INTERMEDIATE ACCOUNTING 1 REVIEWER

advertisement

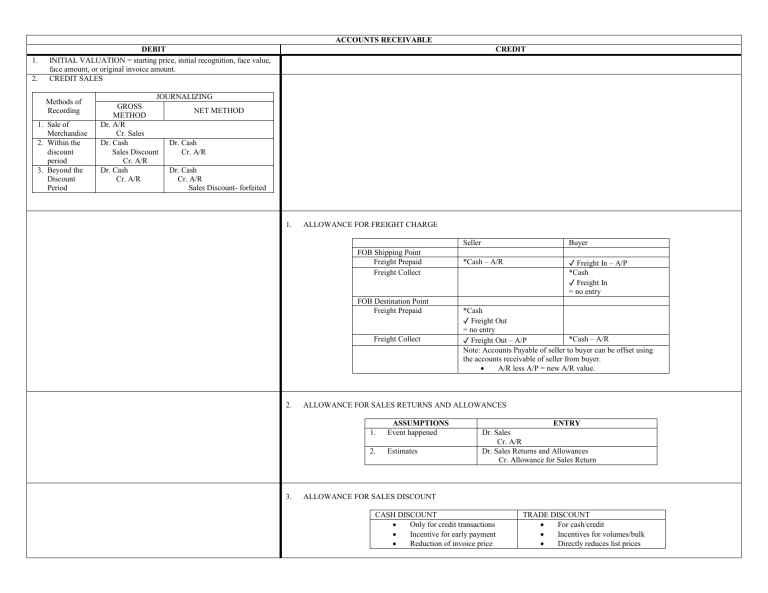

ACCOUNTS RECEIVABLE 1. 2. DEBIT INITIAL VALUATION = starting price, initial recognition, face value, face amount, or original invoice amount. CREDIT SALES Methods of Recording 1. Sale of Merchandise 2. Within the discount period 3. Beyond the Discount Period CREDIT JOURNALIZING GROSS NET METHOD METHOD Dr. A/R Cr. Sales Dr. Cash Dr. Cash Sales Discount Cr. A/R Cr. A/R Dr. Cash Dr. Cash Cr. A/R Cr. A/R Sales Discount- forfeited 1. ALLOWANCE FOR FREIGHT CHARGE FOB Shipping Point Freight Prepaid Freight Collect FOB Destination Point Freight Prepaid Freight Collect 2. 3. Seller Buyer *Cash – A/R ✓ Freight In – A/P *Cash ✓ Freight In = no entry *Cash ✓ Freight Out = no entry *Cash – A/R ✓ Freight Out – A/P Note: Accounts Payable of seller to buyer can be offset using the accounts receivable of seller from buyer. A/R less A/P = new A/R value. ALLOWANCE FOR SALES RETURNS AND ALLOWANCES 1. ASSUMPTIONS Event happened 2. Estimates ENTRY Dr. Sales Cr. A/R Dr. Sales Returns and Allowances Cr. Allowance for Sales Return ALLOWANCE FOR SALES DISCOUNT CASH DISCOUNT Only for credit transactions Incentive for early payment Reduction of invoice price TRADE DISCOUNT For cash/credit Incentives for volumes/bulk Directly reduces list prices 3. 1. ASSUMPTIONS Event happened 2. Estimates ALLOWANCE FOR DOUBTFUL ACCOUNTS DEBIT JOURNALIZE ALLOWANCE DIRECT METHOD WRITE-OFF CREDIT 1. BEGINNING BALANCE (not required allowance) 2. PROVISION (worthless accounts) Methods of Estimating Uncollectibles % of Revenue 1. ENTRY Check with Credit Sales whether the stated problem is Gross Method (common) or Net Method. Dr. Sales Returns and Allowances Cr. Allowance for Sales Return Formula Rate of Uncollectible x Revenue Result Bad Debt Expense WRITE-OFF Dr. A/R Cr. Allowance for DA Dr. Cash Cr. A/R Dr. Doubtful Accounts No entry Cr. Allowance for DA 3. RECOVERY ALLOWANCE, END OR REQUIRED ALLOWANCE Methods of Estimating Uncollectibles % of A/R Receivable Aging of Receivables 4. Formula Rate of Uncollectible x A/R Rate of Uncollectible according to days of (1) current due or (2) past due Dr. Allowance for DA Cr. A/R Result Allowance, END or Required Allowance Allowance, END or required allowance (note: this is when accounts are only considered to be doubtful of collection and not worthless RECOVERY 5. WRITE-OFFS FINAL AMOUNT OR SUBSEQUENT VALUATION = net realizable value or the amortized cost. NOTES RECEIVABLE 1. DEBIT INITIAL VALUATION = present value (common) N/R SHORT-TERM LONG-TERM CREDIT 1. DISHONORED NOTES 2. PRINCIPAL PAYMENT 3. REDUCTION FOR IMPAIRMENT OR UNCOLLECTIBILITY INTEREST-BEARING NON-INTEREST BEARING Face amount/face value Face amount/value upon Present Value/the discounted issuance value of future cash flows using the effective interest rate. FINAL AMOUNT OR SUBSEQUENT MEASUREMENT = amortized cost using the effective interest method. LONG-TERM NON-INTEREST BEARING Present Value Add: Amortization of the Discount/Face Amount Less: Unamortized Unearned Interest Total: Amortized Cost