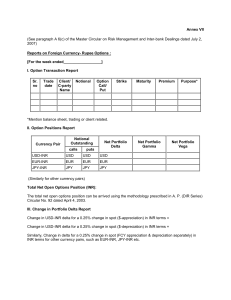

Additional Questions and Solutions (May-2019 Onward) [CA Nagendra Sah] Stay connected on YouTube and Telegram for future updates: Telegram: Search @fmguru on Telegram Apps and join "SFM Gyan (CA Nagendra)" Channel YouTube: www.youtube.com/canagendrasah // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM https://ww w.google.c om/search ?hl=enIN&gl=in &q=NS+L earning+p oint/CA+ Nagendra +Sah,+U158,+Patel +Hospital +Building +Ground+ floor+Nea r+laxmina gar+metro +gate,+Str eet+Numb er+4,+Sha karpur,+N Page 2.2 Forex Additional Q May19 to Jan21 // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.3 Chapter - 2 FOREIGN EXCHANGE EXPOSURE AND RISK MANAGEMENT APPLICATION OF TWO-WAY QUOTE; PREMIUM/DISCOUNT Question No. 1AA The following two way quotes appear in the Foreign Exchange Market ₹/US $ Spot ₹ 66/66.25 Three Months' Forward ₹ 67/67.50 (i) By what % has the Dollar currency changed? Indicate the nature of change. (Answer with reference to the ask rate). (ii) By what % has the Rupee changed? Indicate the nature of change. (Answer with reference to the bid rate). (iii) How many US Dollars should a firm sell to get ₹ 45 lakhs after three months? (iv) How many rupees is the firm required to pay so as to obtain US $ 2,20,000 in the spot market? (v) Assume that the firm has US $ 90,000 in current account earning interest. Return on rupee investment is 10% per annum. Should the firm encash the US $ now or 3 months later? [RTP-CMA-Dec-2018] Solution: Class Note: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.4 Forex Additional Q May19 to Jan21 // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.5 Solution provided by CMA: Disclaimer: Suggested solution (by CMA) has used following formula in (ii) which is not correct: Difference between Forward & Spot rate Discount Rate = 𝐹𝑜𝑟𝑤𝑎𝑟𝑑 𝑟𝑎𝑡𝑒 But for calculating discount rate, following formula should have been used: Difference between Forward & Spot rate Discount Rate = 𝑆𝑝𝑜𝑡 𝑟𝑎𝑡𝑒 0.000226 12 = 0.015152 ×100× 3 = 5.97% // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.6 Forex Additional Q May19 to Jan21 PREMIUM/DISCOUNT, LOSS/GAIN, FORWARD CONTRACT HEDGE Question No. 2EA [Jan-2021-New-8M] XYZ has taken a six-month loan from its foreign collaborator for USD 2 million. Interest is payable on maturity @ LIBOR plus 1%. The following information is available: Spot Rate INR/USD 68.5275 6 months Forward rate 6 months LIBOR for USD INR/USD 2% 68.4575 6 months LIBOR for INR 6% You are required to: (i) Calculate Rupee requirements if forward cover is taken. (ii) Advise the company on the forward cover. What will be your opinion if spot rate of INR/USD is 68.4275? Solution: (i) (ii) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.7 Question No. 2H [May-2019-New-8M] K Ltd. Currently operates from 4 different buildings and wants to consolidate its operations into one building which is expected to cost ₹ 90 crores. The Board of K Ltd. Had approved the above plan and to fund the above cost, agreed to avail an External Commercials Borrowing (ECB) of GBP 10 m from G Bank Ltd. On the following conditions: • The Loan will be availed on 1st April, 2019 with interest payable on half yearly rest. • Average Loan Maturity life will be 3.4 years with an overall tenure of 5 years. • Upfront Fee of 1.20%. • Interest Cost is GBP 6 Month LIBOR + Margin of 2.5%. • The 6 Month LIBOR is expected to be 1.05%. K Ltd. Also entered into a GBP-INR hedge at 1 GBP = INR 90 to cover the exposure on account of the above ECB loan and cost of the hedge is coming to 4.00% p.a. As a Finance Manager, given the above information and taking the 1 GBP = INR 90: (i) Calculate the overall cost both in percentage and rupee terms on an annual basis. (ii) What is the cost of hedging in rupee terms? (iii) If K Ltd. wants to pursue an aggressive approach, what would be the net gain/loss for K Ltd. if the INR depreciates/appreciates against GBP by 10% at the end of the 5 years assuming that the loan is repaid in GBP at the end of 5 years? Ignore time value and taxes and calculate to two decimals. // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.8 Forex Additional Q May19 to Jan21 Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.9 Forex Additional Q May19 to Jan21 Question No. 2I [Nov-2020-New-8M] [Similar to Q-2.5 Nov-2018-8M] ICL an Indian MNC is executing a plant in Sri Lanka. It has raised 400 billion. Half of the amount will be required after six months' time. ICL is looking an opportunity to invest this amount on 1st April, 2020 for a period of six months. It is considering two underlying proposals: Market Japan US Nature of Investment Index Fund (JPY) Treasury Bills (USD) Dividend (in billions) 25 Income from stock lending (in billions) 11.9276 Discount on initial investment at the end 2% Interest 5 Percent per annum Exchange rate (April, 2020) JPY/INR 1.58 USD/INR 0.014 Exchange rate (30th September, 2020) JPY/INR 1.57 USD/INR 0.013 You, as an Investment Manager, is required to suggest the best course of option. Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.10 Forex Additional Q May19 to Jan21 Question No. 2.6 An American importer has purchased goods worth euro 15,00,000. Payments are to be made after 6 months. The spot rate of Euro is US$ 1.2800/€. The American importer expects depreciation of the dollar against the euro in the coming months. A New York bank gives the 6-month forward rate as US$ 1.3381/€. If the American importer makes use of the forward rate to hedge its currency, what is its loss or profit under following circumstances? (i) Spot price of euro after 6 months is US$ 1.2800/€ (ii) Spot price of euro after 6 months is US$ 1.3962/€ (iii) Spot price of euro after 6 months is US$ 1.2000/€ // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.11 [CMA-MTP-June-2020-6M] Solution: The importer will hedge his currency rate fluctuation exposure by hedging (buying euro) in the future market; the rate to be paid by him is US$ 1.3381/€, irrespective of what the rate will be in spot market after 6 months. (i) If the rate in spot market after 6 months is US$ 1.2800/€, the importer suffers a loss due to the forward contract = ($1.3381 – 1.2800) x 15,00,000 = €87,150. (ii) If the rate in spot market after 6 months is US$ 1.3962/€, the importer gains due to the forward contract = ($1.3962 – 1.3381) x 15,00,000 = €87,150. (iii) If the rate in spot market after 6 months is US$ 1.2000/€, the importer suffers a loss due to the forward contract = ($1.3381 – 1.2000) x 15,00,000 = €2,07,150. Question No. 2.7 [Nov-2020-New-8M] [Mixer of Q-2D and Q-2G] ZX Ltd. has made purchases worth USD 80,000 on 1St May 2020 for which it has to make a payment on 1 st November 2020. The present exchange rate is INR/USD 75. The company can purchase forward dollars at INR/USD 74. The company will have to make an upfront premium @ 1 per cent of the forward amount purchased. The cost of funds to ZX Ltd. is 10 per cent per annum. The company can hedge its position with the following expected rate of USD in foreign exchange market on 1st May 2020. Exchange Rate INR/USD 77 INR/USD 71 INR/USD 79 INR/USD 74 Probability 0.15 0.25 0.20 0.40 You are required to advise the company for a suitable cover for risk. Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.12 Forex Additional Q May19 to Jan21 SETTLEMENT OF TRANSACTION AT DIFFERENT DATES Question No. 4.3 [MTP-Nov-2020-10M] XYZ Ltd. has imported goods to the extent of US$ 8 Million. The payment terms are as under: (1) 1% discount if full amount is paid immediately or (2) 60 days interest free credit. However, in case of a further delay up to 30 days, interest at the rate of 8% p.a. will be charged for additional days after 60 days. M/s XYZ Ltd. has 25 Lakh available and for remaining it has an offer from bank for a loan up to 90 days @ 9.0% p.a. The quotes for foreign exchange are as follows: Spot Rate INR/ US$ (buying) 60 days Forward Rate INR/ US$ (buying) 90 days Forward Rate INR/ US$ (buying) 66.98 67.16 68.03 Advise which one of the following options would be better for XYZ Ltd. (i) Pay immediately after utilizing cash available and for balance amount take 90 days loan from bank. (ii) Pay the supplier on 60th day and avail bank’s loan (after utilizing cash) for 30 days. (iii) Avail supplier offer of 90 days credit and utilize cash available. Further presume that the cash available with XYZ Ltd. will fetch a return of 4% p.a. in India till it is utilized. Assume year has 360 days. Ignore Taxation. Compute your working up to four decimals and cash flows in in Crore. Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.13 MONEY MARKET HEDGE AND FORWARD HEDGE Question No. 5F IP, an importer in India has imported a machine from USA for US $ 20,000 for which the payment is due in three months. The following information is given is given: Money Market Rates (p.a.) (Compounded annually) Bid Ask Deposit Borrowing Spot 74.60 74.90 US $ 6% 9% 3 months forward 75.50 75.90 Rupees 7% 11% (i) Show with appropriate supporting calculations whether a money market hedge is possible or not. (ii) Compute the cost (in annualized percentage) of a Forward Contract Hedge. (iii) Present rupee outflow under (i) and (ii) and advice the importer on the best course of action to minimize rupee outflow. (exchange rate and values should be shown upto two decimal places) [CMA-June-2019-8M] Foreign Exchange Rates (₹/US$) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.14 Forex Additional Q May19 to Jan21 Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.15 Question No. 5.3 [Nov-2019-Old-8M] H Ltd. is an Indian firm exporting handicrafts to North America. All the exports are invoiced in US$. The firm is considering the use of money market or forward market to cover the receivable of $50,000 expected to be realized in 3 months’ time and has the following information from its banker: Spot 3m forward Exchange Rates ₹/$ 72.65/73 ₹/$ 72.95/73.40 The borrowing rates in US and India are 6% and 12% p.a. and the deposit rates are 4% and 9% p.a. respectively. (i) Which option is better for H Ltd.? (ii) Assume that H Ltd anticipates the spot exchange rate in 3 months’ time to be equal to the current 3 months forward rate. After 3-months the spot exchange rate turned out to be ₹/$: 73/73.42. What is the foreign exchange exposure and risk of H Ltd? Solution: (i) Money market hedge: For money market hedge Indian Firm shall borrow in US$ and then translate them to Indian Rupee and shall make deposit in Indian Rupee. For receipt of US$ 50,000 in 3 months (@ 1.5% interest) amount required to be borrowed now (US$ 50,000 ÷ 1.015) = US$ 49,261.08 With spot rate of 72.65 the Rupee deposit will be = ₹ 35,78,817.46 Deposit amount will increase over 3 months (@2.25% interest) will be = ₹ 36,59,340.85 Forward market hedge // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.16 Forex Additional Q May19 to Jan21 Sell 3 months' forward contract accordingly, amount receivable after 3 months will be (US$ 50,000 x 72.95) = ₹ 36,47,500 In this case, more will be received under the money market hedge hence it is better option. (ii) Exchange Exposure to H Ltd: ₹ 36,47,500 Expected Realisation as per Forward Rate (US$ 50,000 X 72.95) Actual Realisation as per actual Spot Rate (US$ 50,000 X 73.00) Gain ₹ 36,50,000 ₹ 2,500 CROSS RATE Question No. 6AA [RTP-Nov-2020-New/Old] Given: US$ 1 = ¥ 107.31 £1 = US$ 1.26 A$ 1 = US$ 0.70 (i) Calculate the cross rate for Pound in Yen terms (ii) Calculate the cross rate for Australian Dollar in Yen terms (iii) Calculate the cross rate for Pounds in Australian Dollar terms Ans: (i) £1 = ¥ 135.21 (ii) A$ 1 = ¥ 75.12 (iii) £ 1 = A$ 1.80 Solution: (i) (ii) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.17 (iii) Question No. 6BA From the following quotes of a bank, determine the rate at which yen can be purchased with Rupees. /£ sterling £ sterling/ Dollar ($) Dollar ($)/Yen(¥) 75.31-33 1.563-65 1.048/52 [Per 100 Yen] [CMA-June-2019-2M] Solution: Question No. 6H [Jan-2021-New-8M] M/s. Sky products Ltd., of Mumbai, an exporter of sea foods has submitted a 60 days bill for EUR 5,00,000 drawn under an irrevocable Letter of Credit for negotiation. The company has desired to keep 50% of the bill amount under the Exchange Earners Foreign Currency Account (EEFC). The rates for /USD and USD/EUR in inter-bank market are quoted as follows: Spot 1 month forward 2 months forward 3 months forward /USD USD/EUR 76.8000 - 67.8100 10/11 Paise 21/22 Paise 32/33 Paise 1.0775 - 1.8000 0.20/0.25 Cents 0.40/0.45 Cents 0.70/0.75 Cents // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.18 Forex Additional Q May19 to Jan21 Transit Period is 20 days. Interest on post shipment credit is 8% p.a. Exchange Margin is 0.1%. Assume 365 days in a year. You are required to calculate: (i) Exchange rate quoted to the company. (ii) Cash inflow to the company. (iii) Interest amount to be paid to bank by the company. Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.19 Page 2.20 Forex Additional Q May19 to Jan21 RETURN FROM FOREIGN SECURITY Question No. 9B [MTP-May-2019-New-7M] With relaxation of norms in India for investment in international market up to $ 2,50,000, Mr. X to hedge himself against the risk of declining Indian economy and weakening of Indian Rupee during last few years, decided to diversify in the International Market. Accordingly, Mr. X invested a sum of Rs. 1.58 crore on 1.1.20X1 in Standard & Poor Index. On 1.1.20X2 Mr. X sold his investment. The other relevant data is given below: 1.1.20X1 1.1.20X2 Index of Stock Market in India Standard & Poor Index Exchange Rate (/$) 7395 ? 2028 1919 62.00/62.25 67.25/67.50 // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.21 You are required to Calculate: (i) The return for a US investor; (ii) Holding Period Return to Mr. X. (iii)The value of Index of Stock Market in India as on 1.1.20X2 at which Mr. X would be indifferent between investment in Standard & Poor Index and India Stock Market. Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.22 Forex Additional Q May19 to Jan21 Question No. 9C/7D [Nov-2019-Old-5M] A German subsidiary of an US based MNC has to mobilize 100000 Euro’s working capital for the next 12 months. It has the following options: Loan form German bank Loan from US Parent Bank : : @ 5% p.a @ 4% p.a Loan form Swiss bank : @ 3% p.a Banks in Germany charges an additional 0.25% p.a. towards loan servicing. Loans from outsides Germany attracts withholding tax of 8% on interest payments. If the interest given above are market determined, examine which loan is the most attractive using interest rate differential. Solution: (i) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.23 RETURN FROM FOREIGN SECURITY Question No. 9.2 [Jan-2021-Old-5M] A US investor chose to invest in Sensex for a period of one year. The relevant information is given below: Size of investment ($) 20,00,000 Spot rate 1 year ago (/$) 42.50/60 Spot rate now (/$) 43.85/90 Sensex 1 year ago 3,256 Sensex now 3,765 Inflation in US 5% Inflation in India 9% (i) Compute the nominal rate of return to the US investor. (ii) Compute the real depreciation/appreciation of Rupee. (iii) What should be the exchange rate if relevant purchasing power parity holds good? (iv) What will be the real return to an Indian investor in Sensex? Solution: (i) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.24 Forex Additional Q May19 to Jan21 (ii) (iii) (iv) GEOGRAPHICAL ARBITRAGE Question No. 10.4 [Nov-2020-New-4M] USD 10,000 is lying idle in your Bank Account. You are able to get the following quotes from the dealers: Dealer A B C Quote EUR/USD 1.1539 EUR/GBP 0.9094 GBP/USD 1.2752 Is there an opportunity of gain from these quotes? Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.25 Question No. 10.5 [RTP-Nov-2020-New/Old] Citi Bank quotes JPY/ USD 105.00 -106.50 and Honk Kong Bank quotes USD/JPY 0.0090- 0.0093. (a) Are these quotes identical if not then how they are different? (b) Is there a possibility of arbitrage? (c) If there is an arbitrage opportunity, then show how would you make profit from the given quotation in both cases if you are having JPY 1,00,000 or US$ 1,000. // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.26 Forex Additional Q May19 to Jan21 Solution: (a) No, while Citi Bank’s quote is a Direct Quote for JPY (i.e. for Japan) the Hong Kong Bank quote is a Direct Quote for USD (i.e. for USA). (b) Since Citi Bank quote imply USD/ JPY 0.0094 - 0.0095 and both rates exceed those offered by Hong Kong Bank, there is an arbitrage opportunity. Alternatively, it can also be said that Hong Kong Bank quote imply JPY/ USD 107.53 – 111.11 and both rates exceed quote by Citi Bank, there is an arbitrage opportunity. (c) Let us how arbitrage profit can be made. (i) (ii) COVER INTEREST ARBITRAGE Question No. 11.6 [Jan-2021-Old-8M] (i) Interest rates for 3 months in USA and Canada are as follows: Currency Borrow Interest US $ 4% 2.5% Canadian $ 4.5% 3.5% (ii) Can $/US $ spot 1.235 – 1.240 3 months forward 1.255 – 1.260 Advice, the currency in which borrowing and lending for 3 months needs to be done for the US company. Take 3 months = 90/360 days. Solution: (i) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 (ii) // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.27 Page 2.28 Forex Additional Q May19 to Jan21 AFTER DUE DATE EXECUTION, CANCELLATION & EXTENSION Amendment in FEDAI Rule in respect to Automatic Cancellation Existing Rule: Automatic Cancellation takes place on 15th day from the date of maturity. New Rule: Automatic Cancellation takes place within 3 working days after maturity. Old Study Mat New Study Mat Question No. 19.2 On 1st August 2019, a bank entered into a forward purchase contract with an export customer for USD 25,000 due on 1st November at an exchange rate of INR 72.6000 and covered its position in the market at INR 72.6500. The customer remained silent on the due rate. On 16th November, the bank cancelled the contract without further notice as fifteen days had expired after the contract due date. The following exchange rates prevailed: 1st November Interbank TT rates USD 1 = INR 72.7500/7600 1 month forward INR 72.9500/9600 Merchant TT rates INR 72.6700/9000 16th November Interbank TT rates INR 72.7000/7100 Merchant TT rates INR 72.6400/7800 Interest on outlay of funds is 12% p.a. Explain the position of the bank in relation to the customer and the market on various dates, compute the swap loss/gain, ignore margin and find out the charges payable by the customer on cancellation. [CMA-Dec-2019-10M] // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Forex Additional Q May19 to Jan21 Page 2.29 Solution: Export Customer. Customer wants to sell US $ after three months. Bank will purchase after 3 m from this customer. 1st Aug: Forward contract by bank to purchase on 1st November 25000 $ at 72.6000 1st Aug: Bank covers its position by forward sale agreement due on 1st Nov in inter-bank market at 72.65 1st Nov: Customer default. Bank sells in inter bank market at 72.6500, buys for this purpose in spot at 72.7600 1st Nov: Bank enters into 1 m forward sale with inter-bank market at 72.9500, due 16th November. Bank’s position is open until 16th November 16th November: Bank has to close its position by selling at 72.9500 and purchasing at 72.7100, while charged customer as if it purchased for 72.7800 Exchange Difference: 72.7800 - 72.6000 = 0.1800 per $ x 25000 = 4500, Charged to Customer. Swap Difference: 72.76-72.95 = 0.19 favorable, not passed on to customer Gain to bank = 0.19 per $ x 25000$ = 4,750 Interest for outlay of funds for 15 days from 1st to 15th Nov 72.76-72.65 = 0.11 per $ per day. Interest = 0.11 x 12% x 15/365 x 25000 = 13.56 or 14, Charged to Customer. EXPOSURE MANAGEMENT STRATEGIES MATRIX Question No. 23A [RTP-Nov-2018-New] Place the following strategies by different persons in the Exposure Management Strategies Matrix. Strategy 1: Kuljeet a wholesaler of imported items imports toys from China to sell them in the domestic market to retailers. Being a sole trader, he is always so much involved in the promotion of his trade in domestic market and negotiation with foreign supplier that he never pays attention to hedge his payable in foreign currency and leaves his position unhedged. Strategy 2: Moni, is in the business of exporting and importing brasswares to USA and European countries. In order to capture the market he invoices the customers in their home currency. Lavi enters into forward contracts to sell the foreign exchange only if he expects some profit out of it other-wise he leaves his position open. Strategy 3: TSC Ltd. is in the business of software development. The company has both receivables and payables in foreign currency. The Treasury Manager of TSC Ltd. not only enters into forward contracts to hedge the exposure but carries out cancellation and extension of forward contracts on regular basis to earn profit out of the same. As a result management has started looking Treasury Department as Profit Centre. Strategy 4: DNB Publishers Ltd. in addition to publishing books are also in the business of importing and exporting of books. As a matter of policy the movement company invoices the customer or receives invoice from the supplier immediately covers its position in the Forward or Future markets and hence never leave the exposure open even for a single day // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM Page 2.30 Forex Additional Q May19 to Jan21 Solution: // CA NAGENDRA SAH // WWW.NAGENDRASAH.COM