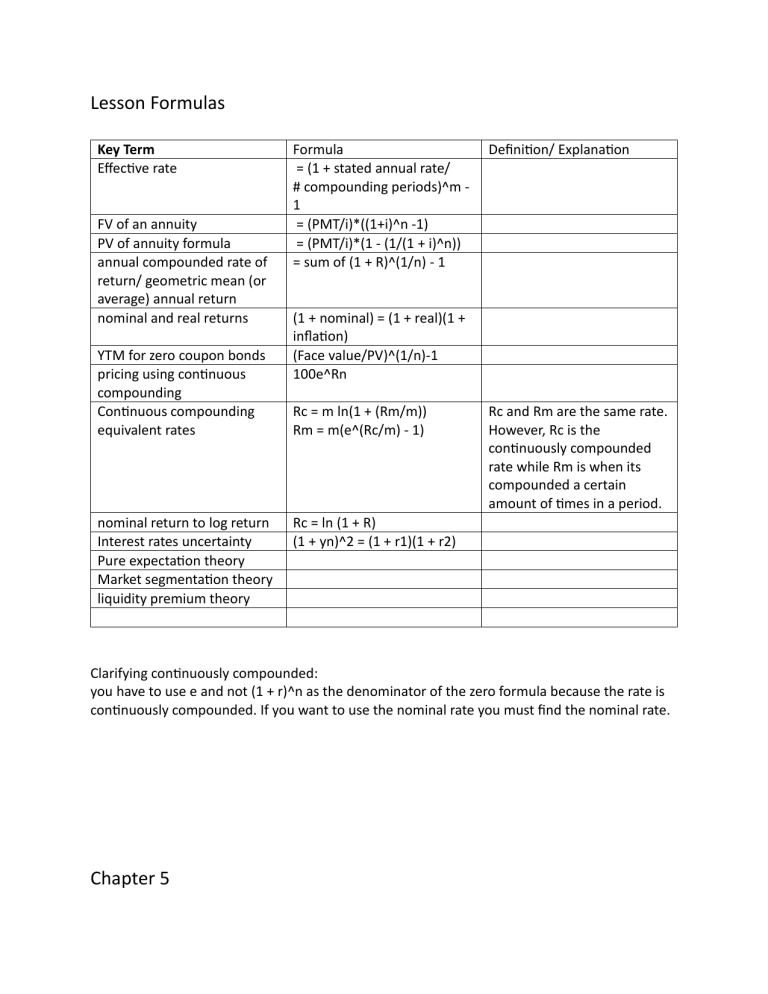

Lesson Formulas Key Term Effective rate FV of an annuity PV of annuity formula annual compounded rate of return/ geometric mean (or average) annual return nominal and real returns YTM for zero coupon bonds pricing using continuous compounding Continuous compounding equivalent rates nominal return to log return Interest rates uncertainty Pure expectation theory Market segmentation theory liquidity premium theory Formula = (1 + stated annual rate/ # compounding periods)^m 1 = (PMT/i)*((1+i)^n -1) = (PMT/i)*(1 - (1/(1 + i)^n)) = sum of (1 + R)^(1/n) - 1 Definition/ Explanation (1 + nominal) = (1 + real)(1 + inflation) (Face value/PV)^(1/n)-1 100e^Rn Rc = m ln(1 + (Rm/m)) Rm = m(e^(Rc/m) - 1) Rc and Rm are the same rate. However, Rc is the continuously compounded rate while Rm is when its compounded a certain amount of times in a period. Rc = ln (1 + R) (1 + yn)^2 = (1 + r1)(1 + r2) Clarifying continuously compounded: you have to use e and not (1 + r)^n as the denominator of the zero formula because the rate is continuously compounded. If you want to use the nominal rate you must find the nominal rate. Chapter 5 Key Term Effective Annual Rate (EAR) Formula = (1 + (APR/n)^n -1 Annual percentage rate (APR) = n*((1 + EAR)^(1/n) -1 ) Value at risk (VaR) Expected shortfall (ES) Conditional Tail Expectation Lower Partial Standard Deviation (LPSD) Sortino Ratio Continuously compounded rate of return real rate of return real rate of return (cc) Skew Kurtosis Definition/Explanation annual interest rate using compound interest rather than simple interest. Annual interest using simple interest rather than compound interest. Measure of downside risk. The loss that will be incurred in the event of an extreme price change, odds are typically low. Expected loos on a security given that returns are on the left tail of the probability distribution. Expectation of a random variable conditional on it falling below some threshold value. often used to measure downside risk. Standard deviation computed using only the portion of a return distribution below a certain threshold. eg. the risk-free rate. excess return/ LPSD cc = ln (1 + EAR) (1 + nominal return)/ (1 + inflation rate) - 1 r (nominal) - inflation rate = average(((R - mean R)^3)/(SD^3)) = average(((R - mean R)^4)/(SD^4)) average cubed deviations from the mean, negative deviations remain negative. Measure if negative or positive extremes are more likely degree of fat tails. more sensitive to extreme outcomes than variance Chapter 14 Key Term Realized compound return Accrued interest Realized compound return vs YTM coverage ratios eg. times-interest-earned eg. fixed charge coverage ratio Leverage ratios (debt to equity) Liquidity ratios eg. current ratio eg. quick ratio Probability ratios eg. return on assets eg. return on equity Formula Definition/Explanation compound rate of return assuming that coupon payments are reinvested until maturity =(annual PMT/m)*(dyas since difference between invoive last PMT/ days in period) price and flat price of bond compound = (reinvested will be the same if coupons coupons + par) / price paid are invested at the YTM. eg. earnings before interest ratios or earnings to fixed payments and taxes to costs. low or falling coverage interest obligations ratios signal possible cash eg. includes lease payments flow difficulties and sinking fund payments with interest obligations to arrive at the ratio of earnings to all fixed cash obligations too high ratio indicates excessive indebtedness, raising concern the firm will be unable to earn enough to satisfy the obligations of its bonds eg. current assets/ current Measure company's ability to liabilities pay coming due with its most eg. current assets excluding liquid asstes inventories/ current liabilities eg. earnings before interest measures the rates of return and taxes divided by total on assets or equity. indicators assets of firm overall financial eg. net income/equity health. more likey to raise money in security markets bc they offer prospects for better returns on the firm's investments cash flow to debt ratio Chapter 15 Key Term Term structure of interest rates Formula bond stripping/ bond reconstruction arbitrage pure yield curve on the run yield curve spot rate Short rate Spot rate and short rate Forward rates (1 + rn) = (1 + yn) ^n mmmm/(1 + yn-1)^n-1 Definiton/Explanation the structure of interest rates for discounting cash flows of different maturities Both offer opportunities for arbitrage exploitation of mispricing among two or more securities to clear a riskless profit. curve for stripped, or zero coupon, treasuries. plot of yield as a function of maturity for recently issued coupon bonds selling at or near par value yield to maturity on zero coupon bonds. The rate that prevails today for a time period corresponding to the zero's maturity interest rate for an interval which is available at different points in time the long term spot rate for a zero is the geometric average of (1 + the short rates in the next 4 years)^1/n numerator is the cumulative growth of an investment in an n-year zero held until maturity. The denominator is the growth of an investment in an (n-1) year zero Forward interest rate Liquidity premium Forward rate - expected future short interest rate The forward rate comes from the actual equation after calculating the different rates. Expected future short interest rate is given. Expected future short rates vs forward rate The interest rate calculated with the forward rate formula. called this rather than future short rate because it need not be the interest rate that actually will prevail at the future date It compensates short term investors for the uncertainty about the price at which they will be able to sell their longterm bonds at the end of the year. If all investors were long term investors, no one would be willing to hold short term bonds unless rolling over those bonds offered a higher reward for bearing interest rate risk. This would cause the forward rate to be less than the expected future spot rate. Expectation hypothesis - it is a thoery of the term structure forward rates = market consensus expectation of the future short interest rate: that is f2 = E(r2) and liquidity premium is 0 LIquidity preference theory IMPORTANT: short term investors will be unwilling to invest in long term bonds unless the forward rate > excepted short term interest rate Long term investors will be unwilling to hold short bonds It is the opposite for short term investors Theory that forwards interest rates are unbiased estimates of expected future interest rates Theory that investors demand a risk premium on long term bonds. Implies that the forward rate generally will exceed the expected future interest rate This thoery advocates that short term investors dominate the market so that unless expected short term interest rate > forward rate. the forward rate will generally exceed the expected short rate.