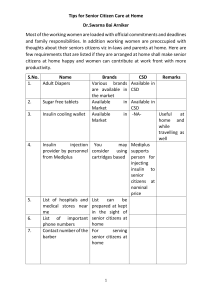

CSD OPERATING STRATEGY Decision Needed Proceed with Option 1 or Option 2 on CSD operating strategy for FY1819 PACE Roles Process Owner: Abhinav Rastogi, Raghu Narayanan Contributors: Ankur B, Navin RD, Gautham V, R Patil, Saurabh K, RV Singh, Charu, Sumit P, Atreya S, Ankur B, Rohit D, PD Team, CSPs Approver: Madhusudan Gopalan Executors: Abhinav Rastogi, Raghu Narayanan, Saurabh K, PSC Team, PD Team Objective Operating Strategy aims to protect CSD business (no incremental business) Business Background Earlier CSD orders were being issued at a depot level on different dates within the month with a 20-day validity period. With the implementation of central ordering system in Sep’18, CSD HO will issue next month’s total orders by depot centrally by the 15 th. Orders will have a validity period of 28 days (1st – 28th of the next month) and can only be served within that month. CSD depots have space constraints and therefore receive trucks on a first cum first serve basis. Additionally, large Canteens (AA, A) have priority to collect stocks from the depot at the beginning of the month. Not supplying by the beginning of the month leads to longer truck detentions and lower OSA especially at large Canteens, which is one of the key business drivers for this channel. CSD depots operate at 45 days inventory towards the beginning of the month which runs down to 15 days by the end of the month leading to OSA issues at sku-canteen level. Operating Strategy Options OPTION 1 Supply 100% orders every month across 34 CSD Depots in the first 72hrs of depot opening. (Project Lakshya) Financial Implications Cash Impact: +$1.3MM (+0.6 DOH / +1.2 idx pts on IYA) to month end inventory of M-1 assuming an average 500 msu monthly order. This is because stocks for M0 will need to be picked against orders in M-1. This cash increase will take our current inventory FF from 93.5 to 94.7 versus a Firm target of 94.0 IYA. A sensitivity analysis of the cash impact for various scenarios of shipment windows (48hrs to 120 hrs) and order quantities is shared in Appendix 1. Cost Upcharge: +$ 320M, in T&W due to higher detentions and increased requirement of vehicles on the same day; +$25M for additional CSO resource on an on-going basis. Option 1 detailed operating strategy is shared in the next page. OPTION 2 Supply 75% orders every month across 34 CSD Depots in the first 96hrs of depot opening and remaining orders before depot closing Financial Implications Zero cash and cost impact on current fiscal year Option 2 there is no change versus the current Project Pegasus operating strategy for CSD The customer team is also working with CSD to increase the month end inventory from current 15 days to 30 days which will give us further improvement on Canteen OSA For reference, our best understanding of current CSD Order generation formula is shared in Appendix 2 and the first 10 days performance of CSD shipments in Sep & Oct is attached in Appendix 3. May we have your decision amongst the options. CSD OPERATING STRATEGY PROJECT LAKSHYA OPERATING STRATEGY Operating Strategy Principles After arrival of stocks truck planning from P&G depots to CSD depots will take 48 hrs and from P&G DC to CSD Depots will take at least 8 hrs (this is on a stretch basis and needs to be tested) Placement across P&G depots need to be at 100% versus orders by 2 nd of the month and 100% at DC by 4th of the month (by 10am) for CSD Depots with 1 day lead time directly connected to DC. Detailed placement plan is shared in Appendix 4. All categories except Fabric and Hair will need to complete the 100% production and deployment in M-1 to meet the Lakshya requirements For categories that have skus with lead time greater 30 days or have constrained capacity (example some skus of Fem, Baby, B&R and Oral) production will be planned based on M-2 inputs. Hence, accuracy of M-2 inputs is important for success of Project Lakshya We will start picking stocks against orders across depots in M-1 based on the principle that FGS+Shipments at depots for the sku is greater than the LBE published on 10th of the month. Stocks will be picked against the CSD orders on that sku for the next month. This will ensure CSD picking does not affect the shipment / service in other channels as per the mid-month LBE and at the same time prevent month end shipments from affecting the CSD opening for next month CSD Depot shipments will be planned in line with the CSD appointments / depot related capacity constraints. This will avoid large P&G truck detentions at CSD Depots. This strategy will require close co-ordination between PD Team, Customer Logistics and Sales team on day to day basis. The new aligned operating strategy is as follows: Please see earlier CSD strategy in Appendix 5 for reference. Category Operating Strategy Key operating strategy for top categories is as follows: Fabric: Timelines for stock availability for North Zirakhpur DC – 4th of the month, Depots served via Hyderabad – 3rd of the month B&R: Demand over and above 2nd week LBE (to be given by 8th- 10th post Saral inputs) at SKU-depot level to be picked up for CSD Shave Care M-2 inputs to be shared for capacity constrained skus Hair: All skus of Haircare a dedicated for CSD. Hence need accurate M-2 forecast for timely shipper procurement. Production in M0 month for demand of CSD depots with lead time of 1 day connected to Zirakhpur DC For remaining 100% production to be completed in the previous month Fem: Ultras 15sx45 is dedicated to CSD, hence need accurate M-2 forecast input to meet month’s demand Maxi Reg 8s and Reg 15s are primarily meant for CSD and have a capacity constraint on production. Priority will be CSD over HFS for these skus. Oral: Production in prev. month in Wk 2 for 100% requirement based on M-2 inputs as lead time from Rialto Chennai is very high. Functional Operating Strategy CSO: Orders punched in the system as soon as CSD orders are shared by 15 th of the previous month Stock picking to be done as per aligned availability strategy in co-ordination with customer logistics team Maintain purchase order, sales order and delivery creation to ensure maximum shipments in the first 72 hrs PD / Transportation: Tentative vehicle requirement plan to be shared with PD/Tpt basis depot-wise orders and expected arrival of stocks Truck load to be calculated on the basis of CSD stocks being deployed at P&G depots/DC CSD OPERATING STRATEGY No. of trucks required to be shipped at CSD depot on daily basis, based on wt./vol. data to be shared daily Partial truck loads will be shipped to complete the last shipments at each depot and will not require by depot approval from the PD manager Sales: Labors to be managed by CSD or P&G aligned upfront between Sales and PD team ZMs to be onboarded on vehicle placement and shipments, appointment with CSD depots and to act according to Lakshya plan Drumbeat to Operationalize these strategies Connect with PSC, SNO and Sales LT by 20th of every month to review the month’s performance and learnings Weekly connect between CSP, PD team, Customer Logistics and Sales team to review current month and next month availability and shipment plan CPS tracker to be published every 2 days based on the aligned operating strategy Daily tracker published on a) availability, picking and shipments by category and by depot b) truck placements, planning and depot related constraints APPENDIX Appendix 1 The incremental cash impact has been worked out versus Project Pegasus. Sensitivity Analysis of Incremental Cash Impact for various scenarios of Project Lakshya is given below: The impact of combining 2 CSD orders into 1 order in the month as part of CSD central ordering is ~$250M impact for Scenario 1 and ~$500M impact for Scenario 2. 70% of the remaining incremental cash impact is due to pre-production required in M-1 on Fabric Care. Appendix 2 Please see below our best understanding of the formula used by CSD to place orders for each month taking Nov as an example: Nov Orders = (Blocking Factor * JAS Average Retailing) + Denials – Sep Depot Closing Inv – Oct In-Transit Legend: Blocking factor - Factor used by CSD to adjust inventory at depots Retailing - Shipments from CSD depots to Canteen Denials - Qty of stocks not served to canteen by the depot In-Transit - Stocks remaining to be received by CSD from P&G Appendix 3 Please see below the first 10 days by-day CSD shipment performance for the last 2 months: CSD OPERATING STRATEGY Appendix 4 Required CSD Depot placement date is shared below: Appendix 5 Earlier CSD Operating Strategy was 80% of placement @Depots by 5th Vs forecast on 18th (M-1) & remaining volumes by 18th. The detailed process is shared below: