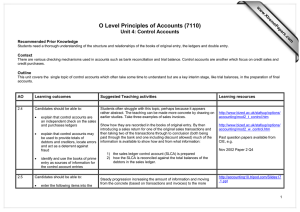

Accounts [5/20, 08:55] +263 77 417 5305: D .Katsere owns a business.He made a gross profit of 33 1/3%.His Turnover is 562500.The net profit is 15% of Turnover.The rate of Turnover was 10 times and the opening inventory was 45000. Calculate 1, gross profit 2, Cost of sales 3, Mark up The closing inventory 4, purchases 5, expenses [5/20, 09:47] +263 77 417 5305: State whether each of the following is capital or revenue expenditure 1, payment for carriage on purchases 2,hire of motor vehicles from D.motors 3, Painting of an extension to the office block 4,wages paid to workers installing a new machine 5,photocopier acquired for use in in the business 6, inventory bought for resale 7, payment of interest on a bank loan 8, stationery bought for use in office [5/20, 21:25] +263 77 417 5305: Q3 The following information was taken from the A Langton's records. _Purchases 112800 _Sales 152250 _Returns outwards 750 _Returns lnwards 2250 _Carriage lnwards 1200 _opening stock 9000 _Closing stock 9750 *Calculate 1, Turnover 2,a cost of goods sold 3, gross profit 4, gross profit mark up 5, gross profit margin 6,Rate of stock turn over [5/20, 21:25] +263 77 417 5305: Q 4 Prepare manufacturing Accountant from the following: _lnventory:1/1/20 Raw materials 6400 WIP 5600 _Depreciation of machinery 1500 _Royalties 3000 _purchases 0f raw materials 40000 _Carriage lnwards 1200 _Factory supervisor's wages 50000 _factory power and rates 9700 _lnventory 31.12.20 Raw materials 8400 W.l.P 4500 Prepare a manufacturing account from the above [5/20, 21:25] +263 77 417 5305: Q 5 Prepare a packing material account from the following: *Packing material 8600(Dr) *Paid 1200 by cheque for packing material. *Bought packing material on credit from Tongai stationers $4500 *Returned damaged packing material Worth $1800 to Tongai stationers At the end of the year the value of unused packing material at the Year end . [6/19, 19:01] +263 77 417 5305: Hie, guys: ALL WRITTEN work should be brought on opening: Take your bookand answer Q1 taking into account the following: For Q1 take note of the following,: Adjustment: ii)lncrease drawings by 10000 and sales by 10000.Sales because goods were taken at selling price iii)Dep: *Reducing,=10%×(120000-12000) *Straight line=10%×300000 iv) insurance 35000-7500= v)*Interest on overdraft 5000 is an expense in the B/sheet a CL vi)*decrease in provision add to Gross profit as other income *In the balance sheet take note of the NCA esp accumulated depreciation columns Also adjust well the debtors figure under CA. [6/19, 19:51] +263 77 417 5305: For question 2 copy the answers below: a I) rent received in advance ii)Rent received in cash iii)480000is the amount chargeable to the tenant iv) Rent received owing- current asset. v) unused packing material vi) Packing material bought on credit from Grand supplies vii)430000is the value of materials used Viii)stock of stationery -current asset [6/19, 20:16] +263 77 417 5305: Debit side *March 1balance b/d 960000 *March 5 sales 675000 *31 Dishoured cheque 900000 *31disallowed discount 60000 Credit side *March 3 cash 900000 *March 3 discount allowed 60000 *March 7 sales returns 75000 *March 20 bank 600000 [6/19, 20:16] +263 77 417 5305: Your answer to the last part of question 2 should be in ledger form [6/19, 20:19] +263 77 417 5305: You draw the ledger by dividing the page into 2 equal halves Just a reminder [6/19, 20:41] +263 77 124 1290: So are u going to mark it or [6/19, 20:51] +263 77 417 5305: These are notes,hence for Question 3 Copy the the sentence and complete it with the following: a (i) Debit (ii) credit b) average inventory c)credit note d)i capital ii Revenue e) undervalued f)i interest ii Dividend g) debit h) 900000-(600000+200000-300000)= Goodwill=purchase price lessc(Assets -Liabilities i) I cost of raw materials used ii Direct costs j)i opening inventory ii trading account k) i straight line method ii reducing balance method L) i accrual ii current liability [6/21, 15:56] +263 77 417 5305: If no questions, let's look at question 5 *Working capital is the difference between Total current assets and Total current liabilities. *Current assets items are:b in _closing inventory _trade receivables _prepayments _cash at bank Cash in hand Petty cash NB* if these items increase WC will increase if they decrease WC decrease *If one of the items increase and the other decrease the will be no Effect Current liabilities items are: Trade payables Bank overdraft Accruals *If these decrease WC increase, decrease WC increase [6/21, 15:56] +263 77 417 5305: If current liabilities increase WC decrease [6/21, 15:56] +263 77 417 5305: About capital *If the owner puts additional capital, capital will increase *Drawings in Cash or goods capital decrease *Bad debts written off(capital will decrease) [6/21, 15:56] +263 77 417 5305: Answers for question 5 I)no effect on capital and also no effect on WC because bank decreased and creditors decreased ii)no effect on capital and WC decrease because creditors increased iii) Capital decrease because of drawings and also WC decrease because bank decreased iv) lncrease/no effect on capital and WC increase/no effect v) decrease capital because of bad debts and also WC decrease because debtors have decreased vi) capital increase WC no effect [6/21, 15:56] +263 77 417 5305: 5b) Accounting Equation=capital=assets-Liabilities [6/21, 15:56] +263 77 417 5305: Notes on question 6 Your answer should have 3subtotals *Cost of raw materials used/consumed *Prime cost *Production cost Be able to classify costs correctly and see to it that the manufacturing account is not disjointed [6/21, 15:57] +263 77 417 5305: Our next topic is control Accounts [6/21, 16:01] +263 77 417 5305: Will give you questions answers,then you will the demonstration to answer the questions that follow [6/21, 17:08] +263 77 417 5305: Will give you questions and answers,then you will follow the demonstration to answer the questions that follow [6/22, 19:32] +263 77 417 5305: About control Accounts You need to memorize what goes on the debit side and also what goes on the credit side [6/22, 19:33] +263 77 501 7105: Noted [6/22, 19:36] +263 77 417 5305: Sales ledger control Accounts is also known as debtors control account [6/22, 19:37] +263 77 417 5305: The new term is Trade receivable account [6/22, 19:43] +263 77 417 5305: Debit entries for Trade receivable account are: *Balance b/d *Credit sale* *Dishoured cheques *Interest on customer's overdue Accounts [6/22, 20:03] +263 77 417 5305: *Credit entries for Trade receivable account* *Cheque or cash received from customers *Discount allowed *Sales returns *Returns lnwards *Bad debts *Set off or contra entries [6/22, 20:03] +263 77 417 5305: *The purchases ledger control Accounts* *Also known as creditors control account or Trade payable Account *Debits are as follows* -payments to suppliers or creditors -discount received -purchases returns -returns outwards - set off or contra entries *Credits are as follows* -balance b/d - credit purchases - cash refunds from suppliers [6/22, 20:03] +263 77 417 5305: Use the above as guide for the preparation of control Accounts *Time is not on our side*.Be serious with these online free lessons. When schools open l would like to see these notes neatly written in your note bks* [6/22, 20:36] +263 77 417 5305: *Question 2* *Sales ledger balances:Dr 20049 Cr56 *Purchases ledger balances :Dr 12 Cr 14680 *Payment to creditors 93685 *Cheques from credit customers 119930 *Purchases on credit 95580 *Sales on credit 124600 *Bad debts 204 *Discount allowed 3480 *Discount received 2850 *Returns lnwards 1063 *Returns outwards 240 *Sales ledger credit balances at 31/12/2009 37 Purchases ledger debit balances at 32/12/2009 *Required to prepare* i) trade receivable control account ii) trade payables control account. [6/22, 20:36] +263 77 417 5305: *I AM REMINDING YOU TO BE SERIOUS ONCE AGAIN* [6/22, 20:37] +263 77 417 5305: *For any questions inbox* [6/24, 15:41] +263 77 417 5305: _*Reasons for keeping control Accounts* i) to reduce fraud and Cheating ii) to obtain summary of trade receivables and trade payables to speed up the preparation of financial statements iii) to check on arithmetical accuracy iv) for management control purposes *Sources of information for control Accounts* -The sales ledger control account: i) Credit sales=sales journal ii) sales returns=sales returns journal iii) Cheques received from customers=cash book iv) cash received from customers=cash book v) balances=list of trade receivable balances vi) discount allowed=cash book *The purchases ledger control account* i) credit purchases=purchases journal ii) purchases returns=purchases returns journal iii) Cheques paid to creditors=cash book iv) cash paid to creditors=cash book v)Discount received=cash book vi) balances =list of trade payables balances *SOURCE means where the figures recorded in the control account are taken from* *QUESTION* The following information appeared in the books of Telford i)Debtors at 1 October. 8200 ii)Interest charged on overdue account 30 iii)Cash and cheques received from customers. 6900 iv)Discount allowed 170 v)Credit sales 6400 vi*Goods returned by credit customers 250 vii)*Bad debts written off 240 *Required to prepare* i) sales ledger control account ii)Name the books of original entry or subsidiary books (SOURCE) from which each of the above entries i to vii would be obtained *Answers to item ii* eg ii=Journal iii=cash book iv=cash book v=sales journal vi=sales returns journal vii=journal *QUESTION 2* The following information was taken from the books of a company: i Total creditors at 1 October 1400 ii . credit purchases 8640 iii.payments to creditors 5000 iv . purchases returns 320 v . discount received 360 vi.contra 480 *Required to prepare* a.purchases ledger control account b.list the items in a above i.e .i ii etc and against each write the appropriate source from which the figures would be obtained. L [6/24, 15:59] +263 77 417 5305: Have 2 ex books 1 for test and exercises and and the other one for notes *Note we are going to write a test on Monday from 7 pm**You will be your own invigilator* [6/24, 18:10] +263 77 417 5305: For those who want to read in advance our next topic is *The trial balance* Be able to i.define a trial balance ii give the purpose iii.prepare a trial balance from a given list of assets and liabilities iv . correct a trial v.list and explain errors not revealed by a trial balance vi.make journal entries for correcting errors vii .prepare the suspense Accounts. viii.prepare revised profit statements *Notes and exercises will follow and as usual , write them for your benefit* [6/25, 15:05] +263 77 417 5305: A Trial ibalance is a list of debit and credit balances taken from the ledger and cash book. *PURPOSE*: -To check the arithmetical accuracy of the bookkeeping process. -To provide a working paper for the preparation of financial statements *How to prepare a trial balance from a list of assets and liabilities* *Debit column show* -assets -expenses -returns outwards -drawings *Credit column show* -Liabilities -All provisions -Returns inwards *Having said this try to answer the question below* [6/25, 15:05] +263 77 417 5305: Hints on preparation of the above: *The total is 90480 *Credit column has five items (figures) *The above format is to be followed when preparing the trial balance* *More about preparing the trial balance from a list of assets and liabilities* *Q 1* [6/25, 15:24] +263 77 417 5305: *;Hints* *Follow the format in the first question *The credit column has 3 items [6/25, 16:55] +263 77 417 5305: NEXT are questions that require correcting the trial balance. *You will be given a trial balance wrongly prepared *Your task will be to re-write the trial balance correctly. *NOTE* a) provisions maybe debited.correct by crediting them b) returns lnwards if credited, correct by debiting them c) returns outwards,if debited, credit them d)*carriage lnwards *Carriage on sales *Railage inwards *Customs duty *Drawings.....are all debits show them in the debit column if credited [6/28, 18:13] +263 77 417 5305: The following information was taken from the books of A.Brendon: #Sales ledger control account balance 13250 Dr # Purchases ledger control account balance 8100 Cr # Credit purchases 5209 # Credit sales 1 1360 # Cheques received from credit customers 8800 # payments to creditors 5820 # Discount received 140 # Discount allowed 220 # Returns lnwards 400 # Returns outwards 200 # Bad debts 540 # Customers Cheques returned unpaid 460 # Contra entries 170 *Required to prepare:* i.)Sales ledger control account ii) purchases ledger control account. *Q 2* Prepare a trial balance from the following list of balances: *Sales 36000 *Purchases 25000 *Returns lnwards 820 * Returns outwards 400 *Opening inventory 2500 *Wages 4000 *Rent and rates 1600 *Carriage lnwards 750 *Carriage outwards 925 *Interest receivable 600 *Premises20000 * Provision for depreciation of premises 2000 *Motor vehicles 8000 * Provision for depreciation of motor vehicles 4000 *Trade receivables 4500 *Trade payables 1250 * Provision for bad debts 200 *Balance at bank 1225 *Capital 30750 *Drawings 5880 *Q 3* a) Assets Accounts have..... balances and liabilities Accounts have...... balances b) The working capital is obtained by deducting....... from....... c) working capital plus non current assets is equal to....... d) Shareholders in a limited company are......but debenture holders are.......of the company e) Fixtures and Fittings are...... assets and arise from....... expenditure but iventory is.......asset and arise from...... Expenditure. f) A debit balance on a capital account means that the business is...... g) In a manufacturing account expenses are divided into...... costs and...... costs. h)In a manufacturing account prime cost is made up of Cost of raw materials used plus......... j) A debit balance in the profit and loss account indicates a......of the year. k) The rate of inventory turnover is found by dividing cost of sales by ...... *Q 4* a) Explain briefly the difference between capital expenditure and revenue expenditure b) lf capital expenditure is in correctly treated as revenue expenditure state the Effect on .i) profit ii)non current assets c) Various business transactions of a department store are given below.state whether they result in capital expenditure or revenue expenditure: i) purchase of a computer print out stationery... ii) purchase of goods for re-sale... iii) Installation of new escalator in the store iv) Cost of painting the store v) purchase of computers for staff use Vi)Cost of re-building a fire damaged warehouse. [7/21, 21:22] +263 77 417 5305: Answer the following questions: 1.ln the books of non profit making organization capital is replaced by...... 2 .ln a manufacturing account........is made up of Cost of raw materials used, direct labour and direct express 3.lf a payment by cheque of 506 for electrity is recorded in error in both bank account and electricity as5064 this is an error of...... 4.cost of transporting new machinery to be used in the business is...... expenditure whereas Cost of repairing the machinery after one month' s use is.......... expenditure 5.Goodwill occurs when the.....of a business exceeds the value of net......taken over. 6.ln the books of a partnership goods taken by owner for own use are entered on the........side of the current account. 7.A...........statement is drawn up to make the cash book bank transactions agree with the transactions compiled by the bank. 8.A business has a total non current assets of 100000, current assets 60000(including inventory 15000), current liabilities 30000 and non current liabilities 20000.The current ratio is........ And the quick ratio is....... 9.Given that the opening capital is 30000, closing capital 40000 and drawings 9000, the net profit is....... 10.A document issued to the business for non current assets bought on credit is known as........ and the transaction for the non current assets is first recorded in the....... [7/21, 21:34] +263 77 417 5305: For your practice.Any questions inbox [7/21, 21:49] +263 77 417 5305: Look at question 2 Specimen paper November 2014 any questions inbox from 6pm tomorrow