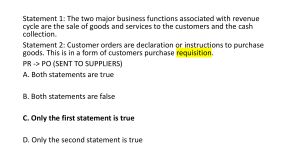

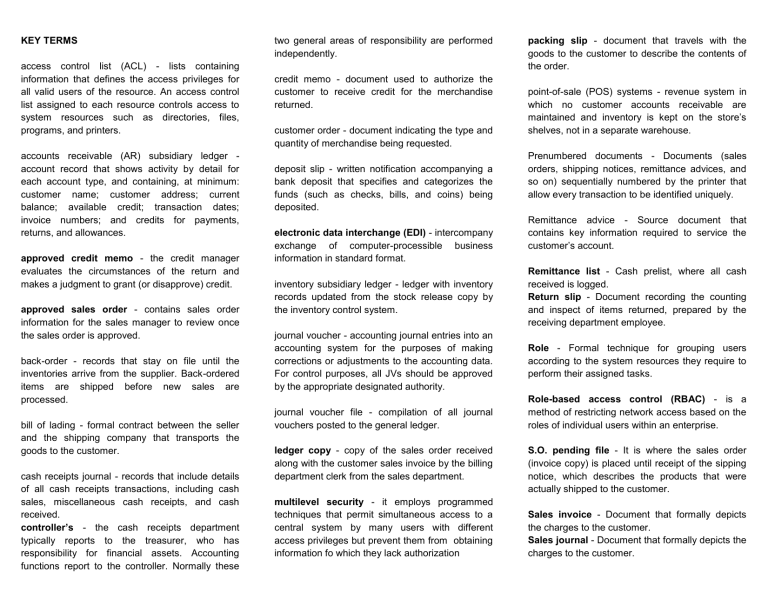

KEY TERMS access control list (ACL) - lists containing information that defines the access privileges for all valid users of the resource. An access control list assigned to each resource controls access to system resources such as directories, files, programs, and printers. accounts receivable (AR) subsidiary ledger account record that shows activity by detail for each account type, and containing, at minimum: customer name; customer address; current balance; available credit; transaction dates; invoice numbers; and credits for payments, returns, and allowances. approved credit memo - the credit manager evaluates the circumstances of the return and makes a judgment to grant (or disapprove) credit. approved sales order - contains sales order information for the sales manager to review once the sales order is approved. back-order - records that stay on file until the inventories arrive from the supplier. Back-ordered items are shipped before new sales are processed. bill of lading - formal contract between the seller and the shipping company that transports the goods to the customer. cash receipts journal - records that include details of all cash receipts transactions, including cash sales, miscellaneous cash receipts, and cash received. controller’s - the cash receipts department typically reports to the treasurer, who has responsibility for financial assets. Accounting functions report to the controller. Normally these two general areas of responsibility are performed independently. credit memo - document used to authorize the customer to receive credit for the merchandise returned. customer order - document indicating the type and quantity of merchandise being requested. deposit slip - written notification accompanying a bank deposit that specifies and categorizes the funds (such as checks, bills, and coins) being deposited. electronic data interchange (EDI) - intercompany exchange of computer-processible business information in standard format. packing slip - document that travels with the goods to the customer to describe the contents of the order. point-of-sale (POS) systems - revenue system in which no customer accounts receivable are maintained and inventory is kept on the store’s shelves, not in a separate warehouse. Prenumbered documents - Documents (sales orders, shipping notices, remittance advices, and so on) sequentially numbered by the printer that allow every transaction to be identified uniquely. Remittance advice - Source document that contains key information required to service the customer’s account. inventory subsidiary ledger - ledger with inventory records updated from the stock release copy by the inventory control system. Remittance list - Cash prelist, where all cash received is logged. Return slip - Document recording the counting and inspect of items returned, prepared by the receiving department employee. journal voucher - accounting journal entries into an accounting system for the purposes of making corrections or adjustments to the accounting data. For control purposes, all JVs should be approved by the appropriate designated authority. Role - Formal technique for grouping users according to the system resources they require to perform their assigned tasks. journal voucher file - compilation of all journal vouchers posted to the general ledger. ledger copy - copy of the sales order received along with the customer sales invoice by the billing department clerk from the sales department. multilevel security - it employs programmed techniques that permit simultaneous access to a central system by many users with different access privileges but prevent them from obtaining information fo which they lack authorization Role-based access control (RBAC) - is a method of restricting network access based on the roles of individual users within an enterprise. S.O. pending file - It is where the sales order (invoice copy) is placed until receipt of the sipping notice, which describes the products that were actually shipped to the customer. Sales invoice - Document that formally depicts the charges to the customer. Sales journal - Document that formally depicts the charges to the customer. Sales order - Source document that captures such vital information as the name and address of the customer making the purchase; the customer’s account number; the name, number, and description of the product; the quantities and unit price of the items sold; and other financial information. Sales order (credit copy) - Copy of sales order sent by the receive-order task to the check-credit task. It is used to check the credit-worthiness of a customer. Sales order (invoice copy) - Copy of sales order to be reconciled with the shipping notice,. It describes the products that were actually shipped to the customer. Shipping log - Specifies orders shipped during the period. Shipping notice - Document that informs the billing department that the customer’s order has been filled and shipped. Stock records - Formal accounting records for controlling inventory assets. Stock release - Document that identifies which items of inventory must be located and picked from the warehouse shelves. Universal product code (UPC) - Label containing price information (and other data) that is attached to items purchased in a point-of-sale system. Verified stock release - After stock is picked, verification of the order for accuracy and release of the goods. REVIEW QUESTIONS 1. What document initiates the sales process? A customer order usually in the form of a purchase order initiates the sales process 2. Distinguish between a packing slip, a shipping notice, and a bill of lading. The packing slip is the document that travels with the goods to the customer to describe the contents of the order. The shipping notice is another document which is forwarded to the billing function as evidence of that the customer’s order was filled and shipped and it conveys pertinent new facts such as the date of shipment, the items and quantities actually shipped, the name of the carrier, and freight charges. The bill of lading is a formal contract between the seller and the shipping company(carrier) to transport the goods to the customer and it establishes legal ownership and responsibility for asset in transit. 3. What function does the receiving department serve in the revenue cycle? When items are returned, the receiving department employee counts, inspects, and prepares a return slip describing the items. The goods, along with a copy of the return slip, go to the warehouse to be restocked. The employee then sends the second copy of the return slip to the sales function to prepare a credit memo. The sales return process begins in the receiving department, where personnel receive, count, inspect for damage, and send returned products to the warehouse. The receiving clerk prepares a return slip, which is forwarded to the sales department for processing. 4. The general ledger clerk receives summary data from which department? What form of summary data? General ledger clerk receives an accounts receivable summary from accounts receivable department and a journal voucher summary from Cash receipt department. 5. What are the three authorization controls The three authorization controls are the following: 1. Credit check 2. Return policy 3. Remittance list 6. What are the three rules that ensure that no single employee or department processes a transaction in its entirety? a. Transaction authorization should be separate from transaction processing. b. Asset custody should be separate from the task of asset record keeping. c. The organization should be structured so that the perpetration of a fraud requires collusion between two or more individuals. 7. At which points in the revenue cycle are independent verification controls necessary? Independent verification controls in the revenue cycle exist at the following points: 1. The shipping function verifies that the goods sent from the warehouse are correct in type and quantity. Before the goods are sent to the customer, the stock release document and the packing slip are reconciled. 2. The billing function reconciles the original sales order with the shipping notice to ensure that customers are billed for only the quantities shipped. 3. Prior to posting to control accounts, the general ledger function reconciles journal vouchers and summary reports prepared independently in different function areas. The billing function summarizes the sales journal, inventory control summarizes the changes in the inventory subsidiary ledger, the cash receipts function summarizes the cash receipts journal, and accounts receivable summarizes the AR subsidiary ledger. 8. What is the purpose of physical controls? Purpose of this section is to support the system concepts presented in the previous section with models depicting people, organizational units, and physical documents and files. This helps you envision the segregation of duties and independent verifications, which are essential to effective internal control regardless of the technology in place. In addition, it highlights inefficiencies intrinsic to manual systems, which gave rise to modern systems using improved technologies. 9. How can we prevent inventory from being reordered automatically each time the system detects a low inventory level? The on-order information will prevent items from being accidentally reordered and will assist customer service clerks in advising customers as to the status of inventory and expected due dates for out-of-stock items. 10. Distinguish between an edit run, a sort run, and an update run. An edit run is the first run; it detects most data entry errors. Only "clean" data progresses to the sort run. The sort run sequences the transaction records according to its primary key field and possibly a secondary key field. Once the data is sorted, the update program posts the transactions to the appropriate corresponding records in the master file. During a sequential update, each record is copied from the original master file to the new master file regardless of whether the balance is affected decisions about existing customers that involve ensuring only that the current transaction does not exceed the customer's credit limit may be dealt with very quickly. 11. What are the key features of a POS system? A point of sale system immediately records both cash and credit transactions and inventory information. The sales journal, accounts receivable, and inventory accounts may be updated in real-time, or a transaction file may be used to later update a master file. 14. Why does billing receive a copy of the sales order when the order is approved but does not bill until the goods are shipped? The billing department's receipt of the sales order occurs in most instances before the goods are actually shipped; thus, the economic event is not complete. Some of the goods may not be available to ship; thus, the customer should not be billed until the goods are shipped and the economic event is complete. 12. How is a credit check in the advanced technology systems fundamentally different from a credit check in the basic technology system? In the advanced technology system, the system logic, not a human being, makes the decision to grant or deny credit based on the customer's credit history contained in the credit history file. If credit is denied, the sales clerk should not be able to force the transaction to continue. In the basic technology system, credit checking of prospective customers is a function of the credit department, which has responsibility for ensuring the proper application of the firm's credit policies. The complexity of credit procedures will vary depending on the organization, its relationship with the customer, and the materiality of the transaction. Credit approval for first-time customers may take time and involve consultation with an outside credit bureau. In contrast, credit 13. What is multilevel security? Multilevel security employs programmed techniques that permit simultaneous access to a central system by many users with different access privileges but prevents them from obtaining information for which they lack authorization 15. Why was EDI devised? EDI technology was devised to expedite routine transactions between manufacturers and wholesalers and between wholesalers and retailers. The customer’s computer is connected directly to the seller’s computer via telephone lines. When the customer’s computer detects the need to order inventory, it automatically transmits an order to the seller. The seller’s system receives the order and processes it automatically. This system requires little or no human involvement. 16. What assets are at greatest risk in a POS system? Inventory and cash. Customers have direct access to inventory in the POS system. 17. In a manual system, after which event is the sales process should the customer be billed? Shipment of goods marks the completion of the economic event and the point at which the customer should be billed. Upon receipt of the shipping notice and stock release, the billing clerk compiles the relevant facts about the transaction (product prices, handling charges, freight, taxes, and discount terms) and bills the customer. 18. What is bill of lading? A bill of lading is a formal contract between the seller and the shipping company that transports the goods to the customer. It also serves as a shipment receipt when the carrier delivers the goods at a predetermined destination. This document must accompany the shipped products, no matter the form of transportation, and must be signed by an authorized representative from the carrier, shipper, and receiver. 19. What documents initiates the billing process? The shipping notice is proof that the product has been shipped and is the trigger document that initiates the billing process. 20. Where in the cash receipts process does supervision play an important role? Supervision plays an important role in the mail room where both the check (asset) and remittance advice (accounting records) are in the hands of one person. Mail room fraud can result, which involves stealing the check and destroying the remittance advice to cover the theft. DISCUSSION QUESTIONS 1. Why do firms have separate departments for warehousing and shipping? What about warehousing and inventory control? Doesn’t this just create more paperwork? The separation of the warehouse and the shipping department allows for segregation of functions over two departments for the custody of the assets during two distinct phases of the revenue cycle. The warehouse attendants have custody over the finished goods until they receive a stock release form from the sales department. The warehouse clerks pick the inventory items from the warehouse and send them to shipping along with a copy of the stock release form. The shipping department is only able to ship goods that it receives from the warehouse personnel. Further, it must match the goods with a packing slip and shipping notice that originates from the sales department. Thus, warehouse personnel are not allowed to ship out any unauthorized inventory items because the shipping personnel would not have the corresponding paperwork. The additional paperwork required is considered a necessary cost for the added benefit of control over inventory. The warehouse personnel do not keep the formal accounting records. The asset custodial tasks must be kept separate from the formal record-keeping tasks. The inventory control keeps the formal accounting records of inventory stock items. 2. Distinguish between the sales order, billing, and AR departments. Why can’t the sales order or AR departments prepare the bills? The sales order department (included in the sales department in the text) is responsible for taking the customer order and placing it into a standard format. This department records information such as the customer's name, address, account number, quantities and units of each item, discounts, freight preferences, etc. The sales order processing may, in some instances, play a role in verifying or determining the promised shipping date. The billing department receives a copy of the sales order from the sales department. Upon receipt of the shipping notice and the stock release documents, the billing department prepares the sales invoice, which is the customer's bill reflecting charges for items shipped, which may be different from items ordered, taxes and freight, and any discounts offered. The sales order department should not prepare the bills because the salespeople may bill their favorite clients less than they should be billed. The salespeople place the order, and thus start the wheels in motion for inventory to be shipped. Further, the salespeople should not be allowed to determine how much the customers pay for their inventory, because they may be tempted to charge lower prices and receive kickbacks. The accounts receivable department receives the sales orders and posts them to the accounts receivable subsidiary ledger. As remittance advices are received, they are posted to the customer's account in the accounts receivable subsidiary ledger. The accounts receivable department should not be allowed to prepare the bills since this department has custody over the accounts receivable assets. Accounts receivable personnel record customer payments and track unpaid bills by customers. If they were allowed to prepare the bills, they might not bill certain customers and receive a kickback from the customers for the free goods. 3. Explain the purpose of having mail room procedures. The checks received in payment for accounts receivable are a crucial asset for the firm. These checks must be protected from individuals who might try to deposit these checks into their own accounts. The process of having a member of the mailroom personnel open the mail and record all checks received before they are routed to the cashier or the accounts receivable department is to ensure that the accounts receivable personnel do not engage in such activities as lapping the accounts receivable accounts. 4. Explain how segregation of duties is accomplished in an integrated data processing environment. In this environment, segregation of duties is accomplished through multilevel security procedures. Multilevel security employs programmed techniques that permit simultaneous access to a central system by many users with different access privileges but prevents them from obtaining information for which they lack authorization. 5. How could an employee embezzle funds by issuing an unauthorized sales credit memo if the appropriate segregation of duties and authorization controls were not in place? An employee who has access to incoming payments, either cash or check, as well as the authorization to issue credit memos may pocket the cash or check of a payment for goods received. This employee could then issue a credit memo to this person's account so that the customer does not show a balance due. 6. What task can the AR department engage in to verify that all customer’s checks have been appropriately deposited and recorded? The company should periodically, perhaps monthly, send an account summary to each customer listing invoices and amounts paid by check number and date. This form allows the customer to verify the accuracy of the records. If any payments are not recorded, they will notify the company of the discrepancy. These reports should not be handled by the accounts receivable clerk or the cashier. 7. Why is access control over revenue cycle documents just as important as the physical control devices over cash and inventory? Access control to the billing and accounts receivable records that are part of the revenue cycle is just as important as the physical control devices over cash and inventory because these records affect the collectability of an asset— accounts receivable—which should eventually be converted into cash. If these records are not adequately controlled, inventory may not be ultimately converted into the cash amount deserved by the firm. 8. How can reengineering of the sales order processing subsystem be accomplished using the Internet? In the past decade, the Internet has become an integral part of our everyday lives, its ability to quickly gather the data we need in a matter of seconds vastly improve a company's margin of error. With the Internet's ability to quickly process and gather data, it would greatly improve sales order processing subsystem by automating much of the data processing and ensuring the margin profit is high through lower rate of error. With the ability to quickly determine the inventory level, it will reduce extra cost a company may incur due to backorder items and will prevent a company from over selling items causing customers to lose faith in the company. 9. What financial statement misrepresentations may result from an inconsistently applied credit policy? Be specific. Financial misinterpretations are made by showing the financial figures in such a way that the overall financial position of the company looks healthier than what is in real life. This can be done in many ways like over evaluation of assets and under evaluation of liabilities. Credit policy implies that the terms at which credits are forwarded to the organization's customer. Inconsistently applied credit policies may result in an overstatement of accounts receivable. Nonstandard or substandard customers having long dues can be provided with further credits, this would result in an overstatement of accounts receivable 10. Give three examples of access control in a POS system. A. Assign each clerk to a separate cash register for an entire shift. When the clerk leaves the register to take a break, the cash drawer should be locked to prevent unauthorized access. B. Magnetic tags are attached to merchandise, which will sound an alarm when removed from the store. C. Locked showcases are used to display jewelry and costly electronic equipment. 11. Discuss the trade-off in choosing to update the general ledger accounts in real time versus batch. In real-time processing, changes are updated in real-time as and when such changes occur; whereas, in batch processing changes are grouped and each group is processed in a single batch. In choosing between real-time or batch update, the following points could be taken into consideration. If the basis is updating method, in real-time processing changes are made at the time such changes occur while in batch processing, updates are accumulated and are processed in batches. If the basis is staffing requirements, in real-time processing it increases while batch processing does not require the recruitment of additional staff. 12. If an automated credit checking function denies a customer credit, should the sales clerk ever be authorized to override the decision? If so when? The sales clerk is not authorized to override the decision because within the revenue cycle, the credit department is segregated from the rest of the process so formal authorization of a transaction is an independent event. Often, compensation for sales staff is based on their individual sales performance. In such cases, sales staff have an incentive to maximize sales volume and thus may not adequately consider the creditworthiness of prospective customers. By acting in an independent capacity, the credit department may objectively detect risky customers and disallow poor and irresponsible sales decisions. 13. How can advanced technology transaction processing systems reduce fraud? Advanced technology transaction processing systems reduce fraud in such a way that there is authorization of transactions. The objective of this is to ensure that only valid transactions are being processed and thus reducing the occurrence of fraud. 14. What makes POS systems different from revenue cycles of manufacturing firms? In point-of-sale systems, the customer literally has possession of the items purchased, thus the inventory is in hand. Typically, for manufacturing firms, the order is placed and the good is shipped to the customer at some later time period. Thus, updating inventory at the time of sale is necessary in point-of-sale systems since the inventory is changing hands, while it is not necessary in manufacturing firms until the goods are actually shipped to the customer. Also, POS systems are used extensively in grocery stores, department stores, and other types of retail organizations. Generally, only cash, checks, and bank credit card sales are valid. Unlike manufacturing firms, the organization maintains no customer accounts receivable. Unlike some manufacturing firms, inventory is kept on the store's shelves, not in a separate warehouse. The customers personally pick the items they wish to buy and carry them to the checkout location, where the transaction begins. Shipping, packing, bills of lading, etc. are not relevant to POS systems. place, no individual in either the buying or selling company actually authorizes or approves a particular EDI transaction. In its purest form, the exchange is completely automated. EDI poses unique control problems for an organization. One problem is ensuring that, in the absence of explicit authorization, only valid transactions are processed. Another risk is that a trading partner, or someone masquerading as a trading partner, will access the firm’s accounting records in a way that is unauthorized by the trading partner agreement. 15. Is a POS system that uses bar coding and a laser light scanner foolproof against inaccurate updates? Discuss. First, the checkout clerk scans the universal product code (UPC) label on the items being purchased with a laser light scanner. The scanner, which is the primary input device of the POS system, may be handheld or mounted on the checkout table. The POS system is connected online to the inventory file from which it retrieves product price data and displays this on the clerk’s terminal. The inventory quantity on hand is reduced in real time to reflect the items sold. As items fall to minimum levels, they are automatically reordered. When all the UPCs are scanned, the system automatically calculates taxes, discounts, and the total for the transaction. 17. Discuss the two common methods of achieving multilevel security in a system. Two methods for achieving multilevel security are the access control list (ACL) and rolebased access control (RBAC). Through these techniques, purchasing, receiving, AP, cash disbursement and general ledger are limited in their access based on the privileges assigned to them. 16. How is EDI more than technology? What unique control problems may it pose? EDI is more than just a technology. It represents a business arrangement between the buyer and seller in which they agree, in advance, to the terms of their relationship. For example, they agree to the selling price, the quantities to be sold, guaranteed delivery times, payment terms, and methods of handling disputes. These terms are specified in a trading partner agreement and are legally binding. Once the agreement is in MULTIPLE CHOICE QUESTION 1. Which function or department records a sale in the sales journal? C. sales department In accounting system, one of the special journals is sales journal. In this, only sales made by a company on account are recorded. Credit sales of inventory and merchandise are recorded in this journal. 2. Which functions should be segregated? B. Picking goods from the warehouse shelves and updating the inventory subsidiary ledger The function segregated is opening the mail and recording the cash receipts in the journal. Segregation duties are very important to the internal control structure as it founds the faults in the system. Its main duties are approval, accounting and asset custody. The above-mentioned function is used in reconciling or accounting purpose. The person who performs the above function cannot make the deposit. In his duties no person can perform the same task. Different job assignments are provided to different person according to shift wise. 3. Which of the following is incompatible task? C. The AR clerk authorizes the write-off of bad debts Weak internal control structure: Account receivable clerk authorizes the write-off bad debts indicates the weak internal control structure. The effective internal control structure is that all the accounting records get matched when the audit takes place. If there is no control on the accounting records that means the internal control structure is weak. Reduced records of transfers between warehouse often results in the ineffective controls in internal structure. 4. Which control helps to ensure that the inventory items shipped to the customer are the correct type and the correct amount? D. Reconcile stock release document and packing slip The effective control that helps ensuring a check of the inventory systems that shipped to the customer are correct type and amount, a proper and effective reconciliation of stock release document with the packing slip. legal ownership and responsibility for assets in transit. 5. The bill of lading is prepared by C. Shipping clerk The shipping clerk packages to goods, attaches the packing slip, completes the shipping notice, and prepares a bill of lading. 8. Which of the following sets of tasks should not be separated? E. All of the above tasks should be separated As a part of independent verification control, duties must be segregated between the employees to avoid fraud in cash transactions. 6. Which of the following is NOT an independent verification control? D. The billing department reconciles the shipping notice with the sales invoice to ensure that customers are billed for only the quantities shipped. The cashier collects the cash receipts from the customers and presents remittance advices, to ensure that the amounts are entered properly for reconciliation. As a part of independent verification control, duties must be segregated between the employees to avoid fraud in cash transactions. In other words, cash collections should be made by one employee and the remittances should be made by another employee to avoid cash have any falsification of information In the present case, both the cash receipts and cash remittances are handled by a single person only. It will lead to fraud by the employee and falsification of financial information. Therefore, it is not an independent verification control. 7. Which department defines terms for shipped goods ownership? D. Bill of Lading The bill of lading is a formal contract between the seller and the shipping company to transport the goods to the customer. This ownership establishes 9. Which of the following is often called a compensating control? A.Supervision Implementing adequate segregation of duties requires that a firm employ a sufficiently large number of employees. Achieving adequate segregation of duties often presents difficulties for small organizations. Obviously, it is impossible to separate five incompatible tasks among three employees. Therefore, in small organizations or in functional areas that lack sufficient personnel, management must compensate for the absence of segregation controls with close supervision. For this reason, supervision is often called a compensating control. 10. Which document triggers the billing function? A. Shipping notice The shipping notice provides proof that the product has been shipped and is the trigger document that initiates the billing process.