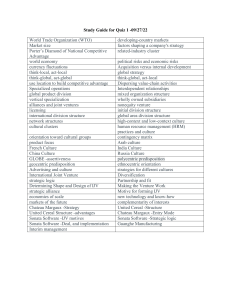

Marketing Château Margaux Submitted to: - Submitted by: - Prof. Niva Bhandari Aditya Bhageria (2018PGP006) Pulkit Jain (2018PGP040) 1 Letter of Transmittal From Mayer and Co. Consultation, Marseille, France January, 2006 To Ms. Corinne Mentzelopoulos Chateau Margaux, Bordeaux, France Subject: Report regarding future course of action for Chateau Margaux Dear Ma’am, We have analysed the current situation and growth prospects of all the main stakeholders at Chateau Margaux. After taking into consideration all the decision criteria’s and evaluating the available options, it is recommended that Chateau Margaux should purchase more premium quality grapes by outsourcing through other reputed Bordeaux vineyards and should also capture the value proposition of the 10% grapes that they sell anonymously by asking for royalty up to 3-5%. Please find enclosed our detailed report. Let us know if you have any further queries. Thanks & Regards Aditya Bhageria Pulkit Jain Enclosure: Report 2 Executive Summary Chateau Margaux has been through various events since Andre Mentzelopoulos bought it in 1977.The primary concern in the present is whether Chateau Margaux will be competitive in the future given the rising competition from the New World producers and increase in demand for wine around the world. Currently, there are various options available with which the company can go forward. One is to stick with the current traditional way of production and take control of distribution channels while the other option is to expand the business to reach to a wider range of people by launching third wine. In this report, we have examined the history of the company and the values associated of the company with the Mentzelopoulos family while taking other decision criteria to reach to a decision while keeping the focus on the brand image of Chateau Margaux. 3 Table of contents Contents Page No. Letter of Transmittal 2 Executive Summary 3 Situation Analysis 5,6 Problem Statement 6 Decision Criteria 6 Generation of Alternatives 7 Evaluation of Alternatives 7-8 Recommendations 9 Action Plan 9 Contingency Plan 9 Exhibits 10 4 Situation Analysis Chateau Margaux is part of the French elite of wines called first growths in Bordeaux region of France. Wine had been grown in this region since sixth century. Bordeaux was the largest wine making region in France. The classification of wines in this region came in 1855 when European Napoleon III introduced a system to classify wines according to estate’s price, its condition, and its overall reputation. It was called Bordeaux Wine Official Classification of 1855 where wines were grouped into 5 categories, from first growth to fifth growth. The Mentzelopoulos family acquired Chateau Margaux in 1997 when Andre Mentzelopoulos bought it for 12 million Euros. It was he who changed the vineyards with better drainage and new plantings along with reintroducing Chateau’s second wine, Pavillon Rouge. Unfortunately, he could not see the full transformation of the chateau as he died suddenly in 1980.As a result, Andre’s daughter, Corinne inherited the estate at the age of 27. She knew the legacy of the estate and knew she had to maintain the standard of the estate. She hired Paul Pontallier, a 27-year-old doctor of enology in 1983 as a successor to the retiring general manager, Philippe Barre. At Chateau Margaux, 80 hectares were devoted to vines for production of red wines and 12 hectares for white wine. Remaining portion of the estate consisted of forests and meadows for the cattle that produced natural fertilizers. It produced an average of 150,000 bottles per year of its first wine, Chateau Margaux. Grapes that were discarded were used in producing second wine, Pavillon Rouge du Chateau Margaux averaging 200,000 bottles per year. Also, it produced 33,000 bottles per year of its white wine Pavillon Blanc du Chateau Margaux. Remaining 10 % of the grapes were sold in bulk to wine merchants on the condition that their source would not be revealed. Here, it was believed that there is a mix of four things for a wine to be great: a grand terroir, the right grape variety, climate and human work. Chateau Margaux had great terroir and thus great first wine. It employed 70 people in production along with 4 in administrative functions. Once a dominant player in international market, it along with French wine industry was facing stiff competition from the New World Producers. New world producers included California, Australia, South Africa and New Zealand. Most of them had bigger vineyards, larger marketing budget, lower costs along with modern production techniques. Their low cost along with accessible flavours made them very popular among consumers. As a result, France’s share of US imported wine market fell from 26 % in 1994 to 14 % in 2004. In domestic market, the competitors were Latour, Lafite- Rothschild, Mouton-Rothschild and Haut Brion. Haut Brion recently launched a branded wine called Clarendelle to compete in the premium brand category. Baron Philippe de Rothschild operated three wines- first growth Chateau Mouton Rothschild, and blended wines like Mouton Cadet for the mass market. Chateau Margaux followed the en primeur system for distribution of their first growths. Only 5 % to 15 % of their wines were sold after bottling. Rest majority was sold while still in the barrel, in an en primeur. The en primeur sales took place in offerings called tranches. There was a strong relationship between the owners and the merchants and thus this system of distribution worked. Even in bad years, they did buy the tranches to be in good books so that they could buy again the next year. There were around 400 merchants in Bordeaux region. The merchants would then allocate the en primeur wine to the buyers which were importers, 5 wholesalers and large retailers. Prices varied even more deep into the distribution channel. Prices usually climbed about 60 % between the first tranche offered en primeur and the bottles sold in the market two years later. UK, Belgium, Netherlands and Germany drove the market for premium wines. Newer market includes US, Japan, China and Russia with US accounting for half of the total demand. Chateau Margaux was careful and tried to keep a balanced distribution. Unlike the British market, the newer market like in the Asian market, it was seen as a status symbol. Though the new markets were booming, they still needed the traditional European customers because though they didn’t have proper knowledge of its customer base, they estimated that about 80 % of their customers were connoisseurs There was a growing trend towards heavier, darker wines. But Chateau Margaux didn’t want to lose its soul, that is, balanced elegant wines. They had a certain style and balance and they didn’t want to alter that a lot. They still believed that their wines were the ones which were meant for long consumption rather than the powerful ones which were generally consumed in less quantity. They firmly believed that as long as drinking long is part of the European culture, people will value their wine. Along with merchants and retailers, journalists and wine critics were major influencers for customers to choose their wine. Parker, an American critic was becoming really popular with his Parker points rating system for wines in which he assigned a single number between 50 and 100. Another famous wine journalist was James Suckling of Wine Spectator. While Parker wrote for connoisseurs, he wrote for younger audience. Parker supported Bordeaux wine while Suckling didn’t. While the New World wineries had systematic marketing strategies and budgets, in case of Chateau Margaux, it was mostly left to retailers. They believed that that it may not be wise to have a marketing team as they didn’t feel the need to push their products. The scarcity of their product itself worked as a marketing tool. Problem Statement: The growing competition from new world wine companies is creating a stiff competition to traditionally operating Chateau Margaux and they have to come up with new strategies to maintain dominant position in market as the premium brand as well as pursue sustainability in profit growths. Decision criteria: The following decision criteria needs to be considered for evaluation of options: Chateau Margaux estate’s reputation and decades long legacy along with Corinne Mentzelopoulos’ primary objective of protection of the brand and her commitment towards taking her father’s vision of producing the finest wine Estate’s relations with local merchants, wholesalers and large retailors The 1885 classification system for prices of wines 6 To ensure self-sustainability in terms of profits as against growing competition from new world wine producers Generation of alternatives: The following options are available in front of Corinne Mentzelopoulos: 1. To expand the product line by start producing a lower priced third wine 2. To start distribution of wines by self, without depending on merchants, or négociants, by creating maintaining, packaging, marketing and sales capability for 150,000 bottles 3. To continue with current proceedings and instead of selling out 10% of the premium grapes anonymously, they can capture the value proposition of those grapes through demanding royalty 4. To increase wine production, they can outsource premium quality grapes from other reputed vineyards of Bordeaux region Evaluation of alternatives: The evaluation of alternatives is done keeping in mind the impact of all the decision criteria: 1. To expand the product line by start producing a lower priced third wine Starting a new line of product in the lower priced third wine will increase the customer base where currently the existing products are beyond the affordability of many desired customers. They can shift their production of 100,000 bottles of second wine (Pavilion Rouge du Chateau Margaux) to the third wine and may price it around €20-25 for first tranche. This would decrease their revenue by around $4,000,000 for initial years, but with large customer base in future, they can increase their production and hence will gain large profits. (see Exhibit 1) Since it will be contradictory to Chateau Margaux’s current proceedings and also can hurt their current image as the premium quality wine producers. Also, there may be some reluctance from merchants who used to make huge profits arising out of heavy margins and may not be willing to support the decision. 2. To start distribution of wines by self without giving it to merchants, or négociants by creating marketing and sales capability for 150,000 bottles Creating marketing and sales capability for 150,000 bottles may result in huge increase in revenues because right now, of the average €290-325 per bottle, the price set by Corinne 7 Mentzelopoulos is only €180 per bottle, hence the margins can result into huge revenues up to €18,000,000 (add: bottling, transportation and storage cost) (less: Maintenance to tranche). (See Exhibit 2) The major problem that is going to occur with this alternative is that this move will result to be a very disruptive one because in current proceeding, all the distribution was done by merchants and negotiators only. This move will cannibalize their relations with merchants and as some of the pricing effect was due to the merchant’s efforts of tasting be journalists and wine tasting experts, and revenues will not be up to the extent as expected. Corinne Mentzelopoulos herself stated that all the work including storage, transportation, temperature control, customer relations, delivery everywhere in the world. There are neither the skills nor means to do it by themselves. In order to take care of all these activities, a separate marketing, supply and distribution framework will be required for Chateau Margaux which will result in additional expense and costs and thus result in further lowering of profits. Also, the prising structure will be needed to be updated. But since currently, all other vineyards are following the 1855 model, if they reject any new model, then there will be problems for Chateau Margaux and their reputation will get affected. 3. To continue with current proceedings and instead of selling out 10% of the premium grapes to anonymous buyers, they can capture the value proposition of those grapes through demanding royalty The whole idea of selling out 10% of premium grapes to anonymous buyers is to have the essence of terroir of Chateau Margaux in every type of premium vines. While the other sellers get benefitted by promoting their vines having premium taste, Chateau Margaux do not actually get any fame as there is condition of mentioning the source of those grapes. The reason for this culture is the decade long tradition that they are following. Instead, Chateau Margaux can continue selling those 10% grapes of other vineyards and in return, may ask for royalty up to 3-5% on the selling prices. This may result in additional profits of more than €25,000 (plus: the mouth publicity of Chateau Margaux’s original products). (see Exhibit 3) But this alternative contains the risk of changing the value proposition of Chateau Margaux as people may perceive that they are tying up with other brands and the sales of our collaborators would rise while our sales will be adversely get affected due to higher prices of our products. 4. To increase wine production, they can outsource premium quality grapes from other reputed vineyards of Bordeaux region Outsourcing premium quality grapes from other reputed Bordeaux vineyards will help in increasing sales of Chateau Margaux. Margins to the distributors may be reduced and this 8 will result in decrease of retail prices which eventually lead to wider customer base and hence increase in revenues through existing products. Through this, Chateau Margaux can continue with their existing distribution cycle ensuring higher incomes to distributors and merchants as well. Still the competition will be stiff from new world wine producers and there would be need of rigorous marketing by merchants and negotiators. Recommendations: It is recommended that Corinne Mentzelopoulos should purchase more premium quality grapes by outsourcing through other reputed Bordeaux vineyards and should also capture the value proposition of the 10% grapes that they sell anonymously by asking for royalty up to 35%. Action Plan: Establish connections with other vineyards of Bordeaux region Increase production capacity with separate department and production line for wine to be produced from outsourced grapes Hire more people for production work and create a separate team for production of wine from outsourced grapes Establish networks with merchants to sell the trachea of new wine and sell them to lower prices Connect with wine expects and reviewers to gain knowledge about how to improve current taste or appearances Continue to sell 10% of the premium grapes to other producers but demand mentioning of their name by those vineyards and 3-5% royalty should be charged Promote and ensure increase in exports of the Chateau Margaux in United states, Russia and Asian countries Contingency Plan: In case of failure of the above recommended action plan, it is recommended that Corinne Mentzelopoulos should go with the plan of expanding the product line by start producing a lower priced third wine. This may be through existing grape production or through outsourcing of moderate quality of grapes. If any of the above recommendations are followed, the task of getting into self-distribution and marketing will be eliminated. In addition, in case of contingency plan, the earlier losses will serve as the base for increase in market capture as well as ensure higher future revenues. 9 Exhibits: Exhibit 1: Current production: First wine: 150,000 bottles, Second wine: 200,000 bottles Recommended production: First wine: 150,000 bottles; Second wine: 100,000 bottles; Third wine: 100,000 bottles Current prices for second wine: €60 Assuming new prices to be €20-25: Change in revenues= 100,000(60-20) Change in revenues= €4,000,000 Exhibit 2: Number of first wine bottles: 150,000 bottles Average retail price of first wine bottles: €290-325 Average price of first wine bottles by Chateau Margaux: €180 Increase in revenues= 150,000(300-180) Increase in revenues= €180,000,000 Exhibit 3: Current total production: 383,000 bottles Expected production with 10% of grapes: 425,555 bottles Assuming a 3% royalty and price of €20 Increase in profits= (425,555-383,000) *0.03 *20 Increase in profits= €25,533 10