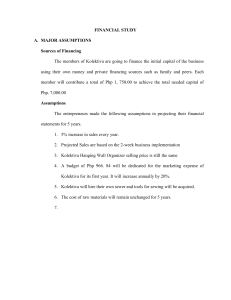

Group 3 FINANCIAL SECTOR 1 2 What is Money? Process of Creating Money 3 Financial Intermediation 4 Financial Institutions in The Philippines FINANCIAL SECTOR BARTERING IS A SYSTEM OF EXCHANGE IN WHICH PARTICIPANTS IN A TRANSACTION DIRECTLY EXCHANGE GOODS OR SERVICES FOR OTHER GOODS OR SERVICES WITHOUT USING A MEDIUM OF EXCHANGE, SUCH AS MONEY. FINANCIAL SECTOR Medium of exchange Standard of Value Store of value -Money can easily be used to buy goods and services with no complications of the barter system. -Money is the expected standard for measuring the relative worth of goods and services. -Money allows you to store purchasing power for the future. -Money’s value can be retained over time. It is a convenient way to store wealth. FINANCIAL SECTOR -Is the most liquid form of money circulating in an economy. Narrow Money (M0/ M1) FINANCIAL SECTOR -Is a category for measuring the amount of money circulating in an economy. It is the most inclusive method of calculating a country's money supply. -It includes little money and other assets that can be easily converted into cash to buy goods and services. Reserves: 25% OR 1/4 PHP 100,000 Reserves: PHP 25,000 (25%/ 1/4 OF 100,000) PHP 75,000 PHP 75,000 Reserves: PHP 18,750 (25%/ 1/4 OF 100,000) PHP 56,250 PHP 56,250 Deposits: First Deposit Second Deposit Third Deposit Fourth Deposit Fifth Deposit PHP 100,000 PHP 75,000 PHP 18,063 PHP 42,187 PHP 36,641 ------------------FINAL DEPOSIT & MONEY CREATED PHP 400,000 = 1 = 0.25 4 Total Money Supply = Money Multiplier x Total Deposits =100,000 x 4 =400,000 Sample problem: Assume the required reserve ratio is 20% and someone deposits PHP 5,000 in a bank. What is the total change in the money supply? Sample problem: Assume the required reserve ratio is 20% and someone deposits PHP 5,000 in a bank. What is the total change in the money supply? Money Multiplier = 1 = 0.2 5 Total Money Supply = Money Multiplier x Total Deposits = PHP 5,000 x 5 = PHP 25,000 BANKS - crucial in the creation of money. FINANCIAL INTERMEDIATION - Another essential function of banks and other financial institutions is to link the savers to the investors in the economy. NONCONSUMPTION -household income that is not spent on consumption. DISEQUILIBRIUM Investment -This will occur in an economy if no corresponding inflow to the counter equals this outflow. Savings 1.Banking institutions 2.Non-Banking institutions Project Finance Corporate Finance Small- Medium Enterprises Retail Short-Term Finance Housing • • Commercial Banks • Thrift Banks • Rural Banks • Specialized Government Banks • Universal Banks • Examples: • Examples: • 3. Thrift Banks Examples: 3. Thrift Banks Non-Banking institutions Examples: Non-Banking institutions Non-Banking institutions • Insurance Companies Non-Banking institutions • • Non-Banking institutions • FINANCIAL SECTOR THANK YOU