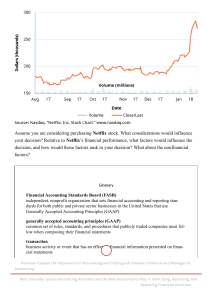

Intermediate Accounting 1 ACC 3000 Spring 2022 Chapter 1. Environment and Theoretical Structure of Financial Accounting LO1-1 Primary Focus of Financial Accounting Healy and Palepu (2001) LO1-1 The Economic Environment and Financial Reporting Capital markets provide a mechanism to help the economy allocate resources efficiently Corporations acquire capital from: • Investors in exchange for ownership interest and; • Creditors by borrowing • Either through individual loans or publicly traded debt such as bonds 01-03 LO1-1 Primary Focus of Financial Accounting • Providing financial information to various external users • Investors • Creditors • Other external users Investors and creditors Use different kinds of information ➢ To predict the Financial information is a key component of that information set future risk and potential return of investments or loans ➢ Before supplying capital to businesses 01-04 LO1-1 Financial Accounting • Financial information is conveyed through financial statements and related disclosure notes • Balance sheet • Income statement (and the statement of comprehensive income) • Statement of cash flows • Statement of shareholders’ equity • Financial Reporting • Refers to the process of providing financial information to external users 01-05 LO1-1 Annual report • Who has to file with the SEC? • What forms are filed? • EDGAR: https://www.sec.gov/edgar/searchedgar/companysearch.html 01-06 LO1-5 Encouraging High-Quality Financial Reporting • Role of an Auditor • Offer credibility to financial statements • Express an opinion on the compliance of financial statements with GAAP • Licensed by states to provide audit services—certified public accountants (CPAs) 01-7 LO1-2 Cash versus Accrual Accounting Cash Basis Accounting • Measurement of cash receipts and cash payments from transactions related to providing goods and services • Difference is net operating cash flow Accrual Basis Accounting • Measurement of revenues and expenses, regardless of when cash is received or paid • Difference is net income or net loss 01-8 LO1-2 Cash Basis Example • Carter Company paid $60,000 for 3 years’ rent at the beginning of year 1 • Under cash basis accounting, the rent payment is shown when paid Year 1 Year 2 Year 3 Total $100,000 $100,000 $100,000 $300,000 $ 50,000 $125,000 $125,000 $300,000 Prepayment of three years’ rent (60,000) –0– –0– (60,000) Salaries to employees (50,000) (50,000) (50,000) (150,000) (5,000) (15,000) (10,000) (30,000) $ (65,000) $ 60,000 $ 65,000 $ 60,000 Sales (on credit) Net Operating Cash Flows Cash receipts from customers Cash disbursements: Utilities Net operating cash flow 01-9 LO1-2 Accrual Basis Example • Carter Company paid $60,000 for 3 years’ rent at the beginning of year 1 • Under accrual basis accounting, rent is recognized as an expense all three years even though it was paid in year 1 CARTER COMPANY Income Statements Year 1 Year 2 Year 3 Total $100,000 $100,000 $100,000 $300,000 Rent 20,000 20,000 20,000 60,000 Salaries 50,000 50,000 50,000 150,000 Utilities 10,000 10,000 10,000 30,000 80,000 80,000 80,000 240,000 $ 20,000 $ 20,000 $ 20,000 $ 60,000 Revenues Expenses: Total expenses Net Income 01-10 LO1-2 Cash versus Accrual Accounting • Over the life of the company, the sum total of operating cash flows equals the sum total of accrual-based income. • For a specific period, however, the amounts will generally differ. • Over short periods of time, operating cash flow may not be an accurate predictor of future operating cash flows. • Accrual-based net income is considered a better indicator of future operating cash flows than is current net operating cash flows. The accrual accounting model is required by US GAAP. 01-11 LO1-2 Concept Check: Accrual Accounting Which of the following is not an advantage of accrual accounting? a. b. c. d. Spreads out the influence of one-time events that affect multiple reporting periods Highlights cash effects of operations Captures long-run performance Recognizes assets and liabilities associated with receivables and payables 01-12 Copyright © 2020 McGraw-Hill Education. All rights reserved. No reproduction or distribution without prior written consent of McGraw-Hill Education. LO1-3 The Development of Financial Accounting and Reporting Standards • Generally Accepted Accounting Principles (GAAP) • GAAP is a dynamic set of both broad and specific guidelines that companies should follow when measuring and reporting the information in their financial statements and related notes • GAAP facilitates decision making by investors and creditors by allowing them to compare financial information among companies • Set by FASB (Financial Accounting Standards Board) 01-13 LO1-3 International Standard Setting • IASB (Financial Accounting Standards Board): • To develop a single set of high-quality, understandable, and enforceable global accounting standards • Issued new standards of its own—called International Financial Reporting Standards (IFRS) • More and more countries are basing their national accounting standards on IFRS • By 2018, more than 120 jurisdictions, including Hong Kong, Egypt, Canada, Australia, and the countries in the European Union (EU), require or permit the use of IFRS or a local variant of IFRS 01-14 LO1-3 Efforts to Converge U.S. and International Standards U.S. GAAP Converged Standards IFRS • FASB and IASB have been working for many years to converge to one global set of accounting standards, however, recent events suggest that full convergence will not be achieved in the foreseeable future • While it appears likely that the FASB and IASB will continue to work together to converge where possible, some differences between IFRS and U.S. GAAP will remain 01-15 LO1-6 The Conceptual Framework 01-16 LO1-8 Underlying Assumptions Four basic assumptions underlie GAAP • The economic entity assumption presumes that economic events can be identified specifically with an economic entity • The going concern assumption anticipates that a business entity will continue to operate indefinitely • The periodicity assumption allows the life of a company to be divided into artificial time periods to provide timely information • The monetary unit used in U.S. financial statements is the U.S. dollar 01-17 LO1-9 Revenue Recognition • Revenue: Inflows of assets or settlements of liabilities resulting from providing a product or service to a customer • Revenue recognition used to be guided by the realization principle (two criteria) • Earnings process is judged to be complete or virtually complete • Reasonable certainty as to the collectability of the asset to be received (usually cash) • FASB issued ASU No. 2014-09, which requires that we recognize revenue when goods or services are transferred to customers for the amount the company expects to be entitled to receive in exchange for those goods or services 01-18 LO1-9 Expense Recognition Often matches revenues and expenses that arise from the same transactions or other events Four approaches: • • • • Based on an exact cause-and-effect relationship By associating an expense with the revenues recognized in a specific time period By a systematic and rational allocation to specific time periods In the period incurred, without regard to related revenue 01-19 LO1-9 Measurement • GAAP currently employs a “mixed attribute” measurement model. • The five attributes are: 1. Historical cost: original transaction value adjusted for depreciation and amortization (e.g. land) 2. Net realizable value: the amount of cash into which an asset is expected to be converted in the ordinary course of business (e.g. inventory) 3. Current cost: the cost that would be incurred to purchase or reproduce the asset 4. Present value: the current value of future cash flows, calculated by applying the time value of money 5. Fair value: the price that would be received to sell assets or paid to transfer a liability in an orderly transaction between market participants at the measurement date (e.g. investment) 01-20 LO1-9 Disclosure • Full-disclosure principle: requires that the financial reports should include any information that could affect the decisions made by external users • Such information can be disclosed in a variety of ways: • Parenthetical comments or modifying comments • Placed on the face of the financial statements • Disclosure notes • Convey additional insights • Supplemental schedules and tables • Report more detailed information than is shown in the primary financial statements 01-21 A detour: Time Value of Money (Chapter 5) • Money has time value which implies the need for a procedure to compare dollar amounts at different points in time. • A dollar today is not equivalent to a dollar received a year from now. • How to decide if X dollars right now (time 0) is preferred to Y dollars t periods in the future? FUTURE VALUE Let: t = number of periods r = rate of interest D = initial deposit Then the future value, FV, of an initial deposit of D left to accumulate interest at rate r per period for t periods is given by FV = D*(1+r)t FUTURE VALUE Interest is the charge (price paid) for the ability to transfer cash across time periods i.e., it is the charge levied to postpone the payment or receipt of funds PRESENT VALUE If the future value is given by FV = D*(1+r)t When the interest rate is r per period and t is the number of periods, then D = FV/(1+r)t Where D is the initial deposit (the Present Value or PV) PV and FV FV = PV * (1+i)n = PV * FV_factor (i%, n) $83.96 + $83.96 * 6% = $89.00 T=0 T=1 $89.00/1.06 = $83.96 =0.83962* $100 $94.34/1.06 = $89.00 + $89.00 * 6% = $94.34 T=2 $100/1.06 = $94.34 PV = FV / (1+i)n = FV * PV_factor (i%, n) + $94.34 * 6% = $100 = 1.19102* $83.96 T=3 $100 Interest Factor Tables Rate Periods 1 2 3 4 5 6 7 8 9 10 1% 1.01000 1.02010 1.03030 1.04060 1.05101 1.06152 1.07214 1.08286 1.09369 1.10462 2% 1.02000 1.04040 1.06121 1.08243 1.10408 1.12616 1.14869 1.17166 1.19509 1.21899 3% 1.03000 1.06090 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 1.30477 1.34392 4% 1.04000 1.08160 1.12486 1.16986 1.21665 1.26532 1.31593 1.36857 1.42331 1.48024 5% 1.05000 1.10250 1.15763 1.21551 1.27628 1.34010 1.40710 1.47746 1.55133 1.62889 6% 1.06000 1.12360 1.19102 1.26248 1.33823 1.41852 1.50363 1.59385 1.68948 1.79085 7% 1.07000 1.14490 1.22504 1.31080 1.40255 1.50073 1.60578 1.71819 1.83846 1.96715 D = 83.96 r = 6% FV = D*(1+r)t = D * Factor = 83.96 * 1.19102 = 100 8% 1.08000 1.16640 1.25971 1.36049 1.46933 1.58687 1.71382 1.85093 1.99900 2.15892 9% 1.09000 1.18810 1.29503 1.41158 1.53862 1.67710 1.82804 1.99256 2.17189 2.36736 10% 1.10000 1.21000 1.33100 1.46410 1.61051 1.77156 1.94872 2.14359 2.35795 2.59374 LO5-5 Concept Check: Valuing a Note Turp and Tyne Distillery is considering investing in a two-year project. The company’s required rate of return is 10%. The present value of $1 for one period at 10% is .909 and .826 for two periods at 10%. The project is expected to create cash flows, net of taxes, of $240,000 in the first year, and $300,000 in the second year. The distillery should invest in the project if the project’s cost is less than or equal to: a. b. c. d. $540,000 $490,860 $465,960 $446,040 05-28 Copyright © 2020 McGraw-Hill Education. All rights reserved. No reproduction or distribution without prior written consent of McGraw-Hill Education.