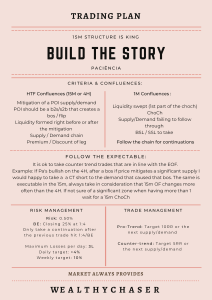

SOLOMON'S TRADING PLAN (Short Version) Narrative Building Step 1: Identify the Higher Timeframe narrative using the weekly, daily and the 4-hourly timeframe with the 4-hourly being the main timeframe for intraday trades. Mark out the the market structure on each timerame. Identify high probability zones. Identify any relevant liquidity. Identify who's in control on each timeframe. Identify in which was in what phase is the current market. Step 2: Identify the Middle Timeframe narrative using the 15m timeframe. Mark out the the market structure on each timerame. Identify high probability zones. Identify any relevant liquidity. Identify who's in control on each timeframe. Identify in which was in what phase is the current market. Entry Conditions Pro-4H-trend trades until ERL is taken. Counter-4H-trend trades after ERL is taken. Step 1: Establish whether the trade idea is pro-orderflow or counter-orderflow. IF PRO-ORDERFLOW Look for 15M POIs such as extremes, flips, chains and LQPOIs. Identify CPBs. Consider ERL/IRL. Consider STRLQ. After price taps the POI Look for a CE on the 5M or 1M timeframe. Look for 5M/1M POIs such as extremes, flips, chains and LQPOIs. Identify CPBs. Consider ERL/IRL. Consider STRLQ. If initial entry missed, look for continuation model. Set a limit order on the POI that fits the criteria. If looking to enter on RE Only nested 5M/1M refined POIs that are either extremes, flips, chains and LQPOIs Scale in only after BE point. Management 0.5% balance based risk on each trade. BE at the break of pullback point. Target the 15m at minimum, the next 4h zone or liquidity pool at maximum. Journal each trade. IF COUNTER-ORDERFLOW Look for 4H zone mitigation, 15M CPB or ERL sweep. Identify 15M pro-orderflow zones. Identify targets. Consider STRLQ. After price taps the POI Look for a FLOR on the 5M or 1M timeframe. Look for confirmation entries with flip zones or chains. If initial entry missed, look for continuation model. Consider STRLQ. Set a limit order on the POI that fits the criteria. Scale in only after BE point. Management 0.5% balance based risk on each trade. BE at the break of pullback point. Target the 15m at minimum, the next 4h zone or liquidity pool at maximum. Journal each trade.