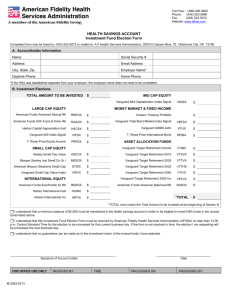

Retirement Services Enrollment Form Enrollment Methods • Retirement Services Online website: http://www.paychexflex.com • Fill out this form and fax it to: 585-389-7252 Note: By using the website, you do not need to send this form to Paychex, Inc. Employee Information (All information is required) Social Security Number XXX ____ − ___ XX − ______________________ Employee Name ______________________________________________ Company Name _____________________________________________________________________________________________________ Encore Series Inc Office/Client Number __________________/________________ 0940 13033485 Date of Birth _______/______/_________ E-mail Address | | | | | | | | | Date of Hire _________/______/_________ | | | | | | | | | | | | | | | | Phone Number (________)________________ | | | | | | | | | | | | | | | | | Enrollment (Check one box) If neither box is checked and a deferral field is filled in, you will be enrolled in the plan at the stated amount. If you wish to change your deferral election to zero percent in any source, place 0% on the line provided for that source. If you do not, the current election for that source will remain as it was prior to completing this updated election. ❐ Yes, I want to enroll in the plan at this time. I acknowledge that I have received a copy of the plan's Fee Disclosure Statement for Participants. I have indicated below the percentage that I want to contribute to the plan through payroll deduction. Deferrals must be in increments of 1% (non-whole numbers will be rounded down to the nearest percent). Pretax Salary Deferral Roth 401(k) Deferral* Pretax Catch-up Deferral** Roth Catch-up Deferral** *Consult with your employer to determine if the Roth 401(k) option is available in your plan. Also, loans and hardship withdrawals will not be issued from your Roth 401(k) balance. **For catch-up deferrals, you must be eligible to make elective deferrals under your employer's 401(k) plan and have, or will have, attained age 50 before the close of the calendar year. If you have not met the age requirement you will not be enrolled in catch-up contributions. Important: All deferrals that you elect in this section will be invested using the same fund allocation percentages that you select in the "Investment Selection" below. ❐ No, I do not want to enroll in the plan at this time. My deferral is zero. Investment Selection Please either check the following box or complete the investment section provided below. ❐ I do not wish to change my current investments at this time. Please leave them as they currently are. I understand that if I do not currently have any investments chosen, I will be enrolled 100% into the default fund. In the "Investment Selection" column, I have entered the percent of my contribution that I want allocated in the investment(s) choices. All contributions elected on this from will be allocated in the investment(s) that I have selected. You may select any combination in 1% increments totaling 100% (non-whole numbers will be rounded down to the nearest percent). These investment selections are for future allocations only and will not impact funds currently invested. MATC I understand the "Investment Selection" and corresponding percentage will remain in effect until I request a change, in accordance with the provisions of the plan. I will receive a confirmation of the requested change. I understand that if this section is not completed, or if the investment percentages do not total 100%, that 100% of the contribution will be invested in the participant default option. Prior to requesting any movement between investments, please review the prospectus for policies regarding frequent trading and market timing. Please review the Fee Disclosure Statement for Participants prior to enrollment. Investment Selection 3367 FIDELITY ADVISOR STRATEGIC INCOME I % 5147 VANGUARD TARGET RETIREMENT 2015 INV % 5148 VANGUARD TARGET RETIREMENT 2025 INV % 5149 VANGUARD TARGET RETIREMENT 2035 INV % 5150 VANGUARD TARGET RETIREMENT 2045 INV % 5151 VANGUARD TARGET RETIREMENT INCOME INV % 7246 VANGUARD TARGET RETIREMENT 2050 INV % 7248 VANGUARD TARGET RETIREMENT 2020 INV % 7249 VANGUARD TARGET RETIREMENT 2030 INV % 7250 VANGUARD TARGET RETIREMENT 2040 INV % 11982 VANGUARD TREASURY MONEY MARKET INV % (Funds continued on next page) Page 1 of 2 MATC Investment Selection 13121 FIRST EAGLE GLOBAL I % 13128 METROPOLITAN WEST TOTAL RETURN BOND I % 13885 VANGUARD TARGET RETIREMENT 2055 INV % 13927 DFA EMERGING MARKETS I % 13964 DFA US LARGE CAP VALUE I % 14148 PRINCIPAL HIGH YIELD I % 14928 VANGUARD TARGET RETIREMENT 2060 INV % 14932 VANGUARD INFLATION PROTECTED SECURITIES ADM % 15006 VANGUARD WELLESLEY INCOME ADML % 15245 VANGUARD GNMA ADML % 15250 VANGUARD INTERNATIONAL GROWTH ADMN % 16316 PRINCIPAL REAL ESTATE SECURITIES I % 17585 VANGUARD SMALL CAP VALUE INDEX ADMIRAL % 17670 VANGUARD TOTAL INTERNATIONAL STOCK INDEX ADML % 17675 VANGUARD MID CAP GROWTH INDEX ADML % 17676 VANGUARD MID CAP VALUE INDEX ADML % 17689 VANGUARD SMALL CAP INDEX ADML % 17699 VANGUARD MID CAP INDEX FUND ADML % 17711 VANGUARD 500 INDEX ADML % 17821 VANGUARD TOTAL INTERNATIONAL BOND INDEX ADML % 17968 VANGUARD GROWTH INDEX ADML % 18130 VANGUARD SMALL CAP GROWTH INDEX ADML % 27094 VANGUARD TARGET RETIREMENT 2065 INV % 39785 VANGUARD TOTAL WORLD STOCK INDEX ADMIRAL % 17967 VANGUARD BALANCED INDEX ADML % Totals 100% Authorization and Signature As a participant in this plan, your employer may provide your investment and plan eligibility information to third parties necessary to administer the plan. I hereby authorize the company to make the necessary payroll deductions from my compensation as indicated above. The authorization set forth in this form shall become effective at the earliest time permitted by the terms of the plan. ➥ Employee Signature: _________________________________________________________ Page 2 of 2 Date: ______/______/________ Encore Series Inc 0940-13033485 10/01/2020 Fee Disclosure Statement for Participants of the Encore Series Inc 401(k) Profit Sharing Plan & Trust Overview As a participant in the retirement plan sponsored by your employer, you are entitled to know the fees and expenses incurred to operate the plan that are paid by participant assets. The Employee Retirement Income Security Act of 1974, as amended ("ERISA"), requires that the plan administrator provide the disclosures of these fees to you, on or before the date you can first direct your investments, and annually thereafter. The disclosure of fees is intended to make you aware of the rights and responsibilities associated with the options made available under the plan so that you may make informed decisions regarding the management of your account. The types of information that must be disclosed are both plan-related and investment-related. Plan-related information includes general operational and identifying information, administrative expenses, and individual expenses. Investment-related information is included on a separate chart which details the fee information of the investment alternatives made available by the plan. Part One: General Plan Information Enrollment Participants and beneficiaries can enroll and make investment changes at any time once eligible to participate in the plan. They can enroll via the internet or by completing an Enrollment/Change Form and either faxing or mailing it to Paychex. ·http://www.paychexflex.com ·Fax: 585-389-7252 ·Mail correspondence: Attn: 401(k) Participant Support 1175 John St., West Henrietta, NY 14586 Plan Investment Changes There are no limitations on the frequency of when investment changes may be made; however, there may be fees associated with such changes. Review the attached Investment Chart or the fund's prospectus for additional information. Voting of Proxy The plan administrator shall have responsibility for instructing the trustee as to voting and the tendering of shares relating to assets held by the trust, by proxy or in person, except to the extent such responsibility is delegated to another person, under the terms of the plan or under an agreement between the adopting employer and an investment manager, in which case such persons shall have such responsibility. Asset Management Your employer has selected the following financial professional to assist with the management of plan assets: KURT ROSSI, 732-280-7550. Page 1 of 17 Rev. 2/20 Part Two: Administrative Expenses Administrative expenses for such duties as recordkeeping, accounting, tax form preparation, and legal fees may be paid by the employer or by the plan. Your employer also has the option to be reimbursed by the plan for expenses they have paid. Fees paid with plan assets will be deducted pro-rata based on account balances and specified on your quarterly participant benefit statement as a plan administration expense. Paychex charges administrative fees for the services provided to the plan which may be paid either by your employer or by plan assets. In the event your employer elects to have fees paid by plan assets the fees will be deducted pro-rata based on the account balances and will be specified on your quarterly participant benefit statement as Plan Administration Fee. Paychex administrative expenses include monthly fees, per participant fees, setup fees, and, when an employer selects specific service offerings or other features, an annual account fee which is charged against plan assets. Paychex administrative fees may be paid from plan assets if elected by the plan administrator. Certain restrictions may apply. You may contact your plan administrator to determine whether administrative fees are paid from plan assets. If this applies, the fees are charged against participant accounts pro-rata based on account balance. Over the previous 13 months, Paychex administrative fees paid from assets totaled $233.52. Paychex returns any payments which Paychex would have received from the investments in the Plan's lineup pro-rata to the Plan and assesses an annual account fee against the Plan assets. The annual account fee is based on the formula below. Minimum Asset Value in the Plan $0.00 $100,000.00 $500,000.00 $1,000,000.00 $3,000,000.00 $4,000,000.00 $10,000,000.00 $15,000,000.00 $40,000,000.00+ Maximum Asset Value in the Plan $99,999.99 $499,999.99 $999,999.99 $2,999,999.99 $3,999,999.99 $9,999,999.99 $14,999,999.99 $39,999,999.99 Annual Account Fee (bps) 31bps 28bps 23bps 20bps 13bps 14bps 13bps 10bps 8bps Basis points (bps) are a unit of measurement equal to 1/100th of 1% (e.g., 40bps = .40%=.004). Quarterly Plan Document Maintenance Fee of $15 will be paid by the employer or the plan. Quarterly Plan Document Maintenance Fees paid with plan assets will be deducted pro rata based on account balances and specified on your quarterly participant benefit statement. In the event that the employer decides to transfer the plan's recordkeeping services to a new service provider, there may be a plan transfer fee charged for services associated with the transfer process. The employer has the option to pay the expense with plan assets. If the expense is paid by the plan, it will be deducted on a pro-rata basis from all account balances, and the portion applied to your account will be reflected on your quarterly participant benefit statement. A registered investment advisor, KURT ROSSI, 732-280-7550, manages the assets of the plan based on direction from the plan administrator. The annual fee is 50 basis points based on the plan's assets including loan balances paid on a Quarterly basis and charged against participant accounts pro-rata based on account balance. Your employer has elected to use the 3(16) services of 401k Generation. An annual account fee against the Plan assets will be charged. The annual account fee is based on the formula below: Page 2 of 17 Rev. 2/20 Tier Plan Assets as of the last business day of the month 1 2 3 4 5 6 7 8 9 10 11 $0.00 - $99,999.99 $100,000.00 - $499,999.99 $500,000.00 - $999,999.99 $1,000,000.00 - $1,999,999.99 $2,000,000.00 - $2,999,999.99 $3,000,000.00 - $3,999,999.99 $4,000,000.00 - $6,999,999.99 $7,000,000.00 - $9,999,999.99 $10,000,000.00 - $14,999,999.99 $15,000,000.00 - $39,999,999.99 $40,000,000.00+ Total 3(16) Service Fee (bps) 55.00bps 50.00bps 45.00bps 30.00bps 25.00bps 20.00bps 14.00bps 10.00bps 6.00bps 4.00bps 3.00bps 401k Generation Fee (bps) Paychex Processing Fee (bps) 41.25bps 37.50bps 33.75bps 22.50bps 18.75bps 15.00bps 10.50bps 7.50bps 4.50bps 3.00bps 2.25bps 13.75bps 12.50bps 11.25bps 7.50bps 6.25bps 5.00bps 3.50bps 2.50bps 1.50bps 1.00bps 0.75bps Basis points(bps) are a unit of measurement equal to 1/100th of 1%(e.g., 40 bps = .40% = .004). The actual fee(s) for administrative expenses assessed against your account will be specified on your quarterly participant benefit statement. Part Three: Individual Expenses The following expenses may be charged against your account as set forth below. The actual fee(s) for any individual expenses assessed will be listed on your quarterly participant benefit statement. Type of Fee Loan Fee Description Fee charged for the initial processing of a loan request including preparation of amortization schedule. Distribution Fee Wire/ACH Fee Fee charged for processing a distribution of plan assets. Fee charged for sending loans and distributions as an automated clearing house (ACH) transaction or via wire transfer. Page 3 of 17 Rev. 2/20 Amount $175 general purpose loan $325 primary residence loan $75 $18 Type of Fee Stale Check Fee Description Fees charged to participants who fail to cash their distribution check by Paychex and third-party vendor. The amount of the fee depends on the services that are necessary to locate the participant. Amount $65 Stale Check Processing to remit to Third-party vendor. Third-party Vendor Fees Participant Search Fee Check Reissue Fee Managed Account Fee Front/Back-End Load Fee Qualified Domestic Relations Order (QDRO) Processing Fee Fee charged in event participant fails to request distribution during a plan termination and search is performed to determine current address. Fee charged for requiring a change in the method of distribution from cash to rollover or vice versa. Fee for using GuidedChoice® managed account services. GuidedChoice® provides investment advisory services to retirement Participants. Services are delivered through online-based software, telephone, paper application and face-to-face meetings. Individuals may receive projections of potential income at retirement, based upon the current value of retirement assets, expected future contributions, earnings and social security. Based upon specific information, income, asset level, risk tolerance and the retirement goal established, recommended changes to saving rate, investment allocation, risk level and retirement age may be provided. Paychex does not deliver the GuidedChoice® managed account services or make recommendations as to the selection of an advice provider or investments. Sales charge or commission to compensate a sales intermediary, such as a broker or financial advisor, for their time and expertise in selecting an appropriate investment option for the investor. Fee charged to the Participant for calculation and division of individual Participants Plan assets pursuant to a QDRO. Page 4 of 17 Rev. 2/20 $5 mailing fee to participant $60 distribution of Stale Check Assets to participant or rollover of Stale Check Assets to IRA fee $125 missing participant search fee $65 $75 45 bps or .45% of the first $100,000 in assets with an annual maximum of $450 regardless of asset level. These fees are prorated and charged on a quarterly basis. None/waived $500 or as set forth on the QDRO determination of status paperwork. Investment Chart This chart includes important information to help you compare the investment options under your retirement plan. Additional information about your investment options and hardcopies can be obtained via the investment option's Web site(s) listed in the chart or by contacting Louis Scaglione III at 1518 Walnut Street Suite 1706, Philadelphia, PA 19102, 215-875-8004. The investment options available within the plan may include certain trading guidelines, imposed by the Investment Company, that restrict or limit the frequency in which purchase, transfer or withdrawals may be made. Any restrictions or limitations are identified in Section II of the Investment Chart under the Shareholder-Type Fees section. This information may also be found in each investment option's prospectus, where applicable, or on the investment option's website. Section I. Performance Information The Variable Return Investments table focuses on the performance of investment options that do not have a fixed or stated rate of return. This table shows how these options have performed over time and allows you to compare them with an appropriate benchmark for the same time periods. Past performance does not guarantee how the investment option will perform in the future. Your investment in these options could lose money. Information about an option's principal risks is available on the Web site(s). Variable Return Investments Name/ Type of Option Bond Bond Funds Funds FIDELITY ADVISOR STRATEGIC INCOME I/ Multisector Bond METROPOLITAN WEST TOTAL RETURN BOND I/ Intermediate Term Bond PRINCIPAL HIGH YIELD I/ High Yield Bond VANGUARD GNMA ADML/ Intermediate Government VANGUARD INFLATION PROTECTED SECURITIES ADM/ Inflation Protected Bond Ticker Symbol Average Annual Total Return as of 06/30/20 1yr. 5yr. 10yr. Since Inception Benchmark 1yr. 5yr. FSRIX 1.69% 4.02% www.fidelity.com 4.77% 6.79% 7.88% 4.42% 4.12% N/A BBgBarc US Universal TR USD MWTIX 9.07% 4.33% www.mwamllc.com 4.87% 6.12% 8.74% 4.30% 3.82% N/A BBgBarc US Agg Bond TR USD PHYTX (0.97%) 4.01% 6.25% 7.28% www.wamu.com/wmgroupoffunds (1.10%) 4.58% 6.48% N/A ICE BofA US High Yield TR USD VFIJX 5.52% 3.09% www.vanguard.com 3.18% 4.52% 10.34% 4.05% 3.34% N/A BBgBarc US Government TR USD VAIPX 8.05% 3.66% www.vanguard.com 3.41% 3.92% 8.28% 3.75% 3.52% N/A BBgBarc US Treasury US TIPS TR USD Page 5 of 17 Rev. 2/20 10yr. Since Inception Name/ Type of Option Ticker Symbol Average Annual Total Return as of 06/30/20 1yr. 5yr. 10yr. Since Inception 4.04% 4.41% N/A 4.20% www.vanguard.com Benchmark 1yr. 5yr. 0.86% 3.32% 1.81% FTSE WGBI NonUSD USD N/A (3.39%) 2.86% MSCI EM NR USD 3.27% N/A (8.84%) 4.64% 10.41% Russell 1000 Value TR USD N/A 3.15% 5.69% 7.23% Morningstar Gbl Allocation TR USD N/A 10yr. Since Inception VANGUARD TOTAL INTERNATIONAL BOND INDEX ADML/ World Bond Equity Equity Funds Funds VTABX DFA EMERGING MARKETS I/ Diversified Emerging Markets DFA US LARGE CAP VALUE I/ Large Value FIRST EAGLE GLOBAL I/ World Allocation PRINCIPAL REAL ESTATE SECURITIES I/ Real Estate VANGUARD 500 INDEX ADML/ Large Blend VANGUARD BALANCED INDEX ADML/ Allocation 50 - 70% Equity VANGUARD GROWTH INDEX ADML/ Large Growth VANGUARD INTERNATIONAL GROWTH ADMN/ Foreign Large Growth VANGUARD MID CAP GROWTH INDEX ADML/ Mid - Cap Growth DFEMX (7.26%) 2.14% www.dfaus.com 3.11% DFLVX (12.44%) 3.56% www.dfaus.com 10.70% SGIIX (2.28%) 4.69% 7.51% www.firsteaglefunds.com PIREX (6.42%) 6.67% 10.70% 10.81% www.wamu.com/wmgroupoffunds (12.95%) 3.86% 8.94% N/A S&P United States REIT TR USD VFIAX 7.47% 10.69% www.vanguard.com 13.95% 7.48% 10.47% 13.97% Russell 1000 TR USD VBIAX 8.24% 8.04% www.vanguard.com 9.94% VIGAX 24.77% 14.92% www.vanguard.com 16.77% 7.24% 23.28% 15.89% 17.23% Russell 1000 Growth TR USD VWILX 24.55% 11.90% www.vanguard.com 11.27% 8.24% 5.80% 5.61% 7.04% N/A MSCI ACWI Ex USA Growth NR USD VMGMX 11.51% 10.12% www.vanguard.com 14.27% 13.56% 11.91% 11.60% 15.09% N/A Russell Mid Cap Growth TR USD Page 6 of 6.17% 9.05% 9.75% 6.38% 6.42% N/A 3.70% 6.00% 7.76% N/A Morningstar Mod Tgt Risk TR USD 17 Rev. 2/20 N/A Name/ Type of Option Ticker Symbol Average Annual Total Return as of 06/30/20 1yr. 5yr. 10yr. Since Inception (0.20%) 6.99% 12.47% 9.40% www.vanguard.com Benchmark 1yr. 5yr. VANGUARD MID CAP INDEX FUND ADML/ Mid - Cap Blend VANGUARD MID CAP VALUE INDEX ADML/ Mid - Cap Value VANGUARD SMALL CAP GROWTH INDEX ADML/ Small Growth VANGUARD SMALL CAP INDEX ADML/ Small Blend VANGUARD SMALL CAP VALUE INDEX ADMIRAL/ Small Value VANGUARD TARGET RETIREMENT 2015 INV/ Target Date 2015 VANGUARD TARGET RETIREMENT 2020 INV/ Target Date 2020 VANGUARD TARGET RETIREMENT 2025 INV/ Target Date 2025 VANGUARD TARGET RETIREMENT 2030 INV/ Target Date 2030 VIMAX VMVAX (11.82%) 3.61% www.vanguard.com (11.81%) 3.32% 10.29% Russell Mid Cap Value TR USD VSGAX 7.78% 9.26% www.vanguard.com 13.91% 13.50% 3.48% 6.86% 12.92% Russell 2000 Growth TR USD N/A VSMAX (5.60%) 5.40% www.vanguard.com 11.59% 8.29% (6.63%) 4.29% 10.50% Russell 2000 TR USD N/A VSIAX (16.48%) 2.00% www.vanguard.com 9.35% 9.56% (17.48%) 1.26% 7.82% Russell 2000 Value TR USD N/A VTXVX 5.45% 5.47% www.vanguard.com 7.55% 6.11% 5.50% 5.57% 7.38% N/A Morningstar Lifetime Mod 2015 TR USD VTWNX 5.09% 5.96% www.vanguard.com 8.31% 6.19% 5.44% 5.90% 8.04% N/A Morningstar Lifetime Mod 2020 TR USD VTTVX 4.82% 6.29% www.vanguard.com 8.88% 6.67% 4.87% 6.17% 8.73% N/A Morningstar Lifetime Mod 2025 TR USD VTHRX 4.40% 6.47% www.vanguard.com 9.37% 6.48% 3.66% 6.32% 9.28% N/A Morningstar Lifetime Mod 2030 TR USD Page 7 10.46% of 10.54% 10yr. Since Inception (2.24%) 6.76% 12.35% Russell Mid Cap TR USD 17 Rev. 2/20 N/A N/A Name/ Type of Option Ticker Symbol Average Annual Total Return as of 06/30/20 1yr. 5yr. 10yr. Since Inception 3.94% 6.62% 9.84% 7.18% www.vanguard.com Benchmark 1yr. 5yr. VANGUARD TARGET RETIREMENT 2035 INV/ Target Date 2035 VANGUARD TARGET RETIREMENT 2040 INV/ Target Date 2040 VANGUARD TARGET RETIREMENT 2045 INV/ Target Date 2045 VANGUARD TARGET RETIREMENT 2050 INV/ Target Date 2050 VANGUARD TARGET RETIREMENT 2055 INV/ Target - Date 2055 VANGUARD TARGET RETIREMENT 2060 INV/ Target - Date 2060+ VANGUARD TARGET RETIREMENT 2065 INV/ Target - Date 2060+ VANGUARD TARGET RETIREMENT INCOME INV/ Target Date Retirement VTTHX VFORX 3.46% 6.76% www.vanguard.com 10.08% 6.77% 0.32% 6.12% 9.57% N/A Morningstar Lifetime Mod 2040 TR USD VTIVX 2.97% 6.79% www.vanguard.com 10.10% 7.52% (0.69%) 5.94% 9.45% N/A Morningstar Lifetime Mod 2045 TR USD VFIFX 3.02% 6.79% www.vanguard.com 10.10% 6.81% (1.13%) 5.81% 9.32% N/A Morningstar Lifetime Mod 2050 TR USD VFFVX 2.95% 6.77% www.vanguard.com N/A 9.55% (1.32%) 5.72% 9.20% N/A Morningstar Lifetime Mod 2055 TR USD VTTSX 2.95% 6.76% www.vanguard.com N/A 9.16% (1.46%) 5.63% 9.06% N/A Morningstar Lifetime Mod 2060 TR USD VLXVX 2.84% N/A www.vanguard.com N/A 6.17% (1.46%) 5.63% 9.06% N/A Morningstar Lifetime Mod 2060 TR USD VTINX 5.69% 4.93% www.vanguard.com 5.84% 5.30% 4.35% 4.54% 5.74% N/A Morningstar Lifetime Mod Incm TR USD Page 8 of 10yr. Since Inception 1.91% 6.28% 9.56% N/A Morningstar Lifetime Mod 2035 TR USD 17 Rev. 2/20 Name/ Type of Option VANGUARD TOTAL INTERNATIONAL STOCK INDEX ADML/ Foreign Large Blend VANGUARD TOTAL WORLD STOCK INDEX ADMIRAL/ World Stock VANGUARD WELLESLEY INCOME ADML/ Allocation 30 - 50% Equity Money Money Market Market Funds Funds VANGUARD TREASURY MONEY MARKET INV/ Money Market Ticker Symbol VTIAX Average Annual Total Return as of 06/30/20 1yr. 5yr. 10yr. Since Inception (4.09%) 2.42% 5.27% 3.72% www.vanguard.com Benchmark 1yr. 5yr. 10yr. Since Inception (4.80%) 2.26% 4.97% MSCI ACWI Ex USA NR USD N/A N/A N/A N/A VTWAX 1.89% 6.49% www.vanguard.com 9.39% 6.99% N/A VWIAX 5.73% 6.72% www.vanguard.com 7.91% 6.89% 5.74% 5.58% 6.43% N/A Morningstar Mod Con Tgt Risk TR USD VUSXX 1.40% 1.08% www.vanguard.com 0.55% 2.43% 2.11% 1.50% 0.91% N/A ICE BofA USD 3M Dep OR CM TR USD N/A- Please refer to the fact sheets on http://www.paychexflex.com by selecting Research Funds from your Home Page and clicking on the name of the investment option. Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates ("BofAML") indices and related information, the name "Bank of America Merrill Lynch", and related trademarks, are intellectual property licensed from BofAML, and may not be copied, used, or distributed without BofAML's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, or promoted by BofAML. BOFAML MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE INDICES, INDEX DATA, ANY RELATED DATA, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS). Copyright © 2020, Citigroup Index LLC ("Citi Index"). All rights reserved. "Citigroup" is a registered trademark and service mark of Citigroup Inc. or its affiliates, is used and registered throughout the world. Citi Index data and information is the property of Citi Index or its licensors, and reproduction in any form is prohibited except with the prior written permission of Citi Index. Because of the possibility of human or mechanical error, Citi Index does not guarantee the accuracy, adequacy, timeliness, completeness or availability of any data and information and is not responsible for any errors or omissions or for the results obtained from the use of such data and information. CITI INDEX GIVES NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall Citi Index be liable for damages of any kind in connection with any use of the Citi Index data and information. The Dow Jones-UBS Commodity Indexes are calculated, distributed and marketed by CME Group Index Services, LLC ("CME Indexes") pursuant to an agreement with UBS Securities, LLC and have been licensed for use. All content of the Dow Jones-UBS Commodity Indexes © CME Group Index Services, LLC and UBS Securities, LLC 2017. "Dow Jones®" is a registered trademark of Dow Jones Trademark Holdings LLC and has been licensed for use by CME Indexes. "UBS®" is a registered trademark of UBS AG. © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Page 9 of 17 Rev. 2/20 Copyright MSCI 2020. All Rights Reserved. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an "as is" basis, and the user of this information assumes the entire risk of any use made of this information. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) relating to any use of this information. Copyright Morgan Stanley Capital International, Inc. 2020. All Rights Reserved. Unpublished. PROPRIETARY TO MORGAN STANLEY CAPITAL INTERNATIONAL INC. Page 10 of 17 Rev. 2/20 Section II. Fee and Expense Information The Fees and Expenses table shows fee and expense information for the investment options listed in the Variable Return Investments table. It lists the Total Annual Operating Expenses of the options in the Variable Return Investments table. Total Annual Operating Expenses are expenses that reduce the rate of return of the investment option. This table also shows Shareholder-Type Fees. These fees are in addition to Total Annual Operating Expenses. A portion of the expense ratio may be returned to Paychex or its subsidiaries in the form of revenue sharing. If an employer has elected the return of concessions feature for its plan the revenue share that would be returned to Paychex or its subsidiaries is returned directly to the participant who incurred the fee charged by the investment and an annual account fee is charged against plan assets. Administrative fees including annual account fees, may be paid directly by your employer or by the Plan as described in Part Two. Fees and Expenses Name/ Type of Option Ticker Symbol Bond Bond Funds Funds FIDELITY FSRIX ADVISOR STRATEGIC INCOME I/ Multisector Bond Additional Description: None METROPOLITAN MWTIX WEST TOTAL RETURN BOND I/ Intermediate Term Bond Additional Description: None PRINCIPAL HIGH PHYTX YIELD I/ High Yield Bond Additional Description: None VANGUARD GNMA VFIJX ADML/ Intermediate Government Additional Description: None Total Annual Operating Expenses As a %* Per $1000 ShareholderType Fees Round Trip Period ** Restriction Restricted Frequency *** Trading Period **** 0.72% $ 7.20 N/A 30 Days 3 in 12 Months 85 Days 0.46% $ 4.60 N/A N/A 2 in 30 Days N/A 0.61% $ 6.10 N/A N/A 1 in 30 Days 30 Days 0.11% $ 1.10 N/A N/A N/A N/A Page 11 of 17 Rev. 2/20 Name/ Type of Option Ticker Symbol VANGUARD VAIPX INFLATION PROTECTED SECURITIES ADM/ Inflation Protected Bond Additional Description: None VANGUARD TOTAL VTABX INTERNATIONAL BOND INDEX ADML/ World Bond Additional Description: None Equity Equity Funds Funds DFA EMERGING DFEMX MARKETS I/ Diversified Emerging Markets Additional Description: None DFA US LARGE DFLVX CAP VALUE I/ Large Value Additional Description: None FIRST EAGLE SGIIX GLOBAL I/ World Allocation Additional Description: None PRINCIPAL REAL PIREX ESTATE SECURITIES I/ Real Estate Additional Description: None VANGUARD 500 VFIAX INDEX ADML/ Large Blend Additional Description: None Total Annual Operating Expenses As a %* Per $1000 0.10% $ 1.00 N/A N/A Restriction Restricted Frequency *** Trading Period **** N/A N/A 0.11% $ 1.10 N/A N/A N/A N/A 0.43% $ 4.30 N/A N/A N/A N/A 1 in 30 Days N/A 90 Days 0.26% $ 2.60 N/A N/A 1 in 30 Days 90 Days 0.85% $ 8.50 N/A N/A N/A N/A 0.91% $ 9.10 N/A N/A 1 in 30 Days 30 Days 0.04% $ 0.40 N/A N/A N/A N/A Page 12 of ShareholderType Fees Round Trip Period ** 17 Rev. 2/20 Name/ Type of Option Ticker Symbol VANGUARD VBIAX BALANCED INDEX ADML/ Allocation 50 - 70% Equity Additional Description: None VANGUARD VIGAX GROWTH INDEX ADML/ Large Growth Additional Description: None VANGUARD VWILX INTERNATIONAL GROWTH ADMN/ Foreign Large Growth Additional Description: None VANGUARD MID VMGMX CAP GROWTH INDEX ADML/ Mid - Cap Growth Additional Description: None VANGUARD MID VIMAX CAP INDEX FUND ADML/ Mid - Cap Blend Additional Description: None VANGUARD MID VMVAX CAP VALUE INDEX ADML/ Mid - Cap Value Additional Description: None VANGUARD SMALL VSGAX CAP GROWTH INDEX ADML/ Small Growth Additional Description: None Total Annual Operating Expenses As a %* Per $1000 0.07% $ 0.70 N/A N/A Restriction Restricted Frequency *** Trading Period **** N/A N/A 0.05% $ 0.50 N/A N/A N/A N/A 0.32% $ 3.20 N/A N/A N/A N/A 0.07% $ 0.70 N/A N/A N/A N/A 0.05% $ 0.50 N/A N/A N/A N/A 0.07% $ 0.70 N/A N/A N/A N/A 0.07% $ 0.70 N/A N/A N/A N/A Page 13 of ShareholderType Fees Round Trip Period ** 17 Rev. 2/20 Name/ Type of Option Ticker Symbol VANGUARD SMALL VSMAX CAP INDEX ADML/ Small Blend Additional Description: None VANGUARD SMALL VSIAX CAP VALUE INDEX ADMIRAL/ Small Value Additional Description: None VANGUARD VTXVX TARGET RETIREMENT 2015 INV/ Target Date 2015 Additional Description: None VANGUARD VTWNX TARGET RETIREMENT 2020 INV/ Target Date 2020 Additional Description: None VANGUARD VTTVX TARGET RETIREMENT 2025 INV/ Target Date 2025 Additional Description: None VANGUARD VTHRX TARGET RETIREMENT 2030 INV/ Target Date 2030 Additional Description: None VANGUARD VTTHX TARGET RETIREMENT 2035 INV/ Target Date 2035 Additional Description: None Total Annual Operating Expenses As a %* Per $1000 0.05% $ 0.50 N/A N/A Restriction Restricted Frequency *** Trading Period **** N/A N/A 0.07% $ 0.70 N/A N/A N/A N/A 0.13% $ 1.30 N/A N/A N/A N/A 0.13% $ 1.30 N/A N/A N/A N/A 0.13% $ 1.30 N/A N/A N/A N/A 0.14% $ 1.40 N/A N/A N/A N/A 0.14% $ 1.40 N/A N/A N/A N/A Page 14 of ShareholderType Fees Round Trip Period ** 17 Rev. 2/20 Name/ Type of Option Ticker Symbol VANGUARD VFORX TARGET RETIREMENT 2040 INV/ Target Date 2040 Additional Description: None VANGUARD VTIVX TARGET RETIREMENT 2045 INV/ Target Date 2045 Additional Description: None VANGUARD VFIFX TARGET RETIREMENT 2050 INV/ Target Date 2050 Additional Description: None VANGUARD VFFVX TARGET RETIREMENT 2055 INV/ Target - Date 2055 Additional Description: None VANGUARD VTTSX TARGET RETIREMENT 2060 INV/ Target - Date 2060+ Additional Description: None VANGUARD VLXVX TARGET RETIREMENT 2065 INV/ Target - Date 2060+ Additional Description: None Total Annual Operating Expenses As a %* Per $1000 0.14% $ 1.40 N/A N/A Restriction Restricted Frequency *** Trading Period **** N/A N/A 0.15% $ 1.50 N/A N/A N/A N/A 0.15% $ 1.50 N/A N/A N/A N/A 0.15% $ 1.50 N/A N/A N/A N/A 0.15% $ 1.50 N/A N/A N/A N/A 0.15% $ 1.50 N/A N/A N/A N/A Page 15 of ShareholderType Fees Round Trip Period ** 17 Rev. 2/20 Name/ Type of Option Ticker Symbol VANGUARD VTINX TARGET RETIREMENT INCOME INV/ Target Date Retirement Additional Description: None VANGUARD TOTAL VTIAX INTERNATIONAL STOCK INDEX ADML/ Foreign Large Blend Additional Description: None VANGUARD TOTAL VTWAX WORLD STOCK INDEX ADMIRAL/ World Stock Additional Description: None VANGUARD VWIAX WELLESLEY INCOME ADML/ Allocation 30 - 50% Equity Additional Description: None Money Money Market Market Funds Funds VANGUARD VUSXX TREASURY MONEY MARKET INV/ Money Market Additional Description: None Total Annual Operating Expenses As a %* Per $1000 0.12% $ 1.20 N/A N/A Restriction Restricted Frequency *** Trading Period **** N/A N/A 0.11% $ 1.10 N/A N/A N/A N/A 0.10% $ 1.00 N/A N/A N/A N/A 0.16% $ 1.60 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 0.09% $ 0.90 ShareholderType Fees Round Trip Period ** N/A * = Total Operating Expense before waivers/reimbursements as taken from the Operating Fees & Expenses table of the prospectus ** = period of time between purchase and redemption of shares of the same investment that qualifies it as a round trip transaction *** = number of round trips permitted **** = amount of time blocked from trading if policy is violated The cumulative effect of fees and expenses can substantially reduce the growth of your retirement savings. Visit the Department of Labor's Web site for an example showing the long-term effect of fees and expenses at http://www.dol.gov/ebsa/publications/undrstndgrtrmnt.html. Fees and expenses are only one of many factors to consider when you decide to invest in an option. You may also want to think about whether an investment in a particular option, along with your other investments, will help you achieve your financial goals. The information set forth in this document is based upon information that Paychex has received from unaffiliated third parties. Paychex has not verified the accuracy or completeness of the information and cannot be responsible for any inaccuracies in the information from third party sources. You must independently determine how to use and interpret the information set forth in this document, including whether you need the assistance of any professionals to assist you in your interpretation of that information and if so, the nature of professional assistance that you may need. Paychex is not responsible for the manner in which you interpret the information in this document. Note: When using this document, be aware that some, and perhaps all, of the information may be time-sensitive. Page 16 of 17 Rev. 2/20 To assist you in understanding your designated investment alternatives, a general glossary of terms can be found at http://www.morningstar.com/InvGlossary/?CustId=&CLogin=&CType=&CName= . In addition, the website provided with each investment alternative may contain its own glossary of terms relevant to that specific alternative, or a link to such a glossary. Page 17 of 17 Rev. 2/20