GSBA 511 Microeconomics for Management Final Exam Master Cheat Sheet.pdf

advertisement

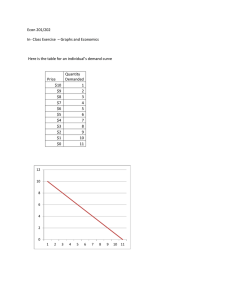

GSBA 511: MICROECONOMICS FOR MANAGEMENT FINAL EXAM MASTER CHEET SHEET CHAPTER 1 • Market: A group of buyers and sellers of a good or service and the institution or arrangement by which they come together to trade. • Three Key Economic Ideas: o People are rational. o People respond to economic incentives. o Optimal decisions are made at the margin. • Economists use the term MARGINAL to mean “extra” or “additional.” • Firms receive REVENUE from selling goods. • Economists reason that the optimal decision is to continue any activity up to the point where the marginal benefit equals the marginal cost – that is, to the point where: MB (marginal benefit) = MC (marginal cost). • Marginal Analysis: The analysis conducted by Economists when comparing marginal benefits to marginal costs. • Trade-Offs: Producing more of one good or service means producing less of another good or service. • Opportunity Cost of Any Activity: The highest valued alternative that must be given up to engage in said activity. • Trade-offs force society to make choices when answering three fundamental questions: o WHAT goods and services will be produced? o HOW will the goods and services be produced? o WHO will receive the goods and services produced? • Three Types of Economies: o Centrally Planned Economy: Government decides how economic resources will be allocated. o Market Economy: The decisions of households and firms interacting in markets allocate economic resources. o Mixed Economy: Primarily a market economy as most economic decisions result from the interaction of buyers and sellers BUT the Government plays a significant role in the allocation of resources. • Two types of Efficiency: o Productive Efficiency: Occurs when a good or service is produced at the lowest possible cost. o Allocative Efficiency: Occurs when production is in accordance with consumer preferences. • Equity: The fair distribution of economic benefits. • To develop an economic model, Economists follow the following steps: o Decide on the assumptions to use. o Formulate a testable hypothesis. o Use economic data to test the hypothesis. o Revise the model if it fails to explain the economic data well. o Retain the revised model to help answer similar economic questions in the future. • Economic Variable: Something measurable that can have different values, such as the number of people employed in manufacturing. • Two Types of Analysis o Positive Analysis: Analysis concerned with WHAT IS. o Normative Analysis: Analysis concerned with WHAT OUGHT TO BE. o Economics is about Positive Analysis, which measures the costs and benefits of different courses of action. • Economics (like Psychology, Political Science and Sociology, among others) is a SOCIAL SCIENCE because it studies the actions of INDIVIDUALS. • MICROECONOMICS: The study of how households and firms make choices, how they interact in markets and how the government attempts to influence their choices. • MACROECONOMICS: The study of the economy as a whole, including topics such as inflation, unemployment and economic growth. • Firm | Company | Business: An organization that produces a good or service. • Entrepreneur: An entrepreneur is someone who operates a business. • Innovation: The practical application of an invention. • Technology: The processes used to produce goods and services. • Goods: Tangible merchandise. • Services: Activities performed for others. • Revenue: The total amount received for selling a good or service as calculated by multiplying the price per unit by the number of units sold. • Profit: The difference between a firm’s revenues and costs. • Household: All persons occupying a home. • Factors of Production | Economic Resources | Inputs: Labor | capital | natural resources | entrepreneurial ability. • Physical Capital: Manufactured goods that are used to produce other goods and services. • Human Capital: The accumulated training and skills that workers possess. CHAPTER 2 • Scarcity: A situation in which unlimited wants exceed the limited resources available to fulfil those wants. • Production Possibilities Frontier (PPF): A curve showing the maximum attainable combinations of two goods that can be produced with available resources and current technology. • Economic Growth: The ability of the economy to increase the production of goods and services. • Trade: The act of buying and selling. • Absolute Advantage: The ability of an individual, a firm, or a country to produce more of a good or service than competitors, using the same amount of resources. • Comparative Advantage: The ability of an individual, a firm, or a country to produce a good or service at a lower opportunity cost than competitors. • Market: A Group of buyers and sellers of a good or service and the institution or arrangement by which they come together to trade. • Two Types of Markets: o Product Market: A market for goods – such as computers – or services – such as medical treatment. o Factor Markets: A market for the factors of production, such as labor, capital, natural resources and entrepreneurial ability. • 4 Categories of Factors of Production: o Labor: Includes all types of “work” ranging from the part-time worker at McDonalds to the CEO of a company. o Capital: Physical capital such as computers, office buildings, etc. used to produce other goods. o Natural Resources: Includes land, water, oil, and other raw materials or “gifts of nature” used in producing goods. o Entrepreneur: Someone that operates a business. • Two Key Groups That Participate in Markets: o Households: The individuals in a home that are employed by firms to make goods and provide services. o Firms: Suppliers of goods and services. • Circular-Flow Diagram: A Model that illustrates how participants in markets are linked. • Free Market: A market with few government restrictions on how a good or service can be produced or sold or on how a factor of production can be employed. • Property Rights: The rights individuals or businesses have to the exclusive use of their property, including the right to buy or sell it. CHAPTER 3 • Perfectly Competitive Market: A market that meets the following conditions: o Many buyers and sellers. o All firms are selling identical products. o There are no barriers to new firms entering the market. • Demand Schedule: A table that shows the relationship between the price of a product and the quantity of the product demanded. • Quantity Demanded: The quantity of a good or service that a consumer is willing and able to purchase at a given price. • Demand Curve: Curve that shows the relationship between the price of a product and the quantity of the product demanded. • Market Demand: The demand by all consumers of a given good or service. • Law of Demand: A rule that states that, holding everything else constant, when the price of a product falls, the quantity demanded of the product will increase, and when the price of a product rises, the quantity demanded of the product will decrease. • The Substitution Effect: The change in the quantity demanded of a good that results from a change in price making the good more or less expensive relative to other goods, holding constant the effect of the price change on consumer purchasing power. • The Income Effect: The change in the quantity demanded of a good that results from the effect of a change in price on consumer purchasing power, holding all other factors constant. • Purchasing Power: The quantity of goods a consumer can buy with a fixed amount of income. • Ceteris Paribus (“all else equal”) Condition: The requirement that when analyzing the relationship between two variables – such as price and quantity demanded – other variables must be held constant. • 5 Most Important Variables (other than “Price”) that Influence Market Demand: o Income. o Price of related goods. o Tastes. o Population and demographics. o Expected future prices. • Normal Good: A good for which the demand increases as income rises and decreases as income falls. • Inferior Good: A good for which the demand increases as income falls and decreases as income rises. • Substitutes: Goods and services that can be used for the same purpose. • Complements: Goods and services that are used together. • Demographics: The characteristics of a population with respect to age, race and gender. • Difference between Change in Demand and Change in Quantity Demanded: o Change in Demand: Refers to a shift in the demand curve due to something OTHER than a change in the good’s price. o Change in Quantity Demanded: Refers to a shift in the demand curve due to a change in the product’s price. • Quantity Supplied: The amount of a good or service that a firm is willing to supply at a given price. • Supply Schedule: A table that shows the relationship between the price of a product and the quantity of the product supplied. • Supply Curve: A curve that shows the relationship between the price of a product and the quantity of the product supplied. • The Law of Supply: A rule that states that, holding everything else constant, increases in price cause increases in the quantity supplied, and decreases in price cause decreases in the quantity supplied. • 5 Most Important Variables (other than “Price”) that Influence Market Supply: o Price of inputs. o Technological change. o Prices of related goods in production. o Number of firms in the market. o Expected future prices. • Supply Input: Anything used in the production of a good or service. • Technological Change: A positive or negative change in the ability of a firm to produce a given level of output with a given quantity of inputs. • Substitutes in Production: Alternative goods that a firm could produce. • Number of Firms in the Market: A change in the number of firms in the market will change supply: o When a new firm ENTERS the market, supply increases. o When a new firm EXITS the market, supply decreases. • Expected Future Prices: The adjusting of price or supply of a good based on expected FUTURE prices… • Change in Supply vs. Change in Quantity Supplied: o Change in Supply: Refers to a shift in the supply curve. The supply curve will shift when there is a change in one of the variables OTHER THAN PRICE that affects the willingness of suppliers to sell the product. o Change in Quantity Supplied: Refers to movement along the supply curve based on a change in the product’s price. • Market Equilibrium: A situation in which quantity demanded equals quantity supplied. • Competitive Market Equilibrium: A market with many buyers and sellers. • Surplus: A situation in which the quantity supplied is greater than the quantity demanded. • Shortage: A situation in which the quantity demanded is greater than the quantity supplied. • KEY NOTE: When a shift in demand or supply curve causes a change in equilibrium price, the change in price does NOT cause a further shift in demand or supply. CHAPTER 4 • Competitive Market Equilibrium: A market where all consumers willing to pay the market price will be able to buy as much of a product as they want and all firms willing to accept the market price will be able to sell as much of the product as they want – In essence, Marginal Benefit = Marginal Cost. • Price Controls: Government mandated and legally binding maximum and minimum prices. • Price Ceiling: Government mandated and legally determined MAXIMUM price that sellers may charge. • Price Floor: Government mandated and legally binding MINIMUM price that sellers may receive. • Consumer Surplus: The difference between the highest price a consumer is willing to pay for a good or service and the actual price the consumer pays. • Marginal Benefit: The additional benefit to a consumer from consuming one more unit of a good or service. • Marginal Cost: A change in a firm’s total cost from producing one more unit of a good or service. • Producer Surplus: The difference between the lowest price a firm would be willing to accept for a good or service and the price it actually receives. • Economic Surplus: The sum of consumer surplus and producer surplus. • Deadweight Loss: The reduction in economic surplus resulting from a market not being in competitive equilibrium. • Economic Efficiency: A market outcome in which the marginal benefit to consumers of the last unit produced is equal to its marginal cost of production and in which the sum of consumer surplus and producer surplus is at a maximum. • Black Market: A market in which buying and selling take place at prices that violate government price regulations. • Three Results from Government Enacted Price Floors & Price Ceilings: o Some people win. o Some lose. o There is a LOSS of economic efficiency. • Tax Incidence: The actual division of the burden of a tax between buyers and sellers in a market. CHAPTER 6 • Elasticity: A measure of how much one economic variable responds to changes in another economic variable. • Price Elasticity of Demand: The responsiveness of the quantity demanded of a good to changes in its price. o Price Elasticity of Demand = Percentage Change in Quantity Demanded ( / ) Percentage Change in Price. o KEY POINT: The Price Elasticity of Demand is NOT THE SAME as the slope of the demand curve. • KEY POINT: The Price Elasticity of Demand is ALWAYS negative. • Price Elasticity of Supply: The responsiveness of the quantity supplied of a good to changes in its price. • Elastic Demand: The case where the percentage change in quantity demanded is GREATER than the percentage change in price, so the price elasticity is GREATER than 1 absolute value. • Inelastic Demand: The case where the percentage change in quantity demanded is LESS than the percentage change in price, so the price elasticity is LESS than 1 absolute value. • Unit Elastic: The case where the percentage change in quantity demanded is EQUAL to the percentage change in price, so the price elasticity is equal to 1 in absolute value. • THE MIDPOINT FORMULA: • KEY POINT: “Elasticity” is NOT the same thing as “Slope.” o Slope is calculated using changes in quantity and price. o Elasticity is calculated using percentage changes. • When Two Demand Curves Intersect: o The demand curve with the SMALLER slope (in absolute value) – the FLATTER demand curve – is MORE elastic. o The demand curve with the LARGER slope (in absolute value) – the STEEPER demand curve – is LESS elastic. • Perfectly Inelastic Demand (a vertical line): The case where the quantity demanded is completely unresponsive to price and the price elasticity of demand equals zero. • Perfectly Elastic Demand (a horizontal line): The case where the quantity demanded is infinitely responsive to price and the price elasticity of demand equals infinity. • The Key Determinants of the Price Elasticity of Demand: o The availability of close substitutes for the good. § If a product has MORE substitutes available, it will have a MORE elastic demand. If a product has LESS substitutes available, it will have a LESS elastic demand. o The passage of time. § The MORE time that passes, the MORE elastic the demand for a product becomes. o Whether the good is a luxury or a necessity. § The demand curve for a luxury is MORE elastic than the demand curve for a necessity. o The definition of the market. § The more narrowly we define a market, the MORE elastic demand will be. o The share of the good in the consumer’s budget. § The demand for a good will be MORE elastic the larger the share of the good in the average consumer’s budget • Total Revenue: The total amount of funds a seller receives from selling a good or service, calculated by multiplying price per unit by the number of units sold. o When demand is INELASTIC, price and total revenue move in the SAME direction: An INCREASE in price RAISES the total revenue, and a DECREASE in price REDUCES total revenue. o When demand is ELASTIC, price and total revenue move in the OPPOSITE direction: An INCREASE in price REDUCES the total revenue, and a DECREASE in price RAISES total revenue. • Cross-Price Elasticity of Demand: The percentage change in the quantity demanded of one good divided by the percentage change in the price of another good. o Cross-Price Elasticity of Demand = Percentage Change in Quantity Demanded of One Good ( / ) Percentage Change in Price of Another Good. • Income Elasticity of Demand: A measure of the responsiveness of the quantity demanded to changes in income, measured by the percentage change in the quantity demanded divided by the percentage change in income. o Income Elasticity of Demand: Percentage Change in Quantity Demanded ( / ) Percentage in Income. • Price Elasticity of Supply: The responsiveness of the quantity supplied to a change in price, measured by dividing the percentage change in the quantity supplied of a product by the percentage change in the product’s price. o Price Elasticity of Supply: Percentage Change in Quantity Supplied ( / ) Percentage Chance in Price. • The Key Determinants of the Price Elasticity of Supply: o If the price elasticity of supply is LESS than 1, then supply is INELASTIC. o If the price elasticity of supply is GREATER than 1, then supply is ELASTIC. o If the price elasticity of supply is EQUAL to 1, then supply is UNIT ELASTIC. CHAPTER 10 • Economists generally ASSUME that consumers have all necessary information to make purchasing decisions, this is NOT NECESSARILY always the case. • Behavioral Economics: The study of situations in which people make choices that do not appear to be economically rational. • Experimental Economics: The effects of factors such as social pressure and notions of fairness on consumer behavior. • Utility: The enjoyment or satisfaction people receive from consuming a good or service. • Marginal Utility (MU): The change in TOTAL Utility a person receives from consuming one additional unit of a good or service. • The Law of Diminishing Marginal Utility: The principle that consumers experience diminishing additional satisfaction as they consume more of a good or service during a given period of time. • Budget Constraint: The limited amount of income available to consumers to spend on goods and services. • Key Economic Principle to Maximize the most “Bang For Your Buck”: Optimal decisions are made at the margin. • Two Conditions for Maximizing Utility (when purchasing two different goods): o The Marginal Utility per dollar spent must be the same for both goods. o Total spending on both goods must equal the amount available to spend (budget constraint). • Income Effect: The change in quantity demanded of a good that results from the effect of a change in price on consumer purchasing power, holding all other factors constant. • The substitution Effect: The change in quantity demanded of a good that results from a change in price making the good more or less expensive relative to other goods, holding constant the effect of the price change on consumer purchasing power. • Network Externalities: A situation in which the usefulness of a product increases with the number of consumers who use it. • Switching Costs: When a product becomes established, consumers may find switching to a new product that contains a better technology too costly. • Path Dependent: Because of switching costs, the technology that was first available may have advantages over better technologies that were developed later. • Market Failure: A situation when the market fails to produce the efficient level of output. • The Ultimatum Game: The Economic experiment that tests whether fairness is important in consumer decision making. • The Three Pitfalls in Decision Making: o People take into account “monetary costs” but ignore “nonmonetary opportunity costs” that don’t involve explicitly spending money. o People fail to ignore sunk costs. o People are unrealistic about their future behavior. • Endowment Effect: The tendency of people to be unwilling to sell a good they already own even if they are offered a price that is greater than the price they would be willing to pay to buy the good if they didn’t already own it. • Sunk Cost: A cost that has already been paid and cannot be recovered. CHAPTER 11 • Technology: The process a firm uses to turn inputs into outputs of goods and services. • Technological Change: A positive or negative change in the ability of a firm to produce a given level of output with a given quantity of inputs. • Short Run: The period of time during which at least one of a firm’s inputs is fixed. • Long Run: The period of time in which a firm can vary all its inputs, adopt new technology, and increase or decrease the size of it’s physical plant. • Total Cost: The cost of all the inputs a firm uses in production. • Variable Costs: Costs that change as output changes. • Fixed Costs: Costs that remain constant as output changes. • KEY FORMULA: Total Cost = Fixed Costs + Variable Costs (TC = FC + VC). • Explicit Cost: A cost that involved spending money. • Implicit Cost: A non-monetary opportunity cost. • Production Function: The relationship between the inputs employed by a firm and the maximum output it can produce with those inputs. • KEY FORMULA: Average Total Cost = Total Cost ( / ) The Quantity of Output Produced. • Marginal Product of Labor: The additional output a firm produces as a result of hiring one more worker. • Law of Diminishing Returns: The principle that, at some point, adding more of a variable input, such as labor, to the same amount of a fixed input, such as capital, will cause the marginal product of the variable input to decline. • Average Product of Labor: The total output produced by a firm divided by the quantity of workers. • KEY POINT: The average product of labor is the average of the marginal products of labor… • KEY FORMULA: Marginal Cost = CHANGE in Total Cost ( / ) CHANGE in Quantity. • KEY POINT: When the marginal product of labor is rising, the marginal cost of output is falling. When the marginal product of labor is falling, the marginal cost of output is rising. • KEY POINT: We can conclude that the marginal cost of output falls and then rises – forming a U shape – because the marginal product of labor rises and then falls. • KEY FORMULA: Average Total Cost = Total Cost ( / ) Quantity of Output Produced. • KEY FORMULA: Average Fix Cost = Fixed Cost ( / ) Quantity of Output Produced. • KEY FORMULA: Average Variable Cost = Variable Cost ( / ) Quantity of Output Produced. • KEY FORMULA: Average Total Cost = Average Fixed Cost ( + ) Average Variable Cost. • 3 KEY POINTS o The marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves are all U shaped, and the marginal cost curve intersects both the average variable cost curve and the average total cost curve at their minimum points. When marginal cost is below either average variable cost or average total cost, it causes them to decrease. When marginal cost is above average variable cost or average total cost, it causes them to increase. Therefore, when marginal cost equals average variable cost or average total cost, they must be at their minimum points. o As output increases, average fixed cost gets smaller and smaller. In calculating average fixed cost, we are dividing something that gets larger and larger—output—into something that remains constant— fixed cost. Firms often refer to this process of lowering average fixed cost by selling more output as “spreading the overhead” (where “overhead” refers to fixed cost). o As output increases, the difference between average total cost and average variable cost decreases. The difference between average total cost and average variable cost is average fixed cost, which gets smaller as output increases. • KEY POINT: The distinction between “fixed” cost and “variable” cost applies to the short run but NOT to the long run…In the long run, ALL COSTS ARE VARIABLE; there are NO FIXED COSTS in the long run. • Long-Run Average Cost Curve: A curve that shows the lowest cost at which a firm is able to produce a given quantity of output in the long run, when no inputs are fixed. • Economies of Scale: The situation in which a firm’s long-run average cost falls as it increases the quantity of output it produces. • Key Factors Influencing Economies of Scale: o As in the case of automobile production, the firm’s technology may make it possible to increase production with a smaller proportional increase in at least one input. o Both workers and managers can become more specialized, enabling them to become more productive, as output expands. o Large firms, like Ford, Walmart, or Apple, may be able to purchase inputs at lower costs than smaller competitors. In fact, as Apple and Walmart expanded, their bargaining power with their suppliers increased, and their average costs fell. o As a firm expands, it may be able to borrow money at a lower interest rate, thereby lowering its costs. • Constant Returns to Scale: The situation in which a firm’s long-run average costs remain unchanged as it increases output. • Minimum Efficient Scale: The level of output at which all economies of scale are exhausted. • Diseconomies of Scale: The situation in which a firm’s long-run average cost rises as the firm increases output. CHAPTER 12 • Perfectly Competitive Market: A market that meets the following THREE conditions: o Many buyers and sellers. o All firms selling identical products. o No barriers to new firms entering the market. • Price Taker: A buyer or seller that is unable to affect the market price in a perfectly competitive market. • KEY FORMULA: Profit = Total Revenue (TR) ( - ) Total Costs (TC). • KEY FORMULA: Average Revenue (AR) = Total Revenue ( / ) Quantity of Product Sold. • KEY POINT: In a perfectly competitive market, for any level of output, a firm’s average revenue is ALWAYS equal to the market price. • Marginal Revenue: The change in total revenue from selling one more unit of a product. • KEY FORMULA: Marginal Revenue (MR) = Change in Total Revenue ( / ) Change in Quantity AKA MR = DTR ( / ) DQ. • KEY POINT: For a firm in a perfectly competitive market, price is equal to BOTH average revenue AND marginal revenue. • KEY POINT: The marginal revenue curve for a perfectly competitive firm is the same as its demand curve. • SUMMARY OF KEY POINTS: o The profit-maximizing level of output is where the positive difference between total revenue and total cost is the GREATEST. o The profit-maximizing level of output is also where marginal revenue equals marginal cost or MR = MC. o For firms in perfectly competitive industries, PRICE is equal to MARGINAL REVENUE or P = MR. We can restate the MR = MC condition as P = MC. • KEY FORMULA: Profit = (Price ( x ) Quantity) ( – ) Total Cost or (P x Q) ( - ) TC. • A firm has two choices in the short-term when operating at a loss: o Continue to produce (at a loss). o Stop production by shutting down temporarily. • Sunk Cost: A cost that has already been paid and cannot be recovered. • KEY POINT: For any firm, whether TOTAL REVENUE is GREATER than or LESS than VARIABLE COST is the key to deciding whether to shut down or continue producing in the short run. • KEY POINT: In a perfectly competitive market, a firm’s marginal cost curve is also it’s supply curve. o A firm’s marginal cost curve is it’s supply curve ONLY for prices at or above average variable cost. • Shutdown Point: The minimum point on a firm’s average variable cost curve; if the price falls below this point, the firm shuts down production in the short run. • Economic Profit: A firm’s revenues minus all of it’s implicit and explicit costs. • Economic Loss: The situation in which a firm’s total revenue is less than its total cost, including all implicit costs. • Long-Run Competitive Equilibrium: The situation in which the entry and exit of firms has resulted in the typical breaking even. • Long-Run Supply Curve: A curve that shows the relationship in the long run between market price and the quantity supplied. • KEY POINT: In the long run, a perfectly competitive market will supply whatever amount of a good consumers demand at a price determined by the minimum point on the typical firm’s average total cost curve. • Constant-Cost Industries: Any industry in which the typical firm’s average costs REMAIN CONSTANT as the industry expands production resulting in a HORIZONTAL long-run supply curve. • Increasing-Cost Industries: Any industry Any industry in which the typical firm’s average costs INCREASE as the industry expands production resulting in an UPWARD SLOPING long-run supply curve. • Decreasing-Cost Industries: Any industry Any industry in which the typical firm’s average costs DECREASE as the industry expands production resulting in an DOWNWARD SLOPING long-run supply curve. • Productive Efficiency: A situation in which a good or service is produced at the lowest possible cost. • Allocative Efficiency: A state of the economy in which production is in accordance with consumer preferences; in particular, every good or service is produced up to the point where the last unit provides a marginal benefit to society equal to the marginal cost of producing it. CHAPTER 15 • Monopoly: A firm that is the only seller of a good or service that does not have a close substitute. • 4 Main Barriers to Entry that Create a Monopoly: o Government action blocks the entry of more than one firm into a market. o One firm has control of a key resource necessary to produce a good. o There are important network externalities in supplying the good or service. o Economies of scale are so large that one firm has a natural monopoly. • Two ways the United Stated government blocks entry into a market: o Granting of a patent, copyright or trademark to an individual or a firm, giving it the exclusive right to produce a product. o Granting a firm public franchise, making it the exclusive legal provider of a good or service. • Patent: The exclusive right to a product for a period of 20 years from the date the patent application is filed with the government. • Trademark (Brand Name): Grants a firm legal protection against other firms using it’s product’s name. • Copyright: A government-granted exclusive right to produce and sell a creation. • Public Franchise: A government designation that a firm is the only legal provider of a good or service. • Network Externalities: A situation in which the usefulness of a product increases with the number of consumers who use it. • Natural Monopoly: A situation in which economies of scale are so large that one firm can supply the entire market at a lower average total cost than can two or more firms. • A firm with a monopoly differs from other firms in that a firm with a monopoly has a demand curve that’s the same as the market demand curve for the product in which they have a monopoly. • KEY POINT: A monopoly will produce a smaller quantity and charge a higher price than would a perfectly competitive industry producing the same good. • Key Effects of a Monopoly: o Monopolies cause a DECREASE in consumer surplus. o Monopolies cause an INCREASE in producer surplus. o Monopolies cause a deadweight loss, which represents a reduction in economic efficiency. • Market Power: The ability of a firm to charge a price greater than marginal cost. • Collusion: An agreement among firms to charge the same price or otherwise not to compete. • The Sherman Act: First important law enacted in the United States to govern the regulation of monopolies. • Antitrust Laws: Laws aimed at eliminating collusion and promoting competition among firms. • Horizontal Mergers: A merger between firms in the same industry. • Vertical Mergers: A merger between firms at different stages in the production of a good. • Merger Guidelines from the United Stated Department of Justice and the FTC include three main parts: o Market definition. o Measure of concentration. Merger standards.