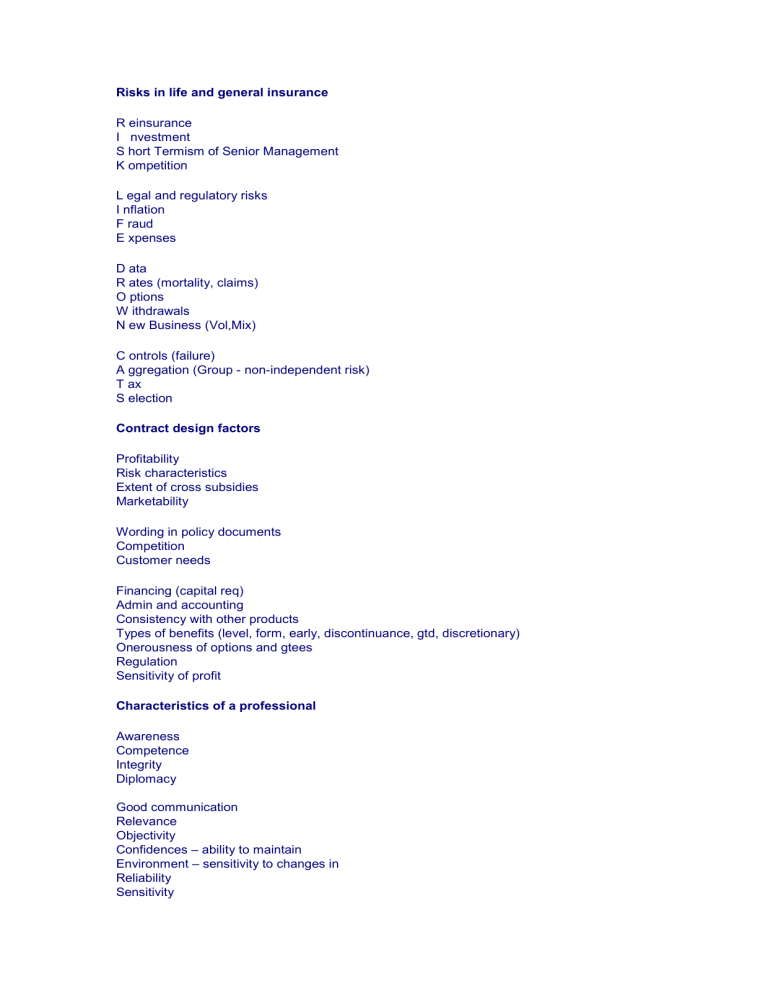

Risks in life and general insurance R einsurance I nvestment S hort Termism of Senior Management K ompetition L egal and regulatory risks I nflation F raud E xpenses D ata R ates (mortality, claims) O ptions W ithdrawals N ew Business (Vol,Mix) C ontrols (failure) A ggregation (Group - non-independent risk) T ax S election Contract design factors Profitability Risk characteristics Extent of cross subsidies Marketability Wording in policy documents Competition Customer needs Financing (capital req) Admin and accounting Consistency with other products Types of benefits (level, form, early, discontinuance, gtd, discretionary) Onerousness of options and gtees Regulation Sensitivity of profit Characteristics of a professional Awareness Competence Integrity Diplomacy Good communication Relevance Objectivity Confidences – ability to maintain Environment – sensitivity to changes in Reliability Sensitivity Insurability Independent risks Data sufficient Ultimate limit on claims Moral hazard minimised Pooling of risk Small probability of occurrence External environment chapter Competition and the underwriting cycle Regulation Environmental and ethical considerations Accounting stds Tax Economics (i, infl, growth, exch rate) Benefits provided by state Institutional structure (mutual or proprietary?) Governance (corporate) Lifestyle Internationalism Social trends Technological advances Reinsurance - reasons for reinsurance Diversification - spreads risk and reciprocal deals Expertise Financial assistance Limits exposure to risk Avoids single large losses and concentration of risk Tax advantages (possible) Opportunity to write larger risks/write more NB/fine tune experience/build up experience Rates seem attractive Smooths profits Capital - reasons for needing Regulatory requirement to demonstrate solvency Expenses of developing new business Guarantees (enables products with them to be written) Credit rating Uncertain/adverse events eg fines, catastrophes Smooth dividends or bonuses Helps show financial strength and attract new business Investment freedom Opportunities eg Merger/growth New business strain and cashflow mismatching Uses of data Statutory returns Investment monitoring Risk management Management information Accounts Pricing Experience investigations Marketing Administration Provisioning Sources of data Tables (eg mortality) Reinsurers Accounts Internal and industrial National statistics Existing products Regulatory returns Similar products Problems with industry data Detail insufficient Recording differences Differences in target market, underwriting, product terms, geographical area, sales channel Out of date Not everyone contributes Errors Quality depends on that of contributors Disclosure of information in a pension scheme - what is disclosed? Directors' pension costs Investment strategy and performance Surplus/deficit arising in last year and surplus/deficit accrued Calculation methods and assumptions Liabilities arising in last year and liabilities accrued Options and guarantees Sponsor's contributions Uncertainties = risks Rights on wind up Expenses Disclosure of information in a pension scheme - when is information disclosed? Payment commencement Request Intervals Combination Entry Why is disclosure important? Sponsor becomes aware of financial significance of benefits Informed decisions can be made Mis-selling avoided Manages the expectations of members Encourages take up Regulatory requirement Security of scheme improved as sponsor/trustees made more accountable Reasons for underwriting Substandard lives (identify and set special terms) Avoid anti-selection Financial underwriting against fraud Experience in line with expected Risk classification to set fair premium Also consider reinsurers, regulators Also there is claims underwriting at the claim stage to assess eligibility of claim Overseas investment problems (practical type problems) Custodian needed Additional Admin required Time delays Expenses incurred Repatriation of funds Political problems and poor regulation Information poorer Language difficulties Liquidity poorer Accounting differences Restrictions on ownership of assets The more fundamental problems are mismatching domestic liabilities, tax, volatility of exchange rate (MTV) Money market instruments - reasons for holding Protect MV Opportunities Uncertain cashflow Recent inflow awaiting investment Short-term liability match General economic uncertainty Recession start Interest rate rises Depreciation of domestic currency SYSTEM T - asset characteristics This is in the notes but doing a full blown SYSTEM T will get you more ideas Security - think of risks in general Yield (running, total return, real vs nominal, compare other investments) Spread (diversification and volatility) Term Expenses and exch rate Marketability Tax NTCC - liability characteristics Nature Term Currency Certainty TRAITOR - investor characteristics Tax status Regulation/solvency requirements Assets already held (diversification) Income vs capital gains (consider cashflow situation) Tastes = preferences = liabilities, education, expertise, tax, fashion Other investors (competitors) and Other investments (alternatives) and Objective Risk appetite Ways of valuing assets Book value Expected utility Discounted cashflow Fair value Ritten up/down book value Arbitrage Market value and smoothed market value Economic value Stochastic modelling Prime property Comparables Age/condition/use/flexibility Location Lease structure Size Tenant quality