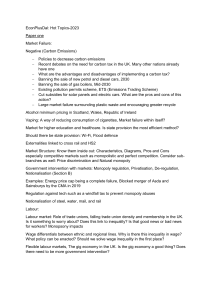

ECON1020 Full Lecture Notes W1: The Capitalist Revolution Introduction GDP per capita → Measures value of all goods & services produced in a economy per person represents average income level → all products will be eventually sold in the market & become somebody's income most popular measure for level of living standards, however; not entirely based on income level, but to an certain extent it is graph observations all countries experienced a rapid & sustained GPD growth from around 1700 → hockey stick growth ECON1020 Full Lecture Notes 1 income disparity between countries in later years → hockey stick growth began at different times for each country Inequality inequality within the world as countries become richer → inequality increases → applicable between & within countries e.g. Singapore → richest country → top 10% earn $67, 436 → bottom 10% earn $3,652 e.g. Liberia → poorest country → top 10% $994 → bottom 10% earn $17 hockey stick growth → countries who grew first are now richer, however have greater inequality gross domestic product → measure of total income & output of the economy in a given period per capita → per person → average income disposable income → total income - taxes + government transfers GDP is a imperfect measure, however correlates strongly with other measures of wellbeing e.g. life expectancy, infant mortality rate, etc ECON1020 Full Lecture Notes 2 Hockey Stick Growth ECON1020 Full Lecture Notes 3 Ratio Scale hockey stick growth→ represents the sustained rapid growth in GDP per capita experienced by countries worldwide PPP → people purchasing parity → essentially inflation adjustment timing of growth occurred at the different times for each country e.g. Britain → 1650, Japan → 1870, China & India → 1950s improvements in living standards didn't happen till independence from colonial rule or interference for some countries technological revolution technology → process that uses input to produce output allows increased output with the same amount of input within a smaller time frame revolution driven by scarcity of time → balance between work & leisure activities ECON1020 Full Lecture Notes 4 technology eases balance → more work & more leisure OR less work in exchange for more leisure industrial revolution technological advances in 18th century Britain → transformed agrarian & craft to commercial & industrial economy e.g. productivity of labour in producing light e.g. speed of information= ECON1020 Full Lecture Notes 5 environmental consequences caused by; expansion of economy → growth of total output organisation of economy → what things are valued generally society values "stuff" as opposed to the consequences to obtaining that "stuff" technology may have instigated these consequences, however may procure a solution → issue → motivation & time to develop these technologies to resolve climate change Capitalism institutions → laws & social customs governing the production & distribution of goods & services capitalism → economic system where the main institutions are private property, markets, & firms ECON1020 Full Lecture Notes 6 private property → ownership rights over possessions capital goods → non-labour inputs used in production does not include essentials → air, knowledge, etc. markets → way for people to exchange products & services for their mutual benefit features; reciprocated transfers voluntary usually competition firms → business organisation that uses in inputs to produce outputs, & sets prices to at least cover production costs features; Inputs & outputs are private property uses markets to sell outputs aim to make profit pursuit of profit provides an incentive to innovate & adopt new technology → scarcity of time capitalism lead to growth of living standards because; technology → firms competed in markets to create new technology specialisation → growth of competency in one particular task or expertise ECON1020 Full Lecture Notes 7 specialisation → increases labour productivity by becoming better at producing when focusing on a limited range of activities learn by doing taking advantage of natural skill differences economies of scale specialisation can only occur if people have another way to acquire other needed goods → done by markets via capitalism comparative advantage e.g. comparative advantage Greta has absolute advantage in both crops Greta has comparative advantage in wheat Carlos has comparative advantage in apples → least disadvantaged comparative advantage → produce the most output through specialisation of all individuals involved divergence of growth did capitalism cause the hockey stick growth? natural experiment → division of Germany into 2 seperate economic systems → west capitalism & east centralism / communism not all capitalist societies are equally successful correct incentives economic → firms, markets, private property ECON1020 Full Lecture Notes 8 political → government regulation promotes institutions & provides essential goods & services political systems → how governments will be selected, & how those governments will make & implement decisions capitalism coexists with many political systems, generally associated with democracy, however has been with non-democratic societies Economics economics → study of how people interact with each other & with their natural surroundings in producing their livelihoods, & how this changes over time W2: Technological Change, Population & Growth Introduction major economic changes occurred 200 years ago why didn't it start earlier, or later? why did it start in Britain ECON1020 Full Lecture Notes 9 real wage index → purchasing power 1850 = 100 → year 1850 used as bench mark nominal wage → physical number written → doesn't account for purchasing power / inflation can be used as another measure of living standards → similar to GDP 2 vertical axes → compare how the variables change in relation to the other variables graph observations; 1350 → black plague population decreases as wages increase as years pass towards 1600, population increases back up & wages decrease back down 1800 → Malthus → economist he said based on past → despite improvements are increasing, as population increases back up , the living standards will come back down post malthus ECON1020 Full Lecture Notes 10 population & real wage have increased together → disproved Malthus' theory technological revolution allowed to escape malthusian trap Economic Models building a model distinguish essential variables relevant to the question omit unimportant variables → model feature NOT bug real world complexity is simplified → too simplified, model is useless steps; 1. capture elements of the economy that matter 2. describe how agents act & interact with each other & other elements agents → consumers, firms, etc. 3. determine outcomes of actions → equilibrium equilibrium → situation that is self perpetuating 4. study what happens when conditions change → change a variable in model features of a good model clear → better understand something important predicts accurately → consistent with real world evidence improves communication → help understand agreements & disagreements useful → help find ways to improve the economy model concepts ceteris paribus → other things equal less is more → keep variables constant incentives → economic rewards or punishments, which influence benefits & costs of alternative courses of actions how they affect rational of people relative prices → compare alternatives ECON1020 Full Lecture Notes 11 price of product relative to the cost of other similar products economic rent → benefit received from a choice, taking into account the next best alternative alternative → reservation option differences between the choices → e.g. going to uni lecture VS skipping and staying at home Explaining Growth I modelling technology technology → a process that uses inputs to produce an output e.g. textile production ECON1020 Full Lecture Notes 12 manager of textile firm wants to produce 100 metres of cloth inputs that matter; how many workers to hire how much energy/coal to purchase 5 different ways to produce 100 metres of cloth each technology expressed as a combination of coal & workers observations; E is relatively labour intensive A is relatively coal intensive no information for cost per unit → unable to determine single cheapest technology able to determine which technologies definite will be inefficient ECON1020 Full Lecture Notes 13 some technologies dominate other technologies → use less workers & energy together tech C is inferior to / dominated by tech A → wont choose C tech D is inferior to / dominated by tech B → wont choose B options left → A,B,E minimising cost firms aim to maximise profit → minimise costs profit = revenue - cost cost = (wages x workers) + (coal cost per ton + no. of tons) cost = (w x L)+(p x R) least cost technology tech B is the cheapest with the 1st input prices → labour intensive is cheaper with coal cost increase tech A is the cheapest with 2nd input prices → coal intensive is cheaper with coal cost reduction isocost lines → combination of inputs that give the same cost ECON1020 Full Lecture Notes 14 slope represents the same cost with different level of each input C = (w x L)+(p x R) rearrange to R = c p − w L p isocost line for $80 when w = 10, p = 20 R= 80 20 − 10 20 L = 4 − 0.5L y = mx+b 4 → intercept -0.5 → gradient tech B is the least cost technology ECON1020 Full Lecture Notes 15 all other techs have the same slope gradient → same worker + coal input costs → above line more expensive, below line less expensive isocost line when changing input variables Explaining Growth II change in relative input price → change in firm's technology choice e.g. increase in coal prices → shift from coal based technology to labour intensive technology technology was labour intensive before industrial revolution increase in wages relative to coal price incentivised firms to innovate capital intensive technology ECON1020 Full Lecture Notes 16 graph observations; tech B is the cheapest technology when there is a lower relative price of coal to workers tech A is the cheapest technology when there is a higher relative price of workers to coal graph observations; ECON1020 Full Lecture Notes 17 relative input price → England had a higher relative wage price compared to France similar in 2nd graph, firms in England had incentive to change their production from labour intensive to capital intensive → wages become relatively higher benefits of innovation innovation rent → reduction of costs associated with adopting the new technology e.g. old tech → $50, new tech → $40, rent → $10 creative destruction → process by which old technologies & the firms that do not adapt are swept away by the new, because they cannot compete in the market first adopter → entrepreneur e.g. textile industry before industrial revolution → making garments were time consuming → made at house hold level by 19th century → single spinning mule operated by a few people could replace 1000 spinsters later, these machines were powered by water wheels then later again, coal powered steamed engines Explaining Stagnation minimal growth before the industrial revolution law of diminishing average product of labour if one input is fixed (land) & the other is expanded (workers) the average output per worker decreasesre ECON1020 Full Lecture Notes 18 malthus' model key ideas; population increases with living standards law of diminishing returns → income with fall → living standards will faill reach equilibrium of subsistence / base level income levels fall back to a subsistence level → enough to sustain basic human consumption ECON1020 Full Lecture Notes 19 malthusian trap conditions; diminishing average product of labour rising fertility in response to wages absence of continual technology improvement to offset diminishing returns technological revolution → condition of no technological improvement was subverted → able to escape malthusian trap ECON1020 Full Lecture Notes 20 W3: Scarcity, Work & Choice A Introduction graph observations; economic progress → consume more goods & enjoy more free time proportion between income & free time differs inverse relationship between GDP & annual hours worked → as GDP increases, hours of free time increase time has been used for more social connections, leisure, sleep, etc. resources are scarce → choices need to be made → money / work VS free time too many hours working costs the free time u could have had ECON1020 Full Lecture Notes 21 model of individual choice → indifference curves how an individual maximises happiness with the constraints faced what we want → indifference curves VS what we can do → feasible frontier Production Functions e.g. grades & study hours student needs to choose between study & free time assume positive relationship between hours studied & GPA is true → although all other factors must be constant → ceteris paribus observations; better environment also impacts GPA → assumption of study hours & GPA is false HS + PE has a lower GPA → ceteris paribus → factors aren't being held constant production function → shows how inputs translate into outputs, holding other factors constant marginal product → change in output per unit change in input evaluated at a given point other inputs held constant average product → average output per unit of input e.g. studying ECON1020 Full Lecture Notes 22 marginal product of the 5th hour 4 hours → 50 mark 5 hours → 57 mark marginal product → 7 average product of 4 hours 4 hours → 50 marks average product → 12.5 diminishing marginal product → studying becomes less productive → marginal & average product decreases as hours increase production function represents what the student is capable of final decision would depend student's preference ECON1020 Full Lecture Notes 23 Indifference Curves indifference curves → shows all combinations of goods that give the same utility/benefit e.g. student studying → all combinations of studying & free time that give the same amount of happiness marginal rate of substitution → the slope of the indifference curve & represents the tradeoffs that an individual faces e.g. student studying → how many marks lost for one extra hour of free time & still feel indifferent ECON1020 Full Lecture Notes 24 indifference curve properties; curves slope downward due to trade offs → inverse relationship higher curves correspond to higher utility levels → further from origin curves are usually smooth → incremental changes don't create large jumps in utility curves do not cross → rational preference is consistent curve flattens as you move to the right → vice versa, becomes more vertical as you go left → relative value of each unit changes depends on abundance of each in every combination e.g. student studying → if you have a lot of marks & little free time, you would be willing to give up more marks for one hour of free time, however give up less marks as you have more & more free time Opportunity Cost opportunity cost → of an action is the net benefit of the next best alternative action economic costs = monetary cost + opportunity cost e.g. opportunity cost of going to 2 concerts ECON1020 Full Lecture Notes 25 economic rent → difference between benefit & cost if the benefit from an action exceeds the economic costs, you receive an economic rent from choosing it Feasible Frontier feasible frontier → maximum output that can be achieved with a given amount of input e.g. student studying → output includes both studying & free time hours → all available resources marginal rate of transformation → slope of the feasible frontier & represents tradeoffs that an individual faces feasible set → all of the combinations of the things under consideration that a decision-maker could choose given the economic, physical or other constraints that they face ECON1020 Full Lecture Notes 26 observations; feasible frontier B is not feasible → outside feasible frontier points on the feasible frontier → feasible D is feasible → but resources were not fully used marginal rate of transformation A→E enjoy one more hour of free time at the cost of 3 marks → opportunity cost of 3 C→F MRT / opportunity cost of 7 Decision Making Under Scarcity indifference curves → what you want trade off you want to make → doesn't translate to reality feasible frontier → what you can do actual trade off differences ECON1020 Full Lecture Notes 27 optimal decision making utility maximising choice is where the trade off an individual wants to make equals the actual trade off that can be made MRS = MRT, slope of indifference curve = slope of feasible frontier observations; F is the most preferred → however not feasible → outside feasible frontier ECON1020 Full Lecture Notes 28 A, B, C, D & E are all feasible → on the feasible frontier C is the least optimal → below feasible frontier E is the most optimal → MRS = MRT & highest level of utility → higher indifference curve W4: Scarcity, Work & Choice B Hours of Work & Economic Growth 1930 → John Maynard suggested; in 100 years, technological improvements would make us 8 times better off only need 15 hours of work per week to satisfy economic needs reality; working hours have fallen, but not to the extent suggested above e.g. farmer deciding hours of work VS free time application of model of constrained choice to a self sufficient farmer choosing number of hours to work assumptions; only grows gain to eat → no selling of surplus ECON1020 Full Lecture Notes 29 not enough grain → will starve scenario change → production function changes → improvement in technology farmer can produce same amount of grain with less hours of work VS more grain with the same hours of work how much free time will they choose? feasible frontier & indifference curves production choice & technological change production function → initial technology → PF point B → works 12 hours → produce 64 units of grain production function → technological improvement → P Fnew point C → works 12 hours → produce 74 units of grain point D → works 8 hours → produce 64 units of grain ECON1020 Full Lecture Notes 30 feasible set → turning production function to feasible frontier adding indifference curves technological improvement → increasing feasible frontier ECON1020 Full Lecture Notes 31 highest level of utility with the initial technology point A → IC3 → 16 hours of free time → produce 55 units of grain highest level of utility with the improved technology point E → IC4 → 17 hours of free time → produce 61 units of grain conclusion; technological improvement raised the farmer's standard of living able to achieve higher utility increase in both grain produced & free time however, just one possible result if feasible frontier or indifference curves were different → optimal choice would differ e.g. preference for free time or grain produced Income & Substitution Effects budget constraints what you can afford to buy & consume ECON1020 Full Lecture Notes 32 assume spending can not exceed your earnings c = w(24 − t) = w × working hours w = wage t = hours of free time per day e.g. working hours calculating budget line c = 15(24 − t) c = 360 − 15t x axis starts at 8 hours → y-int is 240 MRT = 15 → every hour of free time is $15 of consumption opportunity cost for 1 hour of free time ECON1020 Full Lecture Notes 33 slope shape → linear → no diminishing marginal productivity output is a wage → constant wage → regardless of productivity Note; is essentially another feasible frontier → equation used to create budget line level of your consumption that you can afford from working → add indifference curves to find the optimal choice for the level of consumption that you are happy with can only do things below the budget line → within budget constraints another perspective $360 is the maximum wage earned per day → work 24 hours worker spends $360 purchasing consumption & free ti,e at point A → spends $270 on free time & $90 on consumption model changes; wage increases income effect → total earnings increase while work hours stay the same & opportunity cost of free time more consumption & more free time substitution effect → opportunity cost of free time increases more consumption & less free time e.g. effects on working hours ECON1020 Full Lecture Notes 34 new wage → $25 new budget constraint → feasible set has expanded increase in feasible frontier → able to reach higher indifference curves ECON1020 Full Lecture Notes 35 point D → optimal choice only 17 hours of free time but consumption equals $175 hypothetical change no change in opportunity cost of free time flat addition of money → regardless of hours → some income even when working 0 hours dotted line → income increase enough to reach IC4 → point C would become the best optimal choice ECON1020 Full Lecture Notes 36 income effect → hypothetical line shift from point A to C increase in consumption & free time → achieved with increase in income income effect is positive in terms of free time substitution effect → steeper line rise in opportunity cost of free time → make budget constraint steeper optimal choice would be point D → more consumption with less free time negative substitution effect in terms of free time overall effect → sum of income & substitution effect substitution effect was bigger than income effect → negative overall effect Application to Technological Change ECON1020 Full Lecture Notes 37 differences over times observations; US, France & The Netherlands → income effect dominated the substitution effect → consumption & free time increased cross country differences international differences in working hours explained by country differences in preferences & constraints impossible to accurately determine countries' indifference curves determined through data → GPD & hours of free tine → assumes what is happening is the optimal choice US & South Korea indifference curves ECON1020 Full Lecture Notes 38 observations; point Q → intersection for indifference curves of US & South Korea Americans are more willing to give up more daily goods for an hour of free time than South Koreans → US values free time more than South Koreans explanation for differences; cultural & social norms e.g. Asian countries encourage overworking legal & political influences e.g. legal limits on working hours social preferences e.g. social peer pressure model criticisms unrealistic → no one calculates MRS & MRT & people are unable to choose their ideal work hours still a good approximation → gradually adjust work life balance to a satisfactory level, choose full or part time or the type of jobs to do ECON1020 Full Lecture Notes 39 economic models helps understand real world phenomena W5: Social Interactions Introduction context previous models are self contained → no dependancy on outside decisions & influences individuals motivated by self interest could produce beneficial outcomes to society however self interest can be harmful to society social dilemma → when people do not take adequate account of the effects of their decisions on others, whether these are positive or negative selfish decisions result in socially suboptimal outcomes tragedy of the commons → common property or resources are overexploited free riding → benefiting from contributions of others without contributing oneself use tools of game theory to model social interactions & explain social dilemmas Game Theory & Social Dilemmas I key terms; social interaction → situations involving more than one person/party, where one’s actions affect both their own & other people’s outcomes strategic interaction → social interaction where people are aware of the ways that their actions affect others strategy → actions that people can take when engaging in a social interaction game → models of strategic interaction that describes the players, the feasible strategies, the information that the players have, & their payoffs ECON1020 Full Lecture Notes 40 decisions are interdependent on opposing decisions payoff matrix → table of the game's possible outcomes game theory → sets of models of strategic interactions that are widely used in economics & other social sciences how people make decisions invisible hand game rules; 2 farmers decide what crop to grow one shot game → interact once decide simultaneously factors; players → Anil & Baba feasible strategies → rice or cassava information → each player doesn't know what the other will choose payoffs → depends on market prices & quality of land invisible hand game outcomes ECON1020 Full Lecture Notes 41 best response → strategy that yields the highest payoff, given the other player’s strategy if Bala grows rice, Anil's best response is to grow cassava if Bala grows cassava, Anil's best response is to grow cassava vice versa for Bala, he's best response for both situations is to grow rice dominant strategy → best response to all possible strategies of the other player, don't always exist in every game dominant strategy equilibrium → outcome of a game where everyone plays their dominant strategy if Anil & Bala played their dominant strategy, the outcome would be cassava & rice respectively despite being motivated by self interest, the best outcomes for individuals also happened to be the best outcome socially → guided by an invisible hand prisoner's dilemma game game farmers need to use pest control to get rid of pests conditions are the same except for strategy & payoffs dominant strategy Anil → terminator Bala → terminator ECON1020 Full Lecture Notes 42 prisoner's dilemma outcomes best responses if Anil uses IPC, Bala's best response is terminator if Anil uses terminator, Bala's best response is terminator vice versa, Anil's best response in both situations is to use terminator socially optimal strategy → both would use IPC dominant strategy equilibrium → both would use terminator → both farmer's dominant strategy socially sub optimal outcome → thus players are now faced with a social dilemma issue prisoners’ dilemma → game in which the payoffs in the dominant strategy equilibrium are lower for each player & in total than if neither player played the dominant strategy socially optimal outcomes are not achieved when dominant strategies are used nash equilibrium → set of strategies in which each player's strategy is the best response to the strategies chosen by everyone else no incentive to deviate unilaterally games can have more than 1 nash equilibrium ECON1020 Full Lecture Notes 43 how we were able to predict this outcome? players that value the other's payoff nobody could make players pay for the consequences of their actions players could not coordinate their actions beforehand Resolving Social Dilemmas social preference altruism → preference that place value on what happens to other people, even if it results in lower payoffs for the individual prisoners dilemma's are easy to resolve if people care about one another however, more difficult within larger groups e.g. prisoner's dilemma feasible frontier → only 4 possibilities, thus no feasible frontier, instead 4 feasible points selfish preference Anil doesn't care about Bala's payoffs → vertical indifference curves Anil does't care about Bala's payoffs, thus curve is vertical T, I is his preferred outcome ECON1020 Full Lecture Notes 44 altruistic preference Anil cares about Bala's wellbeing → indifference curves are downward slopping I, I is his preferred outcome if both care about each other, both would choose I, I other social preference reciprocity → being kind to other who are kind & vice vera to people who are unkind fairness / inequality aversion → disliking outcomes where some individuals receive more than others social norms → determination of whether being have been nice or not based on social norms these motives affect outcomes in public goods game & the ultimatum game learning about social preferences ECON1020 Full Lecture Notes 45 lab experiments can control participant's decision & outcomes can create a control group for comparison results can be replicated & repeated can control other variable field experiments lab experiments may not be accurate to real world decision making more realistic context & scenarios where people make decisions public goods game game group of farmers each farmer decides whether or not to contribute to the public good public good → good which use by one person does not reduce its availability to others private good → good that reduces its availability for every use individual contribution costs $10, everyone benefits $8 observations; free riding is the dominant strategy for all farmers ECON1020 Full Lecture Notes 46 if all contributed. they get $22 each. however, will gain more if they don't contribute compared to others that do dominant strategy equilibrium → no one contributes & no one gains payoffs → social dilemma similar to prison dilemma, however for more than 2 parties repeated games both games above are one shot → no accountability for the consequences of their actions however, in the real world, social interactions consist of ongoing relationships behaving selfishly in one period has consequences for future periods → one shot dominant strategy may not be the dominant strategy in the futures better outcomes may arise through repeated interactions → social norms, reciprocity & peer pressure / punishment repeated public goods game experiment game experiment conducted in cities participants randomly sorted into groups of 4 10 rounds played, each round decide on contribution from their $20 every dollar contributed, every person receives 40c ECON1020 Full Lecture Notes 47 outcome contributions started of high, but gradually decreased over the periods people are not solely self interested at first → could altruism however, participants want to punish the free riders → unfairness reciprocity → people at first treated others well, however as contributions fell, participants felt to be less generous since others were as well experiment change → punish free riders participants can make a free rider pay $3, costing themselves $1 ECON1020 Full Lecture Notes 48 outcome contributions remained the same or increased thus, with large groups of people, repeated social interactions & social preferences → punishment can produce a socially better outcome ultimatum game used to study social preferences 2 person one shot sequential game proposer is given $100 & gives part of that $100 to responder responder either rejects and nobody gets anything or accepts the offer strategic interaction ECON1020 Full Lecture Notes 49 game provides insights about sharing economic rents that arise prediction; in a world where everyone only care about their own payoffs → responder accepts anything better than nothing, whilst proposers offer the minimum possible experimental data prediction doesn't match lower offers → more rejections better offers → fewer rejections ECON1020 Full Lecture Notes 50 differing results between populations Kenyan farmers tended to make better offers US students tended to make lower offers reasons → social preferences Kenyan farmers had a stronger sense of altruism & fairness differing social norms to US students → higher disregard for other students proposers also offered the amount that would likely be accepted by the responder → maximum payoff for individuals ultimatum game change introduced 2 responders → however still only a 2 way split if no one accepts → no one gets anything if only 1 responder accepts → that responder and proposer get the split if both responders accept → one responder is randomly chosen to receive the split outcome competitiveness → rejecting the offer may not punish the proposer, since the other responder could accept → rejector left with no payout results are closer to the self interested initial prediction ECON1020 Full Lecture Notes 51 coordination issues if there is more than one nash equilibrium & decisions are chosen individually → socially optimal outcome could not be chosen stuck in suboptimal decision → no incentive to change e.g. anil & bala past of producing suboptimal decision if other doesn't change as well, they would get less output → W6: Property & Power: Mutual Gains & Conflict Introduction institutions → rules that govern how an economy & society works written→ legal ECON1020 Full Lecture Notes 52 unwritten → social norms affect social outcomes → can affect income people receive for their work e.g. private property → constraint → individual's are unable to take other people belongings, at least without consequences affect decision making also incentives people to work for things they want to own questions; what other factors determine final outcomes? essentially only institutions affect outcomes what criteria can we use to evaluate outcomes? judgement on differing social outcomes → whether its a large pie or better at splitting the pie how can we improve final outcomes? Evaluating Outcomes many different criteria Pareto efficiency fairness / justice Pareto efficiency allocation → outcome of an economic interaction, describes who does what & who gets what Pareto efficiency→ state where nobody can be better off without making someone else worse off Pareto improvement → change that benefits at least one person without making someone else worse off if Pareto improvement is possible at an allocation → that allocation isn't Pareto efficient vice versa, a Pareto improvement is impossible if an allocation is Pareto efficient e.g. Anil & Bala ECON1020 Full Lecture Notes 53 2 feasible strategies terminator → more effective, inexpensive but more damaging to environment IPC → less effective, expensive but less damaging to environment outcomes if only one choose terminator, the damage is limited if both choose terminator, water contamination is too serious → need to buy expensive filtering system Pareto efficiency allocation I, T → no Pareto improvements possible as all other points makes someone, Bala, worse off as Pareto improvement is not possible → I, T is Pareto efficient allocation T, I → no Pareto improvement possible → T, I. is Pareto efficient allocation T, T → Pareto improvement from T, T to I, I → T, T is not Pareto efficient allocation I, I → Pareto efficient Pareto improvement → I, I Pareto dominates T, T Pareto efficiency caveats often more than one Pareto efficient allocation ECON1020 Full Lecture Notes 54 unable to choose which one, as Pareto efficiency doesn't determine which is fairness or better just cause an allocation is Pareto efficiency, doesn't mean its fair or should be approved e.g. Anil & Bala → Anil using IPC & Bala using terminator is Pareto efficient however Bala free rides & gets the better outcome → unfair to Anil fairness / justice reasons for an unfair allocation inequality of final outcome → substantive judgement of fairness e.g. inequality of wealth & income how they came about → procedural judgement of fairness\ any final results are acceptable as long as the procedure was fair e.g. forced vs fair play, equal & unequal opportunities Rawls' veil of ignorance impartial perspective → when creating a new society, create it without the hindsight or knowledge of knowing how you would turn out in the new system theoretically a fair way to establishing institutions or evaluating allocations fairness & economics does not provide judgements on what is fair however can clarify; how institutions → rules affect inequality tradeoffs in the fairness of outcomes → equality of results vs equality of opportunities how public policies can address unfairness Determining Allocations I e.g. Angela the farmer ECON1020 Full Lecture Notes 55 works on a farm & gets everything she produces Bruno comes along, but as he doesn't have a farm & wants harvest → forces Angela to work for him & now she must do what he says later, rule change → rule of law replaces rule of force Bruno can't coerce Angela to work, but still owns the land if Angela wants to farm his land, she must pay him some of the harvset rule change again → in Angel's favour she & fellow farmers achieve the right to vote → legislation passes that increases Angela's claim on the harvest e.g. coercion → imposing allocations by force combined feasible set → shows all possible allocations between two parties not all allocations possible point H → works 12 hours but Angela receives 0 units of grain → unable to survive → not feasible. even though its within the feasible frontier feasible allocations depend on institutions & policies ECON1020 Full Lecture Notes 56 feasible frontier → shows all technically feasible outcomes biological survival constraint → shows all biologically feasible outcomes similar to indifference curves as Angela works more, she needs to eat more biological survival constraint is higher with less free time feasible allocations by the horizontal & vertical line horizontal line → minimum amount of grain to live, without working subsistence level vertical → maximum hours possible ECON1020 Full Lecture Notes 57 best allocation for Bruno given the constraints work hour with the biggest vertical difference between feasible frontier & biological survival constraint → maximise Bruno's payoff, whilst providing Angela with enough to continue working thus, allocation that maximises his economic rent is when slope of biological constraint equals slope of feasible frontier → at 13 hours of free time for Angela Determining Allocations II ECON1020 Full Lecture Notes 58 e.g. voluntary exchange → bargaining Angela is longer a slave → limited by her agreement, not survival Bruno can make her an offer to work his land point Z → Angela's reservation point → no work, gets survival rations reservation option → if rejects Bruno's offer, she can default to this option reservation indifference curve → all allocations have the same value to her as her reservation option below & left → worse off above & right → better off final allocation determined by; each party's reservation option → better reservation option gives more bargaining power ECON1020 Full Lecture Notes 59 e.g. Angel has an offer at a different farm for a lower cost relative bargaining powers between parties the party with the higher bargaining power would gain a deal more in their favour economically feasible set → all possible allocations that would benefit both parties e.g. if Angela & Bruno make a deal, both gain Bruno's reservation option is no farmer & no grain e.g. coercion vs bargaining ECON1020 Full Lecture Notes 60 under coercion allocation chosen based on slop of biological constraint equals slope of feasible frontier Angela works 11 hours a day total grain output → 10 units Angela → 4 Bruno → 6 ECON1020 Full Lecture Notes 61 under bargaining allocation chosen based on slope of reservation indifference curve equals slope of feasible frontier Angela works 8 hours a day total grain output → 9 units Angela → 4.5 Bruno → 4.5 total production is lower when bargaining compared to coercion evaluating outcome → coercion to bargaining not a Pareto improvement, both Pareto efficient substantive fairness → improvement procedural fairness → improvement bargaining → fair in isolation, unfair given context → Bruno stole from Angela Determining Allocations III Pareto efficiency curve / contract curve → set of all Pareto efficient allocations line where all points within the feasible set where MRS = MRT joint output is maximised & the same throughout all points on the curve however, distribution amount between parties can differ e.g. Pareto efficiency curve ECON1020 Full Lecture Notes 62 point C → Angela gets all grain output point D → Bruno gets all grain output at any allocation within the feasible set can experience a Pareto improvement, as the points on the Pareto curve are the optimal for both, given that the distribution remains the same e.g. institutions & policies → legislation new allocation → give both parties as much as their new reservation option new law → limits work hours & entitled to 4.5 units of grain Angela's new reservation option → point F → higher bargaining power Pareto efficiency curve is now C to G → Bruno's new offer point F to GH → Pareto improvement ECON1020 Full Lecture Notes 63 factors for deterring allocations; technology & biological factors determine technically feasible allocations institutions & policies help determine economically feasible allocations allocation chosen depends on party preferences & their bargaining power ECON1020 Full Lecture Notes 64 one party has power to dictate allocations → capture entire surplus unable to achieve Pareto improvement → Pareto efficient e.g. Bruno's use of coercion allocations influenced by legislation → fairer allocations not necessarily Pareto efficient e.g. coercion to bargaining → Bruno was worse off institutions where people can deliberate, agree & enforce alternative allocations achieve Pareto efficiency & fairness e.g. Angela & Bruno achieved through legislation & bargaining Economic & Ethics: More on Fairness maximise human welfare by producing as many products to satisfy as many wants & needs achieved through; efficiency → most valued products produced at the lowest cost fairness → intersection between economics & ethics e.g. price gauging of essentials during COVID pandemic do people value fairness? yes → ultimatum game → proposer gave some money to responders e.g. Kahneman, Knetsh & Thaler → KKT ultimatum game conducted anonymously results on average; proposers offered just less than 50 50 splits responders tend to reject offers of less than 25% responders are willing to give up monetary gain to punish proposer for being unfair responders value fairness contradict assumption of ability to satisfy personal wants, regardless of others ECON1020 Full Lecture Notes 65 did proposers offer close to 50 50 splits out of value for fairness or value of money and so a fear of rejection? e.g. KKT → variation of ultimatum game proposers given 2 splits $18 & $2 for proposer & responder respectively $10 each responders given no power to reject results; 76% of proposers opted for 50 50 split proposers valued fairness trade off between efficiency & fairness → decreased efficiency to achieve fairness ultimatum game played in small societies in developing countries → same patterns found markets markets evidence some regard markets as unfair allocation mechanism for shortages of products e.g. Kahneman survey football tickets sold in 3 ways; auction → sold to highest bidder lottery → sold to drawn names queue → first come first served ranking results of which are fair; ECON1020 Full Lecture Notes 66 economic efficiency; markets better than → lotteries better than → queueing markets allocate products to those who value it the most → willing to pay queueing → least efficient loss of time when expressing preference → waiting in queue fairness ranking is the reverse of efficiency ranking → trade off between efficiency & fairness marketisation of queueing line sitter services → charge fee to stand in line capacity of paying has replaced capacity of waiting increasing encroachment of the market domain on the non market domain firms provide services like; apologising providing a best man or a bridesmaid → writing speeches kidney transplants altruism & medicine determine kidney supply & recipients Iran → able to purchase & sell kidneys new markets raise questions between economics & ethics market price established on the ability to purchase a friend core econ approach to fairness procedurally judgements of fairness evaluate an outcome based on how the allocation came about and not on the characteristics of the outcome itself. Judgements focus on ECON1020 Full Lecture Notes 67 whether the actions that produce an outcome are voluntary or coerced/forced, equal opportunity to participate and deservingness. substantive judgements of fairness valuations are based on the allocation itself, not how it was determined or came about or the actions that produced it. Judgements focus on the inequality of some aspect of the outcome/allocation – income, happiness or freedom ultimatum game → procedurally fair proposers chosen at random anonymous discrimination not possible voluntary → propose any amount & reject any amount however; fairness was determined by the distribution of the pie unequal splits rejected despite being a Pareto improvement → both gain money moral philosophy consequentialism → substantive judgement → focused on results deontology → procedural judgement → focused on process consequentialism economics is heavily influenced by consequentialist streams of thought → example of consequentialist thinking the consequence that is important in economic theory is economic welfare → arises from the satisfaction of preferences should be maximised however, another consequence → outcome fairness conflicts arise → ultimatum game rejection of unfair offers → fairness over economic welfare e.g. minimum wage ECON1020 Full Lecture Notes 68 consequentialist perspective → fairness is the specified objective choices judged on the fairness of their consequences society decides on the basis of fairness & equity considerations → earnings of unskilled workers are too low government legislation of a minimum wage → justified if earnings of unskilled workers increase as a group, even if it causes some workers to become unemployed → decreased demand from firms due to increased costs earnings will rise if; percentage increase of wage is greater than the percentage decrease of unemployment deontology method of determining final outcomes determines unfairness disregard of consequences no presumption of equality of outcomes unjust to impose changes to outcomes libertarianism → type of deontological approach any outcome from a voluntary exchange is fair & just 2 principles; state must enforce laws that establish & protect private property private property may be transferred from one person to another by only voluntary exchange market transactions → capitalist acts between consenting adults forbidding them infringes freedom, dignity & is unfair all results from this application is fair or just e.g. minimum wage libertarian perspective minimum wage is unfair → prohibit workers & firms from legally entering a voluntary & mutually beneficial market exchange at a wage below the minimum wage ECON1020 Full Lecture Notes 69 alternative deontological perspective minimum wage is just & fair prevent entering into market exchanges that would result in poverty article 23 united nations universal declaration of human rights everyone who works has the right to just and favourable remuneration ensuring for himself and his family an existence worthy of human dignity W7: The Firm: Owners, Managers & Employees Introduction work is important for the ecnomoy workers → income firm → labour is an input for production interactions → bargaining determines division of social surplus → profits & wages → mutual gain & conflicts determines wages economy wide effects from firm interactions Firms firm → way organising production characteristics; individuals who own capital goods used for production capital goods → non labour inputs the production process pay wages & salaries to employees purchase human labour from the labour market owners direct employees, through managers, in production of goods & services ECON1020 Full Lecture Notes 70 labour inputs goods & services are properties of the owners → employees not entitled to the outputs, only the wages & salaries owners sell goods & services on market with intention of making profit power division of labour is coordinated in two ways → firms & markets division of labour → specialisation & comparative advantage → efficiency firm → concentration of economic power at the top → owners issue commands to workers markets → decentralised → no power over who sells or buys able to rejects buyers & sellers firm structure owners decide long term strategy managers implement decisions by assigning tasks to workers ECON1020 Full Lecture Notes 71 hierarchy issues; asymmetric information owners & managers receive limited information about daily operations → much less than the workers difficult for owners & managers to accurately monitor whether tasks are being performed well differing policies by firms to resolve this issue → specific monitoring departments & systems contracts contracts → legal document or understanding that specifies a set of actions that parties to the contract must undertake violation of contracts have consequences → lawsuit market → ownership of a product is permanently sold from the seller to the buyer ECON1020 Full Lecture Notes 72 firm → labour contract → temporarily transfer authority over a person's activities from employee to owner / manager transfer of ownership → slave contract relationships market → limited relationship between buyer & seller → simple exchange firm → extend over a long period of time firm specific assets → valuable when employed by a firm creation of network of colleagues acquisition of skills necessary for the job increase in productivity → benefit for both employee & firm relationship end → value lost to both sides common interest → firm's success failure → loss of firm specific assets Owners & Managers separation of ownership & control → managers decide how to use owner's assets & funds potential conflict of interest conflict of interest firms profits belong to owners of the firm's assets profit → revenue - expenses left over after wages, salaries, creditors & taxes revenue is divided between owners, managers & workers more money for owners → less money for managers & workers & vice versa division of revenue → conflict profit increases due to manager's efforts → owner's benefit, whilst managers not guaranteed to benefit from it → only receive pay stated within contract ECON1020 Full Lecture Notes 73 why work harder to improve firm performance, when you don't receive any benefit from it? aligning interests link manager's pay to firm performance in relation to share price → bonuses received paid in firm's shares monitor manager's performance to assure incentives align with the owner's interests Employees incomplete contract hiring employees different from buying products non labour goods → terms & conditions are straightforward → permanent ownership, full control, explicit usage details, etc labour contracts depend on future events e.g. barista may have to complete waiting responsibilities if needed aspects are difficult to measure & base wages on e.g. barista needs to be friendly → can't exactly measure if they smile enough, etc incomplete contract don't specify, in an enforceable way, every aspect of the exchange that affects the interests of parties most valuable aspect of an employee is the amount of effort when on the job → most difficult to enforce or measure so how do they induce high effort from workers? piece rate pay → employment in which workers are paid a fixed amount for each product produced one way to resolve incomplete contracts → provides incentive to exert effort e.g. manufacturing line however not applicable to every jobs ECON1020 Full Lecture Notes 74 jobs that require teams or delivering a service service → if incentivised with piece rate system → lower quality of service to increase quantity worker's effort why some workers still work hard despite lack of system for measuring effort? individual work ethic feelings of responsibility reciprocate for being treated well by employers promotions → increase chances → increase salary & well being benefits for measurable output → billable hours fear of being fired → receive economic rent from being employed employment rents if the only value gained was money, then paying minimum wage to employees would make them not care about losing however, workers do care, even in minimum wager positions theres a difference between value of having a job and value of being unemployed & searching for a job → employment rent employment rent receive when employees fear being fired from a job that pays them more than their reservation option → unemployed employment rent includes; lost income cost of starting a new job → relocation, equipment, gaining new firm specific assets loss non wage benefits → work benefits like bonuses, insurance, loss of use for prior firm specific assets social costs → stigma of being unemployed, especially being fired benefits to owners & managers employees more like to stay → no cost required to rehire & retrain ECON1020 Full Lecture Notes 75 leverage over employees → fear of being fired induces high effort advantages & disadvantages of working disadvantages disutility → don't like work or some aspects of work, stress monetary costs → travelling, equipment advantages income firm specific assets work place benefits social status e.g. calculating employment rents Maria → earning $12 per hour, 35 hours a week disutility → costs Maria $2 per hour total employment rent → unemployed for 44 weeks if fired before finding another job reservation option → $6 per hour, 35 hours a week → government payments ECON1020 Full Lecture Notes 76 employment rent per hour wage − disutility − reservation wage 12 − 2 − 6 = 4 total employment rent employment rent per hour × expected hours of lost work time 4 × 1540 = 6160 Wages & Effort employer can't directly quantify a worker's level of effort employment rent → cost of job loss → incentive of performing on the job firm benefit; no cost for rehiring & retraining power over employees → induce effort increase employment rent → increase wages employment game rules; 2 players → employer & worker sequential → one player makes a move, then second players reacts employer chooses a wage → if workers works enough, they'll keep the job at the offered wage balance wage → high enough to retain productive workers, but low enough to make a desirable amount of profit worker chooses level of work effort, taking into account the cost of losing her job is she does not provide enough effort payoffs → mutual gains firm → profit → worker's output - wage worker → employment rent ECON1020 Full Lecture Notes 77 involuntary employment → being out of work, but preferring to have a job at the wages & working conditions that otherwise identical employed workers have there must always been some involuntary unemployment → exert force from workers no involuntary unemployment → can get another job right after the previous → no cost of job loss → employment rent of 0 → no incentive to put effort into work → employer gains no benefit → no incentive to pay a wage → no jobs offered → no equilibrium why? equilibrium → wages & involuntary unemployment have to be high enough to ensure employment rent is high enough for workers to put in effort factors impacting unemployment equilibrium employee incentive to put in effort is affected by; utility of items that can be purchased by the wage e.g. increased material wellbeing → higher utility → higher employment rent → employee values the money earned more → higher effort disutility of effort e.g. decreases due to department change → higher employment rent → higher incentive to put in effort reservation wage e.g. decrease in government payments → higher employment rent → higher incentive to put in effort probability of getting fired at each effort level → don't want to be fired → incentive to decrease probability of getting fired by working harder level of unemployment e.g. high unemployment levels, means likely take longer to find another job → increased employment rent → incentive to put in effort Principal Agent Models ECON1020 Full Lecture Notes 78 e.g. incomplete contracts lending money → promise of a full repayment plus interest → unenforceable if unable to be repaid owners want managers to maximise value of assets → conflict of interest → managers have own objectives tenants renting apartments → required to maintain property value → aside from gross neglect, unable to enforce liability if not maintained insurance → customers behave decently & not take risk → unenforceable families purchase educational & health services → unable to specify quality in contract→ unenforceable parents care for children → hope to reciprocate care when older → unenforceable incomplete contracts can arise when; difficult to measure → job output & productivity uncertainty over periods of time → future uncertainty unverifiable information → hearsay judiciary is absent → no judge or legal check preferences for omitting information principal agent models → relationships where agents are supposed to fulfil the interest of the principal, however is not guaranteed e.g. principal → firm, agent → worker hidden actions problem agents can take hidden action from the principal → unable to be verified asymmetrical information → difficult for principals to fully know what is happening → unaware action is occurring occurs when; conflict of interest between principal & agent → agent performs an actions against the principal's interests this action can't be stated or enforced via contract ECON1020 Full Lecture Notes 79 W8: The Firm & Its Customers Introduction many individuals in developed economics work for large firms over 50% of people in the production sector work for firms with 500+ employees how firms were able to grow this large & become this successful? ECON1020 Full Lecture Notes 80 focus on; setting the price quantity decision to achieve profit decomposition of profit profit is total revenue after paying total production costs economic profit = total revenue − total cost = P (Q) − AC(Q) P = selling price per unit Q = quantity AC = average cost per unit ECON1020 Full Lecture Notes 81 economic profit is different to net & gross profit economic cost → monetary & opportunity cost → total cost net & gross profit → monetary cost 0 economic profit / normal profit → doesn't no monetary profit was made → next best alternative would have yielded that same amount → no benefit production & pricing decisions to maximise profit → decide quantity → Q & cost → P for production set Q & P so break even set Q & P as high as possible → maximise profit trade off between Q & P higher price would decrease quantity needed & vice versa information managers need to make decisions about Q & P → restrictions production cost → cost of producing at different quantities → what scale of production product demand → how many consumers are willing to buy & how much their willing to pay Production Key Concepts firm's cost depend on production scale & type of production technology advantages of large scale production ECON1020 Full Lecture Notes 82 economics of scale → large firms are more profitable due to cost advantages fixed cost → independent of production scale e.g. creating software → only need to be developed once production cost is lowered by creating more quantities, spreading the cost lower cost per input → purchasing inputs on more favourable terms → grater bargaining power with suppliers demand advantages → network effects value of output increases with number of consumers e.g. social media, like instagram → more valuable with more people using it smaller platforms → less value as less interaction from fewer users thus, more difficult for new firms to establish themselves in markets reliant on network effects diseconomies of scale in large firms e.g. additional bureaucracy layers from larger amount of employees hiring of more managers to manage new employees, whilst hiring more executives to manage the new managers, etc. cost functions → show how production costs vary with quantity produced total cost ECON1020 Full Lecture Notes 83 increasing quantity increases total costs at 0 quantity → still production costs incurred → fixed costs e.g. building, machinery. etc average cost TC ÷ Q = cost per unit calculated from origin to a point on the slope → straight line rise divided by run → cost per unit graph observations; average costs decrease at first → economies of scale increase afterwards → diseconomies of scale ECON1020 Full Lecture Notes 84 this always occurs as productions increases → bureaucracy issues arise from firm expansion & growth marginal cost → effect on total cost of producing one more unit of output ΔTC ÷ ΔQ = marginal cost calculated by the slope at any point graph observations; marginal costs increase with production relationship between marginal & average costs statements; ECON1020 Full Lecture Notes 85 if AC > MC → AC is decreasing if AC < MC → AC is increasing MC curves always intersects with AC curve at its lowest point Pricing & Production Decisions: Profit Maximisation I pricing & production decisions → managers need to know demand for firm's products demand curve → quantity that consumers will buy at each price theory → firms can estimate demand curve of their products by surveying a large number of consumers reality → difficult to acquire that information willingness to pay → dependent on how much the consumer values the product product will be bought if price is less or equal to their WTP trade off between demand & price → intrinsic nature of consumers to pay less higher price → lower demand, vice versa e.g. willingness to pay graph graph note; ECON1020 Full Lecture Notes 86 price → WTP → willingness to pay P = $3,200 60 consumers with WTP equal & above to P thus, demand for product at $3,200 is 60 Pricing & Production Decisions: Profit Maximisation II economic profit = total revenue − total cost = P (Q) − AC(Q) P = selling price per unit Q = quantity AC = average cost per unit isoprofit curve → shows price & quantity combinations that give the same profit cost function of AC & MC affect isoprofit curve firms have sets of isoprofit curves → show combinations required to make certain profit levels zero economic profit curve if price equals average cost→ economic profit is 0 Q × (P − AC) = Q × 0 = 0 AC curve is also 0 profit curve → combination of price & quantity ECON1020 Full Lecture Notes 87 is also break even curve for every combinations → P = AC same shape as AC curve → both economics & diseconomies of scale marginal cost curve intersects at lowest point of each isoprofit line if AC > MC → AC curve slops down if AC < MC → AC curve slopes up higher isoprofit curves combinations of price & quantity to produce the same level of profit higher curves → higher profit level → higher economic profit e.g. calculating economic profit ECON1020 Full Lecture Notes 88 point G Q = 23 P = $6,820 Q × (P − AC) profit at G → 23 x (6,820 - 3,777) = $70,000 note; isoprofit cures are similar to indifference curves demand curves → feasible frontier Pricing & Production Decisions: Profit Maximisation III profit maximisation → constrained optimisation demand curve → feasible frontier → MRT isoprofit curves → indifference curves → MRS maximised profit where MRS = MRT ECON1020 Full Lecture Notes 89 point E → optimal highest isoprofit curve that is still within the demand curve → maximum profit can't go above → no demand can't go below → less profit Gains From Trade measuring surplus consumer surplus → difference between willingness to pay & purchase price producer surplus → difference between revenue & marginal cost different to profit total surplus = consumer surplus + producer surplus total gains from trade ECON1020 Full Lecture Notes 90 graph observations; orange area → consumer surplus purple area → producer surplus increasing CS → decreases PS & vice versa deadweight loss → loss of total surplus relative to a Pareto efficient allocation unused & unexploited gains from trade → some consumers still willing to pay a price that is above marginal cost total surplus is highest when demand = marginal cost → pareto efficient allocation point E to F → pareto improvement however, pareto efficient allocation is not reached as doing so would put the firm at a lower profit level, despite gaining maximising surplus Price Elasticity of Demand price elasticity of demand → how demand changes when price changes relationship of price increase → demand decrease & vice versa ECON1020 Full Lecture Notes 91 elasticity quantifies this relationship elasticity = percentage change in demand percentage change in price elasticity is always negative → inverse relationship price elasticity & profits firm's markup is inversely proportional to price elasticity ECON1020 Full Lecture Notes 92 relatively lower markup → flatter slope price change → large demand change price sensitive consumers market with many competitors & alternatives relatively higher markup → steeper slope price change → small demand change more loyal consumers market with limited competitors & alternatives price elasticity & policy good specific taxes depend on elasticity of demand of goods government raise more tax revenue by levying taxes on price inelastic goods if tax placed on elastic good → consumers will greatly shift away from it e.g. taxes on unhealthy goods like snacks → addictive substances → people will be willing to pay regardless of price ECON1020 Full Lecture Notes 93 although taxes have been heavily increased in an effort to reduce consumption of certain unhealthy goods price elasticity & market power profit margin dependent on elasticity of demand determined by competition; inelastic → fewer alternatives firms with market power have enough bargaining power to set prices without losing customers to competitors e.g. apple is able to set premium prices, despite communal backlash, consumers still pay for their products competition policy → limits market power by preventing firms from colluding & setting prices high beneficial to consumers market power & monopolies monopolies are an extreme of market power firm sells specialised products; little competition → inelastic demand can set price above marginal cost without losing customers → earn monopoly rent market failure → high level of deadweight loss from the high prices set → many consumers below willingness to pay natural monopoly → cheaper for one firm to produce as oppose to multiple firms e.g. utilities, public transport abuse of monopoly is controlled by either being a government cooporation or heavily controlled & regulated by government gaining market power by; innovating → differentiation of products ECON1020 Full Lecture Notes 94 firms that invent new products can achieve a temporary monopoly through patents & copyright laws → prevent other competitors from entering the market for a certain period advertising → attract consumers to purchase from their firm create brand loyalty reduce competitor's consumers can be more effective than discounts in increasing demand W9: Supply & Demand: Price Taking & Competitive Markets I Introduction market where firms produce identical products how behaviour differs from price setting firms? can competition improve market outcomes → resolve dead weight loss model of interactions between price taking firms & customers perfect competition → extreme competition, firms have no market power 2 perspectives → market & firm supply & demand model model of profit maximisation factors that affect the equilibrium comparison between price taking & price setting firms Competitive Equilibrium I demand curve & willingness to pay demand curve → total quantity that all consumers together want to buy at any given price represents the WTP of buyers consumers in order of who's willing to pay the highest price to the lowest ECON1020 Full Lecture Notes 95 e.g. trade of second hand textbooks competitive equilibrium demand comes from buyers with differing willingness to pay no one will pay above the price of a new copy WTP depends on work ethic, importance placed on textbook & available resources to buy books supply curve & willingness to accept supply curve → total quantity that all firms together would produce at any given price represents the WTA of sellers sellers have different reservation prices sellers in order of who's willing to sell the lowest price to the highest ECON1020 Full Lecture Notes 96 e.g. trade of second hand textbooks supply comes from students who have finished the course supply comes from sellers who differ in their willingness to accept → reservation price reservation price → represents value of keeping the book → only willing to sell if price is the same price or higher lower reservation price if student is poor or no longer studying note; examples show linear lines → simplicity real supply & demand curves will have exact shapes dependant on valuation of the market Competitive Equilibrium II markets if market relies on word of mouth → if buyer finds seller → negotiate a mutually beneficial price no information on market price → reliance on personal willingness to pay & sell seller wants to sell high → buyer wants to buy low differing incentives → conflicts on price in the market ECON1020 Full Lecture Notes 97 information about the other party → higher influence on getting the price you want to buy / sell at historical context traditional markets brought buyers & sellers together → trading routes, set up shops in the same area near customers reducing problem of no information → buyers can find sellers & market price modern markets advertisement → information more widely available → what is available, where to buy, what the price should be consumers & buyers are still close → shopping centres second hand goods → in the past involved specialist dealers modern day → online marketplaces → eBay consumer benefit → more information → get closer to your reservation price price → competitors quality → reviews of goods & services Competitive Equilibrium III note; P* → market price Q* → market quantity equilibrium price alfred marshal → introduced model of supply & demand price that equated supply & demand → equilibrium price prices tended to settle at equilibrium level → where supply & demand equated → equilibrium marketing clearing price ECON1020 Full Lecture Notes 98 marketing clearing price supply equals demand market equilibrium → if actions of buyers & sellers have no tendency to change the price or the quantities bought & sold, unless there is a change in market condition market with many sellers selling identical goods & many buyers wanting to buy them → both parties are price takers competition equilibrium → market where perfect competition has eliminated bargaining power ECON1020 Full Lecture Notes 99 price above equilibrium → excess supply suppliers benefit by reducing price price below equilibrium → excess demand suppliers benefit by increasing price Competitive Equilibrium IV price taking firms unable to benefit at trading at a different price → demand will go to other firms ECON1020 Full Lecture Notes 100 firm demand curve → horizontal price taker → if price is above market price → no demand → thus price must be at or below market for demand to come in profit maximisation where market price equals MC curve → highest profit point within the feasible set price taker firms → must produce quantity where marginal cost is equal to market price if; MC > MP → producing costs more than selling price → loss on every unit sold above MP MC < MP → could still produce more units that would sell a profit MC = MP→ maximum quantity sold before a loss on marginal unit is incurred market supply curve → total amount produced by all firms at each price ECON1020 Full Lecture Notes 101 if all firms have identical cost functions → identical production market supply curve = market marginal cost curve only quantity will change → one firm to entire market Competitive Equilibrium V market price is when supply = demand → all parties are price takers all gain are exploited → no deadweight loss allocation is Pareto efficient assuming; all parties are price takers contracts are complete → all known information no external effects → transaction affects only buyers & sellers ECON1020 Full Lecture Notes 102 differs to differentiated products → reduce quantity to achieve higher isoprofit level → dead weight loss W10: Supply & Demand: Price Taking & Competitive Markets II Factors that Affect Equilibrium I no incentive to change equilibrium point perfect competition → demand & supply are maximised → both parties are as happy as possible changes in supply & demand exogenous → variable whose value is determined outside the model and is imposed on the model outside factor changes supply & demand model e.g. quinoa demand ECON1020 Full Lecture Notes 103 recent years → health consciousness has increased quinoa is a nutritional product richer, health conscious consumers contributed to higher demand increase in demand demand is higher at each price point → demand curve shifts right/up response → market price P* increases increase in quantity supplied → move along the supply curve suppliers increase quantity supplied supply curve has not shifted → increase in quantity supplied, NOT increase in supply e.g. second hand textbooks initial equilibrium point P* → $8 Q* → 24 books P* = marginal cost consumer surplus & producer surplus maximised no deadweight loss → pareto efficient ECON1020 Full Lecture Notes 104 increase in demand more students have entered the uni → more demand for textbooks demand curve shifts right/up → demand is higher at each price point excess demand at original P* if market price remains at $8 → excess demand incentive for sellers to increase price more sellers enter the market → market price has increased, reaching their WTA ECON1020 Full Lecture Notes 105 new equilibrium point new equilibrium point at point B P* → $10 Q* → 32 books increase in demand → quantity increase in equilibrium quantity & price increase in supply can shift due to exogenous shocks → outside factor marginal costs decreases → supply curve shifts down/right ECON1020 Full Lecture Notes 106 increase in quantity supplied at each price point demand curve has not shifted → increase in quantity demanded, NOT increase in demand same number of firms supply at higher quantities e.g. bread bakeries exogenous shock → better baking technology initial equilibrium point P* → $2 Q* → 5,000 loaves decrease in marginal costs & increase in supply cost of producing decreases → P* decreases supply curve shifts right/down → willingness to accept is lower amount supplied at each price increases → increase in supply ECON1020 Full Lecture Notes 107 excess supply at original P* original price at $2 → more supply than demand consumer WTP decreases incentive for suppliers to decrease price ECON1020 Full Lecture Notes 108 new equilibrium point at point B demand curve has not shifted → moved along the demand curve supply has reached more consumer's WTP price decrease → increase in quantity demanded, NOT increase in demand market entry supply curve can shift due to market entry & exit excess supply doesn't introduce more firms market entry introduces more firms market entry → increased competition → decreases P* → supply curve shifts down/right incentive to enter market existing firms earn economic rents & cost of entry isn't too high → firms may enter the market positive economic profit made by firms within the market ECON1020 Full Lecture Notes 109 Factors that Affect Equilibrium II taxes governments use taxation to raise revenue finance government spending redistribute resources e.g. tax the rich, give to the poor affect allocation of products in other ways e.g. reducing spending on harmful products → alcohol, cigarettes supply & demand model taxes on each party shifts their respective curve → price is higher at each quantity e.g. ancient Chinese taxes on salt tax imposed because people needed it → inelastic demand better to tax inelastic products → people will still pay the higher price → higher tax revenue initial equilibrium market equilibrium at point A ECON1020 Full Lecture Notes 110 30% tax imposed tax imposed on suppliers → marginal costs are 30% higher at each quantity supply curve shifts upwards → higher price ECON1020 Full Lecture Notes 111 new equilibrium equilibrium at point B → moved along the demand curve consumer price has increased to P1 → incentive to not buy quantity decreased to Q1 → reduce quantity consumed ECON1020 Full Lecture Notes 112 tax paid to the government P1 − P0 → amount paid to government P1 − P0 → tax per unit Q1 (P1 − P0 )→ total tax revenue P0 → amount paid to supplier ECON1020 Full Lecture Notes 113 taxes & welfare effects tax incidence → how the burden of a tax is distributed between firms and consumers although suppliers pay the tax → felt by consumers as well → higher purchase price depends on relative elasticity of consumers & producers → less elastic groups bears more tax burden maximising gains from trade before tax → total surplus equilibrium allocation is maximised orange → consumer surpluis blue → producer surplus ECON1020 Full Lecture Notes 114 tax reduces consumer surplus reduces quantity traded → Q* to Q1 increases price paid → P* to P1 consumers between Q1 & Q* no longer are willing to pay → reduces consumer surplus ECON1020 Full Lecture Notes 115 tax reduces producer surplus reduced reduces quantity traded → Q* to Q1 reduces price received → P* to P0 producers between Q1 & Q* no longer willing to accept → reduces producer surplus ECON1020 Full Lecture Notes 116 tax revenue & deadweight loss reduced quantity sold → no longer sold due to tax → deadweight loss green → total tax revenue not pareto efficient ECON1020 Full Lecture Notes 117 maximise tax revenue tax an inelastic good → tax increase will change quantity traded minimally taxes change prices → can create deadweight loss pareto inefficient allocation → reduced economic efficiency however, if taxes imposed on certain markets → harmful produts deadweight loss is outweighed by the social benefit incurred benefit from decrease in consumption depends on how government spends the tax revenue if tax is spent on beneficial things → enhance public welfare if tax is spent on activities that don't contribute to wellbeing → deadweight loss incurred is just reduction of living standards Perfect Competition characteristics; ECON1020 Full Lecture Notes 118 products are homogenous → identical large number of potential buyers & sellers no monopoly buyers & sellers all act independently of each other no collusion price information easily available to buyers & sellers price discrimination to some customers law of one price → all transactions take place at a single price at that price → market clearing price → supply equals demand buyers & sellers are price takers → identical products all potential gains from trade are realised → no deadweight loss testing perfect competition do all trades take place at the same price? are firms selling goods at a price equal to marginal cost perfect competition is unrealistic → however, a good approximation to some markets same products differ in price between different firms fulton fish market study → same firm prices of the same fish differed between customer types charged differently depending on customer ethnicity → price discrimination price setters VS price takers ECON1020 Full Lecture Notes 119 W11: The Labour Market: Wages, Profits & Unemployments Introduction how wages & unemployment are determined e.g. pandemic → high unemployment how to improve these outcomes e.g. high unemployment → what can we do ? → government payments real wage → purchasing power nominal wage → dollar figure firms behaviour affect real wage price setting & wage setting → economy wide unemployment rate & real wage nominal wage → amount paid to employees price of things → set by firms selling products unemployment exists even in equilbrium governments policies affect wages & unemployment Measuring Unemployment unemployment → people who are; ECON1020 Full Lecture Notes 120 not in paid employment or self employment caveats; could be retired or children → must follow all 3 rules available for work actively seeking/wanting work labour market labour force → those who seek/want to work statistics participation rate = labour force population of working age unemployed labour force employed population of working age unemployment rate = employment rate = 2 countries with same unemployment rates → may assume labour markets are identical however, can have different employment rates → one has high participation rate, one has lower participation rate unemployment & employment rates can differ → different denominators e.g. norway & spain ECON1020 Full Lecture Notes 121 norway → better labour market → better policies to encourage employment higher participation rate higher employment rate lower unemployment rate Wage Setting wage setting → firms set wage sufficiently high to make job loss costly to motivate employees to work hard in the absence of complete contracts relates to principal agent problem → positive employment rent → employees motivated to work real wage determined by nominal wage & price of goods purchased real wage decreases if prices increases → inflation real wage = wage price firms decides; price → charge consumers wage → nominal wage paid to workers how many people to hire → unemployment rate ECON1020 Full Lecture Notes 122 adding all of these from all firms → total employment & real wage in a economy wage setting curve → real wage level necessary at each level of economy wide employment to provide workers with incentives to work hard and well higher unemployment rate → can pay workers less to induce effort workers have less bargaining power → can't ask for higher wages higher incentive → many more unemployed workers → easily replaceable lower unemployment rate → need to pay workers more to induce effort workers have more bargaining power → could ask for higher wages lower incentive → not many unemployed workers → difficult to replace graph observations; labour force → value less than 1 → dependant on participation rate inactive workers are on the right of labour force employment rate → from origin to vertical dotted line unemployment rate → between employment rate line & labour force line ECON1020 Full Lecture Notes 123 wage setting curve → real wage level needed at each employment rate to induce effort higher employment rate → higher real wage needed → WH lower employment rate → lower real wage needed → WL e.g. estimate wage curve for US data used from unemployment rates & wages in local areas Price Setting price setting → firms set a markup above the cost of production, to maximise their profits subject to demand firm decision on how many people to hire → based on quantity produced quantity produced → labour hours needed → economy wide employment rate profit maximising price → individual firm ECON1020 Full Lecture Notes 124 optimal price when demand curve is tangent to the highest isoprofit curve MRS = MRT quantity → affects hours of labour needed wage level → independent from Q* wage per person per hour doesn't change regardless of production levels P* − W = profit per unit output graph observations; point A → lower isoprofit curve reach optimal point B → increase price & decrease quantity point C → lower isoprofit curve reach optimal point B → decrease price & increase quantity price setting curve all firms within the industry ECON1020 Full Lecture Notes 125 price setting curve → real wage paid when firms choose their profit maximising price horizontal line that gives value of real wage real wage independent of employment rate → horizontal line hours of labour / employment is determined after product price is determined W dependent on firm's markups → P = wage level W → economy wide wage level P → economy wide price level markup dependant on competition → demand curve labour productivity determines real wage for given markup higher labour productivity → markup unchanged → higher price setting curve → higher real wage average product of labour → how much each worker makes graph observations; point A → above price setting curve real wage is higher than optimal point's real wage → markup is too low & quantity produced is too high → employment too high → total wage amount is too high W low price/markup → P → higher real wage value ECON1020 Full Lecture Notes 126 point C → below price setting curve real wage is below optimal point's real wage → mark up is too high & quantity produced too low → employment too low → total wage amount is too low high price/markup → W → lower real wage value P Labour Market Equilibrium labour market equilibrium → where wage setting & price setting curves intersect point X → market equilibrium no incentive to deviate at the employment and real wage level all parties are doing the best they can, give what everyone else is doing; firms offer the minimum wage to induce effort from workers employment is maximised, given the wage if above price setting curve → conflicts with firm's profit maximisation employed workers can't bargain for higher pay or lower work unemployment > 0 → available workers → can be replaced unemployed workers can't persuade firms to hire at lower wages labour discipline concerns → lower wage → lower economic rent → less effort is induced from worker ECON1020 Full Lecture Notes 127 involuntary unemployment unemployment → excess supply in labour market always be unemployment in labour market equilibrium no unemployment → no cost of job loss → no induced effort some unemployment → motivate to induce effort for system to work → always some involuntary unemployment inducing effort compensates for flaws of incomplete contracts unemployment & aggregate demand derived demand for labour → firm's demand of labour depend on the demand for their products aggregate demand → sum of the demand for all products produced in the entire economy demand deficient unemployment → increase in unemployment caused by fall in aggregate demand decrease in aggregate demand → decrease in firm output → decrease in labour demanded → increased unemployment decrease in aggregate demand → point X to point B not an equilibrium → price setting curve doesn't meet wage setting curve to revert back to point X → automatic adjustment ECON1020 Full Lecture Notes 128 lower wages without lowering workers effort → lower prices → increase demand → increase output → increase employment back to point X reality of lowering wages wages tend to not change quickly → sticky employee resistance → lower morale → strikes wages negotiated by contracts → change infrequently lower income → less disposable income → aggregate demand further decreases] falling prices → postpone purchases in the hope of purchasing at a even lower price → further lowering aggregate demand government intervention government increase spending to expand aggregate demand monetary & fiscal policy e.g. building schools → jobs for builders → income spent on clothing → jobs for retail stores → eventually permeates throughout the entire economy ECON1020 Full Lecture Notes 129 e.g. covid-19 stimulus payments → increase income → increase disposable income → increase aggregate demand increasing aggregate demand → increase employment shifting demand curve → firms can achieve higher isoprofit curve → increased production → increased employment point B → more optimal; to produce & hire more than reducing wages Labour Market Policies shifting price setting curve education & training → higher labour productivity increase price setting & average product of labour curves wage subsidy → government pays part of firm wages → lower productive cost & prices change real wage shifting wage setting curve lower unemployment benefit → lower reservation wage shift in labour supply curve immigration policies → higher labour supply childcare provision → higher female labour participation W12: Economic Inequality Introduction models of asymmetric economic interactions → bargaining, labour market asymmetry between parties results in unequal outcomes why do asymmetries exists? how to reduce inequalities? how much equality should society have? → complete equality across society is also unfair ECON1020 Full Lecture Notes 130 Trends in Inequality inequality within countries degree of inequality → gini coefficient 0≤G≤1 0 → perfect equality 1 → perfect inequality market income → income from wages, business & investments earnings inequality → derived from market income disposable income → market income minus taxes & transfers transfers → government added money note; wealth → value of assets → net worth graph observations; wealth is distributed most unequally higher equality levels in disposable income → tax and transfer systems ECON1020 Full Lecture Notes 131 unequal wealth and market income are redistributed from rich to the poor inequality across countries graph observations; before 1980s → decline of inequality across all countries after 1980s left graph → increased inequality → top 1% are growing richer right graph → lower inequality relative to the left → inequality levels has remained somewhat consistent global inequality blue line → gini coefficient for entire world red line → hypothetical line if everyone in the a country earned that countries's average income ECON1020 Full Lecture Notes 132 graph observations; 1980s → between country inequality fell rapidly, but within country inequality increased → previous graph net result → global inequality has declined although both line has decreased → gap between has increased → infer that global inequality is being mainly driven by inequality within countries, as it is not declining at the same rate as the hypothetical line determining inequality between countries due to economies like USA, China & India → large economics with even larger levels of inequality within country inequality increasing inequality is associated with changing distribution of jobs ECON1020 Full Lecture Notes 133 missing middle → low & high paying jobs are increasing, whilst middle income jobs are growing much less due to routine tasks being replaced by technology e.g. accountants → in the past used to be crunching numbers, nowadays, have become much more skilled higher paying jobs, as machines have replaced the routine tasks of number crunching Types of Inequality categorial inequality → economic differences among people who are treated as different categories accidents of birth → no control over situation someone is put in from birth country of citizenship → passports & borders limits access to opportunities gender or ethnic group parentage graph observations; income disparities between men & women at the same education level categorial inequality → implies potential discrimination → different treated between groups despite being similar in ability ECON1020 Full Lecture Notes 134 inherited inequality intergenerational inequality → extent to which differences in parental generations are passed on to the next generation intergenerational transmission → transfer of parental assets wealth genetic make up parental influence on growth → work ethic, home environment, etc. graph observations; percentage of children that stay in the same quintile as their father or move to the other quintile US → lower social mobility → many children stay within the same income level as parents Denmark → higher social mobility → more children move between income level as parents → less intergenerational inequality intergenerational elasticity → percentage difference in the second generation's status associated with a 1% difference in the adult generation's status how richer a child will be from either rich or poor parents high elasticity → low intergenerational mobility ECON1020 Full Lecture Notes 135 relation of intergenerational inequality to cross sectional inequality earnings inequality positively correlates with intergenerational inequality reasons for inequality differences; cultural differences on fairness → policies that reduce cross sectional inequality & promote intergenerational mobility improving cross sectional inequality will lead to increased social mobility → everyone has an equal opportunity to get a high paying job, allowing anyone to escape their parental income levels effects of good & bad shocks → passed onto the next generation → contributes to cross sectional inequality e.g. person with good traits to potentially earn more → hit with bad luck of new tax policy, limiting their ability to earn Evaluating Inequality inequality becomes a problem if theres too much of it study where people in US stated their ideal distribution & estimate of the actual distribution ECON1020 Full Lecture Notes 136 graph observations; actual inequality is higher than peoples estimates, which was higher then their ideal distribution people want decreased inequality but still for some degree to exist everyone thinks existing inequality is too high richer people want more inequality as opposed to poorer people → bias when is inequality unfair? inequality is unfair dependant on how distribution came about → procedural justice ECON1020 Full Lecture Notes 137 graph observations; people who believed wealth is gained through risk taking & hard work → opposed redistributed gains based on "accidents of birth" → support redistribution Explaining Inequality individuals income depends on; endowments → factors of an individual that affect their income wealth, physical assets, human capital → knowledge & skills from education & training value of items in endowments technology & institutions affects value of particular endowments ECON1020 Full Lecture Notes 138 e.g. bruno and angela bruno → land owner → more endowments angela → no land → less endowments technology determined her level of crop production institutions & policies → minimum working hours & reservation wage → government transfers economic inequality isn't static → can have subsequent effects existing economic inequality can affect technology & institutions & policies in future periods e.g. bruno & angela angela bargained into a better position following period → she can purchase better technology to improve her endowments & improve equality ECON1020 Full Lecture Notes 139 e.g. negative policies wealthier people can influence institutions & policies to reduce redistribution → increasing economic inequality differences in endowments → principal agent problem principal agent relationships → principal can exercise power over agent but not vice versa differences in endowments determine the ability to become the principal or agent some borrowers can become employers → become wealthy individuals excluded borrowers & unemployed → principal agent problem → only people with higher endowments will become borrowers or employed easier for those who borrowed or employed to stay employed and/or become wealthy as they have the endowments to become richer → cycle of wealth & knowledge concentration → increase in inequality asymmetric information → those neglected will never gain endowments to enter the cycle → rich get richer, poor stay poor Addressing Inequality government policies influence economic inequality; redistribution → taxes & transfers to reduce differences in disposable income & expenditure on public services predistribution → affect equality of endowments ECON1020 Full Lecture Notes 140 raising value of endowments of the poor → training, education, property redistribution redistribution policies welfare state → policies that turn market income into final/disposable income combination of; taxation → take from the rich expenditure → give to the poor in kind transfers → free/subsidised services social insurance → targeted at specific groups → students, unemployed, etc. progressive policies → directly reduce inequality progressive tax → tax increases as income increases ECON1020 Full Lecture Notes 141 poorer people receive much more benefit from taxes → improves inequality regressive policies → directly increase inequality explaining trends in income equality inequality & economic growth ECON1020 Full Lecture Notes 142 graph observations; most countries have similar growth rates economic growth has no correlation with inequality in fact → countries with higher economic growth also have lower inequality levels economic benefits of lower inequality cooperation & trust economy based on services can't perform well if people are self interested higher equality → higher trust in the system and others → able to perform better and be more productive → higher economic performance policies that enhance endowments of the poor high quality health services & education increase productivity of people → high endowments will employments & output → improve economic performance ECON1020 Full Lecture Notes 143