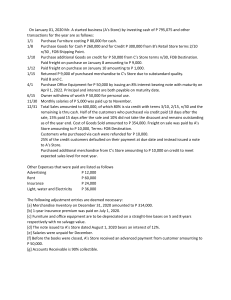

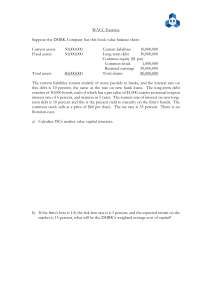

University of Management and Technology School of Commerce and Accountancy SPRING – 22 SEMESTER Course Title: Strategic Performance Measurement/APM (AC 398/399) End Term Examination Course Instructor: Mr. Muhammad Gulzar Paper Review Date: To be communicated Section: Program: M. Com./B. Com.(H) QAC Time Allowed: 2 hours Date: July 04,2022 Maximum Marks: 40 TO BE FILLED IN BY THE STUDENT Student Name: Student ID: Answers must be neat, relevant and brief Shows all workings and Computations Question 01 a) Boom limited and Doom limited is operating in same sector. Boom and Doom limited are almost similar in many aspects except internal economies of scale. Given the financial position of both of the companies: Page 1 of 4 ($ 000) Boom limited Non-Current Assets Intangible Assets Current assets Total Assets Current liabilities Sales Retained earnings Share capital (@ $ .50 each) Long term debt Total liabilities Operating Profit Doom limited 10,500 750 ? 13,800 ? 7,500 450 4,800 6000 9,000 3,000 9,000 600 ? 12,000 2,400 4,500 150 7,500 ? 4,500 2,700 Tax rate for both companies is 40% Market value per share at that date is $ 3.20 per share of Boom limited and $ 3.00 per share of Doom limited. Interest rate on long term debt is 15% per annum for Doom limited and 12% for Boom limited You are required to calculate the Altman Z- Score of each of the above companies and discuss possible reasons that which company is more indicative towards failure. (7) Z-Score = 1.2X1+1.4X2+3.3X3+0.6X4+1.0X5 X1 = working Capital / total Assets; X2 = Retained Earnings / Total Assets; X3 = Earnings before interest and tax / total assets; X4 = market value of equity / book value of total debt; X5 = sales / total assets b) Briefly explain the symptoms of declining companies (3) Question 02 The following information relates to a division of CE limited for the year ended June 30, 2020: $ 000 Net profit before tax 7000 The following adjustment must be considered: At the end of year the equity and long term debt amounting as $ 24 million and 13.5 million respectively Non-cash expenses amounting $ 1300,000 has already been charged Page 2 of 4 Amortization of good will took place amounting $ 900,000 Interest is to be charged amounting $ 1200,000 , however the rate of interest on long term debt is 10% The company has mix sort of capital structure of which 40% belongs to debt The estimated cost of equity is assume to be 12% The good will previously wrote off against reserve amounting $ 1050,000 Non-current assets and current assets at the start of the year amounting $ 25 million and 9 million respectively. Whereas long term liabilities and current liabilities at the start of the period assume to be 12 million and 6 million respectively Research and development cost amounting $ 6 million however the R&D should be divided in to 4 years whereas the whole amount has been charged totally for current year Tax rate applicable for the company is assume to be 40% Required: You are required to calculate the following by using above stated information: a) b) c) d) Return on investment (ROI) Residual income (RI) Economic Value Added (EVA) Explain the difference between EVA and RI briefly (2) (3) (4) (3) Question 03 a) Tiara limited is in process to prepare strategic budget for the coming five years. The company is using cost of capital to discount its cash flows derived from the estimated annual profits of the company. The estimated figures in respect of the cash flows starting from the year 2020 are as under Years $ 000 2020 1170 2021 1430 2022 1625 2023 1690 2024 1365 Page 3 of 4 The estimated cost of capital for the company which is assume to be remain consistent throughout the coming years estimated as 12 % per annum. At the end of year 2020 it was realized that actual cash flows were $ 1105,000 on the basis of the actual cash flows the estimations for the coming years has been changed, hence the following figures came into realized after consultation: Years $ 000 (Budgeted) 2021 1365 2022 1560 2023 1658 2024 1170 2025 1105 Required: Assess the strategic progress of the company for the period five years starting 2020, by calculating Net Present Value. (6) Question 04 Cress and Brass limited are two divisions of MM limited. Extract of income statements of both divisions are as under: Cress limited Brass limited $ 000 $000 Total Sales 5250 6500 Cost of production 3150 3850 Gross profit ? ? Operating expenses 3,500 1,750 Operating Profit ? ? Cress limited currently sells 70% of its output to external market and transfer remaining output to Brass limited. Required: What will be the consequences if business transfers its remaining output to Brass limited? i. ii. iii. iv. v. At market value At marginal cost (suppose costs are 80% variable and 20% fixed) At cost plus 30% What are the disadvantages of Market Based Transfer pricing? (3) (3) (3) (2) Explain the criteria to establish transfer pricing policy? (1) Page 4 of 4