UPDATED Capital Budgeting, Cash Flow and Risk Estimation (1)

advertisement

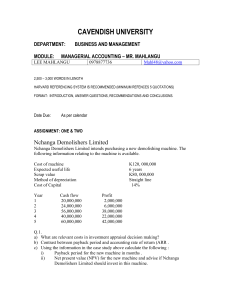

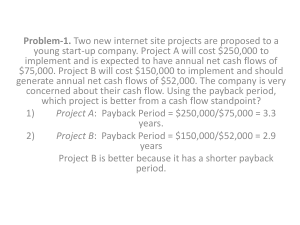

The Basics of Capital Budgeting: Evaluating Cash Flows ❏ ❏ ❏ ❏ ❏ ❏ ❏ NET PRESENT VALUE (NPV) INTERNAL RATE OF RETURN (IRR) MODIFIED INTERNAL RATE OF RETURN (MIRR) NET PRESENT VALUE (NPV) PROFILE PROFITABILITY INDEX REGULAR PAYBACK DISCOUNTED PAYBACK NET PRESENT VALUE (NPV) NET PRESENT VALUE (NPV) The net present value (NPV), defined as the present value of a project’s cash inflows minus the present value of its costs, tells us how much the project contributes to shareholder wealth. Note: the larger the NPV, the more value the project adds and thus the higher the stock’s price. NET PRESENT VALUE (NPV) ● ● ● ● ● CF = cash flow CF0 = initial investment CFt is the expected net cash flow at Time t r is the project’s risk-adjusted cost of capital (or WACC) N is its life NET PRESENT VALUE (NPV) INTERNAL RATE OF RETURN (IRR) INTERNAL RATE OF RETURN (IRR) A project’s IRR is the discount rate that forces the PV of the inflows to equal the initial cost (or to equal the PVs of all the costs if costs are incurred over several years). This is equivalent to forcing the NPV to equal zero. ➔ The IRR is an estimate of the project’s rate of return, and it is comparable to the YTM on a bond. INTERNAL RATE OF RETURN (IRR) MODIFIED INTERNAL RATE OF RETURN (MRR) MODIFIED INTERNAL RATE OF RETURN It is similar to the regular IRR, except it is based on the assumption that cash flows are reinvested at the WACC (or some other explicit rate if that is a more reasonable assumption). NET PRESENT VALUE (NPV) PROFILE NPV PROFILE NPV PROFILE The NPVs vary depending on the actual cost of capital—the higher the cost of capital, the lower the NPV. PROFITABILITY INDEX (PI) PROFITABILITY INDEX The profitability Index is calculation determined by dividing the present value of future cash flow by the initial investment in a project. Here, CFt represents the expected future cash flows and CF0 represents the initial cost. The PI shows the relative profitability of any project, or the present value per dollar of initial cost. PAYBACK DISCOUNTED PAYBACK Payback Period NPV and IRR are the most commonly used methods today, but historically the first selection criterion was the payback period, defined as the number of years required to recover the funds invested in a project from its operating cash flows. Payback Period The shorter the payback, the better the project. ● Discounted Payback Period DISCOUNTED PAYBACK where cash flows are discounted at the WACC and then those discounted cash flows are used to find the payback. Note: that the payback is a “break-even” calculation in the sense that if cash flows come in at the expected rate, then the project will at least break even. THANK YOU! Chapter 11 Cash Flow Estimation and Risk Analysis Cash Flow versus Accounting Income Free Cash Flow is cash flow that is available for distribution to investors. Note! Capital budgeting decisions must be based on cash flows, not accounting income. Refer to chapter 2 figure 9 Incremental Cash Flows the difference between the cash flows the firm will have if it implements the project versus the cash flows it will have if it rejects the project. Note! Only incremental cash flows are relevant. 11.2 Analysis of an Expansion Project Cash Flow Projections: Base Case 11.2 Analysis of an Expansion Project Cash Flow Projections: Base Case Depreciation is calculated as the annual rate allowed by the IRS multiplied by the project’s depreciable cost basis. Taxation of Salvage The after-tax salvage value depends on the price at which GPC can sell the equipment and on the book value of the equipment (i.e., the original basis less all previous depreciation charges). THANK YOU! R I S K A N A LY S I S I N C A P I TA L BUDGETING 1. Stand-alone risk is a project’s risk assuming (a) that it is the firm’s only asset and (b) that each of the firm’s stockholders holds only that one stock in his portfolio. Stand-alone risk is based on uncertainty about the project’s expected cash flows. It is important to remember that stand-alone risk ignores diversification by both the firm and its stockholders. 2. Within-firm risk (also called corporate risk) is a project’s risk to the corpo- ration itself. Within-firm risk recognizes that the project is only one asset in the firm’s portfolio of projects; hence some of its risk is eliminated by diversification within the firm. However, within-firm risk ignores diversification by the firm’s stockholders. Within-firm risk is measured by the project’s impact on uncertainty about the firm’s future total cash flows. 3. Market risk (also called beta risk) is the risk of the project as seen by a well- diversified stockholder who recognizes (a) that the project is only one of the firm’s projects and (b) that the firm’s stock is but one of her stocks. The project’s market risk is measured by its effect on the firm’s beta coefficient.