AUDIT IN CIS ENVIRONMENT – QUIZ NO. 1

advertisement

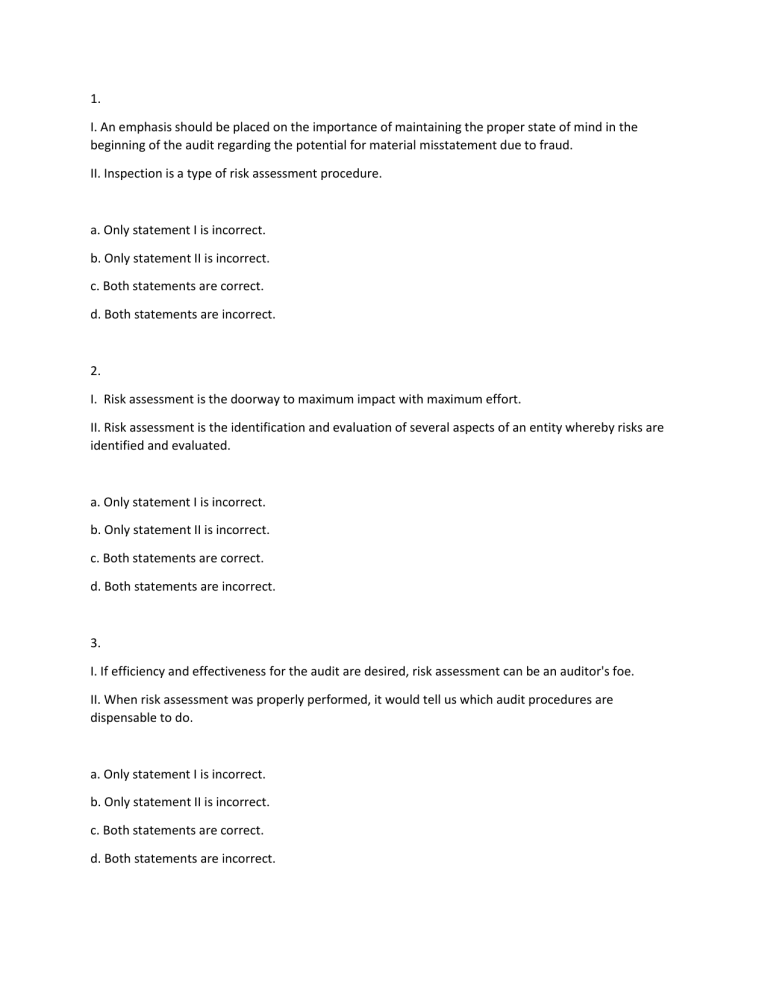

1. I. An emphasis should be placed on the importance of maintaining the proper state of mind in the beginning of the audit regarding the potential for material misstatement due to fraud. II. Inspection is a type of risk assessment procedure. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 2. I. Risk assessment is the doorway to maximum impact with maximum effort. II. Risk assessment is the identification and evaluation of several aspects of an entity whereby risks are identified and evaluated. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 3. I. If efficiency and effectiveness for the audit are desired, risk assessment can be an auditor's foe. II. When risk assessment was properly performed, it would tell us which audit procedures are dispensable to do. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 4. There are several aspects of the risk assessment process including: I. Understanding and evaluating the internal control processes and procedures at the entity. II. Performing an overall evaluation of all information gathered and risks assessed. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 5. I. Inquiry alone is sufficient for testing controls. II. Substantive tests alone are adequate. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 6. I. For an entity with multiple locations, the auditor should inquire of management about the nature and extent of monitoring of operating locations or business segments. II.For an entity with multiple locations, the auditor should inquire of management about whether there are particular operating locations or business segments for which a risk of fraud may be least likely to exist. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 7. I. Analytical procedures must be performed after planning the audit. II. The auditor also should perform analytical procedures relating to revenue with the objective of identifying usual or expected relationships involving revenue accounts that may indicate a material misstatement due to fraudulent financial reporting. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 8. I. Retrospective review of accounting estimates is performed to evaluate the existence of possible management bias. II. Retrospective review of accounting estimates is performed to evaluate the information relevant to current year estimates. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 9. I. In identifying the risk of material misstatement due to fraud, the practitioner should consider any usual or expected relationships that have been identified in performing analytical procedures in planning the audit. II. In identifying the risk of material misstatement due to fraud, the practitioner should consider whether one or more fraud risk factors exist. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 10. I. The overall audit strategy should include identification and evaluation of the resources needed to perform the audit. II. The overall audit strategy should include identification and evaluation of the reporting objectives of the engagement. a. Only statement I is incorrect. b. Only statement II is incorrect. c. Both statements are correct. d. Both statements are incorrect. 11. The following are types of risk assessment procedures, except: a. Inspection b. Benchmarking c. Observation d. Analytical procedures. 12. Which of the following is not an aspect of the risk assessment process? a. Understanding and evaluating the entity and its environment. b. Understanding and evaluating the internal control processes and procedures at the entity. c. Understanding and evaluating the risks of fraud at the entity. d. Performing a partial evaluation of all information gathered and risks assessed. 13. The order of steps in planning: I. Planning the audit resources II. Establishing the audit strategy III. Communication on planning IV. Develop the audit plan a. II,I,IV,III b. I,III,IV,II c. IV,II,I, III d. I,IV,III,II 14. All of the following are components of audit strategy, except: a. Timing b. Materiality and Risk c. Business risk d. Scope of the engagement 15. It is the magnitude of an omission or misstatement of accounting information that, in the light of surrounding circumstances, makes it probably that the judgement of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement. a. Fraud b. Error c. Risk d. Materiality 16. The following are client attributes that affect scope of engagement, which is the exception: a. Entity structure b. Information technology c. Business presentation d. Client outsourcing 17. The fraud triangle is composed of: a. Incentive, opportunity, rationalization b. Input, process, output c. momentum, chance, vindication d. alibi, opportunity encouragement 18. It is an example of something that is material regardless of amount. a. Affinity Fraud b. Management Fraud c. Asset Misappropriation Fraud d. Payroll Fraud 19. These risks are important enough to require special audit consideration. a. Significant Risks b. Control Risks c. Detection Risks d. Business Risks 20. The following are IT expert's potential contributions to the audit, except: a. Understanding the IT controls. b. Designing and performing tests of IT controls c. Designing and performing IT-related or IT-based substantive procedures. d. Overlook the effect of IT on the audit 21. It is pervasive and critical to operations; is new, recently changed, complex; uses emerging technology; used for e-commerce. a. Healthcare system b. Computer system c. Information system d. Education system 22. Anti-fraud controls include those of the following, which is the exception: a. Over related party transactions b. Related to significant management estimates c. Over journal entries and adjustments made in the period-end financial reporting process d. Maintaining professional skepticism 23. Materiality includes what aspect. a. Quantitative b. Qualitative c. Both A & B d. Either A or B 24. It answers the questions is it public or privately owned? is it a parent or subsidiary? does it have multiple locations, and if so what is the materiality at the other locations? a. Accounting presentation b. Entity Structure c. Information technology d. Client outsourcing 25. It refers to the events since the client was accepted. a. Internal events b. Business transaction c. Recurring engagement d. New engagement 26. It refers to events since the last audit. a. Internal events b. Business transaction c. Recurring engagement d. New engagement 27. Interim work helps a. Discover problems earlier so the client can fix them or the auditor can plan to spend more time on them during year end work b. When the client does not retain records or not in the original format. c. Both A & B d. Either A or B 28. All of the following are part of planning the audit resources, which is not: a. Assignments of the audit team b. Timing of audit work c. Engagement budget d. Low-risk areas 29. This refers to when it is to be performed; considerations are having audit resources available, evidence availability, being able to test the period for which evidence is needed. a. Timing b. Availability c. Extent d. Nature 30. This refers to the quantity of testing to be performed. a. Timing b. Availability c. Extent d. Nature