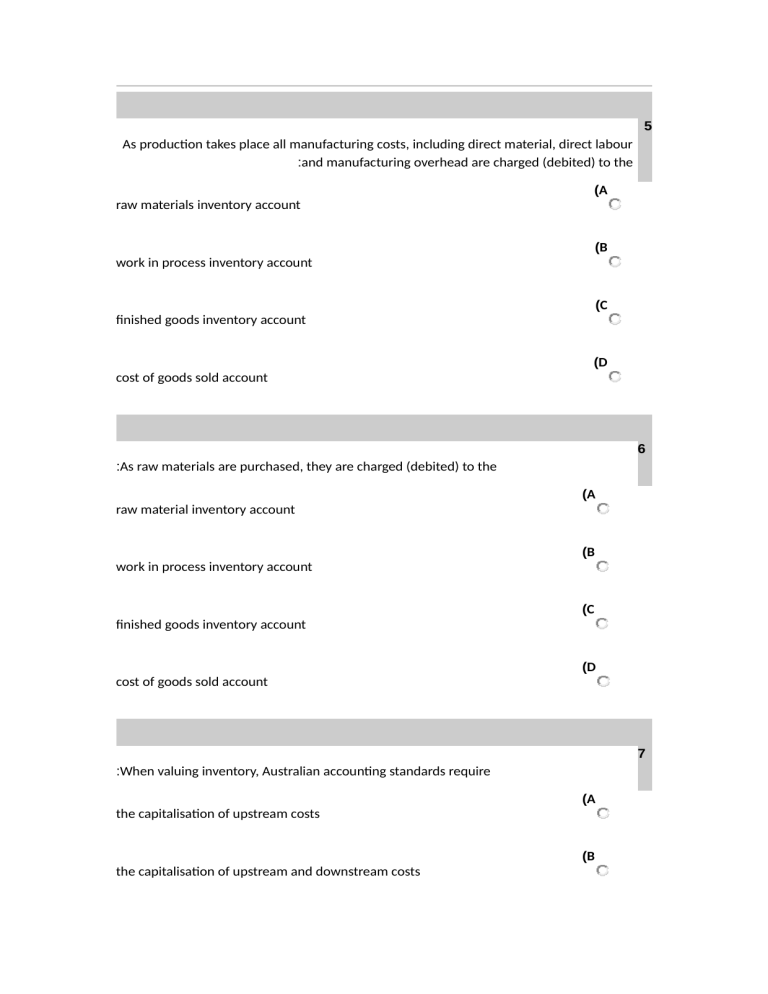

5 As production takes place all manufacturing costs, including direct material, direct labour :and manufacturing overhead are charged (debited) to the raw materials inventory account (A (B work in process inventory account (C finished goods inventory account cost of goods sold account (D 6 :As raw materials are purchased, they are charged (debited) to the raw material inventory account work in process inventory account finished goods inventory account cost of goods sold account (A (B (C (D 7 :When valuing inventory, Australian accounting standards require the capitalisation of upstream costs the capitalisation of upstream and downstream costs (A (B upstream costs to be expensed in the period in which they were incurred upstream and downstream costs to be expensed in the period in which they were incurred (C (D 8 Jason Zammit, a recently appointed trainee accountant, has been assigned the task of accounting for manufacturing overhead for a large multinational manufacturing organisation. Jason seems to have forgotten what he learned in his management accounting studies at university and asks you the following question: What is ?manufacturing overhead Manufacturing overhead includes direct materials, indirect materials, direct .labour and indirect labour .Manufacturing overhead is easily traced to products .Manufacturing overhead includes all selling and administration costs Manufacturing overhead consists of a heterogeneous pool of indirect production costs, such as indirect material, indirect labour, electricity and gas costs, equipment depreciation and insurance and council rates paid for the .factory (A (B (C (D 9 Jason Zammit a recently appointed trainee accountant has been assigned the task of accounting for manufacturing overhead for a large multinational manufacturing organisation. Jason is reading information contained in the general ledger for the past three months and he asks you the following question: When I am looking at the right side (credit side) of the manufacturing overhead account, what do these credits represent? :You reply with the correct answer which is the right side (credit side) of the manufacturing overhead account represents the actual manufacturing overhead costs incurred throughout the accounting period, in this case the past three months (A the right side (credit side) of the manufacturing overhead account represents (B the manufacturing overhead applied to work in process inventory over the past three months the right side (credit side) of the manufacturing overhead account represents the underapplied manufacturing overhead (C the right side (credit side) of the manufacturing overhead account represents the overapplied manufacturing overhead (D Neville’s Gnomes Pty Ltd manufactures decorative garden items. The company incurred the following costs to produce job number 33 which consisted of 1 000 Collingwood footy :gnomes Material requisitions numbers 40-45: $8400 <BR> Direct labour: 420 hours @ $10 per hour <BR> Manufacturing overhead: applied on the basis of direct labour hours at an application rate of $18 per direct labour hour Job number 33 was completed during the year and the company sold 800 Collingwood .footy gnomes. Determine the correct balances in each of the accounts at year-end .Work in process inventory $4032; finished goods inventory $16 128 (A (B .Finished goods inventory $20 160 (C .Work in process inventory $4032; cost of goods sold $16 128 (D .Finished goods inventory $4032; cost of goods sold $16 128 Peters Plumbing Company uses a job order costing system. At the beginning of August, the company had two jobs in process with the following costs: Job 456 Direct Material Direct Labour Manufacturing Overhead $3400 $510 $204 1 0 Job 461 1100 290 ? Peters Plumbing pays its workers $10 per hour and applies overhead on a direct labour hour basis. The predetermined manufacturing overhead rate per direct labour hour is: $0.075 A) $0.50 B) $4 C) $4.25 D) 2 Peters Plumbing Company uses a job order costing system. At the beginning of August, the company had two jobs in process with the following costs: Direct Direct Materia Labour l Manufacturi ng Overhead Job 456 $3400 $510 $204 Job 461 1100 290 ? Peters Plumbing pays its workers $10 per hour and applies overhead on a direct labour hour basis. The manufacturing overhead included in the cost of Job 461 at the beginning of August was: $144.50 A) $153.00 B) $2200.00 C) $116.00 D) 3 Peters Plumbing Company uses a job order costing system. At the beginning of August, the company had two jobs in process with the following costs: Direct Direct Materia Labour l Manufacturi ng Overhead Job 456 $3400 $510 $204 Job 461 1100 290 ? Peters Plumbing pays its workers $10 per hour and applies overhead on a direct labour hour basis. During August, Peters Plumbing employees worked on Job 476. At the end of the month, $500 of manufacturing overhead had been applied to this job. Total work in process inventory at the end of the month was $12 451 and all other jobs had a total cost of $6133. The amount of direct material included in Job 476 is: $1391 A) $2142 B) $3267 C) $4568 D) 4 Doncaster Company uses a predetermined manufacturing overhead application rate of $0.50 per direct labour hour. During the year, Doncaster incurred $575 000 of actual manufacturing overhead, but it planned to incur $625 000 of manufacturing overhead. The company applied $605 000 of manufacturing during the year. How many direct labour hours did the company plan to incur? 1 190 000. A) 1 200 000. B) 1 210 000. C) 1 250 000. D) 5 If manufacturing overhead is overapplied, this indicates: actual manufacturing overhead costs are higher than manufacturing overhead applied to production A) actual manufacturing overhead costs are higher than budgeted manufacturing overhead B) actual manufacturing overhead costs are lower than budgeted manufacturing overhead C) actual manufacturing overhead costs are lower than manufacturing overhead applied to production D) 6 The Components Manufacturing Company uses a predetermined manufacturing overhead application rate of $4 per direct labour hour. During the year, 40 000 direct labour hours were worked. Actual manufacturing overhead costs for the year were $150 000. The Components Manufacturing Company’s manufacturing overhead was: $5000 underapplied A) $5000 overapplied B) $10 000 underapplied C) $10 000 overapplied D) 7 The schedule of cost of goods manufactured details the movements through: raw materials inventory A) work in process inventory B) finished goods inventory C) raw materials inventory and work in process inventory D) 8 The schedule of cost of goods sold details the movements through: raw materials inventory A) work in process inventory B) finished goods inventory C) raw materials inventory and work in process inventory D) 9 The Heidelberg Manufacturing Company has zero balances in its work in process and finished goods inventory accounts on December 31 of the previous year. The balances in Heidelberg’s accounts as of December 31 of the current year are as follows: Cost of goods sold $5 000 000 Selling and Administrative expenses 450 000 Sales Revenue 10 000 000 Actual manufacturing overhead 850 000 Applied manufacturing overhead 900 000 If Heidelberg Manufacturing Company writes off over or underapplied manufacturing overhead to the cost of goods sold, the net profit before taxes for the current year is: $5 000 000 A) $3 700 000 B) $4 600 000 C) $4 500 000 D) 10 Process costing is used by companies that: produce a single product (or a small range of very similar products) in large quantities A) produce a single product (or a small range of very similar products) in small quantities B) produce products in distinct batches and there are significant differences between the batches C) produce products individually and they are of a unique nature D) 5 Buker Corporation bases its predetermined overhead rate on the estimated machinehours for the upcoming year. Data for the upcoming year appear below: The predetermined overhead rate for the recently completed year was closest to: A. B. C. D. $22.04 $29.59 $7.67 $29.71 Estimated total manufacturing overhead = $1,630,960 + ($7.67 per machine-hour × 74,000 machine-hours) = $2,198,540 Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base = $2,198,540 ÷ 74,000 machine-hours = $29.71 per machine-hour Hibshman Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the machine-hours for the upcoming year at 10,000 machine-hours. The estimated variable manufacturing overhead was $6.82 per machine-hour and the estimated total fixed manufacturing overhead was $230,200. The predetermined overhead rate for the recently completed year was closest to: A. $29.84 per machine-hour B. $23.15 per machine-hour C. $23.02 per machine-hour D. $6.82 per machine-hour Estimated total manufacturing overhead = $230,200 + ($6.82 per machine-hour × 10,000 machine-hours) = $298,400 Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base = $298,400 ÷ 10,000 machine-hours = $29.84 per machine-hour CR Corporation has the following estimated costs for the next year: CR Corporation estimates that 20,000 labor-hours will be worked during the year. If overhead is applied on the basis of direct labor-hours, the overhead rate per hour will be: 30. A. B. C. D. $2.25 $3.25 $3.45 $4.70 Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $45,000 ÷ 20,000 direct laborhours = $2.25 per direct labor-hour 31. Jameson Corporation uses a predetermined overhead rate based on direct laborhours to apply manufacturing overhead to jobs. The Corporation has provided the following estimated costs for the next year: Jameson estimates that 24,000 direct labor-hours will be worked during the year. The predetermined overhead rate per hour will be: A. B. C. D. $2.00 $2.79 $3.00 $4.00 Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base Predetermined overhead rate = $48,000 ÷ 24,000 direct labor-hours = $2.00 per direct labor-hour Paulson Corporation uses a predetermined overhead rate based on machinehours to apply manufacturing overhead to jobs. The Corporation has provided the following estimated costs for next year: Paulson estimated that 40,000 direct labor-hours and 20,000 machine-hours would be worked during the year. The predetermined overhead rate per machine-hour will be: 32. A. B. C. D. $1.60 $2.10 $1.00 $1.05 Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base Predetermined overhead rate = $42,000 ÷ 20,000 machine-hours = $2.10 per machine-hour 33. Aksamit Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the most recently completed year appear below: The predetermined overhead rate for the recently completed year was closest to: A. B. C. D. $23.97 $31.00 $7.03 $31.35 Estimated total manufacturing overhead = $1,486,140 + ($7.03 per machinehour × 62,000 machine-hours) = $1,922,000 Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base = $1,922,000 ÷ 62,000 machine- hours = $31.00 per machine-hour 34. Sirmons Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the labor-hours for the upcoming year at 70,000 labor-hours. The estimated variable manufacturing overhead was $9.93 per labor-hour and the estimated total fixed manufacturing overhead was $1,649,200. The actual labor-hours for the year turned out to be 74,000 labor-hours. The predetermined overhead rate for the recently completed year was closest to: A. $32.22 B. $9.93 C. $33.49 D. $23.56 Estimated total manufacturing overhead = $1,649,200 + ($9.93 per labor-hour × 70,000 labor-hours) = $2,344,300 Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base = $2,344,300 ÷ 70,000 laborhours = $33.49 per labor-hour 35. The Work in Process inventory account of a manufacturing Corporation shows a balance of $18,000 at the end of an accounting period. The job cost sheets of the two uncompleted jobs show charges of $6,000 and $3,000 for materials, and charges of $4,000 and $2,000 for direct labor. From this information, it appears that the Corporation is using a predetermined overhead rate, as a percentage of direct labor costs, of: A. 50% B. 200% C. 300% D. 20% ($10,000 + $4,000X) + ($5,000 + $2,000X) = $18,000 $6,000X = $3,000 X = 0.50 36. The following T-accounts have been constructed from last year’s records at C&C Manufacturing: C&C Manufacturing uses job-order costing with a predetermined overhead rate and applies manufacturing overhead to jobs based on direct labor costs. What is the predetermined overhead rate? A. B. C. D. 125% 120% 100% 105% Entry (b) refers to materials from the Raw Materials account. Entry (c) in the Manufacturing Overhead account must Refer To indirect labor because the corresponding entry in the Work In Process account must be for direct labor. Entry (c) could not be for manufacturing overhead because there would be no entry in Work In Process. Therefore, entry (c) must be for direct and indirect labor. The direct labor must be $154,000 and the manufacturing overhead applied is the $192,500 credit entry (e) in the Manufacturing Overhead account. Therefore, Overhead applied = Predetermined overhead rate × Amount of the allocation base incurred $192,500 = Predetermined overhead rate × $154,000 Predetermined overhead rate = $192,500 ÷ $154,000 = 1.25 Bradbeer Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 17,500 hours. At the end of the year, actual direct labor-hours for the year were 16,000 hours, the actual manufacturing overhead for the year was $233,000, and manufacturing overhead for the year was underapplied by $15,400. The estimated manufacturing overhead at the beginning of the year used in the predetermined overhead rate must have been: A. $249,375 B. $217,600 C. $228,000 D. $238,000 37. Underapplied (overapplied) manufacturing overhead = Actual manufacturing overhead – Manufacturing overhead applied Manufacturing overhead applied = Actual manufacturing overhead – Underapplied manufacturing overhead = $233,000 – $15,400 = $217,600 Overhead applied = Predetermined overhead rate × Amount of the allocation base incurred Predetermined overhead rate = Overhead applied ÷ Amount of the allocation base incurred Predetermined overhead rate = $217,600 ÷ 16,000 direct labor-hours = $13.60 per direct labor-hour Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base Estimated total manufacturing overhead = Predetermined overhead rate × Estimated total amount of the allocation base = $13.60 per direct labor-hour × 17,500 direct labor-hours = $238,000 38. Dagger Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the total estimated manufacturing overhead was $423,870. At the end of the year, actual direct labor-hours for the year were 19,400 hours, manufacturing overhead for the year was underapplied by $5,650, and the actual manufacturing overhead was $418,870. The predetermined overhead rate for the year must have been closest to: A. $21.59 B. $20.76 C. $21.30 D. $21.85 Underapplied (overapplied) manufacturing overhead = Actual manufacturing overhead – Manufacturing overhead applied Manufacturing overhead applied = Actual manufacturing overhead – Underapplied manufacturing overhead = $418,870 – $5,650 = $413,220 Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base = $413,220 ÷ 19,400 direct laborhours = $21.30 per direct labor-hour 39. Sawyer Manufacturing Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. Last year, the Corporation worked 57,000 actual direct labor-hours and incurred $345,000 of actual manufacturing overhead cost. The Corporation had estimated that it would work 55,000 direct labor-hours during the year and incur $330,000 of manufacturing overhead cost. The Corporation’s manufacturing overhead cost for the year was: A. overapplied by $15,000 B. underapplied by $15,000 C. overapplied by $3,000 D. underapplied by $3,000 Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $330,000 ÷ 55,000 direct laborhours = $6 per direct labor-hour Overhead over or underapplied Clear Colors Corporation uses a predetermined overhead rate based on direct labor costs to apply manufacturing overhead to jobs. At the beginning of the year the Corporation estimated its total manufacturing overhead cost at $350,000 and its direct labor costs at $200,000. The actual overhead cost incurred during the year was $362,000 and the actual direct labor costs incurred on jobs during the year was $208,000. The manufacturing overhead for the year would be: A. $12,000 underapplied. B. $12,000 overapplied. C. $2,000 underapplied. D. $2,000 overapplied. Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $350,000 ÷ $200,000 = 1.75 Overhead over or underapplied Cribb Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 17,900 hours and the total estimated manufacturing overhead was $341,890. At the end of the year, actual direct labor-hours for the year were 16,700 hours and the actual manufacturing overhead for the year was $336,890. Overhead at the end of the year was: A. $22,920 underapplied B. $17,920 overapplied C. $17,920 underapplied D. $22,920 overapplied 41. Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated total amount of the allocation base = $341,890 ÷ 17,900 direct labor-hours = $19.10 per direct labor-hour Overhead applied = Predetermined overhead rate × Amount of the allocation base incurred = $19.10 per direct labor-hour × 16,700 direct labor-hours = $318,970 Overhead over or underapplied Brusveen Corporation applies manufacturing overhead to jobs on the basis of direct labor-hours. The following information relates to Brusveen for last year: What was Brusveen’s underapplied or overapplied overhead for last year? 42. A. B. C. D. $4,000 underapplied $8,880 underapplied $8,880 overapplied $9,000 underapplied Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $300,000 ÷ 15,000 direct laborhours = $20 per direct labor-hour Overhead over or underapplied 43. Collins Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. The following information applies to the Corporation for the current year: The manufacturing overhead cost for the current year will be: A. B. C. D. $17,000 overapplied $17,000 underapplied $55,000 overapplied $55,000 underapplied Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $240,000 ÷ $300,000 = 0.80 Overhead over or underapplied At the beginning of the year, manufacturing overhead for the year was estimated to be $477,590. At the end of the year, actual direct labor-hours for the year were 29,000 hours, the actual manufacturing overhead for the year was $472,590, and manufacturing overhead for the year was overapplied by $110. If the predetermined overhead rate is based on direct labor-hours, then the estimated direct labor-hours at the beginning of the year used in the predetermined overhead rate must have been: A. 29,300 direct labor-hours B. 28,987 direct labor-hours C. 28,993 direct labor-hours D. 29,000 direct labor-hours 44. Underapplied (overapplied) manufacturing overhead = Actual manufacturing overhead – Manufacturing overhead applied -$110 = $472,590 – Overhead applied Manufacturing overhead applied = $472,590 + $110 = $472,700 Manufacturing overhead applied = Predetermined overhead rate × Actual direct labor-hours Predetermined overhead rate = Manufacturing overhead applied ÷ Actual direct labor-hours = $472,700 ÷ 29,000 direct labor-hours = $16.30 per direct labor-hour Predetermined overhead rate = Estimated total manufacturing overhead ÷ Estimated direct labor-hours Estimated direct labor-hours = Estimated total manufacturing overhead ÷ Predetermined overhead rate = $477,590 ÷ $16.30 per direct labor-hour = 29,300 direct labor-hours 45. Galbraith Corporation applies overhead cost to jobs on the basis of 70% of direct labor cost. If Job 201 shows $28,000 of manufacturing overhead applied, the direct labor cost on the job was: A. $40,000 B. $19,600 C. $28,000 D. $36,400 Manufacturing overhead applied = Predetermined overhead rate × Amount of the allocation base incurred $28,000 = 0.70 × Direct labor cost Direct labor cost = $28,000 ÷ 0.70 = $40,000