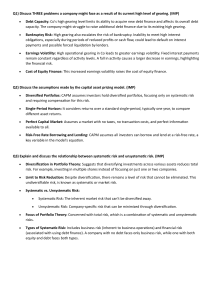

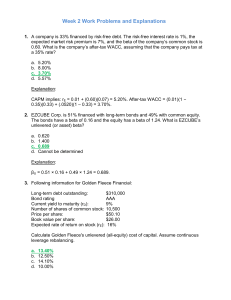

According to CAPM, Cost of Equity = Risk Free Rate + Beta*Equity Risk Premium a) Risk Free Rate = 4.28% Beta = 1.25 Risk Premium = 3.5% Cost of Equity = 4.28% + 1.25*3.5% = 8.66% b) Yield = 5.125% Taxes = 25% C) >>> Assumption that Risk Premium is 3.5% Cost of Debt = 5.125% * (1-25%) = 3.84% At 75% Equity and 25% Debt Weighted Average Cost of Capital (WaCC) = .75*8.66% + .25*3.84% = 7.45% >>> Assumption that Risk Premium is 7% Cost of Equity = 4.28% + 1.25*7% = 13.03% At 75% Equity and 25% Debt Weighted Average Cost of Capital (WaCC) = .75*13.03% + .25*3.84% = 10.73%