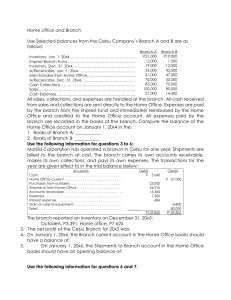

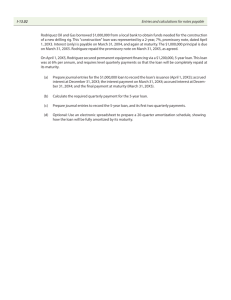

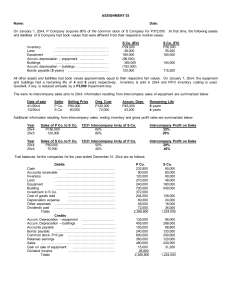

ACCA REVISION MOCK C March 2018 Question paper Time allowed 3 hours and 15 minutes Section A: All FIFTEEN questions are compulsory and MUST be attempted. Section B: All THREE questions are compulsory and MUST be attempted. Section C: BOTH questions are compulsory and MUST be attempted. Do NOT open this paper until instructed by the supervisor. This question paper must not be removed from the examination hall. Kaplan Publishing/Kaplan Financial Paper F7 Financial Reporting P AP E R F7 : FINAN CIAL RE POR TIN G © Kaplan Financial Limited, 2018 The text in this material and any others made available by any Kaplan Group company does not amount to advice on a particular matter and should not be taken as such. No reliance should be placed on the content as the basis for any investment or other decision or in connection with any advice given to third parties. Please consult your appropriate professional adviser as necessary. Kaplan Publishing Limited and all other Kaplan group companies expressly disclaim all liability to any person in respect of any losses or other claims, whether direct, indirect, incidental, consequential or otherwise arising in relation to the use of such materials. All rights reserved. No part of this examination may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without prior permission from Kaplan Publishing. 2 KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS SECTION A All FIFTEEN questions are compulsory and MUST be attempted 1 2 3 4 Which of the following items does NOT represent the correct accounting treatment in accordance with IFRS 15 Revenue from Contracts with Customers? A Treating a sale and repurchase as a loan rather than a sale if control over the goods has not passed to the buyer B Where a sale agreement has a significant financing component, recognising the initial sale at the present value C When a package of goods are sold together at a discount, applying the discount to all parts if none are ever sold separately at a discount D Recognising no revenue in relation to a three year service contract until the service is completed at the end of the third year In what order should the assets in a Cash Generating Unit (CGU) be impaired? A Any obviously impaired asset, purchased goodwill, then all other assets pro‐rata B Purchased goodwill, all other assets pro‐rata, then any obviously impaired asset C Any obviously impaired asset, all other assets pro‐rata, then purchased goodwill D All assets pro‐rata Which of the following conditions must be met in order to capitalise borrowing costs per IAS 23? (i) Expenditure for the asset is being incurred (ii) The loan to finance the construction of the asset has been taken out (iii) Borrowing costs are being incurred (iv) Activities necessary to prepare the asset for its intended use or sale are in progress A (i), (ii) and (iii) B (i), (ii) and (iv) C (i), (iii) and (iv) D All of them Frog Co purchased an asset on 1 January 20X7 at a cost of $90,000. Frog received a grant in relation to the cost of this asset of $15,000. It has decided to write off the grant income against the cost of the non‐current asset. The asset has a useful economic life of nine years. What is the carrying amount of the asset as at 31 December 20X7? A $90,000 B $80,000 C $67,500 D $66,667 KA PLAN PUBLISHING 3 P AP E R F7 : FINAN CIAL RE POR TIN G 5 Coral Co has net profit for the year ended 30 September 20X5 of $10,500,000. Coral Co has had 6 million shares in issue for many years. On 1 October 20X4 Coral Co issued a convertible bond. The liability element was worth $2,500,000, and carries an effective interest rate of 8%. The bond is convertible in five years’ time, with 50 shares issued for every $100 nominal value of convertible bond held. Coral plc pays tax at a rate of 28% What is the Diluted Earnings Per Share figure to be disclosed in Coral Co’s financial statements for the year ended 30 September 20X5? 6 A $1.77 B $1.75 C $1.48 D $1.47 Lestrade Co has the following balances included on its trial balance at 30 June 20X4 Taxation Deferred taxation $6,000 Credit $24,000 Credit The balance on Taxation relates to an overprovision from 30 June 20X3. At 30 June 20X4, the directors estimate that the provision necessary for taxation on current year profits is $30,000. The carrying amount of Lestrade Co’s non‐current assets at this date exceeds the tax written‐down value by $60,000. The rate of tax is 30%. What are the balances that will appear in the Statement of Financial Position as at 30 June 20X4? 7 A Deferred tax $24,000, Taxation $30,000 B Deferred tax $18,000, Taxation $30,000 C Deferred tax $18,000, Taxation $18,000 D Deferred tax $18,000, Taxation $24,000 An enterprise sells goods with a warranty covering customers for the cost of repairs of any defects that are discovered within the first two months after purchase. Past experience suggests that 95% of the goods sold will have no defects, 3% will have minor defects and 2% will have major defects. If minor defects were detected in all products sold, the cost of repairs would be $12,000. If major defects were detected in all products sold, the cost would be $80,000. What provision should be made for the cost of repairs? 4 A Provision should be made for $2,640. B Provision should be made for $1,960. C Provision should be made for $92,000. D No provisions should be made but both items should be disclosed by note. KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS 8 Watts Co acquired 70% of the share capital of Pilkington Co on 1 January 20X2 for $300,000. The goodwill arising on consolidation has been impaired by $43,000 as at 31 December 20X5. The share capital and reserves of the two companies as at 31 December 20X5 were as follows: Share Capital Retained earnings Watts Co $400,000 $300,000 Pilkington Co $150,000 $200,000 At the date of acquisition Pilkington Co had retained earnings of $125,000. Watts Co measures the non‐controlling interest as the proportion of net assets of the subsidiary. In the consolidated statement of financial position of at 31 December 20X5 what amount should appear for the non‐controlling interest? 9 A $105,000 B $90,000 C $82,500 D $60,000 Ben Co bought its 90% share of the 200,000 $1 ordinary share capital in Abi Co for $800,000 on 1 July 20X4 when the balance on Abi Co's retained earnings stood at $475,000. Ben Co measures non‐controlling interest using the fair value method. The fair value of the 10% not owned by Ben Co was $60,000 on 1 July 20X4. At 31 October 20X8 the balances of retained earnings of the two companies were as follows: Ben Co $1,072,000 Abi Co $895,000 A review for impairment indicated that 30% of the goodwill on acquisition should be written off. What will be the balance on the consolidated retained earnings as at 31 October 20X8 to the nearest $000? A $1,334,500 B $1,346,050 C $1,400,050 D $1,394,500 KA PLAN PUBLISHING 5 P AP E R F7 : FINAN CIAL RE POR TIN G 10 Wombat Co is a retailer whose only non‐current assets are fixtures and fittings. The company has been experiencing trading problems for some time. The directors have concluded that the company is no longer a going concern and have changed the basis of preparing the financial statements to the break‐up basis. Which of the following will be the immediate effect of changing to the break‐up basis? 11 A All fixtures and fittings are transferred from non‐current to current assets B Fixtures and fittings are valued at their purchase cost C The company ceases to trade D A liquidator is appointed Negative goodwill (gain on bargain purchase) arises when the acquirer's interest in the fair value of the acquiree's identifiable net assets exceeds the cost of the business combination. Which of the following does IFRS 3 state must be carried out when this arises? 12 (i) Reassess the amount at which consideration has been measured (ii) Reassess the amount at which the acquiree's identifiable net assets have been measured (iii) Take any excess immediately to the statement of profit or loss (iv) Recognise the excess in the statement of profit or loss over the life of the non‐ monetary assets (recognising the gain as the assets are used) A (iii) only B (ii) and (iii) C (i), (ii) and (iii) D (i), (ii) and (iv) The plant and machinery of Crawley Co were shown at a carrying amount of $350,000 at 31 March 20X4. The comparative figure at 31 March 20X5 was $425,000. During the year to 31 March 20X5, property with a carrying amount of $45,000 was sold at a profit of $4,000. The depreciation charge for plant and machinery was $52,000. At 31 March 20X5 a $20,000 payable existed in relation to the purchase of plant and equipment during the year. What figure should be shown for the purchase of property, plant and equipment in Crawley Co’s statement of cash flow for the year ended 31 March 20X5? 6 A $172,000 B $152,000 C $192,000 D $176,000 KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS 13 Cash generated from operations in the statement of cash flow is considerably lower than the profit from operations recorded in the statement of profit or loss. Which of the following could be possible reasons for this? 14 15 (i) A non‐current asset has been sold during the year at a large profit (ii) A large payable was paid off just before year end (iii) A large sale was made just before year end, resulting in many lines being out of stock at the year‐end date (iv) Purchase of new premises during the year has led to an increase in the depreciation charge A All of them B (ii) and (iii) C (i) and (iii) D (i) and (ii) Which ONE of the following would NOT normally explain an increase in receivable days? A Negotiating a contract extension with a major customer, making up 75% of the company’s revenue and who had threatened to go elsewhere B High staff turnover in the credit control department C Entry into an overseas market for the first time D Starting up a new website, meaning products are now sold directly to the public Which ONE of the following would NOT usually cause the ROCE to fall? A A dividend has been paid to shareholders B Profit has fallen in the year C Properties have been revalued upwards during the year D Assets have been acquired under a lease during the year KA PLAN PUBLISHING 7 P AP E R F7 : FINAN CIAL RE POR TIN G SECTION B All THREE questions are compulsory and MUST be attempted The following scenario relates to questions 16–20 The following trial balance relates to Millar Co at 30 September 20X4: $000 38,000 32,500 Owned property carrying amount Investment property (note (ii)) Convertible loan note (note (iii)) Revenue (note (i)) Cost of sales (note (i)) Tax Deferred tax (note (iv)) $000 10,000 387,500 293,130 125 10,500 The following information is relevant: (i) Revenue includes $10 million for goods it sold acting as an agent for Thomas Co. Millar Co earned a commission of 15% on these sales and remitted the difference of $8.5 million (included in cost of sales) to Thomas Co. (ii) Investment property is considered to have a fair value of $31.5 million at 30 September 20X4. Owned property has a fair value of $41 million at 30 September 20X4. Millar uses the fair value model where appropriate. On 1 October 20X3, Millar Co issued a $10 million 4% convertible loan note, which is repayable on 30 September 2017. Millar Co chose to issue the convertible as it meant that there would be a lower finance than the 8% interest rate charged on similar loan notes. The present value of $1 payable at the end of each year, based on discount rates of 4% and 8% are: (iii) End of year 1 2 3 4 4% 0.96 0.92 0.89 0.85 8% 0.93 0.86 0.79 0.735 (iv) The directors have estimated the provision for income tax for the year to 30 September 20X4 at $5.7 million. The tax balance in the trial balance relates to the under/overprovision from the prior year. The required deferred tax provision at 30 September 20X4 is $7 million. 16 Which, if any, of the following statements regarding the agency sale is/are correct? Statement 1: Revenue should be reduced to $377.5 million Statement 2: Cost of sales should be reduced to $284.63 million 8 A Statement 1 only is correct B Statement 2 only is correct C Neither statement is correct D Both statements are correct KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS 17 18 19 20 What should be recorded in other comprehensive income in relation to the property revaluations? A $2 million loss B $2 million gain C $1 million loss D $3 million gain What should be recorded as the initial liability in relation to the convertible loan note? A $2 million B $8.676 million C $8 million D $1.324 million How should the convertible liability be accounted for in subsequent periods? A Present value B Not remeasured C Amortised cost D Fair value through profit or loss What tax expense should be recorded in the statement of profit or loss? A $9,075,000 B $9,325,000 C $2,075,000 D $2,325,000 KA PLAN PUBLISHING 9 P AP E R F7 : FINAN CIAL RE POR TIN G The following scenario relates to questions 21–25 Extracts from the financial statements of Canmore Co are given below: Current assets Inventory Receivables Cash at bank and in hand Non‐current liabilities Deferred taxation Current liabilities Trade payables Overdraft Taxation 20X7 $000 20X6 $000 10,931 4,429 1,658 9,480 3,892 7,518 234 108 24,299 2,123 300 23,162 – 250 Statement of profit or loss for the year ended 31 March 20X7 Profit from operations Taxation 2,064 (672) Additional information: (i) An item of plant was sold for $915,000 during the year, resulting in a loss of $50,000. Depreciation for the year was $2,925. 21 Which of the following items should be added to profit from operations in order to calculate cash generated from operations? 22 (i) Movement in inventories (ii) Movement in receivables (iii) Movement in payables A (i) and (ii) only B (i) only C (iii) only D (ii) and (iii) only Which, if any, of the statements below is/are correct? Statement 1: Depreciation should be added back to profit from operations in calculating cash generated from operations Statement 2: Loss on disposal should be added back to profit from operations in calculating cash generated from operations 10 A Statement 1 only is correct B Statement 2 only is correct C Neither statement is correct D Both statements are correct KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS 23 24 25 What amount should be recorded in the statement of cash flows in relation to tax paid? A $496,000 B $672,000 C $622,000 D $546,000 What should be shown in the statement of cash flow as the net increase/decrease in cash and cash equivalents for the year? A $3,797,000 decrease B $7,053,000 decrease C $7,983,000 decrease D $5,860,000 decrease Where should the proceeds from the sale of the plant be shown? A Cash generated from operations B Operating activities C Investing activities D Financing activities The following scenario relates to questions 26–30 Padgate Co leased an item of plant on 1 April 20X5 at a cost of $100,000 per annum, with rentals payable in advance. The primary lease term is for five years and the machine is expected to have a useful economic life of seven years, with no residual value. The interest rate implicit within the lease agreement is 8% per annum and the present value of the minimum lease payments is $431,200. Padgate Co also entered into a sale and leaseback transaction for a machine at the beginning of the year. At the date of the transaction, the machine had a carrying amount of $2.4m and was sold for its fair value of $6.0m. The sale represents satisfaction of a performance obligation in accordance with IFRS 15 Revenue From Contracts with Customers. The machine was leased back for five years and the present value of the annual lease payments amounted to $4m. The machinery had a remaining useful life of 10 years at the date of the sale. Padgate Co leased equipment with a 20 year life under a 5 year lease on 1 October 20X5. Padgate Co were given the first year rent‐free, but will pay $200,000 a year for the other 4 years. 26 Which, if any, of the statements below regarding the lease of plant is/are correct? Statement 1: If the plant was only to be leased for two years, there would be no need to capitalise the right‐of‐use asset. Statement 2: If ownership of the plant transfers to Padgate Co at the end of the lease, the plant should be depreciated over seven years A Statement 1 only is correct B Statement 2 only is correct C Neither statement is correct D Both statements are correct KA PLAN PUBLISHING 11 P AP E R F7 : FINAN CIAL RE POR TIN G 27 28 29 30 What will the non‐current liability be in relation to the leased plant at 31 March 20X6? A $257,696 B $357,696 C $100,000 D $278,312 What is the value of the right‐of‐use asset recognised by Padgate Co immediately following the sale and leaseback transaction? A $4 million. B $1.6 million C $2.4 million. D $2 million. If Padgate Co had incurred initial direct costs of $250,000 prior to signing the lease of equipment, how should these costs be accounted for? A The costs should be written off immediately as an expense B The costs should be capitalised as part of the right‐of‐use asset. C The costs should be included as part of the present value of the lease obligation D The costs should be written‐off to profit or loss on a straight‐line basis over the lease term. Which, if any, of the statements below regarding the lease of assets is/are correct? Statement 1: All leases should be accounted for to recognise a right‐of use asset in all cases Statement 2: If a sale and leaseback arrangement does not meet the definition of satisfaction of a performance obligation, the receipt of cash should be accounted for as the receipt of a loan 12 A Statement 1 only is correct B Statement 2 only is correct C Neither statement is correct D Both statements are correct KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS SECTION C BOTH questions are compulsory and MUST be attempted 31 During the year ended 31 March 20X4, Huston Co had been subject to much press interest concerning its poor performance and as a result its share price had fallen considerably. To remedy the situation and help improve share price and market confidence Huston Co employed Sparkes, a firm of strategic consultants to recommend the best course of action to improve both its statement of profit or loss and statement of financial position. The board of Huston Co were quick to act on many of Sparkes’ recommendations and are pleased with the effect that it has had on performance during the current year to 31 March 20X5. The draft financial statements are shown below: Statement of profit or loss for the year to: Revenue Cost of sales Gross profit Distribution costs Administration expenses Profit from operations Profit on sale of property Interest expense Profit before tax Taxation Profit for the year 31 March 20X5 $000 9,600 (5,760) –––––– 3,840 (620) (1,860) –––––– 1,360 200 (280) –––––– 1,280 (40) –––––– 1,240 –––––– 31 March 20X4 $000 10,000 (7,200) –––––– 2,800 (380) (660) –––––– 1,760 Nil (320) –––––– 1,440 (600) –––––– 840 –––––– Statement of financial position as at: 31 March 20X5 $000 $000 Non‐current assets Property, plant and equipment Goodwill Development costs 31 March 20X4 $000 $000 3,800 800 Nil ––––––– 800 5,000 800 1,120 ––––––– ––––– 4,600 Current assets Inventory Trade and other receivables Bank 1,800 760 840 ––––––– ––––––– 6,920 3,200 1,880 Nil ––––––– 3,400 ––––– 8,000 ––––– KA PLAN PUBLISHING 1,920 5,080 ––––––– 12,000 ––––––– 13 P AP E R F7 : FINAN CIAL RE POR TIN G Equity Ordinary shares of $1 each Retained earnings Non‐current liabilities 8% Convertible loan note 12% Loan note Deferred tax Provision for overhaul Current liabilities Trade and other payables Taxation Bank overdraft 2,400 1,040 ––––– 3,440 1,600 Nil 440 Nil ––––––– 1,680 840 Nil ––––––– 2,040 2,520 2,400 400 ––––––– 2,800 Nil 2,000 1,200 1,480 ––––––– 2,720 460 1,340 ––––––– ––––– 8,000 ––––– 4,680 4,520 ––––––– 12,000 ––––––– Additional information: During the current year the development expenditure was written off to administration expenses in the statement of profit or loss as the recognition criteria per IAS 38 Intangible Assets were no longer met. In addition, following on from one of the recommendations of Sparkes, Huston Co is outsourcing the manufacturing of one of its products. This has enabled the company to dispose of some surplus plant. This plant had been due for an overhaul in 20X5. Huston Co had been providing for this over a four year period, but due to the disposal this was no longer required and the provision was released to cost of sales. The following ratios were provided by Sparkes: Return on year‐end capital employed Gross profit margin Net profit (before tax) margin Current ratio Quick ratio Inventory holding period Receivables collection period Payables payment period Gearing (debt as a percentage of debt plus equity) 20X5 31% 1.3:1 20X4 28% 28% 14% 1.1:1 0.4:1 162 days 69 days 138 days 42% Required: (a) Calculate the missing ratios in relation to Huston Co (7 marks) (b) Write a report for the directors to assess the financial performance and position of Huston Co for the year ended 31 March 20X5 compared to the previous year. Your answer should refer to the information above and the impact that Sparkes has had during the year. (13 marks) (Total: 20 marks) 14 KA PLAN PUBLISHING REV IS ION MO CK C QUE STI ONS 32 On 1 October 20X4 Pansy Co purchased 64 million of the 80 million $1 ordinary shares of Sunflower Co. The acquisition was through a share exchange of two shares in Pansy Co for every four shares in Sunflower Co. The market price of Pansy Co’s shares at 1 October 20X3 was $5 per share and the market price per share of Sunflower Co was $2.44. The reserves of Sunflower Co on 1 October 20X4 were $82 million. The summarised statements of profit or loss for the two companies for the year ended 31 March 20X5 are: Revenue Cost of sales Gross profit/(loss) Other income (note (iii)) Distribution costs Administrative expenses Finance costs Profit/(loss) before tax Income tax expense Profit for the period Pansy Co $000 420,000 (272,000) ––––––– 148,000 1,600 (16,000) (30,500) (4,800) ––––––– 98,300 (34,800) ––––––– 63,500 ––––––– Sunflower Co $000 248,000 (146,000) ––––––– 102,000 nil (8,000) (28,000) (3,600) ––––––– 62,400 (10,400) ––––––– 52,000 ––––––– The following information is relevant: (i) The fair values of Sunflower Co at the date of acquisition were equal to their carrying amounts with the exception of land and plant. Land and plant had fair values of $2 million and $4 million respectively in excess of their carrying amounts. Plant had a remaining useful economic life at the date of acquisition of 4 years. Plant depreciation is included in cost of sales. The fair values have not been reflected in Sunflower Co’s financial statements. Sunflower Co had been selling its products under the brand name of ‘Seeds’ for many years. At the date of acquisition the brand was considered to have a fair value of $5 million and a remaining useful economic life of 10 years. The brand is not included in Sunflower Co’s statement of financial position. (ii) After the date of acquisition, Pansy Co sold goods to Sunflower Co at a selling price of $28 million. Pansy Co made a profit of cost plus 25% on these sales. $15 million (at cost to Sunflower Co) of these goods were still in the inventories of Sunflower Co at 31 March 2015. (iii) The other income is a dividend received from Sunflower Co on 1 February 20X5. (iv) On 1 October 20X4, Pansy Co also acquired 40% of Amaryllis Co. Amaryllis Co made a loss of $54 million in the year. Due to this loss, Pansy Co’s investment in Amaryllis was deemed to be impaired by $6.2 million. (iv) Pansy Co has a policy of valuing non‐controlling interests at fair value at the date of acquisition. For this purpose the share price of Sunflower Co at this date should be used. KA PLAN PUBLISHING 15 P AP E R F7 : FINAN CIAL RE POR TIN G (v) Impairment tests for Sunflower Co were conducted on 31 March 20X5. They concluded that the goodwill of Sunflower Co should be written down by $5 million. (vi) All items in the above statements of profit or loss are deemed to accrue evenly throughout the year. Required: (a) Calculate the goodwill arising on the purchase of Sunflower Co as at 1 October 20X4. (6 marks) (b) Prepare the consolidated statement of profit or loss for the Pansy Co Group for the year ended 31 March 20X5. (14 marks) (Total: 20 marks) 16 KA PLAN PUBLISHING