A multi cut L shaped method for resilient and responsive supply chain network design

advertisement

International Journal of Production Research

ISSN: (Print) (Online) Journal homepage: https://www.tandfonline.com/loi/tprs20

A multi-cut L-shaped method for resilient and

responsive supply chain network design

Fatemeh Sabouhi, Mohammad Saeed Jabalameli, Armin Jabbarzadeh &

Behnam Fahimnia

To cite this article: Fatemeh Sabouhi, Mohammad Saeed Jabalameli, Armin Jabbarzadeh &

Behnam Fahimnia (2020) A multi-cut L-shaped method for resilient and responsive supply

chain network design, International Journal of Production Research, 58:24, 7353-7381, DOI:

10.1080/00207543.2020.1779369

To link to this article: https://doi.org/10.1080/00207543.2020.1779369

Published online: 23 Jul 2020.

Submit your article to this journal

Article views: 1074

View related articles

View Crossmark data

Citing articles: 24 View citing articles

Full Terms & Conditions of access and use can be found at

https://www.tandfonline.com/action/journalInformation?journalCode=tprs20

International Journal of Production Research, 2020

Vol. 58, No. 24, 7353–7381, https://doi.org/10.1080/00207543.2020.1779369

A multi-cut L-shaped method for resilient and responsive supply chain network design

Fatemeh Sabouhia , Mohammad Saeed Jabalamelia∗ , Armin Jabbarzadeha,b and Behnam Fahimniac

of Industrial Engineering, Iran University of Science and Technology, Tehran, Iran; b Department of Systems Engineering, École

de Technologie Supérieure (ETS), University of Quebec, Montreal, Canada; c Institute of Transport and Logistics Studies (ITLS), The

University of Sydney Business School, The University of Sydney, Sydney, Australia

a School

(Received 14 February 2019; accepted 31 May 2020)

We present a stochastic optimisation model that can be used to design a resilient supply chain operating under random

disruptions. The model aims to determine sourcing and network design decisions that minimise the expected total cost while

ensuring that the minimum customer service level is achieved. The proposed model incorporates several resilience strategies

including multiple sourcing, multiple transport routes, considering backup suppliers, adding extra production capacities,

as well as lateral transshipment and direct shipment. A multi-cut L-shaped solution approach is developed to solve the

proposed model. Data from a real case problem in the paint industry is utilised to test the model and solution approach.

Important managerial insights are obtained from the case study. Our analyses focus on (1) exploring the relationship between

supply chain cost and customer service level, (2) examining the impacts of different types of disruptions on the total cost,

(3) evaluating the utility of resilience strategies, (4) investigating the benefits of the proposed solution approach to solve

problems of different sizes and (5) benchmarking the performance of the proposed stochastic programming approach.

Keywords: resilience; disruption risk; stochastic programming; multi-cut L-shaped method; supplier selection; customer

service level

1. Introduction

Today’s supply chains (SCs) have become more complex than ever before due to intense competition in the global market,

changing and escalating customer expectations and rapid technology advancement (Cardoso et al. 2015; Vaez, Sabouhi, and

Jabalameli 2019). Business enterprises heavily invest in their SCs and adopt new and effective strategies to tackle various

problems. In this regard, the design of a supply chain network (SCN) plays a significant role as it has great impacts on a

firm’s responsiveness to expected and unexpected changes (Zokaee et al. 2017; Adenso-Díaz, Mar-Ortiz, and Lozano 2018).

Practically, most SC decisions are made within certain restrictions that are usually imposed by supply chain network design

(SCND) decisions (Farahani et al. 2014). SCND decisions mostly include locating the facilities, establishing the capacity

of each facility and deciding the number of facilities in order to efficiently and effectively fulfill customer demand (Rezaee

et al. 2017; Sadghiani, Torabi, and Sahebjamnia 2015). Since strategic decisions of this type are costly and hard to reverse,

a SCN isdesigned to remain unchanged for several years. Most importantly, it is essential for SCNs to remain resilient to

various disruptions (Snyder, Daskin, and Teo 2007; Jabbarzadeh, Fahimnia, and Seuring 2014).

Although effective design of a SCN helps organisations reduce their operational costs, it may inevitably increase

their vulnerability to random disruptions (Wright 2013; Nooraie and Parast 2016; Shi et al. 2019). Disruption risks arise

from major events such as man-made and natural disasters (e.g. floods, fires, earthquakes, strikes, terrorist attacks, etc.)

(Baghalian, Rezapour, and Farahani 2013; Tang 2006b). Not only can these risks cause negative operational impacts such

as increased order delays and transportation costs, but they also have dramatic consequences on a firm’s economic performance such as productivity reduction or even production failure (Hendricks and Singhal 2005; Jabbarzadeh, Fahimnia,

and Sheu 2017; Peng et al. 2011; Tang 2006a). Earthquakes in China (2008), Indonesia (2009) and Chili (2011 and 2015),

Tsunamis in the India Ocean (2004) and Japan (2011), floods in the Philippines (2013) and Thailand (2011), Strikes in New

York (2005) and India (2016), 2008 Mumbai attacks and 2013 Boston Marathon bombings are recent cases of disruptions

which have affected the performance of many SCs.

These examples and statistics further highlight the necessity of taking disruptions into account when making SCND

decisions and taking initiaves to mitigate such disruption risks. To this end, firms strive to achieve and create resilient SCs

*Corresponding author. Email: jabal@iust.ac.ir

© 2020 Informa UK Limited, trading as Taylor & Francis Group

7354

F. Sabouhi et al.

(Tomlin 2006; Baghalian, Rezapour, and Farahani 2013). A SC is considered resilient when it is able to survive and retain

basic performance until the disruption is over (Pettit, Fiksel, and Croxton 2010; Bhamra, Dani, and Burnard 2011). The

resilience of a SC depends on its design. In other words, firms with effectively designed SCs are usually resilient against

disruptions (Klibi, Martel, and Guitouni 2010). In spite of the numerous articles addressing the concept of resilience, there

exist a handful of modelling efforts in this regard (Gong et al. 2014; Kim, Chen, and Linderman 2015; Khalili, Jolai, and

Torabi 2017; Dehghani et al. 2018). As a result, the development of optimisation models for designing resilient SCs has

attracted the attention of many researchers in recent years (Ivanov, Dolgui, and Sokolov 2018).

Customer service level (CSL) is another metric to measure the responsiveness level of a SC (Rafiei, Safaei, and Rabbani

2018). A responsive SC is one that can effectively cope with market fluctuations and adapt itself to changes in customer

requirements (Holweg 2005; Fattahi, Govindan, and Keyvanshokooh 2017). Different approaches can be used to incorporate

CSL into optimisation models. It may include setting constraints on customer requirements including service time and

fulfillment rate, or defining objective functions such as maximising/minimising the minimum/maximum met/unmet demand

for each customer. The CSL is usually measured through imposing a constraint on minimum fulfillment rate of customer

demand (Hu and Feng 2017; Sharma, Vlosky, and Romagnoli 2013; Gaury, Pierreval, and Kleijnen 2000).

Indeed, higher CSL is shown to reduce lost sales, which accordingly leads to increased customer satisfaction (Liu and

Papageorgiou 2013). Even though designing a SC network that incorporates total network cost with the CSL is a substantial

undertaking for most business enterprises, it can provide a firm with great competitive benefit in global markets (Shen

and Daskin 2005). While the industry practice acknowledges the need for trade-off between total SC cost and the CSL

(Rafiei, Safaei, and Rabbani 2018; Martins et al. 2017), research efforts in this domain have mainly concentrated on total

cost reduction under normal and disruption situations, ignoring the CSL (Melo, Nickel, and Saldanha-Da-Gama 2009;

Cortinhal, Lopes, and Melo 2019).

The extent to which resilience practices impact the responsiveness and total cost of a SC is an under-investigated area

of research, particularly at the SC design level. It is often quite difficult to manage and model a SC when measures of

resilience and responsiveness are incorporated. Given that increasing customer satisfaction has been a primary goal of

today’s SCs, this calls for modelling and optimisation approaches that are capable of integrating SC responsiveness and

resilience practices (Fattahi, Govindan, and Keyvanshokooh 2017). Therefore, this paper is intended to explore how CSL

and resilience improvement can be coupled for designing responsive and resilient SCNs.

Our study contributes to this literature by providing a new stochastic optimisation model for designing a responsive SCN

that is resilient to different types of disruption risks at transport routes and facilities (i.e. suppliers, distribution centres (DCs)

and factories). The model aims to determine sourcing and network design decisions including supplier selection and order

allocation (SS&OA) and the location/capacity of the DCs. Our modelling effort accounts for several resilience strategies

including contracting with backup suppliers, adding extra production capacities, multiple sourcing, multiple transport routes,

lateral transshipment and direct shipment to hedge the SC against disruptions. The primary goal of the model is to minimise

the total SC cost while ensuring that the minimum CSL is satisfied. A multi-cut L-shaped method is developed to cope

with the computationally intractable of the model. The applicability of our model is examined in a real SC involved in the

production-distribution of industrial paints.

Our aim is to answer the following questions. How could we analyse the conflict between CSL and total cost? In what

ways the joint consideration of CSL and resilience could influence outsourcing and network design decisions? What are

the impacts of disruption risks at facilities and transport routes on the total cost? How could we evaluate the advantages of

the resilience strategies to reduce the influences of disruption risks? SC data from an actual-world company is utilised to

examine responses to these questions.

The remainder of this paper is structured as below. In Section 2, the related literature on resilient SC design is briefly

reviewed. The problem is described in Section 3 and the notations and the formulation of the model are presented in

Section 4. Section 5 introduces the solution approach. Section 6 provides the applicability of the proposed model in an

actual-world case along with the obtained managerial and practical insights. Section 7 presents the concluding remarks.

2. Literature review

2.1. Resilience strategies

For a general review of the recent literature in the field of SC resilience and risk, one can refer to Hosseini, Ivanov, and

Dolgui (2019a), Xu et al. (2020), Baryannis et al. (2019), Ivanov et al. (2017), Dolgui, Ivanov, and Sokolov (2018), Ivanov

(2018b), Ivanov and Dolgui (2019a) and Bier, Lange, and Glock (2020). As stated in Section 1, disruption risks contain

unexpected and huge variations such as facilities’ disruptions due to fires, floods and bankrupt and breakdown in shipment caused by the closure of transport routes because of wars, sanctions, terrorist attacks and extreme weather conditions

(Wilson 2007; Chopra, Reinhardt, and Mohan 2007). Snyder et al. (2016) indicate that discussion about disruption risks

International Journal of Production Research

7355

at the strategic level of SC design is an emerging research trend. To ameliorate robustness against such risks, a number of

resilience strategies have been studied in prior research. Tang and Tomlin (2008) show that these strategies can result in

better performance of SCs by creating flexibility.

To deal with disruptions at facilities (e.g. suppliers, factories and DCs), the following strategies can be adopted: (1)

using multiple sourcing, (2) contracting with backup facilities, (3) adding extra supply/production capacities, (4) holding

emergency inventory, and (5) fortifying the facilities.

Multiple sourcing and contracting with backup facilities are common risk mitigation strategies. Despite the high cost of

multiple sourcing in normal circumstances, it is shown to reduce unexpected losses during disruptions (e.g. Namdar et al.

2018; Rezapour, Farahani, and Pourakbar 2017; Meena and Sarmah 2013; Costantino et al. 2012; Feng and Shi 2012).

Backup facilities are reliable facilities that are not affected by disruptions. Hence, contracting with backup facilities can

be employed when primary facilities are unavailable in disruptive events (e.g. Ivanov, Pavlov et al. 2016; Ni, Howell, and

Sharkey 2017; Azad et al. 2013).

Another mitigation strategy is to add extra supply/production capacities to some suppliers/factories to compensate for

their lost capacities in consequence of disruptions (e.g. Rezapour, Farahani, and Pourakbar 2017; Khalili, Jolai, and Torabi

2017). Moreover, holding emergency inventory is utilised to neutralise the risk of fluctuations in disruption conditions (e.g.

Sawik 2013a; Qin, Liu, and Tang 2013; Lee 2017; Lücker, Seifert, and Biçer 2019). Fortification of facilities is another

approach, which is recently tended to be employed by firms to lessen the vulnerability of their facilities to major disruptions (e.g. Sawik 2013b; Sabouhi, Pishvaee, and Jabalameli 2018; Li, Zeng, and Savachkin 2013; Fattahi, Govindan, and

Keyvanshokooh 2017; Jabbarzadeh et al. 2016).

To hedge against disruptions at transport routes, considering multiple transport routes can be an appropriate strategy (e.g.

Ghavamifar, Makui, and Taleizadeh 2018). Two strategies of lateral transshipment and direct shipment can be also applied

to deal with disruptions of both facilities and transport routes. Lateral transshipment allows to redistribute products from

unaffected facilities to centres that face disruptions (e.g. Jabbarzadeh, Haughton, and Khosrojerdi 2018; Ahmadi, Torabi,

and Tavakkoli-Moghaddam 2016). Moreover, this strategy can be used when direct shipment of products between some

nodes of a SC is impossible. Inversely, if there exist disruptions at distribution facilities/transport routes, direct shipment

provides the transportation of products between available facilities (e.g. Esmaeilikia et al. 2016; Cattani, Perdikaki, and

Marucheck 2007).

2.2. Resilient SC design

There are rigorous studies in the literature of SC resilience (e.g. Ivanov and Dolgui 2020; Ivanov and Sokolov 2019; Pavlov

et al. 2017; Ivanov and Dolgui 2019b; Nguyen et al. 2020; He et al. 2020; Rajesh 2019; Liu et al. 2018; Wang et al. 2018;

Tan, Cai, and Zhang 2019; Ruiz-Benítez, López, and Real 2018; Tan, Zhang, and Cai 2019; Pavlov et al. 2019; Macdonald

et al. 2018; Bevilacqua et al. 2019; Singh, Gupta, and Gunasekaran 2018). Considering the ripple effect in the SC, Dolgui,

Ivanov, and Rozhkov (2020), Ivanov (2019), Ivanov (2018a), Hosseini and Ivanov (2019), Hosseini, Ivanov, and Dolgui

(2019b), Li and Zobel (2020), Ojha et al. (2018), Kinra et al. (2019), Li et al. (2019) and Ivanov, Sokolov et al. (2016)

propose simulation-based models in order to identify resilience strategies that can reduce disruption propagation in SCs.

For instance, Li and Zobel (2020) indicate how node risk capacity and network structure can impact the SC resilience in the

face of the ripple effect. The above-cited works do not provide any optimisation model to determine SC design decisions.

Focusing on supplier selection under supply disruptions, some studies address the resilient SC design problem. A mixedinteger non-linear programming model (MINLP) is presented by Meena and Sarmah (2013) to determine order allocation

decisions considering quantity discounts, failure probability and different capacity levels for any supplier. In another study,

Kamalahmadi and Mellat-Parast (2016) propose a stochastic optimisation model to combine SS&OA and transportation

channel selection under supply risks and regional disruptions. Their model considers contingency plans to cope with disruptions and minimises total network cost. Torabi, Baghersad, and Mansouri (2015) formulate a scenario-based bi-objective

possibilistic model to design a resilient SC in the face of disruptions. Their model applies resilience strategies such as holding emergency inventory, fortification of suppliers and contracting with backup suppliers. In addition, they use a Differential

Evolution (DE) algorithm to solve the model.

Lee (2017) develops a stochastic optimisation model, which considers strategies of holding emergency inventory

and contracting with backup suppliers to design a resilient supply portfolio under disruptive events at suppliers and

multiple breakdown quantity discount. Vahidi, Torabi, and Ramezankhani (2018) propose a bi-objective mixed possibilisticstochastic programming model to investigate sustainable SS&OA problem under random disruptions. They suggest a hybrid

SWOT-QFD structure to choose the most relevant sustainability measures. Their model uses the strategies of contracting

with backup suppliers and considering excess supply capacities to augment the resilience of the SC. Utilising a probabilistic

7356

F. Sabouhi et al.

graphical model, Hosseini et al. (2019) compute the likelihood of disruption scenarios for SS&OA problem. Then, they

propose a stochastic bi-objective model considering backup suppliers, excess supply capacities and supplier reliability.

Using value at risk (VaR) and condition value at risk (CVaR) measures, Sawik (2013a, 2013b) propose portfolio methodologies to manage supply risks. Likewise, Namdar et al. (2018) present a stochastic model, according to the measures of VaR

and CVaR, and study the strategies of contracting with backup suppliers and multiple sourcing to cope with potential disruptions of suppliers. Considering a multi-tire SC, Sawik (2019, 2020) develops a decision-making tool to model disruption

mitigation and recovery approaches. None of the above-mentioned works regard network design decisions.

Few studies have attempted to integrate outsourcing and network design decisions when developing a resilient SC

model. For instance, Fahimnia and Jabbarzadeh (2016) focus on exploring the relationship between the sustainability and

resilience at the SC design level by introducing a multi-objective optimisation model to determine sourcing strategies and

location/capacity of factories and DCs decisions. To obtain trade-off solutions for the problem, they develop a stochastic

fuzzy goal programming model.

There exist only a handful of studies that have considered different types of network disruptions in the literature of

resilient SC. Hasani and Khosrojerdi (2016) investigate a resilient SCND problem under correlated disruptions for which

they develop an MINLP robust optimisation model. Their model accounts for different disruption types at facilities (i.e.

suppliers, factories and DCs) and incorporates various mitigation strategies including fortification of facilities, keeping

emergency inventory and multiple sourcing to hedge against such disruption risks. Moreover, a case study of a medical

equipment manufacturer is applied to solve the model utilising a parallel memetic algorithm. Using the fuzzy c-mean

clustering method, Jabbarzadeh, Fahimnia, and Sabouhi (2018) present a hybrid approach for designing a sustainable SC

that is resilient to disruption risks. They develop a stochastic bi-objective optimisation model to maximise the overall

sustainability performance and minimise the expected total cost. Also, they apply different resilience strategies such as

adding extra production capacities, contracting with backup suppliers and multiple sourcing to deal with random disruptions.

Yang, Pan, and Ballot (2017) examine how inventory models utilising Physical Internet cope with disruptions at intermediate stocking points and a supplier. A simulation-based optimisation model is proposed to determine inventory control

decisions. They purely concentrate on sourcing/procurement operations (i.e. reorder point and order quantity). Also, the

developed model does not take into consideration disruptions at transport routes and strategies such as contracting with

backup suppliers, adding extra supply/production capacities, multiple transport routes and direct shipment to protect the SC

against disruptions.

Table 1 illustrates some features of the studies conducted on resilient SC design which are most relevant to the present

research.

2.3. Research gaps

The research gaps are recognised from Table 1 as follows. First, the joint consideration of responsiveness and resilience

of a SC has not been broadly studied in prior research. Second, only a handful of existing works incorporate outsourcing

and network design decisions when building a resilient SC. Also, most of studies do not account for different types of

network disruptions. Third, a limited number of research have considered the proactive strategies such as contracting with

backup suppliers, adding extra production capacities, multiple transport routes and lateral transshipment to enhance the SC

robustness against disruption risks. Fourth, few studies consider effective solution approaches to deal with the complexities

of stochastic models.

Motivated by an actual problem faced by a paint producing company, this paper presents a stochastic optimisation model

to design a responsive and resilient SCN that can be used to determine sourcing and network design decisions. The model

aims to minimise the expected total cost while ensuring that the demand fulfillment percentage is within an acceptable level.

The proposed model is capable of tackling random disruptions at facilities (i.e. suppliers, factories and DCs) and transport

routes utilising different resilience strategies. For solving the optimisation model, a multi-cut L-shaped method is proposed.

3. Problem statement

Figure 1 depicts a graphic illustration of the SCN under investigation which consists of suppliers, factories, DCs and customers. Factories purchase raw materials from backup or primary suppliers to produce products. The products can be

delivered to customers directly by factories or indirectly through DCs. Multiple transport routes with different travel costs

are available to connect SC nodes.

Suppliers, factories, DCs and transport routes are subject to disruption risks. A set of scenarios are defined to indicate

situations in which one or more facilities and transport routes are influenced by disruptions. To improve the SC resilience

under disruption risks, six strategies can be exploited as follows:

Table 1. Features of the published resilient SC design papers.

Decisions

References

Sourcing

Network

design

Type of disruption

Complete

Partial

Vulnerable sections

Suppliers

Torabi, Baghersad, and

Mansouri (2015)

Kamalahmadi and Mellat-Parast

(2016)

Hasani and Khosrojerdi (2016)

Fahimnia and Jabbarzadeh

(2016)

Yang, Pan, and Ballot (2017)

Lee (2017)

Namdar et al. (2018)

Vahidi, Torabi, and

Ramezankhani (2018)

Jabbarzadeh, Fahimnia, and

Sabouhi (2018)

Hosseini et al. (2019)

This paper

DCs

Exact

Multiple sourcing

Holding emergency inventory,

Fortification of suppliers

Holding emergency inventory,

Considering backup suppliers,

Fortification of suppliers

Adding extra supply capacities,

Multiple sourcing

Multiple sourcing, Holding

emergency inventory,

Fortification of suppliers

Multiple sourcing

Resilience strategies

Lateral transshipment, Multiple

sourcing

Considering backup suppliers,

Holding emergency inventory

Considering backup suppliers,

Multiple sourcing

Adding extra supply capacities,

Considering backup suppliers

Adding extra production

capacities, Considering backup

suppliers, Multiple sourcing

Adding extra supply capacities,

Considering backup suppliers,

Multiple sourcing

Adding extra production

capacities, Considering backup

suppliers, Multiple sourcing,

Multiple transport routes,

Lateral transshipment, Direct

shipment

Heuristics

Meta-heuristics

CSL

Case

study

Genetic algorithm

DE algorithm

Parallel memetic

algorithm

Heuristics algorithm

DE algorithm

Multi-cut L-shaped

method

International Journal of Production Research

Meena and Sarmah (2013)

Sawik (2013a, (2013b)

Factories

Solution approach

Transport

routes

7357

7358

F. Sabouhi et al.

Primary Suppliers

Factories

Distribution Centers

Customers

Backup Suppliers

Figure 1. Graphical representation of studied SCN.

•

•

•

•

•

•

Using multiple sourcing,

Adding extra production capacity in factories,

Contracting with backup suppliers,

Considering multiple transport routes,

Applying the lateral transshipment between DCs and

Allowing the direct shipment of products from factories to customers.

We incorporate these strategies in order to develop a two-stage stochastic programming model. The objective is to

minimise the expected total costs of SC while ensuring that the minimum CSL is satisfied. The proposed model determines

the following decisions:

•

•

•

•

•

•

•

The selection of suppliers,

The number and location of DCs,

The quantity of purchase of raw materials from each supplier under each scenario,

The quantity of production in each factory under each scenario,

The flow of products between each node under each scenario,

The quantity of lateral transshipment between each pair of DCs under each scenario and

The quantityof lost sales at customer zones under each scenario.

4. Model formulation

To formulate the problem mathematically, the following notations are used.

Sets:

J

W

M

I

N

R

S

V

U

K

L

L

O

Set of customers, j ∈ J

Set of potential locations for DCs, w, w ∈ W

Set of factories, m ∈ M

Set of backup suppliers, i ∈ I

Set of primary suppliers, n ∈ N

Set of raw material types, r ∈ R

Set of disruption scenarios, s ∈ S

Set of capacity levels in DC, v ∈ V

Set of transport routes for the shipment of raw material types from suppliers to factories, u ∈ U

Set of transport routes for the shipment of products from factories to DCs, k ∈ K

Set of transport routes for the shipment of products from factories to customers, l ∈ L

Set of transport routes for the shipment of products between DCs, l ∈ L

Set of transport routes for the shipment of products from DCs to customers, o ∈ O

International Journal of Production Research

7359

Parameters:

xi

xn

zvw

em

ψrn

ϕri

τrm

qrimu

qrnmu

pm

prm

ymjl

ymwk

tww l

twjo

dj

α

ci

cn

hr

bj

φm

gm

fm

fm

ηrm

πs

νms

gvw

σns

γws

δnmus

βimus

θmwks

εmjls

μww l s

λ wjos

Mbig

Fixed cost of contracting with backup supplier i

Fixed cost of selecting primary supplier n

Fixed cost of opening a DC with capacity level vat location w

Unit cost of preparing extra production capacity in factory m

Equal to 1 if primary supplierncan provide raw material type r; 0, otherwise

Equal to 1 if backup supplier ican supply raw material type r; 0, otherwise

Equal to 1 if factory m can produce raw material type r; 0, otherwise

Unit cost of purchasing raw material type r from backup supplier i and transporting it to factory musing transport route u

Unit cost of purchasing raw material type r from primary supplier n and transporting it to factory musing transport route u

Cost of producing a unit of final product in factory m

Cost of producing a unit of raw material type r in factory m

Unit cost of transportation from factory m to customerjusing transport route l

Unit cost of transportation from factory m to DC wusing transport route k

Unit cost of transshipment between DC w and w using transport route l

Unit cost of transportation from DC w to customerjusing transport route o

Potential demand of customer j

Acceptable service level for each customer

Supply capacity of backup supplier [i]

Supply capacity of primary supplier [n]

Amount of raw material type r required for production of a unit final product

Unit cost of lost sales in customerj

Percentage production capacity of factory m used for producing of a unit final product

Maximum extendable capacity of factory m

Minimum production capacity of factory m

Maximum production capacity of factory m

Percentage production capacity of factory m used for producing of a unit raw material type r

Occurrence probability of scenario s

Percentage production capacity of factory m disrupted under scenario s

Storage capacity of DC wwith capacity level v

Percentage supply capacity of primary supplier n disrupted under scenario s

Percentage storage capacity of DC wdisrupted under scenario s

Equal to 1 if transport route u between primary supplier n and factory m is disrupted under scenario s; 0, otherwise

Equal to 1 if transport route u between backup supplier i and factory m is disrupted under scenario s; 0, otherwise

Equal to 1 if transport route k between factory m and DC wis disrupted under scenario s; 0, otherwise

Equal to 1 if transport route lbetween factory m and customer j is disrupted under scenario s; 0, otherwise

Equal to 1 if transport route l between DC w and w is disrupted under scenario s; 0, otherwise

Equal to 1 if transport route o between DC w and customer j is disrupted under scenario s; 0, otherwise

A big number

Decision variables:

Xi

Xn

Zvw

Qrimus

Qrnmus

Em

Prms

Pms

Ymwks

Ymjls

Bjs

Twjos

Tww l s

1 if backup supplier i is selected, 0 otherwise

1 if primary supplier n is selected, 0 otherwise

1 if DC wwith capacity level v is opened, 0 otherwise

Quantity of raw material type r shipped from backup supplier i to factory m using transport route u under scenario s

Quantity of raw material type r shipped from primary supplier n to factory m using transport route u under scenario s

Additional production capacity in factory m

Quantity of raw material type r manufactured in factory m under scenario s

Quantity of final product manufactured in factory munder scenario s

Quantity of products transported from factory m to DC wusing transport route k under scenario s

Quantity of products transported from factory m to customer jusing transport route lunder scenario s

Quantity of lost sales in customer j under scenario s

Quantity of products transported from DC w to customer jusing transport route o under scenario s

Quantity of products transshipped from DC w to w using transport route l under scenario s

To formulate the problem, a two-stage stochastic programming approach is applied. Following the two-stage stochastic programming approach, the decision variables are split into two types: scenario-dependent and scenario-independent

variables. The decisions on the scenario-independent variables, which are known as first stage decisions, are taken before

the realisation of disruption scenarios. In the proposed model, the decision variables Xn , Xi , Zvw and Em are scenarioindependent. The values of the scenario-dependent variables are made once a disruption scenario is realised. These are

7360

F. Sabouhi et al.

recognised as second stage decisions. All decision variables except for Zvw , Xi , Xn and Em are scenario-dependent(please

refer to Birge and Louveaux (2011) for more details about the two-stage stochastic programming).

The stochastic SCND model is written as below:

Min Z =

xn Xn +

n∈ N

x i X i +

i∈ I

zvw Zvw +

v∈ V w∈ W

em Em

m∈ M

⎡ ⎤

qrnmu Qrnmus +

q rimu Q rimus

⎢ r∈ R n∈ N m∈ M u∈ U

⎥

r∈ R i∈ I

m∈ M

u∈ U

⎢ ⎥

⎢+

⎥

p

P

+

p

P

+

y

Y

rms

m ms

mjl mjls ⎥

rm

⎢

⎢ r∈ R m∈ M

⎥

m∈

M

m∈

M

j∈J

l∈L

⎥

+

πs ⎢

⎢+

⎥

y

Y

+

t

T

mwks

wjo

wjos

⎢

⎥

mwk

s∈ S

⎢ m∈ M w∈ W k∈ K

⎥

w∈ W j∈J o∈ O

⎢ ⎥

⎣+

⎦

t T +

bB

ww l

ww l s

j

w∈ W w ∈ W ,w= w l ∈L

(1)

js

j∈J

Qrnmus ≤ (1 − σns ) cn Xn

∀s ∈ S, ∀n ∈ N

(2)

r∈R m∈M u∈U

Q rimus ≤ c i X i

∀s ∈ S , ∀i ∈ I

(3)

r∈R m∈M u∈U

φm Pms +

ηrm P rms ≤ (1 − νms ) (fm + Em )

r∈R

Y mwks +

Pms ≥ (1 − νms ) (fm )

Em ≤

∀m ∈ M

ψrn Qrnmus +

w∈ W

(5)

(6)

ϕri Q rimus + τrm P rms = hr Pms

Y mwks

∀s ∈ S, ∀r ∈ R,

∀m ∈ M

∀s ∈ S, ∀m ∈ M

w∈ W k∈K

Y mwks +

Tw wl s =

w ∈ W ,w= w l ∈L

T wjos +

w∈ W o∈ O

∀s ∈ S, ∀w ∈ W

(7)

Ymjls +

m∈ M k∈K

gvw Zvw (1 − γws )

v∈V

(8)

i∈I u∈U

j∈J l∈L

(4)

∀s ∈ S, ∀m ∈ M

n∈N u∈U

Pms =

Tw wls ≤

w ∈ W ,w=w l ∈L

m∈ M k∈K

gm

∀s ∈ S, ∀m ∈ M

T wjos +

j∈J o∈O

Ymjls + Bjs = dj

(9)

Tww l s

∀s ∈ S, ∀w ∈ W

(10)

w ∈ W ,w= w l ∈L

∀s ∈ S, ∀j ∈ J

(11)

m∈M l∈L

o∈ O

T wjos +

j∈J

l∈L

dj

Zvw ≤ 1

Ymjs

≥α

∀s ∈ S, ∀j ∈ J

∀w ∈ W

(12)

(13)

v∈V

Qrnmus ≤ (1 − δnmus ) cn

∀s ∈ S, ∀u ∈ U,

∀m ∈ M , ∀n ∈ N

(14)

Q rimus ≤ (1 − βimus ) ci

∀s ∈ S, ∀u ∈ U,

∀m ∈ M , ∀i ∈ I

(15)

r∈R

r∈R

≤ (1 − θmwks ) (fm + gm )

Ymwks

Twjos

≤ (1 − λwjos ) Mbig

∀s ∈ S, ∀w ∈ W ,

∀k ∈ K, ∀m ∈ M

∀s ∈ S, ∀o ∈ O,

∀j ∈ J, ∀w ∈ W

(16)

(17)

International Journal of Production Research

∀s ∈ S, ∀m ∈ M ,

∀j ∈ J, ∀l ∈ L

Ymjls ≤ (1 − εmjls ) (fm + gm )

Tww l s ≤ (1 − μww l s ) Mbig

Xn , Xi , Zvw ∈ {0, 1}

Em ≥ 0

∀w ∈ W , ∀l ∈ L

∀w ∈ W , ∀s ∈ S

∀n ∈ N, ∀i ∈ I,

∀w ∈ W , ∀v ∈ V

∀m ∈ M

7361

(18)

(19)

(20)

(21)

Qrnmus , Q rimus , Pms , P rms , Ymjls ,

∀u ∈ U, ∀m ∈ M ,

∀n ∈ N, ∀s ∈ S,

∀w ∈ W , ∀i ∈ I,

Y mwks , Tww l s , T wjos , Bjs ≥ 0

∀r ∈ R, ∀l ∈ L,

∀o ∈ O, ∀k ∈ K,

∀w ∈ W , ∀l ∈ L ,

∀j ∈ J,

(22)

The objective function (1) aims at minimising the expected total SC costs. The cost components include cost of selecting

primary and backup suppliers, cost of establishing DCs, cost of preparing additional production capacity in factories, cost

of purchasing and shipment of raw materials from suppliers to factories, production cost (both raw materials and final

products) in factories, transportation cost of products from factories to customers directly, from factories to DCs, and from

DCs to customers, transshipment cost, and cost of lost sales. Constraint sets (2)–(5) are the capacity constraints for the

primary suppliers, backup suppliers, factories and DCs, respectively. Constraint set (6) enforces the minimum production

in the factories. Constraint set (7) limits the maximum extendable production capacities for each factory. Constraint set (8)

warrants that the required raw material in factories is satisfied. Constraint sets (9)–(11) declare the flow balance constraints

at the factories, DCs and customers, respectively. Constraint set (12) ensures the minimum service level for each customer

under each scenario. More precisely, the proportion of the products transported to a customer through the facilities of the

SC to same customer’s demand must not be less than service level α. Constraint set (13) aims to avoid locating more

than one DC at each candidate location. Constraint sets (14)–(19) enforce that there exists no flow of products by the

disrupted links between suppliers and factories, factories and DCs, DCs and customers, factories and customers and DCs

together, respectively. For example, the objective of constraints (17) and (19) in the model is just to ensure that there would

be no product flows between DCs and customers when the connecting links are disrupted. In these constraints, Mbig is a

big number. One possible value for Mbig is v∈V gvw since the quantity of flows cannot exceed the total capacities of DCs.

Constraint sets (20)–(22) determine the problem’s decision variable types.

5. Solution approach

As the scenarios grow in number, the size of the problem increases exponentially (You, Wassick, and Grossmann 2009; Gao

and You 2015). We present an extension of Benders decomposition algorithm, named multi-cut L-shaped method that aims

to speed up the algorithm convergence process.

The multi-cut L-shaped method was first developed by Van Slyke and Wets (1969) and has since been recognised as

a powerful and efficient algorithm to solve large stochastic models (You, Wassick, and Grossmann 2009; Garcia-Herreros,

Wassick, and Grossmann 2014; Restrepo, Gendron, and Rousseau 2017). This method decomposes the original problem into a sub-problem (SP) and a master problem (MP). In general, the MP includes first stage decisions while the

SP involves second stage decisions (Jeihoonian, Zanjani, and Gendreau 2017). Due to the angular structure of two-stage

programming models, the SP can be decomposed into scenario sub-problems (You, Wassick, and Grossmann 2009). The

method provides the lower and upper bounds of the original problem through solving the MP and dual sub-problem (DSP),

respectively.

The multi-cut L-shaped method consists of three steps: (1) developing the SP, (2) finding an upper bound (UB) for optimal solutions and (3) obtaining a lower bound (LB) for optimal solutions. Steps (2) and (3) are iterated until the convergence

of the algorithm is obtained. More precisely, once the LB and UB meet a prescribed gap, the algorithm is converged. In the

following subsections, these steps are discussed to solve the model introduced in Section 4.

7362

F. Sabouhi et al.

5.1. Developing the SP

Let us fix the first stage decisions (Xn = X̄n , Xi = X¯ i , Zvw = Z̄vw , Em = Ēm ). For each scenario s, the SP is represented as

below:

Min SP =

qrnmu Qrnmus +

r∈ R n∈ N m∈ M u∈ U

+

q rimu Q rimus +

r∈ R i∈ I m∈ M u∈ U

ymjl Ymjls +

m∈ M j∈J l∈L

+

p rm P rms +

r∈ R m∈ M

y mwk Y mwks +

m∈ M w∈ W k∈ K

t wjo T wjos +

pm Pms

m∈ M

tww l Tww l s

w∈ W w ∈ W ,w= w l ∈L

w∈ W j∈J o∈ O

bj Bjs

(23)

j∈J

Qrnmus ≤ (1 − σns ) cn X̄n

∀n ∈ N

(24)

r∈R m∈M u∈U

Q rimus ≤ c i X¯ i

∀i ∈ I

(25)

r∈R m∈M u∈U

φm Pms +

ηrm P rms ≤ (1 − νms ) (fm + Ēm )

r∈R

Y mwks +

Tw wl s ≤

w ∈ W ,w=w l ∈L

m∈ M k∈K

∀m ∈ M

(26)

gvw Z̄vw (1 − γws )

Pms ≥ (1 − νms ) (fm ) ∀m ∈ M

ψrn Qrnmus +

ϕri Q rimus + τrm P rms = hr Pms

n∈N u∈U

Pms =

T wjos +

∀m ∈ M , ∀r ∈ R

(29)

Tw wl s =

(30)

T wjos +

j∈J o∈O

Ymjls + Bjs = dj

∀j ∈ J

Tww l s

∀w ∈ W

(31)

w ∈ W ,w= w l ∈L

(32)

m∈M l∈L

o∈ O

T wjos +

j∈J

l∈L

Ymjls

≥α

∀j ∈ J

(33)

Qrnmus ≤ (1 − δnmus ) cn

∀u ∈ U, ∀m ∈ M ,

∀n ∈ N

(34)

Q rimus ≤ (1 − βimus ) ci

∀m ∈ M , ∀u ∈ U,

∀i ∈ I

(35)

r∈R

(28)

∀m ∈ M

w ∈ W ,w= w l ∈L

dj

Y mwks

w∈ W k∈K

Y mwks +

w∈ W o∈ O

w∈ W

Ymjls +

m∈ M k∈K

(27)

i∈I u∈U

j∈J l∈L

∀w ∈ W

v∈V

r∈R

≤ (1 − θmwks ) (fm + gm )

Ymwks

≤ (1 − λwjos )

Twjos

gvw

v∈V

∀o ∈ O, ∀j ∈ J,

∀w ∈ W

Ymjls ≤ (1 − εmjls ) (fm + gm )

Tww l s ≤ (1 − μww l s )

v∈V

∀m ∈ M , ∀k ∈ K,

∀w ∈ W

gvw

∀m ∈ M , ∀j ∈ J,

∀l ∈ L

∀w ∈ W , ∀l ∈ L

∀w ∈ W (36)

(37)

(38)

(39)

International Journal of Production Research

7363

∀u ∈ U, ∀m ∈ M ,

∀n ∈ N, ∀w ∈ W ,

∀i ∈ I, ∀r ∈ R,

∀l ∈ L, ∀w ∈ W ,

∀o ∈ O, ∀l ∈ L ,

∀j ∈ J, ∀k ∈ K

Qrnmus , Q rimus , Pms , P rms , Ymjls ,

Y mwks , Tww l s , T wjos , Bjs ≥ 0

(40)

5.2. Finding an UB

To obtain an UB for the objective function of original problem at each iteration, we define a1 , . . . , a16 as the dual variables

related to the SP’s constraints. The DSP for each scenario s is stated as follows:

Max DSP = −

(1 − σns ) cn X̄n a1ns −

n∈ N

+

(1 − νms ) (f

5

m ) ams

+

dj a9js

j∈ J

(1 − βimus ) c i a12

imus −

i∈ I m∈ M u∈ U

−

+

(1 − νms ) (fm + Ēm ) a3ms −

m∈ M

α dj a10

js

−

j∈ J

gvw Z̄vw (1 − γws ) a4ws

v∈ V w∈ W

(1 − δnmus ) cn a11

nmus

n∈ N m∈ M u∈ U

(1 − θmwks ) (fm + g m ) a13

mwks

m∈ M w∈ W k∈K

(1 − λwjos ) gvw a14

wjos −

w∈ W j∈ J o∈ O v∈V

−

c i X¯ i a2is −

i∈ I

m∈ M

−

(1 − εmjls ) (fm + g m ) a15

mjls

m∈ M j∈ J l∈L

(1 − μww l s ) gvw a16

ww l s

(41)

∀u ∈ U, ∀m ∈ M

∀r ∈ R, ∀n ∈ N

(42)

w∈ W w ∈ W l ∈ L v∈V

− a1ns + a6mvs − a11

nmus ≤ qrnmu

− a2is + a6mvs − a12

imus ≤ qrimu

∀u ∈ U, ∀m ∈ M

∀r ∈ R, ∀i ∈ I

− ηrm a3ms + τrm a6mvs ≤ prm ∀r ∈ R, ∀m ∈ M

− φm a3ms + a5ms −

hr a6mvs + a7ms ≤ pm ∀m ∈ M

(43)

(44)

(45)

r∈R

15

− a7ms + a9js + a10

js − amjls ≤ ymjl

∀m ∈ M , ∀j ∈ J,

∀l ∈ L

− a4ws − a7ms + a8ws − a13

mwks ≤ ymwk

14

− a8ws + a9js + a10

js − awjos ≤ twjo

∀o ∈ O, ∀j ∈ J,

∀w ∈ W

− a4ws + a8w s − a8ws − a16

ww l s ≤ tww l

a9js ≤ bj

∀k ∈ K, ∀m ∈ M ,

∀w ∈ W

∀l ∈ L , ∀w ∈ W ,

w = w , ∀w ∈ W

∀j ∈ J

(47)

(48)

(49)

(50)

11

a1ns , a2is , a3ms , a4ws , a5ms , a10

js , anmus ,

13

14

15

16

a12

imus , amwks , awjos , amjls , aww l s ≥ 0

a6mrs , a7ms , a8ws , a9js free

(46)

∀r ∈ R, ∀u ∈ U,

∀m ∈ M , ∀n ∈ N,

∀j ∈ J, ∀o ∈ O,

∀w ∈ W , ∀i ∈ I,

∀k ∈ K,

∀m ∈ M , r ∈ R

∀j ∈ J, ∀w ∈ W

(51)

(52)

7364

F. Sabouhi et al.

As it can be seen from DSP formulation, instead of getting one solution in each iteration, we can obtain a set of solutions

to determine an UB for the original problem. In other words, if at each iteration DSP is bounded for all scenarios, the sum

of optimal values of DSP under each scenario makes an UB for the objective function of the original problem.

5.3. Obtaining a LB

Based on the solution of the DSP, the MP canprovide a LB for the original problem at each iteration. It is written as below:

Min MP =

xn Xn +

x i X i +

zvw Zvw +

em Em +

πs s

(53)

n∈ N

s ≥ −

i∈ I

v∈ V w∈ W

(1 − σns )

cn Xn ā1iter

ns

−

n∈ N

+

ciX

2iter

i āis

i∈ I

(1 − νms ) (f m ) ā5iter

ms +

m∈ M

−

m∈ M

dj ā9iter

+

js

×(1 − βimus ) c i ā12iter

imus

(1 −

−

w∈ W

0≥−

w ∈ W l ∈ L

λwjos ) gvw ā14iter

wjos

−

v∈V

gvw Zvw (1 −

γws ) ā¯ 4iter

ws

+

v∈ V w∈ W

−

×(1 − δnmus ) cn ā¯ 11iter

nmus −

−

×(1 − δnmus ) cn ā11iter

nmus

(1 − θmwks ) (fm + g m ) ā13iter

mwks

m∈ M w∈ W k∈K

(1 − εmjls ) (fm + g m ) ā15iter

mjls

(54)

(1 − νms ) (fm + Em ) ā¯ 3iter

ms

m∈ M

(1 − νms ) (f m ) ā¯ 5iter

ms +

dj ā¯ 9iter

+

js

j∈ J

×(1 − βimus ) c i ā¯ 12iter

imus

α dj ā¯ 10iter

js

j∈ J

∀s ∈ S, ∀iter

i∈ I m∈ M u∈ U

(1 − θmwks ) (fm + g m ) ā¯ 13iter

mwks −

m∈ M w∈ W k∈K

m∈ M

n∈ N m∈ M u∈ U

−

v∈ V w∈ W

n∈ N m∈ M u∈ U

c i X i ā¯ 2iter

−

is

i∈ I

gvw Zvw (1 − γws ) ā4iter

ws

(1 − μww l s ) gvw ā16iter

ww l s

n∈ N

−

α dj ā10iter

−

js

m∈ M j∈ J l∈L

(1 − σns ) cn Xn ā¯ 1iter

ns −

∀s ∈ S, ∀iter −

w∈ W j∈ J o∈ O v∈V

(1 − νms ) (fm + Em ) ā3iter

ms −

j∈ J

i∈ I m∈ M u∈ U

−

s∈ S

m∈ M

j∈ J

−

(1 − λwjos ) gvw ā¯ 14iter

wjos

w∈ W j∈ J o∈ O v∈V

(1 − εmjls ) (fm + g

m∈ M j∈ J l∈L

s ≥ 0 ∀s ∈ S

¯ 15iter

m ) āmjls

−

(1 − μww l s ) gvw ā¯ 16iter

ww l s

(55)

w∈ W w ∈ W l ∈ L v∈V

(56)

Constraints (7), (13), (20) to (21).

Eqs. (54) and (55) indicate the set of optimality and feasibility cuts generated at any iteration, where ā1iter , . . . , ā16iter

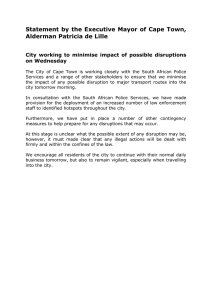

and ā¯ 1iter , . . . , ā¯ 16iter are the extreme points and rays obtained by solving the DSP at iteration iter. Figure 2 illustrates the

pseudocode of the multi-cut L-shaped algorithm.

6. Model implementation and evaluation

6.1. The case study

Industrial paints provide a protective coating for the substrate such as steel and concrete against chemical and physical

attacks. These paints prolong the overall product lifetime and hence reduce replacement costs. In addition to the primary

purpose of their use, industrial paints can give the product a pleasing appearance which is considered as a value-added

from a marketing perspective. The raw materials for producing the industrial paints include solvents, resins, pigments and

additives.

Demand for industrial paints in Asian countries is expected to rise about 8–10% per year by 2020 as the region accounts

for the largest share of the global consumption. Industrial paints are utilised in various industries such as construction,

architectural, aerospace, automotive and electronics. The Iranian Paint and Resin Industry (IPRI), as one of the main manufacturers of industrial paints in Asia, began its activities in 1965. Not only is the IPRI produce and distribute industrial

International Journal of Production Research

7365

Table 2. Characteristics of the case study.

Case study

|N|

|I|

|M |

|J|

| W|

|R|

|S|

| V|

|U|

|K|

|O|

|L|

|L |

5

1

7

7

6

4

30

2

2

2

2

1

1

paints in the Iranian market, it also exports them to neighbour countries such as Turkmenistan and Afghanistan. Industrial

paint is applied widely in the automotive industry.

IPRI has factories in seven cities including Isfahan, Karaj, Varamin, Tabriz, Arak, Qazvin and Shabestar. The required

solvents at each factory can be sourced from suppliers (petrochemical companies) located in Isfahan, Bushehr, Ahvaz,

Tabriz, Abadan and Asaloyeh cities. To improve the cost efficiency of manufacturing industrial paints, the factories are also

able to produce other raw materials (i.e. pigments, additives and resins). IPRI has main customers in Nishapur, Bam, Karaj

and Golpayegan cities who are supplied by the factories either directly or indirectly through six DCs in Yazd, Semnan,

Hamadan, Qom, Gilan and Shiraz provinces. DCs can be established in two sizes: medium and large denoted as M and L,

respectively. DCs with large size have more storage capacity and establishing cost than DCs with medium size. There are

two transport routes between each pair of supplier-factory, factory-DC and DC-customer. Also, there is a single transport

route between each factory and customer, and between DCs. Figure 3 shows the location of suppliers, factories, DCs and

customers. Also, Tables 2 and 3 illustrate the characteristics of the case study and the estimated demand for each market,

respectively.

Iran is widely considered as the most vulnerable country to disruption risks posed by disasters such as floods, strikes and

earthquakes (Sabzehchian et al. 2006; Sabouhi et al. 2018; Sabouhi et al. 2019). This issue has motivated IPRI managers to

design a more resilient SCN. For this purpose, the experts evaluated the disruption risks of petrochemical sites, factories,

DCs and transport routes between the nodes of the SC and grouped the disruption scenarios according to three scales: large,

medium and small. The characteristics of the disruption scenarios of facilities are summarised in Table 4. In our case study,

Multi-cut L-shaped algorithm

LB

,UB

, iteration

0,UB (iteration )

0

While (termination=yes)

Solve the MP

LB

MP

*

For each scenario

s do

Solve the DSP

If the DSP is unbounded then

Generate the relevant feasibility cut

else

UB (iteration )

UB (iteration ) DSP

*

Produce the relevant optimality cut

If the DSP is bounded for all of scenarios

UB

UB (iteration )

n N

If (UB

LB

xn X n

Gap ) then

termination

true

else

Add generated cuts to the MP

iteration

iteration

1

Stop;

Figure 2. Pseudocode of the multi-cut L-shaped algorithm.

i I

xi X i

v V w W

z vw Z vw

m M

em E m

7366

F. Sabouhi et al.

Table 3.

markets.

Customer

1

2

3

4

5

6

7

Product demand in different

Demand(unites)

2400

3800

480

24

220

156

200

we focused on complete disruptions at transport routes. In other words, it was assumed that there are only two possible states

for each route: disrupted or not disrupted. Tables 5 and 6 indicate which routes (upstream or downstream) are disrupted

under each scenario. These routes are labelled n − m − u, i − m − u, m − w − k, w − j − o, m − j − l and w − w − l in

Columns 3–8 of these two tables, respectively. For instance, route ‘2-5-1’ in the 6th column of Table 5 represents that the

first transport route between DC 2 and customer 5 is completely disrupted. To mitigate the impact of these disruptions, six

proactive strategies were considered: (1) using multiple sourcing, (2) adding extra production capacities to factories, (3)

Supplier

Factory

DC

Customer

Figure 3. The SC configuration in IPRI.

International Journal of Production Research

7367

Table 4. Characteristics of the facility disruption scenarios.

percentage lost capacity

of each factory (νms )

percentage lost capacity

of each supplier (σns )

Disruption scale

Small

Medium

Large

percentage lost capacity

of each DC (γws )

Scenario

1

2

3

4

5

6

1

2

3

4

5

6

7

1

2

3

4

5

6

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

0

2

5

5

6

7

8

8

9

10

10

12

14

15

15

18

18

19

20

20

25

25

30

30

35

35

38

38

40

40

5

10

10

12

12

15

15

18

18

20

22

24

24

25

25

28

28

30

30

30

35

35

40

40

45

45

45

48

50

50

0 10

5 12

10 15

10 15

12 18

12 20

15 25

15 30

18 35

20 40

20 40

24 40

25 42

25 43

25 44

28 45

28 45

29 48

30 48

30 50

30 50

35 60

35 65

40 70

40 75

45 80

45 85

50 90

50 95

50 100

8

10

12

15

15

18

20

25

27

30

32

32

35

35

36

36

38

39

40

40

45

45

48

48

50

55

60

65

68

70

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

5

5

10

10

12

12

15

15

20

20

20

24

24

25

25

25

28

28

30

30

30

30

35

35

35

40

40

45

45

50

5

10

10

10

12

12

15

15

20

20

20

20

25

25

25

28

30

30

30

30

35

35

40

40

45

45

50

50

50

50

5

10

10

12

12

15

15

18

18

20

22

24

24

25

25

28

28

30

30

30

35

35

40

40

45

45

45

48

50

50

10

10

12

12

15

15

20

20

25

30

30

32

35

35

35

38

38

40

40

40

40

45

45

50

55

60

65

70

75

80

8

10

10

15

15

20

20

25

25

30

30

35

35

35

38

38

38

40

40

40

45

45

48

48

50

52

55

55

58

60

5 10

5 15

10 20

12 20

12 25

12 25

15 30

15 30

15 35

20 40

22 40

22 40

24 45

24 45

25 45

25 48

28 48

28 48

28 50

30 50

30 55

35 60

35 60

40 65

40 70

45 75

45 80

50 85

50 90

50 100

2

2

5

5

5

8

8

9

9

10

11

11

12

12

15

15

18

18

20

20

22

25

30

30

35

35

38

40

40

40

0

5

5

5

6

6

8

8

10

10

10

12

12

15

15

18

18

20

20

20

25

30

30

35

35

36

36

38

38

40

10

10

15

20

20

25

25

30

30

30

32

32

34

34

35

35

36

38

38

40

45

50

55

55

60

65

70

75

85

90

0

2

5

5

6

7

8

8

9

10

11

12

14

14

15

15

18

18

20

20

20

25

25

30

30

35

35

35

40

40

5

5

10

10

12

12

15

15

20

20

22

24

24

25

25

28

28

30

30

30

30

35

40

45

45

48

48

50

50

50

0

5

10

10

10

12

15

18

20

20

20

20

25

25

25

28

28

30

30

30

35

35

35

40

40

45

45

48

48

50

considering multiple transport routes, (4) contracting with the backup supplier (the supplier located in Tabriz was regarded

as the backup supplier), (5) applying the lateral transshipment between DCs and (6) allowing the direct shipment of products

from factories to customers.

To keep customers satisfied, the industry experts considered three levels 0.6, 0.75 and 0.9 to ensure the minimum

fulfillment rate of customers’ demand under each scenario.

We utilised the proposed approach in this paper to design the IPRI’s SCN. The numerical results and different sensitivity

analyses are presented in the following sections.

6.2. Computational results

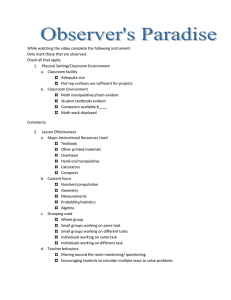

We now present the initial results obtained from implementing the model on the case study. Figure 4 depicts the total cost

breakdown given different CSLs. The expected production costs take approximately more than half of the total cost. Also,

the expected purchasing costs account for a considerable portion of the total cost, at roughly 20%. These results confirm the

importance of purchasing and production strategies to mitigate SC costs.

The expected lost sales and fixed costs depend on CSLs. Therefore, with rise in the CSL (i.e. α) the expected costs

of lost sales decrease, while the fixed costs increase. More specifically, when the CSL increases, the SC needs to involve

more facilities in supply, production and distributions parts to ensure the minimum fulfillment rate of customers’ demands,

which results in increasing the fixed costs and decreasing the expected lost sales costs. For example, as the CSL moves from

α =0.6 to α =0.9, the expected lost sales and fixed cost shares of the total cost change from 14% to 7% and 3% to 15%,

respectively. Figure 4 illustrates the trade-off between the costs of logistics and lost sales under different CSLs. The results

indicate that an increase in the CSL value causes an increase in logistics cost and a decrease in lost sales cost.

7368

Table 5. The impacted routes under each scenario of disruption for small and medium size problems.

Disruption scale Scenario

Small

i − m − u (βimus )

m − w − k (θmwks )

w − j − o (λ wjos )

m − j − l (εmjls )

w − w − l (μww l s )

–

–

–

–

–

–

–

–

–

1-7-1

1-7-1

1-7-1

1-7-1, 2-6-1

1-7-1, 2-6-1

1-7-1, 2-6-1, 3-3-1

–

–

–

–

–

–

–

–

–

1-4-1

1

2

3

4

5

6

7

8

9

10

–

1-2-2

1-2-2, 1-4-1

1-2-2, 1-4-1, 2-1-1

1-2-2, 1-4-1, 2-1-1

1-2-2, 1-4-1, 2-1-1, 2-2-2

1-2-2, 1-4-1, 2-1-1, 2-2-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1

–

–

–

–

–

–

–

–

6-1-1

6-1-1

5-6-2

1-1-1, 5-6-2

1-1-1, 5-6-2

1-1-1, 5-6-2

1-1-1, 5-6-2, 1-1-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-5-1

2-5-1, 2-6-2

2-5-1, 2-6-2, 3-5-1

2-5-1, 2-6-2, 3-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1

2-5-1, 2-6-2, 3-5-1, 3-6-1

2-5-1, 2-6-2, 3-5-1, 3-6-1

11

12

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2, 2-6-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2, 2-6-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2, 2-6-2, 4-1-1

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2, 2-6-2, 4-1-1, 4-6-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1, 2-3-2,

2-4-2 2-5-2, 2-6-2, 4-1-1, 4-6-2

6-1-1

6-1-1

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2

1-7-1, 2-6-1, 3-3-1

1-7-1, 2-6-1, 3-3-1 4-5-1

1-4-1

1-4-1

6-1-1

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

1-7-1, 2-6-1, 3-3-1 4-5-1

1-4-1

6-1-1

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1, 4-2-2

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1, 4-2-2

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1, 4-2-2

1-1-1, 5-6-2, 1-1-2, 6-3-2, 2-3-2

6-4-1, 4-2-2, 7-3-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1

1-4-1

1-7-1, 2-6-1, 3-3-1 4-5-1

1-4-1, 2-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1, 5-1-1

1-4-1, 2-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1, 5-1-1

1-4-1, 2-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1, 5-1-1

1-4-1, 2-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1, 5-1-1

1-4-1, 2-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1, 5-1-1, 6-7-1

1-4-1, 2-6-1

13

14

15

16

17

18

19

20

6-1-1

6-1-1, 6-2-2

6-1-1, 6-2-2

6-1-1, 6-2-2

6-1-1, 6-2-2

6-1-1, 6-2-2

F. Sabouhi et al.

Medium

n − m − u (δnmus )

Table 6. The impacted routes under each scenario of disruption for large size problems.

Disruption

scale

Large

n − m − u (δnmus )

i − m − u (βimus )

21

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1, 4-1-2 3-4-1

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1, 4-1-2

3-4-1, 3-5-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1, 4-1-2

3-4-1, 3-5-2, 3-6-2, 4-2-1, 4-5-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1, 4-1-2

3-4-1, 3-5-2, 3-6-2, 4-2-1, 4-5-2,

5-3-2, 5-4-2, 5-5-2

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1, 4-1-2

3-4-1, 3-5-2, 3-6-2, 4-2-1, 4-5-2,

5-3-2, 5-4-2, 5-5-2 5-6-2, 5-7-2,

5-2-2, 5-1-2, 4-7-2, 3-1-1

1-2-2, 1-4-1, 2-1-1, 2-2-2, 3-7-2, 4-3-1,

2-3-2, 2-4-2 2-5-2, 2-6-2, 4-1-1,

4-6-2, 3-1-2, 3-2-1, 3-3-1, 4-1-2

3-4-1, 3-5-2, 3-6-2, 4-2-1, 4-5-2,

5-3-2, 5-4-2, 5-5-2 5-6-2, 5-7-2,

5-2-2, 5-1-2, 4-7-2, 3-1-1, 4-4-1,

4-5-1, 3-5-1

6-1-1, 6-2-2

22

23

24

25

26

27

28

29

30

m − w − k (θmwks )

w − j − o (λ wjos )

m − j − l (εmjls )

w − w − l (μww l s )

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2, 5-1-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2, 5-1-2, 5-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1

1-4-1, 2-6-1 3-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1

1-4-1, 2-6-1 3-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1

1-4-1, 2-6-1 3-5-1, 4-5-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2, 1-5-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2, 1-5-2

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1

1-4-1, 2-6-1 3-5-1, 4-5-1

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1

1-4-1, 2-6-1 3-5-1, 4-5-1

5-6-1

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1

1-4-1, 2-6-1 3-5-1, 4-5-1

5-6-1, 6-1-1

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2, 5-1-2, 5-5-1

5-5-2

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2, 5-1-2, 5-5-1

5-5-2, 3-2-2

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2, 1-5-2

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1, 1-4-1

1-4-1, 2-6-1 3-5-1, 4-5-1

5-6-1, 6-1-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2, 1-5-2, 1-6-2

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1, 1-4-1

1-4-1, 2-6-1 3-5-1, 4-5-1

5-6-1, 6-1-1

6-1-1, 6-2-2, 6-3-1 6-5-1

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2, 5-1-2, 5-5-1

5-5-2, 3-2-2, 1-4-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2, 1-5-2, 1-6-2 1-4-2

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1, 1-4-1,

7-3-1

1-4-1, 2-6-1 3-5-1, 4-5-1

5-6-1, 6-1-1

6-1-1, 6-2-2, 6-3-1 6-5-1

1-1-1, 5-6-2, 1-1-2, 6-3-2

2-3-2, 6-4-1, 4-2-2, 7-3-2

4-5-1, 4-5-2, 5-1-2, 5-5-1

5-5-2, 3-2-2, 1-4-1, 2-6-1

2-5-1, 2-6-2, 3-5-1, 3-6-1 4-5-2,

4-6-2, 5-5-1, 5-6-1 6-5-2,

6-6-2, 1-5-2, 1-6-2 1-4-2

1-7-1, 2-6-1, 3-3-1 4-5-1,

5-1-1, 6-7-1 6-2-1, 1-4-1,

7-3-1 7-5-1

1-4-1, 2-6-1 3-5-1, 4-5-1

5-6-1, 6-1-1

6-1-1, 6-2-2

6-1-1, 6-2-2

6-1-1, 6-2-2, 6-3-1

6-1-1, 6-2-2, 6-3-1

6-1-1, 6-2-2, 6-3-1

6-1-1, 6-2-2, 6-3-1

6-1-1, 6-2-2, 6-3-1 6-5-1

International Journal of Production Research

Scenario

7369

7370

F. Sabouhi et al.

Expected

shipment

costs; 0.13

(M $)

Expected

costs of last

sales; 0.29

(M $)

Expected

purchasing

costs; 0.45

(M $)

Fixed costs;

0.07 (M $)

3%

14%

22%

6%

Expected

costs of last

sales; 0.23

(M $)

Expected

shipment

costs; 0.13

(M $)

11%

6%

9%

21%

53%

55%

Expected

production

costs; 1.11

(M $)

Expected

purchasing

costs; 0.46

(M $)

Fixed costs;

0.20 (M $)

Expected

production

costs; 1.15

(M $)

Logistics cost=1.75 (M $)

Lost sales cost=0.29 (M$)

Logistics cost=1.95 (M $)

Lost sales cost=0.23 (M$)

b)

a)

Expected

shipment

costs; 0.14

(M $)

Expected

costs of last

sales; 0.15

(M $)

Fixed costs;

0.35 (M $)

7%

6%

15%

Expected

purchasing

costs; 0.48

(M $)

21%

52%

Expected

production

costs; 1.19

(M $)

Logistics cost=2.15 (M$)

Lost sales cost=0.15 (M$)

c)

Figure 4. Breakdown of the total cost for different CSLs. (a) α =0.6. (b) α =0.75. (c) α =0.9.

Table 7. Percentage utilised capacity of each facility under different disruption scales and CSLs.

Supplier

Factory

DC

1

CSL

Disruption scale

1

2

3

4 5

6

1

2

3

4

5

6

7

87

89

89

89

89

89

88

88

88

9

9

83

39

66

90

89

89

89

7

7

83

89

89

89

89 100

89 100

89 100

9

9

83

39

68

100

89

89

89

α = 0.6

small

medium

large

100 26 100

100 53 100

100 92 100

α = 0.75

small

medium

large

100 11 100

100 36 100

100 72 100

100

100

100

7

7

83

α = 0.9

small

medium

large

100 11 100

100 36 100

100 88 100

100 86 98 100 9

37 92 7

100 100 98 100 9

55 100 7

100 100 98 100 100 100 100 83

L M

2

L

3

M

33

33

33

L

4

M

L

5

M L M L

6

M

7 67

33 67

33 67

10

32

33

59

67

67

67

67

67

18

20

33

59

67

67

67

67

67

19

22

33

Let us now determine optimal SC decisions including sourcing, capacity and location decisions. Table 7 shows the

utilised capacity of each facility at different disruption scales and CSLs. Generally, we observe that the level of involvement

of a facility depends on its performance in terms of robustness to disruptions and cost. This result can be explained for each

facility as follows.

International Journal of Production Research

7371

From Table 7, the SC tasks almost half of the suppliers to provide raw materials in all situations. The primary suppliers

1, 2 and 3 serve factories in all circumstances, while the primary suppliers 4 and 5 are selected under any conditions.

Moreover, the supplier 6 acts as a backup supplier in specific situations. Practically, IPRI tends to contract with more robust

to disruptions and less expensive suppliers such as the suppliers 1 and 3. On the other hand, suppliers 4 and 5 are known to

be vulnerable to disruptions, and there is no tendency to purchase raw materials from them by IPRI.

The backup supplier 6 is a more expensive supplier with the least vulnerability to disruptions in comparison with the

other suppliers. When the CSL is higher than 0.75 (i.e. α ≥ 0.75), IPRI would require selecting this backup supplier.

This observation may indicate that the backup supplier contributes to enhancement of IPRI responsiveness to customers’

demands. Another finding is that the capacity utilisation of the supplier 2 increases with the rise in the CSLs and disruption

scales. This may refer to the key role of this supplier to assist IPRI in increasing responsiveness and resilience against higher

fulfillment rate of customers’ demands and larger disruptions, respectively.

There is a similar trend of what was discussed above for the level of involvement of factories in different situations.

That is, factories with the least production costs and vulnerability to disruptions have the most amount of production such

as factories 1, 2, 3 and 6. On the other hand, factories 4 and 7 have less production than the other factories because of their

undesired performance in terms of robustness to disruptions and cost. Another observation is that the capacity utilisation of

factory 5 depends on the disruption scales. More specifically, there exists a direct relation between the amount of production

of this factory and the scale of disruptions. This result is regardless of the CSL. We may imply that factory 5 mainly

contributes to enhancement of IPRI resilience against large-scale disruptions.

From Table 7, all situations, independent of the disruption scales, establish the DCs 2, 4 and 6 to distribute products

to customers. This may be attributed to the suitable distance of these DCs from customers and the other facilities which

helps reduce total transportation costs. The DCs 1 and 5 are opened under any conditions and the DC 3 is activated only in

specific circumstances. Regardless of the CSLs, the DCs 4 and 6 are established with large and medium sizes, respectively.

However, the selection of the size of the DC 2 is a function of the CSL. The DC 2 is a less vulnerable DC with higher

establishing cost compared to other DCs. Therefore, this DC with large size tends to be opened when the CSL increase (i.e.

α ≥ 0.75). The DC 3, which has high establishing cost and low robustness to disruptions, is the least preferred alternative

unless the CSL equals 0.6 (i.e. α = 0.6).

6.3. Trade-off between CSL and total cost

Here, we aim to investigate the effect of varying CSL (α) on the total cost. Figure 5 indicates the conflict between the

CSL and the total cost for four situations including small-scale disruptions only, medium-scale disruptions only, large-scale

disruptions only and all disruption clusters. As illustrated in Figure 5, increasing the CSL results in increasing the total SC

cost. This finding is evident as high fulfillment rate of customers’ demands does not obtain free. As the CSL rises, the SC

has to engage more and more facilities to meet the customers’ demand; the added facilities are likely to generate more costs

and be more vulnerable to disruptions. The pattern of changes in total cost at various CSLs and disruption clusters is also

rather interesting. It appears that in each disruption situation, an increase in the CSL results in a linear increase in total cost.

Consequently, a decision maker will be largely able to apply this pattern when estimating the total SC cost under disruptions

and at various CSLs.

6.4. The effect of facility and transport route disruptions on the total cost