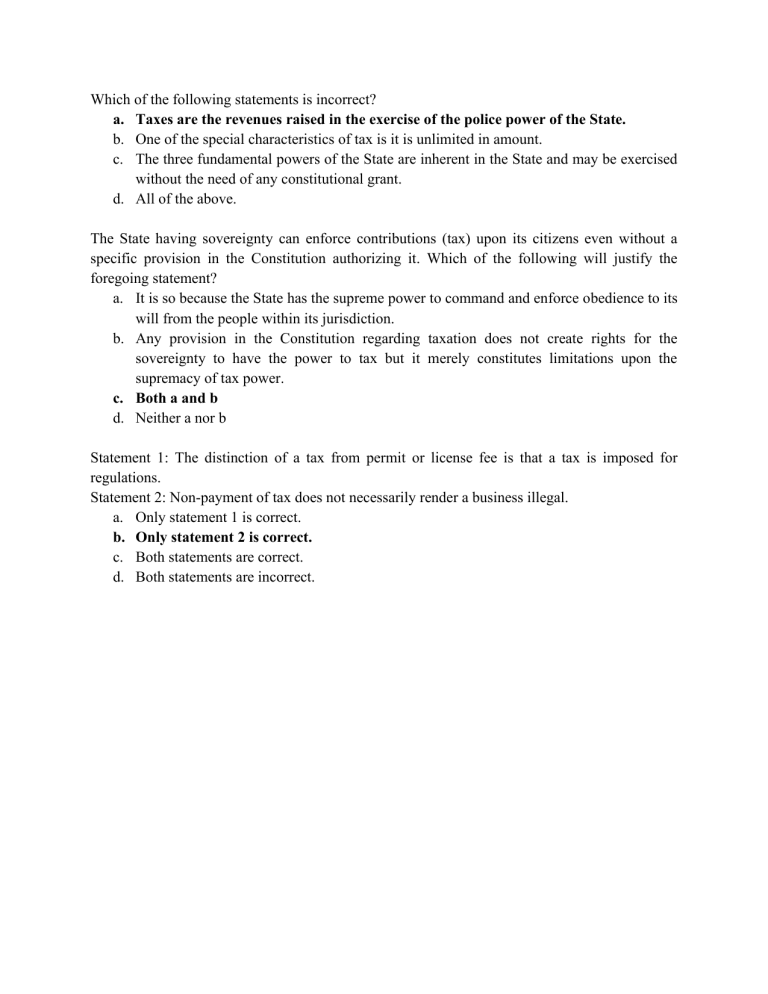

Which of the following statements is incorrect? a. Taxes are the revenues raised in the exercise of the police power of the State. b. One of the special characteristics of tax is it is unlimited in amount. c. The three fundamental powers of the State are inherent in the State and may be exercised without the need of any constitutional grant. d. All of the above. The State having sovereignty can enforce contributions (tax) upon its citizens even without a specific provision in the Constitution authorizing it. Which of the following will justify the foregoing statement? a. It is so because the State has the supreme power to command and enforce obedience to its will from the people within its jurisdiction. b. Any provision in the Constitution regarding taxation does not create rights for the sovereignty to have the power to tax but it merely constitutes limitations upon the supremacy of tax power. c. Both a and b d. Neither a nor b Statement 1: The distinction of a tax from permit or license fee is that a tax is imposed for regulations. Statement 2: Non-payment of tax does not necessarily render a business illegal. a. Only statement 1 is correct. b. Only statement 2 is correct. c. Both statements are correct. d. Both statements are incorrect.