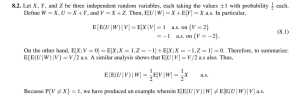

ECN 315 Study Guide – Exam 2 Question topics Chapter 9 • Bank balance sheet • Identify the ways in which banks can manage their assets and liabilities to maximize profits • Identify the ways in which banks can manage their assets and liabilities to maximize profits using T-accounts • Identify the ways in which banks can manage their assets and liabilities to maximize profits using liquidity management • Identify the ways in which banks can manage their assets and liabilities to maximize profits asset liability management • Identify the ways in which banks can manage their assets and liabilities to maximize profits using capital management and leverage ratio calculations • Identify the ways in which banks can manage their assets and liabilities to maximize profits – relationship to bank failure • Identify the was in which banks can manage their assets and liabilities to maximize profits – ROE and capital definition • Describe the ways banks deal with credit risk - sources of risk • Describe the ways banks deal with credit risk – solutions • Apply gap and duration analysis to interest rate risk – gap • Apply gap and duration analysis to interest rate risk - duration definition • Summarize the types of off-balance sheet activities Chapter 10 • Identify the reasons for and forms of a government safety net in financial markets – contagion • Identify the reasons for and forms of a government safety net in financial markets - asymmetric information problems • Identify the reasons for and forms of a government safety net in financial markets - too big to fail • List and summarize the types of financial regulation and how each reduces asymmetric information - restrictions on asset holdings • List and summarize the types of financial regulation and how each reduces asymmetric information - restrictions on capital • List and summarize the types of financial regulation and how each reduces asymmetric information. Basel • List and summarize the types of financial regulation and how each reduces asymmetric information Bank examination and chartering • List and summarize the types of financial regulation and how each reduces asymmetric information - disclosure • List and summarize the types of financial regulation and how each reduces asymmetric information. Consumer protection • List and summarize the types of financial regulation and how each reduces asymmetric information - Restrictions on competition Chapter 11 • Recognize the key features of the banking system and the historical origin of these features • Explain how financial innovation led to the growth of the "shadow banking" system - describe financial innovation • Explain how financial innovation led to the growth of the "shadow banking" system-demand • Explain how financial innovation led to the growth of the "shadow banking" system-supply • Securitization • Identify the key structural changes in the commercial banking industry - Summarize the factors that led to consolidation in the commercial banking industry. - Asses the reasons for separating banking from other financial services. Chapter 13 • Describe the origin and historical context of the Federal Reserve System - Describe the functions and key features of the Federal Reserve System" • Asses the degree of independence of the Federal Reserve - Summarize the arguments for and against the independence of the Federal Reserve • Structure and Independence of the European Central Bank, Structure and independence of other foreign central banks. Chapter 14 • Classify the factors affecting the Federal Reserve's assets and liabilities • Identify the factors that affect the monetary base and show their effects on the Federal Reserve Balance sheet • Illustrate deposit expansion using T-accounts – definitions • Illustrate deposit expansion using T-accounts calculations • List the factors that affect the money supply • Calculate and interpret changes in the money multiplier. Chapter 15 • Illustrate the market for reserve and show how changes in monetary policy can affect the equilibrium Federal Funds rate • Summarize how conventional monetary policy tools are implemented and the relative advantages and limitations of each tool • Explain the monetary policy tools that are used when conventional policy is no longer effective Chapter 16 • Identify potential goals that monetary policy makers may pursue. - Summarize the distinctions between hierarchical and dual mandates-nominal anchor • Identify potential goals that monetary policy makers may pursue. - Summarize the distinctions between hierarchical and dual mandates • Identify the key changes over time made to the Federal Reserve's monetary policy • Describe and asses the criteria for choosing a policy instrument - Interpret and asses the performance of the Taylor rule"