 34 13/01/2023 PGS.TS Trần Thị Thuỳ Linh ’tFigure live in2.4 a Utopian world Stock Price Maximization with Corrective Loop STOCKHOLDERS Have little control over managers Managers put their interests above stockholders Lend Money BONDHOLDERS Managers Bondholders can get ripped off Delay bad news or provide Misleading information Significant Social Costs SOCIETY Some costs cannot be traced to firm Markets make mistakes and can over react FINANCIAL MARKETS n Agency costs refer to the conflict of interest that arise between the different parties and thus make parties act in a manner that is inconsistent with stock price maximization. 35 2.5 Alternatives to stock prices maximization. 13.1 Choosing an Alternative Objective 1. Maximize Market Share . 2. Profit Maximization Objectives 3. Size/Revenue Objectives PGS.TS. TRẦN THỊ THÙY LINH 2.6 Maximize stock prices: Salvaging a Flawed objective. In this section, we consider the case for salvaging value maximization as an objective but consider ways we can reduce some of the problems highlighted in the earlier section. In particular, we consider ways we can reduce the conflicts of interest between stockholders, bondholders, and managers and the potential for market failures. We also present an argument for market-based mechanisms based on the market’s capacity to correct systematic mistakes quickly and effectively. Conflict Resolution: Reducing Agency Problems Stockholders and Managers 13.1 PGS.TS. TRẦN THỊ THÙY LINH 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Firms and Financial Markets Practice Theory n Financial markets are efficient. n Managers convey information honestly and truthfully to financial markets n Financial markets make reasoned judgments of 'true value'. n Management suppress information n Management delay the releasing of bad news n Management sometimes reveal fraudulent information n Some argue that markets are short-sighted n Analyst recommendations are not always unbiased 38 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Firms and Society Theory n There are no costs associated with the firm that cannot be traced to the firm and charged to it. Practice n Financial decisions can create social costs and benefits where, n n A social cost or benefit is a cost or benefit that accrues to society as a whole and NOT to the firm making the decision. These costs/benefits tend to be difficult to quantify 39 PGS.TS Trần Thị Thuỳ Linh 13/01/2023 Counter-reaction to agency costs.. STOCKHOLDERS 1. More active investors 2. Changing Listing Requirements Managers of poorly run firms are put on notice. Protect themselves Managers BONDHOLDERS 1. Covenants 2. New Types Firms are punished for misleading markets Corporate Good Citizen Constraints SOCIETY 1. More laws 2. Investor/Customer Backlash Investors and analysts become more skeptical FINANCIAL MARKETS 40 13/01/2023 PGS.TS Trần Thị Thuỳ Linh Traditional corporate financial theory breaks n The interests/objectives of the decision down when ... makers in the firm conflict with the interests of stockholders. n Bondholders (Lenders) are not protected against expropriation by stockholders. n Financial markets do not operate efficiently, and stock prices do not reflect the underlying value of the firm. n Significant social costs can be created as a byproduct of stock price maximization. 41 2.7 A Postscrip: Limits of Finance corporate 13.1 Corporate finance has come in for more than its fair share of criticism in the past decade or so. There are many who argue that the failures of corporate America can be traced to its dependence on financial markets. Some of the criticism is justified and based on the limitations of a single-minded pursuit of stock price maximization. Some of it, however, is based on a misunderstanding of what corporate finance is about. PGS.TS. TRẦN THỊ THÙY LINH The Goal of Financial Management n The strength of the stock price maximization objective function is its internal self correction mechanism. Excesses on any of the linkages lead, if unregulated, to counter actions which reduce or eliminate these excesses. PGS.TS Trần Thị Thuỳ Linh 43 Text, Ch. 2 CFA Reading LIVE CASE STUDY ▰ Objective: To assess the company’s corporate governance structure and examine the relationships between different stakeholders in the business (society, bondholders, and financial markets) 1.Examine whether there is a separation between the management of a business and its owners. If so, also assess how much power owners have in monitoring management and influencing decisions. 2. If the firm has borrowed money, either in the form banks or in the form of bonds, evaluate the potential for conflicts of interest between the equity investors and lenders and how it is managed. 3. If the firm is publicly traded, examine how markets get information about the firm and investor reactions and assessments of the stock. 4. Evaluate the company’s standing as a corporate citizen, by looking at its reputation (good or bad) in society. 44 PGS.TS Trần Thị Thuỳ Linh PGS.TS TRẦN THỊ THUỲ LINH