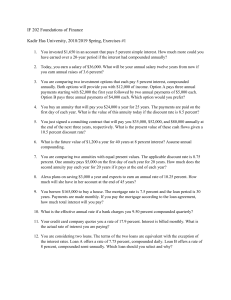

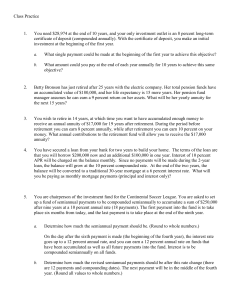

Business Mathematics in Canada (2017, McGraw-Hill Ryerson) F. Ernest Jerome; Tracy Worswick

advertisement