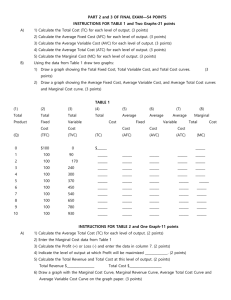

ECON 1001: Introduction to Economics; 1 At the end of this lesson you must be able to: Distinguish between the long run and short run. Discuss the production function and its components. Define the law of variable proportions/ diminishing marginal returns. Distinguish between output/product and product curves. Distinguish between different costs and cost curves. Determine revenue curves. Fixed and variable factors of production. Long run and short run. The production function. The law of diminishing marginal returns. Costs: fixed and variable. Marginal and average. Isoquants and Isocosts. Output and Revenue: marginal and average. Market Structures Shows a purely technical relationship between inputs and outputs. Inputs/ Factors of Production are: -Land -Labour -Capital -Entrepreneurship. Firms aim to maximize profits by minimizing inputs and maximizing outputs. The input that is usually fixed in the short run is usually capital such as plant and equipment, land etc. The use Fixed inputs do not change as output changes (short-run) The inputs that can be varied in the short run are called variable inputs or variable factors. Variable inputs are so called because as output changes, it is implied that the use of these inputs also change. Variable factors can be basic raw materials, electricity, labour etc. By varying inputs in the short run the firm varies output. The total output or product is the total amount produced during some period of time by all the inputs that the firm uses. If one of the inputs is held constant the total product will change as inputs of the other variable factors are changed. The variations in total product is based on the law of diminishing returns. The short run is characterized by at least one fixed factor of production. The law of diminishing returns is a short run phenomenon which states that as more and more of variable factor inputs are added to a given fixed input, the contribution of the variable inputs to total output, decreases. The law of diminishing returns implies that total product or total output in the short run varies as it increases. At first, the curve shows increasing output at an increasing rate. As the law of diminishing returns sets in, output increases at a decreasing rate. Recall: The concept of MARGINAL Average output is the total output per unit of the variable input (labour in the example). It can be expressed as AP=Total Output ÷ Qty Labour Marginal output is the change in total product resulting from the use of one more unit of the variable input. It can be expressed as MP= ΔTotal Output ÷ ΔQty Labour Qty of labour Total ouptut (TP) Average output (AP) Marginal output (MP) 1 10 10 2 24 12 3 37 12.3 4 44 11 5 49 9.8 6 52 8.66 10 14 13 7 5 3 1 7 53 7.57 The TP curve shows that total output is steadily rising, first at an increasing rate, then at a decreasing rate. This causes both the average and the marginal product curves to rise at first and then decline. Where AP reaches The its maximum point, MP=AP level of output where marginal output/ product reaches its maximum is called the point of diminishing marginal returns Output Point of diminishing returns Total Output Quantity of labour Output Diminishing Marginal returns Diminishing Average returns Average Output Marginal Output Quantity of labour The firm aims to maximize profits: Economic Profits/ Economic Profits differ from accounting profits: pure or economic profits take into consideration the opportunity cost of the owners’ capital as part of the firm’s cost. Pure/ economic profit is therefore less than accounting profit. Refer to Lipsey-Pg 118-119 Profit can be expressed as Total revenue less total costs. (TR-TC= π). Production is carried out by firms using the factors of production which must be paid for or rewarded for their use. The cost of production is the total cost of the factors used. The behaviour of costs is usually analyzed under two sets of conditions: the short run and the long run. Just as some inputs (FOPS) can be varied in the short run, while some are held constant (fixed), short run costs consists of variable and fixed costs. The long run period will consist of only variable costs because all the inputs can be changed in the long run. (there are no fixed factors). In the short run, certain costs are fixed because the availability of resources is restricted. Short run costs: the costs of output during a time period when only some inputs can be varied (variable costs) and when some (or at least one) input(s) remain fixed (Fixed Cost). In the long run, most costs are variable, because the supply of skilled labour, machinery, buildings and so on can be increased or decreased. Total Costs= Total Variable Costs + Total Fixed Costs. Fixed costs are those costs that do not vary with output. Variable costs are those costs that vary positively with output, rising as more is produced and falling as less is produced. Costs Total costs = TVC + TFC Total variable costs Total Fixed costs Output/ quantity Average fixed cost (AfC)= Total FIXED cost ÷ Number of Units produced. Average variable cost (AvC)= Total VARIABLE cost ÷ Number of Units produced. Average total cost (ATC)= Total cost ÷ Number of Units produced. OR Average Fixed Costs + Average Variable Costs. ATC is the total cost of producing any given output divided by the number of units produced, i.e the cost per unit Marginal Cost= Δ Total Cost ÷ Δ Output MC is the increase in total cost resulting from raising the rate of production by one unit OR the addition to total cost of producing one more unit of output. The Law of diminishing returns implies eventually increasing marginal and average variable costs. Units of output (Q) Total Cost (TC) Average Cost (AC) Marginal Cost (MC) 1 2 3 1.10 1.60 1.75 1.10 0.80 0.58 1.10 0.50 0.15 4 5 6 2.00 2.50 3.12 0.50 0.50 0.52 0.25 0.5 0.62 7 8 9 3.99 5.12 6.30 0.57 0.64 0.70 0.87 1.13 1.18 10 8.00 0.80 1.70 Costs Short Run Average cost curves ATC AVC AFC Output Short Run Average cost curves and the Marginal cost curve Costs ATC AVC MC MC cuts AVC and ATC at the minimum point of the AVC and ATC Output Total Cost: TC carry on rising as more and more units are produced. Average Cost: AC changes as output increases. It starts by falling, reaches a lowest level, and then starts rising again. Marginal Cost: The MC of each extra unit of output also changes with each unit produced. It too starts by falling, reaches a lowest level, and then starts rising. At lowest levels of output, MC is less than AC. At highest levels of output, though, MC is higher than AC. There is a “cross-over” point where MC is exactly equal to AC. (At 5 units of output in example from the table). When marginal is greater than average, average is rising, when marginal is less than average, average is falling. The Marginal Cost curve always cuts the Average Cost curve at the lowest point of the Average Cost curve. Total fixed cost (TFC) does not vary with output. Total variable cost and the total of all costs (TC=TVC+ TFC) rise with output, first at a decreasing rate, then at an increasing rate. The total cost curves give rise to average and marginal curves. Average fixed cost (AFC) declines as output increases. Average variable cost (AVC) and average total cost (ATC) fall and then rise as output increases. Marginal cost (MC) does the same, intersecting the ATC and AVC at their minimum points. The law of diminishing returns implies eventually increasing marginal and average variable cost. Short-run average and variable cost curves are assumed to be U shaped- the rising portion reflects diminishing average and marginal RETURNS. The marginal cost curve cuts the average variable cost curve at its minimum- this is the firm’s capacity output, any output beyond this point will be at increasing costs. In the short-run, the firm will continue to produce so long as it is able to meet its AVERAGE VARIABLE COSTS. In the long run, the firm must cover all costs to continue operations. The short run supply curve therefore becomes the Marginal COST curve that lies above average variable costs. The long run supply curve becomes the Marginal cost curve that lies above average total costs. Short Run Average cost curves and the Marginal cost curve Costs ATC Long run supply curve MC AVC Short run supply curve Output The output that corresponds to the minimum short-run average total cost is often called capacity. Whereas short-run output decisions are concerned with diminishing returns because of fixed factors, long run output decisions are concerned with economies of scale when all factor inputs are variable. Economies of Scale: factors which cause average cost to decline in the LONG RUN as output increases. Diseconomies of Scale: factors which cause average cost to increase in the LONG RUN as output expands. What are some examples? While Economies of Scales looks at the impact of large SCALE production on average cost, RETURNS TO SCALE looks at the impact of increasing ALL the inputs (the scale of inputs) on either improving or declining productivity (the scale of production). -economies of scale and returns to scale are related. The Long Run Average Cost curve (LRAC) is the boundary between cost levels that are attainable, with known technology and given input prices, and those that are unattainable. ABOVE LRAC: Attainable BELOW LRAC: Unattainable Decreasing Costs: From 0 to Q1, the firm has falling average costs: by expanding output, the firm experiences a reduction in cost per unit of output. Q1 is described as the minimum efficient scale. Increasing Costs: Any output greater than Q1 shows that the firm encounters rising long run average costs and therefore decreasing returns. Can be illustrated using Isoquants and Isocosts curves The Isoquant shows all the combinations of factor inputs (Capital and Labour) that produce a given level of output. Recall Indifference Curve The Isocost shows all the combinations of factor inputs (Capital an Labour) that can be afforded by the firm. Recall Budget Line The optimum level of production is found where MPk = Pk MPl Pl i.e: Where the slope of the Isoquant is equal to the slope of the isocost i.e: where the MRTS = MRMS Total Revenue: The total amount of money that the firm receives from the sale of output over some period of time. $ Price x Quantity Sold. Marginal Revenue: The change in TR resulting from a unit change in the sales per period of time. Change in TR / Change in Quantity Sold Average Revenue: TR divided by the number of units sold OR price per unit sold. Average Revenue= Marginal Revenue Above the AR/MR Curve: No Sales Below the AR/MR Curve: No Sense Whatever the size of the output, the price that a product can fetch in the market remains the same. Price Quantity TR AR (TR/Q) MR (∆TR/∆Q) $5 1 $5 $5 $5 $5 2 $10 $5 $5 $5 3 $15 $5 $5 $5 4 $20 $5 $5 $5 5 $25 $5 $5 Market supply $P $5 equilibrium $P $5 Price = AR = MR Market demand Market Equilibrium Qty Price Taker’s AR and MR Qty A firm that exerts a significant effect on the price of the product it sells by altering its rate of production and sales. The Marginal Revenue curve is twice as steep as the Average Revenue Curve. Average Revenue varies with output, it declines with rising output. Marginal Revenue lies above the x axis as long as total revenue is increasing and lies below the x axis when total revenue is decreasing Price Quantity TR AR (TR/Q) MR (∆TR/∆Q) $5 1 $5 $5 $5 $4 2 $8 $4 $3 $3 3 $9 $3 $1 $2 4 $8 $2 -$1 $1 5 $5 $1 -$3 Price Price Setter’s MR and AR AR = Price Qty MR The FIRM in ANY MARKET STRUCTURE will ALWAYS PRODUCE AN OPTIMUM OUTPUT Where MARGINAL COST= MARGINAL REVENUE. If marginal revenue is greater than marginal cost then the firm should increase output, if marginal cost is greater than marginal revenue, the firm should decrease output. The profit level is determined by looking at the position on the Average Revenue Curve in comparison to the Average Cost curve when the optimum level of output is determined. 1-Equilibrium/Profit Max output is where MC=MR. 2-Revenue is determined from the Average Revenue Curve. 3-Cost is measured from the Average Cost Curve. 4- Profit is the difference in area between AC and AR. A market Structure refers to the characteristics of an Industry such as -number of buyers -number of sellers -nature of product- product homogeneity or differentiation -barriers to entry and exit -information availability The market structure affects market conduct. Perfect Competition Monopoly Oligopoly Duopoly Monopolistic Competition Each Firm is a PRICE TAKER- there are many buyers and sellers. No one firm has influential power. The product is homogenous- the products of every firm are identical to each other, it makes no difference to the buyer from whom he buys the product. There are no barriers to entry or exit all firms have the choice to enter into or exit the market. There is perfect knowledge-all buyers and sellers know the prices at which all transactions are taking place and what the possible alternatives are. No consumer or firm can deviate because of any special information known. Everyone knows the same thing. The profit level is determined by looking at the position on the Average Revenue Curve in comparison to the Average Cost curve when the optimum level of output is determined. 1-Equilibrium/Profit Max output is where MC=MR. 2-Revenue is determined from the Average Revenue Curve. 3-Cost is measured from the Average Cost Curve. 4- Profit is the difference in area between AC and AR. Normal Profits- that level of profits that is just sufficient to induce the firm to stay in the industry. Supernormal/Above Normal Profits- excess profits. Subnormal Profits/Losses- occurs when the firm earns less profits than what is necessary to induce it to remain in the industry. In the short-run, the firm will continue to produce so long as it is able to meet its AVERAGE VARIABLE COSTS. In the long run, the firm must cover all costs to continue operations. The short run supply curve therefore becomes the Marginal COST curve that lies above average variable costs. The long run supply curve becomes the Marginal cost curve that lies above average total costs. 1. Profit (P >ATC) 2. Loss (ATC>P>AVC) 3. Loss (P<AVC) NUMERICAL EXAMPLE Price = $6 Output where MC=MR is = 10 Total Revenue = $6 x 10 = $60 TVC = $50 TFC = $30 Total Cost = $80 Total Revenue- Total Cost : $60-$80 = -$20 (Loss) If the firm, shuts down Output= 0 Total Revenue = 0 x $6 = 0 Total Costs= TFC= $30 Total Revenue- Total Costs = $0- $30 = -$30 (Loss) Short Run Average cost curves and the Marginal cost curve Costs ATC Long run supply curve MC AVC Short run supply curve Output A MONOPOLY IS SAID TO EXIST WHEN THERE IS ONE FIRM/ PRODUCER IN A MARKET PRODUCING SIGNIFICANT % OF INDUSTRY OUTPUT. A MONOPOLY IS A PRICE SETTER. One seller Imperfect knowledge The firm can be a price setter OR quantity setter, that is, the firm can choose either price or quantity and the other variable would be determined by the existing demand curve. This demand curve is downward sloping, illustrating the negative relationship between price and quantity. (what does this say?) Demand = Average revenue, but AR is not equal to MR. (Diagram) Because the firm is the sole producer of the commodity, it benefits from economies of scale and large scale production. The firm is capable of making supernormal profits in the long run- this is because there are barriers to entry and exit. The monopoly always produces in the elastic region on the demand curve In the short-run the monopoly is capable of making normal, subnormal, and above normal profits. Short-run equilibrium is determined under a monoploy at the point where MR=MC. However monopoly price is found by taking a vertical to the AR curve and across to the price axis. (Diagram) Whether the firm is making sub-normal, normal or ab-normal profits depends upon the value of the AC curve in relation to its AR at equilibrium quantity. Due to the existence of barriers to entry and exit, the monopoly is capable of making profits (above-normal) in the long run.