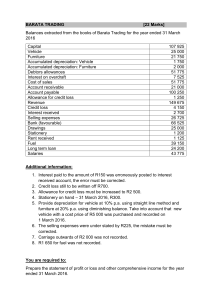

BARATA TRADING [22 Marks] Balances extracted from the books of Barata Trading for the year ended 31 March 2016 Capital Vehicle Furniture Accumulated depreciation: Vehicle Accumulated depreciation: Furniture Debtors allowances Interest on overdraft Cost of sales Account receivable Account payable Allowance for credit loss Revenue Credit loss Interest received Selling expenses Bank (favourable) Drawings Stationery Rent received Fuel Long term loan Salaries 107 925 25 000 21 750 1 750 2 000 51 775 7 525 51 775 21 000 100 250 1 250 149 675 4 150 2 700 26 725 66 525 25 000 1 200 1 125 39 150 24 200 43 775 Additional information: 1. Interest paid to the amount of R150 was erroneously posted to interest received account, the error must be corrected. 2. Credit loss still to be written off R700. 3. Allowance for credit loss must be increased to R2 500. 4. Stationery on hand – 31 March 2016, R300. 5. Provide depreciation for vehicle at 10% p.a. using straight line method and furniture at 20% p.a. using diminishing balance. Take into account that new vehicle with a cost price of R5 000 was purchased and recorded on 1 March 2016. 6. The selling expenses were under stated by R225, the mistake must be corrected. 7. Carriage outwards of R2 000 was not recorded. 8. R1 650 for fuel was not recorded. You are required to: Prepare the statement of profit or loss and other comprehensive income for the year ended 31 March 2016.