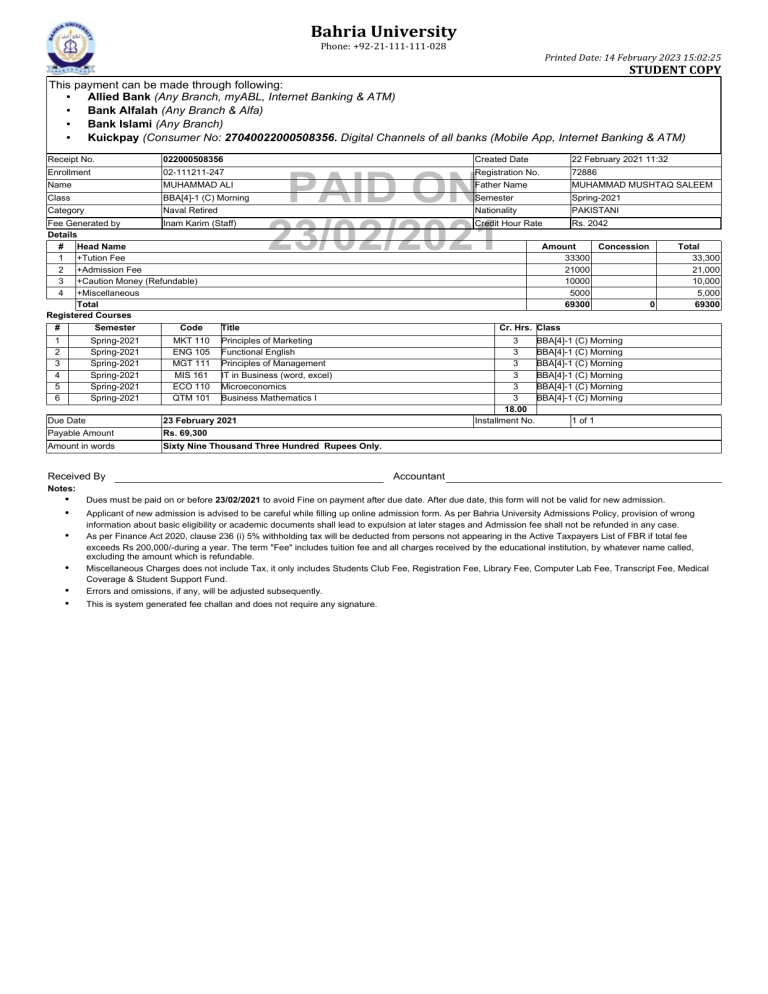

Bahria University Phone: +92-21-111-111-028 Printed Date: 14 February 2023 15:02:25 STUDENT COPY This payment can be made through following: • Allied Bank (Any Branch, myABL, Internet Banking & ATM) • Bank Alfalah (Any Branch & Alfa) • Bank Islami (Any Branch) • Kuickpay (Consumer No: 27040022000508356. Digital Channels of all banks (Mobile App, Internet Banking & ATM) Receipt No. 022000508356 Created Date 22 February 2021 11:32 Enrollment 02-111211-247 Registration No. 72886 Name MUHAMMAD ALI Father Name MUHAMMAD MUSHTAQ SALEEM Class BBA[4]-1 (C) Morning Semester Spring-2021 Category Naval Retired Nationality PAKISTANI Credit Hour Rate Rs. 2042 Fee Generated by Inam Karim (Staff) Details # Head Name 1 +Tution Fee 2 +Admission Fee 3 +Caution Money (Refundable) 4 +Miscellaneous Total Registered Courses # Semester Code 1 2 3 4 5 6 Spring-2021 Spring-2021 Spring-2021 Spring-2021 Spring-2021 Spring-2021 MKT 110 ENG 105 MGT 111 MIS 161 ECO 110 QTM 101 PAID ON 23/02/2021 Title 23 February 2021 Payable Amount Rs. 69,300 Amount in words Sixty Nine Thousand Three Hundred Rupees Only. Received By Total 33,300 21,000 10,000 5,000 69300 Cr. Hrs. Class Principles of Marketing Functional English Principles of Management IT in Business (word, excel) Microeconomics Business Mathematics I Due Date Amount Concession 33300 21000 10000 5000 69300 0 3 BBA[4]-1 (C) Morning 3 BBA[4]-1 (C) Morning 3 BBA[4]-1 (C) Morning 3 BBA[4]-1 (C) Morning 3 BBA[4]-1 (C) Morning 3 BBA[4]-1 (C) Morning 18.00 Installment No. 1 of 1 Accountant Notes: • • • • • • Dues must be paid on or before 23/02/2021 to avoid Fine on payment after due date. After due date, this form will not be valid for new admission. Applicant of new admission is advised to be careful while filling up online admission form. As per Bahria University Admissions Policy, provision of wrong information about basic eligibility or academic documents shall lead to expulsion at later stages and Admission fee shall not be refunded in any case. As per Finance Act 2020, clause 236 (i) 5% withholding tax will be deducted from persons not appearing in the Active Taxpayers List of FBR if total fee exceeds Rs 200,000/-during a year. The term "Fee" includes tuition fee and all charges received by the educational institution, by whatever name called, excluding the amount which is refundable. Miscellaneous Charges does not include Tax, it only includes Students Club Fee, Registration Fee, Library Fee, Computer Lab Fee, Transcript Fee, Medical Coverage & Student Support Fund. Errors and omissions, if any, will be adjusted subsequently. This is system generated fee challan and does not require any signature.