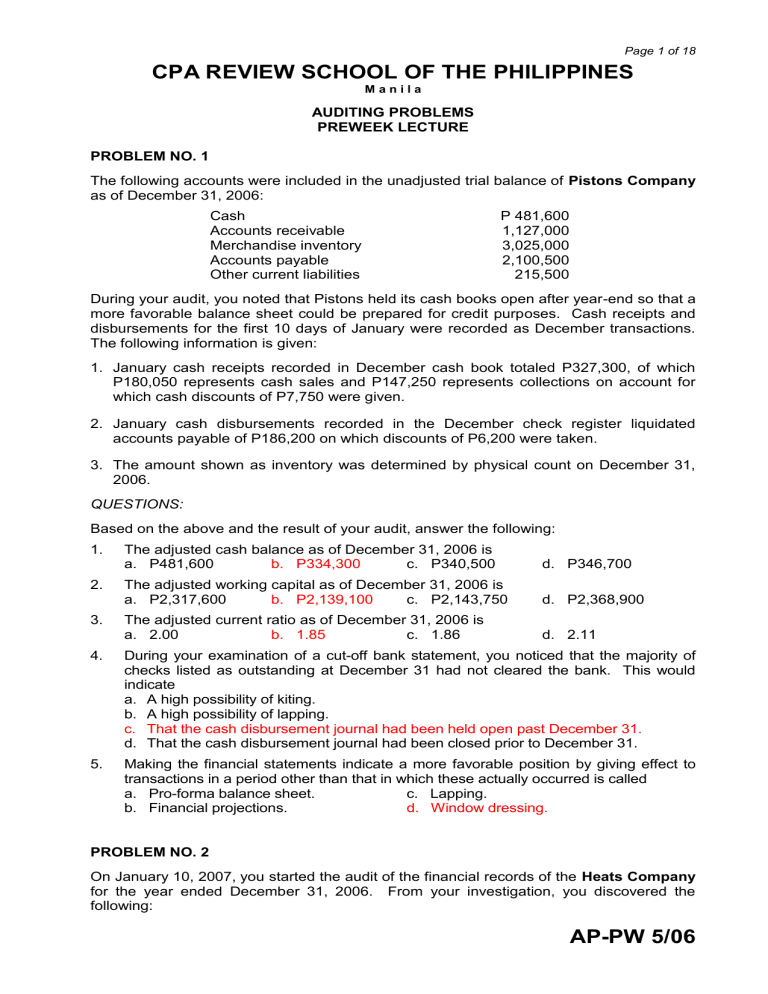

Page 1 of 18 CPA REVIEW SCHOOL OF THE PHILIPPINES Manila AUDITING PROBLEMS PREWEEK LECTURE PROBLEM NO. 1 The following accounts were included in the unadjusted trial balance of Pistons Company as of December 31, 2006: Cash Accounts receivable Merchandise inventory Accounts payable Other current liabilities P 481,600 1,127,000 3,025,000 2,100,500 215,500 During your audit, you noted that Pistons held its cash books open after year-end so that a more favorable balance sheet could be prepared for credit purposes. Cash receipts and disbursements for the first 10 days of January were recorded as December transactions. The following information is given: 1. January cash receipts recorded in December cash book totaled P327,300, of which P180,050 represents cash sales and P147,250 represents collections on account for which cash discounts of P7,750 were given. 2. January cash disbursements recorded in the December check register liquidated accounts payable of P186,200 on which discounts of P6,200 were taken. 3. The amount shown as inventory was determined by physical count on December 31, 2006. QUESTIONS: Based on the above and the result of your audit, answer the following: 1. 2. 3. The adjusted cash balance as of December 31, 2006 is a. P481,600 b. P334,300 c. P340,500 d. P346,700 The adjusted working capital as of December 31, 2006 is a. P2,317,600 b. P2,139,100 c. P2,143,750 d. P2,368,900 The adjusted current ratio as of December 31, 2006 is a. 2.00 b. 1.85 c. 1.86 d. 2.11 4. During your examination of a cut-off bank statement, you noticed that the majority of checks listed as outstanding at December 31 had not cleared the bank. This would indicate a. A high possibility of kiting. b. A high possibility of lapping. c. That the cash disbursement journal had been held open past December 31. d. That the cash disbursement journal had been closed prior to December 31. 5. Making the financial statements indicate a more favorable position by giving effect to transactions in a period other than that in which these actually occurred is called a. Pro-forma balance sheet. c. Lapping. b. Financial projections. d. Window dressing. PROBLEM NO. 2 On January 10, 2007, you started the audit of the financial records of the Heats Company for the year ended December 31, 2006. From your investigation, you discovered the following: AP-PW 5/06 Page 2 of 18 1. The bookkeeper also acts as the cashier. On December 31, 2006, the bookkeeper’s year-end cash reconciliation contains the following items. Cash per ledger, 12-31-06 Cash per bank, 12-31-06 Outstanding checks Miami Co. check charge by bank in error 12-20-06; corrected by bank on 1-5-07 Cash in transit, credited by bank on 1-2-07 P491,200 518,800 41,760 1,200 5,760 2. The cash account balances per ledger as of 12-31-06 were: Cash - P491,200; petty cash - P1,200 3. The count of the cash on hand at the close of business on January 10, 2007, including the petty cash, was as follows: Currency and coin Expense vouchers Employees’ IOU’s dated 1-5-07 Customers’ checks in payment of account P3,080 160 440 2,320 P6,000 4. From January 2, 2007 to January 10, 2007, the date of your cash count, total cash receipts appearing in the cash records were P68,800. According to the bank statement for the period from January 2, 2007 to January 10, 2007, total credits were P60,800. 5. On July 5, 2006, cash of P3,200 was received from an account customer; the Allowance for Doubtful Accounts was charged and Accounts Receivable credited. 6. On December 5, 2006, cash of P2,400 was received from an account customer; Inventory was charged and Accounts Receivable credited. 7. Cash of P5,840 received during 2006 was not recorded. 8. Checks received from customers from January 2, 2007 to January 10, 2007, totaling P3,360, were not recorded but were deposited in bank. 9. On July 1, 2006, the bank refunded interest of P160 because a note of the Heats Company was paid before maturity. No entry had been made for the refund. 10. In the cashier’s petty cash, there were receipts for collections from customers on January 9, 2007, totaling P6,800; these were unrecorded and undeposited. 11. In the outstanding checks, there is one for P400 made payable to a trade creditor; investigation shows that this check had been returned by the creditor on June 14, 2006 and a new check for P800 was issued in its place; the original check for P400 was made in error as to amount. QUESTIONS: Based on the above and the result of your audit, answer the following: 1. 2. 3. 4. Correct bank balance as of December 31, 2006 is a. P484,400 b. P503,200 c. P484,000 d. P483,200 Cash shortage as of December 31, 2006 is a. P19,200 b. P18,800 c. P18,400 d. P0 Cash shortage for the period January 1 to 10, 2007 is a. P13,360 b. P20,320 c. P10,160 d. P0 From the standpoint of good internal control, the monthly bank statements should be reconciled by someone under the direction of the a. Controller. b. Treasurer. c. Cashier. d. Credit manager. AP-PW 5/06 Page 3 of 18 5. An auditor would consider a cashier’s job description to contain compatible duties if the cashier receives remittance from the mailroom and also prepares the a. Daily deposit slip. c. Remittance advices. b. Prelist of individual checks. d. Monthly bank reconciliation. PROBLEM NO. 3 Nets Company produces paints and related products for sale to the construction industry throughout Metro Manila. While sales have remained relatively stable despite a decline in the amount of new construction, there has been a noticeable change in the timeliness with which the company’s customers are paying their bills. The company sells its products on payment terms of 2/10, n/30. In the past, over 75 percent of the credit customers have taken advantage of the discount by paying within 10 days of the invoice date. During the year ended December 31, 2005, the number of customers taking the full 30 days to pay has increased. Current indications are that less than 60% of the customers are now taking the discount. Uncollectible accounts as a percentage of total credit sales have risen from the 1.5% provided in the past years to 4% in the current year. In response to your request for more information on the deterioration of accounts receivable collections, the company’s controller has prepared the following report: Nets Company Accounts Receivable Collections December 31, 2006 The fact that some credit accounts will prove uncollectible is normal, and annual bad debt write-offs had been 1.5% of total credit sales for many years. However, during the year 2006, this percentage increased to 4%. The accounts receivable balance is P1,500,000, and the condition of this balance in terms of age and probability of collection is shown below: Proportion to total 64% 18% 8% 5% 3% 2% Age of accounts 1 – 10 days 11 – 30 days Past due 31 – 60 days Past due 61 – 120 days Past due 121 – 180 days Past due over 180 days Probability of collection 99.0% 97.5% 95.0% 80.0% 65.0% 20.0% At the beginning of the year, the Allowance for Doubtful Accounts had a credit balance of P27,300. The company has provided for a monthly bad debt expense accrual during the year based on the assumption that 4% of total credit sales will be uncollectible. Total credit sales for the year 2006 amounted to P8,000,000, and write-offs of uncollectible accounts during the year totaled P292,500. QUESTIONS: Based on the foregoing, answer the following: 1. How much is the adjusted balance of the allowance for doubtful accounts as of December 31, 2006? a. P104,400 b. P49,800 c. P77,100 d. P27,300 2. The necessary adjusting journal entry to adjust the allowance for doubtful accounts as of December 31, 2006 would include a credit to allowance for doubtful accounts of: a. P27,300 b. P49,800 c. P77,100 d. P22,300 AP-PW 5/06 Page 4 of 18 3. An aging analysis of accounts receivable would provide an indication as to the a. Validity of the accounts. c. Integrity of the credit grantors. b. Collectibility of the accounts. d. Solvency of customers. 4. From the standpoint of good internal control, the billing department, for good internal control should be under directions of the a. Credit manager. c. Controller. b. Sales manager. d. Treasurer. 5. In order that sound internal accounting control could be achieved, which department should perform the activities of matching shipping documents with sales orders and preparing daily sales summaries? a. Billing b. Credit c. Shipping d. Sales order. PROBLEM NO. 4 In connection with your examination of the financial statements of Cavaliers, Inc. for the year ended December 31, 2006, you were able to obtain certain information during your audit of the accounts receivable and related accounts. The December 31, 2006 balance in the Accounts Receivable control accounts is P558,600. An aging schedule of the accounts receivable as of December 31, 2006 is presented below: Age 60 days & under 61 to 90 days 91 to 120 days Over 120 days Net debit balance P258,513 204,735 59,886 35,466 P558,600 Percentage to be applied after corrections have been made 1 percent 3 percent 6 percent Definitely uncollectible, P6,300; the remainder is estimated to be 25% uncollectible. Two entries were made in the Doubtful Accounts Expense account were: 1. A debit on December 31 for the amount of the credit to the Allowance for Doubtful Accounts. 2. A credit for P4,110 on November 30, 2006, and a debit to Allowance for Doubtful Accounts because of a bankruptcy. The related sales took place on October 1, 2006. The Allowance for Doubtful Accounts schedule is presented below: Debit January 1, 2006 November 30, 2006 December 31, 2006 (P558,600 x 5%) Credit Balance P13,125 9,015 P27,930 P36,945 P4,110 There is a credit balance in one account receivable (61 to 90 days) of P7,260; it represents an advance on a sales contract. QUESTIONS: Based on the above and the result of your audit, answer the following: 1. How much is the adjusted balance of Accounts Receivable as of December 31, 2006? a. P555,450 b. P559,560 c. P540,930 d. P548,190 AP-PW 5/06 Page 5 of 18 2. How much is the adjusted balance of the Allowance for Doubtful Accounts as of December 31, 2006? a. P19,706 b. P19,583 c. P19,830 d. P19,147 3. How much is the Doubtful Accounts expense for the year 2006? a. P16,991 b. P16,868 c. P17,115 d. P27,930 4. How much is the net adjustment to the Doubtful Accounts expense account? a. P6,952 credit b. P6,705 credit c. P6,829 credit d. P4,110 debit 5. Authorization for the write-off of accounts receivable should be the responsibility of the a. Credit Manager. c. Accounts receivable clerk. b. Controller. d. Treasurer. PROBLEM NO. 5 Wizards Enterprises loaned P1,000,000 to Washington Inc. on January 1, 2004. The terms of the loan require principal payments of P200,000 each year for 5 years plus interest at 8%. The first principal and interest payment is due on January 1, 2005. Washington made the required payments during 2005 and 2006. However, during 2006 Washington began to experience financial difficulties, requiring Wizards to reassess the collectibility of the loan. On December 31, 2006, Wizards determines that the remaining principal payments will be collected, but the collection of interest is unlikely. The prevailing interest rate for similar type of note as of December 31, 2006 is 10%. QUESTIONS: Based on the above and the result of your audit, answer the following: 1. The present value of the expected future cash flows as of December 31, 2006 is a. P547,100 b. P515,400 c. P556,640 d. P600,000 2. The loan impairment for the year 2006 is a. P84,600 b. P43,360 c. P52,900 d. P0 3. How much is the interest income for the year 2007, assuming that Wizards' assessment of the collectibility of the loan has not changed. a. P27,768 b. P28,531 c. P25,232 d. P32,000 4. Which of the following audit procedures provides the best evidence about the collectibility of notes receivable? a. Confirmation of note receivable balances with the debtors. b. Examination of notes for appropriate debtors' signatures. c. Examination of cash receipts records to determine promptness of interest and principal payments. d. Reconciliation of the detail of notes receivable and the provision for uncollectible amounts to the general ledger control. 5. When auditing the allowance for uncollectible accounts, the least reliance should be placed on which of the following? a. The credit manager's opinion. b. An aging of past due accounts. c. Collection experience of the client's collection agency. d. Ratios that show the past relationship of the allowance to net credit sales. AP-PW 5/06 Page 6 of 18 PROBLEM NO. 6 Pacers Company, a manufacturer of small tools, provided the following information from its accounting records for the year ended December 31, 2006: Inventory at December 31, 2006 (based on physical count on December 31, 2006) Accounts payable at December 31, 2006 Net sales (sales less sales returns) P1,520,000 1,200,000 8,150,000 Additional information follows: a. Included in the physical count were tools billed to a customer FOB shipping point on December 31, 2006. These tools had a cost of P31,000 and were billed at P40,000. The shipment was on Pacers’ loading dock waiting to be picked up by the common carrier. b. Goods were in transit from a vendor to Pacers on December 31, 2006. The invoice cost was P71,000, and the goods were shipped FOB shipping point on December 29, 2006. c. Work in process inventory costing P30,000 was sent to an outside processor for plating on December 30, 2006. d. Tools returned by customers and held pending inspection in the returned goods area on December 31, 2006, were not included in the physical count. On January 8, 2007, the tools costing P32,000 were inspected and returned to inventory. Credit memos totaling P47,000 were issued to the customers on the same date. e. Tools shipped to a customer FOB destination on December 26, 2006, were in transit at December 31, 2006, and had a cost of P21,000. Upon notification of receipt by the customer on January 2, 2007, Pacers issued a sales invoice for P42,000. f. Goods, with an invoice cost of P27,000, received from a vendor at 5:00 p.m. on December 31, 2006, were recorded on a receiving report dated January 2, 2007. The goods were not included in the physical count, but the invoice was included in accounts payable at December 31, 2006. g. Goods received from a vendor on December 26, 2006, were included in the physical count. However, the related P56,000 vendor invoice was not included in accounts payable at December 31, 2006, because the accounts payable copy of the receiving report was lost. h. On January 3, 2007, a monthly freight bill in the amount of P6,000 was received. The bill specifically related to merchandise purchased in December 2006, one-half of which was still in the inventory at December 31, 2006. The freight charges were not included in either the inventory or accounts payable at December 31, 2006. QUESTIONS: Based on the above and the result of your audit, answer the following: 1. The adjusted balance of Inventory as of December 31, 2006 is a. P1,673,000 b. P1,704,000 c. P1,672,000 d. P1,670,000 2. The adjusted balance of Accounts Payable as of December 31, 2006 is a. P1,333,000 b. P1,262,000 c. P1,327,000 d. P1,330,000 3. The adjusted Net Sales fro the year ended December 31, 2006 is a. P8,103,000 b. P8,110,000 c. P8,150,000 d. P8,063,000 AP-PW 5/06 Page 7 of 18 4. When auditing merchandise inventory at year end, the auditor performs a purchase cutoff test to obtain evidence that a. All goods purchased before year end are received before the physical inventory count. b. No goods held on consignment for customers are included in the inventory balance. c. All goods owned at year end are included in the inventory balance. d. No goods observed during the physical count are pledged or sold. 5. Which of the following audit procedures would provide the least reliable evidence that the client has legal title to inventories? a. Analytical review of inventory balances compared to purchasing and sales activities. b. Confirmation of inventories at locations outside the client's facilities. c. Observation of physical inventory counts. d. Examination of paid vendors' invoices. PROBLEM NO. 7 A flood recently destroyed many of the financial records of Bulls Manufacturing Company. Management has hired you to re-create as much financial information as possible for a month of July. You are able to find out that the company uses an average cost inventory valuation system. You also learn that Bulls makes a physical count at the end of each month in order to determine monthly ending inventory values. By examining various documents you are able to gather the following information: Ending inventory at July 31 Total cost of unit available for sale in July Cost of goods sold during July Cost of beginning inventory, July 1 Gross profit on sales for July 50,000 units P118,800 P99,000 P0.35 per unit P101,000 July purchases Date July 5 11 15 16 Units 60,000 50,000 40,000 50,000 Unit Cost P0.40 0.41 0.42 0.45 QUESTIONS: Based on the above and the result of your engagement, you are asked to provide the following information: 1. 2. 3. 4. 5. Number of units on hand, July 1 a. 35,000 b. 41,580 c. P12,250 d. 100,000 Units sold during July a. 185,000 b. 162,250 c. P250,000 d. 191,580 Unit cost of inventory at July 31 a. P0.506 b. P0.396 c. P0.560 d. P0.492 Value of inventory at July 31 a. P25,300 b. P19,800 c. P28,000 d. P24,600 In obtaining evidence to establish the existence of inventories, which one of the following is unlikely to be used by and auditor? a. Reconciliation. b. Inspection. c. Observation. d. Confirmation. AP-PW 5/06 Page 8 of 18 PROBLEM NO. 8 Both BSA Inc. and CPA Corp. have 1,000,000 shares of no-par common stock outstanding. Bucks Inc. acquired 100,000 shares of BSA stock for P5 per share and 250,000 shares of CPA stock for P10 per share on January 2, 2005. Both securities are being held as long term investments. Changes in retained earnings for BSA and CPA for 2005 and 2006 are as follows: Retained earnings (deficit), 1/1/05 Cash dividends, 2005 Net income, 2005 Retained earnings, December 31, 2005 Cash dividends, 2006 Net income, 2006 Retained earnings, December 31, 2006 Market value of stock: 12/31/05 12/31/06 BSA, Inc. P2,000,000 (250,000) 400,000 2,150,000 (300,000) 600,000 P2,450,000 CPA Corp. (P350,000) 650,000 300,000 (100,000) 250,000 P 450,000 P7.00 6.50 P12.00 15.00 QUESTIONS: Based on the above and the result of your audit, answer the following: 1. 2. The income from investment in BSA, Inc. in 2006 is a. P30,000 b. P25,000 c. P2,000 d. P0 The income from investment in CPA, Inc. in 2005 is a. P62,500 b. P5,000 c. P162,500 d. P0 3. The carrying value of Investment in BSA, Inc. as of December 31, 2006 is a. P500,000 b. P650,000 c. P700,000 d. P505,000 4. The carrying value of Investment in CPA, Inc. as of December 31, 2006 is a. P2,500,000 b. P3,750,000 c. P2,537,500 d. P2,700,000 5. How much is the unrealized gain or loss that will be included as component of equity as of December 31, 2006? a. P150,000 gain b. P50,000 gain c. P50,000 loss d. P0 PROBLEM NO. 9 In connection with your examination of the financial statements of the Spurs Corporation for the year 2006, the company presented to you the Property, Plant and Equipment section of its balance sheet as of December 31, 2005 which consists of the following: Land Buildings Leasehold improvements Machinery and equipment P 400,000 3,200,000 2,000,000 2,800,000 The following transactions occurred during 2006: Land site number 102 was acquired for P4,000,000. Additionally, to acquire the land Spurs paid a P240,000 commission to a real estate agent. Costs of P60,000 were incurred to clear the land. During the course of clearing the land, timber and gravel were recovered and sold for P20,000. AP-PW 5/06 Page 9 of 18 A second tract of land (site number 103) with a building was acquired for P1,200,000. The closing statement indicated that the land value was P800,000 and the building value was P400,000. Shortly after acquisition, the building was demolished at a cost of P120,000. A new building was constructed for P600,000 plus the following costs: Excavation fees Architectural design fees Building permit fee Imputed interest on funds used during construction P 44,000 32,000 4,000 24,000 The building was completed and occupied on September 1, 2006. A third tract of land (site number 104) was acquired for P2,400,000 and was put on the market for resale. Extensive work was done to a building occupied by Spurs under a lease agreement. The total cost of the work was P500,000, which consisted of the following: Particulars Painting of ceilings Electrical work Construction of extension to current working area Amount P 40,000 140,000 Useful life One year Ten years 320,000 Thirty years The lessor paid one-half of the costs incurred in connection with the extension to the current working area. During December 2006, costs of P260,000 were incurred to improve leased office space. The related lease will terminate on December 31, 2008, and is not expected to be renewed. A group of new machines was purchased under a royalty agreement which provides for payment of royalties based on units of production for the machines. The invoice price of the machines was P300,000, freight costs were P8,000, unloading charges were P6,000, and royalty payments for 2006 were P52,000. QUESTIONS: Based on the above and the result of your audit, compute for the following as of December 31, 2006: 1. 2. 3. 4. 5. Land a. P8,400,000 b. P5,900,000 c. P5,480,000 d. P6,000,000 Buildings a. P4,280,000 b. P3,880,000 c. P3,800,000 d. P4,200,000 Leasehold improvements a. P2,720,000 b. P2,600,000 c. P2,560,000 d. P2,300,000 Machinery and equipment a. P3,100,000 b. P3,108,000 c. P3,114,000 d. P3,166,000 In testing plant and equipment balances, an auditor examines new additions listed on an analysis of plant and equipment. This procedure most likely obtains evidence concerning management’s assertion of a. Completeness. c. Presentation and disclosure. b. Existence or occurrence. d. Valuation or allocation. AP-PW 5/06 Page 10 of 18 PROBLEM NO. 10 The following independent situations describe facts concerning the ownership of various assets. In each case, compute the amount of depreciation or depletion for 2006. 1. Suns Company purchased a tooling machine in 1996 for P600,000. The machine was being depreciated on the straight-line method over an estimated useful life of 20 years with no salvage value. At the beginning of 2006, when the machine had been in use for 10 years, Suns paid P120,000 to overhaul the machine. As a result of this improvement, Suns estimated that the useful life of the machine would be extended an additional 5 years. a. P28,000 b. P15,000 c. P20,000 d. P23,000 2. Phoenix Manufacturing Co., a calendar-year company, purchased a machine for P650,000 on January 1, 2004. At the date of purchase, Phoenix incurred the following additional costs: Loss on sale of old machinery Freight cost Installation cost Testing costs prior to regular operation P15,000 5,000 20,000 4,000 The estimated salvage value of the machine was P50,000, and Phoenix estimated that the machine would have a useful life of 20 years, with depreciation being computed using the straight-line method. In January 2006, accessories costing P48,600 were added to the machine to reduce its operating costs. These accessories neither prolonged the machine's life nor did they provide any additional salvage value. a. P31,450 b. P34,150 c. P33,880 d. P36,930 3. On July 1, 2006, Nash Corporation purchased equipment at a cost of P340,000. The equipment has an estimated salvage value of P30,000 and is being depreciated over an estimated life of 8 years under the double-declining-balance method of depreciation. a. P77,500 b. P38,750 c. P42,500 d. P85,000 4. In January 2006, Marion Corporation entered into a contract to acquire a new machine for its factory. The machine, which had a cash price of P2,000,000, was paid for as follows: Down payment 5,000 shares of Marion common stock with an agreed-upon value of P370 per share P 300,000 1,850,000 P2,150,000 Prior to the machine's use, installation costs of P70,000 were incurred. The machine has an estimated useful life of 10 years and an estimated salvage value of P100,000. The straight-line method of depreciation is used. a. P212,000 b. P1820,000 c. P190,000 d. P197,000 5. On January 2, 2005, Diaw Corporation purchased land with valuable natural ore deposits for P10 million. The estimated residual value of the land was P2 million. At the time of purchase, a geological survey estimated 2 million tons of removable ore were under the ground. Early in 2005, roads were constructed on the land to aid in the extraction and transportation of the mined ore at a cost of P750,000. In 2005, 50,000 tons were mined. In 2006, Diaw fired its mining engineer and hired a new expert. A new survey made at the end of 2006 estimated 3 million tons of ore were available for mining. In 2006, 150,000 tons were mined. All the ore mined was sold. a. P372,000 b. P426,000 c. P433,500 d. P406,500 AP-PW 5/06 Page 11 of 18 PROBLEM NO. 11 On January 1, 2005, Nuggets Company entered into a lease contract with Denver Company for a new equipment that had a selling price of P2,120,000. The lease contract provides that annual payments of P420,000 will be made for 6 years. Nuggets made the first payment on January 1, 2005, subsequent payments are made on January 1 of each year. Nuggets guarantees a residual value of P367,122 at the end of the lease term. After considering the guaranteed residual value, the rate implicit in the lease is determined to be 12%. Nuggets has an incremental borrowing rate of 15%. The economic life of the equipment is 9 years. Nuggets depreciates its equipment using straight line method. QUESTIONS: Based on the above and the result of your audit, compute for the following: 1. Cost of the leased equipment to be recognized by Nuggets Company a. P1,912,772 b. P2,013,908 c. P2,120,000 d. P0 2. Annual depreciation expense a. P257,608 b. P292,146 c. P274,464 d. P0 Interest expense in 2005 a. P179,133 b. P191,269 c. P204,000 d. P0 3. 4. 5. Liability under finance lease as of December 31, 2006 a. P1,251,905 b. P1,484,000 c. P1,365,177 d. P0 Current portion of the liability under finance lease as of December 31, 2006 a. P241,920 b. P269,771 c. P256,179 d. P0 PROBLEM NO. 12 You were able to obtain the following from the accountant for Mavericks Corp. related to the company’s liabilities as of December 31, 2006. Accounts payable Notes payable – trade Notes payable – bank Wages and salaries payable Interest payable Mortgage notes payable – 10% Mortgage notes payable – 12% Bonds payable P 650,000 190,000 800,000 15,000 ? 600,000 1,500,000 2,000,000 The following additional information pertains to these liabilities. a. All trade notes payable are due within six months of the balance sheet date. b. Bank notes-payable include two separate notes payable to Allied Bank. (1) A P300,000, 8% note issued March 1, 2004, payable on demand. Interest is payable every six months. (2) A 1-year, P500,000, 11 ½% note issued January 2, 2006. On December 30, 2006, Mavericks negotiated a written agreement with Allied Bank to replace the note with a 2-year, P500,000, 10% note to be issued January 2, 2007. The interest was paid on December 31, 2006. c. The 10% mortgage note was issued October 1, 2003, with a term of 10 years. Terms of the note give the holder the right to demand immediate payment if the company fails to make a monthly interest payment within 10 days of the date the payment is due. As of December 31, 2006, Mavericks is three months behind in paying its required interest payment. AP-PW 5/06 Page 12 of 18 d. The 12% mortgage note was issued May 1, 2000, with a term of 20 years. The current principal amount due is P1,500,000. Principal and interest payable annually on April 30. A payment of P220,000 is due April 30, 2007. The payment includes interest of P180,000. e. The bonds payable is 10-year, 8% bonds, issued June 30, 1997. Interest is payable semi-annually every June 30 and December 31. QUESTIONS: Based on the above and the result of your audit, answer the following: 1. Interest payable as of December 31, 2006 is a. P155,000 b. P143,000 c. P203,000 d. P215,000 2. The portion of the Note Payable-bank to be reported under current liabilities as of December 31, 2006 is a. P300,000 b. P500,000 c. P800,000 d. P0 3. Total current liabilities as of December 31, 2006 is a. P3,950,000 b. P4,138,000 c. P3,938,000 d. P3,998,000 Total noncurrent liabilities as of December 31, 2006 is a. P1,760,000 b. P2,560,000 c. P3,960,000 d. P1,960,000 4. 5. Which of the following is correct regarding the classification of financial liabilities? a. An entity classifies financial liabilities as noncurrent when they are due to be settled within 12 months after the balance sheet date. b. If the entity expects, and has the discretion, to refinance or roll over an obligation for at least 12 months after the balance sheet date under an existing loan facility, it classifies obligation as current. c. When refinancing or rolling over is not at the discretion of the entity, the potential to refinance is not considered and the obligation is classified as current. d. When an entity breaches an undertaking under a long-term loan agreement on or before the BS date with the effect that the liability becomes payable on demand, the liability is classified as non-current, if, after the BS date, and before the FS are authorized for issue, the lender has agreed not to demand payment as a consequence of the breach. PROBLEM NO. 13 Grizzlies Inc. was organized on January 2, 2005, with authorized capital stock of 50,000 shares of 10%, P200 par value preferred, and 200,000 shares of no-par, no stated value common. During the first 2 years of the company's existence, the following selected transactions took place: 2005 Jan. 2 2 Mar. 2 Jul. 10 Dec. 16 28 31 Sold 10,000 shares of common stock at P16. Sold 3,000 shares of preferred stock at P216. Sold common stock as follows: 10,800 shares at P22; 2,700 shares at P25. Acquired a nearby piece of land, appraised at P400,000, for 600 shares of preferred stock and 27,000 shares of common. (Preferred stock was recorded at P216, the balance being assigned to common.) Declared the regular preferred dividend and a P1.50 common dividend. Paid dividends declared on December 16. The Income Summary account showed a credit balance of P450,000. 2006 Feb. 27 Reacquired 12,000 shares of common stock at P19. Jun. 17 Resold 10,000 shares of the treasury stock at P23. Jul. 31 Resold all of the remaining treasury stock at P18. AP-PW 5/06 Page 13 of 18 Sep. 30 Dec. 16 28 31 Sold 11,000 additional shares of common stock at P21. Declared the regular preferred dividend and a P0.80 common dividend. Dividends declared on December 16 were paid. The income summary account showed a credit balance of P425,000. QUESTIONS: Based on the above and the result of your audit, determine the balances of the following as of December 31, 2006: 1. 2. 3. 4. 5. Preferred stock a. P777,600 b. P600,000 c. P720,000 d. P729,600 Common stock a. P615,000 b. P966,500 c. P735,500 d. P696,100 Additional paid in capital a. P38,000 b. P93,600 c. P57,600 d. P95,600 Total stockholders’ equity a. P2,498,150 b. P2,388,150 c. P1,892,100 d. P2,376,630 An auditor usually obtains evidence of shareholders’ equity transactions by reviewing the entity’s a. Minutes of board of directors meetings. c. Canceled stock certificates. b. Transfer agent’s records. d. Treasury stock certificate book. PROBLEM NO. 14 Clippers Corporation asked you to review its records and prepare corrected financial statements. The books of accounts are in agreement with the following balance sheet: Clippers Corporation Balance Sheet December 31, 2006 Assets Cash Accounts receivable Notes receivable Inventories Total assets P 40,000 80,000 24,000 200,000 P344,000 Liabilities and Owners’ Equity Accounts payable Notes payable Capital stock Retained earnings Total liabilities and owners’ equity P 16,000 32,000 80,000 216,000 P344,000 A review of the company’s boos indicates that the following errors and omissions had not been corrected during the applicable years: Ending inventory - overstated Ending inventory - understated Prepaid expense Unearned income Accrued expense Accrued income P 2003 48,000 7,200 1,600 - 2004 P56,000 5,600 3,200 600 1,000 2005 P64,000 4,000 800 - P 2006 72,000 4,800 2,400 400 1,200 AP-PW 5/06 Page 14 of 18 No dividends were declared during the years 2003 to 2006 and no adjustments were made to retained earnings. The company’s books reported the following net income: 2003 2004 P60,000 44,000 2005 2006 P52,000 60,000 QUESTIONS: Based on the above and the result of your audit, determine the adjusted amounts of the following: (Disregard tax implications) 1. 2. 3. 4. 5. Net income in 2003 a. P99,200 b. P113,600 c. P116,800 d. P17,600 Net income (loss) in 2004 a. (P62,800) b. (P14,800) c. (P59,600) d. P145,200 Net income (loss) in 2005 a. P60,400 b. P44,800 c. P44,400 d. (P11,600) Net income (loss) in 2006 a. (P76,000) b. P194,400 c. P195,200 d. P196,000 Retained earnings as of December 31, 2006 a. P281,600 b. P291,200 c. P292,000 d. P147,200 - end of preweek lectureGOOD LUCK! SOLUTION GUIDE TO SELECTED PROBLEMS: PROBLEM NO. 1 Per books Adjustments Per audit Current assets Cash 481,600 Accounts receivable 1,127,000 Merchandise inventory 3,025,000 4,633,600 Current liabilities Accounts payable Other current liabilities 2,100,500 215,500 2,316,000 Working capital (CA-CL) Current ratio (CA/CL) 2,317,600 2.00 AP-PW 5/06 Page 15 of 18 PROBLEM NO. 2 Bank Books Unadjusted balances, 12/31/06 Add (deduct) adjustments: Outstanding checks Erroneous bank debit Cash in transit Collection charged to Allow. For Doubtful a/cs Collection charged to Inventory Unrecorded cash receipt Unrecorded interest refund Check returned and replaced not yet cancelled Balances Shortage Adjusted balances PROBLEM NO. 3 Category 1 – 10 days Aging ratio AR Balance 64% 1.00% 11 – 30 days 18% 2.50% 31 – 60 days 8% 5.00% 61 – 120 days 5% 20.00% 121 – 180 days 3% 35.00% over 180 days 2% 80.00% 100% Rate Allowance 1,500,000 PROBLEM NO. 4 GL/SL Unadjusted balances 60 61 to 90 91 to 120 over 120 558,600 Add (deduct) adjustments: AJE No. 1 AJE No. 2 AJE No. 3 Adjusted balances PROBLEM NO. 5 Date January 1, 2007 January 1, 2008 January 1, 2009 Collection 200,000 200,000 200,000 600,000 Period 0 1 2 PV factor PV at 8% AP-PW 5/06 Page 16 of 18 PROBLEM NO. 6 Inventory Unadjusted balances Add (deduct) adjustments: a b c d e f g h Accts. Payable 1,520,000 1,200,000 Net Sales 8,150,000 Adjusted balances PROBLEM NO. 7 Cost of units available for sale Less purchases: July 5 (60,000 units x P0.40) July 11 (50,000 units x P0.41) July 15 (40,000 units x P0.42) July 16 (50,000 units x P0.45) Cost of beginning inventory Divide by cost per unit Number of units on hand, July 1 PROBLEM NO. 8 Acquisition cost (250,000 shares x P10) Share in net income for 2005 (P650,000 x 25%) Carrying value, 12/31/05 Dividends received in 2006 (P100,000 x 25%) Share in net income for 2006 (P250,000 x 25%) Carrying value, 12/31/06 PROBLEM NO. 9 Balance, January 1, 2006 Land site number 102: Acquisition cost Commission paid to real estate agent Clearing costs Amounts recovered Land site number 103: Acquisition cost Demolition cost Balance, December 31, 2006 AP-PW 5/06 Page 17 of 18 PROBLEM NO. 10 Cost of natural resources, net of residual value (P10M - P2M) Mine improvements Cost subject to depletion Divide by total estimated reserves in 2005 Depletion rate in 2005 Number of tons mined in 2005 Depletion for 2005 Original cost subject to depletion Less depletion in 2005 Remaining cost to deplete, 1/1/06 Remaining tons of ore, 1/1/06 (3,000,000+150,000) Depletion rate in 2006 Number of tons mined in 2006 Depletion for 2006 PROBLEM NO. 11 Present value of rental payments (P420,000 x 4.6048) Present value of GRV (P367,122 x 0.5066) Cost of leased equipment Date 01.01.05 01.01.05 01.01.06 01.01.07 01.01.08 01.01.09 01.01.10 01.01.11 Payment Interest Principal Lease liab. 420,000 420,000 420,000 420,000 420,000 420,000 367,122 PROBLEM NO. 12 P300,000 note payable to bank (P300,000 x 8% x 4/12) Mortgage note payable – 10% (P600,000 x 10% x 3/12) Mortgage note payable – 12% (P1,500,000 x 12% x 8/12) Total interest payable, 12/31/06 AP-PW 5/06 Page 18 of 18 PROBLEM NO. 13 Preferred Common stock stock Issuance of CS, 1/2/05 Issuance of PS, 1/2/05 Issuance of CS, 3/2/05 Issuance of PS and CS for land, 7/10/05 Declared cash dividend-PS and CS, 12/16/06 Net income for 2005 Balances, 12/31/05 Acquisition of TS, 2/27/06 Resale of TS above cost, 6/17/06 Resale of TS below cost, 7/31/06 Issuance of CS, 7/31/05 Declared cash dividend-PS and CS, 12/16/06 Net income for 2006 Balances, 12/31/06 720,000 735,500 Retained Treasury earnings stock APIC 57,600 302,250 - PROBLEM NO. 14 Unadjusted balances 1) Ending inventory - overstated 2004 2005 2) Ending inventory - understated 2003 2006 3) Prepaid expense 2003 2004 2005 2006 4) Unearned income 2004 2006 5) Accrued expense 2003 2004 2005 2006 6) Accrued income 2004 2006 NI 2003 60,000 NI 2004 44,000 NI 2005 52,000 NI 2006 60,000 RE 12.31.06 216,000 Adjusted balances AP-PW 5/06