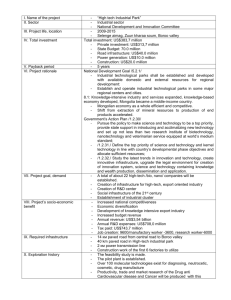

MFIN 301 Corporate Finance Sample Final In November 1974, Bio-Tech faced an urgent decision about the possible sale of its Consumer Product Group (CPG) to General Drugs, a proprietary drug manufacturer. The $25M offer, coming at a time when Bio-Tech's 1975-79 financial plan showed that new financing would be required in large and ever-growing amounts, had sparked spirited discussion among its directors. Company Background Founded in 1921, the Ferguson Supply Company manufactured and sold surgical gloves, but soon began diversifying into other medical and lab supplies via acquisitions and the development of an in-house R&D capability. In 1958, the firm became Bio-Tech to better identify the nature of its business and the fact that internally developed products were contributing to the rapid development of the field it was supplying. 1960 saw its first (and so far only) public equity offering. By 1974, Bio-Tech's several thousand products were divided among three divisions: the Medical Product Group (MPC), the Laboratory Product Group (LPG), and the CPG (Exhibit 1). The R&D group's interest in the disposable-item concept had generated products that contributed most to Bio-Tech's rapid growth over the past 5 years. For example, new techniques replaced staple glass and metal items used by labs, hospitals, and doctor's offices by lower cost and convenient plastic items. With the rapid progress of medical technologies, old products were continuously being replaced with new ones. The management, having little confidence in the protection provided by patents against innovators and imitators, had favored Bio-Tech's development of a strong reputation for lead time, efficient manufacturing and skilled marketing (see Exhibit 2, 3 and 4). The growth of demand for medical and lab supplies had intensified competition among established manufacturers (many being larger and financially stronger than Bio-Tech), triggered the backward integration of several medical distributors and the entry of some foreign firms. Bio-Tech's success, therefore, was best measured by its increased market share in its principal medical and lab product field. The operating plans of MPG and LPG projected 19% and 21% growth in nominal terms (see Exhibit 5). Sale of the Consumer Product Group CPG's performance had been disappointing in the past 5 years. Steady sales growth in disposable products had offset only marginally falling sales in other product lines. Moreover, CPG's profit margins were smaller than other divisions', and worse than firms in businesses most closely comparable to CPG's, i.e. Abbott Laboratories and Johnson & Johnson. While MPG and LPG achieved cost savings through shared distribution channels, CPG used separate channels. When headquarters questioned CPG's ability to use these channels efficiently, CPG's management insisted that their distribution strategy was effective, and that it was unfair to compare CPG with the two other groups, which competed in markets with greater profit and growth potential as well as much higher risk. CPG's lower margins could be justified by the stability of its operations. Unlike the other groups, which depended on a continuous stream of new products, CPG was relatively immune from the effect of an unproductive year or two in R&D, and from the uncertainty created by increasingly stringent federal standards for new products. 1 CPG's management also believed that CPG was unfairly penalized by Bio-Tech's accounting practice of allocating corporate R&D expenditures to each group according to its fraction of sales volume. Indeed, Bio-Tech's R&D activities, costing some $11M per year, were centralized in one facility. While CPG benefited from these expenditures, many of its products were by-products of Bio-Tech's basic R&D. For CPG, the $2.4M charge in 1974 was substantial in relation to profits. General had offered a non-negotiable $25M for CPG. Bio-Tech's headquarters believed that General's strategy was to use its excess cash to purchase complementary product lines, which could be marketed by its strong distribution system. Some Bio-Tech directors questioned the liquidation of such a large portion of the firm. Years had been dedicated to building the company. Was it now to be dismantled? And what were the sale's long-term policy implications? Other directors reopened the question of CPG's role in the future of Bio-Tech. All worried about the effect of a sale on Bio-Tech's financial statement and stock price. For one thing, it was pointed out that the sale of CPG for $25M could create a book loss exceeding $11.9M. Nevertheless, financial managers felt that the offer deserved serious consideration, as it would provide funds needed to finance strong growth of MPG and LPG. They thus asked for financial managers to report on BioTech's future funding needs and financing options. Bio-Tech's Financing Options Financial managers and Bio-Tech's investment banker had been forecasting Bio-Tech's financing needs (exhibit 7) and had been discussing the different alternatives to meet them. The first one was to finance the funding needs with long-term debt. Among other covenants, this option would require that at any point in time, the ratio of long-term debt and bank debt to net worth remain below 50%. An alternative source of funds was to issue equity although the financial markets' recent turmoil made this option less attractive. In particular, a majority of directors wanted to maintain a strong stock price. Finally, financial managers wondered how much of Bio-Tech’s immediate financing needs would be met by the sale of CPG. 2 Questions It is essential that you state clearly the assumptions you are making, and why you are making them. Otherwise, grading becomes impossible. Short explanations are sufficient. Also, recall that making good assumptions is less important than conducting a reasoning that is consistent with the assumptions made. Bio-Tech's management is facing three major questions. 1) How much is CPG worth to Bio-Tech? You first need to estimate CPG's value if retained by Bio-Tech, assuming (as suggested by management) that CPG benefits from R&D that Bio-Tech would undertake anyway. a) Estimate all the components of the WACC and the WACC itself, stating clearly what assumptions you are making, and why you are making them. To make grading easier, use a 14% WACC for the rest of the case. b) Forecast Free Cash Flows for the period 1975-79, as well as their present value. Again, state explicitly all assumptions you are making. c) In the following scenarios, estimate a terminal value and CPG's value to Bio-Tech: (i) CPG is liquidated at the end of 1979, (ii) no growth past 1979, (iii) 5% growth past 1979, and (iv) 8% growth past 1979. State explicitly all assumptions you are making. 2) How attractive is the sale to both parties? a) What are Bio-Tech's net after-tax proceeds if it sells CPG for $25M (i.e., how much funding does the sale of CPG provide to Bio-Tech)? b) Is the sale a good deal for Bio-Tech? And for General? c) We assumed that CPG benefits from R&D that Bio-Tech undertakes anyway. How might your answers to 2a) and 2b) change without this assumption? What issues might arise? (No calculations needed). 3 EXHIBIT 1: Bio-Tech, Inc., Company Products MPG: Reusable and disposable hypodermic syringes and needles, blood-collecting equipment, surgical blades, plastic medical tubing, medical examination gloves, diagnostic instruments, electronic thermometers, inhalation therapy and anesthesia products. LPG: Bacteriological culture media, antimicrobial sensitivity discs, tissue culture media and plastic laboratory ware, syphilis and brucellosis detection kits, injectable diagnostics, disposable pipettes, blood typing sera, cross-matching reagents, blood cell reagents. CPG: Reusable and disposable insulin syringes and needles, thermometers, elastic bandages, household and recreational gloves, athletic training room supplies. EXHIBIT 2: Bio-Tech, Inc., Ten Year Financial Review 1965 1966 1967 Sales ($ 000,000's) Net Income ($ 000,000's) Earnings Per Share Dividends Per Share 80.9 5.3 .69 .13 Market Price of Common Stock High 23 Low 13 Midpoint 18 Midpoint P/E 26 99 7.2 .88 .20 1968 1969 1970 1971 1972 1973 1974 (est) 110.8 122.8 145.3 157.7 172.8 192.7 228.8 275.4 8.1 9.2 10.9 11.7 11.1 12.8 16.5 18.1 .97 1.09 1.27 1.39 1.31 1.52 1.95 2.13 .27 .27 .33 .40 .40 .40 .47 .47 Nov. 22 1974 35 21 28 32 53 31 42 43 60 48 54 50 4 69 53 61 48 78 44 61 44 62 44 53 40 65 35 50 33 57 41 49 25 62 26 44 21 32 15 EXHIBIT 3: Bio-Tech, Inc., Income Statements for Years, 1971-1974, (000’s) 1971 1972 1973 1974 $172,803 98,225 43,375 6,438 2,700 754 $192,665 108,939 48,324 7,549 2,700 502 $228,781 127,118 57,444 8,902 2,700 812 $275,437 159,613 66,266 10,857 3,317 563 INCOME BEFORE TAXES $21,311 $24,651 $31,805 $34,821 FEDERAL INCOME TAXES 10,229 11,832 15,266 16,714 NET INCOME AFTER TAX $11,082 $12,819 $16,539 $18,107 $3,380 7,702 $3,384 9,435 $3,961 12,578 $3,965 14,142 8,447 8,457 8,488 8,492 Earnings Per Share Dividends Per Share 1.31 0.40 1.52 0.40 1.95 0.47 2.13 0.47 Capital Expenditures Depreciation 10,782 5,219 9,598 6,853 16,801 7,915 25,455 8,774 Net Sales Cost of Sales SGA expense R&D expense Interest Expense Other Common Dividends Addition to Retained Earnings Common Shares Outstanding (000's) EXHIBIT 4: Bio-Tech, Inc., Balance Sheets as of December 31, (000’s) 1972 1973 1974 ASSETS Cash and Marketable Securities Accounts Receivable Inventory Other Total Current Assets $32,212 $18,935 $3,251 30,892 39,117 50,019 44,376 58,545 78,730 4,551 4,476 4,091 $112,031 $121,073 $136,091 Net Fixed Assets Other 59,835 3,980 TOTAL ASSETS 68,721 3,176 85,402 2,561 $175,846 $192,970 $224,054 LIABILITIES AND NET WORTH Bank Loans Accounts Payable Accrued Expenses Current Maturities, Long Term Debt Total Current Liabilities $0 12,698 9,651 0 $22,349 $0 15,114 11,445 0 $26,559 $12,258 17,525 13,678 5,000 $48,461 Long Term Debt Stockholders' Equity 45,000 108,497 45,000 121,411 40,000 135,593 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $175,846 $192,970 $224,054 5 EXHIBIT 5: Bio-Tech, Inc., Selected Financial Data by Groups, ($000,000’s) Sales and Profit Performance 1971 1972 1973 1974 (est.) Medical Products Group Sales EBIT1 EBIT as a Percentage of Sales 92.7 15.5 16.7% 102.1 17.1 16.8% 122.3 21.3 17.4% 148.5 24.0 16.2% Laboratory Products Group Sales EBIT1 EBIT as a Percentage of Sales 39.8 4.6 11.7% 46.6 5.8 12.4% 57.3 8.1 14.1% 73.3 9.0 12.3% Consumer Products Group Sales EBIT1 EBIT as a Percentage of Sales 40.3 3.9 9.6% 44.0 4.4 10.1% 49.2 5.1 10.4% 53.6 5.1 9.5% Five Year Plan Projections 2 1975 1976 1977 1978 Medical Products Group Sales EBIT (.17*Sales)1 Capital Expenditures Depreciation Investment in Working Capital 1979 176.5 30.0 8.6 5.7 13.0 209.6 35.6 17.0 5.8 10.8 249.0 42.3 12.0 6.6 14.5 295.8 50.3 17.0 6.9 16.7 351.4 59.8 15.6 7.6 21.6 Laboratory Products Group Sales (.13*Sales)1 EBIT1 Capital Expenditures Depreciation Investment in Working Capital 88.7 11.5 16.0 3.1 7.8 107.2 13.9 10.7 3.6 7.8 129.7 16.9 9.0 4.7 8.0 156.9 20.4 14.0 5.2 8.9 189.8 24.7 12.7 6.3 10.5 Consumer Products Group Sales (.10*Sales) EBIT1 Capital Expenditures Depreciation Investment in Working Capital 59.0 5.9 0.7 1.4 2.5 65.0 6.5 1.0 1.7 2.7 71.7 7.2 1.5 2.1 3.0 78.9 7.9 2.0 2.5 3.4 87.0 8.7 2.7 3.1 3.7 ________________________________________________________________________________________________________________________ 1 2 R&D expenditures are allocated to each group according to sales volume. Assumes annual inflation rate of 8%. 6 EXHIBIT 6 7 EXHIBIT 7: Bio-Tech, Inc., Proforma Balance Sheets, 1975-79 Assuming CPG is retained, ($000,000’s) 1974 1975 1976 1977 1978 1979 ASSETS Cash and Marketable Securities Accounts Receivable and Inventory (.48*change in sales) Other Total Current Assets $3.3 $3.3 $3.3 $3.3 $3.3 $3.3 128.7 4.1 $136.1 155.6 5.0 $163.9 183.2 5.0 $191.5 216.2 5.0 $224.5 255.2 5.0 $263.5 301.6 5.0 $309.9 Net Fixed Assets Other Total Assets 85.4 2.6 $224.1 100.5 3.0 $267.4 118.1 3.0 $312.6 127.2 3.0 $354.7 145.6 3.0 $412.1 159.6 3.0 $472.5 Bank Debt Accounts Payable and Accrued Expenses (11%*change in sales) Current Portion, Long-term Debt Total Current Liabiities $12.3 $12.3 $12.3 $12.3 $12.3 $12.3 31.2 5.0 $48.5 35.7 5.0 $53.0 42.0 5.0 $59.3 49.5 5.0 $66.8 58.5 5.0 $75.8 69.1 5.0 $86.4 Long-term Debt Stockholders' Equity 40.0 135.6 35.0 152.7 30.0 173.3 25.0 198.1 20.0 227.7 15.0 263.1 0 26.7 50 64.8 88.6 108 $224.1 $267.4 $312.6 $354.7 $412.1 $472.5 LIABILITIES AND NET WORTH Funds Need TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY EXHIBIT 8: Bio-Tech, Inc., Proforma Income Statement, 1975-79 Assuming CPG is retained ($000,000’s) 1974 1975 1976 1977 1978 1979 $275.4 38.1 3.3 $324.1 47.4 3.6 $381.8 56.0 3.3 $450.4 66.4 3.0 $531.6 78.6 2.7 $628.2 93.2 2.4 Income Before Taxes Net Income After Tax 34.8 18.1 43.8 22.8 52.7 27.4 63.4 33.0 75.9 39.5 90.8 47.2 Dividends (.25*Net Income) Addition to Retained Earnings 4.0 14.1 5.7 17.1 6.8 20.6 8.2 24.8 9.9 29.6 11.8 35.4 Sales EBIT Interest Expense1 _______________________________________________________________________________________________________________________ 1 Does not include the interest expense on any new debt issues. 8 EXHIBIT 9: CPG Asset Position 1974, (000’s) ASSETS 1 Cash 2 Net Working Capital Net Fixed Assets Total Assets (Net) $ $ 0 24,136 12,800 36,936 __________________________________________________________________ 1 Bio-Tech employs a centralized cash management system administered by corporate headquarters. 2 Consists of: Accounts Receivable $ 12,486 Inventory 17,547 Accounts Payable 3,217 Accrued Expenses 2,680 EXHIBIT 10: Outlook for the Medical Products Industry: Research Update By Grim, Turcotte, Rots and Shoemaker, Inc The recent reports from some firms in the medical products industry that orders have slowed recently do not call for a revision of our optimistic outlook for the industry over the next five years. We expect a very modest slowdown in sales growth for 1975. This is primarily due to cash-short hospitals attempting to cut back inventories to the lowest possible levels. Hospital admissions continue their increase in 1975; the problem is not a shortage of patients but their ability to pay their bills. The proposal, now being considered in the U.S. Senate, to appropriate funds to continue expiring health care benefits for laid-off workers should help ameliorate some of the potential cash flow crises. Earnings prospects for the medical products industry are excellent. We continue to project and average growth in earnings of 15% for the next five years – which compares favorably with the average growth rate of 12% experienced by the industry in the 1965-1974 period. Continued strength in overseas earnings will contribute to this growth, as will continued extensions of private and public insurance programs in the United States, especially Medicare and Medicaid. The following table presents the five-year earnings outlook for the five major medical products companies that were reviewed in our research report of last month. Company American Hospital Supply Abbott Laboratories Baxter Laboratories Beckon-Dickinson Johnson & Johnson Industry Average Projected 1975-1980 EPS Growth Rate Actual 1965-1974 EPS Growth Rate Recent Price-Earnings Ratio 14.0% 13.5 19.0 13.5 15.5 15.5% 9.0 19.0 14.5 20.5 19 12 24 16 28 15.1 12.1 20 9 EXHIBIT 11, Bio-Tech, Inc., Information on Selected Medical Products Companies Sales ($ 000,000) Earnings Per Share Dividends Per Shar P/E (with average price) Common Stock Price Range High Low Beta (1973 Year End Estimate) After Tax Return on Equity Capitalization (Book Values) Short Debt Long Debt ($ 000) Equity Bond Ratings Interest Coverage (1973) Shares Outstanding (1973) Sales ($ 000,000) Earnings Per Share Dividends Per Shar P/E (with average price) Common Stock Price Range High Low Beta (1973 Year End Estimate) After Tax Return on Equity Capitalization (Book Values) Short Debt Long Debt ($ 000) Equity Bond Ratings Interest Coverage (1973) Shares Outstanding (1973) 1970 457 2.92 1.10 23 ABBOTT LABS 1971 1972 458 521 1.71 2.88 1.10 1.10 41 26 78 56 85 54 88 64 15.5% 8.7% 13.4% 40,577 47,169 258,842 12.3 19,248 32,852 90,244 91,693 267,521 293,396 Debentures Aa 4.8 7.4 13,625,275 BECTON-DICKINSON 1970 1971 1972 222 255 289 1.08 1.03 1.24 .30 .30 .30 42 35 34 62 27 47 25 50 33 13.1% 11.3% 12.6% 1973 620 3.35 1.20 19 AMERICAN HOSPITAL SUPPLY 1970 1971 1972 1973 510 576 688 829 0.76 0.85 0.99 1.13 0.24 0.26 0.27 0.28 48 41 47 39 80 47 0.92 14.1% 47 26 40 30 55 37 9.0% 9.4% 10.1% 93,216 98,825 325,807 5,037 17,610 286,234 6 41.2 1973 340 1.45 .35 26 45 33 1.39 13.1% 1,603 6,168 6,002 15,239 77,715 78,463 81,100 76,464 133024 145,788 165,732 186,558 Conv. Subord. Debs. Baa 10.0 7.8 9.1 10.2 16,914,052 10 9,491 7,785 14,916 14,114 307,320 335,735 Not Available 41 48.6 35,302,493 52 36 1.26 10.7% 24,335 18,893 372,157 27.4 JOHNSON & JOHNSON 1970 1971 1972 1,002 1,140 1,317 1.51 1.82 2.15 .34 .43 .45 32 43 53 60 37 100 56 133 94 15.7% 16.4% 16.5% None 25,494 533,829 102.2 None None 20,153 31,475 622,324 732,878 Not rated 74.7 75.6 57,523,443 1970 187 0.52 0.10 52 BAXTER LABS 1971 1972 242 278 0.68 0.77 0.11 0.13 48 60 35 19 39 25 56 35 11.8% 11.4% 11.5% 1973 355 0.95 0.15 54 61 41 1.1 12.4% 9,597 8,177 23,650 40,490 95,802 148,726 147,992 186,609 121,333 168,252 193,374 224,771 Conv.Subord. Debs. Ba 5.8 5.8 7.2 6.4 29,350,000 BIO-TECH 1971 1972 173 193 1.31 1.52 .40 .40 40 33 1973 1,611 2.59 .52 45 1970 158 1.39 .40 44 132 101 0.94 16.2% 78 44 62 44 65 35 12.9% 11.2% 11.9% 15,339 40,569 868,372 0 45,000 91,360 53.0 8.4 0 0 45,000 45,000 99,062 108,497 Not rated 8.9 10.1 8,492,000 1973 229 1.95 .47 25 57 41 1.28 13.6% 17,258 40,000 121,411 12.8 Answers Question 1.a. Debt ratio D/(D+E). We want the target debt ratio D/(D+E) with market values for CPG as a stand-alone. One way to try and estimate this is to examine the debt ratio of firms in the same industry. To save time, we only examine the closest comps, Abbott and Abbott Labs J&J STD ($ M) 93.2 15.3 LTD ($ M) 98.8 40.6 average P/E 192.0 19 55.9 45 average # shares stock price (millions) 3.35 63.7 13.6 2.59 116.6 57.5 D EPS E ($M) 867.2 6,701.6 D/(D+E) 18% 1% J&J. Are these ratios likely to be close to the target? Even without going through the checklist, we see that J&J's 1% is probably below the optimal ratio. We take a conservative 10%. Cost of debt capital kD. We want the expected return to CPG's creditors if it were a stand-alone with a 10% debt ratio. One way to estimate this is to determine CPG's debt rating. Abbott's rating is Aa, with an 18% leverage ratio. CGP's rating may be about the same or better. Recent yields on Aaa-rated bonds are about 9% (ex. 6). For a debt ratio as low as 10%, kD is close to the interest rate. We take a conservative 10%. Marginal tax rate t. If we are trying to determine the value of CPG to Bio-tech, we should use Bio-Tech's marginal tax rate. From ex.8, we have: t = 1-(after-tax income/ before-tax income) = 1 - (47.2/90.8) = 48%. Cost of equity capital kE. We want the expected return to CPG's shareholders if it were a stand-alone with a 10% debt ratio. First, unlever the closest comps' equity beta. Abbott Labs J&J Average E D/(D+E) E/(D+E) 0.92 18% 82% 0.94 0.01 99% 0.75 0.93 0.84 Both A are not too different from each other. We use the average (0.84) as our estimate of CPG's asset beta, and relever it using the 10% debt ratio: E =1/(1-10%)*0.84 = 0.93. We then use the CAPM. For the market risk premium, we use the historical average of 8%. For the risk-free rate, we use the yield on long-term government securities, 7%. kE = 7% + 0.93 * 8% = 14.4% 11 WACC. Altogether we have WACC = 10% * 10% * (1-48%) + 90% * 14.4% = 13.5% From now on, we use WACC= 14% as indicated in the question. Question 1.b. Bio-Tech charges CPG for R&D expenditures that would be undertaken anyway ($2.4M in 1974). These expenditures are not incremental to CPG and should be added back to the EBIT. Thus in 1974, EBIT/Sales = (5.1+2.4) / 53.6 = 14%. Sales EBIT (= 14% * Sales) EBIT(1-t) Dep CAPX NWC FCF PV @ 14% 1975 59.0 8.3 4.3 1.4 0.7 2.5 2.5 9.5 1976 65.0 9.1 4.7 1.7 1.0 2.7 2.7 1977 71.7 10.0 5.2 2.1 1.5 3.0 2.8 1978 78.9 11.0 5.7 2.5 2.0 3.4 2.8 12 1979 87.0 12.2 6.3 3.1 2.7 3.7 3.0 Question 1.c. Liquidation. If the firm is shut down in 1979 and NWC is recovered fully, then TV = NWC + SV - (SV - PPE)*t. Further assuming that SV = 0, then TV = NWC + PPE*t. NWC79 = NWC74 (ex.9)+Sum of all NWC= 24.1+(2.5+2.7+3.0+3.4+3.7) = 39.4 PPE79 = PPE74 (ex.9) + Sum of all CAPX - Sum of all Depreciation = 12.8 + (0.7+1.0+1.5+2.0+2.7) - (1.4+1.7+ 2.1+2.5+3.1) = 9.9 Altogether, TV = 39.4 + 9.9 * 48% = $44.1M and PVTV = 44.1/(1.14)5 = 22.9 PG's value to Bio-Tech is 9.5 + 22.9 = $32.4M Perpetuity. Here are some scenarios with different growth rates g% 0 5 8 TV @14% 21.4 33.3 50.0 PV of TV@14% 11.1 17.3 26.0 CPG Value 20.6 26.8 35.5 It looks like it’s better to liquidate unless CPG can grow at 8%. Question 2.a. Bio-Tech would get the $25M. The book value of CPG = $24.1 + $12.8 = $36.9M. Since they realize a book loss of $11.9M, they will get a tax credit of 48%*11.9 = $5.7M. Altogether, net after-tax proceeds are $30.7M. Question 2.b. Under two of the scenarios (8% growth and liquidation), the proceeds from the sale are less than the value to Bio-Tech, which means this would not be a good deal for Bio-Tech. Under the other two scenarios (0% growth and 5% growth), this would be a good deal. For General paying $25M, this is a good deal under all scenarios except for 0% growth. Moreover, they might improve operations (they have better distribution channels). Question 2.c. 13 Suppose that some R&D costs are due to CPG. For Bio-Tech the sale is more attractive: It allows to reduce R&D costs, or to license this R&D to Generals or rivals (caveat: managers are not confident in patent protection). For Generals, the sale is less attractive unless they are already doing this R&D anyway (as is currently the case for Bio-Tech). 14