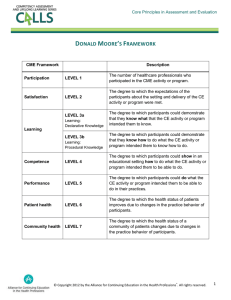

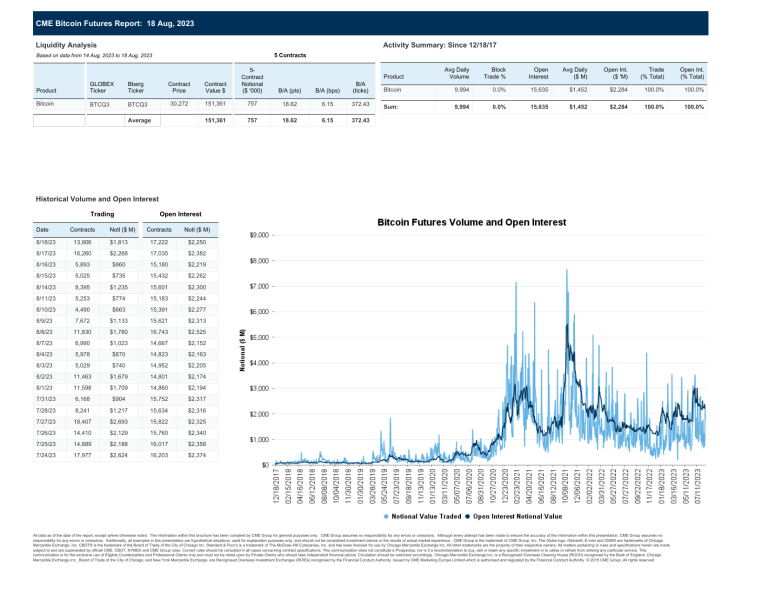

CME Bitcoin Futures Report: 18 Aug, 2023 Activity Summary: Since 12/18/17 Liquidity Analysis 5 Contracts Based on data from 14 Aug, 2023 to 18 Aug, 2023 Product GLOBEX Ticker Bberg Ticker Bitcoin BTCQ3 BTCQ3 Contract Price Contract Value $ 5Contract Notional ($ '000) 30,272 151,361 757 18.62 6.15 372.43 151,361 757 18.62 6.15 372.43 Average Avg Daily Volume Block Trade % Open Interest Avg Daily ($ M) Open Int. ($ 'M) Trade (% Total) Open Int. (% Total) Bitcoin 9,994 0.0% 15,635 $1,452 $2,284 100.0% 100.0% Sum: 9,994 0.0% 15,635 $1,452 $2,284 100.0% 100.0% Product B/A (pts) B/A (bps) B/A (ticks) Historical Volume and Open Interest Trading Date Contracts Notl ($ M) Open Interest Contracts Notl ($ M) 8/18/23 13,906 $1,813 17,222 $2,250 8/17/23 16,260 $2,268 17,035 $2,382 8/16/23 5,893 $860 15,180 $2,219 8/15/23 5,025 $735 15,432 $2,262 8/14/23 8,395 $1,235 15,601 $2,300 8/11/23 5,253 $774 15,183 $2,244 8/10/23 4,490 $663 15,391 $2,277 8/9/23 7,672 $1,133 15,621 $2,313 8/8/23 11,830 $1,780 16,743 $2,525 8/7/23 6,990 $1,023 14,667 $2,152 8/4/23 5,978 $870 14,823 $2,163 8/3/23 5,029 $740 14,952 $2,205 8/2/23 11,463 $1,679 14,801 $2,174 8/1/23 11,598 $1,709 14,860 $2,194 7/31/23 6,168 $904 15,752 $2,317 7/28/23 8,241 $1,217 15,634 $2,316 7/27/23 18,407 $2,693 15,822 $2,325 7/26/23 14,410 $2,129 15,760 $2,340 7/25/23 14,889 $2,188 16,017 $2,358 7/24/23 17,977 $2,624 16,203 $2,374 All data as of the date of the report, except where otherwise noted. The information within this brochure has been complied by CME Group for general purposes only. CME Group assumes no responsibility for any errors or omissions. Although every attempt has been made to ensure the accuracy of the information within this presentation, CME Group assumes no responsibility for any errors or omissions. Additionally, all examples in this presentation are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. CME Group is the trademark of CME Group, Inc. The Globe logo, Globex®, E-mini and CME® are trademarks of Chicago Mercantile Exchange, Inc. CBOT® is the trademark of the Board of Trade of the City of Chicago Inc. Standard & Poor’s is a trademark of The McGraw-Hill Companies, Inc. and has been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, CBOT, NYMEX and CME Group rules. Current rules should be consulted in all cases concerning contract specifications. This communication does not constitute a Prospectus, nor is it a recommendation to buy, sell or retain any specific investment or to utilise or refrain from utilising any particular service. This communication is for the exclusive use of Eligible Counterparties and Professional Clients only and must not be relied upon by Private Clients who should take independent financial advice. Circulation should be restricted accordingly. Chicago Mercantile Exchange Inc. is a Recognised Overseas Clearing House (ROCH) recognised by the Bank of England. Chicago Mercantile Exchange Inc., Board of Trade of the City of Chicago, and New York Mercantile Exchange, are Recognised Overseas Investment Exchanges (ROIEs) recognised by the Financial Conduct Authority. Issued by CME Marketing Europe Limited which is authorised and regulated by the Financial Conduct Authority. © 2015 CME Group. All rights reserved