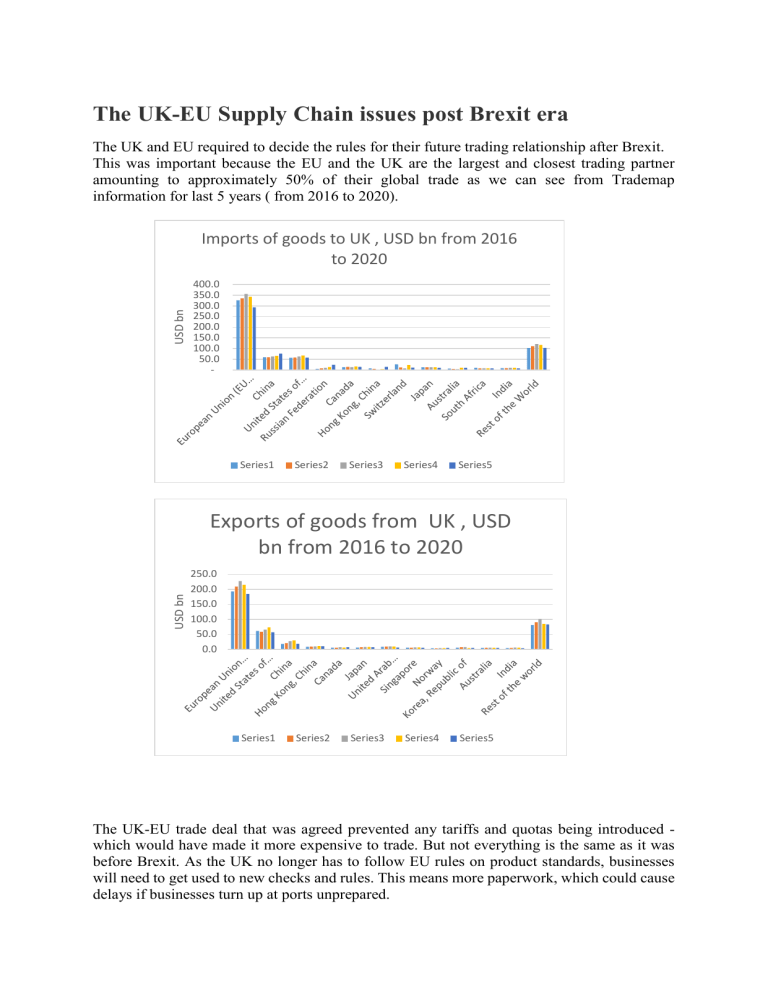

The UK-EU Supply Chain issues post Brexit era The UK and EU required to decide the rules for their future trading relationship after Brexit. This was important because the EU and the UK are the largest and closest trading partner amounting to approximately 50% of their global trade as we can see from Trademap information for last 5 years ( from 2016 to 2020). USD bn Imports of goods to UK , USD bn from 2016 to 2020 400.0 350.0 300.0 250.0 200.0 150.0 100.0 50.0 - Series1 Series2 Series3 Series4 Series5 USD bn Exports of goods from UK , USD bn from 2016 to 2020 250.0 200.0 150.0 100.0 50.0 0.0 Series1 Series2 Series3 Series4 Series5 The UK-EU trade deal that was agreed prevented any tariffs and quotas being introduced which would have made it more expensive to trade. But not everything is the same as it was before Brexit. As the UK no longer has to follow EU rules on product standards, businesses will need to get used to new checks and rules. This means more paperwork, which could cause delays if businesses turn up at ports unprepared. The deal doesn't completely eliminate the possibility of tariffs in future. Both sides will need to stay close to shared rules in areas like workers' rights and environmental protection. If either the UK or the EU shift their rules too far, the other side could introduce tariffs. Before Brexit, the UK was part of any trade deal the EU had negotiated with another country. The EU had about 40 trade deals covering more than 70 countries at the time the UK left. The UK has made deals to continue trading in the same way with 63 of these countries. UK trade agreements with existing and under negotiation countries are shown below diagrammatically. Talks are ongoing with a further five countries or blocs. Any existing EU agreement that was not rolled over, ended on 31 December with trade then taking place on World Trade Organization terms until a deal could be reached. This means importers face tariffs and extra paperwork. For example, a shipment of bananas arriving into Portsmouth from Ghana was charged a tariff of £17,500 in January. The UK signed a deal with Japan on 22 October - the first that differed from an existing EU deal. The total value of UK-Japan trade was of the order of 2% of the UK's total trade. On 31 January, the UK government announced it would apply to join a free trade area with 11 Asia and Pacific nations called the Comprehensive and Progressive Agreement for TransPacific Partnership (CPTPP). Current members include Australia, Canada, Japan and New Zealand. Separately, the UK government is also holding trade talks with the US, Australia and New Zealand. The salient features of UK-EU Trade and Cooperation Agreement: Tariff-free, quota-free trade in goods between the UK and EU. This is very good news for business, particularly those in high tariff sectors such as food and agriculture. Rules of Origin recognise both UK and EU content as “originating” (known as full bilateral cumulation), with a six year phase-in period for electric cars, allowing the UK necessary time to build up qualifying sources. Other helpful measures permit organisations to selfcertify as having fulfilled origin requirements and to provide a single statement of origin even for multiple shipments over the course of a year. The EU has also said statements of origin can be made from day one without the detailed proof required until 2022 outside the FTA. Mutual recognition of Authorised Economic Operator status and agreement on managing “roll-on, roll-off” trade at ports will facilitate a somewhat more straightforward process for the transport of some goods, particularly through Dover-Calais. There is no requirement for international permits for road haulage, and limited cabotage arrangements where drop off and pick up can be made in the EU. In principle, service providers will not need to establish a local presence to trade within each other’s markets – and they will be able to avoid economic needs tests, residency requirements and a range of other non-tariff barriers. However, there are very lengthy reservations listed to these headline provisions. The parties have agreed ‘national treatment’ to prevent discrimination between nationals and ‘most favoured nation’ provisions to ensure the treatment of service suppliers keep pace with either party’s future FTAs. Business mobility rights have been agreed (e.g. attending conferences, seminars, meetings) for short-term stays, permitted for 90 days in any 180 day period. Intra-corporate transfers (with spouses and dependents), contract and self-employed working are also supported. Protection and enforcement of intellectual property rights including patents, trademarks and designs in line with international agreements. The agreement is limited to adherence to international frameworks and cooperation in areas such as tax and debt recovery including VAT, customs duties and excise. UK autonomy on tax rates and rules is preserved. The deal includes agreement on a range of other specific topics negotiated alongside generic trade chapters, including on energy (continued access to EU internal energy market); logistics and haulage (continuity of haulage without permits); and aviation. There are also specific provisions on telecoms, delivery services, chemicals, motor vehicles and medicines. Arbitration of the agreement will be undertaken through a new Partnership Council and there will be no role for the European Court of Justice. Financial services are exempted from potential retaliation in future trade disputes. The FTA is good news for UK trade with Turkey, which would have defaulted to WTO terms without a UK-EU deal. It is evident that the UK-EU Trade and Cooperation Agreement provides business with much needed certainty and a stable start to 2021. Business to understand the details of agreement from the UK government’s website and by HMRC, calculate where changes may need to be made, take the necessary steps to implement the changes required as fast as possible . Organisations need to classify goods, prove origin, update customs process, communicate changes to mobility and right to work across the organization, implement tax and VAT changes and re-evaluate existing or planned corporate structure in EU/UK. Also, organisations to adapt any previous planning to take into account the new deal, identify issues that no longer require immediate attention but may need to be monitored in the long run, identify Tariffs and Trade agreements, new logistics, and supply chain and fulfilment structures. Re-shoring of UK Manufacturing Bringing manufacturing back to the UK is a hot topic. A Make UK survey in middle of 2020 found over a third of manufacturers reported that they intend to moderately increase their use of UK-based suppliers in the next two years, with a further 12% indicating a significant increase. This is different to previous years which showed manufacturers had not significantly increased the number of UK suppliers. Source: Make UK / Oracle survey, June 2020 It indicates that manufacturers are beginning to address the international supply chain risks highlighted by Covid-19. Manufacturers are looking to diversify their supply chains as a way of mitigating risk and exploring the options to use local suppliers is one option. In addition to increased use of local suppliers, increased collaboration was also one of the top three strategies manufacturers will undertake to improve supply chain performance. It is evident that use of data is critical in establishing the successful collaboration necessary for smart, resilient supply chains. Unfortunately, too few manufacturers are using digital solutions to improve supply chain performance (6%) till now. Accurate data can improve supplier selection on cost-quality-delivery parameters, manage relationships and provide real-time analysis to increase agility and predict future shocks. Coupled with automation, predictive analytics will enable businesses to quickly adapt to changing environments, customer needs and commercial demands. The pandemic has shown how vital a strong industrial base is to the overall health of the economy of any country. UK manufacturing has proven essentials for the supply of vital products for critical sectors such as the NHS. To recognise the critical importance of UK manufacturing, Make UK are calling on the Government on following issues: -Identify manufacturing as a critical sector for the UK economy - Aim for the UK to be in the top five manufacturing nations in the world (which is 9th currently) - Work with the sector to effectively map out a global supply chain resilience programme. - Agree coordinated action with key economic partner countries to maintain current trade flows and removing administrative restrictions - Support manufacturers to trade globally using smart supply chains Modern manufacturing needs modern supply chains Teething troubles with new systems: Make UK research indicate that manufacturers still struggling to cope with crippling delays moving goods in and out of EU as described below: Almost three-quarters (74%) of companies have experienced or are experiencing delays in the past 3 months 1 in 3 (28%) are experiencing delays of between 1 to 2 weeks Over half (51%) say this has led to increased costs Over a third (35%) have lost revenue with one in five losing potential business UK manufacturers are in dialogue with the Government to help them sort out delays and problems at ports in and out of the EU. This is leading to lost business, increased costs and losing out on future orders. Make UK further research showed that goods stuck in transit and increasing delays on shipments. Many container ships are not willing to stop in the UK at present, due to delays at British ports. This is resulting in goods bound for the UK being offloaded in EU ports, impacting severely on production schedules. Companies are forced to make alternative and costly arrangements to have their orders delivered. Businesses are also reporting that rules for movement of goods is being interpreted locally within the EU and also at UK ports adding delays. Over half of all companies surveyed (51%) said the delays are leading to increased costs. Almost three quarters of companies have experienced or are still experiencing delays since the transition period ended on January 1st this year. Over a third have lost revenue with one in five reporting they are losing out on future orders. Stephen Phipson, CEO Make UK, the manufacturers’ organisation said: “Government needs to move smooth out difficulties at UK ports so that shipments can easily be delivered. We are encouraged that Government is already working to train more high quality customs officials and to give more assistance with customs paperwork, but this needs to be driven forward at speed to give the quickest possible assistance to British companies already struggling to get back to normal as trade recovers from the Covid pandemic.” “Government should look to quickly get back around the table with our EU partners to find a way to mitigate against ongoing delays at the border and iron out different interpretations of the rules for movement of goods in separate member states.” Government must also continue bring together a haulers and logistics firms to work alongside Britain’s exporters and wider industry to find solutions to the issues currently plaguing the sector.