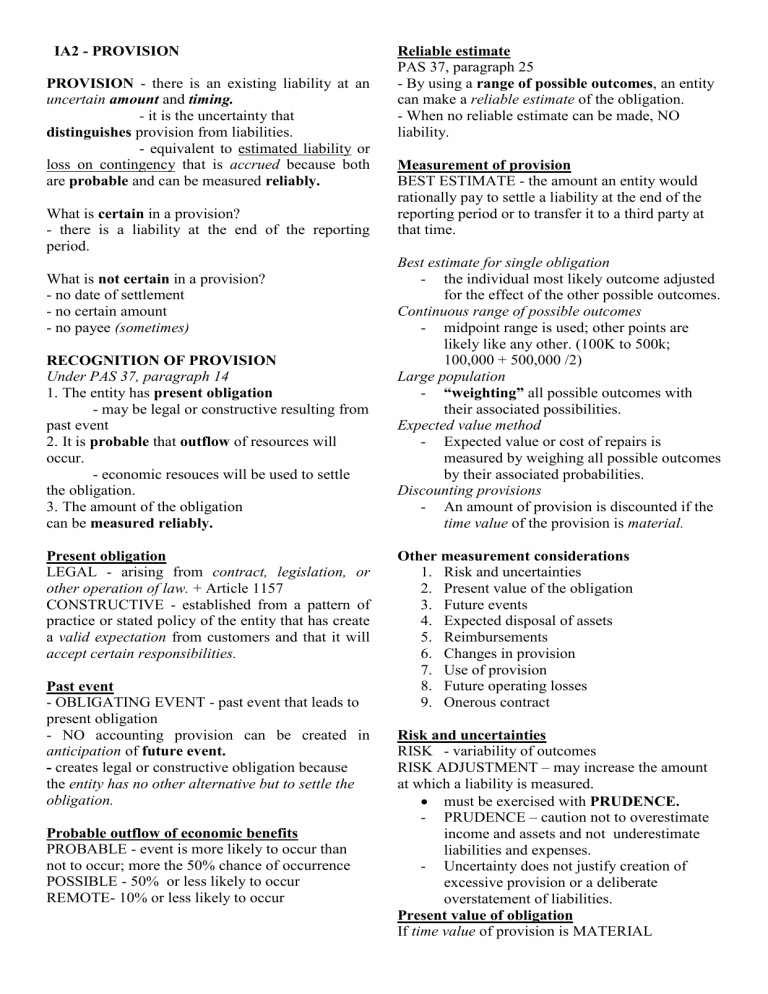

IA2 - PROVISION PROVISION - there is an existing liability at an uncertain amount and timing. - it is the uncertainty that distinguishes provision from liabilities. - equivalent to estimated liability or loss on contingency that is accrued because both are probable and can be measured reliably. What is certain in a provision? - there is a liability at the end of the reporting period. What is not certain in a provision? - no date of settlement - no certain amount - no payee (sometimes) RECOGNITION OF PROVISION Under PAS 37, paragraph 14 1. The entity has present obligation - may be legal or constructive resulting from past event 2. It is probable that outflow of resources will occur. - economic resouces will be used to settle the obligation. 3. The amount of the obligation can be measured reliably. Present obligation LEGAL - arising from contract, legislation, or other operation of law. + Article 1157 CONSTRUCTIVE - established from a pattern of practice or stated policy of the entity that has create a valid expectation from customers and that it will accept certain responsibilities. Past event - OBLIGATING EVENT - past event that leads to present obligation - NO accounting provision can be created in anticipation of future event. - creates legal or constructive obligation because the entity has no other alternative but to settle the obligation. Probable outflow of economic benefits PROBABLE - event is more likely to occur than not to occur; more the 50% chance of occurrence POSSIBLE - 50% or less likely to occur REMOTE- 10% or less likely to occur Reliable estimate PAS 37, paragraph 25 - By using a range of possible outcomes, an entity can make a reliable estimate of the obligation. - When no reliable estimate can be made, NO liability. Measurement of provision BEST ESTIMATE - the amount an entity would rationally pay to settle a liability at the end of the reporting period or to transfer it to a third party at that time. Best estimate for single obligation - the individual most likely outcome adjusted for the effect of the other possible outcomes. Continuous range of possible outcomes - midpoint range is used; other points are likely like any other. (100K to 500k; 100,000 + 500,000 /2) Large population - “weighting” all possible outcomes with their associated possibilities. Expected value method - Expected value or cost of repairs is measured by weighing all possible outcomes by their associated probabilities. Discounting provisions - An amount of provision is discounted if the time value of the provision is material. Other measurement considerations 1. Risk and uncertainties 2. Present value of the obligation 3. Future events 4. Expected disposal of assets 5. Reimbursements 6. Changes in provision 7. Use of provision 8. Future operating losses 9. Onerous contract Risk and uncertainties RISK - variability of outcomes RISK ADJUSTMENT – may increase the amount at which a liability is measured. must be exercised with PRUDENCE. - PRUDENCE – caution not to overestimate income and assets and not underestimate liabilities and expenses. - Uncertainty does not justify creation of excessive provision or a deliberate overstatement of liabilities. Present value of obligation If time value of provision is MATERIAL - - Provision measured at present value of expenditure expected to settle the obligation. Discount rate should be pretax rate that should reflect the current market assessment of the (1) time value of money and (2) risk specific to the liability. Discount rate should not reflect the risk for which cash flow estimates have already been adjusted. Future events - should be reflected in the amount of provision - FUTURE EVENTS – events that may affect the amount required to settle an obligation - Ex. New legislations and changes in technology - There is sufficient evidence that such event will occur. Expected disposal of asset - Cash inflows from disposal of an asset is treated SEPARATELY from measurement of provision. - NOT considered in measuring provision. - Entity shall recognize GAIN ON DISPOSAL OF ASSET on disposition of asset. Reimbursements - When SOME or ALL of the expenditure is to be reimbursed by another party, the reimbursement shall be recognized when it is virtually certain that reimbursement will be received if entity settles the obligation. - Separate ASSET - NOT netted against estimated liability for the provision - Reimbursement shall NOT exceed amount of provision - PRESENTATION IN INCOME STATEMENT – expense net of reimbursement Changes in provision - Provisions are reviewed at every end of reporting period and adjusted according to its best estimate - Reversed if no longer probable that an outflow of economic resources would be required to settle an obligation - When discounting is used, carrying amount of the provision increases every period to reflect passage of time. Use of provision - Provision shall only used for expenditures provision was purported to be used. What will happen if an expenditure is charged to a provision recognized for another purpose? - Camouflage the impact of two different events In effect - Distort financial performance and constitute financial fraud. Future operating losses - NO provision to be recognized for future losses. - An INDICATION for impairment of certain assets, must perform impairment test - Only future event, no obligating event (past event) thus no obligation/liability/provision is to be recognized Onerous contract - ONEROUS contracts are recognized as provision. - Measured at the LEAST COST OF EXITING FROM THE CONTRACT - Lower amount between cost of fulfilling the contract and the compensation/penalty from failure to fulfill the contract EXAMPLES OF PROVISION (WEDCG) 1. Warranty 2. Environmental contamination 3. Decommissioning or Abandonment cost 4. Court case 5. Guarantee