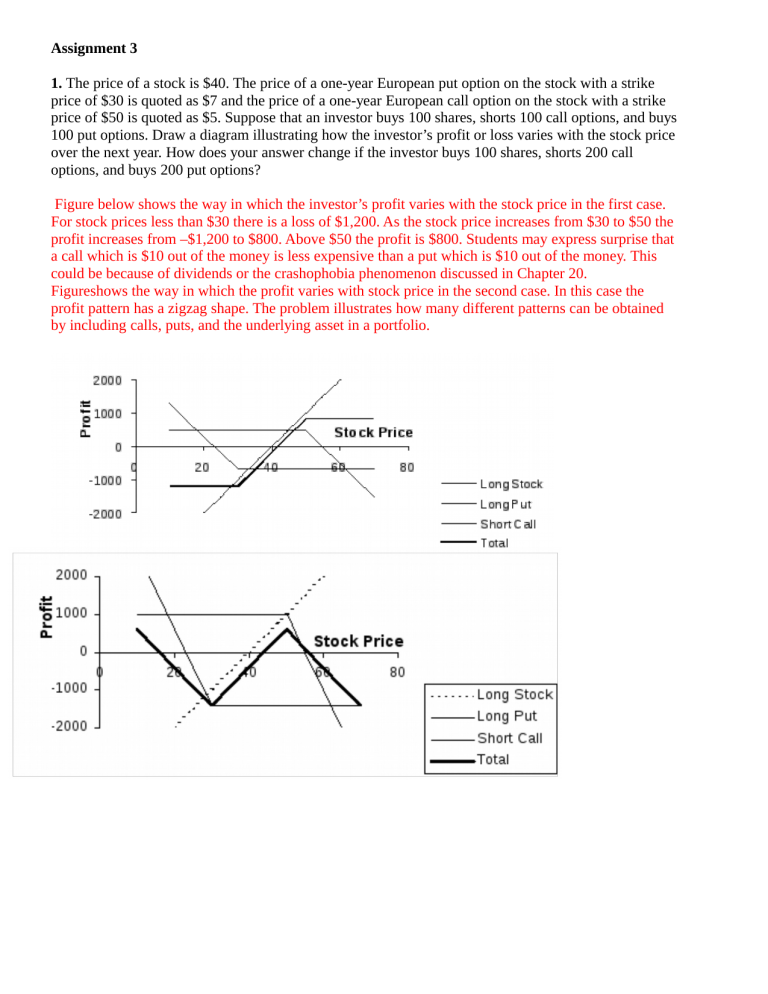

Assignment 3 1. The price of a stock is $40. The price of a one-year European put option on the stock with a strike price of $30 is quoted as $7 and the price of a one-year European call option on the stock with a strike price of $50 is quoted as $5. Suppose that an investor buys 100 shares, shorts 100 call options, and buys 100 put options. Draw a diagram illustrating how the investor’s profit or loss varies with the stock price over the next year. How does your answer change if the investor buys 100 shares, shorts 200 call options, and buys 200 put options? Figure below shows the way in which the investor’s profit varies with the stock price in the first case. For stock prices less than $30 there is a loss of $1,200. As the stock price increases from $30 to $50 the profit increases from –$1,200 to $800. Above $50 the profit is $800. Students may express surprise that a call which is $10 out of the money is less expensive than a put which is $10 out of the money. This could be because of dividends or the crashophobia phenomenon discussed in Chapter 20. Figureshows the way in which the profit varies with stock price in the second case. In this case the profit pattern has a zigzag shape. The problem illustrates how many different patterns can be obtained by including calls, puts, and the underlying asset in a portfolio. 2. The price of a European call that expires in six months and has a strike price of $30 is $2. The underlying stock price is $29, and a dividend of $0.50 is expected in two months and again in five months. Interest rates (all maturities) are 10%. What is the price of a European put option that expires in six months and has a strike price of $30? Using the notation in the chapter, put-call parity gives c Ke rT D p S0 or p c Ke rT D S0 In this case p 2 30e 01612 (05e 012 12 05e 01512 ) 29 251 In other words the put price is $2.51. Show how to exploit the arbitrage opportunities if the European put price is $3. If the put price is $3.00, it is too high relative to the call price. An arbitrageur should buy the call, short the put and short the stock. This generates 2 3 29 $30 in cash which is invested at 10%. Regardless of what happens a profit with a present value of 300 251 $049 is locked in. If the stock price is above $30 in six months, the call option is exercised, and the put option expires worthless. The call option enables the stock to be bought for $30, or 30e 010612 $2854 in present value terms. The dividends on the short position cost 05e 012 12 05e 01512 $097 in present value terms so that there is a profit with a present value of 30 2854 097 $049 . If the stock price is below $30 in six months, the put option is exercised and the call option expires worthless. The short put option leads to the stock being bought for $30, or 30e 0106 12 $2854 in present value terms. The dividends on the short position cost 05e 012 12 05e 01512 $097 in present value terms so that there is a profit with a present value of 30 2854 097 $049 . 3. The following option prices were observed for calls and puts on a stock on July 6 of a particular yea. The stock was priced at 165.13. The expirations are July 17, August 21, and October 16. The standard deviation is 0.21. The continuously compounded risk-free rate is 0.0571. Call Put Strike Price July Aug Oct Jul Aug Oct 160 6.00 8.10 11.10 0.75 2.75 4.50 165 2.70 5.25 8.10 2.40 4.75 6.75 170 0.80 3.25 6.00 5.75 7.50 9.00 a. Construct a bear money spread using the October 165 and 170 calls for possible stock prices of 150, 155, 160, 165, 170, 175, and 180 at the end of the holding period. Hold the position until the options expire. Determine the profits and graph the results. Identify the breakeven stock price at expiration and the maximum and minimum profits. (Bear Spread) Buy the October 170 at 6 and Sell the October 165 at 8.10. Profit = 100(Max(0,ST – 170) – 6 –Max(0,ST – 165) + 8.10) ST 150 155 160 165 170 175 180 Option Value at Expiration October 170 October 165 -600 810 -600 810 -600 810 -600 810 -600 310 -100 -190 400 -690 Profit 210 210 210 210 –290 –290 –290 Breakeven stock price : 167.10 Maximum profit: 210 Minimum profit: –290 b. Repeat question a, but close the position on September 20. Find the profits for the possible stock prices on September 20. Generate a graph and use it to identify the approximate breakeven stock price. (Bear Spread) Rf = 0.0571, = 0.21, Time to expiration: T – t = 26/365 = 0.0712 (26 days between September 20 and October 16) Plugging into the Black-Scholes model, we obtain the option values on September 20 for stock prices of 150, 155, … , 180. Spread value on 9/20 = Value of 170 call on 9/20 – Value of 165 call on 9/20 Profit = 100(Spread Value on 9/20 – 6.00 + 8.10) Option Value on 9/20 St October 165 150 0.1914 155 0.6862 160 1.8642 165 4.0260 170 7.2362 175 11.2934 180 15.8809 October 170 0.0488 0.2234 0.7552 1.9706 4.1480 7.3443 11.3715 Profit 195.74 163.72 99.1 4.46 –98.82 –184.91 –240.94 Approximate breakeven stock price: 166. c. Suppose you are expecting the stock price to move substantially over the next three months. You are considering a butterfly spread. Construct an appropriate butterfly spread using the October 160, 165, and 170 calls. Hold the position until expiration. Determine the profits and graph the results. Identify the two breakeven stock prices and the maximum and minimum profits. (Butterfly Spreads) Sell October 160 at 11.10. Buy two October 165's at 8.10 each. Sell October 170 at 6. Profit = 100(2(Max(0, ST – 165) – 8.10) – Max(0, ST – 160) + 11.10 – Max(0, ST – 170) + 6) ST 150 155 160 165 170 175 180 October 160 1,110 1,110 1,110 610 110 -390 -890 Option Value at Expiration October 165 October 170 -1,620 600 -1,620 600 -1,620 600 -1,620 600 -620 600 380 100 1,380 -400 Profit 90 90 90 –410 90 90 90 Break-evens: 160.90,169.10 Maximum profit: 90 Minimum profit: –410 d. Construct a long straddle using the October 165 options. Hold until the options expire. Determine the profits and graph the results. Identify the breakeven stock prices at expiration and the minimum profit. (Straddle) Buy the October 165 call at 8.10. Buy the October 165 put at 6.75. Profit = 100(Max(0,ST – 165) – 8.10 + Max(0,165 – ST) – 6.75) ST 150 155 160 165 170 175 180 Option Value at Expiration October 165 Call October 165 Put -810 825 -810 325 -810 -175 -810 -675 -310 -675 190 -675 690 -675 Break-evens : 179.85, 150.15 Minimum profit: –1,485 Maximum profit: Profit 15 –485 –985 –1,485 –985 –485 15 e. Repeat question d, but close the positions on September 20. Find the profits for the possible stock prices on September 20. Generate a graph and use it to identify the approximate breakeven stock prices. (Straddle) K = 165, RF = 0.0571, = 0.21, T = 26/365 = 0.0712 (based on 26 days between 9/20 and 10/16) Plugging into the Black-Scholes-Merton model, we obtain the option values on September 20 for stock prices 150, 155, … , 180. Straddle value on 9/20 = Value of October 165 Call on 9/20 + Value of October 165 Put on 9/20 Profit = 100(Straddle Value on 9/20 – 8.10 – 6.75) St 150 155 160 165 170 175 180 Option Value at End of Holding Period October 165 Call October 165 Put 0.1911 14.5217 0.6856 10.0162 1.8633 6.1939 4.0250 3.3555 7.2353 1.5658 11.2927 0.6233 15.8803 0.2109 Approximate breakeven stock prices: 178 and 150 Profit –13.72 –414.82 –679.28 –746.95 –604.89 –293.40 124.12 f. A slight variation of a straddle is a strap. Construct a long strap using the October 165 options. Hold the position until expiration. Determine the profits and graph the results. Identify the breakeven stock prices at expiration and the minimum profit. Compare the results with the October 165 straddle. (Strap) Buy two October 165 calls at 8.10 each. Buy one October 165 put at 6.75. Profit = 100(2(Max(0,ST – 165) – 8.10) + Max(0,ST – 165) – 6.75.) ST 150 155 160 165 170 175 180 Option Values at Expiration October 165 Call October 165 Put -1620 825 -1620 325 -1620 -175 -1620 -675 -620 -675 380 -675 1380 -675 Profit –795 –1,295 –1,795 –2,295 –1,295 –295 705 The graph shows the straddle (the dashed line) overlaid with the strap. The strap provides a higher profit on the upside and a larger loss on the downside. Break-evens: 176.475, 142.05 Minimum profit: –2,295 g. Construct a short strip using the August 170 options. Hold the position until the options expire. Determine the profits and graph the results. Identify the breakeven stock prices at expiration and the minimum profit. (Straddle) Sell two August 170 puts at 7.5. Sell one August 170 call at 3.25. Profit = 100(–2(Max(0,170 – ST) – 7.5) – Max(0,ST – 170) + 3.25) ST 150 155 160 165 170 175 180 Option Value at Expiration August 170 Call(3.25 August 170 Put(7.5 325 -2500 325 -1500 325 -500 325 500 325 1500 -175 1500 -675 1500 Profit –2,175 –1,175 –175 825 1,825 1,325 825 Note that only one breakeven point appears in the graph because of the range of stock prices chosen. Breakevens: 188.25,160.875 Minimum profit:–31,175 4. A stock price is currently $50. It is known that at the end of six months it will be either $45 or $55. The risk-free interest rate is 10% per annum with continuous compounding. What is the value of a sixmonth European put option with a strike price of $50? Consider a portfolio consisting of 1 Put option Shares If the stock price rises to $55, this is worth 55 . If the stock price falls to $45, the portfolio is worth 45 5 . These are the same when 45 5 55 or 050 . The value of the portfolio in six months is 275 for both stock prices. Its value today must be the present value of 275 , or 275e0105 2616 . This means that f 50 2616 where f is the put price. Because 050 , the put price is $1.16. As an alternative approach we can calculate the probability, p , of an up movement in a risk-neutral world. This must satisfy: 55 p 45(1 p ) 50e0105 so that 10 p 50e0105 45 or p 07564 . The value of the option is then its expected payoff discounted at the risk-free rate: [0 07564 5 02436]e0105 116 or $1.16. This agrees with the previous calculation. 5. A stock price is currently $40. Over each of the next two three-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 12% per annum with continuous compounding. a. What is the value of a six-month European put option with a strike price of $42? b. What is the value of a six-month American put option with a strike price of $42? a. The risk-neutral probability of an up move, p , is given by e012312 090 p 06523 11 09 Calculating the expected payoff and discounting, we obtain the value of the option as [24 2 06523 03477 96 03477 2 ]e 0126 12 2118 The value of the European option is 2.118. This can also be calculated by working back through the tree as shown in Figure below. The second number at each node is the value of the European option. b. The value of the American option is shown as the third number at each node on the tree. It is 2.537. This is greater than the value of the European option because it is optimal to exercise early at node C. 6. Suppose that the spot price of the Canadian dollar is U.S. $0.95 and that the Canadian dollar/U.S. dollar exchange rate has a volatility of 8% per annum. The risk-free rates of interest in Canada and the United States are 4% and 5% per annum, respectively. Calculate the value of a European call option to buy one Canadian dollar for U.S. $0.95 in nine months. Use put-call parity to calculate the price of a European put option to sell one Canadian dollar for U.S. $0.95 in nine months. What is the price of a call option to buy U.S. $0.95 with one Canadian dollar in nine months? In this case S0 095 , K 095 , r 005 , rf 004 , 008 and T 075 . The option can be valued using equation (16.8) ln(095 095) (005 004 00064 2) 075 d1 01429 008 075 d 2 d1 008 075 00736 and N (d1 ) 05568 N (d 2 ) 05293 The value of the call, c , is given by c = 0.95e-0.04×0.75×0.5558−0.95e-0.05×0.75×0.5293 = 0.0290 i.e., it is 2.90 cents. From put–call parity p S0 e rf T c Ke rT so that p 0029 095e0059 12 095e 0049 12 00221 The option to buy US$0.95 with C$1.00 is the same as the same as an option to sell one Canadian dollar for US$0.95. This means that it is a put option on the Canadian dollar and its price is US$0.0221.