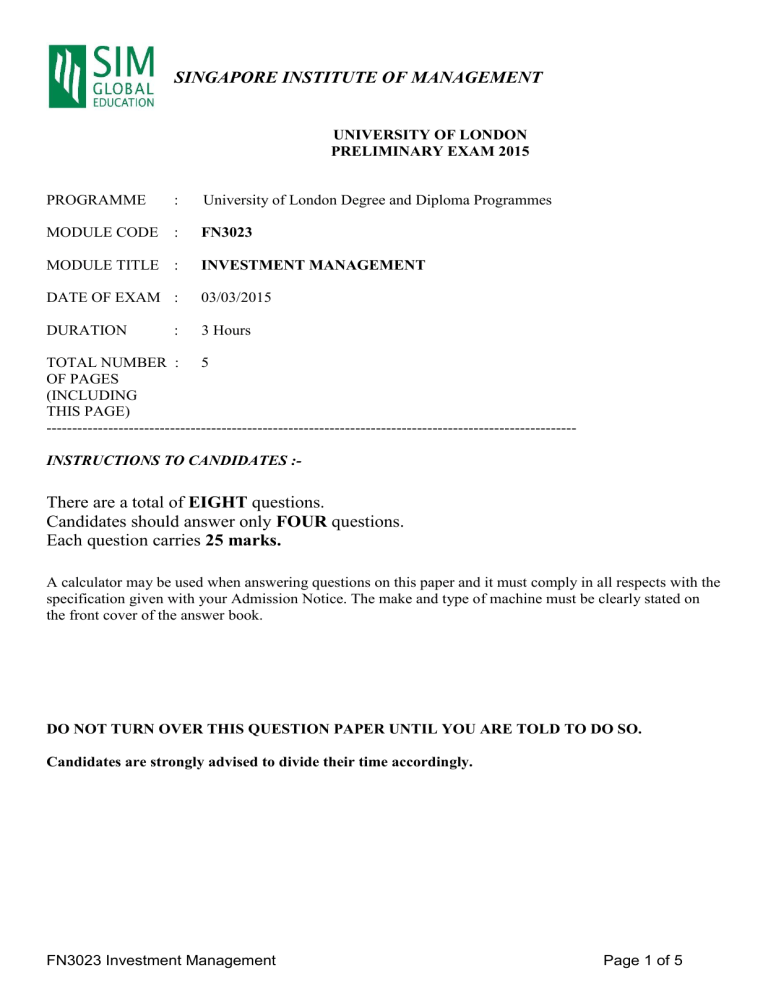

SINGAPORE INSTITUTE OF MANAGEMENT UNIVERSITY OF LONDON PRELIMINARY EXAM 2015 PROGRAMME : University of London Degree and Diploma Programmes MODULE CODE : FN3023 MODULE TITLE : INVESTMENT MANAGEMENT DATE OF EXAM : 03/03/2015 DURATION 3 Hours : TOTAL NUMBER : 5 OF PAGES (INCLUDING THIS PAGE) ------------------------------------------------------------------------------------------------------INSTRUCTIONS TO CANDIDATES :- There are a total of EIGHT questions. Candidates should answer only FOUR questions. Each question carries 25 marks. A calculator may be used when answering questions on this paper and it must comply in all respects with the specification given with your Admission Notice. The make and type of machine must be clearly stated on the front cover of the answer book. DO NOT TURN OVER THIS QUESTION PAPER UNTIL YOU ARE TOLD TO DO SO. Candidates are strongly advised to divide their time accordingly. FN3023 Investment Management Page 1 of 5 1. (a) Distinguish between market timing and asset allocation? Explain an approach for measuring the market timing ability of a fund manager. (7 marks) (b) Consider the following data on prices and coupon rates: Bond price £104.51 per £100 nominal capital £104.63 per £100 nominal capital £91.29 per £100 nominal capital Coupon rate 10% annual coupon of nominal capital 8% annual coupon of nominal capital 2.5% annual coupon of nominal capital Time to maturity 1 year 2 years 3 years Work out the yield on the bonds and the year 1, year 2, and year 3 spot rates. Where you cannot work out the answer as a number just report the simplest algebraic expression. (9 marks) (c) Consider the 3-year bond in question (b) priced at £91.29 per £100 nominal capital and 2.5% annual coupon. What are the duration and the convexity of this bond? Explain how you can use duration and convexity to predict bond price changes. (9 marks) 2. (a) What do we mean by limit order markets? Explain how the priority rules (with respect to price and submission time) work in such markets. (7 marks) (b) The risk free rate is 4% and the expected return on the market portfolio is 10% with standard deviation 20%. Suppose you have identified an active portfolio with a beta of 1, an expected return of 13% and a standard deviation of specific risk of 40%. What weight does the Treynor-Black model suggest should be attached to this portfolio? Draw an appropriate diagram to reflect these numbers. (9 marks) (c) You short 1,000 units of a stock. At the end of the first year you need to make a dividend payment, and also you buy back 400 units of the stock after the dividend transaction has cleared. On the remaining short position you need to make a further dividend at the end of the second year. You then buy back the remaining 600 units and the position is cleared. The prices and dividend payments are given below. Year Stock price 0 1 2 £100 £80 £70 Dividends per share £5 £5 You make the transaction on the basis of a 140% initial and maintenance margin requirement (this corresponds to a margin of 40% in the examples given in the Bodie, Kane, and Marcus Investments textbook). What is the two-year return on your short transaction? (9 marks) FN3023 Investment Management Page 2 of 5 3. (a) Suppose the price of two assets A and B, PA and PB respectively, tend to move together. Designating the quantities traded as XA and XB respectively, if PA < PB, demonstrate how you can construct a trading strategy that delivers a trading profit for any price P* on convergence. (7 marks) (b) A fund is making average return 12% per year over the last 10 years. The standard deviation of the fund is 30%. The risk free rate is 3%, the average return of the market index is 9%, and the standard deviation of the market return is 25%. The covariance of the return on the fund with the return on the market index is 9%. Work out the Sharpe ratio and the Treynor ratio of the fund, and explain whether the fund is an attractive investment opportunity on the basis of your findings. Do you think there may be estimation errors in the data you are presented with? Explain. (9 marks) (c) Consider a share which is currently valued at 100, but has a true value of either 130 or 80 with equal probabilities. The market is cleared by a risk neutral competitive market maker who posts a bid price at which he is prepared to buy from a seller, and an ask price at which he is prepared to sell to a buyer. The market maker believes there is a 90% chance the next trader is an uninformed trader who is equally likely to buy or sell for liquidity reasons, and a 10% chance the next trader is an informed trader who trades on the basis of his or her (perfect) information about the true value of the share. Work out the bid and ask prices for the next transaction. (9 marks) 4. (a) Explain what we mean by efficient markets, and outline the three forms of efficient market hypothesis. (7 marks) (b) You make a stock market investment in 5 stocks, with equal value invested in each stock. The sum of the betas of the 5 stocks is 7. The market portfolio has standard deviation 30%, and the idiosyncratic risk term of each stock has variance 2%. The idiosyncratic risk is uncorrelated across the stocks. What is the standard deviation of the portfolio? Would it matter if the idiosyncratic risk terms were correlated? Explain. Work out the standard deviation in the extreme case that the idiosyncratic risk is perfectly correlated across any pair of stocks in the portfolio. (9 marks) (c) You hold a portfolio where you estimate the return is risky but that it will be between -20% and +30%, assume that any number between these extremes is equally likely. The current value of the portfolio is $20m. You aim to limit your portfolio losses to $1,500,000 with 5% probability (the 5% VaR is $1,500,000). You can offset losses in excess of this by injecting new money as risk capital. Outline the details of your risk management strategy. (9 marks) FN3023 Investment Management Page 3 of 5 5. (a) Explain why the duration method for immunizing bond portfolios is likely to give misleading results if the change in the term structure is very large, or different for the various spot rates. (7 marks) (b) The Black-Scholes value of a European call option on a stock is given by c = S N(d1) – Xe(-r(T-t)) N(d2) where S is the current stock price, X is the exercise price, N(X) is the probability that an outcome drawn from a standard normal probability distribution is less than X, and e(-r(T-t)) is the discounted value of a risk free payoff of 1 at maturity. Assume S = 100 and put and call options exist with the same maturity and an exercise price of 100. The following data is given: e(-r(T-t)) 0.95123 d1 0.35 d2 -0.15 N(d1) 0.63683 N(d2) 0.44038 Suppose you wish to create a volatility hedge, using the put and call options above, which is neutral to small changes in the current stock price but which is sensitive to small changes in the volatility of the stock. Explain the details of your trading strategy, and specify in particular the number of calls traded relative to the number of puts. (9 marks) (c) Suppose stock returns follow a two-factor structure, and assume your portfolio has a beta of 0.8 with respect to the first factor and a beta of 0.9 with respect to the second factor. There also exists a risk free asset with return 2%, and two ‘factor portfolios’ which represents the two factor risks – each has unit beta with respect to their respective factor and zero beta with respect to the other, and no idiosyncratic risk. The ‘factor portfolio’ representing the first factor risk has expected return 4% and the ‘factor portfolio’ representing the second factor risk has expected return 8%. Suppose you wish to immunise your portfolio from factor risk by taking a zero-cost position in the ‘factor portfolios’ and the risk free asset. First, explain the details of your immunisation strategy. Second, explain what return you expect on your original un-immunised portfolio, and what return you expect on your immunised portfolio. Third, explain why you might wish to carry out an immunisation strategy like the one you have worked out. (9 marks) 6. (a) Explain why risk-averse individuals are willing to pay an insurance premium to remove risk. (7 marks) (b) A bond portfolio is worth $5,000,000, and you estimate the duration of the portfolio is 7 years. You are planning to reduce the exposure to interest changes by taking a short position in a 12-year zero coupon bond. The relevant term structure is level at 5% and the target duration for your net position is 5 years (i.e. you do not wish to immunise the portfolio completely – just reduce your equity duration from 7 years to 5 years). Outline the details of your trading. (9 marks) (c) Consider the following table of prices for options with 1 year to maturity. The underlying asset is currently priced at 100. Exercise price 90 100 Call 33 29 Put 19 24 Can you make arbitrage profits in this market? Explain your answer carefully. (9 marks) FN3023 Investment Management Page 4 of 5 7. (a) What do we mean by the term structure of interest rates? Explain what the expectations hypothesis states about the shape of the term structure of interest rates. (7 marks) (b) You analyse the performance of a fund, and find that the return over a 1-year period is 21% with standard deviation of 64%, then over the following 1-year period it is 8% with standard deviation of 12%, and finally if you consider the whole 2-year period you find the average return is 14.5% with standard deviation of 46% (note: all returns and standard deviations are annualised). The risk free return is constant and equal to 3% for both periods. Work out the Sharpe ratio for each year separately, and then for the whole period. Explain why the fund appears to be performing worse over the whole 2year period than in either of the two sub-periods. (9 marks) (c) You manage a fund which is currently valued at 100,000 and consists of a broad diversified portfolio of stocks, and you estimate the portfolio has unit beta (i.e. beta =1). You want to protect the value of this portfolio such that at the end of a 1-year horizon there is no probability that the value goes below 95,000. The risk free rate is 2% per year, and there are 1-year put and call options on the stock market index traded with exercise price 95% of the current stock market index. The call is trading at a price of 15%, and the put is trading at a price of 8.14%, of the current index level. Outline the details of your portfolio protection strategy. (9 marks) 8. (a) Contrast the actual performance of fund managers with that expected from the Efficient Markets hypothesis. (7 marks) (b) The 3-month return on 4 stocks is given below. Stock A B C D 3-month return 7% -2% 4% 3% Outline a strategy for forming a portfolio of these stocks which seeks to take advantage of momentum effects. (9 marks) (c) A 3-year and 200 day bond with annual coupon 8% is trading at a yield of 8%. If you were to trade this bond today, you would pay a price equal to 103.54. Work out the clean price quoted in the financial pages for this bond. Explain why the clean price is not exactly equal to par value in this case even though the bond is trading at yield to maturity equal to the coupon rate. What should the exact expression for accrued interest be (hint: the clean price is the dirty price on the day the coupon payment is made)? (9 marks) END OF PAPER FN3023 Investment Management Page 5 of 5