14.11 types of business organisations e-learning platform (1)

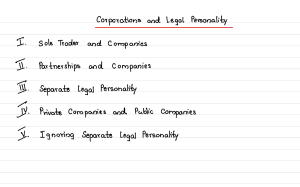

advertisement

TYPES OF BUSINESS ORGANISATION Try to answer the questions below before you read the text 1. What is a sole trader? 2. What is a partnership? 3. What are the advantages and disadvantages of holding sole trader status? 4. What are the advantages and disadvantages of holding partnership status? 5. What is a private limited company? 6. What is a public limited company? 7. What are advantages and disadvantages of holding limited company status? The economy can be divided into two sectors. The public sector includes coal, steel, rail transport, health and education. In the private sector, there are various types of business organisations.There are sole traders, partnerships, private limited companies and public limited companies. SOLE TRADER /'sole proprietor'/ The type of business is one which is owned, run and controlled by one person. It is very often found in retailing /sprzedaż detaliczna/, and in direct services (such as window- cleaning and interior decoration. The advantage of this type of business unit is that the owner can be his own boss and can keep all the profits. Moreover, he does not need much capital to start the business and there are very few legal requirements to follow /wymogi prawne, które trzeba spełnić/ so it is cheap and quick to set up . However, there are disadvantages. First, the sole trader is personally and completely responsible for all the losses of the business. There is no one to share the risk with him. Second, all tasks (selling, invoicing, tax documentation) in the business must be performed by the owner so skills and abilities are limited to those of the owner. He may be good at selling but poor at administration or accounting. Also, if he is ill or wants to to go on holiday there is no one to replace him- and when he is not working no money is coming. And if he wants to expand the business /rozszerzyć działalność/ he seldom has enough capital. PARTNERSHIPS - A partnership, like a sole trader, has unlimited liability but it is an arrangement in which there are at least two but no more than twenty people. Partnership arrangements are common among professions such as architects, accountants, lawyers and management consultants. One advantage of this type of business is that more capital can be raised because more than one person is investing in the business. Also, partners have more skills and abilities from which the business can benefit. Work can be divided up and if somebody is ill or on holiday others may replace them. Moreover, they share the risks and losses and reduce the risk of personal bankruptcy. However, partners cannot enjoy a sole trader's independence. There is a risk of argument and conflict between them as decisions are reached by consultation between partners. There are other types of partners. 'Sleeping partners' contribute capital /wnoszą kapitał/ to the business, but do not participate in its organization and management. Their liability is limited to the amount of capital they contribute. For very large organizations of modern industry and commerce, the amount of capital needed and the potential losses which might result from collapse are very large. Unlimited liability is out of the question Most small businesses that opt for /wybierają/ limited company status become private limited companies rather than public limited companies (PLCs). The main differences between them are that: There is a restriction on the number of members in a private limited company (maximum fifty) There are also restrictions on the transfer of shares in a private limited company. Shareholders /udziałowcy/ need a permission of other shareholders if they want to sell their shares. Private limited companies cannot sell their shares on the stock exchange. PLCs can appeal /wzywa/ to the public /społeczeństwo, ludzie/ to subscribe to new shares /subskrybować, zapisywac sie na nowe akcje/ and so can raise more capital than a private limited company. The public buys shares and they can sell their shares freely on the stock exchange. Match the English words below with their Polish equivalents from the list Personal assets/sole trader/partnership/stock exchange/private limited company/board meeting/ Annual General Meeting/ personal liability/ business partner/ public limited company/sleeping partner/business debts/ board of directors/company directors/ unlimited liability spółka z ograniczoną odpwiedzialnością Roczne Walne Zgromadzenie majątek osobisty zarząd spółka z ograniczoną odpowiedzialnością notowana na giełdzie spółka z ograniczoną odpowiedzialnością nieupoważniona do sprzedawania swoich akcji na giełdzie nieograniczona odpowiedzialność długi firmowe giełda papierów wartościowych cichy wspólnik firma jednoosobowa wspólnik w interesach dyrektorzy firmy spotkanie zarządu odpowiedzialność osobista