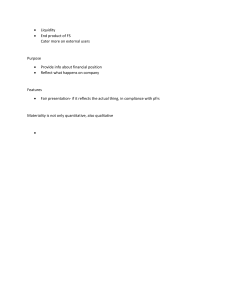

The Conceptual Framework for Financial Reporting (Effective date: January 1, 2020) Philippine Financial Reporting Standards Number Title PFRS 1 First-time Adoption of Philippine (Revised) Financial Reporting Standards PFRS 2 Share-based Payment PFRS 3 Business Combinations (Revised) PFRS 4 Insurance Contracts PFRS 5 Non-current Assets Held for Sale and Discontinued Operations PFRS 6 Exploration for and Evaluation of Mineral Resources PFRS 7 Financial Instruments: Disclosures PFRS 8 Operating Segments PFRS 9 Financial Instruments (2014) PFRS 10 Consolidated Financial Statements PFRS 11 Joint Arrangements PFRS 12 Disclosure of Interests in Other Entities PFRS 13 Fair Value Measurement PFRS 14 Regulatory Deferral Accounts PFRS 15 Revenue from Contracts with Customers PFRS 16 Leases PFRS 17 Insurance Contracts Philippine Accounting Standards Number Title PAS 1 Presentation of Financial Statements (Revised) PAS 2 Inventories PAS 7 Statement of Cash Flows PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors PAS 10 Events after the Reporting Period PAS 12 Income Taxes PAS 16 Property, Plant and Equipment PAS 19 Employee Benefits (Revised) PAS 20 Accounting for Government Grants and Disclosure of Government Assistance PAS 21 The Effects of Changes in Foreign Exchange Rates PAS 23 Borrowing Costs (Revised) PAS 24 Related Party Disclosures (Revised) PAS 26 Accounting and Reporting by Retirement Benefit Plans PAS 27 (Amended) PAS 28 (Amended) PAS 29 PAS 32 PAS 33 PAS 34 PAS 36 PAS 37 PAS 38 PAS 39 PAS 40 PAS 41 Separate Financial Statements Investments in Associates and Joint Ventures Financial Reporting in Hyperinflationary Economies Financial Instruments: Presentation Earnings per Share Interim Financial Reporting Impairment of Assets Provisions, Contingent Liabilities and Contingent Assets Intangible Assets Financial Instruments: Recognition and Measurement Investment Property Agriculture 3 important activities of accounting: 1. Identifying • External events (reciprocal, nonreciprocal, events other than transfer) • Internal (production & casualty) 2. Measuring 3. Communicating • Recording • Classifying • Summarizing Accounting Concepts 1. Double-entry system 2. Going concern assumption 3. Separate entity / Accounting Entity/ Business Entity Concepty/ Entity Concept 4. Stable Monetary Unit (Monertary with Assumption) 5. Time Period (Periodicity / Accounting Period) 6. Materiality Concept 7. Cost-benefit (Cost constraint / Reasonable Assurance) 8. Accrual basis of accounting 9. Historical Concept (Cost principle) 10. Concept of Articulation 11. Full disclosure principle 12. Consistency Concept 13. Matching (Association of Cost and Effect) 14. Entity Theory 15. Proprietary Theory 16. Residual Equity Theory 17. Fund Theory 18. Realization 19. Prudence (Conservatism) Branches of Accounting 1. Financial accounting 2. Management accounting 3. Cost accounting 4. Auditing 5. Tax accounting 6. Government accounting 7. Fiduciary accounting 8. Estate accounting 9. Social accounting (Social and environmental accounting / Social responsibility reporting) 10. Institutional accounting 11. Accounting systems 12. Accounting research Accountig standard bodies and other relevant organizations 1. Financial Reporting Standards Council (FRSC) 15 indviduals & 14 representatives 2. 3. 4. 5. 6. 7. Philippine Interpretations Committee (PIC) Board of Accountancy Securities and Exchange Commission Bureau of Internal Revenue (BIR) Bangko Sentral ng Pilipinas (BSP) Cooperative Development Authority (CDA) International Accounting Standards 1. International Accounting Standards Board (IASB) 2. International Financial Reporting Interpretations Committee (IFRIC) 3. IFRS Advisory Council 4. International Federation of Accountants (IFAC) 5. international Organization of Securities Commissions (IOSO) Continuing Professional Development (CPD) o R.A. No. 101912 is a law mandating and strengthening to the continuing professional development program for all regulated professions, including accountancy profession. Qualitative Characteristics 1. Fundamental (usefulness) a. Relevance (predictive and confirmatory value) ▪ Materiality (cost is not factor ; doctrine of convenience) b. Faithful presentation ▪ Completeness ▪ Neutrality (principle of fairness) ▪ Free from errors 2. Enhancing (enhance the usefulness) a. Verifiability b. Comparability c. Understandability d. Timeliness Recognition of Elements a. Meets the definition of an element. b. Probable future benefits c. Measured Reliability (cost / value) Measurement of Elements 1. Historical cost A: cost at acquisition date L: proceeds received 2. Current cost A: amount of cash to be paid if same asset is acquired currently. L: undiscounted amount of cash required to settle the obligation currently. 3. Realizable value 4. A: value if asset is to be sold L: settlement value Present value A: discounted value L: discounted value Opinions of Auditors Unqualified = no material errors in financial statements Qualified = entity followed with minimal observations Adversed = irregularities but company did not react Disclaimed = error / anomalies (obvious) Agriculture “means farming or the process of producing crops and raising livestock.” PAS 41 [when they relate to agricultural activity] a. Biological assets except bearer plants b. Agricultural produce at the point of harvest c. Unconditional government grants related to biological asset measured at its fair value less costs to sell Biological asset is “a living animal or plant.” a. Consumable biological assets – “harvested as agricultural produce or sold as bological assets.” i. tree cut down for lumber ii. livestock held for sale b. Bearer biological assets – “held to bear produce.” i. livestock where milk is being produced A tree that is intended to be cut down to be used for lumber is a consumable plant, and therefore classified as biological asset. A tree that is intended to bear fruits, and only the fruits are harvested while the tree remains is a bearer plant, and therefore considered as property, plant and equipment. Annual crops that die once their produce has been harvested are considered as consumable plants. (ex. rice) Items Bearer and consumable animals Consumable plants Bearer fruits Produce growing on bearer plants • • • Applicable standard PAS 41 PAS 41 PAS 16 PAS 41 Agricultural produce is “the harvested produce of the entity’s biological assets.” [natural state] Harvest is “the detachment of produce from a biological asset or the cessation of a biological asset’s life processes.” Agricultural produce that are subjected to processing are treated as inventories. [PAS 2] Agricultural activity is “the management by an entity of the biological transformation and harvest of biological assets for sale or for conversion into agricultural produce or into additional biological assets.” Biological transformation – qualitative or quantitative changes in a biological asset. (growth, procreation & degeneration) Measurement of biological assets: • initially and subsequently – fair value less costs to sell. • gain or loss - recognized in profit or loss. If the fair value of a biological asset cannot be reliably determined on initial recognition, it is initially measured at cost and subsequently measured at cost less accumulated depreciation and accumulated impairment losses. Included in costs to sell: • commissions to brokers • levies by regulatory bodies and commodity exchanges • transfer taxes and duties Active market is “a market in which transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis.” Most advantageous market is that market that maximizes the amount that would be received to sell the asset. Agricultural land is accounted for as property, plant and equipment under PAS 16. Government grants that are related to biological assets measured at cost less accumulated depreciation and accumulated impairment losses are accounted for under PAS 20 Accounting for Government Grants and Disclosure of Government Assistance. Under PAS 41, if government grant is: a. Unconditional – recognized in profit and loss when it becomes receivable. b. Conditional - recognized in profit and loss when the attached conditions are met. c. Conditional but the terms of the grant allow part of it to be retained according to the time that has elapsed – a portion of the grant is recognized in profit or loss as time passes. Encouraged Disclosures (encouraged but not required) 1. Disclosure of consumable and bearer biological assets. 2. Disclosure of mature and immature biological assets. Mature biological assets • attained harvestable specifications (consumable) • able to sustain regular harvests (bearer) 3. Disclosure of breakdown of total “Gain/Loss from changes in FVLCS” during the period attributable to price change and physical change. • Useful: production cycle more than one year • Less useful: production cycle less than one year Due to price change means different between prices at the beginning and end of the period. Ignored: changes due to physical growth & age of biological asset at the end. Due to physical change pertains to the difference between prices at the end of the period considering changes in price due to physical growth. Ignored: FVLCS at the beginning of the period. Financial statement presentation: Biological assets are presented in the SFP under the line item “Biological assets.”. These are normally classified as non-current assets. The breakdown is disclosed in the notes. After the point of harvest, agriculutural produce are presented under “Inventories” and are classified as current assets.