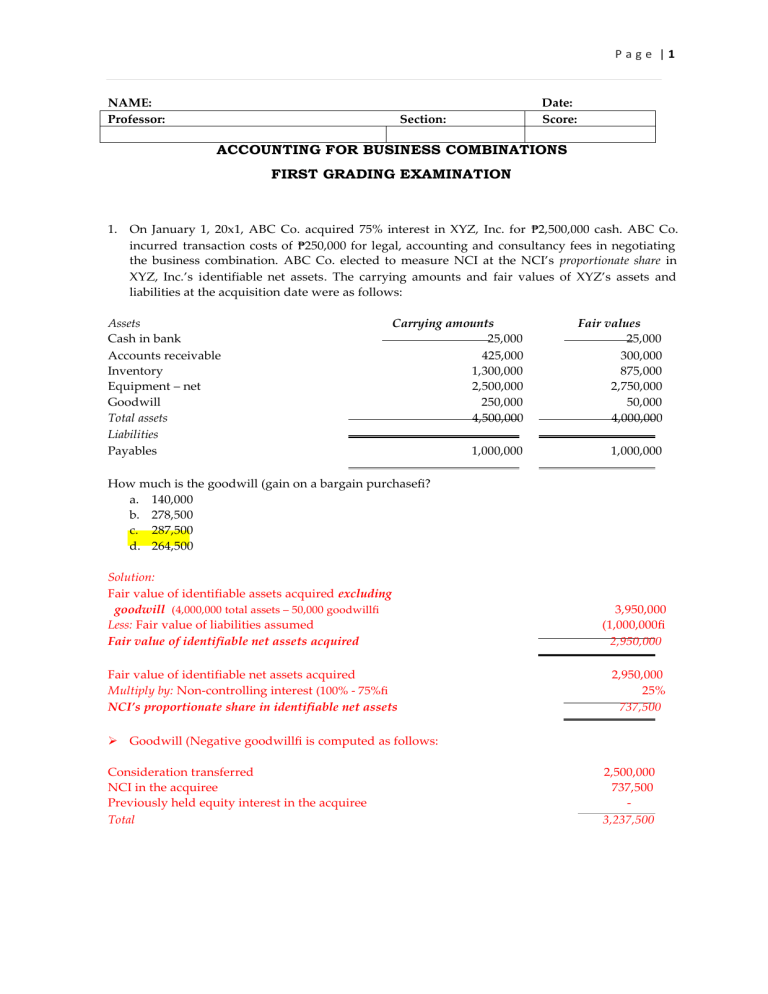

Page |1 NAME: Professor: Date: Score: Section: ACCOUNTING FOR BUSINESS COMBINATIONS FIRST GRADING EXAMINATION 1. On January 1, 20x1, ABC Co. acquired 75% interest in XYZ, Inc. for ₱2,500,000 cash. ABC Co. incurred transaction costs of ₱250,000 for legal, accounting and consultancy fees in negotiating the business combination. ABC Co. elected to measure NCI at the NCI’s proportionate share in XYZ, Inc.’s identifiable net assets. The carrying amounts and fair values of XYZ’s assets and liabilities at the acquisition date were as follows: Assets Cash in bank Accounts receivable Inventory Equipment – net Goodwill Total assets Liabilities Payables Carrying amounts 25,000 425,000 1,300,000 2,500,000 250,000 4,500,000 Fair values 25,000 300,000 875,000 2,750,000 50,000 4,000,000 1,000,000 1,000,000 How much is the goodwill (gain on a bargain purchase)? a. 140,000 b. 278,500 c. 287,500 d. 264,500 Solution: Fair value of identifiable assets acquired excluding goodwill (4,000,000 total assets – 50,000 goodwill) Less: Fair value of liabilities assumed Fair value of identifiable net assets acquired Fair value of identifiable net assets acquired Multiply by: Non-controlling interest (100% - 75%) NCI’s proportionate share in identifiable net assets 3,950,000 (1,000,000) 2,950,000 2,950,000 25% 737,500 Goodwill (Negative goodwill) is computed as follows: Consideration transferred NCI in the acquiree Previously held equity interest in the acquiree Total 2,500,000 737,500 3,237,500 Page |2 Less: Fair value of identifiable net assets acquired Goodwill (2,950,000) 287,500 The ₱250,000 transaction costs are expensed. Acquisition-related costs do not affect the measurement of goodwill. 2. The management of an entity is unsure how to treat a restructuring provision that they wish to set up on the acquisition of another entity. Under PFRS 3, the treatment of this provision will be a. A charge in the income statement in the post-acquisition period. b. To include the provision in the allocated cost of acquisition. c. To provide for the amount and, if the provision is overstated, to release the excess to the income statement in the post-acquisition period. d. To include the provision in the allocated cost of acquisition if the acquired entity commits itself to a restructuring within a year of acquisition. 3. The method required under PFRS 3 to be used in accounting for business combinations is a. Purchase method c. Acquisition method b. Buy method d. Combination method 4. Should the following costs be included in the consideration transferred in a business combination, according to PFRS 3 Business Combinations? I. Costs of maintaining an acquisitions department. II. Fees paid to accountants to effect the combination. a. No No b. No Yes c. Yes No d. Yes Yes 5. PFRS 3 requires that the contingent liabilities of the acquired entity should be recognized in the balance sheet at fair value. The existence of contingent liabilities is often reflected in a lower purchase price. Recognition of such contingent liabilities will a. Decrease the value attributed to goodwill, thus decreasing the risk of impairment of goodwill. b. Decrease the value attributed to goodwill, thus increasing the risk of impairment of goodwill. c. Increase the value attributed to goodwill, thus decreasing the risk of impairment of goodwill. d. Increase the value attributed to goodwill, thus increasing the risk of impairment of goodwill. 6. Are the following statements about an acquisition true or false, according to PFRS 3 Business combinations? I. The acquirer should recognize the acquiree's contingent liabilities if certain conditions are met. II. The acquirer should recognize the acquiree's contingent assets if certain conditions are met. a. False, False b. False, True c. True, False d. True, True 7. Given the following information, how is goodwill from a business combination computed under PFRS 3? Page |3 A = Consideration transferred B = Non-controlling interest in net assets of subsidiary C = Previously held equity interest D = Fair value of net identifiable assets of subsidiary % = Percentage of ownership acquired by the parent in the subsidiary a. A+B+C-D b. A – (D x %) c. (A+C) – (D x %) d. (A+B) – [(D x %) – B] 8. In a business combination, an acquirer's interest in the fair value of the net assets acquired exceeds the consideration transferred in the combination. Under PFRS 3 Business Combinations, the acquirer should a. recognize the excess immediately in profit or loss b. recognize the excess immediately in other comprehensive income c. reassess the recognition and measurement of the net assets acquired and the consideration transferred, then recognize any excess immediately in profit or loss d. reassess the recognition and measurement of the net assets acquired and the consideration transferred, then recognize any excess immediately in other comprehensive income 9. Which one of the following reasons would not contribute to the creation of negative goodwill? a. Errors in measuring the fair value of the acquiree’s net identifiable assets or the cost of the business combination. b. A bargain purchase. c. A requirement in an IFRS to measure net assets acquired at a value other than fair value. d. Making acquisitions at the top of a “bull” market for shares. 10. The “excess of the acquirer’s interest in the net fair value of acquiree’s identifiable assets, liabilities, and contingent liabilities over cost” (formerly known as negative goodwill) should be a. Amortized over the life of the assets acquired. b. Reassessed as to the accuracy of its measurement and then recognized immediately in profit or loss. c. Reassessed as to the accuracy of its measurement and then recognized in retained earnings. d. Carried as a capital reserve indefinitely. 11. This type of business combination occurs when, for example, a private entity decides to have itself “acquired” by a smaller public entity in order to obtain a stock exchange listing. a. Step acquisition c. Reverse acquisition b. Rewind acquisition d. Stock acquisition 12. Acquisition accounting requires an acquirer and an acquiree to be identified for every business combination. Where a new entity (H) is created to acquire two preexisting entities, S and A, which of these entities will be designated as the acquirer? a. H. b. S. c. A. d. A or S. Use the following information for the next four questions: Page |4 On January 1, 20x1, KNAVE acquired 80% of the equity interests of RASCAL, Inc. in exchange for cash. Because the former owners of RASCAL needed to dispose of their investments in RASCAL by a specified date, they did not have sufficient time to market RASCAL to multiple potential buyers. As January 1, 20x1, RASCAL’s identifiable assets and liabilities have fair values of ₱4,800,000 and ₱1,600,000, respectively. 13. KNAVE Co. elects the option to measure non-controlling interest at fair value. An independent consultant was engaged who determined that the fair value of the 20% non-controlling interest in RASCAL, Inc. is ₱620,000. If KNAVE Co. paid ₱4,000,000 cash as consideration for the 80% interest in RASCAL, Inc., how much is the goodwill (gain on bargain purchase) on the business combination? a. 800,000 b. 2,060,000 c. 1,440,000 d. 1,420,000 D Solution: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 4,000,000 620,000 4,620,000 (3,200,000) 1,420,000 14. KNAVE Co. elects the option to measure non-controlling interest at fair value. An independent consultant was engaged who determined that the fair value of the 20% non-controlling interest in RASCAL, Inc. is ₱620,000. If KNAVE Co. paid ₱2,400,000 cash as consideration for the 80% interest in RASCAL, Inc., how much is the goodwill (gain on bargain purchase) on the business combination? a. (180,000) b. (800,000) c. (160,000) d. (200,000) A Solution: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (4.8M –1.6M) Gain on a bargain purchase 2,400,000 620,000 3,020,000 (3,200,000) (180,000) 15. KNAVE Co. elects the option to measure non-controlling interest at fair value. A value of ₱1,000,000 is assigned to the 20% non-controlling interest in RASCAL, Inc. [(₱4M ÷ 80%) x 20% = 1,000,000]. Page |5 If KNAVE Co. paid ₱4,000,000 cash as consideration for the 80% interest in RASCAL, Inc., how much is the goodwill (gain on bargain purchase) on the business combination? a. 200,000 b. 1,800,000 c. 2,440,000 d. 1,440,000 B Solution: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 4,000,000 1,000,000 5,000,000 (3,200,000) 1,800,000 16. KNAVE Co. elects the option to measure the non-controlling interest at the non-controlling interest’s proportionate share of RASCAL, Inc.’s net identifiable assets If KNAVE Co. paid ₱4,000,000 cash as consideration for the 80% interest in RASCAL, Inc. and, how much is the goodwill (gain on bargain purchase) on the business combination? a. 1,440,000 b. 800,000 c. 1,400,000 c. 960,000 A Solution: Fair value of identifiable assets acquired Fair value of liabilities assumed Fair value of net identifiable assets acquired Multiply by: Non-controlling interest NCI’s proportionate share in net identifiable assets Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 4,800,000 (1,600,000) 3,200,000 20% 640,000 4,000,000 640,000 4,640,000 (3,200,000) 1,440,000 Use the following information for the next two questions: On January 1, 20x1, SMUTTY acquired all of the identifiable assets and assumed all of the liabilities of OBSCENE, Inc. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱6,400,000 and ₱3,600,000, respectively. SMUTTY incurred the following acquisition-related costs: legal fees, ₱40,000, due diligence costs, ₱400,000, and general administrative costs of maintaining an internal acquisitions department, ₱80,000. Page |6 17. Case #1: As consideration for the business combination, SMUTTY Co. transferred 8,000 of its own equity instruments with par value per share of ₱400 and fair value per share of ₱500 to OBSCENE’s former owners. Costs of registering the shares amounted to ₱160,000. How much is the goodwill (gain on bargain purchase) on the business combination? a. 716,000 b. 556,000 c. 600,000 d. 1,200,000 D Solution: Consideration transferred (8,000 sh. x ₱500) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (6.4M - 3.6M) Goodwill 4,000,000 4,000,000 (2,800,000) 1,200,000 18. Case #2: As consideration for the business combination, SMUTTY Co. issued bonds with face amount and fair value of ₱4,000,000. Transaction costs incurred in issuing the bonds amounted to ₱200,000. How much is the goodwill (gain on bargain purchase) on the business combination? a. 716,000 b. 556,000 c. 600,000 d. 1,200,000 D Solution: Consideration transferred (fair value of bonds) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (6.4M - 3.6M) Goodwill 4,000,000 4,000,000 (2,800,000) 1,200,000 19. On January 1, 20x1, ENTREAT Co. acquired all of the identifiable assets and assumed all of the liabilities of BEG, Inc. by paying cash of ₱4,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱6,400,000 and ₱3,600,000, respectively. ENTREAT Co. has estimated restructuring provisions of ₱800,000 representing costs of exiting the activity of BEG, costs of terminating employees of BEG, and costs of relocating the terminated employees. How much is the goodwill (gain on bargain purchase)? a. 1,080,000 b. 1,280,000 c. 1,120,000 d. 1,200,000 D Solution: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (6.4M - 3.6M) Goodwill 4,000,000 4,000,000 (2,800,000) 1,200,000 Page |7 The ₱800,000 restructuring provisions are ignored because these are post-acquisition expenses. 20. On January 1, 20x1, HISTRIONAL Co. acquired all of the identifiable assets and assumed all of the liabilities of THEATRICAL, Inc. by paying cash of ₱4,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱6,400,000 and ₱3,600,000, respectively. As of January 1, 20x1, HISTRIONAL holds a building and a patent which are being rented out to THEATRICAL, Inc. under operating leases. HISTRIONAL has determined that the terms of the operating lease on the building compared with market terms are favorable. The fair value of the differential is estimated at ₱80,000. How much is the goodwill (gain on bargain purchase)? a. 1,080,000 b. 1,280,000 c. 1,120,000 d. 1,200,000 C Solution: Fair value of identifiable assets acquired, including intangible asset on the operating lease with favorable terms (₱6.4M + ₱80K) Fair value of liabilities assumed Fair value of net identifiable assets acquired Goodwill (gain on bargain purchase) is computed as follows: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 6,480,000 (3,600,000) 2,880,000 4,000,000 4,000,000 (2,880,000) 1,120,000 21. On January 1, 20x1, SUBTERFUGE Co. acquired all of the identifiable assets and assumed all of the liabilities of DECEPTION, Inc. by paying cash of ₱4,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱6,400,000 and ₱3,600,000, respectively. Additional information: SUBTERFUGE intends to sell immediately a factory plant included in the identifiable assets of DECEPTION. All of the “held for sale” classification criteria under PFRS 5 are met. As of January 1, 20x1, the factory plant has a fair value of ₱1,200,000 and a carrying amount of ₱1,000,000 in the books of DECEPTION. Costs to sell the factory plant is ₱80,000. Not included in the identifiable asset of DECEPTION is a research and development intangible asset that SUBTERFUGE does not intend to use. The fair value of this asset is ₱200,000. Page |8 Also, not included in the identifiable asset of DECEPTION is a customer list, with an estimated value of ₱40,000, in the form of a database where the nature of the information is subject to national laws regarding confidentiality. How much is the goodwill (gain on bargain purchase)? a. 1,200,000 b. 1,280,000 c. 1,080,000 d. 1,040,000 C Solution: Fair value of identifiable assets Costs to sell of the “held for sale” asset Fair value of unrecognized research and development Adjusted value of identifiable assets Fair value of liabilities assumed Fair value of net identifiable assets acquired 6,400,000 (80,000) 200,000 6,520,000 (3,600,000) 2,920,000 Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 4,000,000 4,000,000 (2,920,000) 1,080,000 22. On January 1, 20x1, CHIDE Co. acquired 90% of the identifiable assets and assumed all of the liabilities of SCOLD, Inc. by paying cash of ₱4,000,000. On this date, SCOLD’s identifiable assets and liabilities have fair values of ₱6,400,000 and ₱3,600,000, respectively. Non-controlling interest has a fair value of ₱320,000. As of January 1, 20x1, SCOLD had the following which were not included in the acquisition-date fair value measurement of liabilities: SCOLD has an existing contract with a customer to deliver products at a specified future date. In accordance with the agreement, SCOLD shall pay a penalty for failure to deliver the said goods. CHIDE determined that the fair value of the penalty is ₱40,000. However, because CHIDE expects to comply with the agreement, it was assessed that payment of penalty is improbable. SCOLD has guaranteed a bank loan of a third party. CHIDE shall replace SCOLD as the guarantor. If the third party defaults on the loan, CHIDE will be held liable for the guarantee. CHIDE determined that the fair value of the guarantee is ₱120,000. However, both SCOLD and CHIDE believe that the third party will not default on its loan from the bank. There is a pending unresolved litigation filed by a third party against SCOLD. CHIDE determined that the fair value of settling the litigation is ₱200,000. However, because the legal counsels of both CHIDE and SCOLD strongly believe that they will win the case, it was assessed that payment for the settlement of the litigation is improbable. How much is the goodwill (gain on bargain purchase)? a. 1,880,000 b. 1,200,000 c. 1,560,000 d. 1,520,000 Page |9 A Solution: The adjusted fair value of net identifiable assets acquired is computed as follows: Fair value of identifiable assets acquired Total fair value of liabilities assumed: Fair value of liabilities assumed Fair value of contingent liabilities assumed: Contractual contingent liability assumed Contractual contingent liability assumed Non-contractual contingent liability assumed Fair value of net identifiable assets acquired Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 6,400,000 3,600,000 40,000 120,000 200,000 (3,960,000) 2,440,000 4,000,000 320,000 4,320,000 (2,440,000) 1,880,000 23. On January 1, 20x1, PRODIGIOUS Co. acquired all of the identifiable assets and assumed all of the liabilities of EXTRAORDINARY, Inc. by paying cash of ₱4,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱6,400,000 and ₱3,600,000, respectively. The terms of the business combination agreement are shown below: Half of the ₱4,000,000 agreed consideration shall be paid on January 1, 20x1 and the other half on December 31, 20x5. The prevailing market rate as of January 1, 20x1 is 10%. In addition, PRODIGIOUS agrees to provide for the following: a. A piece of land with a carrying amount of ₱2,000,000 and fair value of ₱1,200,000 shall be transferred to the former owners of EXTRAORDINARY. b. After the combination, EXTRAORDINARY’s activities shall be continued by PRODIGIOUS. PRODIGIOUS agrees to provide a patented technology for use in the activities of EXTRAORDINARY. The patented technology has a carrying amount of ₱240,000 in the books of PRODIGIOUS and a fair value of ₱320,000. Included in the liabilities assumed is an estimated liability on a pending lawsuit filed against EXTRAORDINARY by a third party with an acquisition-date fair value of ₱400,000. The carrying amount of the liability in EXTRAORDINARY’s books immediately before the business combination is ₱480,000. EXTRAORDINARY guarantees to indemnify PRODIGIOUS for any settlement amount of the liability in excess of ₱480,000. How much is the goodwill (gain on bargain purchase)? a. 1,721,843 b. 1,561,843 c. 1,641,843 d. 2,320,000 B Solution: The fair value of the consideration transferred is determined as follows: Cash payment (₱4M x 50%) 2,000,000 P a g e | 10 Present value of future cash payment (Note payable) 1,241,843 (₱4M x 50% x PV of ₱1 @10%, n=5) Land transferred to former owners of XYZ – at fair value Fair value of consideration transferred 1,200,000 4,441,843 The fair value of the net identifiable assets acquired is computed as follows: Fair value of assets Indemnification asset (480,000 – 400,000) Total Fair value of liabilities Fair value of net identifiable assets acquired 6,400,000 80,000 6,480,000 (3,600,000) 2,880,000 Goodwill (gain on bargain purchase) is computed as follows: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total 4,441,843 4,441,844 (2,880,000) 1,561,843 Fair value of net identifiable assets acquired Goodwill / (Gain on a bargain purchase) 24. On January 1, 20x1, ATTAINDER Co. acquired all of the assets and assumed all of the liabilities of DISHONOR, Inc. As of this date, the carrying amounts and fair values of the assets and liabilities of DISHONOR acquired by ATTAINDER are shown below: Assets Carrying amounts Fair values Cash in bank 40,000 40,000 Receivables 800,000 480,000 Allowance for probable losses on (120,000) receivables Inventory 2,080,000 1,400,000 Building – net 4,000,000 4,400,000 Goodwill 400,000 80,000 Total assets 7,200,000 6,400,000 Liabilities Payables 1,600,000 1,600,000 ATTAINDER Co. paid ₱6,000,000 cash as consideration for the assets and liabilities of DISHONOR, Inc. It was determined on acquisition date that DISHONOR, Inc. has an unrecorded patent with a fair value of ₱120,000 and a contingent liability with fair value of ₱80,000. Although adjustments are to be made to the carrying amounts of the assets and liabilities, no adjustments shall be made to their tax bases. All adjustments to the carrying amounts of assets and liabilities result to temporary differences. ATTAINDER’s tax rate is 30%. How much is the goodwill (gain on bargain purchase) on the business combination? a. 1,148,000 b. 1,108,000 c. 1,028,000 d. 1,240,000 P a g e | 11 B Solution: The deferred tax liability and asset are computed as follows: Carrying amounts Cash in bank Receivables – net Inventory Building – net Patent Payables Contingent liability 40,000 680,000 2,080,000 4,000,000 1,600,000 - Fair values Taxable/ (Deductible) Temporary difference 40,000 480,000 1,400,000 4,400,000 120,000 1,600,000 80,000 Total taxable temporary difference (400K + 120K) Multiply by: Tax rate Deferred tax liability 520,000 30% 156,000 Total deductible temporary difference (200K + 680K + 80K) Multiply by: Tax rate Deferred tax asset 960,000 30% 288,000 200,000 680,000 (400,000) (120,000) 80,000 The fair value of the net identifiable assets of the acquiree is computed as follows: Fair value of identifiable assets acquired excluding recorded goodwill (6.4M – 80K goodwill + 120K unrecorded patent + 288K deferred tax asset) Fair value of liabilities assumed (1.6M + 80K contingent liability + 156K deferred tax liability) Fair value of net identifiable assets acquired Goodwill is computed as follows: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 6,728,000 (1,836,000) 4,892,000 6,000,000 6,000,000 (4,892,000) 1,108,000 25. On January 1, 20x1, FARCICAL Co. acquired all of the assets and liabilities of ABSURD, Inc. for ₱6.4M. As of this date, the carrying amounts and fair values of the assets and liabilities of ABSURD are shown below: Assets Carrying amounts Fair values Cash in bank 40,000 40,000 Receivables 800,000 480,000 Allowance for probable losses on (120,000) P a g e | 12 receivables Inventory Building – net Goodwill Total assets Liabilities Dividends payable Other payables 2,080,000 4,000,000 400,000 7,200,000 1,400,000 4,400,000 80,000 6,400,000 400,000 1,600,000 2,000,000 400,000 1,600,000 2,000,000 The dividends payable pertain to dividends declared by ABSURD, Inc. on December 28, 20x0 to shareholders of record on January 15, 20x1. The dividends will be distributed on January 31, 20x1. How much is the goodwill (gain on bargain purchase)? a. 1,280,000 b. 2,080,000 c. 2,480,000 d. 1,680,000 D Solution: The consideration transferred is adjusted for the dividends purchased as follows: Fair value of consideration transferred Dividends-on (Dividends purchased) Adjusted consideration transferred Goodwill is computed as follows: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total FV of net identifiable assets acquired (6.4M – 80K - 2M) Goodwill 6,400,000 (400,000) 6,000,000 6,000,000 6,000,000 (4,320,000) 1,680,000 Use the following information for the next five questions: On January 1, 20x1, COLLOQUY Co. acquired all of the identifiable assets and assumed all of the liabilities of CONVERSATION, Inc. by issuing its own ordinary shares. Information at acquisition date is shown below: Combined COLLOQUY Co. CONVERSATION, Co. entity (carrying amounts) (fair values) Identifiable assets 9,600,000 6,400,000 16,000,000 Goodwill ? Total assets 9,600,000 6,400,000 ? Liabilities 2,800,000 3,600,000 6,400,000 Share capital 2,400,000 1,200,000 2,800,000 Share premium 1,200,000 1,000,000 4,800,000 P a g e | 13 Retained earnings Total liabilities & equity 3,200,000 9,600,000 600,000 6,400,000 ? ? Additional information: COLLOQUY’s share capital consists of 60,000 ordinary shares with par value of ₱40 per share. CONVERSATION’s share capital consists of 3,000 ordinary shares with par value of ₱400 per share. 26. How much is the fair value of consideration transferred on the business combination? a. 4,000,000 b . 2,400,000 c. 4,400,000 d. 4,800,000 A Solution: Share capital Share premium Totals COLLOQUY Co. 2,400,000 1,200,000 3,600,000 Combined entity 2,800,000 4,800,000 7,600,000 Increase 400,000 3,600,000 4,000,000 The fair value of the shares transferred as consideration for the business combination is ₱4,000,000 (i.e., total increase in share capital and share premium accounts). 27. How many shares were issued in the business combination? a. 40,000 b. 12,000 c. 36,000 d. 10,000 D Solution: Increase in COLLOQUY’s share capital account (see table above) Divide by: ABC’s par value per share Number of shares issued 400,000 40 10,000 28. How much is the acquisition-date fair value per share? a. 400 b. 440 c. 280 d. 360 A Solution: Fair value of consideration transferred Divide by: Number of shares issued Acquisition-date fair value per share 29. How much goodwill was recognized on acquisition date? a. 980,000 b. 1,200,000 c. 1,280,000 d. 1,080,000 B 4,000,000 10,000 400 P a g e | 14 Solution: Consideration transferred Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (6.4M - 3.6M) Goodwill 4,000,000 4,000,000 (2,800,000) 1,200,000 30. What is the retained earnings of the combined entity immediately after the business combination? a. 3,120,000 b. 3,320,000 c. 3,280,000 d. 3,200,000 D 3,200,000 – COLLOQUY’s retained earnings 31. On January 1, 20x1, OBDURATE Co. acquired 30% ownership interest in STUBBORN, Inc. for ₱400,000. Because the investment gave OBDURATE significant influence over STUBBORN, the investment was accounted for under the equity method in accordance with PAS 28. From 20x1 to the end of 20x3, OBDURATE recognized ₱200,000 net share in the profits of the associate and ₱40,000 share in dividends. Therefore, the carrying amount of the investment in associate account on January 1, 20x3, is ₱560,000. On January 1, 20x4, OBDURATE acquired additional 60% ownership interest in STUBBORN, Inc. for ₱3,200,000. As of this date, OBDURATE has identified the following: a. The previously held 30% interest has a fair value of ₱720,000. b. STUBBORN’s net identifiable assets have a fair value of ₱4,000,000. c. OBDURATE elected to measure non-controlling interests at the non-controlling interest’s proportionate share of STUBBORN’s identifiable net assets. How much is the goodwill? a. 320,000 b. 240,000 c. 280,000 A Solution: Consideration transferred Non-controlling interest in the acquiree (1M x 10%) Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill d. 360,000 3,200,000 400,000 720,000 4,320,000 (4,000,000) 320,000 32. OBSTREPEROUS Co. and NOISY, Inc. both engage in the same business. On January 1, 20x1, OBSTREPEROUS and NOISY signed a contract, the terms of which resulted in OBSTREPEROUS obtaining control over NOISY without any transfer of consideration between the parties. P a g e | 15 The fair value of the identifiable net assets of NOISY, Inc. on January 1, 20x1 is ₱4,000,000. NOISY chose to measure non-controlling interest at the non-controlling interest’s proportionate share of the acquiree’s identifiable net assets. How much is the goodwill? a. 4,000,000 b.0 c. a or c d. This is not a business combination B Solution: Consideration transferred Non-controlling interest in the acquiree (4M x 100%) Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 4,000,000 4,000,000 (4,000,000) - Use the following information for the next three questions: On September 30, 20x1, INNOCUOUS Co. acquired all of the identifiable assets and assumed all of the liabilities of HARMLESS, Inc. by paying cash of ₱4,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of ₱6,400,000 and ₱3,600,000, respectively. 33. INNOCUOUS engaged an independent valuer to appraise a building acquired from HARMLESS. However, the valuation report was not received by the time INNOCUOUS authorized for issue its financial statements for the year ended December 31, 20x1. As such, the building was assigned a provisional amount of ₱2,800,000. Also, the building was tentatively assigned an estimated useful life of 10 years from acquisition date. INNOCUOUS uses the straight line method of depreciation and recognized three months’ depreciation on the building for 20x1. On July 1, 20x2, INNOCUOUS finally received the valuation report from the independent valuer which shows that the fair value of the building as of September 30, 20x1 is ₱2,000,000 and remaining useful from that date is 5 years. How should INNOCUOUS account for the new information obtained? a. As a retrospective adjustment to the provisional amount of the building resulting to increase in goodwill by ₱800,000. b. As a retrospective adjustment to the provisional amount of the building resulting to decrease in goodwill by ₱800,000. c. As a retrospective restatement to the provisional amount of the building resulting to increase in goodwill by ₱800,000. The adjustment is treated as a correction of a prior period error. d. The new information obtained is ignored. No adjustment to goodwill is necessary. 34. On July 1, 20x2, INNOCUOUS obtained new information that HARMLESS has an unrecorded patent which was not identified on September 30, 20x1. It was believed that the unrecorded P a g e | 16 patent had a fair value of ₱400,000 and a remaining useful life of 4 years as of September 30, 20x1. How should INNOCUOUS account for the new information obtained? a. As a retrospective adjustment to record the previously unrecorded patent resulting to increase in goodwill by ₱400,000. b. As a retrospective adjustment to record the previously unrecorded patent resulting to decrease in goodwill by ₱400,000. c. As a retrospective restatement to record the previously unrecorded patent resulting to decrease in goodwill by ₱400,000. The adjustment is treated as a correction of a prior period error. d. The new information obtained is ignored. No adjustment to goodwill is necessary. 35. On November 1, 20x2, the internal auditors of INNOCUOUS discovered an error on the recorded identifiable assets acquired from HARMLESS on the business combination. A patent with a fair value of ₱400,000 and a remaining useful life of 4 years as of September 30, 20x1 was omitted from the valuation listing. How should INNOCUOUS account for the new information obtained? a. As a retrospective adjustment to record the previously unrecorded patent resulting to increase in goodwill by ₱400,000. b. As a retrospective adjustment to record the previously unrecorded patent resulting to decrease in goodwill by ₱400,000. c. As a retrospective restatement to record the previously unrecorded patent resulting to decrease in goodwill by ₱400,000. The adjustment is treated as a correction of a prior period error. d. The new information obtained is ignored. No adjustment to goodwill is necessary. 36. On September 30, 20x1, RIBALD Co. acquired all of the identifiable assets and assumed all of the liabilities of OFFENSIVE, Inc. by issuing 10,000 shares with par value of ₱20 per share. On this date, RIBALD’s shares were assigned a provisional value of ₱400 per share. Also, because some identifiable assets acquired and liabilities assumed have fair values that were not readily available, a provisional amount of ₱2,800,000 was assigned to OFFENSIVE’s net identifiable assets. On April 1, 20x2, after RIBALD’s 20x1 financial statements were issued, new information was obtained confirming that the fair value of RIBALD’s shares on September 30, 20x1 is ₱440 per share and that the fair value of OFFENSIVE’s net identifiable assets as of September 30, 20x1 is ₱3,600,000. On July 1, 20x2, two competitors of RIBALD have also merged which led to RIBALD believing that the merger with OFFENSIVE is not as profitable as expected. RIBALD now wants to decrease the amount assigned to the consideration transferred to OFFENSIVE on September 30, 20x1 to ₱360 per share and the value of OFFENSIVE’s net identifiable assets to ₱1,600,000. How should RIBALD account for the new information obtained on July 1, 20x2? a. As a retrospective adjustment resulting to increase in goodwill by ₱400,000. b. As a retrospective adjustment resulting to decrease in goodwill by ₱400,000. P a g e | 17 c. As a retrospective restatement resulting to decrease in goodwill by ₱400,000. The adjustment is treated as a correction of a prior period error. d. The new information obtained is ignored. No adjustment to goodwill is necessary. 37. When consolidating the financial statements of a parent and its subsidiary, which of the following is eliminated? a. Goodwill c. Investment in subsidiary b. NCI in net assets d. All of these 38. A British parent entity uses the revaluation model to measure its property, but a Philippine subsidiary uses the cost model. The Philippine subsidiary’s directors find the revaluation model too costly to implement. In the consolidated financial statements, is the group allowed to measure the Philippine subsidiary’s property under the cost model? a. Yes, the British parent’s property shall be adjusted to conform to the subsidiary’s accounting policy of cost model. b. No, the Philippine subsidiary’s property shall be adjusted to conform to the group’s accounting policy of revaluation model. c. Yes, both models will be reflected in the consolidated financial statements, but this fact must be disclosed in the notes. d. None of these, the property is eliminated in the consolidated financial statements. Use the following information for the next two questions: On January 1, 20x1, Entity A acquires Entity B in a business combination. The financial statements of the combining constituents are shown below: Cash in bank Accounts receivable Inventory Investment in subsidiary Building, net Total assets Entity A 12,000 36,000 48,000 90,000 216,000 402,000 Entity B 6,000 14,400 27,600 48,000 96,000 Accounts payable Share capital Share premium Retained earnings Total liabilities and equity 60,000 204,000 78,000 60,000 402,000 7,200 60,000 28,800 96,000 Additional information: Entity B’s assets and liabilities are stated at their acquisition-date fair values, except for the following: - Inventory, ₱37,200 - Building, net, ₱57,600 The goodwill determined under PFRS 3 is ₱3,600. P a g e | 18 The NCI in the net assets of the subsidiary, also determined under PFRS 3, is ₱21,600. 39. How much is the consolidated total assets on January 1, 20x1? a. 430,800 c. 428,600 b. 440,800 d. 465,800 A Solution: Entity A Entity B Consolidated Cash in bank 12,000 6,000 18,000 Accounts rec. Inventory 36,000 48,000 14,400 27,600 50,400 (48K + 37.2K) 85,200 Inv. in sub. 90,000 - eliminated - Building, net 216,000 48,000 (216K + 57.6K) 273,600 given 3,600 Goodwill Total assets 402,000 96,000 430,800 Accounts payable 60,000 7,200 Share capital Share premium 204,000 78,000 60,000 - parent's only parent's only 204,000 Retained earnings 60,000 28,800 parent's only 60,000 given 21,600 430,800 67,200 NCI in net assets Total liab. & equity 342,000 96,000 78,000 40. How much is the consolidated total equity on January 1, 20x1? a. 330,800 c. 328,600 b. 340,800 d. 363,600 D 204,000 + 78,000 + 60,000 + 21,600 (see table above) = 363,600 “He will have no fear of bad news; his heart is steadfast, trusting in the Lord. His heart is secure, he will have no fear; in the end he will look in triumph on his foes.” (Psalm 112:7-8) - END -

![[Date] [Name of College] ATTN: [Department]](http://s2.studylib.net/store/data/015675584_1-19c1f2d4f2acfcfa6a51fd36241fad38-300x300.png)