Challenges faced by small enterprises in Bangladesh the case of JNA Pulp paper business

advertisement

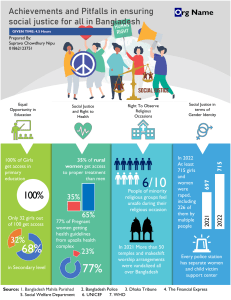

Small Enterprise Research ISSN: (Print) (Online) Journal homepage: https://www.tandfonline.com/loi/rser20 Challenges faced by small enterprises in Bangladesh: the case of JNA Pulp paper business Jashim Uddin Ahmed, Niza Talukder, Asma Ahmed & Meshbaul Hassan Chowdhury To cite this article: Jashim Uddin Ahmed, Niza Talukder, Asma Ahmed & Meshbaul Hassan Chowdhury (2021) Challenges faced by small enterprises in Bangladesh: the case of JNA Pulp paper business, Small Enterprise Research, 28:1, 75-82, DOI: 10.1080/13215906.2021.1872686 To link to this article: https://doi.org/10.1080/13215906.2021.1872686 Published online: 16 Feb 2021. Submit your article to this journal Article views: 212 View related articles View Crossmark data Full Terms & Conditions of access and use can be found at https://www.tandfonline.com/action/journalInformation?journalCode=rser20 SMALL ENTERPRISE RESEARCH 2021, VOL. 28, NO. 1, 75–82 https://doi.org/10.1080/13215906.2021.1872686 Challenges faced by small enterprises in Bangladesh: the case of JNA Pulp paper business Jashim Uddin Ahmed Hassan Chowdhurya a,b , Niza Talukdera, Asma Ahmedb and Meshbaul a Department of Management, School of Business and Economics, North South University, Dhaka, Bangladesh; bInterResearch, Dhaka, Bangladesh ABSTRACT KEYWORDS This practitioner paper presents the case of a small paper business named JNA Pulp,1 initiated with the vision to provide high-quality imported paper to the market. The paper discusses several hurdles faced by the company which eventually pushed the owner to contemplate shutting down the business in the first quarter of 2020. With the rise of COVID-19, it was clear that considering the stance of the business in local market, survival would be impossible. Using the Fishbone analysis, the paper analyses the problems that lead to the closure of this business in April 2020 and further evaluates the strategies that could possibly contribute towards the survival of small businesses in the domestic market. Bangladesh; JNA Pulp; smalland medium-sized enterprises; paper business; Fishbone analysis Introduction Bangladesh has witnessed a rapid expansion of small and medium-sized enterprises (SMEs) for the preceding two decades. There are about 7,900,000 SMEs out of which, a proportion of 93.6% are small and 6.4% are medium establishments (GOB, 2015). Standing as the backbone of the economy, the SMEs have the capacity to generate job opportunities and provide some source of income when structural reforms and privatized enterprises leave a large part of labour force out of payroll. They can also contribute towards reducing urban migration and other major cities, increasing cash flow in rural areas and thereby improving the standard of living for rural people. Apart from contributing to indirect social benefits, small businesses are also a major driver of innovation and competition. SMEs are distributed countrywide which means their expansion will be crucial in minimizing the urban–rural income gap and contribute towards inclusive growth. In fact, inclusive growth can only be achieved by developing a sustainable SME sector in a nation like Bangladesh. To incentivize the SMEs, the turnover tax has recently been reduced from 4% to 3% in fiscal year 2020–2021 (Byron, 2020). Despite playing a substantial role in providing impetus to the development of the economy, they still face numerous constraints and challenges. SMEs are heterogeneous by their mode of operation, characteristics and CONTACT Jashim Uddin Ahmed jashim.ahmed@northsouth.edu © 2021 Informa UK Limited, trading as Taylor & Francis Group 76 J. U. AHMED ET AL. type of products offered, thereby making it difficult to generalize the constraints they face. Some of the major issues are inability to market products, inability to maintain product quality, lack of investment and working capital finance, insufficient skilled technicians and workers, poor management skills of entrepreneurs, lack of information, nontariff barriers, changing world trade regimes and non-supportive environment for business. Other general constraints include inefficient infrastructural framework, low labour productivity, and inefficient technology, lack of R&D and low level of educational attainment of SME entrepreneurs. In the first quarter of 2020, the SME sector faced a new challenge that is, surviving the global pandemic in the wake of COVID-19. A large number of micro, small and medium businesses were hit hard as the nation was initially in a state of full lockdown starting from 26 March 2020 to 30 May 2020. A small paper business named JNA Pulp which was already facing a number of challenges in the domestic market, decided to permanently shut down as the COVID- 19 situation in Bangladesh exacerbated. Their case is a classic example of the constraints most small businesses face and eventually cease to exist. The business case: JNA Pulp Background scenario At present, 110 paper mills are operating in Bangladesh with a production capacity of 1.5 million metric tons annually. Less than half of this capacity is used to meet domestic demand of 0.9–1 million metric tons (Parvez, 2019). The remaining capacity is utilized to serve the foreign markets. The export of paper and paper products gained momentum after the government offered 10% cash incentive for exporters in 2016. Paper products are exported to India, Myanmar, Nepal, Bhutan, Sri Lanka, Pakistan and many Middle Eastern and African countries. Due to high production costs and environmental concerns, many factories in China and Europe have recently closed down. This has created further export opportunities for Bangladesh. The industry has a huge demand for paper and paper products albeit the slump in consumption in the face of rapid digitization and move towards paperless business operations. Local production is adequate to cater for writing, printing and newsprint purposes. Bangladesh still has to import several types of paper including duplex board, art card, art paper and packaging papers, mainly from South Korea, Japan, China, Indonesia, India and some countries in the USA and Europe. Among the international brands, Paperone and Double A brands are the most prominent in the market. Besides, counterfeit products of these brands abound are sold every month at an alarming all over the country. The paper market is saturated, hence creating high barriers to entry for potential competitors. The inception of JNA Pulp JNA Pulp, initiated in March 2018, imported high-quality cut-size papers from Thailand. The man behind this business, Mr Jamal Hasan worked for a premium paper brand, Double A Pulp & Paper Co. Ltd for nearly four-and-half years from January 2013 to September 2016. Afterwards, he went to UK to obtain a Masters degree in Logistic, Materials SMALL ENTERPRISE RESEARCH 77 and Supply Chain Management. Upon successful completion of the programme, he returned to his home country with the goal to establish his own business. From January 2018, Mr Jamal Hasan started conducting research on the domestic paper market and gathering information from various dealers and distributors. His plan was to import paper from Thailand; he discussed his idea with few of his ex-colleagues from Thailand and they presented valuable information about the brand he intended import. Assistance from people around him heightened his confidence and he spared no time in starting JNA Pulp. The first consignment arrived from Thailand in March 2018 and the products were available in local market from April. JNA Pulp mainly imported cut-size papers of various sizes including A4, F14 and A11 in 80, 70 and 65 gsm. Amongst these, A4 in 80 gsm was the most popular in Bangladesh. The papers were sold directly to dealers and distributors located in different areas of the capital city of Dhaka, Bangladesh. It was mainly an import oriented business. After importing the products, he used to sell the products directly to some paper distributors and dealers located in various areas of Dhaka city. In addition to this, JNA Pulp had dealers that supplied the products to different corporate offices. Establishing good rapport with few retailers helped the company make its products available to end-users. Initially, JNA Pulp imported 1 container per month (around 16 MT) A4 paper to comprehend feedback of the product. Gradually, they increased the volume to 2 containers (around 33 MT) per month to penetrate the markets countrywide. Shortly after inception, JNA Pulp started facing the brunt of constraints that small business in Bangladesh generally encounter. As a result, the company did not increase the volume of imports and neither imported F14 size. Challenges of JNA Pulp For those starting a new business, the importance of first carrying out market research is of profound importance. It helps with building a foundation for the business to be built upon, prepares the company for constraints they may face, gives an insight about the target audience and provides information about potential competitors. JNA Pulp sought information from different individuals involved in the market but did not resort to conducting a rigorous market research. Knowing whether majority of the people would choose price over quality would have given the company an idea about the preferences of the consumers. Investigating on the pricing of its competitors such as Paperone, Bashundhara paper and Double A would have helped JNA Pulp comprehend whether imported papers had a chance amid the ones already available in the market. Market research would have enabled this small business to identify its competitive advantage and lower the risk of failure. Fishbone analysis The case of JNA Pulp can be exhibited using a Fishbone analysis (Figure 1) that will showcase the causes leading to the company’s high priced products. The Fishbone diagram or the cause-and-effect diagram is widely used to identify, explore and display possible causes leading to a problem or event. This analysis can equip small businesses with information regarding the challenges they may face and the possible effects. This 78 J. U. AHMED ET AL. Figure 1. Fishbone diagram. will enable them to be prepared for the constraints and implement strategies to tackle them. Counterfeit products and product alteration Counterfeiting is used to denote an instance where the manufacture, producing, packaging, re-packing, labelling or making of any good imitate original products to such an extent that they look identical or substantially similar copies of original products. Counterfeits are largely a developing country problem, particularly due to lax laws and low purchasing power of the citizens. Counterfeit products are a major problem for the paper market in Bangladesh. A large number of counterfeiters have been in the paper business for a prolonged time, holding a strong syndicate. Previously, government law enforcement agencies attempted to stop the production of duplicate papers but unfortunately, they are still widely available in the market countrywide. Duplicate paper of international brands can be found in the market mostly due to their limited representatives in Bangladesh. Even though Double A and Paperone have strong presence, their counterfeits are produced in bulk. Paper businesses claimed that the sale of duplicate versions of the foreign brands surpasses that of the original ones. Local paper businesses are equally exposed to counterfeiting problems, but they are in a position to crack down the vendors unlike the international brands that have limited access to the market. Manufacturers are constantly under threat as counterfeit papers are sold at a lower price. For a country like Bangladesh where majority lives on less than USD 1.91 a day, many people opt to buy the copied versions irrespective of the quality. SMEs of Bangladesh have failed in quality control of products and services in both domestic and international markets due to the lack of national quality policy, lack of credibility of the qualification certification authority and adequate support system (Ahmed et al., 2004). Also, lack of awareness is another reason for the counterfeiters to thrive. In most cases, buyers cannot differentiate between the original and duplicate papers. Besides, they are often bought by the official blue collar staff who ignores the authenticity of SMALL ENTERPRISE RESEARCH 79 the products. Circulation of the counterfeit papers can cause businesses to experience an increase in costs and loss of productivity. Predominantly, they can contribute to a slump in revenue and negative impact on the company’s reputation. Product alteration has become another major issue in the paper market of Bangladesh. The people who are behind this alter the packs of original products with duplicate ones. In addition, they take out the papers from the reams and alter with duplicate papers which cannot be identified easily. As this tendency is quite profitable, many business persons do this activity deliberately. They often charge the original price for the altered products as no one can notice it before opening the packs. Besides, even after opening the packs, people cannot identify the alteration as most of the time they give local products instead of international brands during alteration. Moreover, local papers also suffer this product alteration due to packet alteration or replacing their papers with lower graded ones. Tax issue Bangladesh government has imposed 62% tax on foreign paper brands, positing a challenge for small businesses that import paper from international market. Substantial investment coupled with high taxes eventually leads to a high mark up, thereby making foreign paper more expensive than the local ones. Furthermore, government encourages the use of local papers to uphold the local industry that suffered unemployment issues due to the closure of three state-run paper mills. The government offers considerable support to encourage the entry of potential local paper brands into the market. However, the quality of foreign brands is far superior to that of local products. This is the only advantage the foreign brands bear, but this is insufficient to cover up other financial hurdles. The lack of favourable tax policies and benefits from the government may make the survival of international brands extremely difficult in the long run. Logistics challenges Mr Jamal Hasan has been facing logistics challenges since the day he started the business. Unlike the prominent local brands, JNA Pulp had to deliver the products in various markets through third-party transportation agencies. As per his opinion, it is not always easy to get the required mode of transportation at suitable time. Sometimes, these logistic agencies increase the price if the timing is not suitable for them. Besides, local polices harass the driver or helper of the vehicle to earn some extra money. These factors cause the amplification of the costing of papers immensely. Moreover, contingencies like heavy rain, strike and labour protest also increase the prices of logistics which are also some major challenges for small business starters like Mr Jamal Hasan. Price barrier High tax on imports of paper translates to elevated prices of international brands. As per the information from the market, the difference between the foreign and local brands is around BDT 1.18 per ream. As a result, per box difference becomes around USD 5.89 which is a huge difference for a commodity product like paper. Secondly, the aggressive promotion of local brands has become another barrier for the progression of foreign brands operating in Bangladesh. Many local paper brands offer gift items and cash incentives quite frequently to local stationery shop owners which 80 J. U. AHMED ET AL. encourages businesses to promote more local brands instead of foreign products even though the quality difference is clearly visible. Finally, the availability of low-cost products can be another difficulty for businesses importing foreign goods. In the local market, there are abundant brands producing low-quality products in cost-effective ways. These brands are preferred by companies that are not willing to invest on stationery items. Besides, they are not concerned about the quality as their paper usage is very limited. JNA Pulp’s retail price ranged between USD 4.1 and USD 4.13 per ream. Wholesaler and dealers offered price was USD 4.07 per ream and the distributor’s price was USD 4.01–4.03 per ream. The price of JNA Pulp was slightly higher in comparison to established local brands like Bashundhara, Papertech and Idea that are sold between USD 2.95 and USD 3.54. However, international brands like Double A, and Paperone are sold at even higher prices; Double A papers are available at USD 4.54–4.71 per ream and Paperone at USD 4.24–4.36 per ream. Credit system on sale In Bangladesh, selling on credit is a common practice, especially in local paper market. Most of the stationery shop owners are comfortable conducting their business on credit. After selling out the products, they try to pay back to the manufacturers. Local paper brand manufacturers have financial capabilities for which they do not face difficulties selling products on credit. However, this business practice is an obstacle for small businesses like JNA Pulp. Selling on credit and creating a cycle based on it is a major problem as stationery shop owners take time to pay back the money. The owner of JNA Pulp often had to wait to pay the letter of credit (LC) amount in bank. There was a frequent delay of 2–3 months to pay back for which opening LC to import new products becomes tough. Besides, without this, LC payment bank cannot open any LC leading to products becoming unavailable in the market. In addition, local shop owners are also unwilling to pay in advance to get the products before others. As a result, there is often a shortage of products in the market. Exit barrier Paper business in Bangladesh is very competitive. Lower entry restriction and smaller investment has made easier for everyone to start with this business. However, the profit margin is very low because of the availability of products (original or duplicate) and stationery shops in different markets. In addition, as discussed in the previous section, paper merchants often give late payment after purchasing paper. This creates an exit barrier occasionally for small business persons like Mr Jamal Hasan. Several businesses expressed their disappointment with this payment trend and margin because they cannot stop this business whenever they want. Without pulling out money or investment from the market, it is quite impossible for them to shut down the business. Besides, it will incur huge loss for them. Thus, it often feels like ‘there is no turning back from this business once someone starts it’. Paper merchants or shop owners are not liable for this exit barrier. It is the market trend of Bangladesh where every player of the market plays the same rule for making payment. Hence, small businesses do not receive payment in due time and then the lower profit margin exacerbates the scenario making owners consider that closing down the business is the most viable option. SMALL ENTERPRISE RESEARCH 81 Moreover, small businesses are bearing most the brunt of the pandemic as they are dependent on a short cash cycle. Enterprises not related to emergency food and medicine are also suffering immensely. Bangladesh was in a state of partial to full lockdown from 26 March 2020 to 30 May 2020 which led to supply chain disruptions and loss of sales. JNA Pulp was in a dire situation as international borders were closed and this meant importing further consignments would be impossible. The owner, who was already overburdened with countless other constraints, finally decided to shut down the business permanently. Conclusion SMEs are drivers of economic growth and job creation in emerging economies. Therefore, it is predominant to comprehend the factors that hinder their growth. This case portrays the story of a struggling small enterprise that encountered several obstacles since its operation. Challenges faced by SMEs in Bangladesh vary based on the nature of their businesses and industries, although some challenges are inherent for all. For instance, SMEs perceive access to finance as the primary barrier to growth in a market. However, this was not the case with JNA Pulp which was initiated by Jamal Hasan using personal funds. One of the factors leading to JNA Pulp’s closure was the global pandemic resulting from COVID-19. It would be interesting to study whether the SMEs that decided to shut down when Bangladesh was hit by COVID-19 could have tackled the challenges if the global pandemic did not happen. Note 1. For the purpose of this case, we interviewed JNA Pulp’s owner, Mr Jamal Hasan to learn about his business and experience of operating a small company in Bangladesh. The data and information he provided enabled us to gain an insight into the challenges the business had to bear. Disclosure statement No potential conflict of interest was reported by the author(s). Funding This work was supported by the InterResearch, Dhaka, Bangladesh (2019). ORCID Jashim Uddin Ahmed http://orcid.org/0000-0001-8145-6912 References Ahmed, M. U., Mannan, M. A., Razzaque, A., & Sinha, A. (2004). Taking stock and charting a path for SMEs in Bangladesh. Bangladesh Enterprise Institute. Byron, R. K. (2020). SMEs to be gifted with turnover tax cut. The Daily Star. https://www. thedailystar.net/business/news/smes-be-gifted-turnover-tax-cut-1910369 82 J. U. AHMED ET AL. GOB. (2015). Government of the People’s Republic of Bangladesh Ministry of Planning Division, Study on Future Direction of SMEs in Bangladesh. https://plandiv.portal.gov.bd/sites/default/ files/files/plandiv.portal.gov.bd/notices/afbffe34_be4c_417d_b36c_ecf8db4614fc/ToR%20final %20SME.pdf Parvez, S. (2019). Exports prove a boon for paper mills. The Daily Star. https://www.thedailystar. net/business/news/exports-prove-boon-paper-mills-1686010