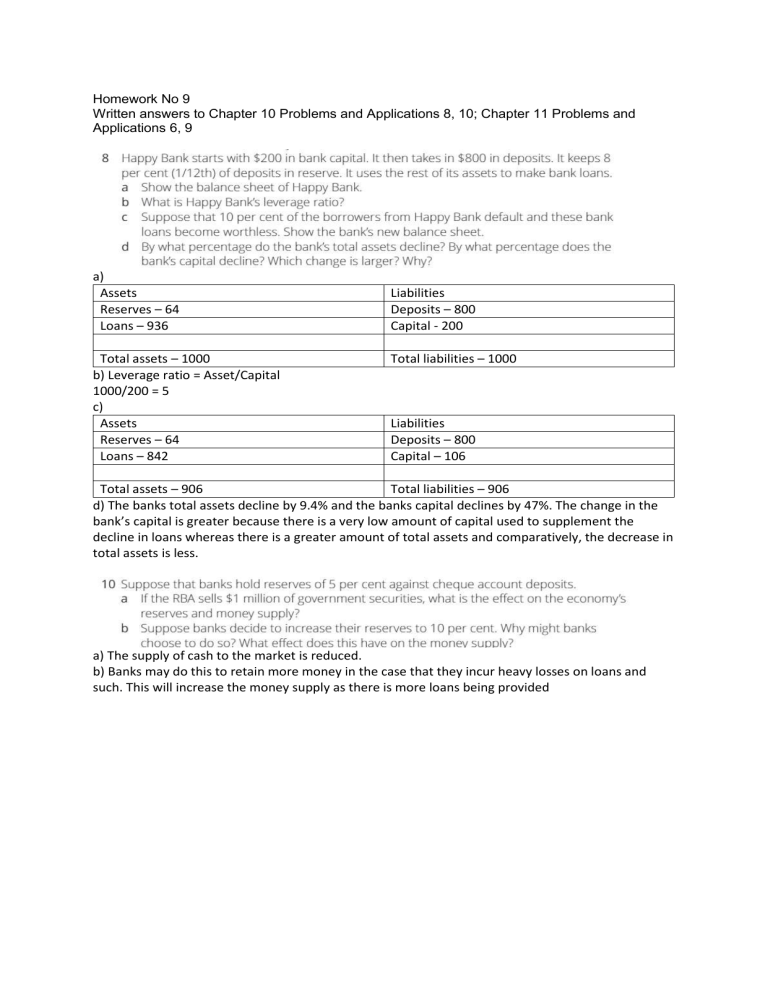

Homework No 9 Written answers to Chapter 10 Problems and Applications 8, 10; Chapter 11 Problems and Applications 6, 9 a) Assets Reserves – 64 Loans – 936 Total assets – 1000 b) Leverage ratio = Asset/Capital 1000/200 = 5 c) Assets Reserves – 64 Loans – 842 Liabilities Deposits – 800 Capital - 200 Total liabilities – 1000 Liabilities Deposits – 800 Capital – 106 Total assets – 906 Total liabilities – 906 d) The banks total assets decline by 9.4% and the banks capital declines by 47%. The change in the bank’s capital is greater because there is a very low amount of capital used to supplement the decline in loans whereas there is a greater amount of total assets and comparatively, the decrease in total assets is less. a) The supply of cash to the market is reduced. b) Banks may do this to retain more money in the case that they incur heavy losses on loans and such. This will increase the money supply as there is more loans being provided a) Inflation was 68.8%. Nick and Aneta were better off by the change in price b) There was inflation of 10%. Nick was better off the change in price and Aneta was unaffected c) There was deflation of 18.8%. Nick and Aneta were both worse off a)