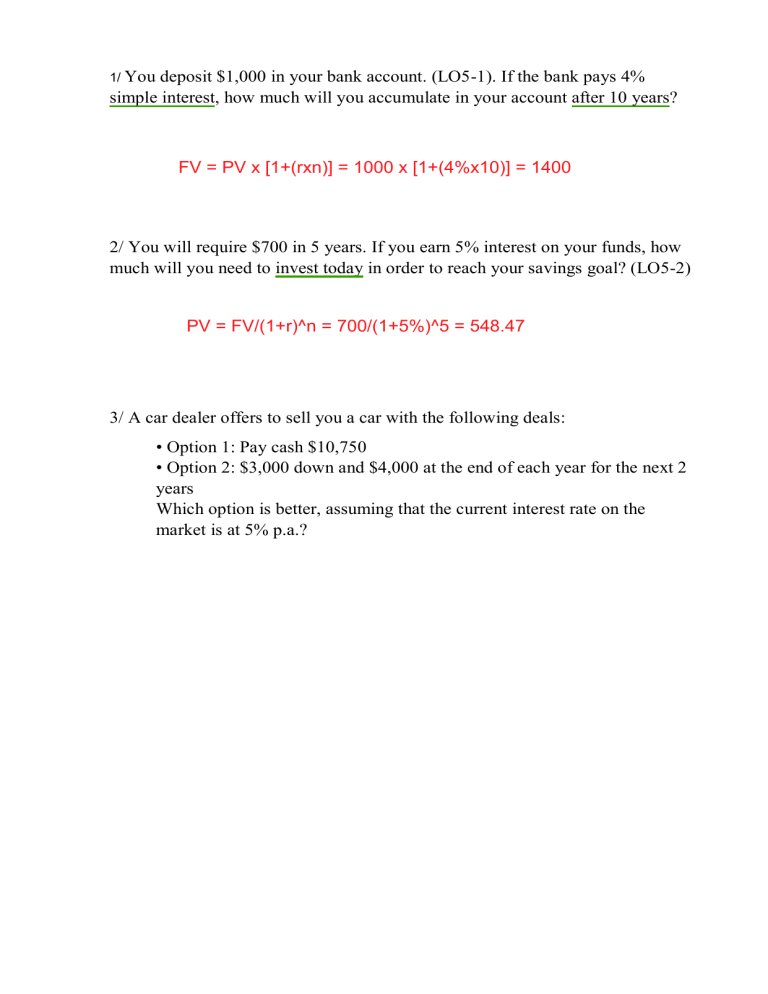

1/ You deposit $1,000 in your bank account. (LO5-1). If the bank pays 4% simple interest, how much will you accumulate in your account after 10 years? FV = PV x [1+(rxn)] = 1000 x [1+(4%x10)] = 1400 2/ You will require $700 in 5 years. If you earn 5% interest on your funds, how much will you need to invest today in order to reach your savings goal? (LO5-2) PV = FV/(1+r)^n = 700/(1+5%)^5 = 548.47 3/ A car dealer offers to sell you a car with the following deals: • Option 1: Pay cash $10,750 • Option 2: $3,000 down and $4,000 at the end of each year for the next 2 years Which option is better, assuming that the current interest rate on the market is at 5% p.a.? 4/ A famous quarterback just signed a $15 million contract providing $3 million a year for 5 years. A less famous receiver signed a $14 million 5-year contract providing $4 million now and $2 million a year for 5 years. The interest rate is 10%. Who is better paid? (LO5-3) 5/ The $40 million lottery payment that you have just won actually pays $2 million per year for 20 years. The interest rate is 8%. (LO5-3). What is the present value if the first payment comes immediately? 6/ John decides to fund a scholarship for IU students for the next 10 years of $300,000 in the first year, and this amount will increase by 5% each year. How much should he donates today, if the school can earn 10% p.a.? 7/ You decide to endow a scholarship of $10,000 per year in perpetuity for your school. How much do you need to donate if the university can earn a return of 10% p.a. on the endowment 8/ Which rate is better? 6% p.a. compounded monthly EAR = (1+6%/12)^12 - 1 = 6.17% 6% p.a. compounded quarterly EAR = (1+6%/4)^4 -1 = 6.14% 6.1% p.a. compounded annually 9/ You take out a 30-year $100,000 mortgage loan with an APR of 6% and monthly payments. In 12 years you decide to sell your house and pay off the mortgage. What is the principal balance on the loan? (LO5-3) 10/ Mary enters into a loan agreement to borrow $90,000 to help finance the purchase of her new home. • The agreement specifies the term of 20 years with monthly repayment at the fixed rate of 9% p.a. (compounded monthly). What is her monthly payment? • Five years has passed. A rival lender offers to refinance Mary her loan at fixed rate of 8% p.a. (compounded monthly). Cost associated with this refinancing is $1,500. Should her refinance? • Suppose 9 years have passed since Mary enters the original loan. She’s considering making an extra payment of $10,000 off her loan. If she plans to keep the term of the loan the same, how much will her monthly repayment reduce? 809.753 b/ Payout figure = 809.753 x 79,836.30 + 1,500 =81,336.308 777.292 81,336.308 = A x => refinance c/ payout figure = 809.753 x 67,700.55 - 10,000 = 57,700.55 690.145 57,700.55 = A x A - Anew = 809.753 - 690.145 = 119.608 11/ You have just won the prize in the State lottery. A recent innovation is to offer prize winners a choice of payoffs. Require: You believe that 8% p.a. compounded annually is an appropriate discount rate. Assuming you wish to maximize your current 1 0 3 wealth, which is the best prize? 2 You must choose one of the following prizes: 600k 600k a. $1,000,000 paid immediately b. $ 600,000 paid exactly one year from today, and another $600,000 paid exactly 3 years from today 1,031,854.9 c. $ 70,000 payment at the end of each year forever (first payment occurs exactly 1 year from today) PV = A/r = 70,000/8% = 875,000 d. an immediate payment of $600,000, then beginning exactly 5 years from today, an annual payment of $50,000 forever e. an annual payment of $200,000 for the next 7 years (first payment occurs exactly 1 year from today 0 1 2 3 4 5 PV = 50,000/0.08 = 625,000 459,393.658 600k 50k => PV = 1,059,393.658 1,041,274.012 1/ Answer: Applying the formula (1), we have FV = PV × [1 + (r × n)] = 1,000 × [1 + (0.04 × 10)] = $1,400 2/ Answer: We need to calculate PV having FV = $700, n = 5 years, r = 5% - Applying the formular (4), we have PV = 𝐹𝑉 = (1 + r )n 700 (1 + 0.05 )5 ≈ $548.47 3/ Answer: - Option 2: First we need to draw the timeline to make it more easily to look and avoid the mistakes + We need to calculate PV to compare with the option 1 PV = 3000 + 4000 1+0.05 + 4000 (1 + 0.05 )2 ≈ 10,437.64 < 10,750 Option 2 is much better as its PV is lower than that of option 1 4/ Answer: If you want to know who is better paid in this case, you have to bring them back to the same time to compare, here is the present value at time 0 - The first one: + Applying the formula, we have: 1−(1+0.1)^−5 PV1 = 3,000,000 × [ 0.1 ] = 11,372,360.31 15,000,000 – 11,372,360.31 = 3,627,639.69 => Paid more than 3 mil compared to its original value - The second one: Hoang Quynh Nhi + Applying the formula, we have: 1−(1+0.1)^−5 PV2 = 4,000,000 + 2,000,000 × [ 0.1 ] = 11,581,573.5 14,000,000 – 11,581,573.5 = 2,418,426.5 => Paid more than 2 mil compared to its original value The first one is better paid 5/ Answer: Appying the formula, we have 1−(1+0.08)^−20 PV = 2,000,000 × [ 0.08 ] × (1+0.08) = $21,207,198.4 6/ Answer: - Applying the formula, we have PV = 300,000 10%−5% × [1- (1+5%)10×(1+10%)-10] = 2,231,943.645 7/ Answer: Applying the formula, we have PV = 10,000 10% = $100,000 8/ Answer EAR = (1+ 0.06 12 ) 12 EAR = (1+ 0.06 4 ) 4 EAR = (1+ 0.061 1 ) 1 -1 = 6.17% -1 = 6.14% -1 = 6.1% Hoang Quynh Nhi 9/ Answer: 1−(1 +6%/12)^(−30×12) PV = 100,000 = A × [ ] => A ≈ 599.55 6%/12 - Sau 12 năm, bán nhà để trả nợ, lúc này nợ còn: PV = 599.55 6%/12 × [1 − (1 1 ] = 79,079.371 +6%/12)^(30×12−12×12) 10/ Answer: PV = 90,000; n=20×12=240 months; a/ Applying the formula, we have the monthly payment: 1−(1 +9%/12)^(−240) PV = 90,000 = A × [ 9%/12 ] => A ≈ 809.753 b/ Payout figure: PV = 809.753 9%/12 × [1 − (1 1 ] ≈ 79,836.308 +9%/12)^(240−5×12) Add transaction cost => PV = 79,836.308 + 1,500 = 81,336.308 Calculate new monthly payment (A’): 1−(1 +8%/12)^(−15×12) PV = 81,336.308 = A’ × [ ] => A’ ≈ 777.292 8%/12 Compare: A’ < A => Mary should refinance c/ Payout figure: PV = 809.753 9%/12 × [1 − (1 1 ] ≈ 67,700.55 +9%/12)^(240−9×12) After making extra payment: PV = 67,700.55 – 10,000 = 57,700.55 Calculate new monthly payment (A”): 1−(1 +9%/12)^(−11×12) PV = 57,700.55 = A” × [ 9%/12 ] => A” ≈ 690.145 Reduction = A – A” = 809.753 – 690.145 = 119.608 Hoang Quynh Nhi Q&A: 1/ Daryl wishes to save money to provide for his retirement. Beginning one month from now, he will deposit a fixed amount into a retirement savings account that will earn 12% p.a. compounded monthly for 30 years. Then, one year after making his final deposit, he will withdraw $100,000 annually for 25 years. How much should Daryl deposit for the first 30 years to meet his objective if the fund earns the interest rate of 12.68% p.a., compounded annually during the last 25 years? 0 1 2 3 ... 360 (30) 31 A A A A A 32 33 34 100k 100k 100k 100k 748,767.698 748,767.698 ... 55 100k 2/ After graduation, you plan to work for your local bank for 12 years and then start your own business. You expect to save and deposit $7,500 a year for the first 6 years and $15,000 annually for the following 6 years. The first deposit will be made a year from today. In addition, your grandfather just gave you a $25,000 graduation gift which you will deposit immediately. If the account earns 9% compounded annually, how much will you have when you start your business 12 years from now? 1 0 25k 7500 3 2 4 5 6 7 8 7500 7500 7500 7500 7500 15k 15k ... 12 ... 15k FV1 = 25,000 x (1+9%)^12 = 70,316.62 94,630.39 56,425.01 FV2 = 7,500 x 112,850.02 FV3 = 15,000 x => FV = 70,316.62 + 94,630.39+ 112,850.02 =277797.03 3/ A local bank advertises the following deal: “Pay us $100 a year for 10 years and then we will pay you (or your beneficiaries) $100 a year forever.” Is this a good deal if the interest rate is 6%? 0 1 2 3 100 100 100 ... 10 11 12 13 100 100 100 100 1318.079 ... 1666.67 => good deal 4/ You want to buy a new car, but you can make an initial payment of only $2,000 and can afford monthly payments of at most $400. APR = 12% (LO5-3) b. How much can you afford if you finance the purchase over 60 months? 0 4 60 1 3 ... 2 2000 400 400 400 400 400 400 400 400 17982.015 + 2000 = 19982.015 5/ A store offers two payment plans. Under the installment plan, you pay 25% down and 25% of the purchase price in each of the next 3 years. If you pay the entire bill immediately, you can take a 10% discount from the purchase price. (LO5-3). Interest rate 5%3 b. How will your answer change if the payments on the 4-year installment plan do not start for a full year? Assume the product price = $100 0 1 2 3 4 25 25 25 25 Nếu pay entire bill immediately PV = 100 - 100.10% = 90 88.65 6/ You believe you will need to have saved $500,000 by the time you retire in 40 years in order to live comfortably. You also believe that you will inherit $100,000 in 10 years. If the interest rate is 6% per year, how much must you save each year to meet your retirement goal? (LO5-3) giải sau 7/ You take out a 30-year $100,000 mortgage loan with an APR of 6% and monthly payments. In 12 years you decide to sell your house and pay off the mortgage. What is the principal balance on the loan? Monthly payment 599.55 Payout figure = 599.55 x 79,079.37 8/ A couple will retire in 50 years; they plan to spend about $30,000 a year in retirement, which should last about 25 years. They believe that they can earn 8% interest on retirement savings. (LO5-3) a. If they make annual payments into a savings plan, how much will they need to save each year? Assume the first payment comes in 1 year. b. How would the answer to part (a) change if the couple also realize that in 20 years they will need to spend $60,000 on their child’s college education? 0 1 2 ... 20 ... 50 51 52 ... 75 A A A A A A 30k 30k ... 30k a/ 320,243.2857 FV = 320,243.2857 = A b/ 60,000 (1+8%)^30 = 603,759.41 FV' = 320,243.2857 + 603,759.41 = 924002.69 => A' = 1610.41 558.138 0 1 2 ... 30 31 45 ... A A A A 30k 30k 30k 30k 9/ You plan to retire in 30 years and want to accumulate enough by then to provide yourself with $30,000 a year for 15 years. (LO5-5) a. If the interest rate is 10%, how much must you accumulate by the time you retire? PV = 30,000 228,182.39 b. How much must you save each year until retirement in order to finance your retirement consumption? c. Now you remember that the annual inflation rate is 4%. If a loaf of bread costs $1 today, what will it cost by the time you retire? 1 x (1+4%)^30 = 3.24 d. You really want to consume $30,000 a year in real dollars during retirement and wish to save an equal real amount each year until then. What is the real amount of savings that you need to accumulate by the time you retire? e. Calculate the required preretirement real annual savings necessary to meet your consumption goals. f. What is the nominal value of the amount you need to save during the first year? (Assume the savings are put aside at the end of each year.) g. What is the nominal value of the amount you need to save during the 30th year? 295,796.6 e/ f/ A = 3895.66 A' = A/(1+4%) = 3895.66/(1+4%) = 3746 g/ A'' = 3895.66/(1+4%)^30 = 1201.1 10/ HCMC Transport provides two payment options: 0 - Register for 12 months: $500 1 0 - Register for 6 months: $264.3 1 FV = 500 x (1+12%/2)^2 = 561.8 2 Assume interest rate is 12% p.a compounded semi-annually